- Home

- »

- Digital Media

- »

-

Audio Codec Market Size & Share, Industry Report, 2033GVR Report cover

![Audio Codec Market Size, Share & Trends Report]()

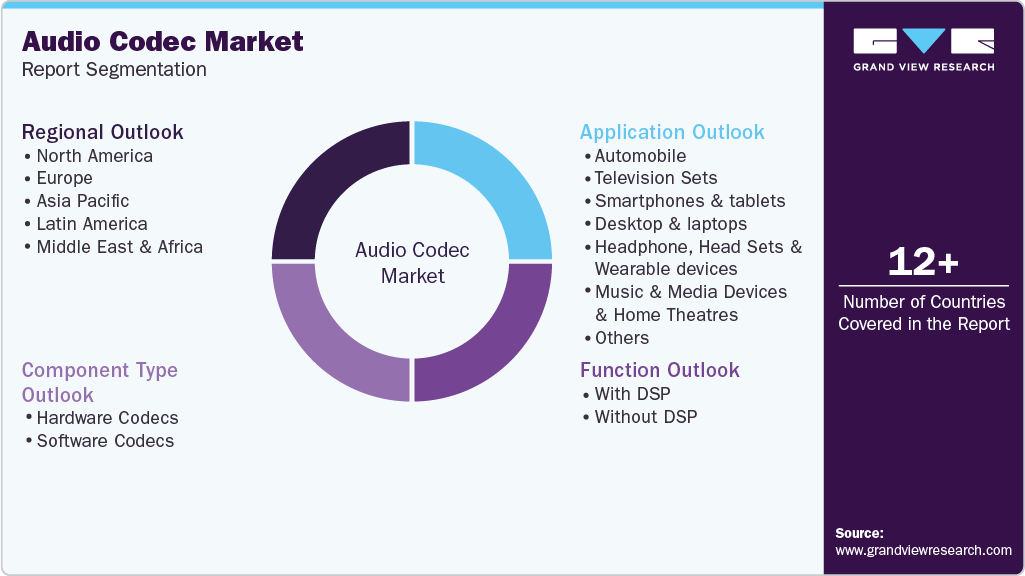

Audio Codec Market (2025 - 2033) Size, Share & Trends Analysis Report By Function (With DSP, Without DSP), By Component Type (Hardware, Software), By Application (Smartphones And Tablets, Headphones), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-391-9

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Audio Codec Market Summary

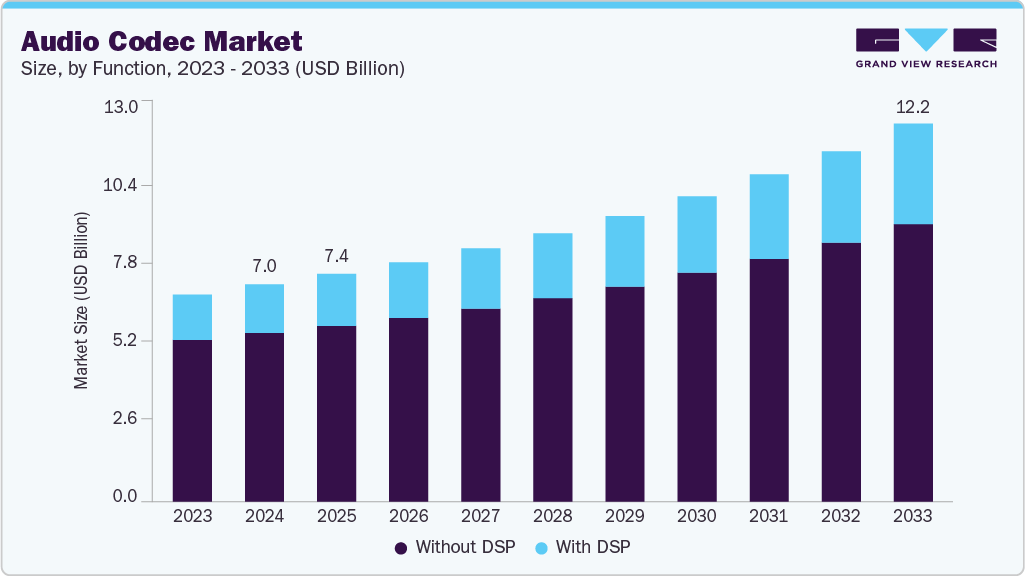

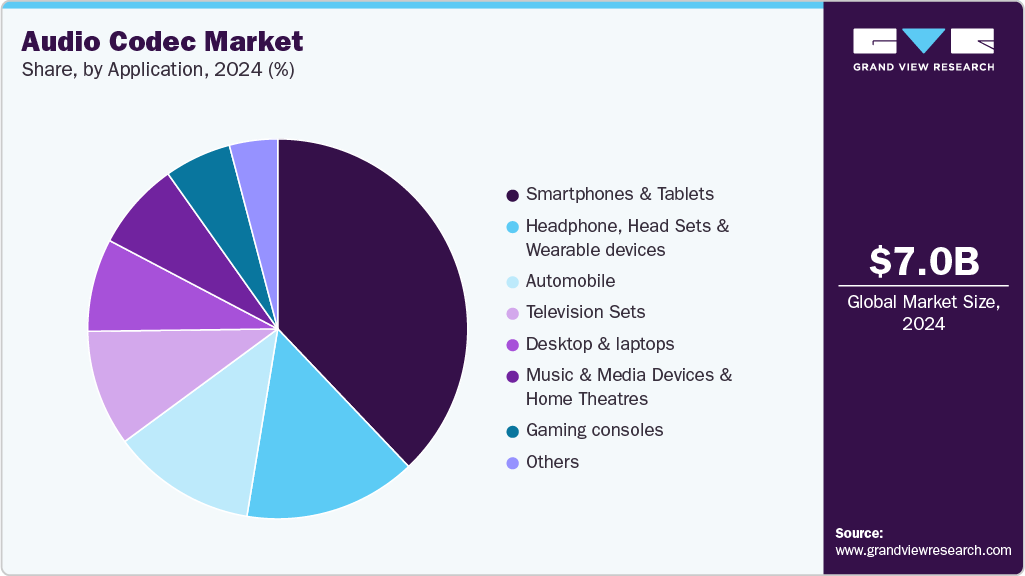

The global audio codec market size was estimated at USD 7,024.6 million in 2024 and is projected to reach USD 12,233.6 million by 2033, growing at a CAGR of 6.5% from 2025 to 2033. AI-controlled audio codecs are disrupting the global audio codec market by utilizing machine learning to enhance compression and preserve audio fidelity.

Key Market Trends & Insights

- North America Audio Codec dominated the global market with the largest revenue share of 34.0% in 2024.

- The Audio Codec market in the U.S. led the North America market and held the largest revenue share in 2024.

- By function, without DSP segment held the largest revenue share of 77.9% in 2024.

- By component type, the hardware codecs segment held the dominant position in the market and accounted for the largest revenue share of 64.6% in 2024.

- By application, the headphone, head sets and wearable devices segment is expected to grow at the fastest CAGR of 7.8% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 7,024.6 Million

- 2033 Projected Market Size: USD 12,233.6 Million

- CAGR (2025-2033): 6.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest market in 2024

AI-audio codecs enhance the clarity of sound by adapting to the audio material in real-time. The use of real-time processing allows for smoother playback on various devices and networks. These changes are spawning innovations in both consumer electronics and streaming services. There is an increased need for low-power, high-fidelity audio solutions in professional and portable applications. Musicians, sound technicians, and artists are looking for equipment that provides superior audio quality with no loss of power efficiency. This promotes codec innovation with a focus on dynamic range, hybrid gain control, and small form factor. Portable and battery-driven devices particularly benefit from energy-efficient codecs with consistent performance.Consequently, manufacturers are addressing the expectations of studio and live performance users by incorporating leading-edge features. For example, in June 2025, Cirrus Logic Inc. released a line of professional-quality DACs and the CS4282P audio codec for musicians, live performers, and recording engineers requiring high-fidelity audio. These products come equipped with hybrid gain control, low power consumption, and dynamic range up to 129 dB, delivering superior sound quality with simple integration.

Immersive and standardized 3D audio is emerging as a major priority in the audio codec space. Engineers are developing enhanced depth, spatial fidelity, and multi-dimensional sound to stay ahead of changing playback technologies. A definite trend toward standardized formats supporting better integration across devices and platforms is driving innovation in smart TVs, wireless earbuds, gaming consoles, and virtual reality headsets.

With spatial audio fast becoming an essential feature in consumer devices, there is an increased need for codecs that preserve sound quality and reduce latency and bandwidth consumption. To remain competitive, most organizations are investing in spatial audio codec creation to provide consistent, good-quality sound within their ecosystems of products. For instance, in January 2025, Samsung Electronics and Google LLC collaborated to introduce Eclipsa Audio, a 3D audio technology. The integration is intended to provide spatial sound experiences and will feature YouTube content that is optimized for Eclipsa Audio.

Automotive companies are increasingly embedding high-performance audio systems to address consumer needs for immersive in-vehicle entertainment. Audio codecs make it possible to compress and transmit high-fidelity sound across various vehicle platforms effectively. As electric vehicles have become the new direction, cabin noise has been reduced, and therefore, the focus is on better audio clarity. New codecs such as AAC, LDAC, and aptX Adaptive are being utilized to provide uninterrupted wireless audio experiences. The increasing adoption of Bluetooth-enabled infotainment systems complements the trend.

With cars becoming increasingly networked, multi-channel audio support and low-latency streaming are becoming essential. Codecs also assist in bandwidth optimization to provide consistent audio performance across different connectivity situations. Automotive OEMs are working in tandem with codec developers to tailor solutions to individual speaker setups. In high-end segments, demand for surround sound and spatial audio is also propelling codec innovation.

Function Insights

The without DSP segment dominated the audio codec market with a revenue share of 77.9% in 2024. Without DSP segment audio codecs remain superior in cost-sensitive electronics, particularly in low-end smartphones and simple IoT devices. Their minimalistic nature lowers overall system cost greatly, making them a choice for manufacturers. In areas where the cost per unit is more critical, such codecs continue to be a reliable option. With their support in legacy hardware designs, they provide a long lifecycle and fewer integration headaches. Supply chains with favor without DSP codecs are well established and cost-effective. This allows manufacturers to keep prices competitive without sacrificing critical audio performance. The stability of the segment also prevents redesign loops or redundant component changes.

The use of DSP audio codecs is expanding in the mainstream automotive market. Automakers are adding immersive sound features even in non-premium models. This shift shows growing consumer expectations for better in-car audio experiences. DSPs help optimize sound processing while keeping power use low. Codec suppliers are now building flexible, high-performance architectures to support this trend. As vehicles become more software-defined, DSP-driven audio systems are becoming a standard feature. This also allows manufacturers to push updates and improvements through software without changing hardware. As a result, in-car audio is becoming more adaptive and future-ready.

Component Type Insights

Hardware codecs dominated the audio codec market in 2024. They have low latency and high reliability, hence suitable for real-time use. Most producers such as hardware due to its predictable performance in embedded systems. Hardware codecs are popular in smartphones, automotive systems, and professional audio devices. Their fixed-function nature makes them use power efficiently and process. Even with an increasing capacity of software, hardware is the go-to option for stability-critical environments. Their dominance is buttressed by established industry faith and well-established supply chains.

Software codecs are gaining momentum as systems become increasingly software-defined. Software codecs are more flexible and simpler to update later down the road. Developers can also dial in performance without altering hardware components. Software codecs are attractive in usage, such as streaming, mobile applications, and cloud audio services. Better processing capability in current chips is making solutions based on software increasingly viable. Consequently, software codecs are poised to exhibit robust growth among consumer and connected devices. Their flexibility is particularly beneficial in dynamically changing digital ecosystems.

Application Insights

Smartphones and tablets dominate the audio codec market in 2024. These devices require highly integrated, low-power codecs to support voice, media playback, and video calls. Hardware-based codecs are preferred here due to their efficiency and compact size. Demand is driven by constant upgrades in mobile audio quality, including support for high-resolution formats. Manufacturers continue to prioritize audio innovations as a key feature in mobile devices. Their large-scale production secures the top position for this category in the audio codec space. The inclusion of spatial and noise-cancellation features is also driving more sophisticated codec adoption.

Headphones, headsets, and wearable devices are witnessing rapid growth in the audio codec market. Increasing use of wireless audio is fueling demand for efficient Bluetooth codecs. These devices require codecs that balance audio quality, low latency, and power efficiency. Software codecs are becoming more common due to their flexibility in updates and tuning. Growth is also tied to trends such as fitness tracking, mobile gaming, and remote work. This segment is quickly expanding and closing the gap with smartphones and tablets. The push for longer battery life and adaptive sound is also shaping codec development in this space. As consumers look for seamless audio experiences across multiple devices, demand for intelligent and responsive codec solutions continues to accelerate.

Regional Insights

North America audio codec market held the largest revenue share of 34.0% of the market in 2024. High demand for advanced consumer electronics and automotive infotainment systems supported this dominance. The region benefits from a strong presence of leading chipset and device manufacturers. Rapid adoption of technologies such as spatial audio, 5G, and connected wearables also contributed to market growth. Continued investment in R&D and innovation keeps North America at the forefront of audio codec development.

U.S. Audio Codec Market Trends

The U.S. audio codec market is driven by strong demand for advanced DSP-enabled solutions across consumer electronics and automotive applications. There is consistent demand for high-quality audio codecs across consumer electronics, automotive, and entertainment sectors in the U.S. device manufacturers are focusing on DSP-based and software-defined audio solutions to deliver premium experiences in smartphones, wearables, and connected home devices.

Europe Audio Codec Market Trends

The Europe audio codec market is supported by strong regulations and a mature industrial base. Automakers are adopting multi-channel and spatial codecs to enhance in-vehicle sound, especially in electric cars. The growing use of wireless earbuds, smart assistants, and health wearables is driving demand for low-power, high-clarity audio solutions. European firms are aligning with codec providers to ensure data compliance and device compatibility.

Asia Pacific Audio Codec Market Trends

The Asia Pacific audio codec market is emerging as the fastest-growing region. The expansion of the audio codec sector within the Asia-Pacific territory is propelled by the ongoing increase in production from creators of mobile phones, intelligent televisions, and personal wearable technologies. Original equipment manufacturers located in China, South Korea, and India are manufacturing significant quantities of consumer electronics that necessitate economical, energy-efficient, and potent codec resolutions with minimalist configurations.

Key Audio Codec Company Insights

Some key companies in the audio codec market include Analog Devices, Inc., ATC LABS, Barix AG, Cirrus Logic Inc., Qualcomm Technologies, Inc., Realtek Semiconductor Corp., and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Analog Devices, Inc. is advancing audio codec technology with a focus on precision and low-latency signal processing. The company integrates high-performance DSPs into its codec solutions for professional and automotive applications. Its codecs support wide dynamic range and low power operation, suitable for mission-critical sound systems. ADI’s expertise in analog and mixed-signal design enhances audio clarity and system integration. Recent developments aim to meet growing demands in spatial audio and real-time processing environments.

-

Qualcomm Technologies, Inc. is driving innovation in audio codecs through its Snapdragon Sound platform. The company focuses on delivering high-resolution, low-latency wireless audio experiences. Its adaptive codec technologies, such as aptX Adaptive and aptX Lossless, are widely used in earbuds and smartphones. Qualcomm's audio solutions are designed to optimize performance across Bluetooth and 5G-enabled devices. These advancements align with the growing need for seamless, high-quality mobile audio.

Key Audio Codec Companies:

The following are the leading companies in the audio codec market. These companies collectively hold the largest market share and dictate industry trends.

- Analog Devices, Inc.

- ATC LABS

- Barix AG

- Cirrus Logic Inc.

- Qualcomm Technologies, Inc.

- Realtek Semiconductor Corp.

- ROHM Co., Ltd.

- Sony Corporation

- STMicroelectronics

- Synopsys, Inc.

- Texas Instruments Incorporated

Recent Developments

-

In June 2025, Barix AG launched the Annuncicom AHE-YA404, an analog headend with VoIP SIP support and onboard amplification, to connect IP intercom and paging systems with legacy 4-wire installations. It enables two-way HDX communication and room monitoring without needing to replace existing speaker/microphone panels or cabling.

-

In October 2024, ATC Labs launched enhanced versions of its Perceptual SoundMax audio processing and ALCO Professional IP Soft Codec product lines, integrating AI-based models for improved real-time audio decisions and immersive spatial sound. These updates include the new AIdeal Audio platform, SpatialMax Immersive Audio, and expanded API availability across embedded platforms, to elevate professional and broadcast audio experiences.

-

In August 2024, Sony Corporation and AIROHA Technology Corp formed a strategic partnership, with Airoha officially recognized as an LDAC Technical Partner. This partnership focuses on expanding Sony’s LDAC high-resolution Bluetooth audio technology, with Airoha integrating LDAC into its Bluetooth audio platforms and supplying over 70 million compatible chips worldwide, supporting a broad range of devices.

Audio Codec Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7,371.2 million

Revenue forecast in 2033

USD 12,233.6 million

Growth rate

CAGR of 6.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Report updated

July 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Function, component type, application, and region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Analog Devices, Inc.; ATC LABS; Barix AG; Cirrus Logic Inc.; Qualcomm Technologies, Inc.; Realtek Semiconductor Corp.; ROHM Co., Ltd.; Sony Corporation; STMicroelectronics; Synopsys, Inc.; Texas Instruments Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Audio Codec Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global audio codec market report based on function, component type, application, and region.

-

Function Outlook (Revenue, USD Million, 2021 - 2033)

-

With DSP

-

Without DSP

-

-

Component Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware Codecs

-

Software Codecs

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Automobile

-

Television Sets

-

Smartphones and tablets

-

Desktop and laptops

-

Headphone, Head Sets and Wearable devices

-

Music & Media Devices and Home Theatres

-

Gaming consoles

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global audio codec market size was estimated at USD 7,024.6 million in 2024 and is expected to reach USD 7,371.2 million in 2025.

b. The global audio codec market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2033 to reach USD 12,233.6 million by 2033

b. North America dominated the audio codec market with a share of 34.0% in 2024. North America is witnessing a strong demand for premium audio experiences, driven by the popularity of high-end consumer electronics and advanced in-car entertainment systems. This trend is leading to increased adoption of sophisticated audio codecs that support high-resolution audio and immersive sound technologies.

b. Some key players operating in the audio codec market include Analog Devices, Inc., ATC LABS, Barix AG, Cirrus Logic Inc., Qualcomm Technologies, Inc., Realtek Semiconductor Corp., ROHM Co., Ltd., Sony Corporation, STMicroelectronics, Synopsys, Inc., and Texas Instruments Incorporated

b. Key factors driving market growth include Rising Demand for Mobile Devices, Market Fragmentation and Competition, and Advancements in Audio Streaming.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.