- Home

- »

- Next Generation Technologies

- »

-

Augmented Analytics Market Size And Share Report, 2030GVR Report cover

![Augmented Analytics Market Size, Share & Trends Report]()

Augmented Analytics Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Enterprise Size, By Deployment Type (Cloud, On-premise) By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-364-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Augmented Analytics Market Size & Trends

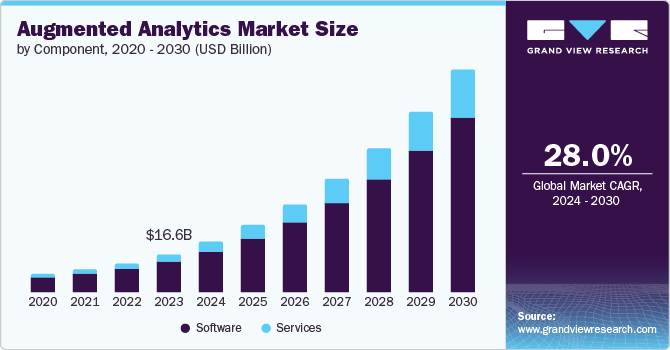

The global augmented analytics market size was valued at USD 16.60 billion in 2023 and is projected to grow at a CAGR of 28.0% from 2024 to 2030. Increasing volume of complex data and growing adoption of advanced analytics tools, and advances artificial technology are the factors driving the augmented analytics market.

As organizations continue to generate large and complex datasets, the need for advanced analytics solutions that can handle and derive insights from this data effectively is paramount. The rapid pace of data generation is pushing organizations to seek tools that can automate data preparation and analysis, thereby enabling them to make informed decisions in a timely manner.

The adoption of advanced technologies such as artificial intelligence (AI), machine learning (ML), and natural language processing (NLP) is also driving the growth of the augmented analytics market. These technologies enable the automation of data processing and enable users to gain actionable insights without requiring extensive technical expertise. This democratization of analytics is particularly attractive to small and medium enterprises (SMEs) as well as large corporations, who are looking to improve their decision-making processes and gain a competitive edge in their respective markets.

Furthermore, the ongoing digital transformation across industries is leading to increased demand for advanced analytics solutions. As organizations undergo digital transformation, they are leveraging augmented analytics to improve their decision-making processes and gain a competitive edge in their respective markets. This is particularly evident in industries such as travel and hospitality, where augmented analytics is being used to discover the best-personalized deals for upselling or cross-selling clients.

Component Insights

Software dominated the market and accounted for a share of 80.5% in 2023. Augmented analytics software aids both new and established businesses in deriving accurate insights from contextual analysis of data for new business projects and other data analysis. Moreover, it offers quicker answers to analysis-related queries without disrupting the analysis process. For instance, in July 2024, the Oracle Analytics Cloud July 2024 update introduced key features, including improved augmented analytics, enhanced data actions, and new visualization controls, empowering business users to streamline data exploration and share insights.

Services is expected to register the fastest CAGR of 29.7% over the forecast period. Services such as training, consulting, deployment, and maintenance assist organizations in maximizing their analytics workflows and ensuring successful adoption. These parts create a complete ecosystem that enables companies to utilize the complete power of augmented analytics, promote innovation, and gain a competitive edge in the current data-focused business environment.

Enterprise Size Insights

Large enterprises dominated the market and accounted for a share of 74.5% in 2023, driven by increasing investments in digital solutions. These corporations leverage advanced analytics to expedite decision-making and automate manual processes, thereby enhancing customer satisfaction. As businesses prioritize data-driven decision-making, the demand for augmented analytics solutions is expected to rise, fueled by investments in advanced analytics technologies.

Small and medium-sized enterprises (SMEs) are expected to register the fastest CAGR of 29.6% over the forecast period. In a highly competitive environment, businesses must prioritize customer satisfaction. Analytics tools enable the gathering of valuable customer insights, which can inform business strategies and drive growth. The market is expanding rapidly, serving not only large enterprises but also small and medium-sized businesses, which are increasingly adopting augmented analytics to extract valuable information and make informed decisions.

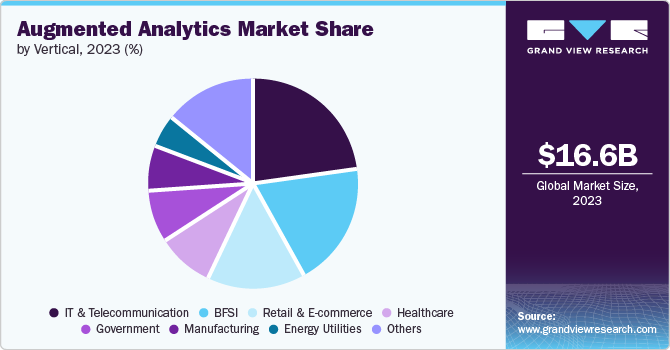

Vertical Type

The IT and telecommunication segment accounted for the largest market share of 22.7% in 2023. Telecommunication companies are increasingly adopting augmented analytics solutions to unlock valuable insights from big data. Key areas of focus include enhancing customer experience, optimizing costs, and driving revenue growth. AI technologies such as NLP and computer vision help analyze complex telecommunications systems, providing deeper understanding of customer behavior and informing data-driven decisions.

Healthcare is projected to be the fastest-growing vertical in the market, registering a CAGR of 30.2% over the forecast period. Healthcare organizations are leveraging augmented analytics to gain a deeper understanding of patient safety, reduce costs, and improve clinical decision-making. AI-powered solutions are being utilized to minimize administrative costs, identify medical errors, and enable predictive analysis. For instance, in June 2024, SAS Institute Inc. expanded its portfolio of data and AI solutions for life sciences and health care, introducing a new clinical data repository built on SAS Viya, which offers a secure, cloud-native, and scalable analytics platform.

Deployment Type Insights

Cloud accounted for the largest market revenue share of 56.2% in 2023. The cloud-based deployment of augmented analytics solutions is favored for its cost-effectiveness, scalability, accessibility, and ease of use. Cloud platforms offer flexible storage and computing power, automatic updates, and centralized data management, making it an attractive choice for organizations seeking data-driven insights. This trend is expected to continue, driven by the demand for scalability and agility.

On-premise is expected to grow significantly with a CAGR of 16.8% during the forecast period. Segment growth is significantly driven by organizations’ need for data security, compliance, and customization. This deployment type allows for robust security measures, leveraging existing infrastructure and expertise, and tailoring systems to unique business processes. It is particularly popular in regulated industries and regions with established on-premises infrastructure.

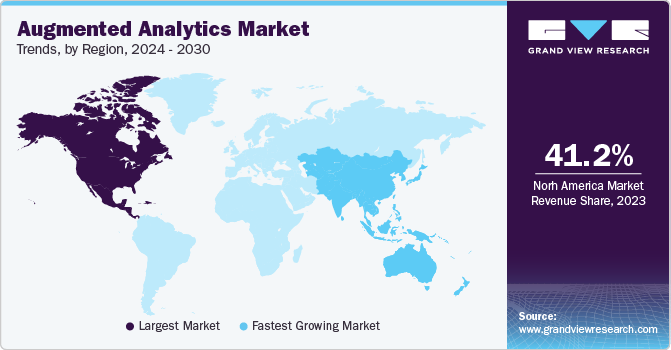

Regional Insights

North America augmented analytics market dominated the global augmented analytics market in 2023, accounting for 41.2% of the total revenue share. Businesses across various sectors, including finance, healthcare, retail, and e-commerce, are rapidly adopting augmented analytics tools to enhance data-driven decision-making in North America. The favorable regulatory environment fosters innovation in analytics, while data privacy laws such as GDPR and CCPA provide opportunities for companies to improve data governance and risk management.

U.S. Augmented Analytics Market Trends

The augmented analytics market in the U.S. dominated the North America augmented analytics market with a share of 75.3% in 2023. The demand for augmented analytics is expected to surge due to intensified research and development, cloud integration, and advancements in infrastructure. The market’s growth is driven by a favorable funding environment, diverse customer base, and increasing adoption of augmented analytics software and services. The U.S. market is poised for rapid expansion, driven by the shift towards data-driven operations among businesses.

Europe Augmented Analytics Market Trends

Europe augmented analytics market was identified as a lucrative region in the global augmented analytics market in 2023, fueled by the increase in investments in AI, ML, and other NLPs to aid in data analysis. SMEs in the region are growing rapidly, generating the need to provide better customer service by implementing analytical tools.

The augmented analytics market in the UK is poised for rapid growth, driven by the adoption of research and development in the field. The country’s thriving AI and analytics community has led to the creation of innovative solutions, meeting the growing demand for data-driven insights. The presence of numerous small and large businesses in the UK, combined with the broader digital transformation trend, will further accelerate the adoption of augmented analytics.

Asia Pacific Augmented Analytics Market Trends

Asia Pacific augmented analytics market is anticipated to witness the fastest growth of 30.7% over the forecast period in the global augmented analytics market. The rapid adoption of digital technologies in Asia-Pacific countries, such as China, India, South Korea, and Japan, is expected to propel market growth in the region. The demand for advanced customer insights driven by densely populated countries with diverse demographics will fuel the expansion of augmented analytics. Consequently, the market share of augmented analytics in the Asia-Pacific region is anticipated to increase.

The augmented analytics market in India is expected to experience significant growth due to the vast amount of data generated across various industries, including e-commerce, healthcare, finance, and telecommunications. Businesses are implementing digital transformation initiatives to remain competitive in the global market. The expansion of e-commerce and digital platforms has led to a growing need for businesses to analyze consumer behavior, driving demand for augmented analytics solutions.

Key Augmented Analytics Company Insights

Some key companies in augmented analytics market include Cloud Software Group, Inc.; International Business Machines Corporation; and Microsoft; among others. The industry is characterized by intense competition among top vendors that are driving innovation through significant R&D investments and strategic partnerships and acquisitions, aimed at enhancing their offerings and expanding their customer base to maintain market leadership.

-

Cloud Software Group, Inc., a provider of unified workspace, analytics, and networking solutions, delivers on-demand technology solutions that enable IT services to be seamlessly managed. Leveraging the expertise of Citrix and TIBCO, the company serves various industries, including healthcare, finance, and retail, to enhance operational efficiency and informed decision-making.

-

MicroStrategy Incorporated provides a comprehensive platform for enterprise analytics, enabling organizations to visualize and analyze data for informed decision-making. With a focus on self-service capabilities, mobile analytics, and cloud-based solutions, the company empowers users to explore and generate insights.

Key Augmented Analytics Companies:

The following are the leading companies in the augmented analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Cloud Software Group, Inc.

- International Business Machines Corporation

- Microsoft

- MicroStrategy Incorporated

- Oracle

- QlikTech International AB

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Sisense Ltd.

- ThoughtSpot Inc.

Recent Developments

-

In July 2024, Qlik announced the general availability of Qlik Talend Cloud, a comprehensive integrated solution that combined advanced AI with trusted data foundations to ensure seamless and secure AI adoption at scale.

-

In April 2024, Cloud Software Group, Inc. and Microsoft signed an eight-year strategic partnership, deepening their collaboration and committing USD 1.65 billion to Microsoft’s cloud and AI capabilities. The partnership aimed to bring joint cloud solutions and generative AI to over 100 million people.

-

In May 2024, Oracle and Accenture collaborated to accelerate generative AI adoption, introducing new solutions and use cases to empower CFOs with AI-driven financial planning and analysis, optimizing operations and fueling growth.

-

In May 2024, IBM unveiled updates to its Watson X platform, including releasing a family of Granite models into open source, launching InstructLab, and introducing new generative AI-powered data products and capabilities.

-

In March 2024, SAP and NVIDIA announced a partnership expansion to accelerate enterprise customers’ adoption of generative AI across SAP’s cloud solutions, leveraging NVIDIA’s expertise in delivering AI capabilities at scale.

Augmented Analytics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.21 billion

Revenue forecast in 2030

USD 97.87 billion

Growth rate

CAGR of 28.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, enterprise size, deployment type, vertical, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Cloud Software Group, Inc.; International Business Machines Corporation; Microsoft ; MicroStrategy Incorporated; QlikTech International AB; Salesforce, Inc.; SAP SE; SAS Institute Inc.; Sisense Ltd.; ThoughtSpot Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Augmented Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global augmented analytics market report based on component, enterprise size, deployment type, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium-sized Enterprises (SMEs)

-

Large Enterprises

-

-

Deployment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail & E-commerce

-

Healthcare

-

BFSI

-

IT & Telecommunication

-

Manufacturing

-

Government

-

Energy utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.