- Home

- »

- Medical Devices

- »

-

Australia Clear Aligners Market Size Report, 2021-2028GVR Report cover

![Australia Clear Aligner Market Size, Share & Trends Report]()

Australia Clear Aligner Market (2021 - 2028) Size, Share & Trends Analysis Report By Age (Adults, Teenage), By End Use (Hospitals, Stand-alone Practices, Group Practices), By Distribution Channel (Online, Offline), And Segment Forecasts

- Report ID: GVR-4-68039-472-8

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

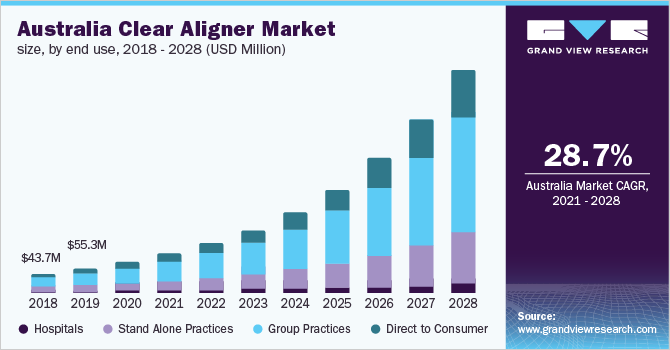

The Australia clear aligner market size to be valued at USD 534.3 million by 2028 and is expected to grow at a compound annual growth rate (CAGR) of 28.7% during the forecast period. Clear aligners are a series of tight-fitting custom-made mouthpieces or orthodontic systems that are useful in correcting crowded, misaligned, or crooked teeth. Clear aligners are virtually discreet and removable alternatives to braces designed around patients’ convenience and flexibility. Factors such as the growing patient population suffering from malocclusions, rising technological advancements pertaining to dental treatment, and growing demand for customized clear aligners are driving the overall market growth.

Clear aligners brought in technological advancements and became an effective alternative to traditional braces which has held to its high demand globally. In Australia too, the demand for clear aligners provided by Align Technology and other direct-to-consumer aligner companies has seen a surge, especially among the teen population. This is because clear aligners are more comfortable and are very cheap as compared to conventional metal braces. According to the Sydney Morning Herald, the average cost of a doctor-directed clear aligner system ranges from USD 1,500 to USD 2,500, and metal braces treatment cost is around USD 9,000.

According to Health Government Australia, even though the overall dental health of the country’s population has improved in the last 25 years, there is still room for improvement. They also reported that three out of ten Australians avoid visiting the dentist due to the high cost associated with dental treatments. To tackle this, state and territory governments provide public dental services. From 2018 to 2019, private health insurance providers in the country subsidized over 42.9 million dental services, and over 5.4 million dental services were subsidized under the Australian Government’s Child Dental Benefits Schedule.

Moreover, the Australian government is also increasing its funding for dental services to improve oral health in Australia and has launched National Oral Health Plan 2015 to 2024 to provide more public dental services for adults. Moreover, cosmetic dentistry procedures in Australia have also witnessed an increase. Various factors such as increasing dental disease burden, a large pool of skilled dental practitioners, high access to healthcare service, and growing government initiatives to raise awareness about dental health are expected to boost the growth of the clear aligners market in the country.

According to Orthodontics Australia, 60% of the Australian population perceives that a good smile gives a boost to confidence and 46% of the population would like to change the appearance of their teeth if given the chance. Over half of the Australian population stated that they would smile more if they had a perfect smile and these facts will prove to be a driving factor for the market growth. However, according to Sydney Morning Herald, many industry leaders have warned against direct-to-consumer operators or mail-order aligners that sell directly to consumers without any clinical oversight and may pose an irreversible health risk. This factor will most likely hinder market growth.

The coronavirus outbreak had resulted in historic losses across markets, pushing countries into a financial crisis. According to Oral Health Group, in March 2020, regulators and health authorities ordered all dental offices to immediately stop seeing patients, with an exception for emergency treatment, resulting in office closures and unprecedented revenue declines across the sector. Companies like Align Technologies faced supply chain and distribution hurdles for their clear aligner systems which affected their sales growth. However, the third quarter of 2020 witnessed a gradual increase as the lockdown was eased and dental practices were cautiously resumed, but at capacities less than pre-pandemic levels. As a step to assist doctors and stimulate the demand for their products, in 2020, Align Technology did not implement annual price increases on its clear aligner products.

Australia Clear Aligner Market Trends

The increasing use of clear aligners in orthodontic treatment is the primary factor driving the market growth. Patients preferably choose clear aligners over conventional brackets for orthodontic treatment owing to the superior comfort and dental esthetics offered by the product. In addition, the product facilitates oral hygiene, provides more control on tooth movement, is less painful as compared to fixed orthodontic apparatus, and lacks soft tissue irritation requiring fewer emergency visits which reduces the duration and number of appointments.

However, the inability to treat certain malocclusions has arisen as a limiting factor in the usage of clear aligners. The product is convenient for mild to moderate diastema or crowding or distal tipping of molars. Moreover, dental treatments such as molar uprighting, correction of severe rotations, and others are more challenging to achieve with aligners.

However, rapid technological improvements in production techniques and aligner materials have increased the number of complex cases treated with the use of the product, and are further supporting the market growth. In addition, the increasing demand for orthodontic treatment and rise in awareness of dental esthetics among adults are fueling the demand for esthetic orthodontic treatment techniques thereby, augmenting the demand of the market.

Age Insights

The adults segment held the largest market share of 63.0% in 2020. Based on age, the market is segmented into adults and teens. Dental conditions like malocclusion are prevalent amongst the population and apart from affecting the quality of life, they can also lead to problems such as impaired dentofacial aesthetics, disturbances of oral function such as mastication, swallowing, and speech, and greater susceptibility to trauma and periodontal disease. Nowadays, acceptable aesthetic appearance including dental appearance plays a vital role in society. An increasing concern for dental appearance is seen more among the adolescent population.

An increasing number of Australian teens are adopting clear aligner therapy and according to a survey carried out by Orthodontics Australia, around 55% of Australians are self-conscious about their teeth and 62% are willing to fix their crooked smiles. An increasing concern for dental appearance is seen more among the adolescent population. For these reasons, teenagers are highly opting for clear aligners to get treated for their dental conditions. To date, over 1 million teenagers have started orthodontic treatment with Invisalign clear aligners. These are the factors promoting segmental growth in the country.

End-use Insights

The group practices segment held the highest market share of 50.4% in 2020 and is also expected to register a significant CAGR over the forecast period. The end-use segment is divided into hospitals, stand-alone practitioners, group practices, and direct to consumer.

The group practices segment of end-use reciprocated the largest share in 2020 as such dental settings are readily adopting clear aligner systems and are equipped with advanced digital technologies. According to Grattan Institute, around 7,000 general practitioners are working in Australia, and a majority of these GPs work in private group practices.

Moreover, direct to consumer segment is projected to register the highest CAGR over the forecast period. According to Straumann, the online and direct-to-consumer approach in the future is expected to be the most prominent trend in the market. According to a survey carried out by NCBI, in 2020, a majority of people are opting for DTC (direct-to-consumer) aligners because of the cost and convenience. Social media is playing a crucial role in the growing demand for clear aligners.

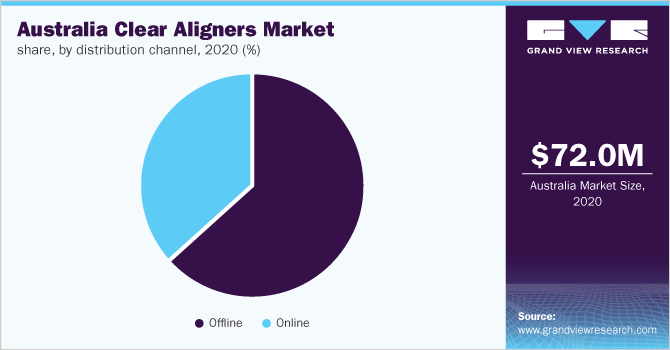

Distribution Channel Insights

The offline distribution segment held the highest market share of 61.6% in 2020. The distribution segment is divided into offline and online. A major portion of the distribution and sales of digitally automated clear aligners is through doctor-directed treatments. These buyers mainly include general dentists, dental hygienists, dental specialists, dental laboratories, orthodontists, DSOs, and third-party distributors. Clear aligners are high technicality products, and it is majorly pitched to dental specialists and therefore offline sales wherein the company is directly selling its products to the dental professional and is then prescribing aligner therapy to a patient held the highest market share.

However, the online distribution segment is expected to witness the highest growth over the forecast period. According to Straumann, the direct-to-patient approach is expected to outpace the conventional doctor-directed approach in the future. In January 2021, Dentsply Sirona acquired Byte, to tap the direct-to-consumer clear aligner market and this acquisition is expected to strengthen its SureSmile business. This is because there has been the emergence of direct to consumer’s aligner companies like SmileDirectClub, Candid, Byte, Smile Love, and SmilePath. However there are still some concerns related to online sales due to minimal clinical supervision and the possibility of irreversible tooth damage; in spite of this, it is still the most promising future trend in the market.

Key Companies & Market Share Insights

The global market is highly competitive and includes players such as Align Technology, Byte, SmilePath, EZSmile, Beam Australia, WonderSmile, and SmileStyler, SmileDirectClub. One of the key factors driving competitiveness among market players in the country is the high adoption of invisible aligners, high government spending on dental care, and the rising adult population. Many clear aligner manufacturers are rapidly opting for strategic expansions and collaborations in the country to capture their foothold in the Australian market. For instance, in April 2020, Byte, which is a direct-to-consumer aligner company, announced its expansion into the Australian market.

Recent Developments

-

In June 2022, Beam’s subsidiary Beam Clear Aligners a Sydney, Australia-based brand acquired anthonyspinkdentalsuite.com.au. The acquisition will boost the company’s mission to make dental care more accessible and affordable for all Australians.

-

In January 2021, Dentsply Sirona a dental equipment and supplies manufacturing company acquired Byte, a clear aligner manufacturing company.

-

In January 2021, SmileDirectClub, Inc. an oral care company, introduced aligners with Comfort Sense™ technology. It is stated to be the company’s patented laser technology.

Some of the key players operating in the Australia clear aligner market are:

-

Align Technology

-

Byte

-

SmilePath

-

EZSmile

-

Beam Australia

-

WonderSmile

-

SmileStyler

-

SmileDirectClub

Australia Clear Aligners Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 91.3 million

Revenue forecast in 2028

USD 534.3 million

Growth Rate

CAGR of 28.7% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2020 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Age, end-use, distribution channel

Country scope

Australia

Key companies profiled

Align technology; Byte; SmilePath; EZSmile; Beam Australia; WonderSmile; SmileStyler; SmileDirectClub

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia Clear Aligner Market SegmentationThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For this study, Grand View Research has segmented the Australia clear aligner market report based on age, end-use, and distribution channel:

-

Age Outlook (Revenue, USD Million, 2016 - 2028)

-

Adult

-

Teenage

-

-

End-use Outlook, (Revenue, USD Million, 2016 - 2028)

-

Hospitals

-

Stand-alone Practices

-

Group Practices

-

Direct to Consumers

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The Australia clear aligners market size was estimated at USD 72.0 million in 2020 and is expected to reach USD 91.3 million in 2021.

b. The global Australia clear aligners market is expected to grow at a compound annual growth rate of 28.7% from 2021 to 2028 to reach USD 534.3 million by 2028.

b. The adult segment dominated the Australia clear aligners market and held the largest revenue share of 62% in 2020.

b. Some key players operating in the Australia clear aligners market include Align technology, Byte, SmilePath, EZSmile, Beam Australia, WonderSmile, SmileStyler, SmileDirectClub.

b. Key factors that are driving the Australia clear aligners market growth include rising incidences of malocclusions, rising advancement in dental health, growing demand for invisible orthodontics, discreet nature of aligners, and its aesthetic appeal.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.