- Home

- »

- Medical Devices

- »

-

Dental Laboratories Market Size, Share, Growth Report 2033GVR Report cover

![Dental Laboratories Market Size, Share & Trends Report]()

Dental Laboratories Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Restorative, Orthodontic), By Material (Metal-Ceramic, Plastic), By Equipment, By Prosthetic Type, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-949-4

- Number of Report Pages: 234

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Laboratories Market Summary

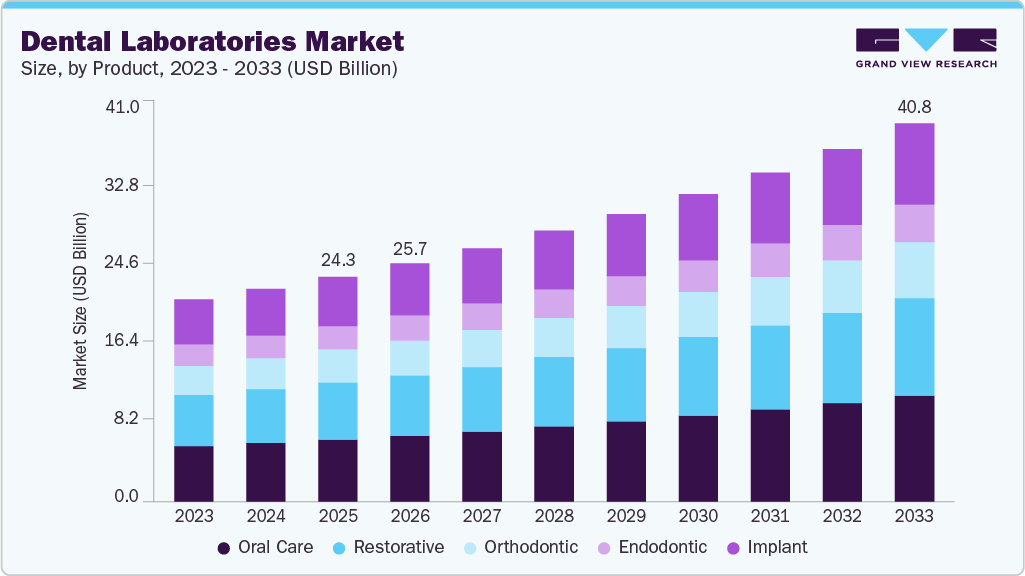

The global dental laboratories market size was estimated at USD 24.26 billion in 2025 and is projected to reach USD 40.76 billion by 2033, growing at a CAGR of 6.80% from 2026 to 2033. The dental laboratories industry is driven by rising demand for restorative and cosmetic dental procedures, supported by an aging population and increasing focus on oral aesthetics.

Key Market Trends & Insights

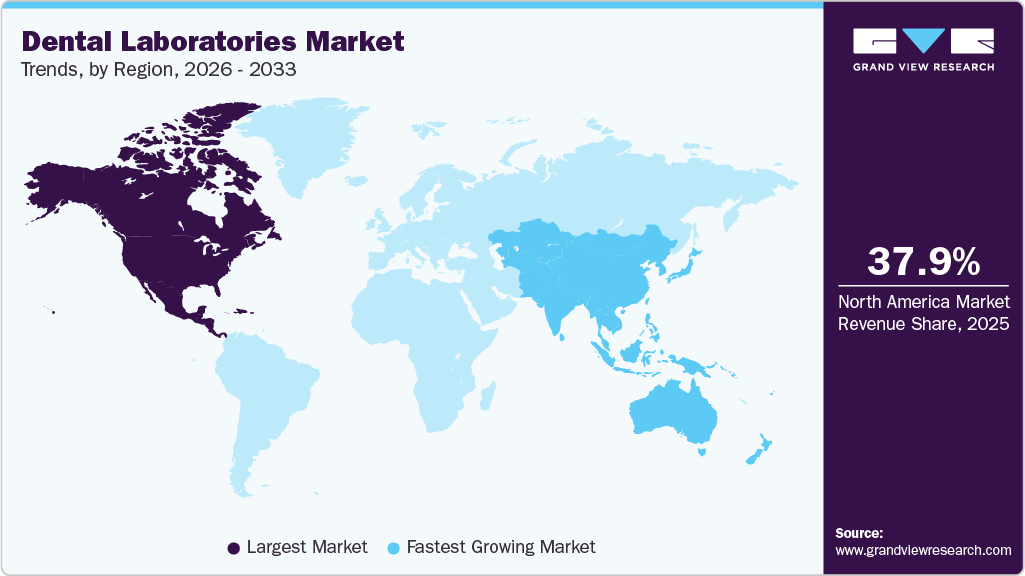

- North America dominated the global dental laboratories market with the largest revenue share of 37.95% in 2025.

- The dental laboratories industry in the U.S. accounted for the largest market revenue share in North America in 2025.

- By product, the oral care segment accounted for the largest market revenue share in 2025.

- By equipment type, the dental lasers segment anticipated to grow at the fastest CAGR during the forecast period.

- By material, the metal ceramics segment accounted for the largest market revenue share in 2025.

- By prosthetic type, the crown segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 24.26 Billion

- 2033 Projected Market Size: USD 40.76 Billion

- CAGR (2026-2033): 6.80%

The rapid adoption of digital dentistry technologies, such as CAD/CAM and 3D printing, is improving efficiency, precision, and customization, thereby further accelerating market growth.According to the State of America’s Oral Health and Wellness Report, preventive dental care remained a top priority for parents in 2025. Nearly 95% of parents reported taking their child to the dentist within the past year, with 94% of those visits primarily focused on preventive care, indicating a strong awareness and proactive approach to oral health among families.

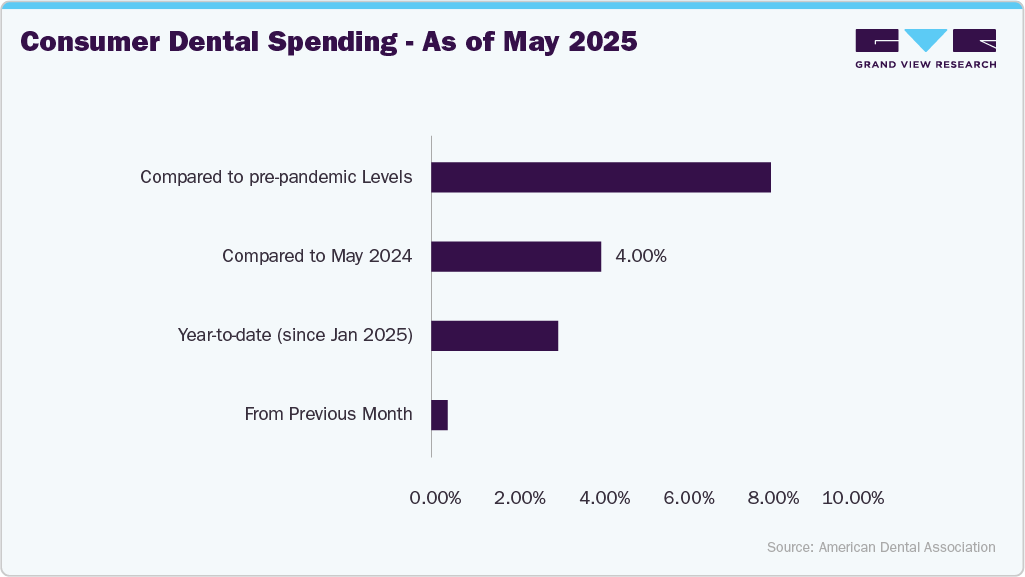

The rising awareness about oral hygiene and increasing dental spending play a significant role in driving the dental laboratories industry. As patients become more informed about preventive care and the long-term benefits of oral health, they are more likely to seek timely dental treatments, including restorative and cosmetic procedures. Higher out-of-pocket spending and greater acceptance of elective treatments such as crowns, veneers, and implants increase demand for laboratory-fabricated dental prosthetics. This growing patient willingness to invest in oral care directly supports higher case volumes and sustained growth for dental laboratories.

An aging population and the rising prevalence of tooth loss and dental disorders are key drivers of the dental laboratories industry. Older adults are more prone to conditions such as edentulism, periodontal disease, and tooth wear, which increase the need for crowns, bridges, dentures, and implant-supported restorations. As life expectancy increases, demand for durable, functional, and aesthetically pleasing dental prosthetics rises, leading to a higher reliance on laboratory-fabricated solutions. This demographic trend results in sustained case volumes and long-term demand growth for dental laboratory services.

The rapid adoption of digital dentistry technologies is a major driver of the dental laboratories industry, as they transform traditional workflows into faster, more precise, and scalable processes. Technologies such as CAD/CAM systems, intraoral scanning, and 3D printing enable laboratories to produce highly customized restorations with improved accuracy and shorter turnaround times. Digital integration also reduces errors, enhances collaboration with dental clinics, and increases overall productivity, making laboratory services more efficient and attractive. As a result, digitally enabled laboratories are experiencing higher case volumes and gaining competitive advantages, thereby supporting market growth.

In April 2025, Yage Wu, DDS, highlighted five key technological advancements in dentistry that are directly influencing the dental laboratory market, driving greater adoption of digital workflows, CAD/CAM systems, 3D printing, and advanced dental materials for faster, more precise, and cost-efficient restorations.

-

Digital Impressions Instead of Physical Molds

-

Intraoral Cameras for Accurate and Patient-Friendly Diagnoses

-

Cone Beam 3D Imaging for Better Diagnostics

-

Smart Toothbrushes for Better At-Home Care

-

Accurate Root Canal Treatments with Electronic Apex Locators

According to Adams Cameron Park Dentistry, in August 2025, advances in dental technology—including digital radiography, CEREC (Chairside Economical Restoration of Esthetic Ceramics) restorations, and CBCT (Cone Beam Computed Tomography) imaging have significantly transformed dental care by enabling faster, safer, and more precise treatments with improved patient outcomes. Understanding these technological shifts is crucial to modern dentistry, as they enable quicker diagnoses, shorter treatment times, and enhanced patient comfort, all while maintaining high standards of clinical accuracy and quality.

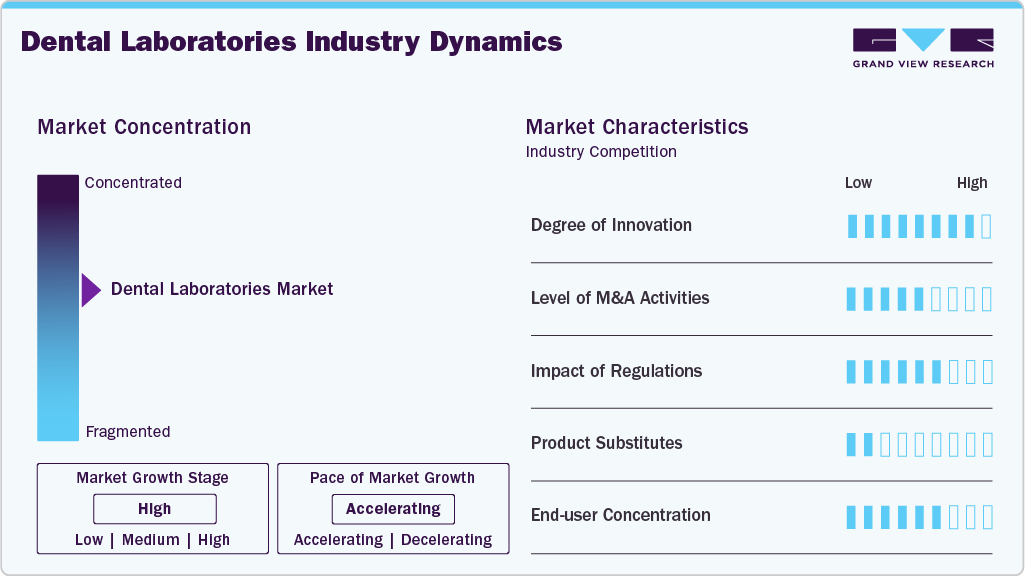

Market Concentration & Characteristics

The dental laboratories industry demonstrates a moderate to high degree of innovation, driven by the rapid adoption of digital dentistry technologies. Advances in CAD/CAM systems, 3D printing, digital design software, and new restorative materials are revolutionizing laboratory workflows, enhancing precision and reducing turnaround times. For instance, in February 2025, 3D Systems announced a range of innovations it plans to present at LMT Lab Day 2025, including the NextDent Jetted Denture Solution for multi-material, monolithic dentures, along with previews of solutions for night guards and directly printed aligners. Recognized for its strong presence in digital dentistry, the company continues to advance the industry through one of the broadest portfolios of integrated solutions, enabling dental laboratories and clinics to manufacture patient-specific devices efficiently. Its expansion into dentures and future applications such as night guards and direct-printed aligners further strengthens its position in digital dental manufacturing and innovation.

The dental laboratories industry exhibits a moderate level of merger and acquisition activity, as companies seek to consolidate and enhance scale and operational efficiency. Acquisitions are commonly used to expand regional presence, broaden service offerings, and strengthen ties with dental service organizations. This consolidation trend is supporting standardized quality, improved digital integration, and a more organized competitive environment. For instance, in September 2025, SprintRay, a global provider in dental 3D printing, announced the acquisition of the EnvisionTEC / ETEC dental product portfolio (formerly part of Desktop Health). The acquisition includes patents, trademarks, inventory, and other intellectual property related to dental materials and 3D printing technologies. This strategic move highlights SprintRay’s strong focus on dentistry and reinforces its commitment to delivering advanced, reliable hardware and regulatory-compliant resins to dental professionals worldwide.

"SprintRay's acquisition of EnvisionTEC's dental portfolio ensures existing customers continue to have the tools and support they rely on, while also strengthening our position in dental labs," said Amir Mansouri, PhD, SprintRay Co-founder and CEO. "Our mission to transform dentistry through accessible, reliable 3D printing technology hasn't wavered. This strategic move reinforces that commitment."

Regulatory frameworks have a significant impact on the dental laboratories industry by governing material safety, product quality, and traceability of dental restorations. Compliance with medical device regulations, infection control standards, and documentation requirements increases operational complexity and costs, particularly for smaller laboratories. Furthermore, clear regulatory standards help improve product consistency, patient safety, and confidence in laboratory-fabricated dental solutions, supporting long-term market stability. For instance, during an FDA inspection from October 29 to December 20, 2024, it was determined that firm manufactures the ResetSmile Partial Denture Device and the at-home ResetSmile Impression Kit Device, which are classified as medical devices under Section 201(h) of the Federal Food, Drug, and Cosmetic Act (21 U.S.C. § 321(h)) because they are intended to affect the structure or function of the body.

The dental laboratories industry exhibits a high concentration of end-users, primarily among dental clinics and dental service organizations (DSOs), which collectively account for the majority of laboratory orders. These providers rely heavily on outsourced laboratory services for crowns, bridges, dentures, and implant-supported restorations. Large multi-clinic groups contribute significantly to volume demand, while smaller independent practices create steady, recurring orders. This concentration supports predictable workflows but also increases pricing and service-level pressure on laboratories.

-

Approximately 18.1 million adults received care from an NHS dentist during the 24 months ending 30 June 2023.

-

Around 6.4 million children received care from an NHS dentist during the 12 months ending 30 June 2023.

-

A total of 32.5 million courses of treatment were delivered in 2022-23, representing a 23.2% increase compared to the previous year.

The high number of adults and children accessing NHS dental services, along with the significant increase in courses of treatment delivered, reflects strong patient footfall and treatment volumes concentrated within dental clinics. This end-user concentration drives sustained demand for prosthetics, crowns, bridges, and orthodontic appliances, thereby supporting consistent workflow and revenue growth for the dental laboratories industry.

Product Insights

The oral care segment led the market with the largest revenue share of 27.68% in 2025, driven by the high and consistent demand for crowns, bridges, dentures, and orthodontic appliances required for routine and restorative dental care. The rising prevalence of dental caries, periodontal diseases, and tooth loss, particularly among aging populations, supported sustained laboratory workloads. Furthermore, increasing adoption of CAD/CAM and digital workflows in oral care applications improved turnaround times and accuracy, further reinforcing the segment’s leading market position.

As oral care demand continues to rise, registrations by specialty type in 2025 reflect this growth, as summarized in the table below, highlighting increased participation across key dental specialties driven by higher patient volumes and expanding oral healthcare needs.

Specialty Description

Male

Female

Total

Orthodontics

634

747

1,381

Pediatric Dentistry

43

222

265

Periodontics

261

145

406

Prosthodontics

335

110

445

Restorative Dentistry

219

89

308

Special Care Dentistry

60

195

255

Total

1,552

1,508

3,060

Source: GDC UK

The orthodontic segment is anticipated to grow at the fastest CAGR during the forecast period. Driven by increasing demand for aesthetic and digitally customized solutions such as clear aligners and advanced functional appliances. The adoption of digital workflows, including intraoral scanning and 3D printing, enables labs to deliver faster turnaround times with greater precision, particularly for complex orthodontic cases. In addition, heightened patient awareness of orthodontic treatment options and broader insurance coverage are fueling sustained growth in this segment. For instance, in December 2025, a collaborative study conducted by Graphy Inc. and the University of Bonn confirmed the efficiency and reproducibility of Graphy’s Shape Memory Aligner (SMA) in correcting anterior tooth rotations without the use of attachments. The research introduced an innovative preclinical evaluation model based on an electro-typodont, enabling quantitative assessment of rotational correction performance.

Material Insights

The metal ceramics segment accounted for the largest market revenue share in 2025. Due to its long-established clinical reliability, cost-effectiveness, and widespread acceptance among dentists. Metal-ceramic restorations remain the preferred choice for posterior crowns and bridges, where high strength, durability, and load-bearing performance are crucial. In addition, the existing infrastructure and technical expertise within dental laboratories support consistent demand for metal-ceramic solutions, reinforcing the segment’s leading market position. For instance, in October 2025, Lucky Dental Lab highlighted that metal-ceramic (PFM) crowns remain widely used due to their strength and reliability, combining metal alloys with porcelain veneers. However, their role is gradually evolving as newer ceramic materials and changing patient preferences influence restorative choices.

A five-year clinical trial published in July 2025 reported that porcelain-fused-to-metal (PFM) crowns achieved a 100% survival rate, comparable to newer zirconia restorations, although they showed a higher incidence of minor ceramic chipping. Their proven durability and lower treatment costs, approximately $1,500-$2,800 per crown in Auckland, compared with $3,500 or more for zirconia, continue to support strong demand for posterior restorations. However, aesthetic limitations such as visible metal margins and potential discoloration have reduced their use in anterior teeth, where all-ceramic crowns are now the preferred option.

As digital dentistry continues to evolve, PFM crowns are being produced using CAD/CAM technologies, enabling greater precision and customization. However, they face growing competition from 3D-printed zirconia restorations, which support faster workflows and even same-day placement. The decision between PFM and all-ceramic crowns depends on individual patient preferences, cost considerations, and oral health requirements. Dentists place greater emphasis on personalized treatment planning to strike a balance between strength and aesthetics.

The CAD/CAM materials segment is anticipated to grow at the fastest CAGR during the forecast period, driven by increasing adoption of digital workflows and demand for high-precision restorations. Enhanced material options such as advanced zirconia, lithium disilicate, and hybrid ceramics are enabling laboratories to produce stronger, more aesthetically pleasing prosthetics with greater efficiency. As dental professionals seek faster turnaround times and improved consistency, investment in CAD/CAM technology and materials continue to accelerate across laboratories worldwide. For instance, in December 2025, Leaders Dental Laboratory highlighted the accelerating growth of the global CAD/CAM-based digital prosthetics market, noting the increasing importance of laboratories with advanced automation and high-precision manufacturing capabilities. By leveraging extensive clinical case experience and deep expertise in operating advanced digital equipment, the laboratory is strengthening its competitive position within the global digital prosthetics landscape.

Equipment Insights

The system and parts segment accounted for the largest market revenue share in 2025, driven by the widespread adoption of digital manufacturing infrastructure, including CAD/CAM systems, milling machines, scanners, and 3D printers. Continuous upgrades, maintenance requirements, and replacement of critical components sustained strong demand across established and emerging laboratories. In addition, the shift toward fully digital workflows increased reliance on integrated systems and high-performance parts, reinforcing the segment’s leading market position.

The dental lasers segment is anticipated to grow at the fastest CAGR during the forecast period, driven by increasing adoption of laser-assisted procedures that enhance precision and reduce processing time. As laboratories integrate laser technology for tasks such as cutting, trimming, and surface modification, they can deliver higher-quality dental prosthetics with improved fit and aesthetics. The growing interest in digital and minimally invasive workflows, combined with technological advancements that make lasers more accessible and cost-effective, is further accelerating the adoption of dental laser systems across dental labs. According to Dentistry, in August 2025, growing awareness of the therapeutic benefits of light-based treatments is driving rapid adoption of lasers in dentistry. Patients are opting for minimally invasive laser procedures over conventional methods, drawn by faster healing, shorter recovery times, and reduced discomfort.

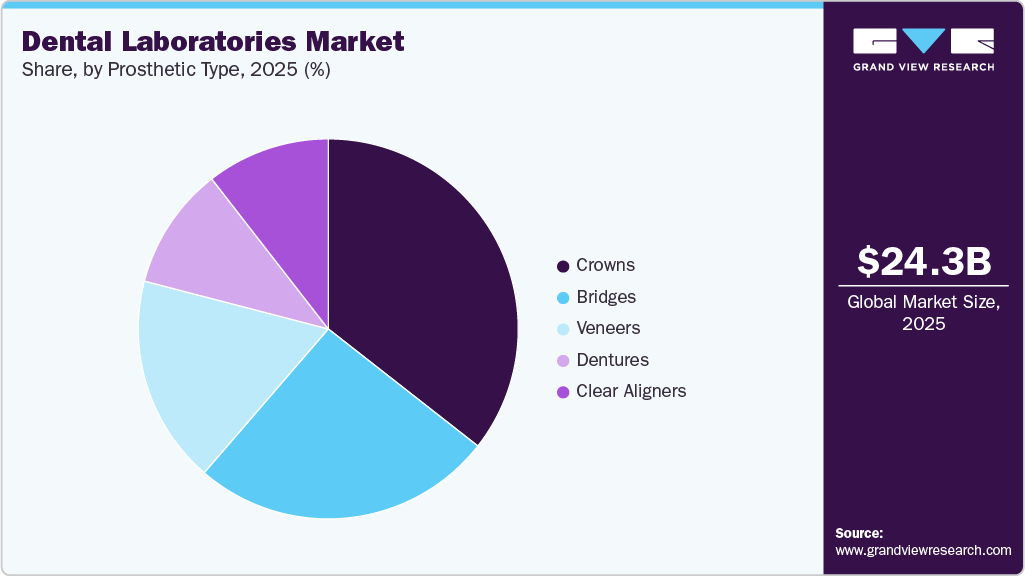

Prosthetic Type Insights

The crowns segment accounted for the largest market revenue share in 2025, due to their widespread use in restorative dentistry. Crowns are custom-made caps that cover a damaged or decayed tooth, restoring its shape, size, strength, and appearance. They are highly versatile and can be crafted from various materials such as metal, porcelain-fused-to-metal (PFM), all-ceramic, or zirconia, catering to different patient needs and preferences. In addition, the increasing demand for cosmetic dentistry and the growing awareness among patients about the benefits of dental prosthetics further propel the dominance of crowns. According to Fundamental Dental, in October 2025, dental crowns remain a cornerstone of restorative dentistry, supported by significant advances in materials, digital technologies, and clinical techniques. These innovations have transformed the design and placement of crowns, enabling greater precision and efficiency. As a result, patients benefit from quicker procedures, improved comfort, and more durable, long-lasting restorative outcomes.

The bridges segment is estimated to register at the fastest CAGR over the forecast period. Dental bridges are prosthetic devices that consist of two or more crowns, anchoring onto adjacent teeth implants to bridge the gap caused by one or more missing teeth. The rising prevalence of tooth loss, whether due to decay, trauma, or age-related factors, has fueled the demand for the bridges as a reliable and aesthetically pleasing solution.

Regional Insights

North America dominated the global dental laboratories market with the largest revenue share of 37.95% in 2025. This can be attributed to the rising demand for restorative, cosmetic, and implant dentistry, supported by an aging population and a high prevalence of dental disorders. The widespread adoption of digital dentistry technologies, including CAD/CAM systems, intraoral scanning, and 3D printing, is enhancing productivity, precision, and turnaround times for dental laboratories. A strong dental healthcare infrastructure, higher spending on oral care, and the growing presence of dental service organizations (DSOs) are further driving outsourcing to laboratories. Furthermore, patient preference for customized, high-quality dental prosthetics continues to drive market growth across the region.

U.S. Dental Laboratories Market Trends

The dental laboratories market in the U.S. is driven by strong demand for restorative and cosmetic dental procedures, including crowns, bridges, dentures, and implant-supported prosthetics. An aging population, a high prevalence of tooth loss, and a growing preference for aesthetic dentistry are increasing the reliance on laboratory services. The rapid adoption of digital dentistry technologies, such as CAD/CAM, intraoral scanning, and 3D printing, is improving efficiency and customization. Meanwhile, outsourcing by dental clinics and dental service organizations (DSOs) continues to support sustained market growth.

Prevalence and Impact of Severe Tooth Loss Among Adults Aged 65 and Older in U.S. (2024)

Indicator

Statistic

Adults aged ≥65 with 8 or fewer teeth

26% (approximately one in four older adults)

Adults aged ≥65 with complete tooth loss (edentulism)

15% (more than one in seven)

Higher prevalence of total tooth loss observed among

Non-Hispanic Black adults, individuals with lower income, those with a high school education or less, and current smokers

Source: CDC

Europe Dental Laboratories Market Trends

The dental laboratories market in Europe is driven by rising demand for restorative, cosmetic, and implant dentistry, supported by an aging population and increasing focus on oral aesthetics. The growing adoption of digital dentistry technologies, including CAD/CAM systems, intraoral scanning, and 3D printing, is enhancing accuracy, productivity, and turnaround times for laboratories. Strong dental healthcare infrastructure, high treatment standards, and increasing private dental expenditure further support market growth. In addition, expanding use of implant-supported prosthetics and outsourcing by dental clinics are reinforcing demand for advanced laboratory services across the region.

The UK dental laboratories market is being shaped by rising demand for aesthetic and restorative treatments, especially implant-supported prosthetics and cosmetic dentistry. The increasing adoption of digital dentistry technologies, such as CAD/CAM, intraoral scanning, and 3D printing, is enhancing precision and reducing turnaround times. Collaboration between dental practices and labs is strengthening, supported by professional standards and quality-driven service expectations. Growth in private dental care and cosmetic procedures is contributing to an increase in laboratory service needs nationwide.

The table below presents key indicators highlighting the oral health status and dental disease burden in the UK, reflecting the widespread prevalence of dental conditions across the population. These statistics underscore the ongoing impact of oral diseases on public health and daily life.

Key Oral Health Statistics and Dental Disease Burden in the UK (2025)

Indicator

Statistic

Average school days are missed annually due to dental problems

3 days

Adults who do not visit the dentist regularly

39% (almost two in five)

Adults with visible plaque

66% (two in three)

Adults who do not brush twice daily with fluoride toothpaste

25% (one in four)

Adults with tooth decay

31% (almost one in three)

Adults who have had a tooth extracted

74% (around three in four)

New cases of mouth cancer each year

8,772 cases

UK adults experiencing long-lasting toothache (over two weeks) in the past year

~6 million adults

Source: National Smile Month

The dental laboratories market in France is progressing, driven by rising demand for advanced restorative and aesthetic dental treatments, as well as a strong awareness of oral health. Increasing use of digital workflows, including CAD/CAM and 3D printing, is improving accuracy, efficiency, and turnaround times. Well-established dental infrastructure and closer collaboration between clinics and laboratories are reinforcing service quality, while growing adoption of implant-based and premium cosmetic solutions continues to drive market growth.

Asia Pacific Dental Laboratories Market Trends

The dental laboratories market in the Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period, driven by increasing demand for cosmetic, restorative, and implant dentistry as oral health awareness continues to grow across the region. The rising adoption of digital dentistry technologies, such as CAD/CAM systems and 3D printing, is enhancing lab efficiency and service quality. Investments in dental infrastructure and training, along with a growing middle-class population, are further boosting market growth. The expansion of dental insurance coverage and cross-border service collaborations is creating new opportunities for laboratory services.

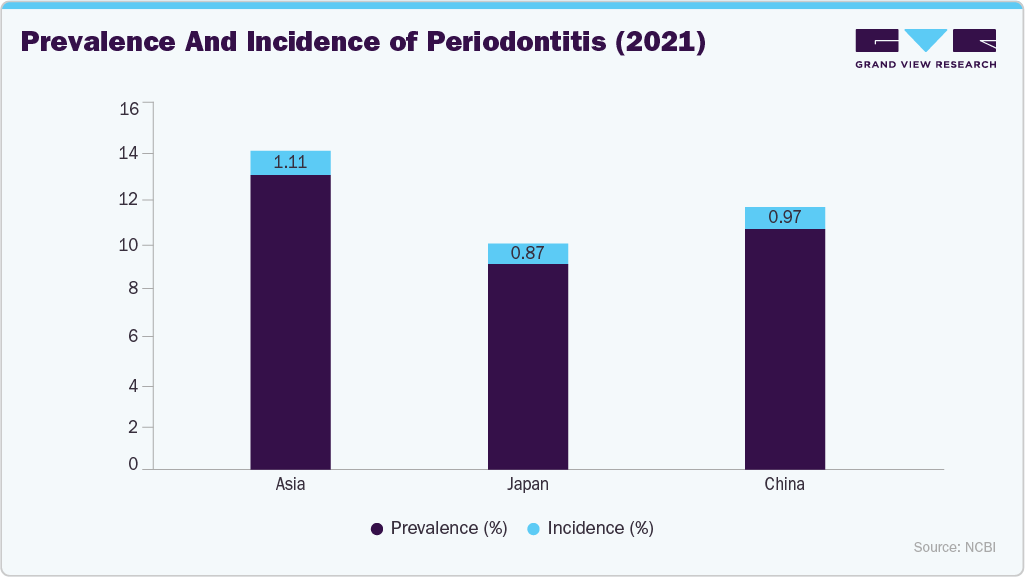

The China dental laboratories market is growing rapidly, driven by rising demand for dental services, an increasing focus on cosmetic and implant dentistry, and expanding middle-class healthcare spending. The adoption of digital technologies, such as intraoral scanning, CAD/CAM systems, and 3D printing, is accelerating, improving precision and efficiency in laboratory workflows. Furthermore, growing partnerships between dental clinics and labs are strengthening service networks, while urbanization and improved insurance coverage support broader access to advanced dental solutions. According to the NCBI, in 2021, China reported approximately 18,295,038 new cases of severe periodontitis, with the total number of prevalent cases reaching about 220,238,287, underscoring the substantial national burden of periodontal disease.

Latin America Dental Laboratories Market Trends

The dental laboratories market in Latin America is experiencing significant growth as oral health awareness and demand for aesthetic dentistry rise among expanding middle-class populations. Increased investments in dental clinics and the adoption of digital technologies, such as CAD/CAM systems, are improving service quality and reducing turnaround times. However, cost sensitivity and uneven access to advanced equipment result in varying growth rates across countries. Partnership opportunities with dental service providers and rising interest in implant-supported prosthetics are further supporting market development. According to the National Library of Medicine, in November 2024, the prevalence of severe periodontitis among adults ranged widely from 5.8% to 49.7%, reflecting significant variation across populations. The same source reported that 15.3% of adolescents were affected by moderate to severe periodontitis, highlighting the growing burden of periodontal disease across age groups.

MEA Dental Laboratories Market Trends

The dental laboratories market in the Middle East & Africa is experiencing significant expansion, driven by increasing oral healthcare awareness and rising spending on dental services in urban areas. Demand for cosmetic, restorative, and implant dentistry is driving higher utilization of laboratory services. The adoption of digital workflows, such as CAD/CAM and 3D printing, is gradually increasing, although uptake varies due to cost and infrastructure limitations. The growth of dental tourism and private clinic investments is creating new opportunities for growth across the region. For example, in November 2025, a study published by Springer found that the UAE ranked second in the GCC region for adult tobacco smoking prevalence, with 34.9% of males and 1.6% of females identified as smokers. The analysis indicated a 3.34% relative risk of lip and oral cavity cancer among tobacco users, rising markedly to 12% overall when cancers of the pharynx and nasopharynx were included.

Key Dental Laboratories Company Insights

The dental laboratories industry is moderately fragmented, with market share distributed among large, organized laboratories and a wide base of small and mid-sized regional players. Larger labs hold a significant share due to their scale, standardized processes, and strong relationships with dental clinics and service organizations. In comparison, smaller labs compete through customization, faster turnaround times, and niche expertise. The increasing adoption of digital dentistry is gradually shifting market share toward technologically advanced laboratories, while consolidation continues to shape competitive dynamics.

Key Dental Laboratories Companies:

The following are the leading companies in the dental laboratories market. These companies collectively hold the largest Market share and dictate industry trends.

- Envista Holdings Corporation

- Dentsply Sirona

- A-dec Inc.

- Straumann AG

- 3M

- Glidewell

- Ivoclar Vivadent

- Keystone Industries

- Garreco, LLC.

- GCDL Complete Dental Solutions

- 3D Systems, Inc.

- ZimVie Inc.

- SprintRay Inc.

- DDS Lab

- Lucky Dental Lab

- The Dental Lab

- Advance Dental Export

- BioHorizons

- Modern Dental Pacific Group

- Fotona

- BIOLASE MG LLC.

- Carestream Dental LLC

- 3Shape A/S

- Dantech Digital Dental Solutions Pvt. Ltd.

- Institut Straumann AG

- DentiumUSA

- Apex Dental Laboratory Group

- Solventum

- Planmeca Oy

- GC Corporation

- Align Technology, Inc.

- Neoss Inc

Recent Developments

-

In December 2025, Shinoda Dental, a well-established supplier of dental equipment and laboratory tools, announced the signing of a Memorandum of Understanding (MOU) with a leading international manufacturer of dental milling machines. Through this strategic agreement, Shinoda Dental aims to strengthen its support for dental laboratories and clinics by expanding access to advanced, reliable CAD/CAM systems, reinforcing its commitment to delivering high-quality digital dentistry solutions.

-

In September 2025, SprintRay, a global provider in dental 3D printing, announced the acquisition of the EnvisionTEC / ETEC dental product portfolio (formerly part of Desktop Health). The acquisition includes patents, trademarks, inventory, and other intellectual property related to dental materials and 3D printing technologies. This strategic move highlights SprintRay’s strong focus on dentistry and reinforces its commitment to delivering advanced, reliable hardware and regulatory-compliant resins to dental professionals worldwide.

-

In July 2025, ZimVie Inc., a global leader in the life sciences sector, specifically in the dental implant market, announced that it had entered into a definitive agreement to be acquired by an affiliate of ARCHIMED, an investment firm dedicated exclusively to the healthcare sector. Under the terms of the merger agreement, ZimVie shareholders will receive $19.00 in cash per share, valuing the transaction at an enterprise value of approximately $730 million. The offer represents a 99% premium to ZimVie’s 90-day volume-weighted average share price of $9.57, underscoring the strategic value of the company within the global dental implant industry.

-

In February 2025, Zahn Dental, the U.S. dental laboratory division of Henry Schein, Inc., announced its participation at LMT LAB DAY 2025, where it will highlight the latest advancements in dental laboratory technologies. The company will also host expert-led panel discussions and interactive educational workshops designed to help dental laboratories improve operational efficiency and profitability.

-

In September 2024, Mesirow, an independent, employee-owned financial services firm, announced that it served as the exclusive financial advisor to Golden Ceramic Dental Lab in connection with its recapitalization with The Zabel Companies, a private investment firm headquartered in Charlotte.

-

In May 2024, Keystone Industries and Carbon announced an expansion of their partnership with the validation of KeyMask for Carbon M-Series printers. KeyMask offers high strength, flexibility, and natural aesthetics, delivering durable and lifelike representations of gingival tissue. Compatibility with Carbon’s M-Series printers allows dental laboratories to improve digital restoration planning through accurate, low-shrinkage, and easily trimmable gingival masks. This advancement is expected to enhance efficiency and precision in prosthetic and restorative dental workflows.

-

In June 2023, A-dec announced a major milestone in dental equipment with the introduction of its first digitally connected dental chair and delivery systems. The launch of the A-dec 500 Pro and A-dec 300 Pro platforms marks the company’s entry into connected solutions, enabling enhanced workflow integration, real-time system insights, and improved operational efficiency for modern dental practices.

Dental Laboratories Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 25.70 billion

Revenue forecast in 2033

USD 40.76 billion

Growth rate

CAGR of 6.80% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, equipment, prosthetic type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Envista Holdings Corporation; Dentsply Sirona; A-dec Inc.; Straumann AG; 3M; Glidewell; Ivoclar Vivadent; Keystone Industries; Garreco, LLC.; GCDL Complete Dental Solutions; 3D Systems, Inc.; ZimVie Inc.; SprintRay Inc.; DDS Lab; Lucky Dental Lab; The Dental Lab; Advance Dental Export, BioHorizons, Modern Dental Pacific Group, Fotona, BIOLASE MG LLC., Carestream Dental LLC, 3Shape A/S, Dantech Digital Dental Solutions Pvt. Ltd., Institut Straumann AG, DentiumUSA, Apex Dental Laboratory Group, Solventum, Planmeca Oy, GC Corporation, Align Technology, Inc., Neoss Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase option

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Laboratories Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global dental laboratories market report based on the product, material, equipment, prosthetic type, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Restorative

-

Orthodontic

-

Endodontic

-

Oral care

-

Implant

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Metal Ceramics

-

Traditional All Ceramics

-

CAD/CAM Materials

-

Plastic

-

Metals

-

-

Equipment Outlook (Revenue, USD Million, 2021 - 2033)

-

Dental Radiology Equipment

-

Dental Lasers

-

System and Parts

-

3D Printing Systems

-

Integrated CAD/CAM Systems

-

Other Systems and Parts

-

-

Laboratory Machines

-

Casting Machines

-

Milling Equipment

-

Furnaces

-

Articulators

-

Other Laboratory Machines

-

-

Dental Scanners

-

Others

-

-

Prosthetic Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Bridges

-

Crowns

-

Veneers

-

Dentures

-

Clear Aligners

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the dental laboratories market include Dental Services Group; Lord’s Dental Studio; Dentsply Sirona Inc.; Straumann; Henry Schein Inc.; National Dentex Corp; Danaher Corporation; Champlain Dental Laboratory; and Modern Dental Laboratory.

b. Key factors that are driving the dental laboratories market growth include increasing demand for cosmetic dental procedures along with a rise in the geriatric population.

b. The global dental laboratories market size was estimated at USD 24.26 billion in 2025 and is expected to reach USD 25.70 billion in 2026.

b. The global dental laboratories market is expected to grow at a compound annual growth rate of 6.81% from 2026 to 2033 to reach USD 40.76 billion by 2033.

b. North America dominated the dental laboratories market with a share of 38.04% in 2025. This is attributable to the presence of sophisticated medical infrastructure and supportive government initiatives in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.