- Home

- »

- Next Generation Technologies

- »

-

Australia Commercial Drone Market, Industry Report, 2030GVR Report cover

![Australia Commercial Drone Market Size, Share & Trends Report]()

Australia Commercial Drone Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Application, By End-use, By Propulsion Type, By Range, By Operating Mode, By Endurance, And Segment Forecasts

- Report ID: GVR-4-68040-251-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Australia Commercial Drone Market Trends

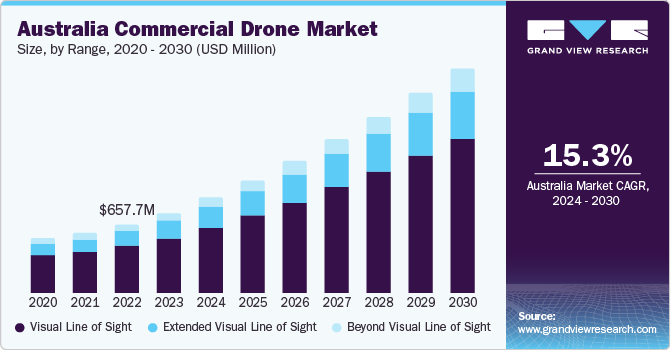

The Australia commercial drone market size was estimated at USD 772 million in 2023 and is expected to grow at a CAGR of 15.3% from 2024 to 2030. Due to the increasing application of drones in various industries such as agriculture, delivery and logistics, energy, etc., the market is rapidly growing. Commercial drones can complete their tasks efficiently and can help reduce staff costs. These are battery-powered, hence these drones provide an environment-friendly way of performing tasks.

Drones are increasingly being adopted in several sectors. For instance, in the construction and real estate sectors, they can perform monitoring, surveillance and the survey of property, and can offer constant project alerts with accuracy. Technological advancements have made it possible for companies to design and construct measurement and annotation tools for estimating area, volume, and distance.

Artificial Intelligence (AI) and Machine Learning (ML) solutions are also being applied to retrieve accurate findings from large volumes of data. Integration of these modern technologies facilitates real-time and data-driven decision-making as these drones allow users to interact and observe footage captured by other drones in real-time and track their flight paths.

Apart from the above-mentioned advantages, these drones offer many more benefits. These machines are always operational and they also perform dangerous tasks instead of human, hence reducing the risk. Drones can also get to hard-to-reach areas more efficiently than humans. These features are expected to propel the market for commercial drones in Australia.

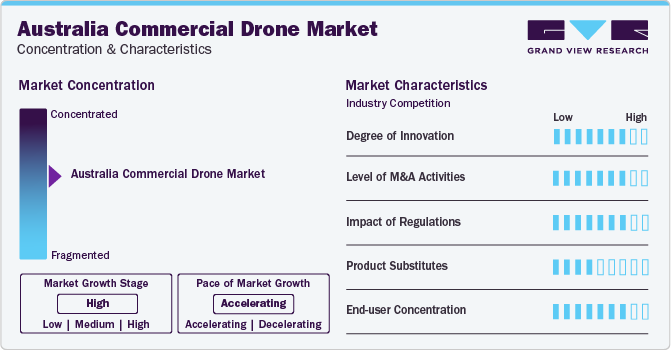

Market Concentration & Characteristics

The degree of innovation is high in the market. Companies are deploying modern computing, microcontrollers, processors, mobile hardware, and cameras in their products. For instance, in September 2022, AeroVironment Inc. launched Vapor 55MX, a next-generation VAPOR Helicopter that caters to customers from the defense, commercial, and industrial sectors.

The market is characterized by a moderate to high degree of merger and acquisition activities. For instance, in April 2020, Draganfly announced the acquisition of Dronelogics Systems. This acquisition helps Draganfly expand the product offering in the integration and engineering segments.

Impacts of regulation is also high on the market. Australia’s Civil Aviation Safety Authority (CASA) has set some general rules for flying drones in the country. For instance, flying of drone is allowed during the day time and within visual line-of-sight. Flying of drones is restricted 120 meters above the ground and recording of video of photograph people is not allowed without their consent. Commercial flying of drone also requires a remote pilot’s license RePL and a certified operator.

End-use concentration is also high in the market as these drones are used in industries such as agriculture, delivery & logistics, energy, media & entertainment, real estate & construction, and security & law enforcement among others. There is a minimal threat of product substitute on the market as the demand for commercial drones is rising due to their versatility and applications.

Application Insights

Based on applications, the market can be segmented into commercial and government & law enforcement. The commercial segment dominated the market with the largest revenue share of over 75% in 2023. Drones are mostly used in filming & photography for shooting movies by photographers. Today small and light-weight drones are being developed by manufacturers for capturing high-quality images for professional photographers. Inspection & maintenance, mapping & surveying, precision agriculture, surveillance & monitoring are some other applications of the segment.

The government & law enforcement segment is expected to grow at the highest CAGR over the forecast period due to the growing adoption of drones in firefighting & disaster management, search & rescue, maritime security, border patrol, police operations, and traffic monitoring, etc. These drones can be deployed in complex rescue and emergency operations and assist emergency responders with quick responses and safe evacuations processes.

Product Insights

The rotary blade segment dominated the market with the largest revenue share in 2023. This can be attributed to their use in inspection activities due to their ability to hover and maneuver with agility, while maintaining visual observation for prolonged periods. These drones are also used in small and confined spaces with no special requirement for take-off and landing as they can take-off and landing vertically. They are also easier to control than hybrid and fixed-wing drones.

The hybrid segment is expected to grow at the highest CAGR over the forecast period. These drones are used for long-range and heavy payload application, even in severe weather conditions, which often include crop inspection and search & rescue (SAR) operations. These drones have the features of both fixed-wing and rotary-blade drones which makes them more efficient, which is expected to drive the segment growth over the forecast period.

End-use Insights

The media & entertainment segment dominated the market with the largest revenue share in 2023. The media & entertainment industry is the biggest end-user of commercial drones. Filmmakers use drones for stunning aerial photography and cinematography. Apart from news gathering, in countries like Australia, drones are also used for making wildlife documentaries as they can capture natural behavior of wild animals, which gives authentic footages.

The delivery and logistics segment is expected to grow at the highest CAGR over the forecast period. Drones have redefined conventional logistics methods by adding more speed and efficiency to the process and by reducing shipping and operational costs significantly. Drones also increase the access as they can reach remote and rural areas quickly.

Range Insights

The visual line of sight (VLOS) segment dominated the market with the largest revenue share in 2023. Visual line of sight simply means the visual contact the pilot must maintain with the aircraft at all times during its flight. It helps the pilot see the drone without any unaided vision, such as binoculars or any other devices. It ensures that the pilot can monitor the drone's position, altitude, and flight path effectively, avoiding collisions. The segment growth can be attributed to government legislations regarding the operations of drones for commercial purposes.

The beyond visual line of sight (BVLOS) segment is expected to grow at the highest CAGR over the forecast period. Drones are being used for long distances and complex commercial tasks, and the beyond visual line of sight abilities of these drones enable operators to use them in increasing instances. This facility enables drones to cover far greater distances which improves the economics and feasibility of the operation significantly.

Operating Mode Insights

Based on operating mode, the remotely piloted segment dominated the market with the largest revenue share in 2023. This operating mode is beneficial in agriculture, videography, surveillance, delivery services, infrastructure monitoring, etc. The growing trend of manual drone operation is anticipated to drive the segment growth as a pilots operate the device remotely, using a console.

The fully autonomous segment is expected to grow at the fastest CAGR over the forecast period. Such drones can perform operations without any human intervention and can complete the maneuvers entirely on their own, including take-off and landing. These drones rely on onboard sensors and AI algorithms to perform these tasks. In addition, multiple autonomous drones can be deployed simultaneously, working in a coordinated pattern, covering large areas to perform critical tasks.

Endurance Insights

Based on endurance, the less than 5 hours segment dominated the market with the largest revenue share in 2023. Commercial drones carrying payloads and equipment for various applications come under this segment. For instance, pesticide spraying drone in the agriculture sector and drones being used for surveillance are expected to add to the segment’s growth.

The 5 - 10 hours segment is expected to grow at the highest CAGR over the forecast period. This growth is majorly due to the capability of such drones to carry larger payloads for long time. Enterprises that require large amounts of data gathering and monitoring use such drones.

Propulsion Type Insights

Based on propulsion type, the electric propulsion segment dominated the market with the largest revenue share in 2023. Electric drones with rechargeable batteries are becoming popular among users, as these drones offer numerous advantages such as quiet operations, flight efficiency, longer flight times, and easy maintenance, etc. Electric motors in these devices help reduce emissions, and the growing environmental concern is expected to add to the growth of this segment.

The hybrid segment is expected to grow at the fastest CAGR over the forecast period. This segment provides efficient power solutions in drones with the use of both gasoline and electric type. This type of hybrid propulsion gives improved flight performance in relation to the distance and stability of the drone.

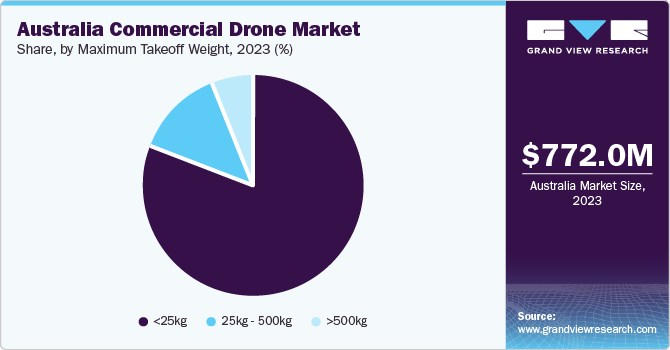

Maximum Takeoff Weight Insights

The less than 25 kg segment dominated the market with the largest revenue share in 2023. Drones under this segment offer operational flexibility, affordability, and easy operational functionality. 25 kg takeoff weight makes the drone suitable for a wide range of applications while adhering to stringent regulations. Such drones are capable of maneuverability in compact areas while maintaining efficient flight capabilities.

The 25 - 500 kg segment is expected to grow at the highest CAGR over the forecast period. Such drones are deployed in complex commercial applications that require larger takeoff weight. These drones can carry heavy payloads with the help of sensors, and autonomous capabilities. Such drones have been used to transfer medicines and other healthcare supplies to remote areas during the COVID-19 pandemic.

Key Australia Commercial Drone Company Insights

Some of the leading companies in the market include Aeronavics Ltd., Autel Robotics, SZ DJI Technology Co Ltd, Intel Corporation, etc.

-

DJI is the industry leader in manufacturing commercial and recreational drones. The company manufactures and supplies a range of commercial drones along with accessories and payloads. Its product portfolio includes drone series such as the Phantom, Inspire, Ronin, and Spreading Winds.

-

AeroVironment Inc. designs and manufactures a line of small Unmanned Aircraft Systems (UAS) for commercial and military applications. In 2017, it partnered with the Australian defense force for a small unmanned aircraft systems program.

PrecisionHawk Inc., Elistair, Flyability, and Draganfly Innovations Inc. are some other companies operating in the Australia commercial drone market.

- PrecisionHawk is a manufacturer of drones and is also engaged in developing software for aerial data analysis (DataMapper) and drone safety systems (LATAS). Since 2016, the company is operating in the Australian market.

Key Australia Commercial Drone Companies:

- Aeronavics Ltd.

- Autel Robotics

- PrecisionHawk Inc.

- SZ DJI Technology Co Ltd

- Elistair

- Flyability

- Draganfly Innovations Inc.

- AeroVironment Inc.

- Intel Corporation

- Tekuma.tech

Recent Developments

-

In March 2024, Autel Robotics launched new industrial drone Autel Alpha. It’s a multi-purpose drone having autonomous flight, anti-interference, obstacle avoidance, and video transmission technology capabilities.

-

In March 2021, DJI launched an entirely new type of hybrid drone DJI FPV. The drone combines the first-person view (FPV) and high-speed performance of racing drones, cinematic camera and reliability of traditional consumer drones with an optional innovative motion controller. The drone also features high-performance motors for a maximum air speed of 140 km/h and a 0-100 km acceleration of just 2 seconds.

Australia Commercial Drone Maket Report Scope

Report Attribute

Details

Market size value in 2023

USD 772 million

Revenue forecast in 2030

USD 2.1 billion

Growth rate

CAGR of 15.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in thousand units, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-user, propulsion type, range, operating mode, endurance

Country scope

Australia

Key companies profiled

Aeronavics Ltd.; Autel Robotics; PrecisionHawk Inc.; SZ DJI Technology Co Ltd.; Elistair; Flyability; Draganfly Innovations Inc.; AeroVironment Inc.; Intel Corporation; Tekuma.tech

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia Commercial Drone Market Report Segmentation

This report forecasts volume and revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Australia commercial drone market report on the basis of product, application, end-use, propulsion type, range, operating mode, and endurance:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Fixed-wing

-

Hybrid

-

Rotary Blade

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Filming & Photography

-

Inspection & Maintenance

-

Mapping & Surveying

-

Precision Agriculture

-

Surveillance & Monitoring

-

Others

-

-

Government & Law Enforcement

-

Firefighting & Disaster Management

-

Search & Rescue

-

Maritime Security

-

Border Patrol

-

Police Operations

-

Traffic Monitoring

-

Others

-

-

-

End-use Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Real Estate & Construction

-

Agriculture

-

Energy

-

Media & Entertainment

-

Security & Law Enforcement

-

Delivery & Logistics

-

Others

-

-

Propulsion Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Gasoline

-

Electric

-

Hybrid

-

-

Range Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Visual Line of Sight (VLOS)

-

Extended Visual Line of Sight (EVLOS)

-

Beyond Visual Line of Sight (BVLOS)

-

-

Operating Mode Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Remotely Piloted

-

Partially Piloted

-

Fully Autonomous

-

-

Endurance Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

<5 Hours

-

5 - 10 Hours

-

>10 Hours

-

-

Maximum Takeoff Weight Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

<25 Kg

-

25 - 500 Kg

-

>500 Kg

-

Frequently Asked Questions About This Report

b. The global Australia commercial drone market size was valued at USD 772 million in 2023 and is expected to reach USD 915.2 million in 2024.

b. The global Australia commercial drone market is expected to grow at a compound annual growth rate (CAGR) of 15.3% from 2024 to 2030 to reach USD 2.1 billion by 2030.

b. The commercial segment dominated the market with the largest revenue share of over 75% in 2023. Drones are mostly used in filming & photography for shooting movies by photographers. Today small and light-weight drones are being developed by manufacturers for capturing high-quality images for professional photographers, thereby driving the segment growth.

b. Some key players operating in the Australia commercial drone market include Aeronavics Ltd., Autel Robotics, PrecisionHawk Inc., SZ DJI Technology Co Ltd, Elistair, Flyability, Draganfly Innovations Inc., AeroVironment Inc., Intel Corporation, Tekuma.tech.

b. The market growth is attributed to the increasing enterprise application of drones across various industry verticals and the integration of modern technologies in commercial drones to deliver enhanced solutions is opening new growth opportunities for the Australia commercial drone market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.