- Home

- »

- Automotive & Transportation

- »

-

Australia Forklift Rental Market Size & Share Report, 2030GVR Report cover

![Australia Forklift Rental Market Size, Share & Trends Report]()

Australia Forklift Rental Market Size, Share & Trends Analysis Report By Tonnage Capacity (6-30 Ton, Below 5 Ton), By End-use (Construction, Automotive), By State, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-097-7

- Number of Report Pages: 109

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

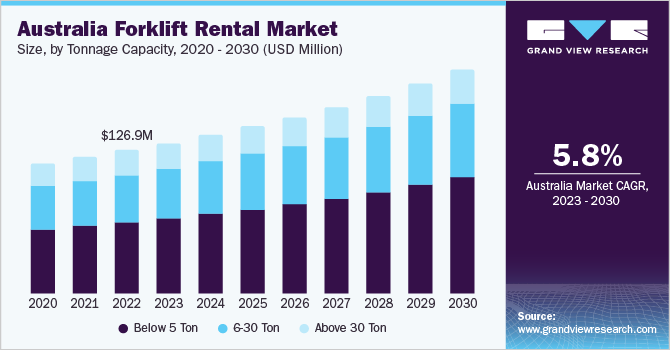

The Australia forklift rental market size was estimated at USD 126.9 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Australia’s warehouse and e-commerce sector has grown significantly in recent years. The rise in evolving consumer preferences and online retail sales fueled the demand for larger, more advanced warehouses. In this industry, short-term projects and seasonal fluctuations in demand are common. To address these needs, businesses have turned to rental forklifts, which offer the flexibility required to meet project-specific requirements or handle spikes in workload during busy seasons. By opting for rental forklifts, businesses can avoid long-term commitments and adopt their equipment usage to specific timeframes.

This helps reduce overall costs and optimize resource allocation for maximum efficiency. In recent years, advancements in forklift technology have influenced the market. The emergence of modern forklifts, equipped with cutting-edge features, such as electric power systems, improved ergonomics, integrated telematics, and enhanced safety features, has revolutionized the industry. Renting forklifts enables businesses to access the latest models and leverage technological innovations without making substantial capital investments. Among the notable trends, electric forklifts are gaining considerable popularity due to their eco-friendliness and operational efficiency.

These electric-powered forklifts offer businesses a sustainable alternative while maintaining high productivity levels. Furthermore, the development of autonomous forklifts is underway, aiming to augment further efficiency and safety in material handling operations. The integration of autonomous technologies in forklifts has the potential to revolutionize the industry by enhancing productivity and reducing the risk of accidents. To cater to the evolving needs of businesses and provide innovative solutions, rental forklift providers should proactively invest in these advanced technologies. By adopting electric and autonomous forklifts, rental providers can meet the demands of the market, offer environmentally friendly options, and deliver efficient and safe solutions for material handling tasks.

The market is facing a significant challenge as alternative options, including leasing and the availability of both used and new forklifts, have emerged. The lower upfront costs of purchasing used forklifts have made them a preferred choice for many businesses. In addition, the availability of both used and new forklifts enables companies to acquire their own equipment directly, potentially reducing their reliance on rentals altogether. This is causing a decline in the customer base of rental forklift providers. Leasing offers businesses the flexibility to access forklifts without being tied down by long-term commitments typically associated with rentals.

The industrial sector presents significant growth opportunities for the market over the forecast period. As Australia's manufacturing, logistics, and construction industries continue to grow, there will be a greater need for flexible and cost-effective material handling solutions. Rental forklifts allow businesses to scale their operations according to their specific requirements without the burden of heavy capital investments. This enables companies to enhance productivity and efficiency while reducing maintenance and ownership costs. With the industrial sector poised for expansion, the market is well-positioned to benefit from the increasing demand for reliable and adaptable equipment.

Tonnage Capacity Insights

Based on tonnage capacity, below 5 tons accounted for the market share of over 49.0% in 2022 and is also expected to register the highest CAGR over the forecast period. The segment is influenced by factors catering to businesses' wide-ranging requirements. Their small size and agility make them perfectly suited for navigating tight spaces and narrow passageways, allowing for efficient operations in warehouses, factories, and distribution centers. Furthermore, their ability to handle different types of loads, ranging from pallets to containers, makes them versatile and adaptable across the logistics, construction, and manufacturing sectors.

The 6-30 ton forklifts segment is expected to grow at a significant CAGR over the forecast period. The increasing expansion of the industrial sector, encompassing manufacturing, warehousing, and logistics, is expected to generate a surge in the need for high-performing and dependable material handling equipment in the foreseeable future. Forklifts, with their versatility, play an essential role in numerous applications, including the loading and unloading of heavy cargo, pallet stacking, and transportation of goods within expansive facilities. As businesses place a growing emphasis on cost-effective solutions and operational adaptability, they are opting for rental alternatives to fulfill their forklift requirements without enduring long-term bonds.

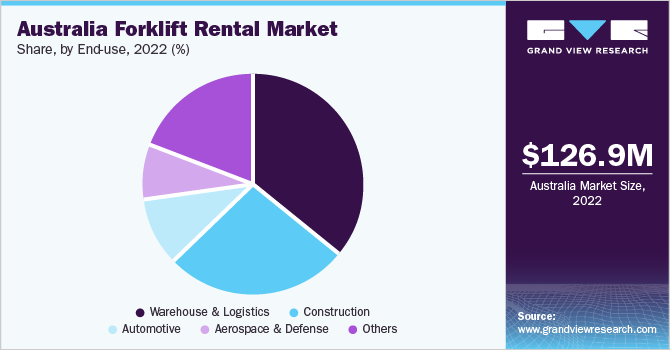

End-use Insights

Based on end-use, the warehouse & logistics segment accounted for the largest share exceeding 36.0% in 2022 and is also anticipated to register the highest CAGR over the forecast period. Warehouse and logistics operations frequently face varying demands, seasonal surges, or temporary projects. The utilization of rented forklifts enables businesses to adjust their equipment requirements according to the current demand, whether scaling up or down. Moreover, warehouse and logistics operations come with inherent risks, necessitating the safe operation of forklifts and adherence to relevant regulations. In Australia, providers of forklift rentals ensure that their fleet meets safety standards and complies with industry regulations.

They offer meticulously maintained and inspected forklifts equipped with essential safety features. The construction sector is expected to grow at a significant CAGR over the forecast period. Robust infrastructure development demands efficient material handling solutions, including commercial buildings, residential projects, and transportation networks. Australia’s thriving mining and resources sector and ongoing construction projects require reliable forklift rentals to support material handling and logistics in these demanding environments. Moreover, the focus on workplace safety and compliance regulations underscores the importance of well-maintained and modern forklift fleets. This presents an opportunity for rental companies to offer specialized equipment that meets industry standards.

State Insights

New South Wales accounted for the largest revenue share of nearly 23.0% in 2022 and is anticipated to register the highest CAGR over the forecast period. The increasing presence of e-commerce in the area is set to boost the adoption of rental forklifts in New South Wales. The rental forklift market provides the warehouse and e-commerce sectors with the flexibility and scalability necessary to meet the changing demands. As businesses experience seasonal fluctuations and heightened activity during Christmas and Black Friday events, extra forklifts are often needed to handle the increased workload.

Companies can expand their operations without making substantial investments in purchasing new equipment by opting for rental forklifts. Victoria is expected to grow at a significant CAGR over the forecast period. Due to its flourishing economy and the presence of various industries, such as manufacturing, warehousing, construction, and logistics, there is an increasing need for rental forklifts in the state. Businesses in these sectors are drawn to the advantages of renting forklifts rather than buying them, as it offers flexibility and cost-effectiveness while avoiding significant capital investments.

Key Companies & Market Share Insights

Major participants are entering into strategic collaborations, mergers & acquisitions, and partnerships to expand their organizations’ footprint and survive the competitive environment. For instance, in April 2023, Toyota Material Handling Australia Pty. Ltd. announced a partnership with Australian Turf Club (ATC), an event management company organizing racing, entertainment, and hospitality events. The 3-year partnership envisaged the Toyota Forklift brand acquiring the naming rights to Group 3 races along with being their material handling partner for races. The company would promote itself among the target audience as part of the partnership. Some prominent players in the Australia forklift rental market include:

-

CLARK

-

Crown Equipment Corp.

-

Doosan Corp.

-

Hangcha

-

Hyster-Yale Materials Handling, Inc.

-

Jungheinrich AG

-

Komatsu Ltd.

-

Toyota Material Handling

Australia Forklift Rental Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 197.3 million

Growth rate

CAGR of 5.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Tonnage capacity, end-use, state

State scope

New South Wales; Northern Territory; Queensland; South Australia; Tasmania; Victoria; Western Australia

Key companies profiled

CLARK; Crown Equipment Corporation; Doosan Corporation; Hangcha; Hyster-Yale Materials Handling, Inc.; Jungheinrich AG; Komatsu Ltd.; Toyota Material Handling

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia Forklift Rental Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Australia forklift rental market report based on tonnage capacity, end-use, and state:

-

Tonnage Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 5 Ton

-

6-30 Ton

-

Above 30 Ton

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Automotive

-

Aerospace & Defense

-

Warehouse & Logistics

-

Others

-

-

State Outlook (Revenue, USD Million, 2018 - 2030)

-

New South Wales

-

Northern Territory

-

Queensland

-

South Australia

-

Tasmania

-

Victoria

-

Western Australia

-

Frequently Asked Questions About This Report

b. The Australia forklift rental market size was estimated at USD 126.9 million in 2022 and is expected to reach USD 133.18 million in 2023.

b. The Australia forklift rental market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 197.3 million by 2030.

b. The warehouse & logistics dominated the owing to operations frequently facing varying demands, seasonal surges, or temporary projects. In addition, the segment comes with inherent risks, necessitating the safe operation of forklifts and adherence to relevant regulations.

b. Some key players operating in the Australia forklift rental market include CLARK; Crown Equipment Corporation; Doosan Corporation; Hangcha; Hyster-Yale Materials Handling, Inc.; Jungheinrich AG; Komatsu Ltd.; and Toyota Material Handling.

b. Key factors that are driving the Australia Forklift Rental market growth include owing to increasing construction, manufacturing, warehouse & e-commerce sector, and the emergence of modern forklifts.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."