- Home

- »

- Automotive & Transportation

- »

-

Electric Forklift Market Size, Share & Growth Report, 2030GVR Report cover

![Electric Forklift Market Size, Share & Trends Report]()

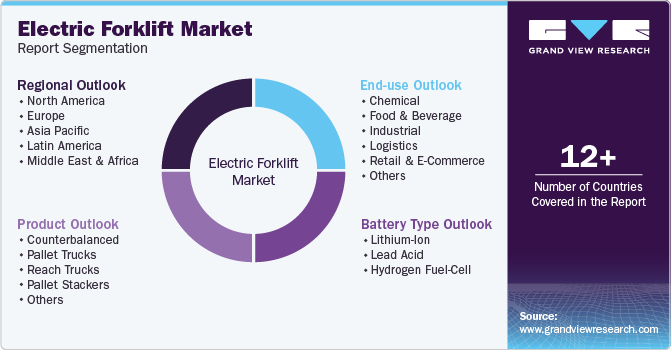

Electric Forklift Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Counterbalanced, Pallet Trucks), By Battery Type (Lithium-Ion, Lead Acid), By End-use (Chemical, Food & Beverage), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-075-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Forklift Market Summary

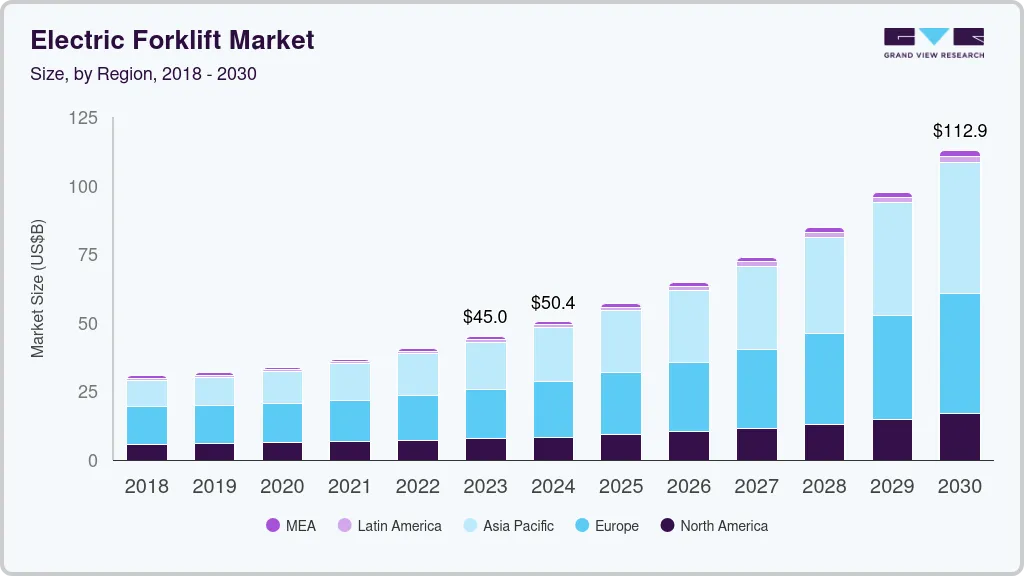

The global electric forklift market size was estimated at USD 45,013.0 million in 2023 and is projected to reach USD 112,870.2 million by 2030, growing at a CAGR of 14.4% from 2024 to 2030. The market is experiencing rapid growth, driven by rising environmental consciousness and strict emission regulations.

Key Market Trends & Insights

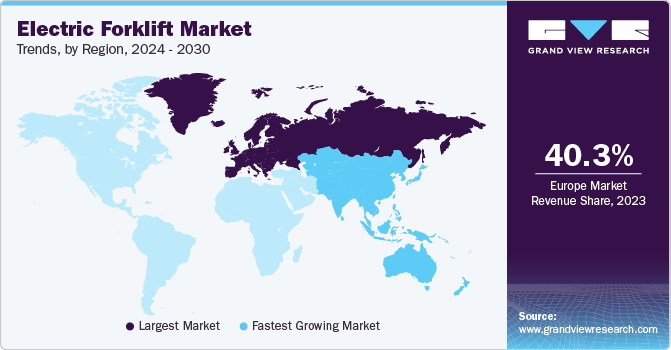

- In terms of region, Europe was the largest revenue generating market in 2023.

- Country-wise, Argentina is expected to register the highest CAGR from 2024 to 2030.

- In terms of battery type, Li-ion accounted for the largest revenue share in 2023.

- The hydrogen fuel-cell segment is projected to witness significant growth from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 45,013.0 Million

- 2030 Projected Market Size: USD 112,870.2 Million

- CAGR (2024-2030): 14.4%

- Europe: Largest market in 2023

In addition, electric forklifts provide numerous benefits, such as minimized accidents, smoother acceleration and braking, reduced noise levels, and a safer working environment for employees. These factors are expected to create significant growth opportunities for the market in the coming years.

Electric forklifts are transforming the material handling industry by leveraging battery-powered electric motors, which significantly reduce emissions and operating costs compared to traditional fossil fuel-based forklifts. Furthermore, the integration of automation and robotics is rapidly gaining momentum within warehouses. The primary objective is to boost operational efficiency, streamline processes, and reduce labor costs. Urban environments face limitations in available land, making efficient space utilization a critical concern. Hence, warehouses are being constructed or revamped with a major emphasis on maximizing storage capacity to tackle this challenge effectively.

The decreasing cost of batteries and the growing demand for fuel-efficient and low-maintenance equipment are making electric forklifts increasingly attractive to customers. The performance and efficiency of electric forklifts have undergone significant transformations due to the remarkable advancements in battery technology. The introduction of lithium-ion batteries has been a transformative factor in the forklift industry, offering higher energy density compared to conventional lead-acid batteries. Lithium-ion batteries can store more energy in a compact and lightweight form, enabling electric forklifts to operate on a single charge for an extended period without compromising performance. This innovation has revolutionized the forklift industry by providing a more efficient and sustainable solution for material handling operations.

Several manufacturers are focusing on investing heavily in their research & development activities to manufacture technologically advanced electric forklifts. For instance, in January 2024, Hyster-Yale Materials Handling, Inc. expanded its integrated lithium-ion forklift lineup with the introduction of the four-wheel J30-70UTL and three-wheel J32-40UTTL. The new electric forklift models, available in capacity ranges of 3,200 to 4,000 pounds and 3,000 to 7,000 pounds, are designed to cater to a broader range of operations. These models provide benefits such as fast charging times, zero tailpipe emissions, zero battery maintenance, and consistent power delivery. Such initiatives are expected to contribute to the market’s growth from 2024 to 2030.

High upfront costs of electric forklifts compared to IC forklifts hamper the growth of the market. The higher upfront investment in electric forklifts includes the cost of the forklift's battery, chassis, and charger. Additionally, electric forklifts require the installation of battery charging stations, which adds to the initial costs. However, electric forklift’s operational costs decrease over time compared to those of IC forklifts due to reduced maintenance requirements.

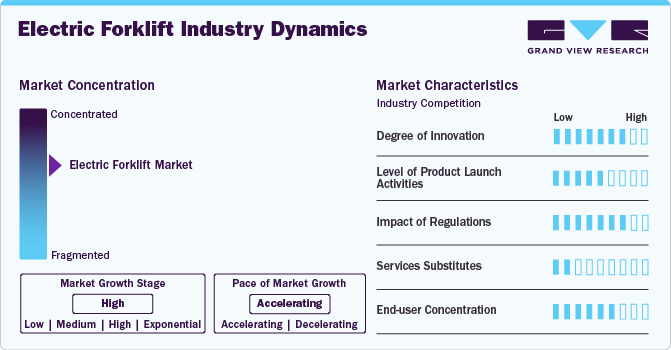

Market Concentration & Characteristics

The industry's growth stage is high, and the pace of growth is accelerating. The electric forklift industry can be characterized by a high degree of innovation. These innovations include the integration of advanced automation and connectivity features, such as the Internet of Things (IoT), telematics, and autonomous functionalities.

The electric forklift industry is also characterized by a high level of new product launch activities by key companies. Companies are adopting this strategy to enhance their electric forklift offerings in the global industry.

The regulatory trends play a substantial role in influencing the electric forklift industry. For instance, the Occupational Safety & Health Administration (OSHA) and the Canadian Standards Association (CSA) regulate forklift operator training and licensing in the U.S. and Canada, respectively.

There are no direct substitutes available for the electric forklift in terms of features and benefits. However, ICE forklifts and battery-powered tugs can be considered substitutes for electric forklifts.

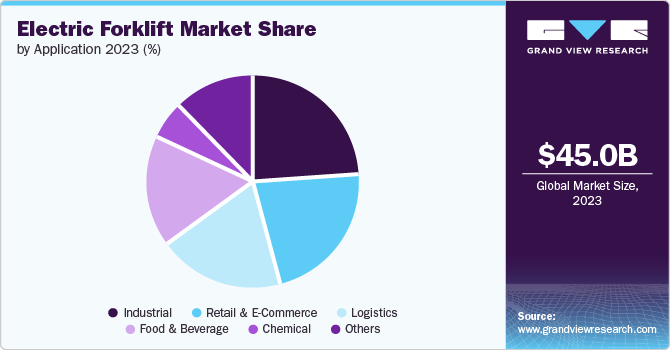

The electric forklift industry has a high concentration of end users. An increasing adoption of electric forklifts in end-use industries, including food and beverage, manufacturing, automotive and logistics, retail and e-commerce, and chemical applications, is driving the market's growth.

Product Insights

The pallet trucks segment dominated the market in 2023 and accounted for a 28.4% share of the global revenue. The segment is driven by high demand in end-use industries and the availability of a diverse product range in terms of load-handling capability. Electric pallet truck forklifts provide benefits such as efficiency and ease of use, leading to increased productivity in material handling tasks. Thus, electric pallet trucks are becoming increasingly used in logistics and warehouses for efficient item handling.

The reach truck segment is projected to witness significant growth from 2024 to 2030. The reach trucks are ideal for maneuvering within a narrow aisle as the truck wheels are positioned right below the operator, creating space for a restricted turn radius. The growing traction e-commerce and retail have stimulated the growth of warehouses across different locations. Thus, the demand for reach trucks is also observing in growth.

Battery Type Insights

The lithium-ion segment dominated the market in 2023. Lithium-ion forklift batteries offer numerous benefits, including higher energy density, longer lifespan, reduced maintenance requirements, faster charging capabilities, and more eco-friendly options compared to other battery types. These advantages are transforming the application of lithium-ion batteries in electric forklifts, providing new opportunities for efficient and sustainable material handling operations. In addition, as businesses are seeking eco-friendly solutions to reduce their carbon footprint due to growing environmental concerns, the demand for lithium-ion based electric forklift is expected to improve from 2024 to 2030.

The hydrogen fuel-cell segment is projected to witness significant growth from 2024 to 2030. With hydrogen fuel-cell batteries, electric forklifts can operate continuously for extended periods without the need for lengthy recharge cycles. In addition, hydrogen fuel-cell batteries deliver consistent and high-power output, allowing electric forklifts to handle heavy loads and operate swiftly. Thus, the increasing adoption of hydrogen fuel-cell batteries in electric forklifts owing to their advantages, such as lower emission rate and no charging, swapping, or maintenance of batteries, is driving the segment’s growth.

End-use Insights

The industrial segment dominated the market in 2023. Economic expansion and an increase in disposable income are driving the thriving manufacturing across different industries which is expected to boost the industrial segment growth. The use of robotics and automation in the industrial sector has increased the demand for electric forklifts. These machines have the potential to improve operational efficiency. Thus, the multiple advantages of electric forklifts, including lower operating costs, reduced maintenance, quieter operation, and zero emissions, make them an increasingly popular choice across various industrial applications.

The retail & e-commerce segment is projected to witness significant growth from 2024 to 2030. The rapid expansion of the e-commerce industry has driven a significant surge in demand for warehousing and logistics services. As a result, electric forklifts have become essential tools in logistics centers and warehouses globally, playing a crucial role in optimizing efficiency and maximizing productivity. In addition, electric forklifts allow operators to quickly move substantial quantities of stock, ensuring that warehouses and e-commerce distribution centers maintain optimal efficiency and continuous operations. Thus, the increasing adoption of electric forklifts in the retail and e-commerce sectors owing to their abovementioned benefits is boosting the segment’s growth.

Regional Insights

The market in North America is expected to witness considerable growth from 2024 to 2030. In North America, electric forklifts are gaining traction among end users due to their lower operating costs, environmental sustainability, and advancements in battery technology.

U.S. Electric Forklift Market Trends

The market in the U.S. is expected to grow at a CAGR of 12.2% from 2024 to 2030. Factors such as rapid advancements in battery technology and rapid growth in the industries such as retail and e-commerce can be attributed to the market’s growth in the U.S.

The electric forklift market in Canada is expected to grow at the fastest CAGR from 2024 to 2030. The increasing government initiatives for enhancing environmental sustainability and the development of charging infrastructure are propelling the demand for electric forklifts in Canada.

Asia Pacific Electric Forklift Market Trends

The market in Asia Pacific is expected to grow at the fastest CAGR of 15.9% from 2024 to 2030. Manufacturers are increasingly inclining toward plant automation, contributing to the growth. Further, forklifts improve operational efficiency and workflow in production processes by easing supply chain distribution activities. The introduction of new products is a major strategy of several regional players for attracting new customers and improving their customer base.

The electric forklift market in China is expected to grow at a notable CAGR of 16.7% from 2024 to 2030. The vast presence of electric forklift manufacturers in China can contribute to the market’s growth. In the competitive landscape of electric forklift manufacturers, several Chinese companies have emerged, each striving to dominate the market with their innovative designs and cutting-edge technology.

India electric forklift market is anticipated to grow at a significant CAGR from 2024 to 2030. The market in India is undergoing a transformative shift driven by technological advancements and automation. Electric, connected, and automated forklifts are emerging as the new standard, enhancing safety, efficiency, and workplace ergonomics.

The electric forklift market in Japan is expected witness moderate growth rate from 2024 to 2030. As the Japanese manufacturing sector increasingly adopts automation and Industry 4.0 technologies, electric forklifts are being integrated into automated material handling systems, propelling the market’s growth in the country.

Europe Electric Forklift Market Trends

Europe region dominated the market in 2023 and accounted for a 40.3% share of the global revenue. The region is experiencing increased demand for electric forklifts owing to its flouring automotive and electronic industry. Being a manufacturing hub for major automotive and consumer electronics OEMs, the demand for forklifts is set to increase within the region.

The electric forklift market in the UK is expected to grow at the highest CAGR from 2024 to 2030. The rapid growth of the retail and e-commerce sectors in the UK and the growing consumer demand for environmentally responsible practices is driving the demand for electric forklifts in the country.

Germany electric forklift market is expected to grow at a considerable CAGR from 2024 to 2030. The growth can be attributed to factors such as growing technological advancements, evolving consumer preferences, and regulatory support.

MEA Electric Forklift Market Trends

The market in MEA is expected to experience steady growth, registering a CAGR of 11.5% from 2024 to 2030. Increasing demand for electric forklifts in the manufacturing and e-commerce industries, infrastructure development, and rapid urbanization in the country are driving the growth of the market in the MEA region.

The electric forklift market in KSA is anticipated to grow at a notable CAGR from 2024 to 2030. The demand for forklifts in the country can be attributed to the growth of the petrochemical and export industries. The country holds a major share of crude oil reserves, and the use of electric forklifts to carry equipment, oil barrels, and containers is expected to drive the demand for these forklifts.

Key Electric Forklift Company Insights

Some of the key companies operating in the market include Toyota Material Handling, KION Group AG, Jungheinrich AG, Mitsubishi Logisnext Co., Ltd., Crown Equipment Corporation, and Hyster-Yale Materials Handling, Inc.

-

Toyota Material Handling is a subsidiary of Toyota Industries Corporation. The company offers an extensive product range of forklifts and business services, such as forklift renting, selling used forklifts, fleet management solutions, financing, along with equipment maintenance services.

-

The KION Group AG manufactures and supplies industrial trucks and offers supply chain solutions. The company’s product portfolio encompasses material handling trucks, such as warehouse and forklift trucks, along with software solutions and automation technology for optimizing supply chains and related services.

Clark Material Handing Company, Doosan Corporation, Hangcha Forklift, Komatsu Ltd., and Anhui Heli Co., Ltd., are some of the emerging companies in the electric forklift market.

-

Clark Material Handing Company, a subsidiary of Clark Equipment Company, manufactures and distributes forklifts, pallet jacks, pallet stackers, and working platform vehicles for indoor warehousing and shipping application.

-

Anhui Heli Co., Ltd. manufactures and distributes industrial machines and trucks. The company’s product portfolio encompasses electric & ICE forklifts, warehouse equipment, heavy forklifts, tractors, wheel loaders, and attachments.

Key Electric Forklift Companies:

The following are the leading companies in the electric forklift market. These companies collectively hold the largest market share and dictate industry trends.

- Anhui Heli Co., Ltd.

- Clark Material Handing Company

- Crown Equipment Corporation

- Doosan Corporation

- Hangcha Forklift

- Hyster-Yale Materials Handling, Inc.

- Jungheinrich AG

- KION Group AG

- Komatsu Ltd.

- Mitsubishi Logisnext Co., Ltd.

- Toyota Material Handling

Recent Developments

-

In March 2023, Hangcha Forklift announced the launch of the XE series electric forklifts for the global market. The electric forklifts fall under the 1.5 to 3.8-ton category and have a battery capacity of up to 80 V/608 Ah The forklift has a range of 18 km/h and a gradeability of 25%. The launch of the new series is another addition to the company’s electric forklift product portfolio.

-

In February 2023, Doosan Corporation announced the launch of B60NX and B80NS heavy-lifting electric counterbalance forklift trucks under the NXE series. The B80NS series is available in 8.0 to 10.0-ton capacity, while the B60NX is available in 6.0 to 8.0-ton capacity. Both forklifts have a compact design for increased maneuverability in congested areas. The forklifts are designed for light to heavy-duty tasks with enhanced ergonomic features for improved productivity and safety of the operator.

-

In October 2022, Toyota Material Handling announced the launch of a 3-wheel electric forklift with features such as a full-suspension seat, operator assistance, EZ fingertip control option, a 4.3-inch high-resolution display, onboard programming, and diagnostics. The base features of the vehicle include an AC drive motor and a 3,000-4,000 lbs. capacity.

-

In April 2022, Toyota Material Handling Ohio (TMH Ohio) announced a merger dealership with ProLift to expand its footprint in Northern Ohio, Indiana, and Kentucky regions. The merger aims to expand the company’s customer base and allow the company to provide consistent performance across three regions.

Electric Forklift Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 50.40 billion

Revenue forecast in 2030

USD 112.87 billion

Growth rate

CAGR of 14.4% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, battery type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; India; Japan; South Korea; Australia; Brazil; Argentina; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Clark Material Handing Company; Crown Equipment Corporation; Doosan Corporation; Hangcha Forklift; Hyster-Yale Materials Handling, Inc.; Jungheinrich AG; Komatsu Ltd.; Toyota Material Handling; Anhui Heli Co., Ltd.; KION Group AG; Mitsubishi Logisnext Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Forklift Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the electric forklift market based on product, battery type, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Counterbalanced

-

Pallet Trucks

-

Reach Trucks

-

Pallet Stackers

-

Others

-

-

Battery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lithium-Ion

-

Lead Acid

-

Hydrogen Fuel-Cell

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical

-

Food & Beverage

-

Industrial

-

Logistics

-

Retail & E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric forklift market size was estimated at USD 45.01 billion in 2023 and is expected to reach USD 50.40 billion in 2024.

b. The global electric forklift market is expected to grow at a compound annual growth rate of 14.4% from 2024 to 2030 to reach USD 112.87 billion by 2030.

b. Pallet trucks dominated the electric forklift market with a market share of 28.4% in 2023. Pallet trucks growth is attributed owing to their eco-friendly nature. They emit zero emissions, helping to lower carbon footprints and enhance air quality. Industries are embracing these EVs to meet environmental regulations and sustainability targets.

b. Some key players operating in the electric forklift market include Anhui Heli Co., Ltd.; CLARK.; COMBILIFT; Crown Equipment Corporation; Doosan Industrial Vehicle; Godrej.com; Hangcha Forklift; Hyster-Yale Materials Handling, Inc.; Jungheinrich AG; Komatsu; Nichiyu Forklifts India Pvt Ltd.; and Toyota Material Handling.

b. Increasing emphasis on environmental sustainability is a major driving force behind the global electric forklift market. Unlike ICE forklifts, electric forklifts generate zero direct emissions while in operation. This has become particularly significant owing to mounting concerns about climate change and the implementation of more stringent environmental regulations. As a result, businesses are increasingly choosing electric forklifts to minimize their carbon footprint and align with their sustainability objectives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.