- Home

- »

- Homecare & Decor

- »

-

Australia Glamping Market Size & Share Report, 2021-2028GVR Report cover

![Australia Glamping Market Size, Share & Trends Report]()

Australia Glamping Market (2021 - 2028) Size, Share & Trends Analysis Report By Accommodation Type (Cabins & Pods, Tents, Yurts, Treehouse), By Age Group (18 - 32 Years, 33 - 50 Years, 51 - 65 Years), And Segment Forecasts

- Report ID: GVR-4-68039-446-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

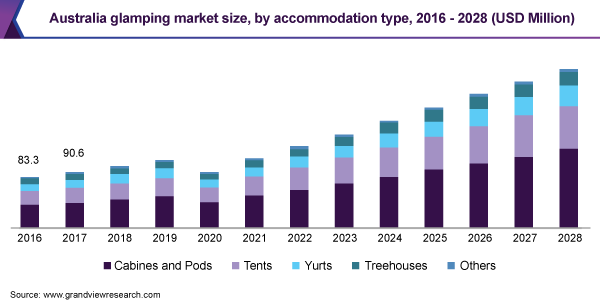

The Australia glamping market size was valued at USD 90.1 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 14.0% from 2021 to 2028. Glamping or glamorous camping has become a trend in outdoor recreation among tourists across the globe. At music festivals, glamping is offered as an upgrade option at a reasonable price, especially if it is going to be a multiday activity. The rising number of concerts and big music festivals in various parts of the world is expected to be one of the key driving factors for the market growth over the forecast period.

Before the COVID-19 outbreak across the globe, the interest in camping among new and experienced campers was on the rise. However, in the unprecedented times of the COVID-19 pandemic travelers are maintaining distance from outdoor recreation, natural spaces, and in general people. Consequently, negative impacts on travelers and art enthusiasts continue to mount up causing the decline of the glamping industry in 2020 and a significant part of 2021. In response to COVID-19, the Gold Coast music and sports festival was canceled while events from Marcus King Band, Sunshine Coast drive-in festival, and many others were rescheduled which affected the growth of the glamping market in Australia.

Glamping makes up a considerable part of the hospitality industry. It is a popular activity and an emerging trend among tourists where the idea of camping is shifting from being a cheap form of travel to a real outdoor experience. Traveling with tents is the conventional way of camping, but with the addition of caravans and recreation vehicles, more and more tourists are attracted to glamping.

Long working hours, hectic lifestyles, and less time for self-care activities and relaxation are projected to be the key factors boosting the growth of the Australia glamping market growth. Millennials are attracted to glamping as it is an enhanced form of camping that allows them to escape daily life without compromising on comfort. With luxury furnishing and soft beds, consumers are more drawn to the idea of glamping as opposed to regular camping. In addition, various initiatives taken on by Airbnb coupled with in-country advertising by various governments about the benefits of glamping are expected to have a positive impact on the market growth over the forecast period.

Staycations allow people from wandering in nature and choose from a wide range of destinations to unwind during their time off. Consumers while on vacation can also involve in a variety of activities offered by glamping resorts. Various initiatives taken on by Airbnb coupled with in-country advertising by various governments to promote the benefits of glamping are expected to have a positive impact on the market growth. Kampgrounds of America, Inc.’s report published in 2019 stated that around 63% of the consumers seek services and facilities during their glamping experience usually unavailable with camping while 56% say that they look to stay at unique accommodations. The report also stated that 67% of enthusiasts agree that glamping offers an excellent outdoor experience. This is likely to have a positive impact on the growth of the glamping market in Australia.

Glamping permits an outdoor travel experience without the need for buying any related equipment. Certain properties also provide various services and luxurious amenities similar to hotels. According to the 2019 North American Camping Report 5-Year Trends, around 54% of old-style campers prefer traveling within 100 miles of their residence. Meanwhile, today’s glamping consumers imply that guests may arrive by car or by plane, indicating the strength of the drive-to glamping guest.

Baby boomers and millennials are the current generations producing major demand for glamping. New data released from Tourism Research Australia indicated that camping trips and caravans are the most favorite holiday options among Australians. The recently released statistics show that the total nights spent in caravans and camping reached 51.3 million in 2018 and increased by 3.5% as compared to 2017. This exponential growth in the number of people is expected to drive the growth of the market.

Accommodation Type Insights

Based on the accommodation type, the market is segmented into cabins and pods, tents, yurts, treehouses, and others. The cabins and pods accommodation type segment led the market with a revenue share of 47.1% in 2020. The growth of the segment is mainly attributed to prominent features offered by cabins and pods such as safety features including lockable windows and doors, a private bathroom, and a large kitchen and living space. Cabins made with solid timber or log shelters provide an exceptional space within wooden shells with a framed, elevated or tented format with doors and windows.

The tents segment is expected to expand at a healthy CAGR over the forecast period. Although a tent is a traditional way of camping, with a shift in time it has become more comfortable. Tents also offer extraordinary views due to the wide window structure coupled with various other amenities. The emerging trend of outdoor corporate events, destination weddings, and parties at off-grid locations is another factor driving the growth.

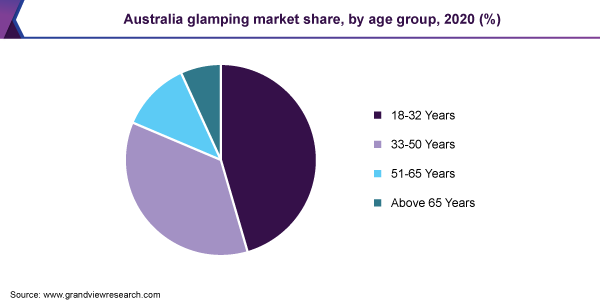

Age Group Insights

The age group between 18 - 32 years dominated the market with a revenue share of 45.6% and is projected to continue growing over the forecast period. This is ascribed to the growing trend of camping within this age group. The growing trend of tours and traveling is boosting the demand for glamping among the consumers in this age group. The prominence of destination weddings is another factor driving the demand for wedding glamping and thus, the market players are increasing this category in their portfolio. For instance, Buffalo, a New York-based startup, offers luxury rentals for weddings, private events, and festivals. These trends are also anticipated to boost the adoption of glamping culture in this age category.

The 33 - 50 years age group segment is likely to expand at a significant CAGR from 2021 to 2028. Financial freedom and high spending power are the primary factors contributing to the growth of this segment. Glamping amenities including kitchens, Wi-Fi, private washrooms, pools, linen service, and others offer scope for consumers looking for camping with luxury. For instance, more than 50% of glampers expressed that they would prefer accommodation equipped with Wi-Fi. Therefore, the glamping market is anticipated to experience growth in the segment during the forecast period.

Key Companies & Market Share Insights

The market is comprised of many large and medium-scale players offering different kinds of services. The market is fairly competitive with the addition of advanced technology and with the idea of luxurious camping getting more and more popular among travelers. Glamping service providers mainly emphasize collaborating and partnering with resorts and hotels to build a larger consumer base and gain higher profits. With constant innovations and modifications in service offerings, glamping is expected to witness a prominent acceptance among travelers who prefer to stay closer to home. Staycations are becoming increasingly popular and are expected to continue growing through Airbnb and various other in-country advertising campaigns supported by the governments across all the regions. Some of the prominent players operating in the Australia glamping market are:

-

Under Canvas

-

Canopy and Stars

-

Baillie Lodges

-

Tanja Lagoon Camp

-

Collective Retreats

-

Tentrr

-

Nightfall Camp Pty Ltd

-

Glampique

-

The Last Best Beef LLC

-

Eco Retreats

-

Wildman Wilderness Lodge

Australia Glamping Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 112.8 million

Revenue forecast in 2028

USD 256.5 million

Growth rate

CAGR of 14.0% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD Million & CAGR from 2021 to 2028

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Accommodation type, age group

Country scope

Australia

Key companies profiled

Under Canvas; Canopy and Stars; Baillie Lodges; Tanja Lagoon Camp; Collective Retreats; Tentrr; Nightfall Camp Pty Ltd.; Glampique; The Last Best Beef LLC; Eco Retreats; Wildman Wilderness Lodge

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For this study, Grand View Research has segmented the Australia glamping market report based on accommodation type and age group:

-

Accommodation Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Cabins and Pods

-

Tents

-

Yurts

-

Treehouses

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2016 - 2028)

-

18 - 32 years

-

33 - 50 years

-

51 - 65 years

-

Above 65 years

-

Frequently Asked Questions About This Report

b. The age group between 18 - 32 years dominated the Australia glamping market with a revenue share of 45.6% and is projected to continue growing over the forecast period.

b. The Australia glamping market size was estimated at USD 90.1 million in 2020 and is expected to reach USD 112.8 million in 2021.

b. The Australia glamping market is expected to grow at a compound annual growth rate of 14.0% from 2021 to 2028 to reach USD 256.5 million by 2028.

b. The cabins and pods accommodation type segment led the Australia glamping market with a revenue share of 47.1% in 2020.

b. Some key players operating in the Australia glamping market include Under Canvas, Canopy and Stars, Baillie Lodges, Tanja Lagoon Camp, Collective Retreats, Tentrr, Nightfall Camp Pty Ltd, Glampique, The Last Best Beef LLC, Eco Retreats, Wildman Wilderness Lodge.

b. Key factors that are driving the Australia glamping market growth include the rising number of concerts and big music festivals happening every other week in various parts of the world is expected to be one of the key driving factors for the market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.