- Home

- »

- Consumer F&B

- »

-

Australia Kombucha Market Size, Industry Report, 2033GVR Report cover

![Australia Kombucha Market Size, Share & Trends Report]()

Australia Kombucha Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Conventional Kombucha, Hard Kombucha), By Distribution Channel (On-Trade, Off-Trade), And Segment Forecasts

- Report ID: GVR-4-68040-639-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Australia Kombucha Market Summary

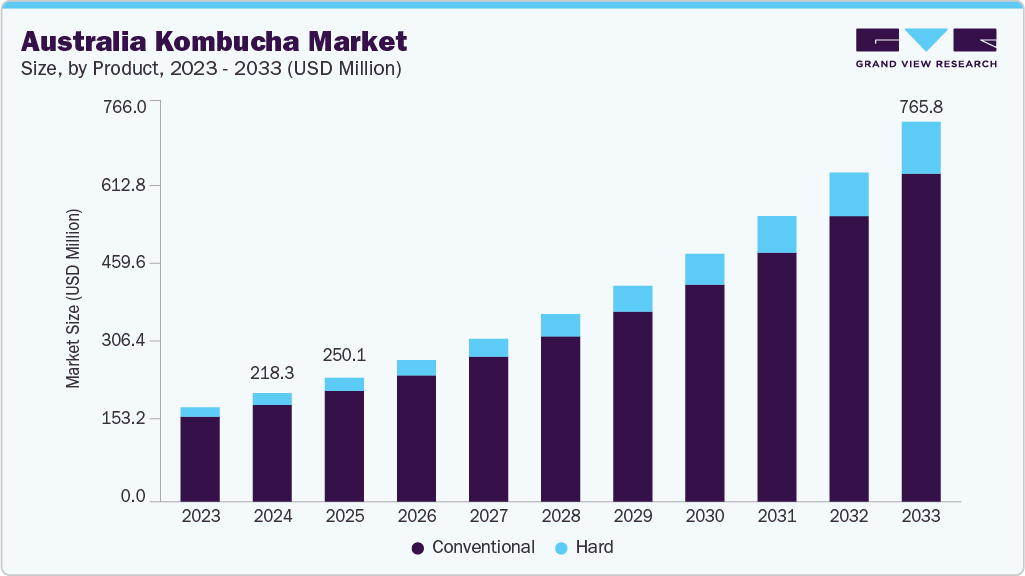

The Australia kombucha market size was estimated at USD 218.3 million in 2024 and is projected to reach USD 765.8 million by 2033, growing at a CAGR of 15.0% from 2025 to 2033. The market is primarily driven by increasing health consciousness among consumers, particularly the growing interest in digestive health and probiotic-rich products.

Key Market Trends & Insights

- The conventional kombucha segment led the market and accounted for a share of 89.8% in 2024.

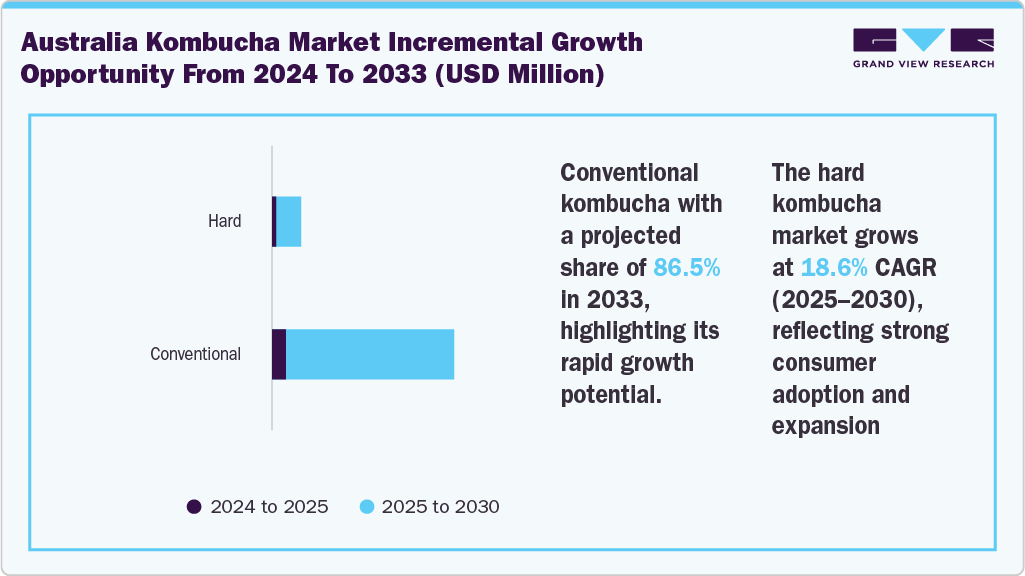

- Hard kombucha is expected to grow at a CAGR of 18.6% during the forecast period.

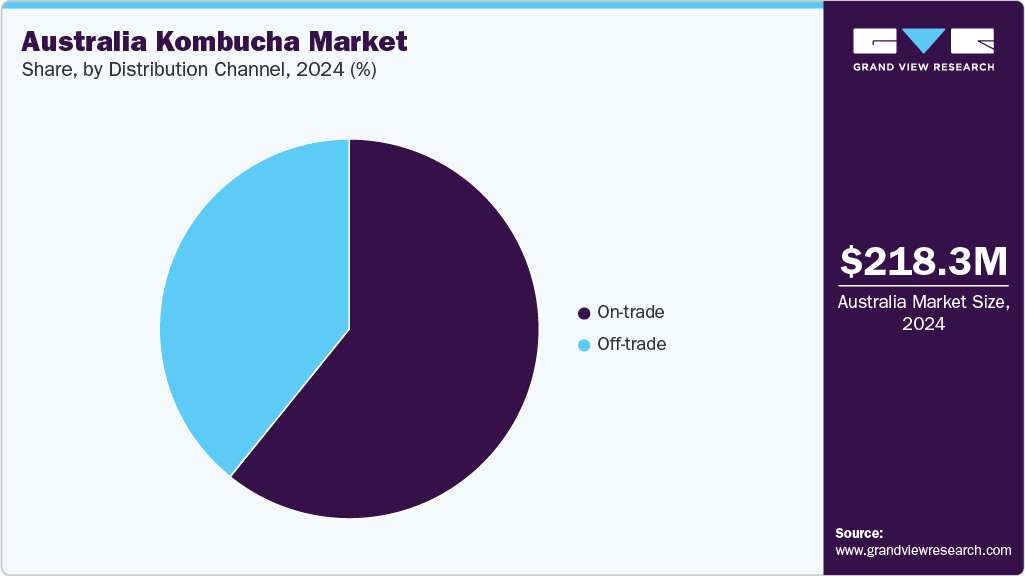

- By distribution channel, the on-trade channel led the market and accounted for a share of 60.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 218.3 Million

- 2033 Projected Market Size: USD 765.8 Million

- CAGR (2025-2033): 15.0%

As more Australians look to reduce sugar intake and avoid artificial ingredients, kombucha has emerged as a popular alternative to traditional soft drinks. Wider product availability in supermarkets and specialty health stores, along with local production by Australian kombucha brands, has also made the drink more accessible and appealing.

The kombucha market in Australia is experiencing steady growth, largely fueled by increasing consumer awareness of health and wellness. With rising focus on gut health and natural nutrition, many Australians are turning to fermented beverages like kombucha, which contain probiotics that support digestion. This shift is part of a broader movement away from sugary carbonated drinks towards functional alternatives. For instance, consumers often replace soft drinks with kombucha for its digestive benefits and lower sugar content. Brands such as Nexba promote their kombucha as naturally sugar-free, appealing to this trend of mindful consumption.

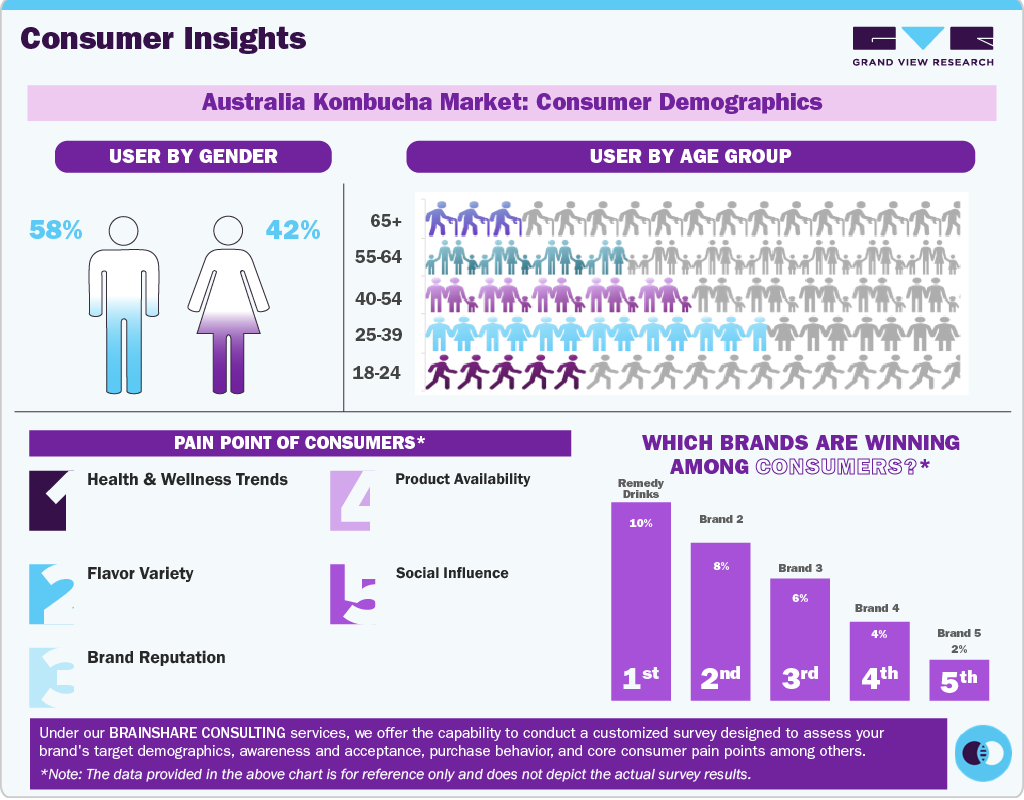

Consumer Insights

In the kombucha market in Australia, younger consumers are the most active participants, with the 25-34 age group leading in both trial and repeat purchases. This demographic is particularly drawn to kombucha for its perceived digestive benefits, natural ingredients, and alignment with wellness lifestyles. The 18-24 group also shows strong adoption, influenced by social trends and functional beverage experimentation. Meanwhile, the 35-44 segment participates with a focus on gut health and low-sugar alternatives to soda or alcohol. Adoption rates decline among the 45-55 and 55+ groups due to taste unfamiliarity and price sensitivity, although interest in functional health products is gradually creating entry points among older adults.

Male consumers now slightly outpace females in kombucha consumption in the Australian market. Men are increasingly attracted to kombucha as a healthier alternative to beer or soda, especially in flavored or hard kombucha formats. Their purchasing behavior is driven more by performance-related health claims, low sugar, and perceived authenticity rather than detox or beauty-oriented benefits. While women still represent a large and engaged segment, particularly around non-alcoholic and traditional kombucha, men are becoming a key growth driver, especially in crossover categories like hard kombucha and functional energy blends.

Consumer pain points in the kombucha market remain significant barriers to broader adoption. Chief among them is the high price point, which limits repeat purchases and deters price-sensitive demographics despite small-pack convenience. Many consumers also report issues with taste profile-either too vinegary or too unfamiliar-making trial conversion difficult. Concerns around sugar content and alcohol levels (especially for those avoiding even trace alcohol) are prevalent, as is digestive sensitivity, with some new users experiencing bloating or discomfort. Packaging and portability limitations, such as glass bottles and refrigeration needs, further restrict usage occasions and on-the-go consumption. Addressing these barriers is critical for expanding kombucha’s reach beyond its core health-conscious niche.

Product Insights

Conventional kombucha accounted for a revenue share of 89.8% in 2024, driven by increasing consumer awareness of gut health and natural wellness. Its accessibility in major supermarkets and affordable pricing appeal to a broad demographic. Rising demand for low-sugar alternatives to soft drinks also supports its growth. Additionally, local brands offering a variety of flavors cater to evolving taste preferences.

The hard kombucha segment is expected to grow at a CAGR of 18.6% from 2025 to 2033. Hard kombucha is gaining momentum in Australia due to rising interest in healthier alcoholic alternatives. Younger consumers are drawn to its probiotic benefits combined with a light alcohol content. The craft beverage trend further boosts its appeal, with artisanal brewing and unique flavors. Availability in bars, specialty liquor stores, and festivals enhances exposure and trial. Companies such as Ventura Brewing Pty Ltd offer hard kombucha in a variety of flavors, including Passionfruit Orange Guava, Lychee & Grapefruit, Hibiscus & Rosemary, and Watermelon & Mint.

Distribution Channel Insights

The sales through the on-trade distribution channel accounted for a revenue share of 60.7% in 2024. The on-trade channel encompasses establishments like bars, cafés, restaurants, and hotels, where consumers purchase kombucha directly for immediate consumption. This segment is experiencing growth as consumers seek healthier, functional alternatives to traditional alcoholic beverages. The increasing popularity of hard kombucha, with its low alcohol content and probiotic benefits, is particularly notable in this channel. Establishments are expanding their beverage offerings to cater to the rising demand for such alternatives, thereby enhancing the visibility and availability of kombucha in social settings.

The sales through the off-trade distribution channel are expected to grow at a CAGR of 16.9% during the forecast period. Off-trade refers to the sale of kombucha through retail outlets such as supermarkets, convenience stores, health food stores, and online platforms, where consumers purchase products for home consumption. This channel dominates the kombucha market due to its widespread accessibility and convenience. The growth of e-commerce has further bolstered off-trade sales, allowing consumers to explore a diverse range of kombucha brands and flavors from the comfort of their homes. Retailers often offer promotions and discounts, making kombucha more attractive to a broader audience seeking health-conscious beverage options. Supermarkets in the region, such as Woolworths Group Limited and Coles, offer kombucha in various flavors, catering to the evolving consumer needs.

Regional Insights

The kombucha market in Australia is driven by rising health consciousness and a growing demand for natural, probiotic-rich beverages. Consumers are increasingly seeking alternatives to sugary soft drinks, with kombucha offering digestive and immune system benefits. The clean-label trend, emphasizing organic and preservative-free ingredients, is further fueling market interest. Expanding flavor varieties and innovative product formats are attracting both mainstream and niche health-conscious audiences. Additionally, increased retail presence across supermarkets, cafes, and e-commerce platforms is boosting product accessibility and consumer trial. According to the data published in October 2023, Remedy Drinks, the region’s leading kombucha brand, offers kombucha available through 8,000 outlets.

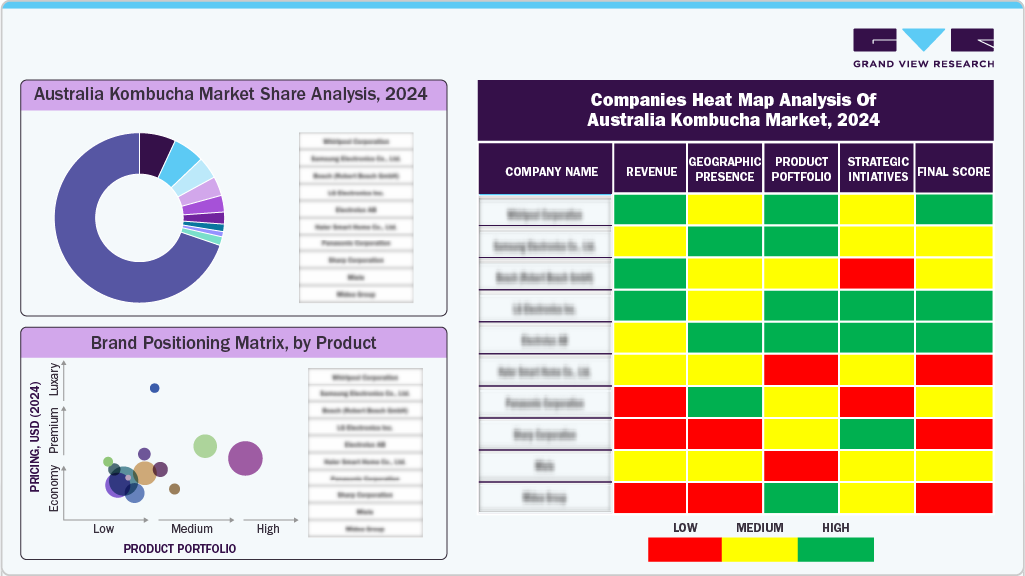

Key Australia Kombucha Company Insights

The kombucha market in Australia features a mix of established domestic brands and emerging local players competing for market share. Key companies have built strong brand recognition through early market entry, consistent product quality, and alignment with health and wellness trends. These players maintain a competitive edge through wide distribution across major supermarkets, health food stores, and cafés. Innovation in flavors, sustainable packaging, and functional formulations further supports differentiation. While smaller artisanal brands appeal to niche consumers, leading companies dominate mainstream visibility and shelf space, consolidating their market presence.

Key Australia Kombucha Companies:

- Kombucha Bros Australia

- The Good Brew Company

- Buchi Kombucha

- Remedy Drinks

- Rok Kombucha

- Nexba

- Kommunity Brew

- Australian kombucha

- SCULL kombucha

- JIVA

Recent Developments

-

In June 2021, Remedy Drinks, a leading Australian kombucha brand, launched kombucha in the U.S. market in delicious flavors such as Ginger Lemon Kombucha, Peach Kombucha, Mixed Berry Kombucha, and Raspberry Lemonade Kombucha.

Australia Kombucha Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 250.1 million

Revenue forecast in 2033

USD 765.8 million

Growth rate (Revenue)

CAGR of 15.0% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/ billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product and distribution channel

Key companies profiled

Kombucha Bros Australia; The Good Brew Company; Buchi Kombucha; Remedy Drinks; Rok Kombucha; Nexba; Kommunity Brew; Australian kombucha; SCULL kombucha; JIVA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia Kombucha Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Australia kombucha market report based on product and distribution channel.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Conventional

-

Hard

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

On-Trade

-

Off-Trade

-

Frequently Asked Questions About This Report

b. The Australia kombucha market size was estimated at USD 218.3 million in 2024 and is expected to reach USD 250.1 million in 2025.

b. The Australia kombucha market is expected to grow at a compound annual growth rate (CAGR) of 15.0 % from 2025 to 2033 to reach USD 765.8 million by 2033.

b. Conventional kombucha accounted for a revenue share of 89.8% in 2024, driven by rising consumer health and wellness consciousness, particularly interest in gut-friendly, probiotic-rich beverages.

b. Some key players operating in the Australia kombucha market include Kombucha Bros Australia, The Good Brew Company, Buchi Kombucha, Remedy Drinks, Rok Kombucha, and SCULL Kombucha.

b. Key factors driving growth in the Australia kombucha market include increasing health consciousness and a rising preference for natural, probiotic-rich beverages that support digestive wellness. Expanding retail distribution, product innovation, and growing demand for clean-label, low-sugar alternatives further contribute to market expansion across the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.