- Home

- »

- Pharmaceuticals

- »

-

Australia Medical Cannabis Market, Industry Report, 2030GVR Report cover

![Australia Medical Cannabis Market Size, Share & Trends Report]()

Australia Medical Cannabis Market Size, Share & Trends Analysis Report By Application (Cancer, AIDS), By Sources (Hemp, Marijuana), By Derivatives (CBD, THC), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-301-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Australia Medical Cannabis Market Trends

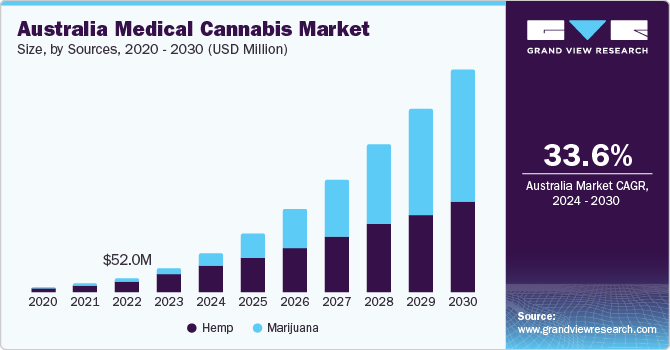

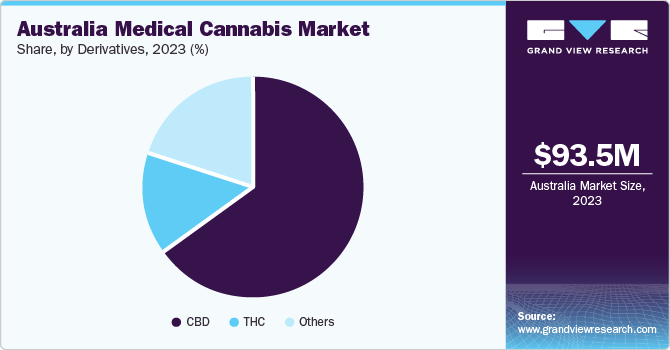

The Australia medical cannabis market size was estimated at USD 93.54 million in 2023 and is projected to grow at a CAGR of 33.6% from 2024 to 2030. This growth is driven by a rising interest in alternative therapies for managing chronic pain, nausea, and various other health issues, as well as the introduction of new products and formulations. This surge in demand for non-traditional therapeutic options reflects a shift in consumer preferences and a growing acknowledgment of the potential health benefits of these alternatives. The market is also witnessing a significant increase in new and diverse product offerings, ranging from edibles and topicals.

In addition, factors contributing to the growth of the market include the expansion of licensed growers and manufacturers, the increasing number of prescriptions and patient access, and the growing acceptance of cannabis as a valid treatment option among healthcare professionals. For instance, in August 2022, the Centre for Medicinal Cannabis Research and Innovation announced that it initiated the second stage of a clinical study, "Palliative care trial," focused on exploring how tetrahydrocannabinol (THC) affects appetite in terminally ill cancer patients. This research aims to delve deeper into THC's impact on appetite, with the potential to guide the creation of innovative treatments for cancer.

The number of people adopting cannabis for medical purposes has recently increased in Australia. According to Data estimates, in 2020, the annual cannabis usage rate was recorded at 12.2% of the population. Favorable government reforms, increasing awareness regarding cannabis, and the growing number of research studies claiming positive effects of cannabis for treating certain conditions are the factors boosting medical cannabis adoption. According to a study published in Harm Reduction Journal in 2020, the main areas wherein cannabis for medical purposes is used in Australia include chronic pain (36.4%), mental health (32.8%), sleep (9.2%), cancer (3.8%), and neurology (5.2%). Patients in Australia have access to medical cannabis products through two government-regulated channels: Authorized Prescriber (AP) (usually a physician) or Special Access Scheme Category B (SAS-B). In addition, the rising number of physicians prescribing medical cannabis in Australia is increasing the patient population opting for cannabis.

With the growing demand, the entry of international players in the market has increased. Favorable government initiatives and the rising preference for cannabis-based products are major factors creating lucrative opportunities for key international players to enter the market. For instance, in March 2024, Aurora Cannabis Inc. was awarded GMP certification by the Therapeutic Goods Administration (TGA) of Australia for its Canadian production facilities, River and Ridge. This certification allows Aurora to expand its product offerings in Australia, including dried flower, resin cartridges, pastilles, and oils, providing patients with a wider range of treatment options.

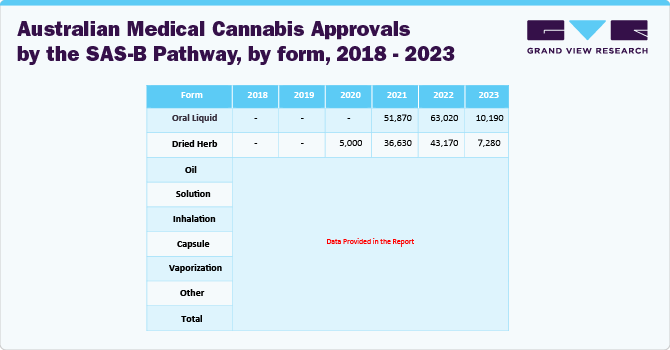

Furthermore, the growing number of approvals of different forms & formulations of cannabis for medicinal usage is another factor expected to propel market growth. According to TGA data estimates between 2018 and 2023, dried herb and oral liquid were the two most commonly manufactured formulations of cannabis and approved by the SAS-B patient pathway.

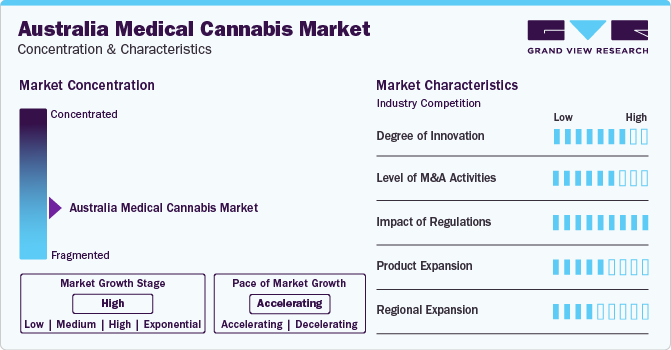

Market Concentration & Characteristics

The market is characterized as fragmented, with many small to medium-sized players competing in the market. This is due to the relatively low barriers to entry, combined with the government's decision to license multiple cultivators and manufacturers. As a result, the market is made up of numerous small-scale producers, processing companies, and distributors. This fragmentation is driven by factors such as limited economies of scale, high regulatory costs, and the need for specialized expertise in cannabis cultivation and production.

Degree of innovation in the market is high, driven by the growing number of competitors entering the market. These competitors introduce diverse, sophisticated cannabis products to secure a competitive advantage. For instance, in March 2024, a global medical cannabis company and its Australian subsidiary, MedReleaf Australia, announced the launch of medical cannabis pastilles in Australia. This new product is available for doctors to prescribe to patients, providing a convenient and discreet alternative to traditional methods of cannabis consumption. The industry is developing new products and delivery methods, such as precision-dosed oils and topical creams tailored to specific patient needs.

Regulations has a significant impact on the industry. The TGA has introduced a framework for the cultivation, production, and distribution of medical cannabis, providing a clear path for companies to enter the market. The regulations have also increased transparency and accountability, increasing patient confidence and trust in the products. In addition, the regulation has encouraged industry investment and innovation, driving market growth and development.

The market has experienced a significant level of mergers and acquisitions in recent years, driven by the growing demand for cannabis-based products. For instance, In February 2024, Aurora Cannabis Inc. announced that one of its wholly owned subsidiaries has acquired the remaining 90% equity stake in Indica Industries Pty Ltd, trading as MedReleaf Australia. This trend is expected to continue, with many companies seeking to expand their operations through strategic partnerships and acquisitions.

The market has seen a significant expansion of product offerings in recent years, driven by the growing demand for high-quality cannabis-based products. For instance, in February 2024, SOMAÍ Pharmaceuticals, a company based in Portugal, announced its entry into the Australian market. They intend to produce and distribute various vape and oil products through a partnership with Airo Brands, the initial products are anticipated to be accessible via the Special Access Scheme starting in the year's second quarter. This expansion has been driven by introducing new products, including oil extracts, edibles, and topicals, and the development of new delivery methods, such as inhalers and transdermal patches.

The market is witnessing a geographical expansion, with major pharmaceutical companies and cannabis operators expanding their presence across the country. For instance, in January 2024, Cronos Group Inc. expanded its distribution network to the Australian market by providing its first delivery of cannabis flowers to Vitura Health Limited, a medicinal cannabis products manufacturer. The company owns approximately 10% of the common shares of Vitura (Cronos Australia).

Sources Insights

Hemp dominated the market with a revenue share of 74.12% in 2023. The segment's growth is driven by the use of hemp-derived CBD products in several sectors, including cosmetics, pharmaceuticals, nutraceuticals, and food & beverages. The demand for CBD-infused cosmetics and personal care products is rapidly growing owing to CBD’s anti-inflammatory, anti-seborrheic, and antioxidant properties. Numerous beauty brands, such as The Body Shop and MGC Derma, are now involved in producing personal care & cosmetic products infused with hemp-derived CBD. For instance, in March 2024, Hemp Foods Australia announced the launch of its first beauty supplement that focuses on enhancing the health of hair, skin, and nails. This new product, a vegan collagen supplement, marks the company's entry into the beauty-from-within category and aims to address the demand for plant-based alternatives.

Marijuana is expected to grow at the fastest CAGR during the forecast period. This growth can be attributed to the recognized therapeutic benefits of marijuana in alleviating the symptoms of various illnesses, including cancer, AIDS, multiple sclerosis, glaucoma, seizure disorders, spinal cord injuries, chronic pain, and other medical conditions. According to data from the Australian Institute of Health and Welfare, by 2033, it's projected that Australia will see more than 200,000 cancer diagnoses, a number that's expected to rise due to population growth and the anticipated increase in cancer rates. As the prevalence of such medical conditions continues to rise, there is a corresponding expectation of increased utilization of marijuana for medical purposes, thereby driving growth in this segment.

Derivatives Insights

The CBD segment had the largest market share of 64.85% in the derivatives segment in 2023.CBD, or cannabidiol, is the non-psychoactive compound found in the cannabis plant, and its adoption is increasing for a wide range of health issues. There are ongoing studies that signify the potential benefits of CBD on certain health conditions. For instance, as of October 2022, there was a study sponsored by the Medical University of Silesia about the effectiveness of CBD intraoral application on temporomandibular disease, and this was completed in 2023. Another study sponsored by the University of Colorado began in February 2022 to assess the efficacy of broad-spectrum & full-spectrum CBD for reducing opioid use, pain, & anxiety and improving cognitive function & sleep. This study is expected to be completed by February 2027.

The others segment is expected to grow at the fastest CAGR during the forecast period. The other segment includes derivatives or elements derived from the cannabis plant, such as flavonoids, terpenes, and other lesser-known cannabinoids. Factors including expanding research endeavors, rising interest in minor cannabinoids, and the implementation of diverse distribution strategies are expected to drive growth in this segment. For instance, in May 2022, Bod Australia (BOD) conducted a study yielding promising results concerning the safety and efficacy of a cannabis extract rich in cannabigerol (CBG).

Application Insights

Based on application, the chronic pain segment held the largest share of 26.52%, driven by the increasing demand for alternative treatments. Chronic pain is a major health issue in Australia. According to Painaustralia in 2020, 3.37 million people were living with chronic pain in Australia, with women making up 53.8% (1.81 million) and men 46.2% (1.56 million) of this group. Medical cannabis products, particularly THC-rich products, are being recognized as a potential solution for managing chronic pain. With the Australian government's relaxed regulations and increasing awareness among healthcare professionals, the market is expected to experience rapid growth in this segment.

The Tourette’s syndrome segment is expected to experience the fastest CAGR over the forecast period. Medicinal cannabis has shown promising results in reducing tics and associated symptoms in patients with Tourette’s syndrome. In addition, in Australia, several ongoing clinical studies are investigating the use of medicinal cannabis for Tourette’s syndrome. For instance, a study published in the “New England Journal of Medicine” involving 22 adult patients with severe Tourette’s syndrome symptoms revealed that medicinal cannabis oil significantly reduced tics, obsessive-compulsive disorder symptoms, and anxiety. The study revealed a significant correlation between the concentration of cannabis in the blood and the effectiveness of treatment. THC, the psychoactive component in cannabis causing a euphoric sensation, and CBD, a non-psychoactive compound, are both utilized for medicinal purposes in Australia. The study highlights the potential of medicinal cannabis as an alternative therapy for Tourette’s syndrome.

Key Australia Medical Cannabis Company Insights

The competitive scenario in the market is highly competitive, with key players such as Cann Group Limited, Zelira Therapeutics, AusCann Group Holdings Ltd., Bod Australia, Althea Group, ECOFIBRE, Botanix Pharmaceuticals, EPSILON, Little Green Pharma, Incannex, Bod Australia, Cann Group Limited, and ECOFIBRE holding significant positions. The major companies are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Australia Medical Cannabis Companies:

- Cann Group Limited

- Zelira Therapeutics

- AusCann Group Holdings Ltd.

- Bod Australia

- Althea Group

- ECOFIBRE

- Botanix Pharmaceuticals

- EPSILON

- Little Green Pharma

- Incannex

- Bod Australia

- Cann Group Limited

- ECOFIBRE

Recent Developments

-

In February 2024, Peak Processing Solutions, a subsidiary of Althea Group Holdings, entered into a contract with Collective Project to manufacture six cannabis-infused beverage products.

-

In January 2024, Althea Group Holdings Limited, a company specializing in producing and distributing cannabis-based items, introduced two new offerings: Althea THC10 and Althea CBD3:THC2.

-

In September 2023, MediPharm Labs introduced GMP strain-specific full-spectrum cannabis oil and inhalation cartridge products under the Beacon Medical brand.

-

In September 2023, The Therapeutic Goods Administration (TGA) of Australia granted Cannatrek GMP accreditation for its newly established processing facility in Shepparton, which was developed with an investment of USD 5 million.

Australia Medical Cannabis Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 151.20 million

Revenue forecast in 2030

USD 860.74 million

Growth rate

CAGR of 33.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sources, application, derivatives

Country scope

Australia

Key companies profiled

Cann Group Limited; Zelira Therapeutics; AusCann Group Holdings Ltd.; Bod Australia; Althea Group; ECOFIBRE; Botanix Pharmaceuticals; EPSILON; Little Green Pharma; Incannex; Bod Australia; Cann Group Limited; ECOFIBRE

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia Medical Cannabis Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Australia medical cannabis market report based on of sources, derivatives, and application.

-

Sources Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemp

-

Hemp CBD Oil

-

Industrial Hemp

-

-

Marijuana

-

Flower

-

Oil And Tinctures

-

-

-

Derivatives Outlook (Revenue, USD Million, 2018 - 2030)

-

CBD

-

THC

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Chronic Pain

-

Anxiety And Depression

-

Arthritis

-

Diabetes

-

Glaucoma

-

Migraines

-

Epilepsy

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Alzheimer’s Disease

-

Post-traumatic Stress Disorder (PTSD)

-

Parkinson's Disease

-

Tourette’s Syndrome

-

Others

-

Frequently Asked Questions About This Report

b. The Australia medical cannabis market size was estimated at USD 93.54 million in 2023 and is expected to reach USD 151.2 million in 2024.

b. The Australia medical cannabis market is expected to grow at a compound annual growth rate of 33.6% from 2024 to 2030 to reach USD 860.74 million by 2030.

b. Hemp dominated the Australia medical cannabis market with a share of 74.1% in 2023. This is attributable to the increased number of patients consuming hemp-based products such as hemp CBD and supplements for various health benefits.

b. Some key players operating in the Australia medical cannabis market include Cann Group Limited; Zelira Therapeutics; AusCann Group Holdings Ltd.; Bod Australia; Althea Group; ECOFIBRE; Botanix Pharmaceuticals; EPSILON; Little Green Pharma; Incannex; Bod Australia; Cann Group Limited; ECOFIBRE

b. Key factors that are driving the Australia medical cannabis market growth include the rising interest in alternative therapies for managing chronic pain, nausea, and various other health issues, as well as the introduction of new products and formulations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."