- Home

- »

- Automotive & Transportation

- »

-

Automated Parking System Market, Industry Report, 2030GVR Report cover

![Automated Parking System Market Size, Share & Trends Report]()

Automated Parking System Market (2025 - 2030) Size, Share & Trends Analysis Report By Component, By Structure Type, By Platform Type, By Automation Level, By End Use, By Region (North America, Europe, Asia Pacific, Latin America, MEA) And Segment Forecasts

- Report ID: GVR-4-68039-054-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automated Parking System Market Summary

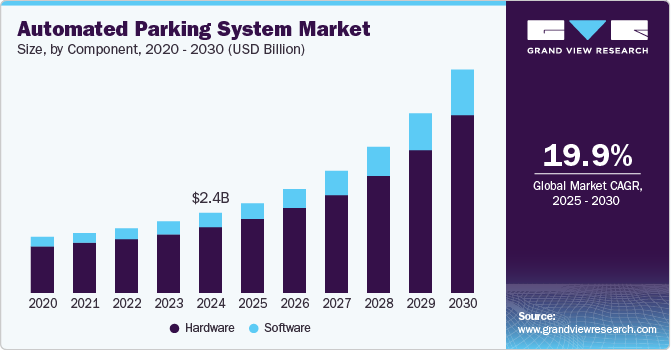

The global automated parking system market size was estimated at USD 2.37 billion in 2024 and is projected to grow at a CAGR of 19.9% from 2025 to 2030. Growing demand for green & sustainable parking solutions can be attributed to the growth of the automated parking system market.

Key Market Trends & Insights

- North America automated parking system market was identified as a lucrative region in 2024.

- By component, the hardware segment accounted for the largest share of 81.9% in 2024.

- By structure type, the tower system segment held the largest market share in 2024.

- By platform type, the palleted segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.37 Billion

- 2030 Projected Market Size: USD 6.66 Billion

- CAGR (2025-2030): 19.9%

- North America: Largest market in 2024

These systems maximize parking capacity, reduce the need for expansive parking lots, and offer a more streamlined, user-friendly experience. In addition, the continuous advancement in robotics and artificial intelligence (AI) is a major factor contributing to the growth of the market. These technologies enable more efficient, precise, and safe parking operations.

The rapid growth of smart cities is another significant trend fueling the growth of the automated parking system market. Cities are increasingly adopting technologies that improve efficiency, sustainability, and urban mobility, and automated parking systems are seen as a vital part of this transition. By utilizing IoT, AI, and sensor technology, APS can optimize parking space utilization, reduce traffic congestion, and contribute to more sustainable urban environments. In smart cities, APS not only provides a solution to limited parking space but also integrates with other smart infrastructure systems, such as traffic management and environmental monitoring, to create a seamless, efficient urban experience.

The growing population and widespread use of cars throughout the world have generated concerns about parking infrastructure and necessitated the development of the available infrastructure in urban areas. Furthermore, an increase in per capita income, coupled with improved lifestyles, has enhanced the demand for personal mobility, thereby driving automobile sales in metropolitan cities. Due to the increasing scarcity of available free space, there will be a challenge for parking capacity in metro cities, while decreasing the demand will subdue the citizen’s mobility experience.

The number of high-rise constructions has increased significantly in the past few years. Real estate developers are increasingly focusing on offering sustainable homes with reduced emissions, particularly in luxury projects, as these parking systems are most effective in coping with the intensifying problem of insufficient parking spaces. For instance, the Beacon residential facility in London offers sustainable homes with zero-emission, facilitating a fully automated solution with 320 parking spaces. The steady rise in the number of luxury construction projects globally is expected to favor automated parking system industry growth.

With the expansion of automated solutions across various geographies, the initial investment for developing high-caliber parking solutions is significantly high. The requirement for the construction of such systems may limit the growth of the market to a certain extent. Moreover, these are highly complex solutions with quality control issues. Furthermore, the construction and management of these systems are also high and require the consideration of many factors. The absence of regulation for monitoring the working of these systems and quality control issues also pose significant challenges for manufacturers. Nevertheless, enforcing regulations related to quality control to avoid accidents and damage could help overcome these challenges.

Component Insights

The hardware segment accounted for the largest share of 81.9% in 2024. The hardware components include microcontrollers, GSM modules, RF modules, displays, motor drivers, ultrasonic sensors, DC motors, and camera units, and the structure of the entire system varies across projects in a parking system. Depending on the budget, several solutions such as guidance systems, web-based solutions, sensor-based recognition, license plate recognition solutions, mobile-based parking, and RFID solutions can be integrated into the systems. Hardware systems contribute to the highest share of the total cost of the automated parking system. Hence, the segment is expected to continue its dominance over the forecast period.

The software segment is expected to grow at the fastest CAGR during the forecast period. The software plays a vital role in the proper functioning of the system. The expansion of this segment is majorly driven by controlling, managing, and orchestrating the moves involved in parking and retrieving vehicles with the help of parking sensors that provide information about vacant and occupied parking areas using analytics solutions. The software also includes inventory accuracies that are not easily achieved through manual systems. Therefore, with advancements and further automation in parking solutions, the software segment is expected to gain significant momentum over the forecast period.

Structure Type Insights

The tower system segment held the largest market share in 2024. Tower systems are the most efficient systems as they save significant horizontal space and utilize the advantages of vertical space. These solutions can be built and designed in lower configurations to accommodate different height restrictions. With the increase in advancement and further automation in the parking solution, the segment is expected to gain significant momentum over the years.

The puzzle system segment is expected to register a fastest CAGR during the forecast period. The growth is attributed to the increase in demand for space-efficient parking solutions, lower cost of installation and maintenance, and Improved safety features. Puzzle parking systems are very space-efficient, which is important in urban areas where space is limited, and are relatively easy to install and maintain, which can save businesses money.

Platform Type Insights

The palleted segment dominated the market in 2024. These solutions simplify the movement of vehicles in the parking space as the vehicles cannot be moved or lifted without the driver. As the number of people preferring work from home option is increasing, these parking solutions are estimated to have an attractive growth in the future as they increase the security of the vehicles, improve cityscape, and higher parking density compared to conventional car parks. No accommodations for car size are required in these solutions, which minimizes the complication of transport mechanisms.

The non-palleted segment is expected to grow at the fastest CAGR during the forecast period. These solutions directly lift, transfer, and park the vehicle in empty spots, eliminate the movement of empty pallets, and enhance the overall system’s efficiency. These solutions automatically adjust themselves according to the size of the vehicle, eliminate the drawbacks of palleted solutions, and reduce the parking and retrieval time by up to 30%. These factors, along with the growing number of vehicles globally, are expected to boost the growth of the market in the forthcoming years.

Automation Level Insights

The fully automated segment dominated the market in 2024. The advantages of fully automated parking systems such as higher efficiency, increased capacity, reduced emission, and enhanced safety & convenience over semi-automated solutions are highly in demand in developing economies. However, the choice between fully automated and semi-automated solutions varies based on factors such as the available budget, location, and application of the project. Often, systems with higher capacity tend to be fully automated, while low-capacity systems remain semi-automated. In addition, fully automated parking solutions are completely touchless, and designed to work without human intervention.

The semi-automated management segment is expected to grow at a moderate CAGR during the forecast period. Semi-automatic solutions are deployed in various residential, commercial, and mixed-use applications. The installation cost for these solutions is low and they are easy to maintain. The structure is based on lifting and sliding the pallet holding the vehicle for parking. These systems are generally adopted when a limited number of vehicles are to be parked in a given space. Furthermore, factors such as increasing urbanization and rising disposable income are the key driving factors for the growth of the market.

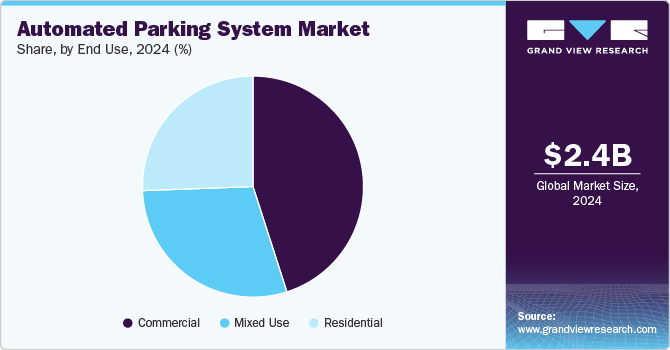

End Use Insights

The commercial segment dominated the market in 2024.This can be attributed to the increasing demand for parking spaces in commercial buildings and shopping complexes. The growing number of vehicles on the road has lowered the availability of spaces, leading to traffic jams and a rise in air pollution across major cities around the world. Owing to the several benefits of automated parking systems in tackling these issues, combined with benefits such as optimal use of space and enhanced security, the demand and adoption for these systems is expected to expand at a promising pace in the commercial space soon.

The residential segment is anticipated to grow rapidly during the forecast period. The growth of the segment can be attributed to the rising number of high-rise residential buildings and the increasing adoption of these solutions in luxury residential facilities across the globe. Moreover, factors, such as rapid urbanization, increased disposable income, and increased purchasing power, have resulted in a significant rise in the sales of vehicles in the past few years. The demand for automated parking systems is also anticipated to increase due to the rising need for vertical parking spaces in constantly shrinking urban residential spaces.

Regional Insights

The North America automated parking system market was identified as a lucrative region in 2024. The region's growing focus on smart city infrastructure, coupled with the adoption of advanced technologies, has propelled the demand for automated parking solutions, especially in densely populated cities. In particular, the U.S. has seen substantial investments in APS, with both private and public sectors recognizing the potential benefits, such as optimizing space, reducing congestion, and enhancing overall efficiency.

U.S. Automated Parking System Market Trends

The U.S. automated parking system market held a dominant position in 2024. Increasing urban density, limited space for parking, and a growing emphasis on sustainability can be attributed to the growth of the market. The demand for APS is also fueled by the rise in consumer preference for smart, connected infrastructure, driven by innovations in artificial intelligence (AI) and Internet of Things (IoT) technologies. In addition, the U.S. is home to several players in the automotive and tech industries, encouraging collaborations that advance the development of APS solutions. With a strong push toward electric vehicles, the market for APS tailored for EV charging is also on the rise, further supporting growth in the country.

Europe Automated Parking System Market Trends

Europe automated parking system market is expected to register a moderate CAGR from 2025 to 2030. The rise in the initiatives for the development of smart cities and growing demand from commercial and residential buildings will provide beneficial opportunities for the growth of the market in the region. The adoption of automated parking systems is also high in these countries to save space and reduce vehicle emissions while parking the car. The presence of technologically advanced infrastructure has further encouraged the public and private sectors to adopt automated solutions for eliminating parking problems.

The UK automated parking system market is expected to grow rapidly in the coming years due to increasing urbanization, the need for space optimization, and the government’s focus on smart city initiatives. In cities such as London, where parking demand is high, APS provides an efficient solution by saving space and reducing congestion. London is leading the way in smart city development. The city’s smart initiatives encompass Smart Transportation: Transport for London (TfL) has introduced contactless payment systems, real-time travel updates, and congestion charging zones to enhance traffic flow and decrease emissions. Such initiatives are expected to contribute to the growth of the market.

Automated parking system market in Germany held a substantial market share in 2024. The country’s cities are increasingly adopting automated parking solutions to tackle space constraints in urban areas. Germany’s strong push towards sustainability, energy efficiency, and reduced carbon emissions has fueled the demand for APS, particularly in the context of rising electric vehicle adoption. Furthermore, the country’s automotive giants, such as BMW and Mercedes-Benz, are investing heavily in the development of automated technologies, including parking systems, which is further driving market growth.

Asia Pacific Automated Parking System Market Trends

The Asia Pacific automated parking system market dominated the global market in 2024 and accounted for 33.9% of the overall market share. This can be attributed to the huge population and prevalence of vehicle parking on the roads. The region is home to 40% of the global population and some of the fastest-growing economies, such as India. Moreover, various smart city projects are enrolled to enhance citizen services. These projects affect challenges associated with transit, infrastructure, connectivity & utilities, and are certain to reinforce the expansion of the market for automated parking systems. Therefore, governments in the region are focusing on urban planning by implementing smart city solutions to derive benefits from the existing infrastructure.

Japan's automated parking system market is expected to grow at a moderate growth rate during the forecast period. Japan’s automated parking system market is driven by the country's advanced technological infrastructure and a high level of innovation in the automotive sector. Japanese cities are highly urbanized and face space constraints, making APS an ideal solution for parking challenges. With an aging population and a shrinking workforce, Japan is also looking to automate many services, including parking, to maintain efficiency. Japan's commitment to integrating smart technologies into urban spaces makes it a significant contributor to the global automated parking system industry.

Automated parking system market in China held a substantial market share in 2024 owing to rapid urbanization and increasing vehicle ownership. Furthermore, the increasing popularity of electric vehicles in China, along with the expansion of EV charging infrastructure, has further accelerated the demand for APS. The large-scale manufacturing capacity and technological advancements in China make it a vital country for the continued growth of the global automated parking system industry.

Key Automated Parking System Company Insights

Some of the key companies in the automated parking system industry include Robotic Parking Systems, Inc., Westfalia Technologies, Inc., Klaus Multiparking GmbH, Wohr Parking System Pvt. Ltd., and others. Organizations are focusing on integrating advanced technologies into their offerings to maintain competitive advantages. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships, among others.

-

Westfalia Technologies Inc. specializes in designing, manufacturing, installing, and supporting automated solutions that optimize capacity utilization in distribution centers, warehouses, and parking areas. The company’s automated parking systems, designed and manufactured in the U.S., employ cutting-edge robotic technology to efficiently park and retrieve vehicles within a secure garage.

-

Robotic Parking Systems, Inc. is a prominent provider of automated parking solutions. The company consistently invests in research and development to advance its technology. Innovations in Robotic Parking Systems Inc.’s offerings include patented pallet technology, FireBox technology, and integration with emerging technologies.

Key Automated Parking System Companies:

The following are the leading companies in the automated parking system market. These companies collectively hold the largest market share and dictate industry trends.

- Skyline Parking AG

- Westfalia Technologies, Inc.

- Unitronics

- Klaus Multiparking GmbH

- Robotic Parking Systems, Inc.

- City Lift Parking, LLC

- Park Plus Inc.

- Wohr Parking System Pvt. Ltd.

- Parkmatic

- AutoMotion Parking Systems

Recent Developments

-

In March 2024, Applied Intuition, a supplier of vehicle software, unveiled an automated parking development solution designed for automated driving (AD) and advanced driver-assistance systems (ADAS). This solution enables AD and ADAS development teams to create, test, and deploy machine learning-based or traditional automated parking systems (APS) up to 12 times faster, while enhancing safety and reliability.

-

In February 2023, BMW and Valeo formed a strategic cooperation to jointly develop the next generation of Level 4 autonomous parking technology. The system ranges from automated deploy assistance to level 4 automated valet parking and is based on sensors and technology in the car. The companies also collaborate on infrastructure-based services to enable entirely automated parking and charging in equipped public parking facilities and venues.

-

In January 2023, Thiruvananthapuram International Airport, India deployed a fully automated parking system. As per the airport authorities, this system represents a significant enhancement in passenger safety, vehicle security, and the overall convenience of the airport experience.

-

In November 2022, Mercedes-Benz, in collaboration with Bosch, obtained approval for a fully automated self-parking software. This software empowers vehicles to autonomously navigate to a predetermined parking space within a parking lot at Stuttgart Airport.

Automated Parking System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.68 billion

Revenue forecast in 2030

USD 6.66 billion

Growth Rate

CAGR of 19.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, structure type, platform type, automation level, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; and South Africa

Key companies profiled

Skyline Parking AG; Westfalia Technologies, Inc.; Unitronics; Klaus Multiparking GmbH; Robotic Parking Systems, Inc.; City Lift Parking, LLC; Park Plus Inc.; Wohr Parking System Pvt. Ltd.; Parkmatic; AutoMotion Parking Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automated Parking System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automated parking system market report based on component, structure type, platform type, automation level, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Structure Type Outlook (Revenue, USD Million, 2018 - 2030)

-

AGV system

-

Silo system

-

Tower system

-

Rail Guided Cart (RGC) system

-

Puzzle system

-

Shuttle system

-

-

Platform Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Palleted

-

Non-palleted

-

-

Automation Level Outlook (Revenue, USD Million, 2018 - 2030)

-

Fully Automated

-

Semi-automated

-

-

EndUse Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Mixed-use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automated parking system market size was estimated at USD 2.37 billion in 2024 and is expected to reach USD 2.68 billion in 2025.

b. The global automated parking system market is expected to grow at a compound annual growth rate of 19.9% from 2025 to 2030 to reach USD 6.66 billion by 2030.

b. Asia Pacific dominated the automated parking system market with a share of 33.9% in 2024. The rise in the initiatives for the development of smart cities and growing demand from commercial and residential buildings will provide beneficial opportunities for the growth of the market in the region.

b. Some key players operating in the automated parking system market include Skyline Parking AG, Westfalia Technologies, Inc., Unitronics, Klaus Multiparking GmbH, Robotic Parking Systems, Inc., City Lift Parking, LLC, Park Plus Inc., Wohr Parking System Pvt. Ltd., Parkmatic, AutoMotion Parking Systems.

b. The key drivers for the automated parking system market are the increasing number of vehicles, scarcity of land for parking, rising urbanization, growing demand for green & sustainable parking solutions, and smart city initiatives by the governments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.