- Home

- »

- Electronic Devices

- »

-

Automated Test Equipment Market Size, Share Report, 2030GVR Report cover

![Automated Test Equipment Market Size, Share & Trends Report]()

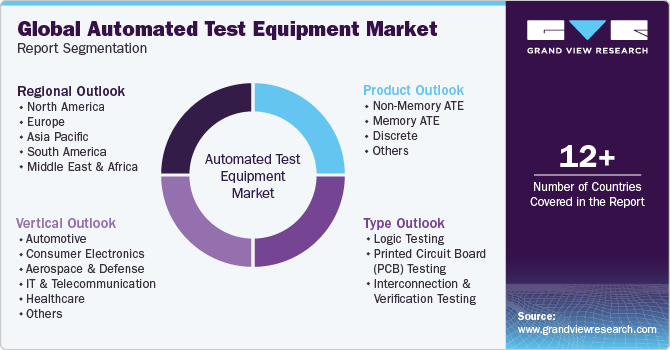

Automated Test Equipment Market Size, Share & Trends Analysis Report By Product (Non-memory ATE, Memory ATE, Discrete), By Type (Logic Testing, PCB Testing, Interconnection & Verification Testing), By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-176-4

- Number of Report Pages: 167

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Automated Test Equipment Market Trends

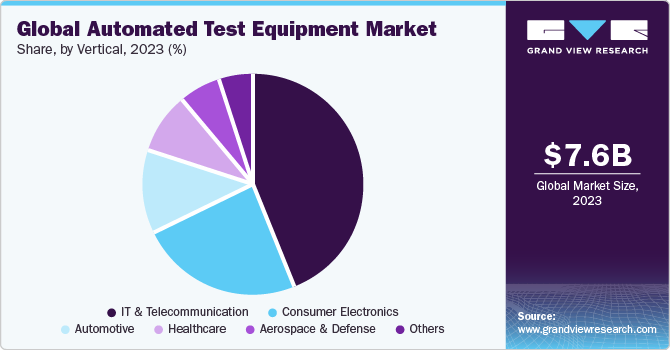

The global automated test equipment market size was valued at USD 7,643.8 million in 2023 and is expected to register a compound annual growth rate (CAGR) of 3.1% from 2024 to 2030. The growth is driven by the use of Automated Test Equipment (ATE) in the automotive and semiconductor industry. A significant increase in the number of connected devices and consumer electronics, along with an increasing focus of many companies on quality improvement along with end-to-end testing solutions, is expected to further drive the market. Implementation of ATE in semiconductor manufacturing companies to enhance performance capability and speed of operation and, in turn, reduce the cost of semiconductor devices is expected to positively influence growth.

Increasing adoption of System on Chip (SoC) and high demand for consumer electronics is expected to be a key driving force for the ATE market over the forecast period. Growing electronic components in the automotive sector and penetration of smartphones are expected to drive the market. Miniaturization has widened the scope of ATE application. Additionally, considerable technological advancements coupled with design complexity and the need for effective testing are expected to fuel the market.

Advancements in semiconductor manufacturing processes, along with the expansion of wireless networks in developing nations, are expected to significantly drive the automatic test equipment market growth in the forthcoming years. Additionally, considerable technological advancements coupled with design complexity and the need for effective testing are a few factors expected to benefit the market expansion.

Recent technological advancements have significantly reduced the cost and time for manufacturing semiconductor ICs and have increased the profit margin for the companies. Automated test equipment manufacturers constantly invest in R&D activities to enhance their product portfolio and to fit in with the latest improvements in semiconductor devices.

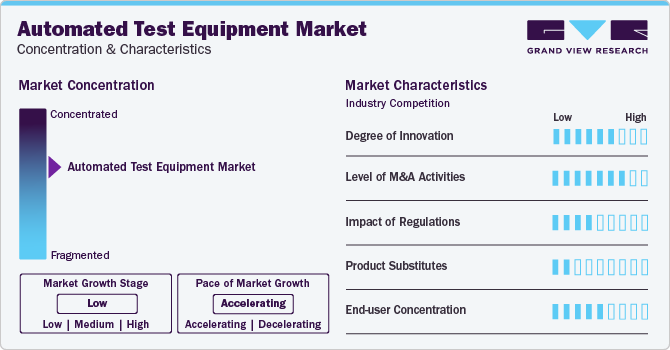

Market Concentration & Characteristics

The ATE market growth stage is low, and the pace of the market growth is accelerating. The market is consolidated, with the top players capturing a significant share of the market. The target market is characterized by a high degree of innovation, and automated test equipment companies are investing in Research & Development (R&D) and launching new products. For instance, Aemulus Corporation, a Malaysia-based company, spent over USD 660,000 on R&D

The target market is also characterized by a high number of product launches by the leading players. For instance, in April 2023, STAr Technologies Inc. unveiled the latest 3D/2.5D MEMS micro-cantilever probe card for the reliability testing of Wafer Acceptance Test (WAT). The probe card provides physical characteristics, thus contributing towards enhanced testing efficiency.

The target market players are subject to various local and international laws and regulations. These regulations can include regulations related to technology transfer restrictions and import-export control, among others. Vendors face challenges regarding standardization as they need to meet regional requirements and regulations. For instance, Directive 2002/95/EC of the European Parliament bans the use of a few hazardous substances in electronic and electrical equipment.

The ATE market has a low threat of external substitutes, and further manual testing is not a reliable method for equipment testing and will eventually phase out owing to technological advancements. Continuous changing technology in the semiconductor industry makes it difficult to create low-cost substitutes for ATE equipment.

Numerous sectors, including IT & telecommunication, semiconductor, automotive and transportation, and healthcare, among others, use ATE. For instance, in the consumer electronics industry, the ATE is used to test the functionality of appliances, smartphones, and fitness wearables, among others. At the same time, ATE validates the functionality of semiconductor devices by measuring the output signals.

COVID-19 Impact Analysis

The COVID-19 pandemic has had an adverse impact on several markets, and the ATE market is no exception. The stringent lockdowns implemented due to the rapid spread of the virus meant that the ATE market had to suffer from a production standpoint. From the demand perspective, regulated demand from the IT & Telecom segment, especially during the second half of 2020, kept the demand for ATE products afloat in 2020. The ongoing trend of working remotely led to increased demand for connectivity and IT products, consequently driving the need for automated test equipment.

Market Dynamics

Automated Test Equipment (ATE) is used to identify defects in Devices Under Tests (DUT) and helps to ensure the quality of devices. Significant increase in the number of consumer electronics along with an increasing focus of the companies on quality improvement is driving the market demand. Consumer electronics industry had grown significantly in terms of revenue. The major factor for the growth of the consumer electronics industry is the rise in smartphone sales. Technological advancements and the emergence of 5G technology are expected to drive smartphones demand in the forthcoming years.

Companies focus on reducing the selling price of electronic devices, such as personal computers, cell phones, and other electronics devices, as a marketing strategy to maintain their position and stay ahead in the competition. Due to growing consumer demands, there is a continuous price pressure on semiconductor manufacturers wherein they adopt economies of scale to maintain their margins. Packaging and testing costs account for more than 50% of the overall production cost of ICs, which is expected to rise to over 73% in the future. The fabrication costs are not considered as a part of the profit margin in the manufacturing of semiconductor chips. The companies concentrate on enhancing their fabrication technologies to reduce losses due to damages.

Product Insights

The non-memory ATE segment led the automated test equipment market and accounted for more than 63% share of the global revenue in 2023. Recent innovations in IoT devices and autonomous vehicles, along with significant advancements in the defense and aerospace sectors, have drastically changed the market dynamics. Companies are focusing on enhancing customer satisfaction by ensuring faster time-to-market along with superior product quality and low testing costs. These factors act as significant growth drivers for the market.

The product segment is further segregated into non-memory, memory, and discrete, others automated test equipment. Increased complexities in semiconductor chip manufacturing need a significant amount of test cost and time. Semiconductor companies focus on reducing testing costs and consider outsourced equipment for the testing process instead of in-house development, which is one of the primary factors driving the growth.

Vertical Insights

The IT & telecommunications ATE segment led the market and accounted for more than 48.5% share of the global revenue in 2023. Based on vertical, the market is categorized into automotive, consumer electronics, aerospace & defense, IT & telecommunication, healthcare, and others. The others segment includes Banking, Financial Services and Insurance (BFSI), entertainment, and e-commerce. Increasing application of automatic test equipment in the semiconductor assembly and manufacturing industry is expected to drive the demand for ATE. The IT & telecommunication vertical is expected to have a significant market over the forecast period.

Demand for automated test equipment is driven mainly by increasing ST production, complexity, and performance level of semiconductor devices used in electronic products along with the emergence of development in semiconductor device technology. Furthermore, increasing pricing pressure among semiconductor manufacturers has forced suppliers to leverage the utilization of capital equipment across multiple devices. Increasing application in the semiconductor assemble and manufacturing industry is expected to drive the the growth of the automotive test equipment semiconductor market.

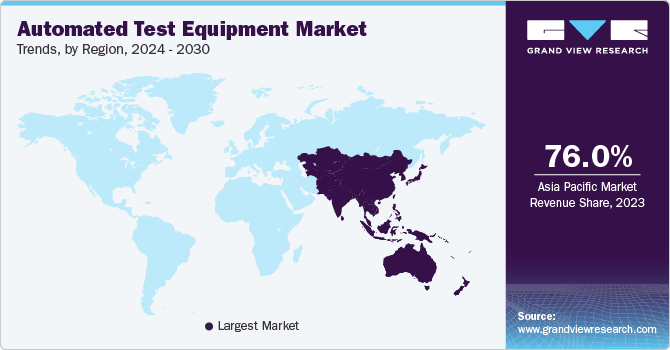

Regional Insights

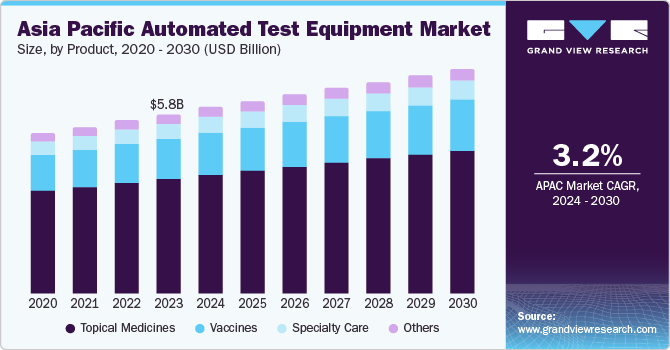

The Asia Pacific segment led the market and accounted for more than 76% share of the global revenue in 2023. The region is expected to dominate over the forecast period, attributed to the significant presence of semiconductor industries. China and Taiwan are expected to hold the maximum regional revenue share. Adaptive testing, advanced Design-For-Test (DFT), faster mixed-signal testers, fine-pitch probe cards, and design standards among others are few future technologies expected to significantly change the market dynamics. Increase in government initiatives by countries like China, Indonesia, Malaysia, Singapore, Thailand, and Taiwan to develop advanced manufacturing processes is also expected to boost growth.

North America automated test equipment market is anticipated to witness significant gains, in terms of revenue share, over the forecast period due to the increasing application of automated test equipment in the aerospace and defense sector.

Key Companies & Market Share Insights

Some of the key players operating in the market include Astronics Corporation, ADVANTEST CORPORATION, Chroma ATE Inc., and Teradyne Inc.

-

Astronics Corporation is a U.S.-based company offering advanced technology solutions to electronics, aerospace & defense industries. The company offers numerous products and services, including avionics products and automated test systems. It operates in two segments, namely Aerospace and Test Systems. The company has principal operations in the U.S., France, Canada, and U.K.

-

Chroma ATE Inc. is a Taiwan-based company that offers intelligent manufacturing systems, precision test and measurement instrumentation, and automated test systems. The company serves various markets, including power electronics, semiconductors, electric vehicles, and passive components. It has a global presence with offices in the U.S., Europe, Japan, South Korea, Southeast Asia, and China.

- TESEC Corporation and Roos Instruments are some of the emerging automated test equipment manufacturers.

-

TESEC Corporation is a Japan-based manufacturer of semiconductor equipment. The company offers automated handlers and test systems for the semiconductor industry. Along with handlers and test systems, the company also offers after-sale support services. It has a global presence with companies in the U.S., Malaysia, and China.

-

Roos Instruments is a U.S.-based company that offers manufactures automated test equipment and develops software for the semiconductor industry. The company offers application-based solutions to automated test equipment and designs test instrument modules. It develops end-to-end solutions, test infrastructure, and expert system software.

Key Automated Test Equipment Companies:

- Aemulus Corporation

- Chroma ATE Inc.

- VIAVI Solutions Inc.

- Astronics Corporation

- ADVANTEST CORPORATION

- Cohu, Inc

- Teradyne Inc.

- STAr Technologies Inc.

- TESEC Corporation

- Roos Instruments

- Marvin Test Solutions, Inc.

- Danaher

Recent Developments

-

In January 2023, Roos Instruments announced the launch of the RI8607 50 GHz Test Set. The new instrument enhances the capabilities of Cassini's vector measurement system. The instruments can be used for various applications, including automotive radar and cellular backhaul.

-

In October 2022, Chroma ATE Inc. launched the next generation Chroma 3650-S2 high performance power IC test platform. It is an automated testing equipment designed for testing battery, power management ICs (PMICs), and power conversion.

-

In May 2022, Advantest Corporation launched the compact test station for the V93000 Platform while enabling 4x capacity increase in IC engineering laboratories. This equipment is designed for functional and structural test of digital devices in engineering environments.

-

In May 2021, Astronics Corporation introduced anti-microbial outlet units. These units are advanced test equipment for providing additional safety attributes, and the organization is able to uplift the travel experience and provide solutions for passengers, and airlines.

Automated Test Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7,643.8 million

Revenue forecast in 2030

USD 9,443.4 million

Growth rate

CAGR of 3.1% from 2024 to 2030

Actual values

2017 - 2023

Forecast values

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, vertical, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, Japan, South Korea, Taiwan, Singapore, India, Malaysia, Australia, Brazil, KSA, UAE, and South Africa

Key companies profiled

Aemulus Corporation, Chroma ATE Inc., VIAVI Solutions Inc., Astronics Corporation, ADVANTEST CORPORATION, Cohu, Inc, Teradyne Inc., STAr Technologies Inc., TESEC Corporation, Roos Instruments, Marvin Test Solutions, Inc., and Danaher

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automated Test Equipment Market Report SegmentationThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the global automated test equipment market report based on product, type, vertical, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Non-Memory ATE

-

Memory ATE

-

Discrete ATE

- Others

-

-

Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Logic Testing

-

Linear or mixed Signal Equipment

-

Passive Component ATE

-

Discrete ATE

-

-

Printed Circuit Board (PCB) Testing

-

Interconnection and Verification Testing

-

-

Vertical Outlook (Revenue, USD Million; 2017 - 2030)

-

Automotive

-

Consumer Electronics

-

Aerospace & Defense

-

IT & Telecommunication

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Taiwan

-

Thailand

-

Singapore

-

Malaysia

-

Australia

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ATE market size was estimated at USD 6.87 billion in 2020 and is expected to reach USD 7.12 billion in 2021.

b. The global ATE market is expected to grow at a compound annual growth rate of 3.3% from 2021 to 2028 to reach USD 8.94 billion by 2028.

b. Asia Pacific dominated the ATE market with a share of 75.7% in 2020. This is attributable to the significant presence of semiconductor industries. China and Taiwan are expected to hold the maximum regional revenue share.

b. Some key players operating in the ATE market include Aemulus Holdings Bhd (“Aemulusâ€); Chroma ATE Inc.; Aeroflex Inc. Astronics Corporation; Advantest Corporation; LTX-Credence Corporation; Teradyne Inc.; STAr Technologies Inc.; Tesec Corporation.

b. Key factors that are driving the ATE market growth include a significant increase in the number of connected devices and consumer electronics along with the increasing focus of the companies on quality improvement and end-to-end testing solutions.

Table of Contents

Chapter 1. Automated Test Equipment Market: Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Automated Test Equipment Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Automated Test Equipment Market: Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.1.1. Growth in consumer electronics

3.3.1.2. Surge in connected devices

3.3.1.3. Company focuses on cost-effective testing

3.3.1.4. Major innovations in technology and increased device complexity

3.3.2. Market Restraints Analysis

3.3.2.1. Competition for innovation products among major players

3.3.3. Industry Opportunities

3.3.3.1. Recent innovations in autonomous vehicles

3.3.3.2. Increased usage in virtual reality and wireless communication industries

3.3.4. Industry Challenges

3.4. Automated Test Equipment Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

3.5. Case Study Analysis

Chapter 4. Automated Test Equipment Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Automated Test Equipment Market: Product Movement Analysis, USD Million, 2023 & 2030

4.3. Non-Memory ATE

4.3.1. Non-Memory ATE Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.4. Memory ATE

4.4.1. Memory ATE Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.5. Discrete

4.5.1. Discrete Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.6. Others

4.6.1. Others Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 5. Automated Test Equipment Market: Type Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Automated Test Equipment Market: Type Movement Analysis, USD Million, 2023 & 2030

5.3. Logic Testing

5.3.1. Logic Testing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.3.2. Linear of mixed Signal Equipment

5.3.2.1. Linear or mixed Signal Equipment Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.3.3. Passive Component ATE

5.3.3.1. Passive Component ATE Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.3.4. Discrete ATE

5.3.4.1. Discrete ATE Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.4. Printed Circuit Board (PCB) Testing

5.4.1. Printed Circuit Board (PCB) Testing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.5. Interconnection and Verification Testing

5.5.1. Interconnection and Verification Testing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 6. Automated Test Equipment Market: Vertical Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Automated Test Equipment Market: Vertical Movement Analysis, USD Million, 2023 & 2030

6.3. Automotive

6.3.1. Automotive Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.4. Consumer Electronics

6.4.1. Consumer Electronics Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.5. Aerospace & Defense

6.5.1. Aerospace & Defense Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.6. IT & Telecommunication

6.6.1. IT & Telecommunication Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.7. Healthcare

6.7.1. Healthcare Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.8. Others

6.8.1. Others Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 7. Automated Test Equipment Market: Regional Estimates & Trend Analysis

7.1. Automated Test Equipment Market Share, By Region, 2023 & 2030, USD Million

7.2. North America

7.2.1. North America Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.2.2. North America Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.2.3. North America Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.2.4. North America Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.2.5. U.S.

7.2.5.1. U.S. Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.2.5.2. U.S. Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.2.5.3. U.S. Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.2.5.4. U.S. Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.2.6. Canada

7.2.6.1. Canada Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.2.6.2. Canada Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.2.6.3. Canada Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.2.6.4. Canada Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.2.7. Mexico

7.2.7.1. Mexico Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.2.7.2. Mexico Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.2.7.3. Mexico Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.2.7.4. Mexico Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.3. Europe

7.3.1. Europe Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.3.2. Europe Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.3.3. Europe Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.3.4. Europe Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.3.5. U.K.

7.3.5.1. U.K. Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.3.5.2. U.K. Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.3.5.3. U.K. Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.3.5.4. U.K. Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.3.6. Germany

7.3.6.1. Germany Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.3.6.2. Germany Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.3.6.3. Germany Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.3.6.4. Germany Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.3.7. France

7.3.7.1. France Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.3.7.2. France Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.3.7.3. France Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.3.7.4. France Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.4. Asia Pacific

7.4.1. Asia Pacific Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.2. Asia Pacific Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.4.3. Asia Pacific Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.4.4. Asia Pacific Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.4.5. China

7.4.5.1. China Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.5.2. China Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.4.5.3. China Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.4.5.4. China Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.4.6. Japan

7.4.6.1. Japan Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.6.2. Japan Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.4.6.3. Japan Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.4.6.4. Japan Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.4.7. India

7.4.7.1. India Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.7.2. India Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.4.7.3. India Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.4.7.4. India Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.4.8. South Korea

7.4.8.1. South Korea Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.8.2. South Korea Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.4.8.3. South Korea Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.4.8.4. South Korea Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.4.9. Taiwan

7.4.9.1. Taiwan Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.9.2. Taiwan Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.4.9.3. Taiwan Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.4.9.4. Taiwan Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.4.10. Singapore

7.4.10.1. Singapore Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.10.2. Singapore Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.4.10.3. Singapore Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.4.10.4. Singapore Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.4.11. Malaysia

7.4.11.1. Malaysia Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.11.2. Malaysia Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.4.11.3. Malaysia Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.4.11.4. Malaysia Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.4.12. Australia

7.4.12.1. Australia Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.12.2. Australia Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.4.12.3. Australia Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.4.12.4. Australia Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.5. South America

7.5.1. South America Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.5.2. South America Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.5.3. South America Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.5.4. South America Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.5.5. Brazil

7.5.5.1. Brazil Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.5.5.2. Brazil Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.5.5.3. Brazil Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.5.5.4. Brazil Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.6. Middle East and Africa

7.6.1. Middle East and Africa Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.6.2. Middle East and Africa Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.6.3. Middle East and Africa Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.6.4. Middle East and Africa Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.6.5. Kingdom of Saudi Arabia (KSA)

7.6.5.1. Kingdom of Saudi Arabia (KSA)Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.6.5.2. Kingdom of Saudi Arabia (KSA) Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.6.5.3. Kingdom of Saudi Arabia (KSA) Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.6.5.4. Kingdom of Saudi Arabia (KSA) Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.6.6. UAE

7.6.6.1. UAE Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.6.6.2. UAE Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.6.6.3. UAE Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.6.6.4. UAE Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

7.6.7. South Africa

7.6.7.1. South Africa Automated Test Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.6.7.2. South Africa Automated Test Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Million)

7.6.7.3. South Africa Automated Test Equipment Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

7.6.7.4. South Africa Automated Test Equipment Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis by Key Market Participants

8.2. Company Categorization

8.3. Company Market Positioning

8.4. Company Market Share Analysis

8.5. Strategy Mapping

8.5.1. Expansion

8.5.2. Mergers & Acquisition

8.5.3. Partnerships & Collaborations

8.5.4. New Transport Launches

8.5.5. Research And Development

8.6. Company Profiles

8.6.1. Aemulus Corporation

8.6.1.1. Participant’s Overview

8.6.1.2. Financial Performance

8.6.1.3. Product Benchmarking

8.6.1.4. Recent Developments

8.6.2. Chroma ATE Inc.

8.6.2.1. Participant’s Overview

8.6.2.2. Financial Performance

8.6.2.3. Product Benchmarking

8.6.2.4. Recent Developments

8.6.3. VIAVI Solutions Inc.

8.6.3.1. Participant’s Overview

8.6.3.2. Financial Performance

8.6.3.3. Product Benchmarking

8.6.3.4. Recent Developments

8.6.4. Astronics Corporation

8.6.4.1. Participant’s Overview

8.6.4.2. Financial Performance

8.6.4.3. Product Benchmarking

8.6.4.4. Recent Developments

8.6.5. ADVANTEST CORPORATION

8.6.5.1. Participant’s Overview

8.6.5.2. Financial Performance

8.6.5.3. Product Benchmarking

8.6.5.4. Recent Developments

8.6.6. Cohu, Inc

8.6.6.1. Participant’s Overview

8.6.6.2. Financial Performance

8.6.6.3. Product Benchmarking

8.6.6.4. Recent Developments

8.6.7. Teradyne Inc.

8.6.7.1. Participant’s Overview

8.6.7.2. Financial Performance

8.6.7.3. Product Benchmarking

8.6.7.4. Recent Developments

8.6.8. STAr Technologies Inc.

8.6.8.1. Participant’s Overview

8.6.8.2. Financial Performance

8.6.8.3. Product Benchmarking

8.6.8.4. Recent Developments

8.6.9. TESEC Corporation

8.6.9.1. Participant’s Overview

8.6.9.2. Financial Performance

8.6.9.3. Product Benchmarking

8.6.9.4. Recent Developments

8.6.10. Roos Instruments

8.6.10.1. Participant’s Overview

8.6.10.2. Financial Performance

8.6.10.3. Product Benchmarking

8.6.10.4. Recent Developments

8.6.11. Marvin Test Solutions, Inc.

8.6.11.1. Participant’s Overview

8.6.11.2. Financial Performance

8.6.11.3. Product Benchmarking

8.6.11.4. Recent Developments

8.6.12. Danaher

8.6.12.1. Participant’s Overview

8.6.12.2. Financial Performance

8.6.12.3. Product Benchmarking

8.6.12.4. Recent Developments

List of Tables

TABLE 1 List of Abrevation

TABLE 2 Global Automated Test Equipment Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

TABLE 3 Global Automated Test Equipment Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

TABLE 4 Global Automated Test Equipment Market revenue estimates and forecast, By Vertical, 2017 - 2030 (USD Million)

TABLE 5 Global Automated Test Equipment Market revenue, by Region, 2023 & 2030, (USD Million)

TABLE 6 North America Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 7 North America Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 8 North America Automated Test Equipment Market estimates & forecasts, by typ, 2017 - 2030 (USD Million)

TABLE 9 North America Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 10 U.S. Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 11 U.S. Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 12 U.S. Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 13 U.S. Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 14 Canada Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 15 Canada Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 16 Canada Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 17 Canada Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 18 Mexico Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 19 Mexico Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 20 Mexico Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 21 Mexico Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 22 Europe Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 23 Europe Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 24 Europe Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 25 Europe Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 26 U.K. Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 27 U.K. Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 28 U.K. Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 29 U.K. Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 30 Germany Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 31 Germany Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 32 Germany Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 33 Germany Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 34 France Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 35 France Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 36 France Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 37 France Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 38 Asia Pacific Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 39 Asia Pacific Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 40 Asia Pacific Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 41 Asia Pacific Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 42 China Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 43 China Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 44 China Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 45 China Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 46 India Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 47 India Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 48 India Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 49 India Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 50 Japan Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 51 Japan Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 52 Japan Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 53 Japan Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 54 South Korea Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 55 South Korea Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 56 South Korea Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 57 South Korea Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 58 Taiwan Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 59 Taiwan Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 60 Taiwan Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 61 Taiwan Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 62 Singapore Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 63 Singapore Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 64 Singapore Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 65 Singapore Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 66 Malaysia Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 67 Malaysia Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 68 Malaysia Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 69 Malaysia Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 70 Australia Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 71 Australia Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 72 Australia Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 73 Australia Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 74 South America Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 75 South America Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 76 South America Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 77 South America Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 78 Brazil Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 79 Brazil Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 80 Brazil Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 81 Brazil Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 82 Middle East & Africa Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 83 Middle East & Africa Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 84 Middle East & Africa Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 85 Middle East & Africa Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 86 KSA Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 87 KSA Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 88 KSA Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 89 KSA Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 90 UAE Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 91 UAE Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 92 UAE Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 93 UAE Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 94 South Africa Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

TABLE 95 South Africa Automated Test Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Million)

TABLE 96 South Africa Automated Test Equipment Market estimates & forecasts, by type, 2017 - 2030 (USD Million)

TABLE 97 South Africa Automated Test Equipment Market estimates & forecasts, by vertical, 2017 - 2030 (USD Million)

TABLE 98 Participant’s Overview

TABLE 99 Financial Performance

TABLE 100 Product Benchmarking

TABLE 101 Key companies undergoing expansion

TABLE 102 Key companies involved in mergers & acquisitions

TABLE 103 Key companies undertaking partnerships and collaboration

TABLE 104 Key companies launching new product/service launches

List of Figures

FIG. 1 Automated Test Equipment Market segmentation

FIG. 2 Information procurement

FIG. 3 Data analysis models

FIG. 4 Market formulation and validation

FIG. 5 Data validating & publishing

FIG. 6 Market snapshot

FIG. 7 Segment snapshot, by Product and Type

FIG. 8 Segment snapshot By Vertical

FIG. 9 Competitive landscape snapshot

FIG. 10 Automated Test Equipment Market value, 2017 - 2030 (USD Million)

FIG. 11 Automated Test Equipment Market - Industry value chain analysis

FIG. 12 Automated Test Equipment Market - Market trends

FIG. 13 Automated Test Equipment Market: Porter’s analysis

FIG. 14 Automated Test Equipment Market: PESTEL analysis

FIG. 15 Automated Test Equipment Market, by Product: Key takeaways

FIG. 16 Automated Test Equipment Market, by Product: Market share, 2023 & 2030

FIG. 17 Non-Memory ATE Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 18 Memory ATE Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 19 Discrete Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 20 Others Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 21 Automated Test Equipment Market, by Type: Key takeaways

FIG. 22 Automated Test Equipment Market, by Type: Market share, 2023 & 2030

FIG. 23 Logic Testing Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 24 Linear or mixed Signal Equipment Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 25 Passive Component ATE Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 26 Discrete ATE Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 27 Printed Circuit Board (PCB) Testing Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 28 Interconnection and Verification Testing Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 29 Automated Test Equipment Market, By Vertical: Key takeaways

FIG. 30 Automated Test Equipment Market, By Vertical: Market share, 2023 & 2030

FIG. 31 Automotive Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 32 Consumer Electronics Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 33 Aerospace & Defense Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 34 IT & Telecommunication Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 35 Healthcare Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 36 Others Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 37 Global Automated Test Equipment Market revenue, by Region, 2023 & 2030 (USD Million)

FIG. 38 North America Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 39 U.S. Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 40 Canada Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 41 Mexico Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 42 Europe Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 43 U.K. Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 44 Germany Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 45 France Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 46 Asia Pacific Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 47 China Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 48 India Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 49 Japan Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 50 South Korea Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 51 Taiwan Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 52 Singapore Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 53 Malaysia Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 54 Australia Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 55 South America Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 56 Brazil Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 57 Middle East & Africa Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 58 KSA Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 59 UAE Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 60 South Africa Automated Test Equipment Market estimates & forecasts, 2017 - 2030 (USD Million)

FIG. 61 Key company categorization

FIG. 62 Automated Test Equipment Market - Key company market share analysis, 2023

FIG. 63 Strategic frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Automated Test Equipment Product Outlook (Revenue, USD Million; 2017 - 2030)

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- Automated Test Equipment Type Outlook (Revenue, USD Million; 2017 - 2030)

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- Automated Test Equipment Vertical Outlook (Revenue, USD Million; 2017 - 2030)

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- Automated Test Equipment Regional Outlook (Revenue, USD Million; 2017 - 2030)

- North America

- North America Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- North America Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- North America Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- U.S.

- U.S. Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- U.S. Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- U.S. Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- U.S. Automated Test Equipment Market by Product

- Canada

- Canada Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- Canada Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- Canada Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- Canada Automated Test Equipment Market by Product

- Mexico

- Mexico Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- Mexico Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- Mexico Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- Mexico Automated Test Equipment Market by Product

- North America Automated Test Equipment Market by Product

- Europe

- Europe Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- Europe Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- Europe Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- U.K.

- U.K. Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- U.K. Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- U.K. Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- U.K. Automated Test Equipment Market by Product

- Germany

- Germany Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- Germany Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- Germany Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- Germany Automated Test Equipment Market by Product

- France

- France Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- France Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- France Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- France Automated Test Equipment Market by Product

- Europe Automated Test Equipment Market by Product

- Asia Pacific

- Asia Pacific Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- Asia Pacific Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- Asia Pacific Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- China

- China Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- China Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- China Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- China Automated Test Equipment Market by Product

- Japan

- Japan Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- Japan Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- Japan Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- Japan Automated Test Equipment Market by Product

- India

- India Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- India Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- India Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- India Automated Test Equipment Market by Product

- South Korea

- South Korea Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- South Korea Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- South Korea Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- South Korea Automated Test Equipment Market by Product

- Taiwan

- Taiwan Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- Taiwan Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- Taiwan Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- Taiwan Automated Test Equipment Market by Product

- Thailand

- Thailand Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- Thailand Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- Thailand Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- Thailand Automated Test Equipment Market by Product

- Singapore

- Singapore Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- Singapore Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- Singapore Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- Singapore Automated Test Equipment Market by Product

- Malaysia

- Malaysia Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- Malaysia Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- Malaysia Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- Malaysia Automated Test Equipment Market by Product

- Australia

- Australia Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- Australia Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- Australia Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- Australia Automated Test Equipment Market by Product

- Asia Pacific Automated Test Equipment Market by Product

- South America

- South America Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- South America Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- South America Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- Brazil

- Brazil Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- Brazil Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- Brazil Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- Brazil Automated Test Equipment Market by Product

- South America Automated Test Equipment Market by Product

- Middle East & Africa

- Middle East & Africa Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- Middle East & Africa Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- Middle East & Africa Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- KSA

- KSA Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- KSA Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- KSA Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- KSA Automated Test Equipment Market by Product

- UAE

- UAE Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- UAE Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- UAE Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- UAE Automated Test Equipment Market by Product

- South Africa

- South Africa Automated Test Equipment Market by Product

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

- South Africa Automated Test Equipment Market by Type

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

- Logic Testing

- South Africa Automated Test Equipment Market by Vertical

- Automotive

- Consumer Electronics

- Aerospace & Defense

- IT & Telecommunication

- Healthcare

- Others

- South Africa Automated Test Equipment Market by Product

- Middle East & Africa Automated Test Equipment Market by Product

- North America

Automated Test Equipment Market Dynamics

Driver: Rapidly growing demand for consumer electronics

Automated Test Equipment (ATE) is used to identify defects in Devices Under Tests (DUT) and helps to ensure the quality of devices. Significant increase in the number of consumer electronics along with an increasing focus of the companies on quality improvement is driving the market demand. The major factor for the growth of the consumer electronics industry is the rise in smartphone sales. Technological advancements and the emergence of 5G are expected to drive smartphones demand in the forthcoming years. Smartphone companies shipped approximately 394 million smartphones worldwide in the fourth quarter of 2020 and 354 million smartphones in the first quarter of 2021.

Additionally, there is growing consumer demand for products that exhibit more flexibility, better quality, and new features at lower prices, which has, in turn, spurred the demand in the ATE market. With the increasing demand for smartphones, there is a greater need for increased network capacity. Nowadays, smart products include complex electronic systems that need flawless operation. Support for multiple wireless technologies, longer battery life, and faster data rates, demand rigorous analysis. Moreover, demand for numerous feature integrations onto a single device have led to complex circuit board designs of these electronics.

Restraint: High competition among established players

In recent years, many ATE manufacturers have undergone mergers and acquisitions. The present market is shared by two major players, namely Advantest Corporation and Teradyne Inc. Many smaller companies have also established their presence in the market. Intel Corporation and National Instruments entered the testing market (confined to semiconductor testing), which changed the market ecosystem. Many companies are focusing on improving their testing assembly lines to acquaint with recent technological progresses. The increased competition and entry of new ATE companies can be a threat to the already existing companies. Companies prefer buying commercially available ATEs rather than building their technology tester, as it will have significant ROI

Opportunity: Rising usage of VR and wireless communication systems

Recent innovations in Virtual Reality (VR) applications are expected to be a significant opportunity for ATE companies. There is growing penetration of smartphones, broadband, and other wireless devices. Companies need high-speed test solutions in order to ensure quality and offer the best quality products. They need to ensure that the products developed are accurate, cost-effective, and reliable. Hence, intensive testing is undertaken before commercializing the products that reach the end user. ATE companies can offer more powerful wireless test solutions with lower test times and lower costs. Automated testing is very crucial for wireless technologies such as 5G, 4G, Wi-Fi, and LTE. Low latency, high network speed, and increased capacity are the key benefits of 5G. Moreover, avoiding network outages, protecting the network and customer information, ensuring quality of service, and the rapid delivery of new services are at the forefront of operators’ priorities. Automating the testing framework substantially reduces human errors and help operators accelerate the pace of delivering differentiated customer experience across the various technology fabric in their network.

What Does This Report Include?

This section will provide insights into the contents included in this automated test equipment market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Automated test equipment market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Automated test equipment market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the automated test equipment market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for automated test equipment market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of automated test equipment market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Automated Test Equipment Market Categorization: