- Home

- »

- Next Generation Technologies

- »

-

Automation Testing Market Size, Share, Trends Report, 2030GVR Report cover

![Automation Testing Market Size, Share & Trends Report]()

Automation Testing Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Testing Type, Service), By Vertical (Healthcare, BFSI), By Organization Size (Large Enterprises, SMEs), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-101-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automation Testing Market Summary

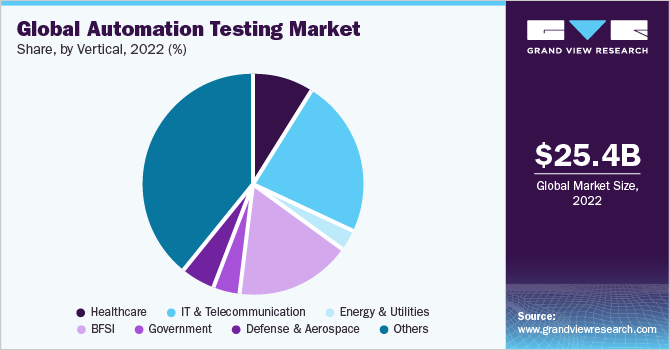

The global automation testing market size was estimated at USD 25.43 billion in 2022 and is projected to reach USD 92.45 billion by 2030, growing at a CAGR of 17.3% from 2023 to 2030. Businesses' growing readiness to use advanced automation testing techniques like DevOps and Agile methodologies propels the market's growth.

Key Market Trends & Insights

- North America dominated the market and accounted for a revenue share of 39% in 2022.

- By component, the service segment led the market and accounted for a revenue share of over 56% in 2022.

- Based on organization size, large enterprises dominated the market and accounted for the highest revenue share of over 68% in 2022.

- By vertical, the BFSI segment accounted for a revenue share of over 15% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 25.43 Billion

- 2030 Projected Market Size: USD 92.45 Billion

- CAGR (2023-2030): 17.3%

- North America: Largest market in 2022

By lowering the time, it takes to automate analysis, these strategies help businesses accelerate the commercialization of their software products. Due to most businesses relying on mobile applications, the rapid digitalization of end-user industries creates an urgent need for automation testing. Furthermore, the industry is expanding due to the evolving nature of work arrangements.

Artificial intelligence (AI) and machine learning (ML) have further accelerated the shift toward automation testing. Since AI shortens the test lifecycle, automation testing is becoming more common in the testing industry. It is used in every type of testing, including functional, regression, performance, and automation. The emerging adoption of cloud-based automation tools is propelling market growth. Since they are affordable, flexible, and scalable, cloud-based automation systems are preferred by SMEs and startups. Moreover, cloud-based automation testing solutions are also being greatly simplified by incorporating ML & AI, which is anticipated to support market growth.

Component Insights

The service segment led the market and accounted for a revenue share of over 56% in 2022. Based on service, the market is segmented into planning & development, advisory & consulting Services, managed services, implementation services, and others. The implementation services segment accounted for a sizeable market share. Implementation services make it easier to include automation into a functioning infrastructure for software testing. With the aid of this service, automation is simply integrated into an existing software automation testing setup. Numerous hardware components must be connected to the solutions to properly integrate automated analysis solutions, and the system's overall functionality must be evaluated. The testing type segment is expected to register the highest CAGR of over 18% from 2023 to 2030.

The testing type segment is further categorized into static and dynamic testing. Static testing is software testing that looks for program bugs without running the code. Before the deployment of the code, it is carried out at the first stage of the SDLC. Static testing utilizes various methods, including technical reviews, structured walkthroughs, and software inspection. Static analysis and review are used in static testing. Static review is usually conducted to discover and remove errors and ambiguities in supporting documents. Software requirements specifications, designs, and test cases are among the documents analyzed. Static analysis is the following stage, in which the developer's code is examined. The assessment is performed to identify any structural issues that could result in mistakes whenever the code is executed.

Organization Size Insights

Based on organization size, large enterprises dominated the market and accounted for the highest revenue share of over 68% in 2022. Automation testing plays a crucial role in large enterprises with complex systems, multiple applications, and a high volume of test cases. It helps improve efficiency, reduce manual effort, increase test coverage, and ensure the quality of software applications.Developing a comprehensive test strategy is essential for automation in large enterprises. This includes identifying the right automation tools, frameworks, and methodologies based on the organization’s specific needs. Test planning should prioritize the selection of test cases for automation, considering critical functionalities, high-risk areas, and frequently executed scenarios.

The small- and medium-sized enterprises segment is expected to register a CAGR of 19.8% over the forecast period. Automation testing is a crucial part of small-sized enterprises as it helps improve the efficiency of testing processes, saves time and resources, and ensures the quality of software applications. In a small-sized enterprise, where resources and time are limited, prioritize the selection of test cases for automation—focusing on critical functionalities, high-risk areas, and frequently executed scenarios fuel market growth. This also helps to ensure maximum coverage with minimal effort and resources.

Vertical Insights

The BFSI segment accounted for a revenue share of over 15% in 2022. Adopting digitalization in the BFSI sector creates a significant demand for application software automation testing. Complex, integrated applications and legacy systems regulating mission-critical activities set the BFSI sector apart. These programs are always being updated to meet the requirements of the new technological era. However, the healthcare sector is estimated to register the highest CAGR over the forecast period. Automation testing plays a crucial role in the healthcare industry, where software applications' accuracy, reliability, and security are of utmost importance. Electronic health record (EHR) systems are central to healthcare organizations for managing patient information.

Automation testing ensures the proper functioning of EHR systems, including patient registration, medical history, medication management, lab results, and interoperability with other systems. Moreover, healthcare applications often integrate with various systems and devices, such as laboratory information systems, radiology systems, medical devices, billing systems, and more. Automation testing verifies the smooth integration of these systems, including data exchange, interoperability, and adherence to industry standards like HL7 or DICOM.

Regional Insights

North America dominated the market and accounted for a revenue share of 39% in 2022. The widespread distribution of technology suppliers is driving the market in the area. In the United States, the popularity of smart consumer devices, such as smart TVs, home appliances, and laptops, is rising, which is driving market demand. Software, web applications, and operating systems (OS) are closely related to smart consumer electronics. The demand for test automation services in the area will rise as these smart consumer devices gain more acceptance.

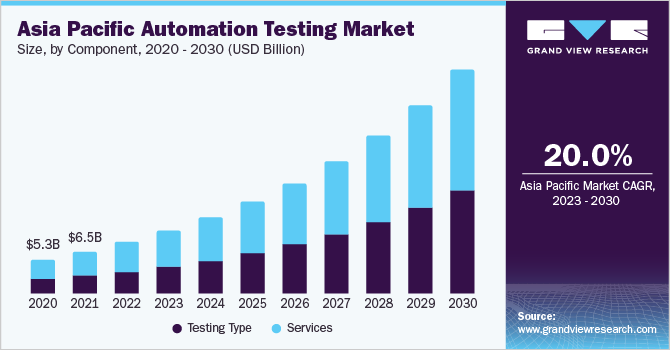

Asia Pacific is anticipated to witness a CAGR of 20% over the forecast period. The regional market is promising as it is home to economies like Singapore, China, India, Japan, New Zealand, and Hong Kong, all of which can significantly boost the growth of organizations that conduct automation analysis. Key economies in the Asia Pacific, such as China and India, have vast populations of consumers, which has a significant impact on the region's expansion. Governments are implementing regulations to hasten the adoption of cutting-edge technology like automation, AI & ML, mobile & online apps, cloud-based services, and other innovations.

Key Companies & Market Share Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations, as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in June 2023, With the E8717A Lidar Target Simulator (LTS), Keysight Technologies, Inc. is extending its acclaimed portfolio of autonomous driving validation test solutions. This tool enables automakers and lidar sensor manufacturers to test and certify lidar sensors for autonomous vehicles. Some prominent players in the global automation testing market include:

-

IBM Corporation

-

Apexon

-

Accenture

-

Cigniti Technologies

-

Capgemini SE

-

Microsoft

-

Tricentis

-

Keysight technologies

-

Sauce Labs

-

Parasoft

Automation Testing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 30.24 billion

Revenue forecast in 2030

USD 92.45 billion

Growth rate

CAGR of 17.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, organization size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

IBM Corp.; Apexon; Accenture; Cigniti Technologies; Capgemini SE; Microsoft; Tricentis; Keysight technologies; Sauce Labs; Parasoft

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automation Testing Market Report Segmentation

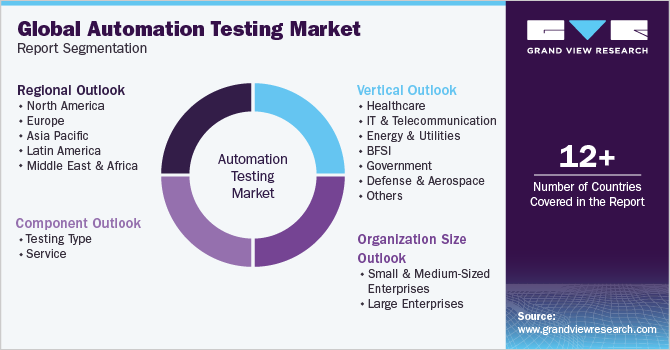

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global automation testing market report based on component, organization size, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Testing Type

-

Static Testing

-

Dynamic Testing

-

Functional Testing

-

Non-functional Testing

-

Performance Testing

-

API Testing

-

Security Testing

-

Load Testing

-

Regression testing

-

Others

-

-

-

-

Service

-

Managed services

-

Professional services

-

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small And Medium-Sized Enterprises

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare

-

IT & Telecommunication

-

Energy & Utilities

-

BFSI

-

Government

-

Defense And Aerospace

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE (United Arab Emirates)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automation testing market size was estimated at USD 25.43 billion in 2022 and is expected to reach USD 30.24 billion in 2023.

b. The global automation testing market is expected to grow at a compound annual growth rate of 17.3% from 2023 to 2030 to reach USD 92.45 billion by 2030.

b. North America accounted for the highest value share in 2022 owing to Al's strong research and development capabilities in developed economies, research institutes, and several prominent Al enterprises in this region.

b. Some key players operating in the automation testing market include IBM Corporation; Apexon; Accenture; Cigniti Technologies’; Capgimini; Microsoft; Tricentris; Keysight technologies; Sauce Labs; Parasoft; among others.

b. Key factors that are driving the automation testing market growth include the increasing demand for AI & ML applications and the growing adoption of edge computing, IoT, and data science across several industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.