- Home

- »

- Plastics, Polymers & Resins

- »

-

Automotive Adhesives Market Size, Industry Report, 2030GVR Report cover

![Automotive Adhesives Market Size, Share & Trends Report]()

Automotive Adhesives Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Water Based, Solvent Based, Hot Melt), By Application (Passenger Cars, LCV, MCV & HCV), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-270-9

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Adhesives Market Summary

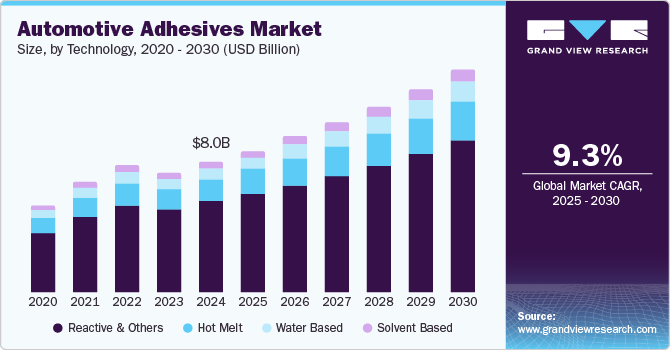

The global automotive adhesives market size was valued at USD 8.0 billion in 2024 and is anticipated to reach USD 13.6 billion in 2030, growing at a CAGR of 9.3% from 2025 to 2030, owing to the rising demand for lightweight vehicles. As automakers strive to reduce vehicle weight for improved fuel efficiency and reduced emissions, adhesives play a crucial role in bonding lightweight materials such as aluminum, carbon fiber, and plastics.

Key Market Trends & Insights

- Asia Pacific held the largest market share of 50.1% in 2024.

- By technology, the reactive & others technology segment captured the largest share of 69.9% in 2024.

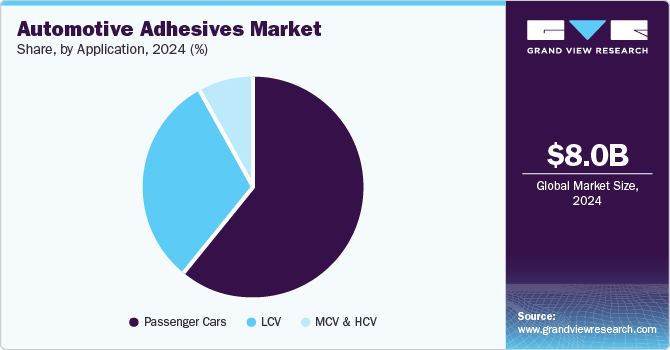

- By application, the passenger cars segment held the largest share of 60.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.0 Billion

- 2030 Projected Market Size: USD 13.6 Billion

- CAGR (2025-2030): 9.3%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Innovations in adhesive formulations fuel market growth by developing strong, versatile, and eco-friendly adhesives that enhance vehicle performance, durability, and safety.

Advancements in adhesive formulations are driving their adoption across traditional and electric vehicle segments. Furthermore, the escalating consumer demand for vehicle customization and cost-effective manufacturing is anticipated to favor the market growth. As consumers seek personalized features and unique designs, adhesives are increasingly used to bond components, enabling flexibility in vehicle customization efficiently. In addition, adhesives offer cost-effective alternatives to traditional fastening options, such as welding and mechanical fasteners, reducing production costs while improving manufacturing efficiency. The market is thereby benefitted by the ability of adhesives to bond a wide variety of materials and the growing demand for innovative and customized vehicles.

Technology Insights

The reactive & others technology segment captured the largest share of 69.9% in 2024, fueled by its superior bonding properties and versatility. Reactive adhesives, particularly polyurethane and epoxy-based formulations, provide strong, durable bonds ideal for various automotive applications, including structural bonding, interior assembly, and glass installation. These adhesives offer high resistance to temperature fluctuations, chemicals, and environmental factors, making them increasingly popular among automotive manufacturers. Their ability to meet evolving industry standards and enhance vehicle performance further boosts their dominance in the market.

The water-based segment is expected to emerge as the fastest-growing segment, with a CAGR of 10.5% over the forecast period, attributed to increasing environmental concerns and stricter regulations related to volatile organic compound (VOC) emissions. Water-based adhesives offer an eco-friendly alternative, providing lower toxicity and safer application processes than solvent-based counterparts. The rising demand for lightweight vehicles, improved fuel efficiency, and sustainable manufacturing practices are driving the adoption of water-based adhesives. With advancements in formulation technologies, water-based solutions are gaining popularity in bonding, sealing, and laminating applications in the automotive industry.

Application Insights

The passenger cars segment held the largest share of 60.9% in 2024, owing to the burgeoning demand for lightweight, fuel-efficient, and durable vehicles. Adhesives are essential in passenger car manufacturing for bonding components, such as body panels, windshields, and interiors, providing enhanced structural integrity and vibration damping. As automakers shift toward innovative designs and eco-friendly materials, adhesives are crucial in improving vehicle performance and safety. Moreover, the increasing production of electric vehicles (EVs), which require advanced bonding technologies, further drives the demand for automotive adhesives in the passenger cars segment.

Light commercial vehicle (LCV) is anticipated to be the fastest-growing segment, recording a CAGR of 10.4% from 2025 to 2030. The projected growth can be attributed to the surging demand for delivery and transport vehicles in e-commerce and logistics. LCVs require advanced adhesives for bonding lightweight materials, enhancing fuel efficiency, and improving vehicle durability. With the growing trend toward electric LCVs, which require specialized adhesives for battery and structural components, the demand for adhesives in this segment is surging rapidly. Increasing stringent regulations for fuel efficiency and safety standards are other factors boosting the adoption of automotive adhesives in LCVs.

Regional Insights

North America automotive adhesives market is expected to record the highest CAGR of 9.1% from 2025 to 2030, attributed to the increasing adoption of electric vehicles (EVs) and advancements in automotive manufacturing technologies. As automakers focus on improving vehicle performance, safety, and fuel efficiency, adhesives play a critical role in bonding lightweight materials and enhancing structural integrity. The region's strong automotive industry, particularly in the U.S. and Canada, is also contributing to the growth of the automotive adhesives industry. Also, stringent environmental regulations are boosting the shift toward water-based and low-VOC adhesives.

U.S. Automotive Adhesives Market Trends

The U.S. automotive adhesives market held a significant position in the automotive adhesives industry in 2024, driven by the emphasis on sustainability and automation in manufacturing. As automakers prioritize eco-friendly materials and processes, a rising demand for sustainable adhesives with low emissions and minimal environmental impact is rising. Moreover, automation in production lines is enhancing the precision and efficiency of adhesive applications, leading to higher adoption of advanced bonding technologies. This shift toward greener practices and automated manufacturing is set to propel market expansion by improving adhesive performance and reducing overall production costs.

Innovations in adhesive technologies and surging aftermarket demand are projected to fuel the growth of the Canada automotive adhesives market over the forecast period. The development of advanced adhesives with enhanced bonding strength, durability, and resistance to extreme conditions supports the increasing use of these materials in vehicle manufacturing. Besides, the expanding aftermarket sector, driven by vehicle maintenance, repairs, and customization, is boosting demand for adhesives in applications such as body repairs, windshield bonding, and interior fittings. As vehicle owners seek longer-lasting and more efficient solutions, these factors will significantly drive market expansion in Canada over the coming years.

Europe Automotive Adhesives Market Trends

Furthermore, a surge in demand for electric and autonomous vehicles and their increasing use in exterior applications is expected to significantly boost the Europe automotive adhesives market. As electric vehicles (EVs) require lightweight, durable materials for improved energy efficiency, adhesives are becoming essential for bonding components such as batteries, panels, and windows. Also, autonomous vehicles demand advanced bonding solutions for sensors and structural components. These trends are driving the need for high-performance adhesives, contributing to market growth as manufacturers seek innovative, sustainable, and cost-effective bonding technologies.

Germany automotive adhesives market is anticipated to accumulate sizable gains by 2030, propelled by innovations in adhesive technologies and advancements in application techniques. The development of high-performance, lightweight, and durable adhesives enables manufacturers to meet the increasing demand for fuel-efficient and eco-friendly vehicles. Enhanced bonding solutions also support the shift toward electric vehicles (EVs), which require specialized adhesives for battery assemblies and components. Technological improvements in application processes, including automation and precision bonding, are improving efficiency, reducing costs, and enabling faster production, further boosting market expansion.

The increased focus on durability and the rising preference for eco-friendly, sustainable adhesives are set to drive the growth of the UK automotive adhesives market. As vehicle manufacturers prioritize long-lasting, high-performance solutions, there is a heightened demand for adhesives that withstand harsh conditions, particularly extreme temperatures and weather. Besides, the push for sustainability and adherence to environmental regulations is encouraging the use of eco-friendly adhesives. This shift toward durable and green bonding solutions aligns with industry needs and consumer preferences, thereby complementing market expansion.

Asia Pacific Automotive Adhesives Market Trends

Asia Pacific held the largest market share of 50.1% in 2024, fueled by its booming automotive manufacturing sector, particularly in countries including China, Japan, and India. The region’s fast-paced industrialization, high vehicle production rates, and demand for lightweight, fuel-efficient vehicles have driven the need for advanced adhesive solutions. In addition, the region’s emphasis on electric vehicles and stringent emission regulations enhance the demand for innovative adhesives that improve performance, durability, and safety.

Burgeoning demand for adhesives in the automotive aftermarket as vehicle owners seek repairs, upgrades, and customizations is another notable factor positively affecting the market growth. The rise of autonomous vehicles, which require advanced bonding for sensor integration, structural components, and lightweight materials, is further fueling market growth. The availability of cost-effective labor and substantial regional investments in automotive technology have also contributed to this growth. This shift toward high-performance adhesives for both new and aftermarket applications has contributed to the expansion of the automotive adhesives industry in the region.

China is expected to record the fastest CAGR in the region over the forecast period, driven by the adoption of automated adhesive application systems and increasing safety standards. Automated systems enhance precision, reduce material waste, and improve production efficiency, meeting the rising demand for high-quality adhesive bonding in vehicle manufacturing process. Moreover, stricter safety standards push automakers to use advanced adhesives for critical applications, including crash resistance, structural integrity, and airbag systems. As both automation and safety requirements continue to evolve, the demand for automotive adhesives in China is expected to surge.

The growth in automotive production and escalating demand for lightweight materials are expected to promote the growth of automotive adhesives industry in India. As vehicle manufacturing accelerates, the demand for high-performance adhesives to bond diverse materials, such as aluminum, composites, and plastics, is expected to surge. Lightweight materials, which improve fuel efficiency and reduce emissions, require specialized adhesives for structural integrity and safety. This shift toward lightweight vehicle design further boosts the demand for innovative adhesives, enhancing bonding strength & durability and propelling the expansion of automotive adhesives market.

Key Automotive Adhesives Company Insights

Some of the key companies in the automotive adhesives industry include Henkel AG & Co. KGaA; H.B. Fuller Company; Sika AG; Dow; Arkema; 3M; BASF; Illinois Tool Works Inc.; PPG Industries, Inc.; Solvay and Akzo Nobel N.V.

-

Henkel offers a wide range of advanced adhesives, sealants, and coatings for the automotive industry, with a focus on enhancing performance, durability, and sustainability.

-

Dow provides innovative materials, including silicones and adhesives, that improve vehicle manufacturing and have applications in electric vehicles, hybrid cars, and other automotive solutions for enhanced safety, efficiency, and sustainability.

Key Automotive Adhesives Companies:

The following are the leading companies in the automotive adhesives market. These companies collectively hold the largest market share and dictate industry trends.

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- Sika AG

- Dow

- Arkema

- 3M

- BASF

- Illinois Tool Works Inc.

- PPG Industries, Inc.

- Solvay

- Akzo Nobel N.V.

Recent Developments

-

In September 2024, Covestro introduced the Dispercoll U bonding solution for automotive interior lamination, which offers improved heat resistance. This solution balances excellent initial bonding strength with superior heat resistance, making it ideal for complex, three-dimensional trim parts.

-

In August 2024,Henkel launched three new Loctite automotive potting adhesives. These adhesives are designed to enhance performance and protection in vehicle components, offering improved durability, thermal stability, and resistance to environmental factors.

Automotive Adhesives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.7 billion

Revenue forecast in 2030

USD 13.6 billion

Growth rate

CAGR of 9.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilo tons, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Henkel AG & Co. KGaA; H.B. Fuller Company; Sika AG; Dow; Arkema; 3M; BASF; Illinois Tool Works Inc.; PPG Industries, Inc.; Solvay and Akzo Nobel N.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Adhesives Market Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global automotive adhesives market report on the basis of technology, application, and region:

-

Technology Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Water Based

-

Solvent Based

-

Hot Melt

-

Reactive & Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

LCV

-

MCV & HCV

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.