- Home

- »

- Advanced Interior Materials

- »

-

Automotive Air Filters Market Size, Industry Report, 2030GVR Report cover

![Automotive Air Filters Market Size, Share & Trends Report]()

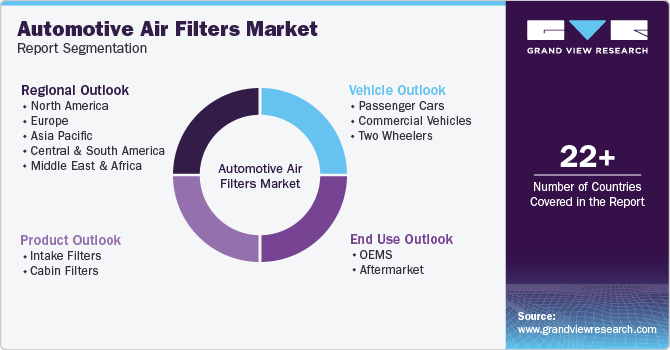

Automotive Air Filters Market (2025 - 2030) Size, Share & Trends Analysis Report By End Use (OEMs, Aftermarket), By Product (Intake Filters, Cabin Filters), By Vehicle, By Region, And Segment Forecasts

- Report ID: 978-1-68038-255-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Air Filters Market Summary

The global automotive air filters market size was estimated at USD 4.86 billion in 2024 and is projected to reach USD 6.74 billion by 2030, growing at a CAGR of 5.7% from 2025 to 2030. The market is driven by multiple factors influencing the increased adoption of air filters in vehicles globally. One of the primary drivers is the growing awareness of air quality issues, both inside and outside vehicles.

Key Market Trends & Insights

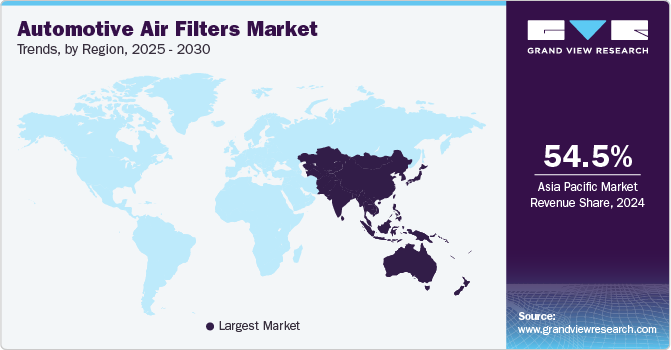

- Asia Pacific air filters market dominated globally and accounted for 54.5% share of the global revenue in 2024.

- Based on end use, the aftermarket segment accounted for 77.9% of the revenue share in 2024.

- Based on vehicle, the passenger cars segment accounted for 53.1% of the revenue share in 2024.

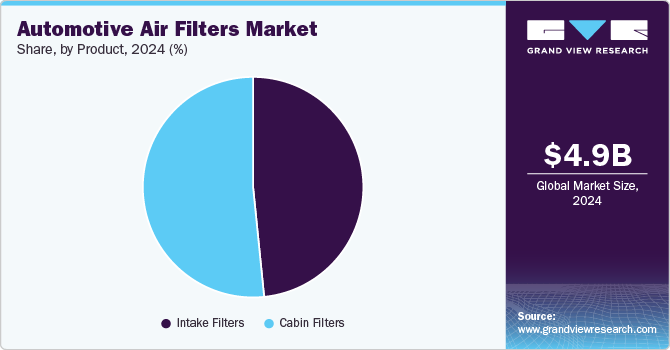

- Based on Product, the cabin filters segment accounted for 51.6% of the revenue share in 2024.

Market Size & Forecast

- 2023 Market Size: USD 4.86 Billion

- 2030 Projected Market Size: USD 6.74 Billion

- CAGR (2025-2030): 5.7%

- Asia Pacific: Largest market in 2024

As more consumers and automotive manufacturers prioritize health and environmental concerns, the demand for air filters that remove pollutants, allergens, and particulate matter from vehicle cabins has increased.

Enhanced consumer awareness of the health risks associated with poor air quality is leading to a steady increase in air filter installations across various vehicle segments, especially in urban areas with high levels of pollution. Stringent regulatory standards on vehicle emissions are also a key driver for market growth. Governments worldwide are implementing policies to curb automotive emissions, and air filters play a crucial role in reducing the number of pollutants that vehicles emit into the atmosphere. This includes regulations targeting exhaust emissions and fuel efficiency, which further incentivize automotive manufacturers to incorporate high-quality air filters that can reduce emissions. For example, the Euro 6 and Bharat Stage VI standards require car manufacturers to meet strict emission limits, creating a significant demand for air filters that help achieve these regulatory requirements.

Technological advancements in automotive air filter materials and designs are another factor driving market growth. With innovations like nano-fiber technology and synthetic materials, manufacturers can now produce air filters that are more efficient, durable, and capable of filtering finer particles than traditional materials. These technological advancements allow for the creation of specialized filters that not only improve air quality but also enhance vehicle performance by ensuring optimal airflow to the engine. This aspect is particularly appealing in the high-performance and luxury vehicle segments, where efficiency and driving experience are critical.

End Use Insights

The aftermarket segment accounted for 77.9% of the revenue share in 2024. Rising consumer awareness around vehicle health and maintenance is driving this segment's growth. Many vehicle owners are becoming more proactive in maintaining their vehicles, which includes routine air filter replacements to optimize fuel efficiency, reduce emissions, and enhance engine performance. This awareness is especially pronounced among consumers in regions with high pollution levels, where clogged air filters can significantly impact both air quality in the cabin and the overall functioning of the engine. As more consumers recognize the benefits of regularly replacing air filters, the aftermarket segment sees increased demand.

The OEMs segment is expected to grow significantly at a CAGR of 3.1% over the forecast period. OEMs are driven by stringent regulatory standards worldwide, which mandate the reduction of vehicular emissions and improvement in fuel efficiency. Governments in many regions have established strict emission norms, such as the Euro 6, Bharat Stage VI, and the U.S. Environmental Protection Agency (EPA) standards, which compel automakers to incorporate high-efficiency air filters to control particulate emissions and meet these requirements. OEMs, therefore, invest heavily in air filtration technologies to comply with these regulations from the manufacturing stage, allowing vehicles to pass regulatory inspections and meet consumer expectations for environment-friendly options.

Vehicle Insights

The passenger cars segment accounted for 53.1% of the revenue share in 2024. The steady rise in global vehicle production, especially in emerging markets, has created a substantial demand for automotive air filters. With more cars on the road, the need for maintenance and replacement parts, including air filters, has also increased. Modern automotive engines require clean air to operate efficiently. High-performance air filters contribute to better engine efficiency and longevity by preventing dust and debris from entering the engine, thus reducing maintenance costs and enhancing vehicle performance.

The commercial vehicles segment is expected to grow at the fastest CAGR of 6.0% over the forecast period. The increased use of commercial vehicles for logistics, transportation, and goods delivery is a significant driver for market growth. This trend is heightened by e-commerce growth and last-mile delivery services, which necessitate large fleets of vehicles that require regular maintenance and air filter replacements to ensure efficient operation. The demand for commercial vehicles in the construction and mining sectors, which require robust engines to operate in dusty and harsh conditions, has contributed to the growth in air filter replacements. These environments demand regular air filter changes to protect engines from dust and debris.

Product Insights

The cabin filters segment accounted for 51.6% of the revenue share in 2024. Technological advancements in cabin filters, such as the use of activated carbon and multi-layer filters, have improved the ability of these systems to capture a range of pollutants and odors. This innovation is driving the adoption of cabin air filters, especially in passenger vehicles, which make up a substantial portion of the market.

The intake filters segment is expected to grow significantly at a CAGR of 4.9% over the forecast period. Rising global vehicle production, especially in emerging markets, boosts demand for intake filters. The growing automotive industry necessitates high-performance intake filters to ensure engine efficiency and longevity. Modern engines require clean air intake to maintain fuel efficiency and power output. Intake filters prevent contaminants from reaching the engine, enhancing performance and reducing maintenance needs, appealing to both manufacturers and consumers focused on efficiency.

Regional Insights

The North America automotive air filters market is driven by the growing awareness among consumers about the importance of regular vehicle maintenance and its impact on vehicle performance, which has contributed to the increased replacement of air filters. Clean air filters are essential for preventing engine damage and ensuring optimal functioning. New materials and filtration technologies, such as synthetic fibers and high-efficiency particulate air (HEPA) filters, are boosting the performance and longevity of automotive air filters. These innovations are driving demand for more advanced filters that offer better protection against dust and pollutants.

U.S. Automotive Air Filters Market Trends

The automotive air filters market in the U.S. is driven by the increasing production and sales of vehicles, especially passenger cars. With more vehicles on the road, the demand for replacement air filters in both new and existing vehicles is growing. The growing adoption of electric vehicles (EVs) presents new opportunities for specialized air filters, such as cabin air filters designed to maintain clean air inside the vehicle and enhance passenger comfort.

Asia Pacific Automotive Air Filters Market Trends

Asia Pacific air filters market dominated globally and accounted for 54.5% share of the global revenue in 2024. Stringent government regulations on emissions in the Asia Pacific region are driving the adoption of high-performance automotive air filters. For instance, countries like China and India have implemented strict emission standards, such as China’s National VI and India’s Bharat Stage VI, to reduce vehicular pollution. These regulatory frameworks mandate automotive manufacturers to equip vehicles with advanced filtration systems that can minimize pollutants, which has led to a surge in demand for air filters capable of meeting these stringent standards.

China automotive air filters market is driven by a combination of regulatory pressures, environmental awareness, and a booming automotive industry. As one of the largest automotive markets globally, China experiences significant demand for automotive air filters due to high vehicle production and ownership rates. Rapid urbanization and the increase in disposable income among Chinese consumers have contributed to the growth in vehicle purchases, which in turn drives demand for air filters to enhance air quality within vehicles and optimize engine performance.

Central & South America Automotive Air Filters Market Trends

The Central & South America automotive air filters market is driven by the increasing concerns over air pollution that have led to a higher demand for advanced automotive air filters. These filters help in reducing the harmful effects of air pollutants inside vehicles, especially in regions with poor air quality. Manufacturers are innovating high-performance air filters, such as HEPA filters, that provide better filtration, especially for particulate matter and harmful gases. This is further driven by demand from both standard and luxury vehicle segments.

Europe Automotive Air Filters Market Trends

The Europe automotive air filters market is expected to grow significantly at 5.5% CAGR, driven by several key factors, particularly the increasing demand for vehicle performance and air quality management. One prominent driver is the rising consumer awareness of air pollution and its adverse health effects. As vehicles in Europe become more advanced and focused on sustainability, there is an emphasis on reducing emissions and improving in-vehicle air quality, especially considering stricter emissions regulations. In addition, the growing demand for high-performance vehicles has spurred the adoption of advanced air filtration systems. With the rising popularity of electric vehicles (EVs), there is also a push for more efficient air filtration to enhance cabin air quality and ensure better functioning of EV systems.

Key Automotive Air Filters Company Insights

Some of the key players operating in the global automotive air filters industry include Clarcor, Inc., K&N Engineering, Inc., Others.

-

Clarcor, Inc. offers a wide range of filtration solutions designed for air, oil, and fuel filtration. Clarcor’s automotive air filters helped enhance engine efficiency, reduce emissions, and ensure the optimal performance of vehicles. Their product portfolio featured advanced filtration technologies such as air filters, cabin air filters, fuel filters, and oil filters tailored to meet the evolving needs of both consumer vehicles and commercial transportation systems.

-

K&N Engineering, Inc. is an American manufacturer specializing in high-performance air filtration products for automotive and industrial applications. The company offers a wide range of products, including air intake systems, cabin air filters, oil filters, and performance air filters designed to improve vehicle engine efficiency, fuel economy, and overall performance. Their filters are widely used in various vehicle categories, including passenger cars, trucks, motorcycles, and racing vehicles.

Key Automotive Air Filters Companies:

The following are the leading companies in the automotive air filters market. These companies collectively hold the largest market share and dictate industry trends.

- Mann+Hummel GmbH

- Clarcor, Inc.

- K&N Engineering, Inc.

- Donaldson Company, Inc

- Cummins Inc.

- Parker Hannifin Corporation

- SOGEFI Group

- Hengst SE

- Mahle GmbH

- Robert Bosch GmbH

- Ahlstrom Corporation

- Freudenberg & Co.KG

- ACDelco Inc.

- Denso Corporation

- Hollingsworth & Vose Co. Inc.

- Lydall Inc.

- Neenah Paper Inc.

- Toyota Boshoku Corporation

- Valeo SA

- Roki Co., Ltd.

Automotive Air Filters Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.12 billion

Revenue forecast in 2030

USD 6.74 billion

Growth Rate

CAGR of 5.7% from 2025 to 2030

Base year for estimation

2024

Actual estimates/Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Germany, UK, China, India, Japan, Brazil

Segments covered

End use, product, vehicle, region

Key companies profiled

Mann+Hummel GmbH; Clarcor, Inc.; K&N Engineering, Inc.; Donaldson Company, Inc; Cummins Inc.; Parker Hannifin Corporation; SOGEFI Group; Hengst SE; Mahle GmbH; Robert Bosch GmbH; Ahlstrom Corporation; Freudenberg & Co.KG; ACDelco Inc.; Denso Corporation; Hollingsworth & Vose Co. Inc.; Lydall Inc.; Neenah Paper Inc.; Toyota Boshoku Corporation; Valeo SA; Roki Co.; Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Air Filters Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive air filters market report based on end use, vehicle, product, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Intake Filters

-

Cabin Filters

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

OEMS

-

Vehicle

-

Passenger Cars

-

Commercial vehicle

-

Two Wheelers

-

-

-

Aftermarket

-

Vehicle

-

Passenger Cars

-

Commercial vehicle

-

Two Wheelers

-

-

-

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

Two Wheelers

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global automotive air filters market size was estimated at USD 4.86 billion in 2024 and is expected to reach USD 5.11 billion in 2025.

b. The global automotive air filters market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2030, reaching USD 6.74 billion by 2030.

b. The aftermarket segment accounted for 77.9% of the revenue share in 2024. Rising consumer awareness around vehicle health and maintenance is driving the segment's growth.

b. Some of the key players operating in the automotive air filters market include Mann+Hummel GmbH, Clarcor, Inc., K&N Engineering, Inc., Donaldson Company, Inc., and Cummins Inc.

b. The key factor that is driving the automotive air filters market is the growing demand for high energy conservation and lower emissions, along with favorable regulatory norms & guidelines for both water and air filtration.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.