- Home

- »

- Automotive & Transportation

- »

-

Automotive Biometric Market Size, Industry Report, 2033GVR Report cover

![Automotive Biometric Market Size, Share & Trends Report]()

Automotive Biometric Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Fingerprint Recognition, Facial Recognition, Voice Recognition), By Offering (Hardware, Software), By Application, By Vehicle Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-643-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2020 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Biometric Market Summary

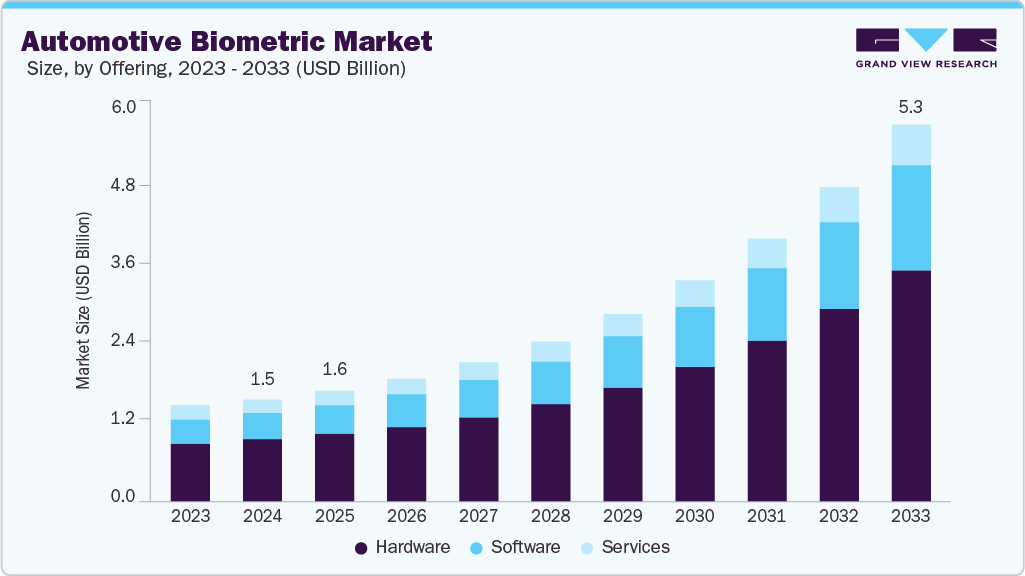

The global automotive biometric market size was estimated at USD 1.47 billion in 2024 and is projected to reach USD 5.33 billion by 2033, growing at a CAGR of 16.3% from 2025 to 2033.The market is gaining momentum, driven by rising demand for enhanced vehicle security through biometric authentication methods such as fingerprint and facial recognition.

Key Market Trends & Insights

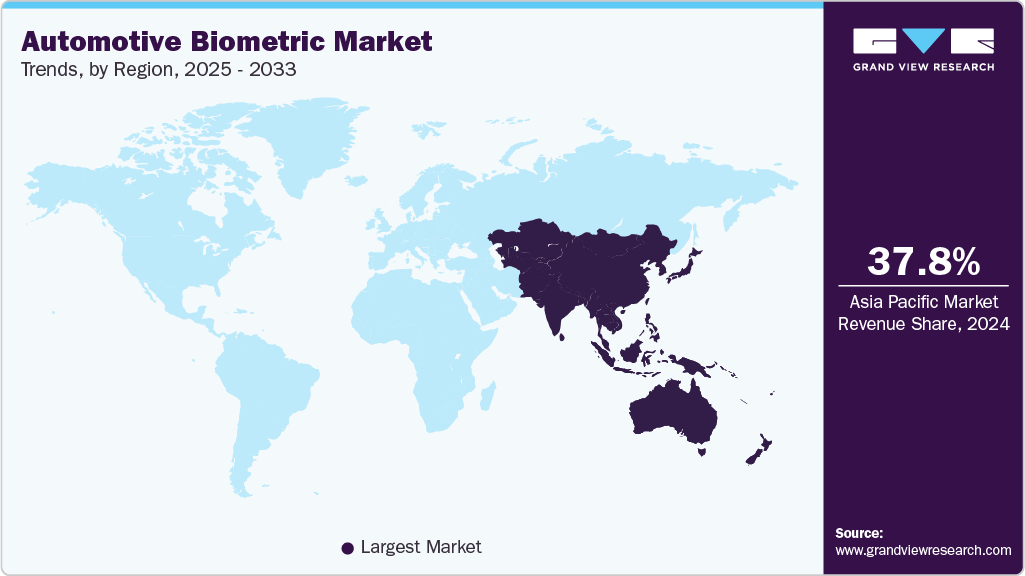

- The Asia Pacific automotive biometric market accounted for a 37.8% share of the overall market in 2024.

- The automotive biometric industry in the U.S. held a dominant position in 2024.

- By technology, the fingerprint recognition segment accounted for the largest share of 38.6% in 2024.

- By component, the hardware segment held the largest market share in 2024.

- By application, the vehicle access control segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.47 Billion

- 2033 Projected Market Size: USD 5.33 Billion

- CAGR (2025-2033): 16.3%

- Asia Pacific: Largest market in 2024

Increasing integration of biometrics with infotainment and connected car systems is enabling a personalized user experience, further propelling market adoption. Additionally, the growing focus on driver monitoring systems (DMS) aimed at improving safety and meeting regulatory compliance is accelerating the deployment of biometric technologies in vehicles. Advancements in artificial intelligence and machine learning present significant opportunities to improve biometric accuracy and usability, making these systems more reliable and user-friendly. However, high implementation costs and integration complexities remain major challenges, particularly limiting widespread adoption among mid and low-end vehicle segments.

Automotive manufacturers are investing in biometric systems that enable personalized settings based on driver recognition, improving comfort and user experience. Additionally, real-time biometric monitoring of drivers’ vital signs, such as heart rate and stress levels, is being integrated to enhance safety by detecting fatigue or medical emergencies early. The adoption of contactless biometric solutions reduces the need for physical interaction, aligning with hygiene concerns post-pandemic. Also, regulatory pressures to improve driver monitoring systems to prevent accidents are encouraging the incorporation of advanced biometric sensors. This growing emphasis on both personalization and safety through biometrics is expected to drive substantial market expansion globally.

The increasing integration of biometric authentication with infotainment and connected car platforms is driving the automotive biometric market. This trend supports personalized in-vehicle experiences by enabling secure user profiles, preferences, and access controls tailored to individual occupants. According to a Salesforce survey of over 2,000 car owners, connected vehicles are projected to constitute 95% of all vehicles by 2030, highlighting the critical role of biometrics in enhancing user engagement and data security. Automakers and technology providers are investing in biometric solutions to facilitate seamless, secure interactions within smart vehicles, contributing to market expansion. The convergence of biometrics with connected car systems fosters improved convenience, safety, and customer loyalty, strengthening the overall appeal of advanced automotive technologies worldwide.

According to a European Commission report, fatigue contributes to approximately 15-20% of severe road accidents, with higher risks among truck, shift, taxi drivers, and young men. Additionally, a survey found that one in five drivers experience significant sleepiness while driving, and over 50% of long-distance drivers have fallen asleep or nearly fallen asleep behind the wheel. Regulatory frameworks such as the EU Regulation 2019/2144 mandate the implementation of DMS for enhanced safety is further accelerating the adoption. Biometric-based DMS solutions that monitor driver alertness and vital signs are increasingly integrated into vehicles to mitigate risks, improve road safety, and ensure compliance with evolving safety standards globally.

Advancements in artificial intelligence (AI) and machine learning are significantly improving the precision and user-friendliness of biometric systems in automotive applications. In May 2022, DERMALOG[ and Rheinmetall launched the Rheinmetall Dermalog SensorTec to develop next-generation driver monitoring systems. By integrating biometrics, AI, and radar technology, this system can accurately detect driver distractions, fatigue, and other cabin risks, contributing to enhanced vehicle safety. These technological improvements support the broader integration of biometric solutions within connected and autonomous vehicles, addressing challenges related to false positives and system responsiveness. Continued innovation in AI-driven biometrics is expected to drive market growth by enabling seamless, secure, and reliable driver identification and monitoring functions aligned with increasing safety regulations and consumer expectations.

The expense of advanced biometric sensors, AI processing units, and secure data management systems often results in higher vehicle prices, restricting accessibility for budget-conscious consumers. Also, integrating biometric systems with existing vehicle electronics, infotainment, and security platforms presents technical hurdles, including compatibility issues and increased development time. For example, ensuring seamless communication between biometric modules and electronic control units (ECUs) demands specialized software and hardware calibration, raising complexity and cost. Consequently, these factors slow the deployment of biometric authentication and driver monitoring solutions in more affordable vehicles, limiting market penetration despite growing interest in enhanced security and personalization features.

Offering Insights

The hardware segment accounted for the largest share of 60.7% in 2024. Factors such as the increasing need for advanced in-cabin security, increasing deployment of driver monitoring systems (DMS), rising preference for seamless in-vehicle payments, and expanding integration of biometric modules with infotainment units. As OEMs shift toward higher personalization and safety standards, the demand for embedded biometric sensors is accelerating across premium and mid-range models. A growing number of Tier 1 suppliers are launching compact, automotive-grade biometric sensors optimized for harsh in-vehicle environments. For instance, in October 2024, Infineon Technologies AG introduced fingerprint sensor ICs CYFP10020A00 and CYFP10020S00 for automotive use. Designed for personalization and in-car payment authentication, these sensors integrate with TRAVEO T2G MCUs to deliver secure and accurate biometric recognition.

The software segment of the automotive biometric industry is expected to grow at a significant CAGR during the forecast period, driven by the rising demand for real-time data processing, multimodal biometric authentication, and seamless integration with advanced vehicle systems. Additionally, the growing adoption of connected car ecosystems is pushing the need for intelligent biometric software capable of integrating with infotainment, navigation, and driver monitoring systems.

Technology Insights

The fingerprint recognition segment accounted for the largest share of the automotive biometric market in 2024. Factors such as the increasing demand for secure and convenient driver authentication, rising adoption of fingerprint-based vehicle access systems, and compatibility with existing hardware infrastructure are driving this dominance. Unlike facial or iris recognition, fingerprint systems are relatively mature, cost-effective, and easier to implement without requiring major modifications to vehicle interiors. Their growing integration in push-start ignition systems and infotainment personalization also enhances user convenience and system security, further reinforcing the segment’s strong market presence.

The iris recognition segment is expected to grow at the fastest CAGR from 2025 to 2033. This growth is driven by rising demand for highly secure, contactless biometric solutions that function reliably even in low-light or constrained environments. Iris recognition offers greater accuracy and resistance to spoofing compared to other biometric methods, making it increasingly attractive for in-vehicle applications such as driver authentication and secure digital transactions.

For instance, in April 2025, FORVIA and Smart Eye launched the first in-car biometric authentication system using iris and facial recognition through the existing DMS camera. This world-first technology supports secure payments and personalized access, showcased at Auto Shanghai, driving innovation in connected, secure automotive user experiences. This advancement highlights the expanding role of iris biometrics in next-generation vehicle systems.

Application Insights

The vehicle access control segment accounted for the largest share of the automotive biometric industry in 2024, driven by increasing demand for keyless entry systems, growing adoption of biometric authentication technologies, heightened focus on anti-theft measures, and rising integration of personalization features in connected vehicles. The shift toward smart mobility is prompting OEMs to incorporate advanced access solutions that enhance both convenience and security for users. For instance, in April 2023, Antolin partnered with Biometric Vox to develop a voice biometric vehicle access system, enabling secure, keyless entry and driver personalization through voice recognition. Unveiled at CES 2023, the solution reflects the industry's move toward seamless, intelligent in-vehicle experiences.

The driver monitoring systems (DMS) segment is expected to register a notable CAGR from 2025 to 2033. The driver monitoring systems (DMS) segment is expected to register a notable CAGR from 2025 to 2033, driven by rising concerns over road safety, increasing regulatory mandates in Europe and Asia, growing demand for fatigue and distraction detection, and the integration of AI-enhanced biometric technologies. Automakers are actively investing in intelligent in-cabin systems to meet safety standards while enabling personalization features.

In May 2022, DERMALOG and Rheinmetall launched a joint venture to develop biometric-based driver monitoring systems. The technology detects distractions and fatigue using advanced sensors and cameras, enhancing vehicle safety and supporting the trend of biometric integration in next-gen DMS solutions.This reflects the automotive industry’s growing focus on proactive safety through intelligent driver analytics and behavior-based personalization.

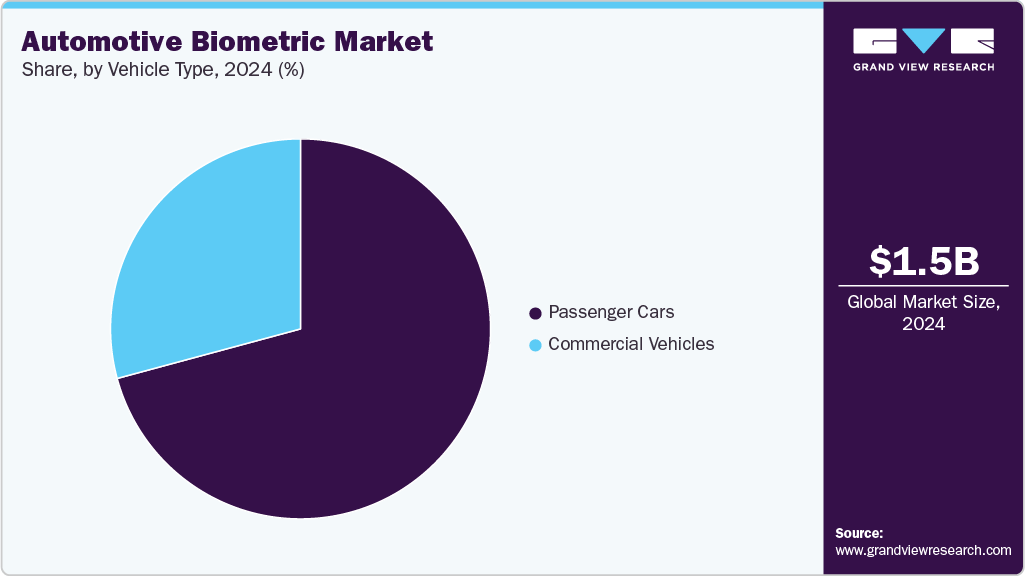

Vehicle Type Insights

The passenger cars segment accounted for the largest share in 2024, driven by the widespread adoption of biometric systems for enhanced security, increasing consumer demand for personalized in-car experiences, rising vehicle production across key markets, and growing regulatory focus on driver monitoring. Passenger cars offer high feasibility for integrating biometric features such as fingerprint ignition, facial recognition, and DMS, particularly in mid to high-end models. According to CEIC Data, the U.S. recorded 283.4 million registered vehicles in 2022, with passenger car sales reaching 3.1 million units in December 2023, up from 2.86 million in December 2022, indicating strong demand. This growing vehicle base, coupled with advancements in in-car tech, reinforces the dominant position of passenger cars in the automotive biometrics market.

The commercial vehicles segment is expected to register a notable CAGR from 2025 to 2033, owing to its increasing adoption of biometric technologies for driver authentication, fatigue monitoring, fleet security, and compliance with evolving safety regulations. Rising concerns over driver safety and cargo theft are pushing fleet operators to integrate advanced biometric systems into trucks and vans to ensure accountability and real-time monitoring. According to CEIC Data, in 2023 , China’s commercial vehicle sales totaled 4.03 million units, up from 3.3 million units in 2022, with trucks accounting for a significant portion of the demand. This growing commercial fleet base, especially in logistics-intensive markets including China, supports the need for robust biometric solutions, positioning the segment for strong growth over the coming years.

Regional Insights

The Asia Pacific automotive biometric market accounted for 37.8% of the global share in 2024, driven by the rapid adoption of connected vehicles, growing focus on vehicular safety, rising investments in smart mobility infrastructure, and increased demand for personalized driving experiences. Regional governments and OEMs are actively promoting technology-driven automotive innovation to enhance road safety and digital vehicle access. In March 2025, Fingerprints partnered with SM Electronic Technologies to distribute fingerprint and iris biometric solutions across India. This collaboration aims to meet the surging demand for secure, personalized in-car technologies amid India’s expanding connected vehicle ecosystem.

South Korea is a key hub for automotive biometric innovation, supported by strong government backing for advanced mobility technologies and a robust automotive industry focused on integrating AI and biometrics. In January 2022, LG introduced a biometric system enabling vehicle ignition through facial recognition and hand gestures, based on its earlier patent. The system, developed in South Korea, highlights the country’s commitment to next-generation mobility solutions. These developments reflect Asia Pacific’s growing role in pioneering biometric innovation for safer, smarter vehicles.

The China automotive biometric market held a substantial market share in 2024, driven by government incentives for smart vehicle technologies, increasing consumer demand for enhanced vehicle security, rapid urbanization, and the growing adoption of connected car systems. The country’s strong focus on technological innovation and digital infrastructure expansion supports this growth. For instance, in March 2023, BYD secured a patent for a vein recognition system using infrared imaging of the back of the hand to control vehicle access. This innovative biometric key technology, if commercialized, would offer a unique and secure vehicle authentication method in the automotive market. This development underscores China’s leadership in integrating cutting-edge biometric solutions to enhance automotive security and user experience.

The automotive biometric market in Japan held a significant share in 2024, influenced by steady government support for advanced safety regulations, increasing focus on driver health monitoring, rising adoption of AI-powered vehicle technologies, and a strong automotive manufacturing ecosystem. Japan’s commitment to enhancing road safety and integrating smart vehicle systems fuels market growth. For instance, in April 2023, Mitsubishi Electric introduced an AI-driven Driver Monitoring System that estimates biometric data via a contactless camera to detect serious driver health conditions such as loss of consciousness. This technology aims to prevent accidents caused by sudden medical emergencies, advancing automotive biometric safety solutions.

Europe Automotive Biometric Market Industry Trends

The Europe automotive biometric industry was recognized as a key growth region in 2024, driven by increasing regulatory requirements for advanced driver safety systems, a growing focus on driver monitoring technologies, rising adoption of connected vehicle solutions, and stronger consumer demand for improved in-car security. The region is experiencing rapid transformation as regulators and automakers emphasize road safety and regulatory compliance. For example, in November 2019, the Council of the European Union adopted regulations requiring advanced safety features, including driver monitoring systems (DMS), in all new motor vehicles from mid-2022 onward. These systems are mandated to include warnings for driver drowsiness, inattention, and distractions. The European Commission estimates that these regulations could prevent over 140,000 serious injuries by 2038. This highlights Europe’s proactive approach in integrating biometric technologies to boost automotive safety and reduce traffic-related injuries.

The German automotive biometric market is being shaped by increasing demand for enhanced vehicle security, stringent regulatory standards on driver monitoring and safety, growing integration of biometric authentication in connected cars, and expanding adoption of digital payment systems. The country’s commitment to road safety and data security is driving manufacturers to adopt advanced biometric technologies. For instance , in February 2023, Continental and trinamiX unveiled the Driver Identification Display, the world’s first in-vehicle biometric authentication system integrated directly into a display. This technology strengthens theft protection by requiring driver verification to start the vehicle and supports secure digital payments, earning a CES 2023 Innovation Award.

The automotive biometric market in the UK is driven by increasing government regulations on vehicle safety, growing adoption of connected vehicle technologies, rising consumer demand for enhanced in-car security, and expanding integration of biometric authentication in smart mobility solutions. The market is supported by regulatory mandates encouraging the implementation of advanced safety features like driver monitoring systems, while consumer preference shifts toward personalized and secure vehicle access methods. According to the UK government report, 625,000 vehicles were registered for the first time in Q2 2024, marking a 2% increase compared to Q2 2023. Additionally, the total number of licensed vehicles in the UK rose by 1% to 41.7 million as of June 2024. This growth in vehicle registrations and fleet size highlights an expanding market base for biometric adoption.

In December 2024, Mitsubishi Electric Mobility invested (USD32.8 million) (GBP 26 million) in Seeing Machines, a company specializing in driver monitoring systems. This partnership aims to accelerate the adoption of biometric-based safety technologies, aligning with global regulatory trends and enhancing overall vehicle safety. This demonstrates the UK market’s proactive approach toward integrating biometric solutions to meet evolving regulatory requirements and consumer expectations, positioning biometric systems as a key element in the future of safer, smarter vehicles.

North America Automotive Biometric Market Industry Trends

The North America automotive biometric industry was identified as a lucrative region in 2024. The market is being driven by increasing government regulations on vehicle safety, rapid adoption of connected and autonomous vehicles, growing consumer demand for secure and personalized vehicle access, and continuous technological advancements in biometric authentication. In Canada, stricter vehicle safety standards and government incentives to promote smart mobility solutions are encouraging automakers to incorporate biometric systems for driver monitoring and vehicle access security. Similarly, in Mexico, the rise in vehicle manufacturing and sales, combined with efforts to enhance road safety and vehicle security, supports biometric technology adoption in both passenger and commercial vehicles.

For instance, the U.S. National Highway Traffic Safety Administration (NHTSA) has been advancing regulatory frameworks that encourage the integration of advanced driver assistance systems (ADAS), including biometric driver monitoring systems, to improve road safety and reduce accidents. This reflects North America’s proactive regulatory environment and technological readiness, positioning the region as a leader in the automotive biometric market driven by safety, security, and convenience.

U.S. Automotive Biometric Industry Trends

The U.S. automotive biometric industry held a dominant position in 2024. The U.S. market is witnessing significant transformation, driven by stringent government safety regulations, rapid growth of the electric vehicle market, rising adoption of advanced driver assistance systems (ADAS), and increasing consumer demand for enhanced vehicle security and personalization. The U.S. government has been actively promoting road safety through legislative measures. For instance, the Moving Forward Act, passed by the House of Representatives in July[RB17] 2020, includes provisions to mandate technologies that detect inattentive or intoxicated driving in new vehicles. Additionally, the SAFE Act of 2021, introduced in the Senate, aims to require driver monitoring systems in all new cars by 2027 to ensure safe engagement with semi-autonomous driving features.

The growing electric vehicle market, reaching 1.56 million sales in 2024 and capturing 10% of total light-duty vehicle sales according to the International Council on Clean Transportation, further supports the demand for biometric innovations. This convergence of regulatory support, market growth, and evolving consumer expectations reinforces the U.S. market’s leadership in automotive biometrics, positioning it at the forefront of safer, smarter vehicle technologies.

Key Automotive Biometric Company Insights

Some of the key players operating in the market include Fujitsu Limited, Continental AG, Synaptics Incorporated, Fingerprint Cards AB, and Hitachi Ltd.

-

Founded in 1935 and headquartered in Tokyo, Japan, Fujitsu Limited is a global information and communication technology company. The company specializes in providing advanced biometric solutions, including facial recognition and fingerprint authentication technologies for the automotive sector. Fujitsu offers a range of services spanning hardware, software, and IT infrastructure, supporting smart mobility, secure vehicle access, and driver monitoring systems.

-

Founded in 1871 and headquartered in Hanover, Germany, Continental AG is a leading automotive technology company specializing in automotive safety and biometric solutions. The company develops innovative systems such as driver monitoring, biometric authentication, and secure vehicle access technologies. Continental integrates these solutions with its expertise in tire manufacturing, brake systems, and automotive electronics.

Key Automotive Biometric Companies:

The following are the leading companies in the automotive biometric market. These companies collectively hold the largest market share and dictate industry trends.

- Fujitsu Limited

- Synaptics Incorporated

- Continental AG

- Fingerprint Cards AB

- Hitachi Ltd.

- Methode Electronics Inc.

- VOXX International Corporation

- Safran S.A.

- HID Global Corporation

- BioEnable Technologies Pvt. Ltd.

Recent Developments

-

In May 2025, GIS shifted its focus from legacy touch panels to biometrics, optics, and automotive technology. Expanding fingerprint recognition and exploring automotive HUDs and interfaces, GIS aims to capture the growing demand for secure digital ID and connected vehicle features, while expanding R&D and manufacturing in Asia.

-

In November 2024, Continental and trinamiX unveiled the Invisible Biometrics Sensing Display, featuring concealed cameras and laser projectors behind OLED screens. The system monitors vital signs and uses 3D mapping for airbag deployment and seatbelt detection, enhancing safety and biometric monitoring in vehicles.

-

In September 2024, Precise Biometrics and Infineon expanded their partnership to offer a packaged fingerprint sensor solution optimized for automotive applications. Demonstrated at Embedded World and CES, the product enables secure vehicle access, driver personalization, and in-car payment authentication, accelerating biometric adoption in cars.

-

In September 2023, Mercedes-Benz and Mastercard launched a biometric fuel payment system in Germany, allowing drivers to pay via fingerprint scan integrated in the MBUX infotainment system. Supported at 3,600+ gas stations, this system enhances secure, seamless in-car payments and reflects Mercedes-Benz’s broader biometric technology strategy.

Automotive Biometric Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.59 billion

Revenue forecast in 2033

USD 5.33 billion

Growth rate

CAGR of 16.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2020 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Offering, technology, application, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Fujitsu Limited; Synaptics Incorporated; Continental AG; Fingerprint Cards AB; Hitachi Ltd.; Methode Electronics Inc.; VOXX International Corporation; Safran S.A.; HID Global Corporation; BioEnable Technologies Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Biometric Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global automotive biometric market report based on technology, offering, application, vehicle type, and region:

-

Offering Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Service

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Fingerprint Recognition

-

Facial Recognition

-

Voice Recognition

-

Iris Recognition

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Vehicle Access Control

-

Driver Identification & Personalization

-

Driver Monitoring Systems (DMS)

-

Infotainment & HMI Control

-

In-Car Payment Authentication

-

-

Vehicle Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Passenger Cars

-

Commercial Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive biometric market size was estimated at USD 1.47 billion in 2024 and is expected to reach USD 5.33 billion in 2033.

b. The global automotive biometric market is expected to grow at a compound annual growth rate of 16.3% from 2025 to 2033 to reach USD 5.33 billion by 2033.

b. The Asia Pacific automotive biometric market accounted for 37.8% of the global share in 2024, driven by the rapid adoption of connected vehicles, growing focus on vehicular safety, rising investments in smart mobility infrastructure, and increased demand for personalized driving experiences. Regional governments and OEMs are actively promoting technology-driven automotive innovation to enhance road safety and digital vehicle access.

b. Some key players operating in the automotive biometric market include Fujitsu Limited, Synaptics Incorporated, Continental AG, Fingerprint Cards AB, Hitachi Ltd., Methode Electronics Inc., VOXX International Corporation, Safran S.A., HID Global Corporation, BioEnable Technologies Pvt. Ltd.

b. Key factors that are driving the market growth include rising demand for enhanced vehicle security through biometric authentication methods such as fingerprint and facial recognition. Increasing integration of biometrics with infotainment and connected car systems is enabling a personalized user experience, further propelling market adoption. Also, the growing focus on driver monitoring systems (DMS) aimed at improving safety and meeting regulatory compliance is accelerating the deployment of biometric technologies in vehicles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.