- Home

- »

- Automotive & Transportation

- »

-

Automotive Charge Air Cooler Market Size & Share Report 2030GVR Report cover

![Automotive Charge Air Cooler Market Size, Share & Trends Report]()

Automotive Charge Air Cooler Market Size, Share & Trends Analysis Report By Product Type (Air-cooled, Liquid-cooled), By Vehicle Type, By Design Type, By Fuel Type, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-013-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

Report Overview

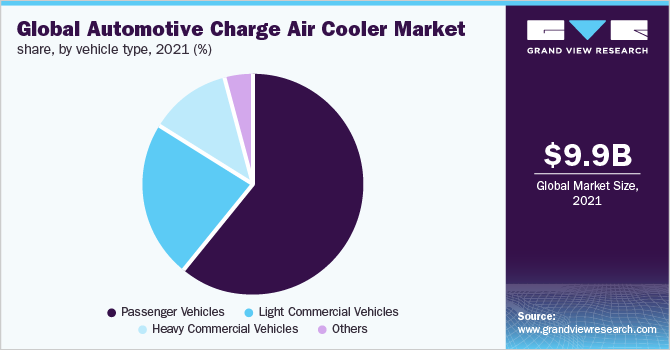

The global automotive charge air cooler market was valued at USD 9.9 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 7.2% from 2022 to 2030. The function of a charge air cooler is to cool the combustion air, thus reducing the temperature to a level most favorable to power output and fuel consumption. The air with lower temperature and increased density helps achieve optimum power for the combustion process within the engine. It also reduces the fuel consumption required. It is used in passenger as well as commercial vehicles. Demand for a reduction in fuel consumption and increased engine power and reduced emissions, growing use of turbochargers in vehicles, and, an increase in demand for passenger and commercial vehicles are the factors accountable for the growth of the industry.

The COVID-19 pandemic significantly impacted the industry. At the beginning of the pandemic in China, export had impacted auto manufacturing facilities in Europe and the U.S. Shutdowns of the large production facilities and many of its suppliers around the world were marked as one of the worst crises in the automotive industry. According to the International Organization of Motor Vehicle Manufacturers, (OICA), there was a 16% drop in 2020 production, to less than 78 million vehicles. According to the organization, Europe witnessed a drop of more than 21% in 2020.

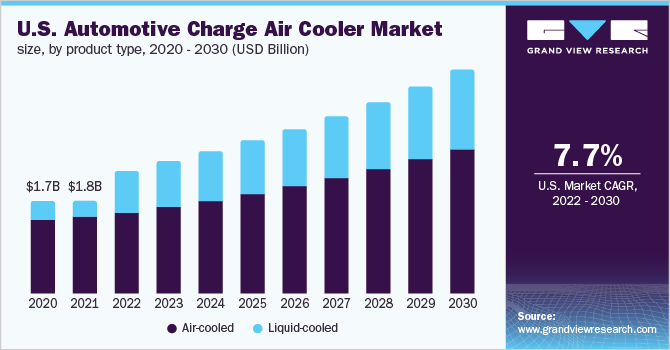

U.S. production had witnessed a drop of 19%. Nevertheless, an increase in disposable income, changes in lifestyle, urbanization, etc. fuel the demand for passenger cars, which is beneficial for the industry. Moreover, consistent investments by automakers in the research and development of eco-friendly, cost-effective, and high-performance engines are expected to offer major growth opportunities to the market over the forecast period. However, the rising demand for electric vehicles (EVs) could hamper the growth of the market.

Product Type Insights

The air-cooled charge air cooler segment accounted for the largest share of 59.5% of the global revenue in 2021. An air-cooler or direct charge cooler is a widely used automotive charge air cooler in the market. With this system, the charge air gets cooled with external ambient air. Some of the benefits of air-cooled coolers are low cost & weight, design simplicity, improved reliability, and simple operation. As a result, these charge coolers can be used in a variety of vehicle categories. Furthermore, the cooling offered by these air coolers is adequate, making them OEMs' favored choice.

The liquid-cooled charge air cooler segment is anticipated to register the highest CAGR over the forecast period. Liquid-cooled or indirect charge air cooler offers charge-air thermal management by regulating the coolant flow and also helps to reduce air volume between the compressor of the turbocharger and intake ports of the engine. Liquid-cooled charge air cooling technology replaces the conventional air-to-air technique with a more advanced system consisting temperature cooling circuit, coolant circulation pump, and liquid-cooled air charge cooler. This charge air cooler helps engine manufacturers meet the emission regulation and at the same time improve engine power.

Design Type Insights

Based on designs, the industry has been further categorized into fin & tube and bar & plate. The fin & tube designed segment dominated the industry in 2021 and accounted for the maximum share of more than 58.30% of the overall revenue. The segment will expand further at a significant growth rate during the forecast period. It has better cooling than a bar & plate when constructed for high-boost pressure applications.

Its pressure rating is also high and can withstand very high temperatures as well as pressure. The bar & plate segment is anticipated to register a significant CAGR over the forecast period. Bar and plate design is weightier than tube and fin; however, this comes out to be advantageous. One of the advantages of the bar & plate charge air cooler is its extraordinary diversity of fin designs. These devices are ideal for high-stress, high-boost pressure, heavy off-road equipment, and heavy vehicles.

Fuel Type Insights

Based on fuel types, the industry has been further categorized into diesel and gasoline. The diesel fuel type segment dominated the industry in 2021 and accounted for the largest share of 62.45% of the overall revenue. The segment will expand further at a steady growth rate during the forecast period. The charge air cooler acts as a middleman between the turbocharger and the engine. It cools the engine air after it has passed through a turbocharger and before it goes into the combustion chambers of the engine. This improves the engine performance noticeably and reduces emissions.

The gasoline segment is anticipated to register the highest CAGR over the forecast period. Many countries around the world are planning to phase out diesel vehicles, because of emission concerns. This, in turn, will give a boost to gasoline vehicles. The use of turbocharging in gasoline vehicles is increasing owing to emission norms. Also, the emission norms are the factors adding up to the cost of diesel vehicles, which will help in the growth of gasoline vehicle sales.

Position Type Insights

Based on positions, the industry has been further categorized into integrated and standalone. The standalone position type segment accounted for the maximum share of more than 79.20% of the global revenue in 2021. This is a conventional system and costly as compared to the integrated system. The number of components required in this system is higher as compared to the integrated type. This works on the mechanism of separate components for the intake manifold and charges the air cooler.

The integrated segment is anticipated to register the highest CAGR over the forecast period. Some of the advantages of the integrated mechanism are outstanding temperature distribution, no transfer of vibrations, increased cooling performance independent of speed, fewer interfaces in the intake system, short air duct path response characteristics, only small pipes in the front end, etc. The whole system is exposed to high-temperature differences between the air inlets and outlets. The light construction solution reduces weight and cost.

Vehicle Type Insights

Based on vehicle types, the industry has been further categorized into passenger vehicles, light commercial vehicles, heavy commercial vehicles, and others. The passenger vehicles segment accounted for the maximum share of 60.9% of the global revenue in 2021. For passenger vehicles, the automotive charge air cooler is used to improve the efficiency of the turbo-charged combustion engine. It also results in a reduction in fuel consumption and a decrease in the level of pollutant emissions. Furthermore, improvement in power output and shortened torque lead to improvement in the vehicle’s acceleration behavior.

The light commercial vehicles segment is anticipated to register a significant growth rate during the forecast period. The use of automotive charge air coolers in light commercial vehicles is the same as in passenger vehicles. The use of gasoline engines is common in light commercial vehicles and passenger cars. The governments of various countries are planning to phase-out diesel vehicles in the coming future owing to environmental concerns.

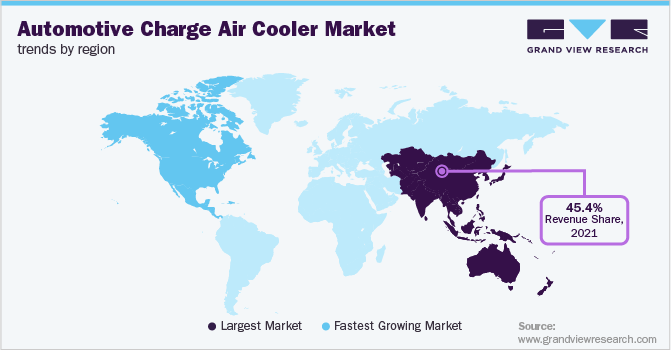

Regional Insights

Asia Pacific dominated the industry in 2021 and accounted for the largest share of 45.37% of the global revenue. Asia Pacific includes countries, such as China and India, which are among the fastest-growing nations in terms of population as well as GDP. The Asian industries and economies are evolving, which is creating a great demand for products including automotive. Countries like Japan and South Korea are home to some of the largest automotive producers in the world. North America is anticipated to grow at the fastest CAGR over the forecast period.

The U.S. is the largest automotive market in the North America region. The automotive market is mature in the U.S. The Center for Auto Research (CAR) estimated thatU.S. auto production will reach 12.2 million cars. The center also forecasted that U.S. auto sales will reach 17.6 million cars by 2028. The automotive industry is one of the largest industrial sectors in Canada. It accounts for 10% of manufacturing GDP and 23% of manufacturing trade. The automotive industry produces passenger vehicles, trucks & buses, truck bodies & trailers, auto parts & systems, etc.

Key Companies & Market Share Insights

The market has a fragmented competitive landscape as it features various global and regional market players. Leading industry players are adopting strategies, such as partnerships, collaborations, acquisitions & mergers, and agreements, to survive the highly competitive environment and expand their business footprints. Moreover, automotive charge air cooler providers are spending extensively on research and development activities to develop advanced products and integrate new technologies and features in their offerings. For instance, in February 2020, Dana Inc. acquired Ashwood Innovations Ltd. from Curtis Instruments Inc.

Ashwood designs and manufactures permanent magnet electric motors for automotive and material-handling vehicles. Ashwood’s acquisition is expected to give Dana Inc. an edge in the off-road market segment. In August 2018, Sterling Thermal Technology partnered with Fluid dynamics. These two companies had been working together to make Avantair available in Australia, New Zealand, and Oceania. This was expected to enable these companies to deliver heat exchanger products to their clients in new markets. Some of the prominent players operating in the global automotive charge air cooler market are:

-

Dana Ltd.

-

T.RAD Co., Ltd.

-

Valeo

-

Modine Manufacturing Company

-

MAHLE GmbH

-

AKG Group

-

Hanon Systems

-

Banco Products (India) Ltd.

-

Sterling Thermal Technology

-

C, G, & J Inc.

-

Radicon Company Ltd.

-

Kelvion Holding GmbH

-

Delphi Technologies (BorgWarner Inc.)

-

Dura-Lite Heat Transfer Products Ltd.

Automotive Charge Air Cooler Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 10.36 billion

Revenue forecast in 2030

USD 18.02 billion

Growth rate

CAGR of 7.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in 000’ units, revenue in USD million/billion, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, vehicle type, design type, fuel type, position type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Rest of Europe; China; India; Japan; Rest of Asia Pacific; Brazil; Mexico; Rest of Latin America; Middle East & Africa

Key companies profiled

Dana Ltd.; T.RAD Co., Ltd.; Valeo;Modine Manufacturing Company; MAHLE GmbH; AKG Group; Hanon Systems; Banco Products (India) Ltd.; C, G, & J Inc.; Sterling Thermal Technology; Radicon Company Ltd.; Kelvion Holding GmbH; Delphi Technologies (BorgWarner Inc.); Dura-Lite Heat Transfer Products Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Charge Air Cooler Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive charge air cooler market report based on product type, vehicle type, design type, fuel type, position type, and region:

-

Product Type Outlook (Volume, 000’ Units; Revenue, USD Million, 2018 - 2030)

-

Air-cooled

-

Liquid-cooled

-

-

Vehicle Type Outlook (Volume, 000’ Units; Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicles

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

Others

-

-

Design Type Outlook (Volume, 000’ Units; Revenue, USD Million, 2018 - 2030)

-

Fin & Tube

-

Bar & Plate

-

-

Fuel Type Outlook (Volume, 000’ Units; Revenue, USD Million, 2018 - 2030)

-

Diesel

-

Gasoline

-

-

Position Type Outlook (Volume, 000’ Units; Revenue, USD Million, 2018 - 2030)

-

Integrated

-

Standalone

-

-

Regional Outlook (Volume, 000’ Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global automotive charge air cooler market size was estimated at 9.9 billion in 2021 and is expected to reach USD 10.36 billion in 2022.

b. The global automotive charge air cooler market is expected to grow at a compound annual growth rate of 7.2% from 2022 to 2030 to reach USD 18.02 billion by 2030.

b. The Asia Pacific region dominated the automotive charge air cooler market with a share of 45.37% in 2021. The Asian industries and economies are evolving that creating a great demand for products including automotive. Countries like Japan and South Korea are home to some of the largest automotive producers in the world.

b. Some key players operating in the automotive charge air cooler market include Dana Limited, T.RAD Co., Ltd., Valeo, MODINE MANUFACTURING COMPANY, MAHLE GmbH, AKG Group, Hanon Systems, Banco Products (India) Ltd., Sterling Thermal Technology, and C, G, & J Inc.

b. Key factors that are driving the automotive charge air cooler market growth include demand for a reduction in fuel consumption and increased engine power and reduced emissions, growing use of turbochargers in vehicles, and an increase in demand for passenger and commercial vehicles.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."