- Home

- »

- Automotive & Transportation

- »

-

Automotive Collision Repair Market Size, Share Report, 2030GVR Report cover

![Automotive Collision Repair Market Size, Share & Trends Report]()

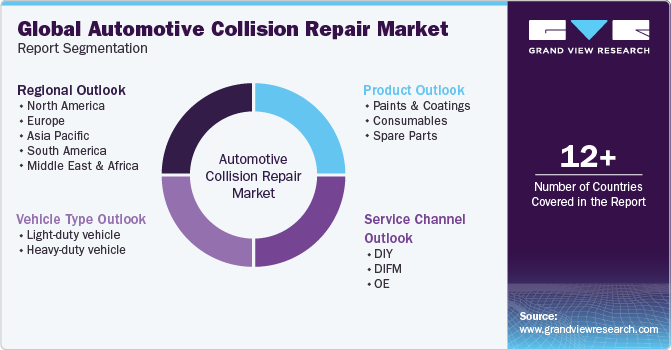

Automotive Collision Repair Market Size, Share & Trends Analysis Report By Product (Paint & Coatings, Consumables), By Vehicle Type (Light-duty Vehicle, Heavy-duty Vehicle), By Service Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-444-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

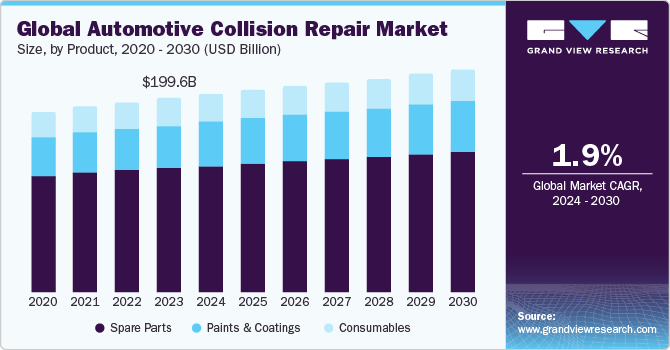

The global automotive collision repair market size was valued at USD 199.56 billion in 2023 and is anticipated to grow at a CAGR of 1.9% from 2024 to 2030. The increase in the number of subscriptions of automobile insurance and technological advancements in the automobile sector are expected to further propel the market growth. The growing number of road accidents and fatalities worldwide drives the market growth. Moreover, many automobile retailers sell Do-It-Yourself (DIY) kits to consumers who prefer to repair their cars at home without assistance. This trend is observed in many South American and Asia Pacific suburban parts.

OEMs have developed several channels to distribute their branded parts to different service departments. The rising demand for hybrid and electric cars is expected to further increase the demand for specific tools and spare parts used in such vehicles. This is anticipated to improve the demand for the automotive collision repair. In addition, the vehicle owner is obligated to get a notice that the warranties that apply to the non-OEM and nonstandard parts will not be provided by the manufacturer of the vehicle but by the manufacturer or distributor of the parts.

Technological advancement has brought a number of benefits to the organizations. Furthermore, digitalization has allowed all of us to experience a more personalized service, quicker delivery, and instant access to support, thus enhancing automotive collision repair technology. There are a number of advantages associated with inspection and repair by a collision repair specialist. Furthermore, the collision repair specialist’s service is used to analyze vehicles’ problems and find the best solution possible with new parts with significant research. For instance, in July 2023, Palladium Equity Partners launched the Collision Auto Parts platform by acquiring NAP San Diego, National Auto Parts, USA, and National Auto Parts-Oakland. The company intends to utilize non-organic growth strategies to enhance the presence and product offerings of these entities, positioning itself as a prominent distributor of value-added collision repair parts.

The companies support customers from repairing and diagnosing issues on vehicles to provide and service preventative maintenance. Customers are often concerned about the vehicles after the collision and are unable to get specialist services at a low cost. Additionally, auto collision repair shops are equipped with modern repair equipment and staffed by collision repair experts. Automotive collision repair services have a number of disadvantages such as boosting car safety, maintaining the value of the vehicle, lowering the company’s cost, and others.

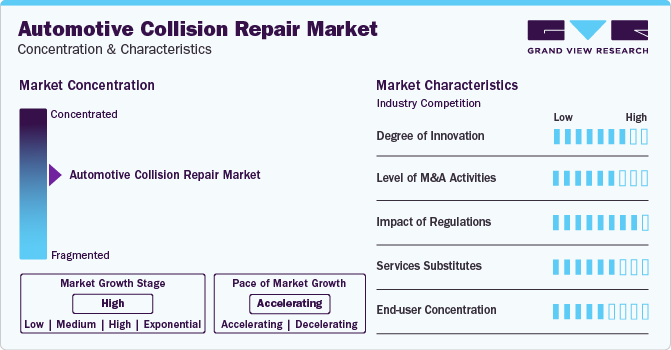

Market Concentration & Characteristics

The automotive collision repair market witnessed prominent innovations, steered by advancements in technology, materials, and repair processes. Repair shops are increasingly adopting advanced tools and techniques, such as paintless dent repair and augmented reality for diagnostics, to enhance the efficiency and quality of services.

The market also encounters a notable level of mergers and acquisitions (M&A) activities as companies seek strategic partnerships and acquisitions to enhance their solution & service portfolios, leverage synergies, and expand the channel reach in untapped markets across the regions.

The impact of regulatory compliance has a substantial influence on the automotive collision repair market. The stringent safety and environmental standards compel market companies to implement improved repair practices and materials used. Additionally, there is a growing focus on sustainable and eco-friendly repair solutions.

The end-user concentration in the market is notable, with some regions experiencing a more dispersed customer base and others with a higher concentration of consumers. While few major insurance companies and automotive manufacturers exert significant influence and shape collision repair industry dynamics through partnerships and collaborations.

Product Insights

The spare parts segment dominates the market, with a revenue share of 64.0% in 2023. The spare parts used in automobile service delivery include crash parts, repair materials, supplementary mechanical parts, restoration materials, and tools. The high number of road accidents leading to the damage of integral elements such as grilles, bumpers, fenders, dents, and scratches are fueling the demand for replacement spare parts. The increasing consumer awareness of the importance of maintenance and repair in improving vehicle performance and lifecycle is driving the growth of the spare parts segment.

The paints & coatings segment is expected to grow at the fastest CAGR of 2.7% from 2024 to 2030. The rapidly evolving paints & coatings technology, which meets the latest protective automobile materials and aesthetic demands, is the key reason for the growth of the segment in the automotive industry. Paints & coatings are anticipated to witness higher adoption in high-volume markets over the forecast period, owing to the surging environmental concerns about the use of detrimental synthetic coatings and refinishing materials. The paints and coatings segment is projected to grow steadily during the forecast period because of the environmental and health risks associated with automotive body paint materials.

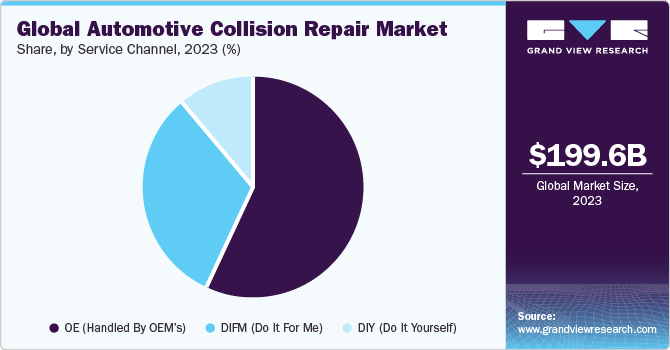

Service Channel Insights

The OE (handled by OEM's) segment dominates the market in terms of revenue share in 2023. The DIY (Do It Yourself) segment, on the other hand, is expected to grow at the fastest CAGR of 2.5% from 2024 to 2030. Globally, people have been retaining their car usage for longer periods, which has supported the demand for replacement parts. The automotive collision repair industry will continue to significantly grow, which is attributed to its robust demand from emerging economies. The DIY segment is expected to grow at the highest CAGR in the Asia Pacific region from 2024 to 2030, followed by South America. Manufacturers in the automotive industry are gradually shifting their focus to vehicle modification, where they can customize the vehicle to meet the needs of the customer rather than purchasing new vehicles.

The future of the collision repair industry is with DIY kits. Thus, several companies have initiated the production of complete kits that provide DIY solutions to users. The increased preference of customers for warranty is one of the major factors that support the dominance of OE in the market. OEMs offer products with benefits such as longer product lifecycles, reliability, and better performance. The abovementioned factors are expected to strengthen the position of OEMs in the market from 2024 to 2030.

Vehicle Type Insights

The light-duty segment dominated the market in 2023. The light-duty vehicles segment comprises hatchbacks, sedans, SUVs, and crossover cars. The demand for alternative transportation options, government initiatives for improving fuel economy, and the availability of alternative fuel vehicles are expected to increase the sales of light-duty vehicles in the coming years. Furthermore, vehicle sales in the industry are anticipated to be primarily driven by the adoption of vehicles that require alternative fuels and vehicles with several levels of drivetrain electrification.

The heavy-duty vehicles segment is expected to grow at a CAGR of 1.5% from 2024 to 2030. The heavy-duty vehicles segment includes commercial and multi-axle vehicles such as trucks and buses. Heavy-duty vehicles are anticipated to be used for the transportation of bulk products within any country or region. Increasing trade activities are expected to augment the demand for heavy-duty vehicles equipped with the latest technologies for hauling and loading.

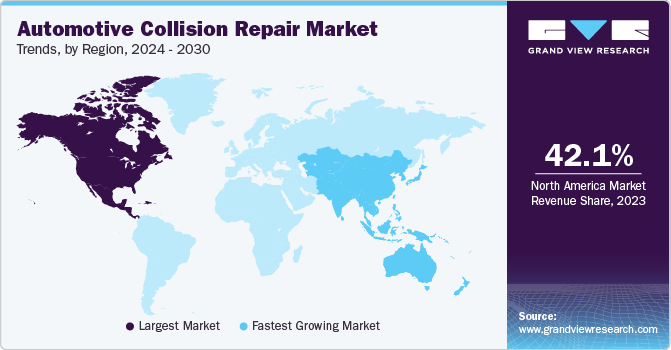

Regional Insights

North America accounted for a significant revenue share of the global market in 2023. The region has a higher technology adoption rate, which will result in the faster and higher adoption of hybrid electric automobiles in the region as compared to other geographies. Due to this trend, the region is anticipated to witness a growing proportion of specialized automotive collision repair centers that are dedicated to servicing the vehicles of a particular make, such as alternate fuel powered vehicles

U.S. Automotive Collision Repair Market Trends

The U.S. automotive collision repair market was valued at USD 36.66 billion in 2023. The U.S. market is undergoing a major transformation. This is due to two things: the increasing use of technology and the growing demand for convenient car repair services. As a result, many new businesses have started offering easy and accessible repair options, whether for everyday maintenance or after an accident.

Europe Automotive Collision Repair Market Trends

Europe dominated the global market in 2023. The region is expected to witness a steady CAGR from 2024 to 2030, owing to the penetration of vehicles with enhanced safety features and stagnated sales. Moreover, rising metal part replacements and damaged plastics are expected to boost the regional market growth.

The UK automotive collision repair market is adapting to a changing landscape. The rise of electric vehicles demands specialized repair expertise, while advancements like 3D printing and AI are streamlining processes. To stay competitive, shops are prioritizing customer experience with convenient booking and clear communication, while also embracing eco-friendly practices.

Asia Pacific Automotive Collision Repair Market Trends

Asia Pacific is expected to grow at the fastest CAGR of 3.5% from 2024 to 2030. The increasing number of vehicle sales is leading to significant growth of the regional industry. An upsurge in vehicular damage due to lack of stringent driving regulations in Asia Pacific is further driving the regional market growth. The region is perceived to be a source of components for local companies and multinationals, who aim to supply low-cost components to prominent vehicle manufacturers.

The China automotive collision repair market is experiencing significant growth, propelled by rising vehicle ownership and an increase in traffic accidents. Factors such as expanding urbanization and disposable incomes are further boosting the market growth. Moreover, the government's focus on improving vehicle safety standards is influencing demand for high-quality collision repair.

Key Automotive Collision Repair Company Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is on developing new products and collaboration among the key companies. In February 2023, Classic Collision LLC, a U.S.-based auto repair center, acquired Gale’s Auto Body, a motor vehicle manufacturer in the Blaine. Through this acquisition, Classic Collision intends to extend its presence in Minnesota and provide improved customer service during the repair process.

Key Automotive Collision Repair Companies:

The following are the leading companies in the automotive collision repair market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Automotive Technology Products LLC (subsidiary of Lodi Group of Monterrey)

- Continental AG

- Denso Corporation

- Faurecia

- Federal-Mogul LLC

- Honeywell International, Inc.

- International Automotive Components Group

- Johnson Controls, Inc.

- Magna International Inc.

- Mann+Hummel Group

- Martinrea International Inc.

- Mitsuba Corporation

- Robert Bosch GmbH

- Takata Corporation ODU GmbH & Co.KG

Recent Developments

-

In July 2023- BMW North America joined Sustaining Partner Program by I-CAR. The program helps fund support initiatives and collision repair education that reduce training redundancies. It is also designed for partners to demonstrate advocacy and provide funding for industry-wide efforts by I-CAR.

-

In July 2023, Classic Collision announced the acquisition of the Dayton Collision Center in Dayton, Tennessee, enabling the company to expand its operations in the state. This follows the company’s successful operational expansion in other states, including Minnesota, Georgia, Texas, Colorado, and Florida, in 2023

-

In March 2023, DENSO Products and Services Americas, Inc. announced the expansion of its aftermarket ignition coils range with the addition of nine new part numbers covering over 9 million vehicles in operation. With this launch, DENSO has expanded its offering of high-quality replacement ignition coils for various Buick, BMW, Cadillac, GMC, Infiniti, Lincoln, Ford, Nissan, Chevrolet, and Volvo models

-

In September 2022, the Bosch Automotive Aftermarket division introduced several products for the workshop industry at the Automechanika trade fair. Notable ones included the DAS 3000 for precise calibration and adjustment of vehicle sensors & camera systems that support modern driver assistance systems; the DCU 120 diagnostic control unit for reliable and convenient mobile workshop usage; and the availability of ‘Bosch Automotive Training Solutions’ platform for planning and administering technical training courses, among others

-

In April 2022, 3M announced the acquisition of the technology assets of LeanTec, which provides digital inventory management solutions for the automotive aftermarket sector in the U.S. and Canada. The development showcases 3M’s commitment to its "connected bodyshop” platform, with LeanTec’s technology complementing ‘3M RepairStack Performance Solutions’, a hardware and software system that ensures on-hand material availability for reliable and safe repairs

Automotive Collision Repair Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 203.85 billion

Revenue forecast in 2030

USD 227.60 billion

Growth rate

CAGR 1.9% of from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Market revenue in USD billion & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, vehicle type, service channel, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; China; India; Japan; Brazil

Key companies profiled

3M; Automotive Technology Products LLC; Continental AG; Denso Corporation; Faurecia; Federal-Mogul LLC; Honeywell International, Inc.; International Automotive Components Group; Johnson Controls, Inc.; Magna International Inc.; Mann+Hummel Group; Martinrea International Inc.; Mitsuba Corporation; Robert Bosch GmbH; Takata Corporation ODU GmbH & Co.KG; QPC FIBER OPTIC, LLC; Smiths Interconnect; Souriau; Stäubli International AG; Stran Technologies; TE Connectivity; Teledyne Defense Electronics; TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION; X-BEAM TECH CO, LTD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Global Automotive Collision Repair Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global automotive collision repair market report based on product, vehicle type, service channel,and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Paints & coatings

-

Consumables

-

Spare parts

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Light-duty vehicle

-

Heavy-duty vehicle

-

-

Service channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

DIY

-

DIFM

-

OE

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global automotive collision repair market size was estimated at USD 199.56 billion in 2023 and is expected to reach USD 203.85 billion in 2024.

b. The global automotive collision repair market is expected to grow at a compound annual growth rate of 1.9% from 2024 to 2030 to reach USD 227.60 billion by 2030.

b. In terms of market size, Europe dominated the automotive collision repair market with a revenue share of 42.0% in 2023. This is due to the stringency of roads and vehicle safety standards and increased demand for luxury vehicles.

b. Some key players operating in the automotive collision repair market include 3M; Automotive Technology Products LLC; Continental AG; Denso Corporation; Faurecia; Federal-Mogul LLC; Honeywell International, Inc.; and International Automotive Components Group.

b. Key factors that are driving the automotive collision repair market growth include advancements in auto parts fabrication and the surge in consumer and passenger automobile production.

b. In terms of market size, the spare parts segment dominated the automotive collision repair market with a revenue share of 64.0% in 2023.

Table of Contents

Chapter 1. Methodology and Scope

1.1 Information Procurement and Research Scope

1.2 Information Analysis

1.3 Market Formulation & Data Visualization

1.4 Market Scope and Assumptions

1.4.1 Secondary Sources

1.4.2 Primary Sources

Chapter 2. Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot

2.3 Competitive Landscape Snapshot

Chapter 3. Automotive Collision Repair Market Variables, Trends & Scope

3.1 Market Segmentation & Scope

3.2 Automotive Collision Repair Market - Value Chain Analysis

3.3 Market Dynamics

3.3.1 Market Drivers

3.3.2 Market Restraints

3.3.3 Market Opportunities

3.4 Industry Analysis - Porter’s

3.4.1 Supplier Power:

3.4.2 Buyer Power:

3.4.3 Substitution Threat:

3.4.4 Threat From New Entrant:

3.4.5 Competitive Rivalry

3.5 Key Opportunities - Prioritized

3.6 Automotive Collision Repair Market - PEST Analysis

3.6.1 Political

3.6.2 Economic

3.6.3 Social

3.6.4 Technological

Chapter 4. Automotive Collision Repair Market: Product Outlook

4.1 Automotive Collision Repair Market Share by Product, 2023 & 2030

4.2 Paints & Coatings

4.2.1 Paints & Coatings Automotive Collision Repair Market, by Region, 2017 - 2030

4.3 Consumables

4.3.1 Consumables Automotive Collision Repair Market, by Region, 2017 - 2030

4.4 Spare Parts

4.4.1 Spare Parts Automotive Collision Repair Market, by Region, 2017 - 2030

Chapter 5. Automotive Collision Repair Market: Vehicle Type Outlook

5.1 Automotive Collision Repair Market Share by Vehicle Type, 2023 & 2030

5.2 Light-duty vehicle

5.2.1 Light-duty vehicle Automotive Collision Repair Market, by Region, 2017 - 2030

5.3 Heavy-duty vehicle

5.3.1 Heavy-duty vehicle Automotive Collision Repair Market, by Region, 2017 - 2030

Chapter 6. Automotive Collision Repair Market: Service Channel Outlook

6.1 Automotive Collision Repair Market Share by Service Channel, 2023 & 2030

6.2 DIY

6.2.1 DIY Automotive Collision Repair Market, by Region, 2017 - 2030

6.3 DIFM

6.3.1 DIFM Automotive Collision Repair Market, by Region, 2017 - 2030

6.4 OE

6.4.1 OE Automotive Collision Repair Market, by Region, 2017 - 2030

Chapter 7. Automotive Collision Repair Market: Regional Outlook

7.1 North America

7.1.1 North America Automotive Collision Repair Market, by Product, 2017 - 2030

7.1.2 North America Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030

7.1.3 North America Automotive Collision Repair Market, by Service Channel, 2017 - 2030

7.1.4 U.S.

7.1.4.1 U.S. Automotive Collision Repair Market, by Product, 2017 - 2030

7.1.4.2 U.S. Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030

7.1.4.3 U.S. Automotive Collision Repair Market, by Service Channel, 2017 - 2030

7.1.5 Canada

7.1.5.1 Canada Automotive Collision Repair Market, by Product, 2017 - 2030

7.1.5.2 Canada Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030

7.1.5.3 Canada Automotive Collision Repair Market, by Service Channel, 2017 - 2030

7.1.6 Mexico

7.1.6.1 Mexico Automotive Collision Repair Market, by Product, 2017 - 2030

7.1.6.2 Mexico Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030

7.1.6.3 Mexico Automotive Collision Repair Market, by Service Channel, 2017 - 2030

7.2 Europe

7.2.1 Europe Automotive Collision Repair Market, by Product, 2017 - 2030

7.2.2 Europe Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030

7.2.3 Europe Automotive Collision Repair Market, by Service Channel, 2017 - 2030

7.2.4 Germany

7.2.4.1 Germany Automotive Collision Repair Market, by Product, 2017 - 2030

7.2.4.2 Germany Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030

7.2.4.3 Germany Automotive Collision Repair Market, by Service Channel, 2017 - 2030

7.2.5 UK

7.2.5.1 UK Automotive Collision Repair Market, by Product, 2017 - 2030

7.2.5.2 UK Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030

7.2.5.3 UK Automotive Collision Repair Market, by Service Channel, 2017 - 2030

7.2.6 France

7.2.6.1 France Automotive Collision Repair Market, by Product, 2017 - 2030

7.2.6.2 France Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030

7.2.6.3 France Automotive Collision Repair Market, by Service Channel, 2017 - 2030

7.3 Asia Pacific

7.3.1 Asia Pacific Automotive Collision Repair Market, by Product, 2017 - 2030

7.3.2 Asia Pacific Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030

7.3.3 Asia Pacific Automotive Collision Repair Market, by Service Channel, 2017 - 2030

7.3.4 China

7.3.4.1 China Automotive Collision Repair Market, by Product, 2017 - 2030

7.3.4.2 China Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030

7.3.4.3 China Automotive Collision Repair Market, by Service Channel, 2017 - 2030

7.3.5 Japan

7.3.5.1 Japan Automotive Collision Repair Market, by Product, 2017 - 2030

7.3.5.2 Japan Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030

7.3.5.3 Japan Automotive Collision Repair Market, by Service Channel, 2017 - 2030

7.3.6 India

7.3.6.1 India Automotive Collision Repair Market, by Product, 2017 - 2030

7.3.6.2 India Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030

7.3.6.3 India Automotive Collision Repair Market, by Service Channel, 2017 - 2030

7.4 South America

7.4.1 South America Automotive Collision Repair Market, by Product, 2017 - 2030

7.4.2 South America Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030

7.4.3 South America Automotive Collision Repair Market, by Service Channel, 2017 - 2030

7.4.4 Brazil

7.4.4.1 Brazil Automotive Collision Repair Market, by Product, 2017 - 2030

7.4.4.2 Brazil Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030

7.4.4.2 Brazil Automotive Collision Repair Market, by Service Channel, 2017 - 2030

7.5 MEA

7.5.1 MEA Automotive Collision Repair Market, by Product, 2017 - 2030

7.5.2 MEA Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030

7.5.2 MEA Automotive Collision Repair Market, by Service Channel, 2017 - 2030

Chapter 8. Competitive Landscape

8.1 3M

8.1.1 Company Overview

8.1.2 Financial Performance

8.1.3 Product Benchmarking

8.1.4 Recent Developments

8.2 Automotive Technology Products LLC

8.2.1 Company Overview

8.2.2 Financial Performance

8.2.3 Product Benchmarking

8.2.4 Recent Developments

8.3 Continental AG

8.3.1 Company Overview

8.3.2 Financial Performance

8.3.3 Product Benchmarking

8.3.4 Recent Developments

8.4 Denso Corporation

8.4.1 Company Overview

8.4.2 Financial Performance

8.4.3 Product Benchmarking

8.4.4 Recent Developments

8.5 Faurecia

8.5.1 Company Overview

8.5.2 Financial Performance

8.5.3 Product Benchmarking

8.5.4 Recent Developments

8.6 Federal-Mogul LLC

8.6.1 Company Overview

8.6.2 Financial Performance

8.6.3 Product Benchmarking

8.6.4 Recent Developments

8.7 Honeywell International, Inc.

8.7.1 Company Overview

8.7.2 Financial Performance

8.7.3 Product Benchmarking

8.7.4 Recent Developments

8.8 International Automotive Components Group

8.8.1 Company Overview

8.8.2 Financial Performance

8.8.3 Product Benchmarking

8.8.4 Recent Developments

8.9 Johnson Controls, Inc.

8.9.1 Company Overview

8.9.2 Financial Performance

8.9.3 Product Benchmarking

8.9.4 Recent Developments

8.10 Magna International Inc.

8.10.1 Company Overview

8.10.2 Financial Performance

8.10.3 Product Benchmarking

8.10.4 Recent Developments

8.11 Mann+Hummel Group

8.11.1 Company Overview

8.11.2 Financial Performance

8.11.3 Product Benchmarking

8.11.4 Recent Developments

8.12 Martinrea International Inc.

8.12.1 Company Overview

8.12.2 Financial Performance

8.12.3 Product Benchmarking

8.12.4 Recent Developments

8.13 Mitsuba Corporation

8.13.1 Company Overview

8.13.2 Financial Performance

8.13.3 Product Benchmarking

8.13.4 Recent Developments

8.14 Takata Corporation ODU GmbH & Co.KG

8.14.1 Company Overview

8.14.2 Financial Performance

8.14.3 Product Benchmarking

8.14.4 Recent Developments

List of Tables

Table 1 Automotive Collision Repair Market - Industry Snapshot & Key Buying Criteria, 2017 - 2030

Table 2 Global Automotive Collision Repair Market, 2017 - 2030 (USD Billion)

Table 3 Global Automotive Collision Repair Market, by Region, 2017 - 2030 (USD Billion)

Table 4 Global Automotive Collision Repair Market, by Product, 2017 - 2030 (USD Billion)

Table 5 Global Automotive Collision Repair Market, by Vehicle Product, 2017 - 2030 (USD Billion)

Table 6 Global Automotive Collision Repair Market, by Service Channel, 2017 - 2030 (USD Billion)

Table 7 Key Market Driver Impact

Table 8 Key Market Restraint Impact

Table 9 Key Market Opportunity Impact

Table 10 List of Key Market Companies

Table 11 Paints & coatings Automotive Collision Repair Market, by Region, 2017 - 2030 (USD Billion)

Table 12 Consumables Automotive Collision Repair Market, by Region, 2017 - 2030 (USD Billion)

Table 13 Spare parts Automotive Collision Repair Market, by Region, 2017 - 2030 (USD Billion)

Table 14 Light-duty vehicle Automotive Collision Repair Market, by Region, 2017 - 2030 (USD Billion)

Table 15 Heavy-duty vehicle Automotive Collision Repair Market, by Region, 2017 - 2030 (USD Billion)

Table 16 DIY Automotive Collision Repair Market, by Region, 2017 - 2030 (USD Billion)

Table 17 DIFM Automotive Collision Repair Market, by Region, 2017 - 2030 (USD Billion)

Table 18 OE Automotive Collision Repair Market, by Region, 2017 - 2030 (USD Billion)

Table 19 North America Automotive Collision Repair Market, by Product, 2017 - 2030 (USD Billion)

Table 20 North America Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030 (USD Billion)

Table 21 North America Automotive Collision Repair Market, by Service Channel, 2017 - 2030 (USD Billion)

Table 22 U.S. Automotive Collision Repair Market, by Product, 2017 - 2030 (USD Billion)

Table 23 U.S. Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030 (USD Billion)

Table 24 U.S. Automotive Collision Repair Market, by Service Channel, 2017 - 2030 (USD Billion)

Table 25 Canada Automotive Collision Repair Market, by Product, 2017 - 2030 (USD Billion)

Table 26 Canada Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030 (USD Billion)

Table 27 Canada Automotive Collision Repair Market, by Service Channel, 2017 - 2030 (USD Billion)

Table 28 Mexico Automotive Collision Repair Market, by Product, 2017 - 2030 (USD Billion)

Table 29 Mexico Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030 (USD Billion)

Table 30 Mexico Automotive Collision Repair Market, by Service Channel, 2017 - 2030 (USD Billion)

Table 31 Europe Automotive Collision Repair Market, by Product, 2017 - 2030 (USD Billion)

Table 32 Europe Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030 (USD Billion)

Table 33 Europe Automotive Collision Repair Market, by Service Channel, 2017 - 2030 (USD Billion)

Table 34 Germany Automotive Collision Repair Market, by Product, 2017 - 2030 (USD Billion)

Table 35 Germany Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030 (USD Billion)

Table 36 Germany Automotive Collision Repair Market, by Service Channel, 2017 - 2030 (USD Billion)

Table 37 UK Automotive Collision Repair Market, by Product, 2017 - 2030 (USD Billion)

Table 38 UK Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030 (USD Billion)

Table 39 UK Automotive Collision Repair Market, by Service Channel, 2017 - 2030 (USD Billion)

Table 40 France Automotive Collision Repair Market, by Product, 2017 - 2030 (USD Billion)

Table 41 France Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030 (USD Billion)

Table 42 France Automotive Collision Repair Market, by Service Channel, 2017 - 2030 (USD Billion)

Table 43 Asia Pacific Automotive Collision Repair Market, by Product, 2017 - 2030 (USD Billion)

Table 44 Asia Pacific Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030 (USD Billion)

Table 45 Asia Pacific Automotive Collision Repair Market, by Service Channel, 2017 - 2030 (USD Billion)

Table 46 China Automotive Collision Repair Market, by Product, 2017 - 2030 (USD Billion)

Table 47 China Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030 (USD Billion)

Table 48 China Automotive Collision Repair Market, by Service Channel, 2017 - 2030 (USD Billion)

Table 49 Japan Automotive Collision Repair Market, by Product, 2017 - 2030 (USD Billion)

Table 50 Japan Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030 (USD Billion)

Table 51 Japan Automotive Collision Repair Market, by Service Channel, 2017 - 2030 (USD Billion)

Table 52 India Automotive Collision Repair Market, by Product, 2017 - 2030 (USD Billion)

Table 53 India Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030 (USD Billion)

Table 54 India Automotive Collision Repair Market, by Service Channel, 2017 - 2030 (USD Billion)

Table 55 South America Automotive Collision Repair Market, by Product, 2017 - 2030 (USD Billion)

Table 56 South America Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030 (USD Billion)

Table 57 South America Automotive Collision Repair Market, by Service Channel, 2017 - 2030 (USD Billion)

Table 58 Brazil Automotive Collision Repair Market, by Product, 2017 - 2030 (USD Billion)

Table 59 Brazil Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030 (USD Billion)

Table 60 Brazil Automotive Collision Repair Market, by Service Channel, 2017 - 2030 (USD Billion)

Table 61 MEA Automotive Collision Repair Market, by Product, 2017 - 2030 (USD Billion)

Table 62 MEA Automotive Collision Repair Market, by Vehicle Type, 2017 - 2030 (USD Billion)

Table 63 MEA Automotive Collision Repair Market, by Service Channel, 2017 - 2030 (USD Billion)

List of Figures

Fig. 1 Research Process

Fig. 2 Market Formulation

Fig. 3 Market Segmentation and Scope

Fig. 4 Automotive Collision Repair Market, 2017 - 2030

Fig. 5 Key Opportunities Analysis

Fig. 6 Automotive Collision Repair - Value Chain Analysis

Fig. 7 Automotive Collision Repair Market Dynamics

Fig. 8 Industry Analysis - Porter’s Five Forces Analysis

Fig. 9 Automotive Collision Repair Market - Pest Analysis

Fig. 10 Automotive Collision Repair Market Share by Product, 2023 & 2030

Fig. 11 Automotive Collision Repair Market Share by Vehicle Type, 2023 & 2030

Fig. 12 Automotive Collision Repair Market Share by Service Channel, 2023 & 2030

Fig. 13 Automotive Collision Repair Market Share by Region, 2023 & 2030

Fig. 14 North America Marketplace: Key Takeaways

Fig. 15 Europe Marketplace: Key Takeaways

Fig. 16 Asia Pacific Marketplace: Key Takeaways

Fig. 17 South America Marketplace: Key Takeaways

Fig. 18 MEA Marketplace: Key TakeawaysWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Automotive Collision Repair Product Outlook (Revenue, USD Billion, 2017 - 2030)

- Paints & coatings

- Consumables

- Spare parts

- Automotive Collision Repair Vehicle Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Light-duty vehicle

- Heavy-duty vehicle

- Automotive Collision Repair Service Channel Outlook (Revenue, USD Billion, 2017 - 2030)

- DIY

- DIFM

- OE

- Automotive Collision Repair Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- North America Automotive Collision Repair Market, By Product

- Paints & coatings

- Consumables

- Spare parts

- North America Automotive Collision Repair Market, By Vehicle Type

- Light-duty vehicle

- Heavy-duty vehicle

- North America Automotive Collision Repair Market, By Service Channel

- DIY

- DIFM

- OE

- U.S.

- U.S. Automotive Collision Repair Market, By Product

- Paints & coatings

- Consumables

- Spare parts

- U.S. Automotive Collision Repair Market, By Vehicle Type

- Light-duty vehicle

- Heavy-duty vehicle

- U.S. Automotive Collision Repair Market, By Service Channel

- DIY

- DIFM

- OE

- U.S. Automotive Collision Repair Market, By Product

- Canada

- Canada Automotive Collision Repair Market, By Product

- Paints & coatings

- Consumables

- Spare parts

- Canada Automotive Collision Repair Market, By Vehicle Type

- Light-duty vehicle

- Heavy-duty vehicle

- Canada Automotive Collision Repair Market, By Service Channel

- DIY

- DIFM

- OE

- Canada Automotive Collision Repair Market, By Product

- Mexico

- Mexico Automotive Collision Repair Market, By Product

- Paints & coatings

- Consumables

- Spare parts

- Mexico Automotive Collision Repair Market, By Vehicle Type

- Light-duty vehicle

- Heavy-duty vehicle

- Mexico. Automotive Collision Repair Market, By Service Channel

- DIY

- DIFM

- OE

- Mexico Automotive Collision Repair Market, By Product

- North America Automotive Collision Repair Market, By Product

- Europe

- Europe Automotive Collision Repair Market, By Product

- Paints & coatings

- Consumables

- Spare parts

- Europe Automotive Collision Repair Market, By Vehicle Type

- Light-duty vehicle

- Heavy-duty vehicle

- Europe Automotive Collision Repair Market, By Service Channel

- DIY

- DIFM

- OE

- UK

- UK Automotive Collision Repair Market, By Product

- Paints & coatings

- Consumables

- Spare parts

- UK Automotive Collision Repair Market, By Vehicle Type

- Light-duty vehicle

- Heavy-duty vehicle

- UK Automotive Collision Repair Market, By Service Channel

- DIY

- DIFM

- OE

- UK Automotive Collision Repair Market, By Product

- Germany

- Germany Automotive Collision Repair Market, By Product

- Paints & coatings

- Consumables

- Spare parts

- Germany Automotive Collision Repair Market, By Vehicle Type

- Light-duty vehicle

- Heavy-duty vehicle

- Germany Automotive Collision Repair Market, By Service Channel

- DIY

- DIFM

- OE

- Germany Automotive Collision Repair Market, By Product

- France

- France Automotive Collision Repair Market, By Product

- Paints & coatings

- Consumables

- Spare parts

- France Automotive Collision Repair Market, By Vehicle Type

- Light-duty vehicle

- Heavy-duty vehicle

- France Automotive Collision Repair Market, By Service Channel

- DIY

- DIFM

- OE

- France Automotive Collision Repair Market, By Product

- Europe Automotive Collision Repair Market, By Product

- Asia Pacific

- Asia Pacific Automotive Collision Repair Market, By Product

- Paints & coatings

- Consumables

- Spare parts

- Asia Pacific Automotive Collision Repair Market, By Vehicle Type

- Light-duty vehicle

- Heavy-duty vehicle

- Asia Pacific Automotive Collision Repair Market, By Service Channel

- DIY

- DIFM

- OE

- China

- China Automotive Collision Repair Market, By Product

- Paints & coatings

- Consumables

- Spare parts

- China Automotive Collision Repair Market, By Vehicle Type

- Light-duty vehicle

- Heavy-duty vehicle

- China Automotive Collision Repair Market, By Service Channel

- DIY

- DIFM

- OE

- China Automotive Collision Repair Market, By Product

- Japan

- Japan Automotive Collision Repair Market, By Product

- Paints & coatings

- Consumables

- Spare parts

- Japan Automotive Collision Repair Market, By Vehicle Type

- Light-duty vehicle

- Heavy-duty vehicle

- Japan Automotive Collision Repair Market, By Service Channel

- DIY

- DIFM

- OE

- Japan Automotive Collision Repair Market, By Product

- India

- India Automotive Collision Repair Market, By Product

- Paints & coatings

- Consumables

- Spare parts

- India Automotive Collision Repair Market, By Vehicle Type

- Light-duty vehicle

- Heavy-duty vehicle

- India Automotive Collision Repair Market, By Service Channel

- DIY

- DIFM

- OE

- India Automotive Collision Repair Market, By Product

- Asia Pacific Automotive Collision Repair Market, By Product

- South America

- South America Automotive Collision Repair Market, By Product

- Paints & coatings

- Consumables

- Spare parts

- South America Automotive Collision Repair Market, By Vehicle Type

- Light-duty vehicle

- Heavy-duty vehicle

- South America Automotive Collision Repair Market, By Service Channel

- DIY

- DIFM

- OE

- Brazil

- Brazil Automotive Collision Repair Market, By Product

- Paints & coatings

- Consumables

- Spare parts

- Brazil Automotive Collision Repair Market, By Vehicle Type

- Light-duty vehicle

- Heavy-duty vehicle

- Brazil Automotive Collision Repair Market, By Service Channel

- DIY

- DIFM

- OE

- Brazil Automotive Collision Repair Market, By Product

- South America Automotive Collision Repair Market, By Product

- MEA

- MEA Automotive Collision Repair Market, By Product

- Paints & coatings

- Consumables

- Spare parts

- MEA Automotive Collision Repair Market, By Vehicle Type

- Light-duty vehicle

- Heavy-duty vehicle

- MEA Automotive Collision Repair Market, By Service Channel

- DIY

- DIFM

- OE

- MEA Automotive Collision Repair Market, By Product

- North America

Automotive Collision Repair Market Dynamics

Advanced Technology Usage in Auto Parts Fabrication

With advancements in technology, there has been a significant global growth in the market. Repair experts can now use computerized measurement to help with frame straightening, which offers a level of accuracy, empowering the technician to refurbish the frame according to the producer’s needs. Furthermore, computerized alignment technology permits technicians to execute more accurate vehicle and wheel alignments, restoring optimal balance and averting irregular tire wear. Rigorous production protocols intended at decreasing vehicle production costs have made automotive vendors improvise on enhancing their techniques and bring in advanced technology and innovation to their products to reduce automobile production costs in price complex markets. The modern age production technology, such as 3D printing of automotive parts, is expansively being deployed by chief players in the industry to optimize their production costs, with 3D printing allowing proficient fabrication performance and decreasing of emission toxicity.

Surge in Consumer and Passenger Automobile Production

The development in the global automotive collision repair market is connected to the progression of the global automobiles market. As the rising sales of automobiles across the globe, the demand for the automotive collision repair is predicted to grow. In emerging regions, such as Asia Pacific, Latin America, and the Middle East, a rise in the utilization of passenger vehicles is expected to develop over the upcoming decade, encouraging the growth of the automotive collision repair market. Increasing disposable incomes across numerous sections of the society have led to the growth of the automotive industry in the developed countries such as Italy, the Netherlands, and France from the European region.

Restraint: Insurance Dependence

Non-traditional players, such as insurers and fleet operators, are reshaping the marketplace by directing the business to their selected repair networks. Some shops feel forced to conform to insurance demands and suggestions to install cheaper aftermarket parts at certain billable rates, to maintain the sales levels and business. Insurance companies are increasingly moving towards nominating collision centers for repairs because of extensive Direct Repair Program (DRP) networks. Most insurance companies have a DRP program in association with many auto repair service shops all over the nation. For a shop to get on an insurance company’s favored DRP list, it approves all varied concessions that the insurance company demands. Trade-off results in the insurance companies’ favoring repair centers and directing customers to those shops. The concessions the DRP shop has agreed to may comprise using cheaper materials, used parts& aftermarket parts, and skipping certain safety procedures. The DRP shops with an intent to acquire more business trying to save the insurance company’s money by indulging in deceitful service policies that the insurance company demands.

What Does This Report Include?

This section will provide insights into the contents included in this automotive collision repair market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Automotive collision repair market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Automotive collision repair market quantitative analysis

-

Market size, estimates, and forecast from 2017 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the automotive collision repair market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for automotive collision repair market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of automotive collision repair market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Automotive Collision Repair Market Categorization:

The automotive collision repair market was categorized into four segments, namely product (Paints & coatings, Consumables, Spare parts), vehicle type (Light-duty vehicle, Heavy-duty vehicle), service channel (DIY, DIFM, OE), and region (North America, Europe, Asia Pacific, South America, Middle East & Africa).

Segment Market Methodology:

The automotive collision repair market was segmented into product, vehicle type, service channel, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The automotive collision repair market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into ten countries, namely, the U.S.; Canada, Mexico; the UK; Germany; France; China; India; Japan; and Brazil.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Automotive collision repair market companies & financials:

The automotive collision repair market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

3M - 3M is a conglomerate based in the U.S. operating in industrial engineering and related services. The company offers a wide range of products to customers through five business groups: consumer, industrial, safety & graphics, healthcare, and electronics & energy markets. Automotive Aftermarkets Division (AAD) is a part of the safety and industrial segment of the company and is involved in vehicle care and repair. The firm’s product offering includes abrasives, adhesives, buffing pads, cleaners & removers, headlight lens restoration, coatings, body filler, masking, seam sealers, paint booth protection, welding and compounds, and polishes & glazes. 3M AAD provides distributors with information, knowledge, and skills required to perform complete and safe repairs through approved training providers. The company has a vast geographic presence across regions, including MEA, APAC, Americas, and Europe. The critical competitors for 3M include Mann+Hummel Group(Germany) and Robert Bosch GmbH (Germany). The firm markets its products through a network of distributors around the globe.

-

Automotive Technology Products LLC (ATP.) - Automotive Technology Products LLC is based in the U.S. and provides aftermarket replacement parts for automatic transmissions. Initially, ATP supplied only mechanical transmission replacement parts. However, over the years, the company diversified its offerings to include repair kits, flywheel & ring gears, chemicals, cables, cabin air filters, and automatic transmission filter kits to its product portfolio. The company offers a wide range of products to its customers and includes automatic transmission, cabin air filters, fluids & additives, manual transmission, cables, engines, and line splices.

-

Continental AG - Continental AG is a German-based automotive manufacturing company. The firm operates through three business segments: automotive technologies, rubber technologies, and powertrain technologies. The automotive technologies segment consists of autonomous mobility and safety and vehicle networking and information. The rubber technology consists of tires and ContiTech divisions. Powertrain technologies encompasses technolgoies related to powertrain systems. Continental AG is a publicly operated firm listed on Frankfurt Stock Exchange as FWB: CON. The subsidiaries of the firm include ContiTech, Continental Tire Canada, and Continental Automotive Systems. The company offers automotive solutions for two wheelers, trucks, bicycles, agricultural products, and cars. The firm has vast geographic footprints with offices and facilities across regions including APAC, Europe, the MEA, and Americas.

-

Denso Corporation - Denso Corporation is based in Japan and is a global supplier of advanced automotive technologies, components, and systems. Initially, the company was a part of Toyota Motors, and it became independent in 1949. The company comprises various business segments, including powertrain control systems, thermal systems, electrification systems, mobility systems, sensors & semiconductors, non-automotive businesses. Denso extensively offers gasoline and diesel engine control systems and related products, hybrid and electric car products, powertrain products, and power supply and starting system parts such as alternators and starters.

-

Faurecia - Faurecia is based in France and manufactures vehicle interiors, door exhaust systems, and front-end systems. The company’s business segments include seating, interior, clean mobility, and clarion electronics. Seatings include padding, seat covers, frames, mechanisms, and motors. The interiors consist of cockpits, instrument panels & center consoles, acoustic products, door panels & modules, and modules & decorative components such as film, paint, aluminum, and wood.

-

Federal-Mogul LLC - Federal-Mogul LLC is based in the U.S. and is a developer, manufacturer, and supplier of powertrain and vehicle safety products. The company supplies products & services to automotive servicers and manufacturers of vehicle equipment in the light, automotive, power generation, marine, aerospace, medium & heavy-duty commercial, rail, and industrial markets. The company operates under two distinct segments; powertrain and motor parts. In April 2018, the company announced that Tenneco acquired it. The company sells and distributes products through recognized brands such as Anco wiper blades, Champion spark plugs, Sealed Power engines, Speed Pro, Wagner brake products, MOOG steering and suspension parts, and Fel-Pro gaskets in the global vehicle aftermarket. It also serves products to original equipment vehicle manufacturers, including braking, wipers, chassis, and other associated vehicle components. The company’s offerings include suspension and steering parts, engine products, wiper blades, spark plugs, wipers & filters, and brake products in the collision repair market. The firm has a vast geographic presence across regions, including APAC, Americas, Europe, and MEA.

-

Honeywell International, Inc. - Honeywell International, Inc. is a diversified manufacturing and technology company based in the U.S. that provides aerospace products and services, turbochargers; performance materials; and control technologies for buildings, homes, and industry. The company offers a wide range of products through its business segments; Aerospace, Performance Materials & Technologies, Honeywell Building Technologies, and Automation and Control Solutions. In October 2018, Honeywell International Inc. announced the spin-off of its transportation systems business from the company. The new company has been named Garrett Motion Inc.

-

International Automotive Components Group - International Automotive Components Group is a Luxembourgbased automotive parts manufacturer. The company is a supplier of automotive interior parts, such as consoles & cockpits, headliners, instrument panels & consoles, headliners & overhead systems. The company collaborates with many global automotive interior manufacturers, such as Stankiewicz, United Technologies, Automotive Industries, and Masland Industries. The company’s plastic, fabric, and leather parts are supplied to every major automotive company worldwide, such as Ford and GM in the U.S.; Daimler and Volkswagen in Germany; and Honda and Toyota in Japan. The firm has a vast geographic presence across regions, including North America, Europe, and Asia. The company markets its products through its subsidiaries and distributors around the globe.

-

Johnson Controls, Inc. - Johnson Controls, Inc. is based in the U.S and is a manufacturer and supplier of automotive electronics and body parts. The company operates through three primary businesses automotive experience, building efficiency, and power solutions. Johnson Control, Inc. is a publicly operated company listed on the New York Stock Exchange as NYSE: JCI. In October 2016, the company completed its spin-off to form Adient plc, an automotive seating, and interiors provider. Adient plc. has its presence in Europe, the Americas, and China. The company has 234 assembly and manufacturing plants in more than 30 countries. Lear Corporation, Magna International Inc., and Faurecia SA are Adient plc.’s, principal competitors.

-

MAGNA INTERNATIONAL INC.- Magna International Inc. is based in Canada and is a supplier of automobile parts. Magna International’s capabilities include engineering, design, and manufacture & testing of diverse automotive systems. The product line comprises interior, exterior, powertrain, vision, closure, seating, body & chassis systems, roof systems, electronic systems, vehicle engineering & contract assembly, and hybrid & electric vehicle systems. The company has a vast geographic presence with manufacturing facilities and product development centers across regions, including the Americas, Europe, APAC, and MEA. The firm markets its products through subsidiaries and distributors across the globe. The acquisition of the UK-based Stadco Automotive in 2015 enabled Cosmas International, an operating unit of Magna, to expand its geographic presence.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Automotive Collision Repair Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2023, historic information from 2017 to 2030, and forecast from 2024 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Automotive Collision Repair Market Report Assumptions:

-

The report provides market value for the base year 2023 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."