- Home

- »

- Automotive & Transportation

- »

-

Automotive Electronic Control Unit Market Size Report, 2030GVR Report cover

![Automotive Electronic Control Unit Market Size, Share & Trends Report]()

Automotive Electronic Control Unit Market (2023 - 2030) Size, Share & Trends Analysis Report By Capacity Type, By Application (ADAS & Safety System, Body Electronics, Powertrain), By Propulsion Type, By Vehicle Type, By Region, And Segment Forecasts

- Report ID: 978-1-68038-367-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Electronic Control Unit Market Summary

The global automotive electronic control unit market size was valued at USD 99.39 billion in 2022 and is anticipated to grow at a CAGR of 5.9% from 2023 to 2030. Rising demand for feature-intensive vehicles and the growing focus of OEMs to provide advanced software features are primarily attributed to the market growth of automotive electronic control units (ECUs).

Key Market Trends & Insights

- North America dominated the on-demand insurance industry in 2022.

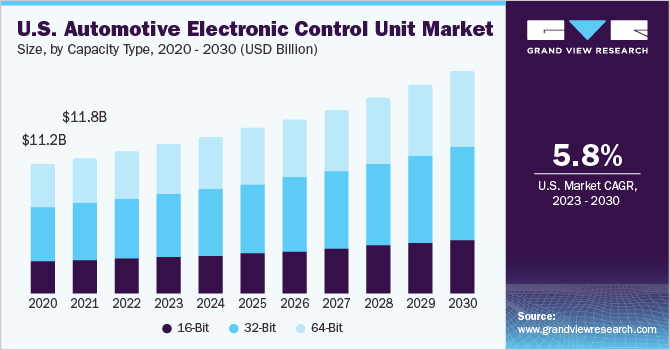

- By capacity type, the 32-bit segment accounted for the largest share of over 41% of the market in 2022.

- By vehicle type, the passenger cars segment accounted for the largest share of over 64% in the market for automotive electric control units in 2022.

Market Size & Forecast

- 2022 Market Size: USD 99.39 Billion

- 2030 Projected Market Size: USD 156.0 Billion

- CAGR (2023-2030): 5.9%

- North America: Largest market in 2022

In addition, the growing demand for safety systems in vehicles and the increasing need to reduce fuel consumption and pollutant emissions are further attributed to driving the market growth. However, rising operational issues in the supply chain of automotive components and the need for digitalization with respect to supply chain management in emerging countries are creating hurdles in the rapid growth of the global automotive ECU market.

The growing adoption of automotive driver-assisted system technology (ADAS), including parking guidance, adaptive cruise control (ACC), and automatic emergency braking (AEB), has been propelling the growth of the market for automotive electronic control units. For instance, in February 2023, Continental AG, an automotive manufacturer, announced that it was working with India’s OEM manufacturers, such as Maruti Suzuki India Limited and Tata Motors, to develop numerous features associated with advanced driving assistance system technology. The initial stage involves the development of systems such as emergency brake assist, blind spot detection, and rear cross-traffic alert.

However, government initiatives and rising disposable income have increased the number of automotive electronic control units used per vehicle; COVID-19 negatively impacted the market sales of automotive ECUs. The pandemic interrupted China's export operations, leading to a shortage of parts needed to make electronic control units, which has hampered market expansion.

Additionally, the pandemic hampered assembly operations in the U.S. and European production facilities, which caused a considerable delay in delivery times and decreased revenue projections. The automotive electronic control unit industry gained impetus due to the lifting of lockdown mandates, which caused a sharp increase in sales of commercial and passenger vehicles across all categories and allowed the global automobile market to begin operations. Thus, surging automobile sales have had a cascading effect on the market for automotive ECUs.

The inclusion of control systems in automobiles has increased recently. Automotive electronic control units realize specific tasks, including managing the drivetrain, infotainment systems, and ADAS. They also help to improve the user experience. The rise of luxury offerings such as ambient lighting, ADAS, and body electronics offer greater comfort and safety to drivers and passengers. For instance, in February 2023, Elektrobit, an automotive software provider, announced the immediate availability of its newly launched EB tresos 9 update that supports AUTOSTAR R20-11 specifications. The software is integrated with the latest intrusion detection technology, onboard diagnostics, traffic monitoring, and OTA firmware updates that allow drivers to secure their vehicles efficiently.

The integration of electronic control units by automobile manufacturers improves vehicle comfort and performance. In January 2023, NVIDIA Corporation partnered with Foxconn, a manufacturing company, to create platforms for autonomous vehicles at the CES in 2023. Foxconn is expected to produce ECUs for vehicles based on Nvidia's DRIVE Orin chip and DRIVE Hyperion sensors for autonomous vehicles. The chip was specifically developed for networked autonomous vehicles.

The demand for semiconductors needed for vehicle electrification is rising quickly, along with the development and uptake of electric vehicles, amid increasing global efforts to cut down on carbon emissions. IGBTs are key components of power cards and act as effective power switches in inverters, converting DC and AC currents to operate and regulate the motors of electric vehicles.

The increasing complexity and sophistication of electronic control units are major factors expected to restrain market growth during the forecast period. ECU software has code for an increasing number of functions, which adds to its complexity. Major technical problems with automobiles are caused by a complex network structure and connectivity issues with the ECU caused by the increasing ECU count. It is complicated to connect automotive electronic control units in commercial and passenger vehicles due to the usage of multiple ECUs, especially in low-cost automobiles.

Due to the interrelated nature of many ECUs, technical flaws in the automotive electronic control unit can also result in problems with the engine's fuel scheduling and setting, which have a negative impact on the vehicle's performance. These flaws may result in unintended acceleration, increased fuel consumption, unintended airbag deployment, and decreased vehicle performance.

Capacity Type Insights

Based on capacity type, the 32-bit segment accounted for the largest share of over 41% of the market in 2022. The rise in demand for these components can be attributed to their beneficial qualities, such as reduced design intricacy and low energy use. Furthermore, the enhanced performance provided by these 32-bit components has increased their application in engine control systems, automotive power drills, and transmission control units.

The 64-bit segment is expected to register the highest CAGR over the forecast period, owing to the improved operating system and memory support. These parts are utilized in high-tech autonomous vehicle applications such as traffic control systems, lane management systems, and ADAS. Additionally, 64-bit ECU improves transmission, which necessitates using fewer ECUs per car. Automotive electronic control unit consolidation saves vehicle weight and costs, therefore 64-bit is a high-performance electronic control unit that is frequently employed to carry out operations of several systems.

Vehicle Type Insights

By vehicle, the passenger cars segment accounted for the largest share of over 64% in the market for automotive electric control units in 2022. The growth of this segment is attributed to the additional features provided by in-vehicle management systems, such as greater driver remote capabilities and vehicle software updates; passenger automobiles, even luxury vehicles, have a greater number of ECUs than other vehicles.

For instance, in January 2023, NVIDIA Corporation partnered with Foxconn, a manufacturing company, to create platforms for autonomous vehicles at the CES in 2023. Foxconn will produce an automotive electronic control unit for vehicles based on Nvidia's DRIVE Orin chip and DRIVE Hyperion sensors for autonomous vehicles. The chip will be specifically developed for networked autonomous vehicles. The growing demand for luxury vehicles, rising disposable income, and improved lifestyles of consumers have all been contributing to the expansion of the passenger vehicle segment.

The passenger cars segment is expected to expand at the highest CAGR over the forecast period. Theindustry is experiencing increased demand for high-end vehicles due to rising purchasing power in developing countries. High levels of automotive electronic system integration are present in luxury automobiles, and automotive electronic control units are necessary to operate this system. Also, the need for ECUs is rising due to autonomous driving, IoT-controlled functions, and telematics; these factors, along with the ease of configuration and availability of various engine and transmission safety features in ECUs, are developing the passenger car segment.

Application Insights

Based on application, the powertrain segment accounted for the largest share of over 27% of the automotive electronic control unit market in 2022. The segment growth is attributed to the demand for powertrain electronic control units that improve engine performance by managing the vehicle's warning lights, fuel injection, valve timings, and spark timing. In addition, the powertrain electric control components also offer a number of benefits, such as being lightweight, small, and simple to install; as a result, these qualities promote their application in cars and contribute to the high segment share.

The ADAS & safety system segment is expected to witness considerable growth over the forecast period. Growing consumer awareness of the need for driver and passenger safety and declining prices for in-car electronic safety systems are propelling segment expansion. The need for ADAS safety systems and associated regulations in the automobile electronic control unit market is further fueled by the fact that major auto manufacturers are embracing ADAS solutions by adding them to raise the safety rating of their vehicles and attract consumers.

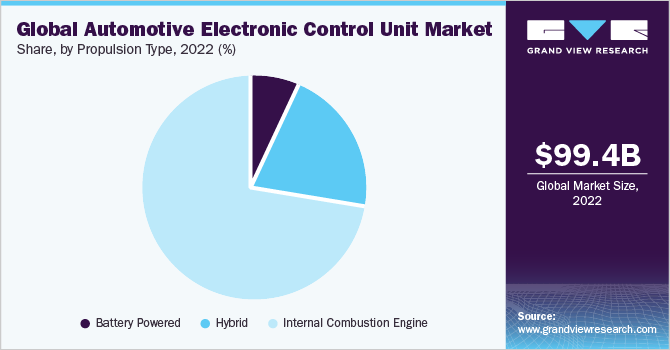

Propulsion Type Insights

The internal combustion engine segment accounted for the largest share of over 72% in the automotive ECU market in 2022. This is due to the growing automobile manufacturing in emerging economies such as India and China. For instance,in December 2022,Stellantis NV partnered with Qinomic to develop an e-drivetrain retrofit solution for converting light commercial vehicles with ICEs to electric drivetrains while enhancing OEM quality and requirements, such as safety, longevity, and type approval. With an economical option that satisfies customer desires to prolong the life of their vehicles and maintain business operations while entering Low Emissions Zones (LEZ) in localities, the electric retrofit solution strives to protect freedom of mobility.

The battery-powered propulsion segment is expected to witness considerable growth over the forecast period. The growth of this segment is owing to the increased government efforts to reduce pollution, along with the increasing acceptance of vehicles that use less energy. The development of battery-powered vehicles is also being fueled by government incentives encouraging the use of EVs and infrastructure investments to establish EV charging and hydrogen fueling stations. Lower battery costs for personal and commercial vehicles are driving the expansion of the automotive ECU market.

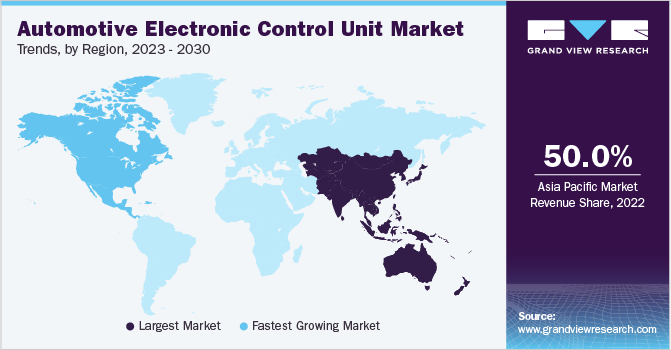

Regional Insights

In 2022, Asia Pacific held the largest market share of around 50% in terms of revenue, owing to the increase in demand for passenger-car entertainment and communication apps. The automobile industry is expanding rapidly in countries such as South Korea, India, and China, which creates several opportunities to integrate ECUs into new cars. Moreover, rising demand for personal vehicles is fueling automobile production and creating new opportunities for the market growth of automotive electronic control units in this region.

North America is projected to emerge as one of the most lucrative regions for the market in terms of revenue during the forecast period, expanding at a significant CAGR. The region's dominance can be attributed to the increase in the installation of electronic systems in light commercial vehicles, passenger cars, and SUVs. The demand for energy-efficient automobiles and stringent government regulations to reduce carbon emissions are also propelling the growth of the automotive electronics industry. Moreover, the rising demand for luxury cars also contributes to the regional automotive electronic control unit (ECU) market growth.

Key Companies & Market Share Insights

The market for automotive electronic control units is highly consolidated, with numerous large players present. These businesses have implemented various strategies to increase their clientele globally. They are also utilizing a plethora of advanced technologies and spending a significant amount on R&D to launch new items and expand existing product lines. For instance, in January 2023, ZF Friedrichshafen AG announced the introduction of Smart Camera 6, a next-generation camera for automated driving and safety systems. The main focus of Smart Camera 6 is to fulfill the demand for 3D surround view and Interior Monitoring Systems (IMS) with the support of image processing module systems.

Moreover, to increase revenues and solidify their market position, these businesses use a variety of growth tactics, including mergers, acquisitions, collaborations, and partnerships. For instance, in January 2023, ZF Friedrichshafen AG partnered with Beep, Inc., a mobility services provider, to introduce a next-generation autonomous Level 4 shuttle to the U.S. market. The main focus of this partnership is to deliver several shuttle services with its Autonomous Transport System (ATS), including training, maintenance, fleet management, and repair to customers in the coming years. Some of the prominent players operating in the global automotive electronic control unit market are:

-

Autoliv Inc.

-

BorgWarner Inc.

-

Continental AG

-

Denso Corporation

-

Hella KGaA Hueck & Co. (Hella)

-

Hitachi Astemo Americas, Inc.

-

Panasonic Holdings Corporation

-

Robert Bosch GmbH

-

Valeo S.A.

-

ZF Friedrichshafen AG

Automotive Electronic Control Unit Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 104.34 billion

Revenue forecast in 2030

USD 156.0 billion

Growth rate

CAGR of 5.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Capacity type, vehicle type, application, propulsion type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Mexico; UAE; South Africa

Key Companies Profiled

Autoliv Inc.; BorgWarner Inc.; Continental AG; Denso Corporation; Hella KGaA Hueck & Co. (Hella); Hitachi Astemo Americas, Inc.; Panasonic Holdings Corporation; Robert Bosch GmbH; Valeo S.A.; ZF Friedrichshafen AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Electronic Control Unit Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive electronic control unit market report based on capacity type, vehicle type, application, propulsion type, and region:

-

Capacity Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

16-Bit

-

32-Bit

-

64-Bit

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicle

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

ADAS & Safety System

-

Body Electronics

-

Powertrain

-

Infotainment

-

Others

-

-

Propulsion Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Battery Powered

-

Hybrid

-

Internal Combustion Engine

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Rising demand for luxurious cars coupled with innovations in the electronics sector are driving the growth of the automotive electronic control unit market. Additionally, several government mandates to reduce fuel usage and rising demand for better mileage of automobiles for the consumer are other factors driving the automotive electronic control unit market growth.

b. The global automotive electronic control unit market size was estimated at USD 99.39 billion in 2022 and is expected to reach USD 104.34 billion in 2023.

b. The global automotive electronic control unit market is expected to grow at a compound annual growth rate of 5.9% from 2023 to 2030 to reach USD 156.00 billion by 2030.

b. Asia Pacific region dominates the automotive electric control unit market and witnesses a market share of over 49.83% in 2022 owing to rising demand for in-vehicle infotainment and communication apps in passenger vehicles. The rapid growth of the automotive industry in countries such as India, China, and South Korea offers ample opportunity to incorporate ECU into the new vehicle.

b. Some key players operating in the automotive electronic control unit market include Hitachi Automotive Systems Ltd, Continental AG, Robert Bosch GmbH, Denso Corporation, and Delphi Technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.