- Home

- »

- Automotive & Transportation

- »

-

Automotive Exhaust Systems Market Size Report, 2030GVR Report cover

![Automotive Exhaust Systems Market Size, Share & Trends Report]()

Automotive Exhaust Systems Market Size, Share & Trends Analysis Report By Component, By Fuel Type (Gasoline, Diesel), By Vehicle Type, (Passenger Car, Commercial Vehicles) By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-358-4

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Automotive Exhaust Systems Market Trends

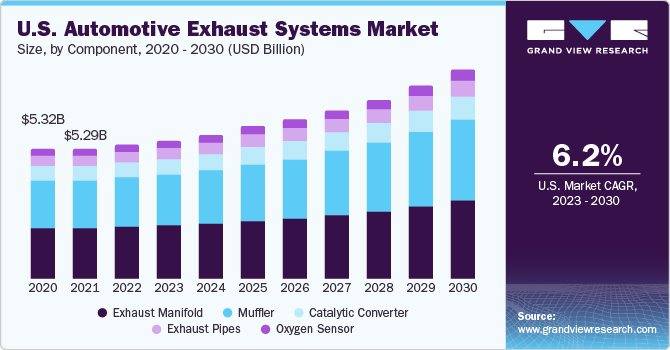

The global automotive exhaust systems market size was valued at USD 46.53 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.7% from 2023 to 2030. The demand for automotive exhaust systems directly depends on production and sales units. Thus, the increasing sales of passenger cars and commercial vehicles across developed and emerging economies drive global demand for automotive exhaust systems. Moreover, stringent government standards associated with carbon emissions are expected to drive the market over the forecast period, as gasoline and diesel engines emit toxic gases and particles that are hazardous to the environment.

Governments across the globe are imposing stricter regulations for vehicular emissions to reduce the environmental impacts associated with the automotive industry. Such regulations are compelling component suppliers to produce high-efficiency and environment-friendly automotive exhaust systems for domestic and international markets.

Moreover, increasing disposable incomes across various sections of society have led to the growth of the automotive industry in the developed economies of Europe, such as Italy, the Netherlands, and France. The demand for passenger and commercial vehicles is also expected to rise in regions such as the Asia Pacific, the Middle East and Africa, and Latin America, which is expected to strengthen the growth prospects of the automotive exhaust systems industry.

The COVID-19 pandemic impacted the demand for automotive exhaust systems in 2020. The virus spread resulted in lockdowns and social distancing globally, leading to losses for industries such as manufacturing, automobile, entertainment, restaurant, and hospitality. This slumped business scenario is negatively impacted automotive production and the demand for automotive exhaust systems. The overall automotive production volumes declined globally year-on-year, mainly due to the decreased production volumes in North America and Europe, among other regions. According to OICA, global automotive production dropped by over 15% year-over-year to 77.6 million units.

Component Insights

Based on component, the market is segmented into exhaust manifolds, mufflers, catalytic converters, oxygen sensors, and exhaust pipes. The exhaust manifold segment accounted for the largest revenue share of 38.8% in 2022. The growing demand for vehicles, particularly in emerging economies, has expanded the market. As more people acquire cars, the need for exhaust systems that offer superior performance, durability, and noise reduction becomes paramount. It led to increased investments in research and development by exhaust manifold manufacturers to develop technologically advanced products that cater to evolving consumer preferences.

The muffler segment is estimated to register the fastest CAGR of 8.6% over the forecast period, accounting for most automotive exhaust system components sales by 2028. As emission norms get stricter, automotive OEMs focus on incorporating efficient exhaust systems to curb noise pollution and reduce toxic emissions. In 2020, Hyundai launched Creta mid-SUV equipped with a dual-exhaust muffler system.

Fuel Type Insights

Based on fuel type, the market is segmented into gasoline and diesel. The gasoline segment accounted for the largest revenue share of 83.9% in 2022 and is estimated to register the fastest CAGR over the forecast period. In emerging economies, 9 out of 10 vehicles have an internal combustion engine. While the popularity of electric vehicles in regions such as North America and Europe has dwindled ICE vehicle sales, limited electric vehicle infrastructure in emerging countries continues to contribute to the growing sales of gasoline-driven vehicles.

The diesel segment is estimated to register a significant growth of 3.3% over the forecast period. The increasing focus on fuel economy and the pursuit of higher engine performance have contributed to the growth of the diesel segment and, consequently, the automotive exhaust systems market. Diesel engines have superior fuel efficiency to gasoline engines, making them a preferred choice in certain applications.

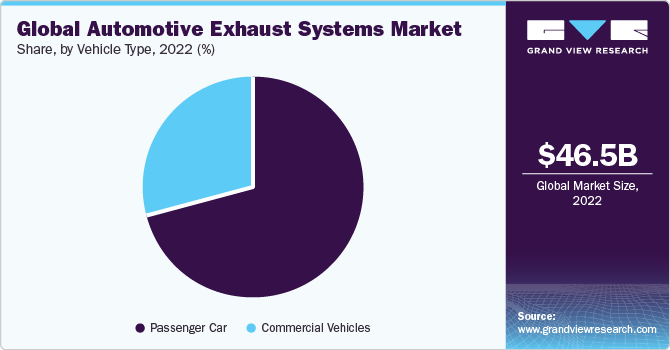

Vehicle Type Insights

Based on vehicle type, the market is segmented into passenger car and commercial vehicles. The passenger car segment accounted for the largest revenue share of 71.1% in 2022. In Europe, according to European Automobile Manufacturers' Association (ACEA), vehicles per capita were recorded at 569 vehicles per 1,000 inhabitants in 2019. Besides, emerging economies such as China and India are expected to accelerate market growth over the forecast period.

The commercial vehicles segment is estimated to register the fastest CAGR of 9.4% over the forecast period. The growth can be attributed to the increasing demand for heavy trucks across the logistics and transportation sectors. Logistics is one of the key end-use industries for commercial vehicles. The use of trailers and trucks for the transportation of goods is increasing rapidly. With changing lifestyles and urbanization, people are more inclined toward getting the goods and products delivered to them.

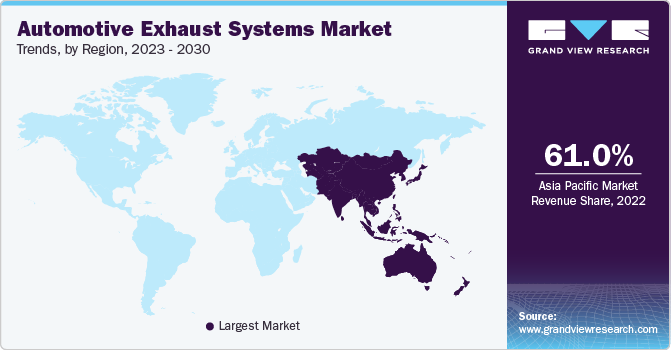

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 61.0% in 2022 and is expected to register the highest CAGR over the forecast period. This can be attributed to the increasing technological awareness and spending capacity of customers in the region. Moreover, the evolving automotive industry in emerging economies such as China and India is expected to drive market growth. The Make In India campaign is expected to draw substantial investments in the automotive sector as India offers several benefits, such as low-cost labor and cheaper raw materials. India and China comprise large supply chains & logistics networks and are among the fastest-growing economies globally. The growing e-commerce industry in the region is also anticipated to boost the demand for commercial vehicles over the coming years.

Latin America is projected to expand significantly at a CAGR of 7.7% over the forecast period. The increasing automotive production and sales across countries such as Brazil and Mexico are expected to support the regional market's growth. Brazil is the largest automotive producer in South America, accounting for almost 50% of vehicles sold in the region. The country also ranks eighth in the world for automotive production. Its automotive industry comprises over 5.5% of the overall GDP of the country, contributing over BRL 266 (USD 52.5) billion. Meanwhile, Mexico is the sixth-largest passenger car manufacturing country globally and the fifth-largest auto parts producer.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in February 2020, Tenneco Inc.'s Walker Emissions Control announced the launch of a new replacement catalytic converter called Walker CalCat and a muffler called Walker Ultra in North America.

Market players also focus on expansion to increase their presence across untapped markets. For instance, in March 2021, Eberspacher announced the opening of a new exhaust technology plant in Ramos Arizpe, close to Saltillo, Mexico. The start of the new plant is part of the company's expansion strategy in North America.

Key Automotive Exhaust Systems Companies:

- BENTELER International Aktiengesellschaft

- BOSAL

- Continental AG

- Eberspächer

- FORVIA Faurecia

- FUTABA INDUSTRIAL CO., LTD

- Boysen

- Sejong Industrial Co., Ltd

- Tenneco Inc.

- Yutaka Giken Company Limited

Recent Developments

-

In July 2023, Proton AG and AAPICO Hitech Public Company Limited formed a strategic partnership through a joint venture, Purem Aapico. This collaboration aims to supply exhaust emission control systems to Proton and other vehicle manufacturers in Thailand and the ASEAN market. The newly constructed plant in Amata City Rayong, Thailand, will manufacture exhaust systems and components for commercial vehicles and passenger cars.

-

In May 2023, Cummins Inc. announced the acquisition of FORVIA Faurecia's commercial automotive exhaust business in Europe and the U.S. The manufacturing plants in Columbus, Indiana, and Roermond are included in this acquisition. This proposed deal aims to help both companies achieve their long-term strategic objectives. By doing so, they intend to safeguard the operations and jobs of skilled employees in these two plants and associated technology centers, all while generating value for customers and suppliers throughout the entire supply chain.

-

In March 2023, Milltek Sport Ltd launched a new lineup of upgraded performance exhaust systems for the BMW M3 Touring. These exhaust systems are meticulously designed, developed, and manufactured at Milltek Sport's state-of-the-art advanced facility. Furthermore, additional testing has been conducted at Milltek Sport's German R&D Centre, where the standard production BMW M3 Touring achieved the fastest lap time for an estate car in 2022, clocking in at 7 minutes and 35.06 seconds.

-

In March 2023, Vance & Hines announced a Vance & Hines HoleShot Series Cat-Back Performance Exhaust Systems for U.S. most popular truck models. The HoleShot Series offers exhaust systems designed to replace the original stock exhaust systems from the catalytic converter to the exhaust tips. These systems retain all the emissions-control equipment while providing a richer exhaust sound through a turbo-chambered muffler design. Additionally, the muffler is engineered to eliminate any unpleasant in-cabin resonances.

-

In September 2022, Mangla Tubes and Cornaglia SpA announced a strategic partnership to establish a three-way partnership firm called Mangla Cor-Tubi Pvt Ltd. This collaboration aims to focus on designing, developing, and producing advanced emission technology exhaust systems. The joint venture will operate a state-of-the-art research and development center in Palwal, Haryana, along with Palwal, Pantnager, and Zaheerabad manufacturing facilities. By collaborating with Mangla Tubes, Cornaglia will benefit from enhanced design capabilities, enabling the production of Trim IV and Trim V exhaust systems for their customers at competitive prices.

-

In May 2022, Allied Distribution, a wholesale distributor specializing in exhaust, performance, and accessories, acquired Indy Exhaust Products, Incorporated, a distributor of automotive exhaust components. This strategic acquisition by Allied Distribution aims to capitalize on new opportunities, allowing them to expand their market reach and enhance their level of service even further.

Automotive Exhaust Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 48.67 billion

Revenue forecast in 2030

USD 82.06 billion

Growth Rate

CAGR of 7.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, fuel type, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; United Arab Emirates; Saudi Arabia; South Africa

Key companies profiled

BENTELER International Aktiengesellschaft; BOSAL; Continental AG; Eberspächer; FORVIA Faurecia; FUTABA INDUSTRIAL CO.,LTD; Boysen; Sejong Industrial Co.,Ltd; Tenneco Inc.; Yutaka Giken Company Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Exhaust Systems Market Report Segmentation

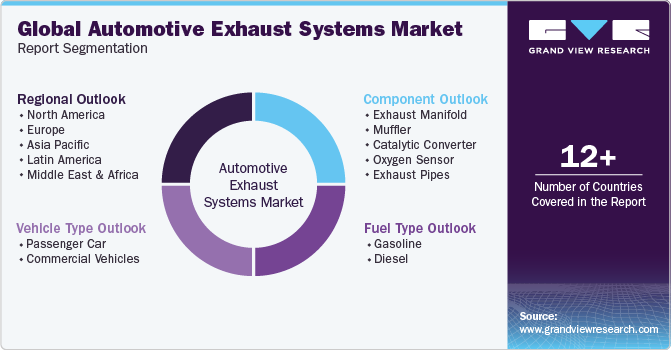

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive exhaust systems market based on component, fuel type, vehicle type, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Exhaust Manifold

-

Muffler

-

Catalytic Converter

-

Oxygen Sensor

-

Exhaust Pipes

-

-

Fuel Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Gasoline

-

Diesel

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Car

-

Commercial Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive exhaust systems market size was estimated at USD 46.53 billion in 2022 and is expected to reach USD 48.67 billion in 2023.

b. The global automotive exhaust systems market is expected to grow at a compound annual growth rate of 7.7% from 2023 to 2030 to reach USD 82.06 billion by 2030.

b. The Asia Pacific dominated the automotive exhaust systems market with a share of 60.9% in 2022. This is attributable to the increasing technological awareness and the spending capacity of customers in the region.

b. Some key players operating in the automotive exhaust systems market include Faurecia, Friedrich Boysen, BENTELER International, Tenneco Inc., and Continental AG, among others

b. Key factors that are driving the automotive exhaust systems market growth include stringent government standards associated with carbon emission and increasing sales of passenger and commercial vehicles globally.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."