- Home

- »

- Plastics, Polymers & Resins

- »

-

Automotive Interior Leather Market Size & Share Report 2030GVR Report cover

![Automotive Interior Leather Market Size, Share & Trends Report]()

Automotive Interior Leather Market Size, Share & Trends Analysis Report By Material (Genuine, Synthetic), By Car Class (Economy Car, Luxury Car), By Vehicle Type, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-524-3

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Automotive Interior Leather Market Trends

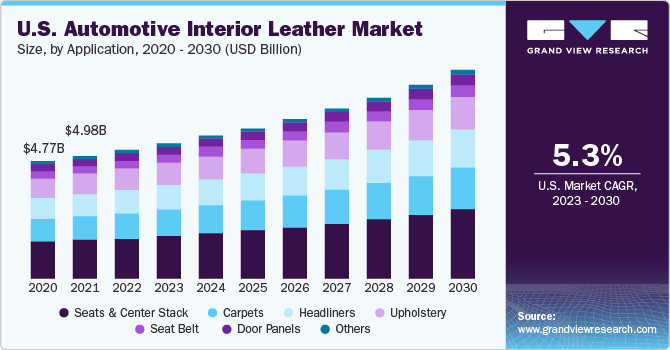

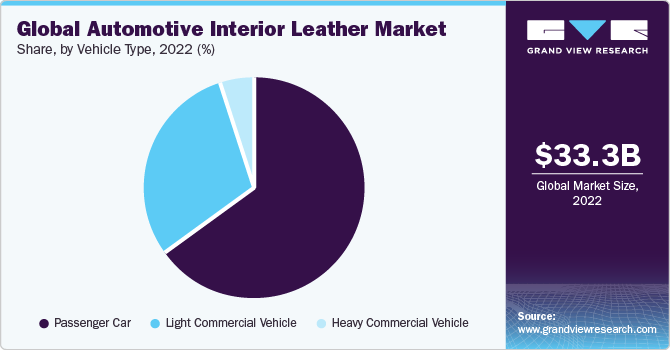

The global automotive interior leather market size was estimated at USD 33.35 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.43% from 2023 to 2030. The growing demand for leather in upholstery applications is likely to contribute to the market demand. The market in the U.S. is predicted to experience significant growth in recent years, with several factors driving this expansion. Consumer desire for high-quality and elegant interior materials is likely to drive market expansion in the country throughout the forecast period. A significant increase in demand for automobile synthetic leather upholstery is likely to push the entire industry growth in the U.S. Initiatives to enhance the supply chain are expected to benefit the market in the U.S. over the forecast period.

The expansion of the luxury and premium car categories in the United States is critical to boosting demand for high-quality leather interiors. Leather interiors in automobiles provide an exquisite aesthetic, as well as comfort and durability. The rise in the adoption of leather for automotive interiors is expected to propel the market growth in the country.

The increased consumer preference for car safety and comfort amenities is catered for by cutting-edge technologies such as advanced driver-assistance systems (ADAS). The country is home to major automakers and benefits from the US government's substantial supportive infrastructure and electric vehicle legislation. The growing preference of the younger generation for luxury and premium automobiles is also predicted to boost the demand for the product, thus contributing to the growth of the market.

Application Insights

Based on application, the seats & center stack segment dominated the market in 2022 with the largest revenue share of over 31.70%. Leather in vehicle interior components such as the seat and center stack has grown increasingly common owing to its attributes such as durability, fewer vibrations, reduced interior noise levels, and aesthetic qualities. Furthermore, demand for leather in automobile interiors is projected to be driven by demand from premium vehicles over the forecast period.

In addition, car seats play a major role in the reduction of the overall weight of the vehicle and boosting its fuel consumption. Furthermore, it is expected that rising customer demand for convenience, security, and style is expected to boost demand for leather in automotive interiors. Moreover, improvements in leather quality, tenacity, and sustainability are being achieved mainly due to innovations in production and treatment technology.

Material Insights

In terms of material, the genuine material segment dominated the market in 2022 with the largest revenue share of over 59.0% in 2022. The majority of genuine leather is manufactured by tanning animal hide and is made from the skins of lamb, deer, and cattle. Some of the major end customers of the product include Land Rover, Bayerische Motoren Werke AG, and Rolls-Royce Motor Cars. These factors are likely to augment the demand for genuine leather in the coming years.

Moreover, the synthetic leather segment is anticipated to witness the fastest CAGR of 7.03% over the forecast period as a result of expanding production operations in emerging markets, superior product performance compared to leather alternatives, and consistent technological developments. Faux leather and artificial leather are other names for synthetic leather. In the automotive industry, it is used as a leather substitute when a leather-like finish is needed but the material is either too expensive, inappropriate, or unacceptable. Over the projection period, it is anticipated that these factors will increase the demand for the material.

Vehicle Type Insights

Based on vehicle type, the passenger car segment held the largest revenue share of over 65.0% in 2022. The increase in the use of passenger cars due to their protection from various environmental conditions including dust, heat, accidents, and others is likely to increase the output of passenger cars, which is anticipated to have a favorable effect on growth throughout the forecast period.

In addition, over the forecast period, the market for light commercial vehicles (LCV) is anticipated to expand significantly. The demand for LCVs is expected to be driven by a favorable expansion of commercial transportation services, such as taxis. Sales of LCVs are anticipated to increase due to the growth of emerging economies brought on by fast industrialization and an expansion of logistics facilities. These elements are anticipated to increase demand for leather for automobile interiors.

Car Class Insights

In terms of car class, the luxury car segment held the largest revenue share of over 69.0% in 2022. The high-net-worth population has significantly increased their desire for luxury cars over the past few years. These vehicles are also technologically improved, offer superior performance and comfort, and are acceptable for purchase by populations with different vehicle needs. Furthermore, it is anticipated that rising luxury vehicle demand is expected to fuel industry expansion.

Moreover, the demand for mid-segment vehicles is anticipated to increase due to rising middle-class demand owing to rising disposable income and purchasing power parity as well as rising desires for an improved lifestyle over the course of the forecast period.

Regional Insights

Asia Pacific dominated the market with the largest revenue share of over 41% in 2022. Due to the increased per capita income in emerging countries, an increase in the number of the middle class, and rising standards of living, the Asia Pacific market is anticipated to grow at the fastest CAGR of 7.25% over the forecast period.

The continuously growing automotive manufacturing companies serve to fill the product gaps in the local market. China, Indonesia, India, and Bangladesh are expected to be the main factors driving the rise of the regional market. China is one of the major manufacturers and users of leather globally. A number of industry participants are actively increasing their production capacity in Asia Pacific to meet the import demands of nations, including the U.S., Germany, and the United Kingdom. To meet the growing product demand and boost their profitability, major market participants are focusing on developing economies.

Moreover, Europe is expected to grow at a significant rate in the coming years. The region is distinguished by its highly skilled workforce, advanced R&D infrastructure, and strong value chain integration, among other attributes that enable the development of cutting-edge technology for the automotive industry. Investments are being drawn to the region's car manufacturing industry by favorable government policies, availability of inexpensive labor, and rising disposable income. The market expansion in this region is anticipated to propel the demand in the European market for automotive interior leather.

Key Companies & Market Share Insights

The global market is highly competitive due to the presence of major industries across the region as these companies are comparatively concentrated and fiercely competitive along with acquisitions, mergers, and collaborations.For Instance, in August 2023, Katzkin announced the acquisition of the Roadwire automobile leather business's assets. This acquisition broadens Katzkin's ability to serve all of its clients, from OEMs and dealers to thousands of restylers and, ultimately, the millions of consumers who drive Katzkin-equipped vehicles.

Key Automotive Interior Leather Companies:

- GST Autoleather Inc

- Eagle Ottawa

- CTL leather

- Alphaline auto

- DK leather corporation

- Scottish leather group

- Wollsdorf leder schmidt & Co Ges

- Classic soft trim

- Katzkin Leather inc

- Kuraray plastics

- Alfatex Italia

- Seiren Co Ltd

- Lear Corporation

- Bader GmbH & Co. KG

- BOXMARK Leather GmbH & Co KG

Automotive Interior Leather Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 35.05 billion

Revenue forecast in 2030

USD 54.22 billion

Growth rate

CAGR of 6.43% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Volume in million Sq. Ft, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material; vehicle type; car class; application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; The Netherlands; China; India; Japan; South Korea; Australia; Malaysia; Singapore; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

GST Autoleather Inc.; Eagle Ottawa; CTL Leather; Alphaline Auto; DK leather Corporation; Scottish Leather Group; Wollsdorf Leder Schmidt & Co Ges; Classic Soft Trim; Katzkin Leather Inc; Kuraray Plastics; Alfatex Italia; Seiren Co Ltd; Lear Corporation; Bader GmbH & Co. KG; BOXMARK Leather GmbH & Co KG

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Interior Leather Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. Forthis study, Grand View Research has segmented the global automotive interior leather market report based on material, vehicle type, car class, application, and region:

-

Material Outlook (Volume, Million Sq. Ft; Revenue, USD Million, 2018 - 2030)

-

Genuine

-

Synthetic

-

PU

-

PVC

-

Others

-

-

-

Vehicle Type Outlook (Volume, Million Sq. Ft; Revenue, USD Million, 2018 - 2030)

-

Passenger Car

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

-

-

Car Class Outlook (Volume, Million Sq. Ft; Revenue, USD Million, 2018 - 2030)

-

Economy Car

-

Mid-Segment Car

-

Luxury Car

-

-

Application Outlook (Volume, Million Sq. Ft; Revenue, USD Million, 2018 - 2030)

-

Seats & Center Stack

-

Carpets

-

Headliners

-

Upholstery

-

Seat Belt

-

Door Panels

-

Others

-

-

Regional Outlook (Volume, Million Sq. Ft; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Malaysia

-

Singapore

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive interior leather market size was estimated at USD 33.35 billion in 2022 and is expected to reach USD 35.05 billion in 2023.

b. The global automotive interior leather market is expected to grow at a compound annual growth rate of 6.43% from 2023 to 2030 to reach USD 54.22 billion by 2030.

b. The passenger car segment dominated the automotive interior leather market with a share of 65.11% in 2022. This is attributed to the rising demand for individual vehicles in emerging countries and the growing need for safe and comfortable travel.

b. Some of the key players operating in the Automotive Interior Leather market includes: GST Autoleather Inc, Eagle Ottawa, CTL leather, Alphaline auto, DK leather corporation, Scottish leather group, Wollsdorf leder schmidt & Co Ges, Classic soft trim, Katzkin Leather inc, Mayur uniquoters, Kuraray plastics, Alfatex Italia, Seiren Co Ltd, Lear Corporation, and Bader GmbH & Co. KG

b. Key factors that are driving the market growth include the rising popularity of synthetic leather owing to the low cost and increasing demand for lightweight passenger cars.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."