- Home

- »

- Plastics, Polymers & Resins

- »

-

Synthetic Leather Market Size & Share, Industry Report, 2033GVR Report cover

![Synthetic Leather Market Size, Share & Trends Report]()

Synthetic Leather Market (2025 - 2033) Size, Share & Trends Analysis Report By Leather Type (PU, PVC, TPO, Bio-based), By Application (Footwear, Automotive, Furnishing, Clothing, Wallets, Bags & Purses), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-821-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Synthetic Leather Market Summary

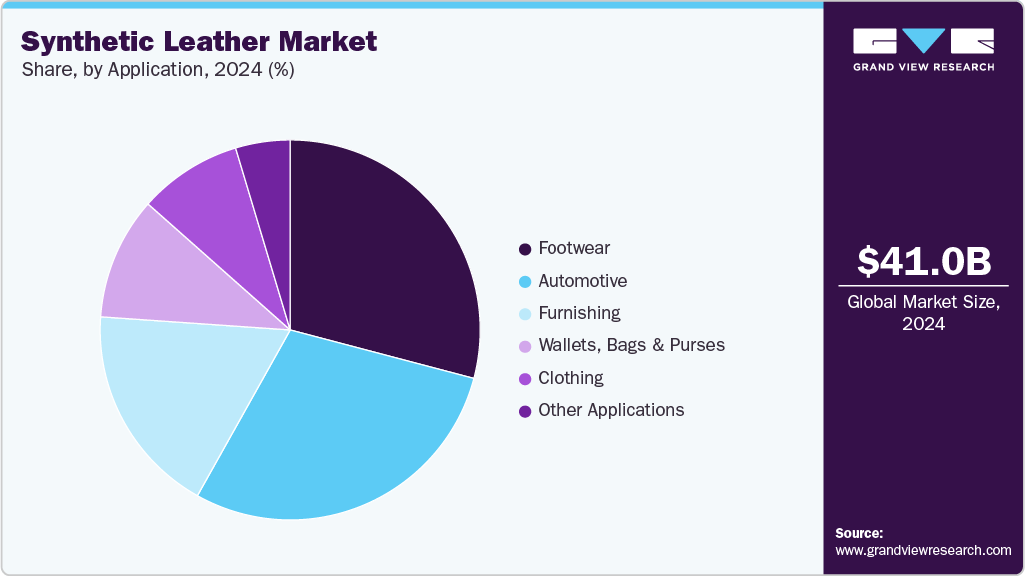

The global synthetic leather market size was estimated at USD 41.05 billion in 2024 and is projected to reach USD 115.39 billion by 2033, growing at a CAGR of 12.33% from 2025 to 2033. Globally increasing demand from the footwear sector is expected to be a key factor propelling the overall market growth.

Key Market Trends & Insights

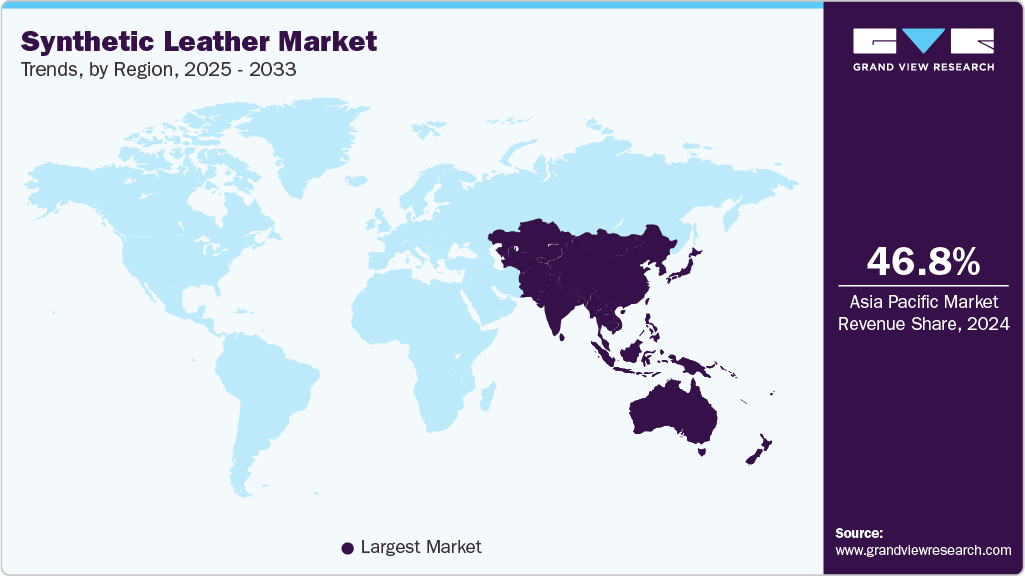

- Asia Pacific dominated the synthetic leather market with the largest revenue share of 46.78% in 2024.

- India synthetic leather market is expected to grow at the fastest CAGR of 21.93% from 2025 to 2033.

- By leather type, the TPO synthetic leather is expected to grow at the fastest CAGR of 21.70% from 2025 to 2033 in terms of revenue.

- By application, the automotive industry is expected to grow at the fastest CAGR of 20.15% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 41.05 Billion

- 2033 Projected Market Size: USD 115.39 Billion

- CAGR (2025-2033): 12.33%

- Asia Pacific: Largest market in 2024

The high cost of natural leather is another factor that has driven the need for natural leather replacements. PVC leather is another essential type of synthetic leather that has grown in popularity due to its diverse variety of uses, which include shopping bags, cosmetic bags, wallets, suitcases, purses, and travel bags. It is used in various applications, including fabrics, footwear, clothing, upholstery, and others, where a leather-like finish is required, and the material is unusable, unsuitable, and cost-prohibitive. The production process has evolved over the past few years for the shell coating to go on top of the synthetic polymer blend.

Drivers, Opportunities & Restraints

The market is primarily driven by the increasing demand for animal-free, cost-effective, and durable alternatives to genuine leather across industries such as automotive, fashion, and furniture. Growing consumer awareness regarding animal cruelty and environmental concerns associated with traditional leather production has significantly boosted the adoption of synthetic leather.

The rapid development of bio-based and sustainable synthetic leather presents a major growth opportunity for the market. Companies are investing in eco-friendly alternatives made from plant-based sources like corn, mushrooms, and recycled plastics to meet the rising consumer demand for sustainable products. This innovation is opening up new possibilities in premium markets such as luxury fashion and high-end automotive interiors, where environmental consciousness is becoming a key purchasing criterion.

One of the key restraints for the industry is the environmental impact of conventional synthetic materials such as polyvinyl chloride (PVC) and polyurethane (PU), which are derived from fossil fuels and are not biodegradable. The production and disposal of these materials can contribute to pollution and raise regulatory concerns, especially in regions with stringent environmental policies. This could limit market growth unless manufacturers rapidly transition to more sustainable alternatives.

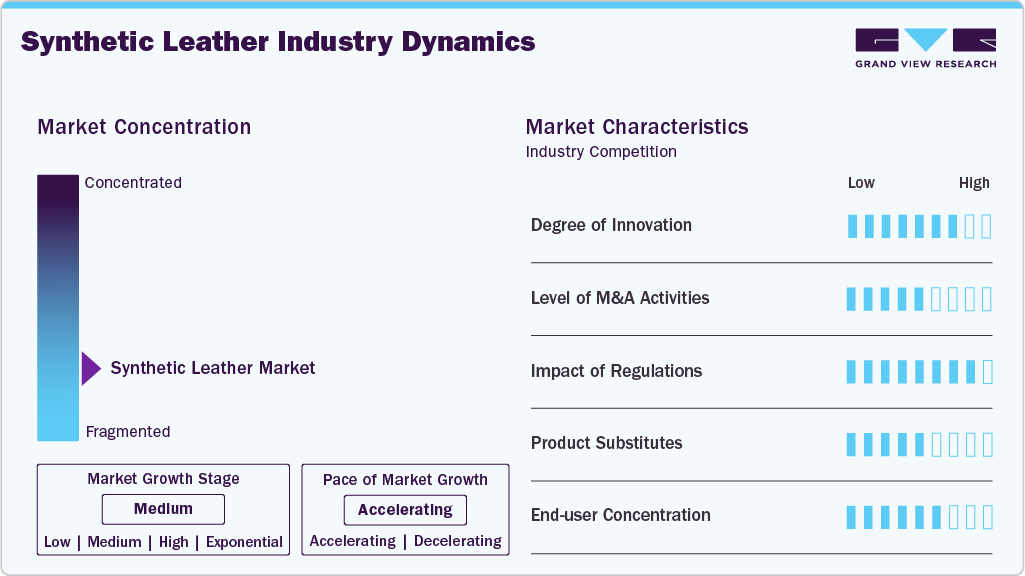

Market Concentration & Characteristics

The industry is in a medium growth stage, and the pace is accelerating. The market exhibits a moderate to high degree of innovation, particularly driven by the development of bio-based, plant-derived, and recycled materials aimed at reducing the environmental footprint of synthetic leather products. Innovations in coating technologies, surface finishes, and texturing have significantly improved the feel, durability, and aesthetic appeal, making synthetic leather nearly indistinguishable from genuine leather.

The market has seen a moderate level of mergers and acquisitions in recent years, as companies aim to strengthen their market positions, expand geographical reach, and diversify product portfolios. Larger players are actively acquiring smaller, innovative firms with bio-based material capabilities or advanced manufacturing technologies to stay competitive in a rapidly evolving landscape.

Regulations significantly impact the market, especially concerning the use of hazardous chemicals, volatile organic compounds (VOCs), and non-biodegradable plastics like PVC. Stringent environmental policies in Europe, North America, and parts of Asia are compelling manufacturers to adopt eco-friendly processes and shift toward greener raw materials.

The market faces competition from several substitutes, including genuine leather, high-performance textiles, coated fabrics, and emerging bio-fabricated leather alternatives. While synthetic leather offers advantages in cost, versatility, and ethical appeal, genuine leather continues to dominate luxury segments where natural aesthetics and durability are prioritized.

The end-user concentration in the synthetic leather market is moderately fragmented, with major demand distributed across automotive, footwear, fashion, furniture, and consumer electronics industries. However, key sectors such as automotive upholstery and branded footwear exhibit relatively higher concentration, with a few large manufacturers and brands accounting for substantial purchasing volumes.

Leather Type Insights

The PU synthetic leather segment led the market and accounted for 57.07% share of the global revenue in 2024. It has been witnessing promising growth in product quality, variety, and yield. Polyurethane is waterproof, softer, and lighter than genuine leather and can be dry-cleaned and torn more easily than genuine hides. It also remains unaffected by sunlight. In addition, it is an eco-friendly substitute for vinyl-based products as it does not emit dioxins. All these factors are expected to augment its demand further.

The PVC synthetic leather segment is expected to grow at a CAGR of 19.86% during the forecast period. PVC was the first form of synthetic leather created in 1920. It was initially produced with carcinogenic chemicals and proved to be an ideal material for applications in furnishing and household items. PVC faced significant competition from PU as PVC gave a sticky feel and could not retain body heat.

As a result, its demand decreased in the clothing and bag application segment. The bio-based product consists of polyester polyol and has 70-75% renewable content. It is softer and has better scratch resistance properties than PU and PVC. Key companies in the global market are focusing on developing new products through collaboration with polyol producers. Rapid industrialization and constant R&D will continue to supplement the segment's growth in the upcoming years.

Application Insights

The footwear segment led the market and accounted for 29.11% of the global revenue in 2024. Synthetic leather is widely used to manufacture shoe uppers, shoe lining, and soles for sports shoes, formal shoes, flip flops, soccer shoes, sandals, slippers, and boots. These shoes are also cost-effective, environmentally friendly, and long-lasting. Synthetic leather shoes possess higher water resistance than genuine leather shoes, which can get stained due to exposure to certain elements. Faux leather shoes are durable enough to be used for a more extended period when walking or running.

There is a wide range of synthetic leather materials available in the market that serve varied requirements of the furnishing industry in terms of color, texture, and fabric look. Moreover, such artificial alternatives can be used in marine furnishing as it is saltwater resistant. Faux leather is used in cars, trucks, motorcycles, buses, and agricultural vehicles as it is lighter than animal hides.

Polyurethane is the most widely used material in the automotive sector as it is non-sticky and softer than other products. The wallets, bags, and purses segment is estimated to witness significant growth over the coming years due to the high product demand. Using faux leather enables the production of lightweight, breathable, scratch- and water-proof, and easy-to-maintain bags.

The application of synthetic leather in manufacturing wallets, bags, and purses has increased significantly in recent years. Synthetic leather is extremely popular since it is softer than natural leather and has high durability. Synthetic leather wallets, bags, and purses are easy to maintain as they are lightweight, breathable, waterproof, and scratchproof. The lower cost of synthetic leather has also been a significant factor in driving the demand in this market. Baggit, Solo, ZARA, Lavie World, and KENNETH COLE PRODUCTIONS, INC. are some brands that use synthetic leather to create a wide selection of elegant and trendy bags.

With the evolving textile technology, consumers prefer vegan fashion, which refers to adopting non-leather products. Thus, synthetic leather serves as the most suitable alternative in textile applications. PU synthetic leather is also used in clothing, where it is used to create spandex and add buoyancy to competitive swimsuits.

Regional Insights

North America synthetic leather market is expected to grow at a slow rate compared to other regions on account of the saturation of more prominent domestic fashion brands. Growing concerns from animal rights organizations such as PETA, WWF, and others have resulted in growth restraints in the leather market.

U.S. Synthetic Leather Market Trends

The synthetic leather market in the U.S. is driven by strong demand from the automotive, footwear, and consumer goods sectors, along with increasing consumer preference for animal-free and sustainable alternatives. Regulatory pressures to reduce VOC emissions and the growing adoption of bio-based materials are pushing manufacturers to innovate and offer environmentally friendly products.

Asia Pacific Synthetic Leather Market Trends

Asia Pacific synthetic leather industry dominated the global market and accounted for 46.78% share of the global revenue in 2024. China, India, and South Korea are expected to be the significant growth-driving economies in APAC. Rising disposable income, coupled with the increasing population, will provide numerous opportunities for the market.

China synthetic leather market is one of the prominent markets in terms of production and sales. However, the coronavirus outbreak has severely affected the country’s manufacturing output. Several manufacturers have either closed or slowed down their operations to contain the spread of the virus. Limited production in the manufacturing industry due to a halt or slowdown in operations, limitations on the supply and transportation in the country, and infrastructure slowdown are anticipated to negatively affect the demand for synthetic leather from the end-use application in the near future.

Europe Synthetic Leather Market Trends

The synthetic leather market in Europe is witnessing significant growth owing to the flourishing automobile and consumer appliances sectors in the region. Amid the global crisis, governments in the region are focusing on bio-based, low-cost, and long-lasting products. The market for synthetic leather in this region is expected to grow substantially over the forecast period.

Germany synthetic leather market represents a mature yet steadily growing synthetic leather market, strongly influenced by its leadership in automotive manufacturing and its commitment to environmental sustainability. German automotive OEMs are increasingly integrating synthetic leather for car interiors as part of their broader shift toward sustainable and vegan materials.

Latin America Synthetic Leather Market Trends

The synthetic leather market in Latin America is experiencing gradual growth, driven by the expanding footwear and automotive industries, particularly in countries like Brazil and Mexico. Price sensitivity remains a critical factor, making synthetic leather an attractive option compared to genuine leather. However, the market still faces challenges such as limited local production capacities and dependence on imports.

Middle East & Africa Synthetic Leather Market Trends

The synthetic leather market in the Middle East & Africa is at a developing stage but shows promising potential, especially in automotive interiors, furniture, and fashion accessories. Growing urbanization, rising disposable incomes, and expanding automotive sectors in countries like the UAE and South Africa are supporting market growth. However, limited local manufacturing, high reliance on imports, and relatively low consumer awareness about sustainable alternatives currently restrain the market’s full potential in the region.

Saudi Arabia synthetic leather market is gaining momentum, supported by the country’s Vision 2030 initiatives aimed at diversifying its economy beyond oil and expanding its automotive and manufacturing sectors. The demand for affordable, durable, and easy-to-maintain materials in automotive, construction, and consumer goods is driving synthetic leather adoption.

Key Synthetic Leather Market Companies Insights

Key players operating in the synthetic leather market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Synthetic Leather Companies:

The following are the leading companies in the synthetic leather market. These companies collectively hold the largest market share and dictate industry trends.

- Kuraray Co., Ltd.

- H.R. Polycoats Pvt. Ltd.

- Alfatex Italia SRL

- Filwel Co., Ltd.

- Yantai Wanhua Synthetic Leather Group Co., Ltd.

- San Fang Chemical Industry Co., Ltd.

- Mayur Uniquoters Limited

- Teijin Limited

- Nan Ya Plastics Corporation

Recent Developments

-

In April 2025, BASF SE highlighted innovations like Haptex, a synthetic leather solution that significantly reduces environmental impact and insustainability at PU TECH 2025. Haptex offers 52% lower greenhouse gas emissions, over 20% energy savings, and 30% less water usage compared to traditional solvent-based polyurethane leather production, achieved by eliminating the wet line process. These advancements align with the synthetic leather market's shift towards eco-friendly alternatives, driven by consumer demand and regulatory pressures.

-

In June 2024, Germany's DITF and FILK developed a sustainable synthetic leather using bio-based polybutylene succinate (PBS) for both the fiber substrate and coating. This uniform material composition facilitates efficient recycling, addressing challenges associated with traditional synthetic leathers that combine different, non-biodegradable materials.

Synthetic Leather Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 45.53 billion

Revenue forecast in 2033

USD 115.39 billion

Growth rate

CAGR of 12.33% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in million meters; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Leather type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

U.S.; Canada. Mexico; Germany; UK; France; Italy; The Netherlands; Türkiye; China; India; Japan; Malaysia; Vietnam; Indonesia; Thailand; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Kuraray Co., Ltd.; H.R. Polycoats Pvt. Ltd.; Alfatex Italia SRL; Filwel Co., Ltd.; Yantai Wanhua Synthetic Leather Group Co., Ltd.; San Fang Chemical Industry Co., Ltd.; Mayur Uniquoters Limited; Teijin Limited; Nan Ya Plastics Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Synthetic Leather Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global synthetic leather market report on the basis of leather type, application, and region:

-

Leather Type Outlook (Volume, Million Meters; Revenue, USD Million, 2021 - 2033)

-

PU Synthetic Leather

-

PVC Synthetic Leather

-

TPO Synthetic Leather

-

Bio-based Leather

-

-

Application Outlook (Volume, Million Meters; Revenue, USD Million, 2021 - 2033)

-

Furnishing

-

Chairs

-

Sofas

-

Other furnishing

-

-

Automotive

-

Seats

-

Door Panels

-

Dashboard

-

Other interior furnishings

-

-

Footwear

-

Sports Shoes

-

Formals Shoes

-

-

Wallets, Bags & Purses

-

Wallets

-

Bags

-

Purses

-

-

Clothing

-

Jackets

-

Belts

-

Other Clothing

-

-

Others

-

-

Regional Outlook (Volume, Million Meters; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Türkiye

-

The Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global synthetic leather market size was estimated at USD 41.05 billion in 2024 and is expected to reach USD 45.53 billion in 2025.

b. The global synthetic leather market is expected to witness a compound annual growth rate of 12.33% from 2025 to 2033 to reach USD 115.39 billion by 2030.

b. The PU synthetic leather segment led the global synthetic leather market, accounting for the largest revenue share of more than 57.07% in 2024.

b. The footwear segment led the global synthetic leather market and accounted for the highest revenue share of more than 29.11% in 2024.

b. Key factors that are driving the synthetic leather market growth include rising applications across furnishing, automotive, clothing, bags, and also artificial alternatives leather can also be used in marine furnishing as it is saltwater resistant is better comparatively.

b. Asia Pacific held the largest share of 46.78% in 2024 owing to rising per capita income in emerging economies, expanding middle-class population, and improving standards of living. Moreover, the rapid development of the construction and automotive manufacturing industries is also supplementing the product demand in the regional market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.