- Home

- »

- Electronic Devices

- »

-

Automotive Lighting Market Size And Share Report, 2030GVR Report cover

![Automotive Lighting Market Size, Share & Trends Report]()

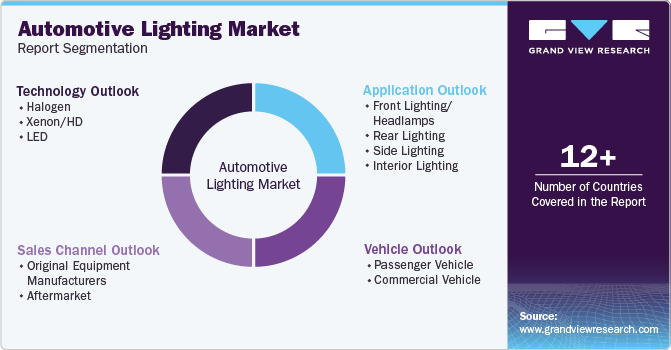

Automotive Lighting Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution, By Technology (Halogen, Xenon/HID, LED), By Application, By Sales Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-657-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Lighting Market Summary

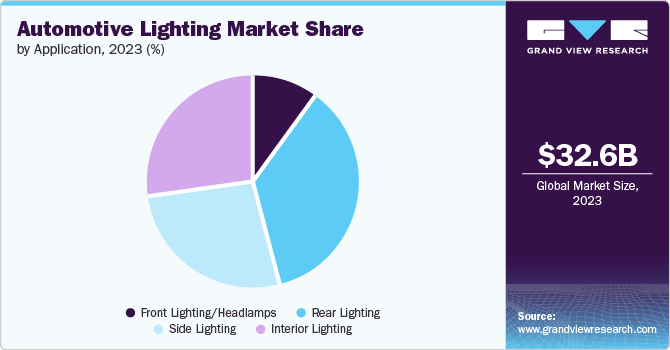

The global automotive lighting market size was estimated at USD 32,599.0 million in 2023 and is projected to reach USD 48,727.0 million by 2030, growing at a CAGR of 5.95% from 2024 to 2030. The automotive lighting market is experiencing significant growth driven by factors such as the increasing emphasis on road safety, government regulations mandating advanced lighting systems, and the global rise in automobile production.

Key Market Trends & Insights

- North America was the largest revenue generating market in 2023.

- The U.S. dominated the regional automotive lighting market with a share of 81.3% in 2023.

- By technology, LED segment accounted for the largest market revenue share of 46.4% in 2023.

- By application, front lighting/headlamps accounted for the largest market revenue share in 2023.

- By sales channel, Original Equipment Manufacturers (OEMs) accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 32,599.0 Million

- 2030 Projected Market Size: USD 48,727.0 Million

- CAGR (2024-2030): 5.95%

- North America: Largest market in 2023

The demand for automotive lighting equipment is propelled by the need to enhance driver visibility, improve vehicle conspicuity for other road users, and add aesthetic appeal to vehicles. Additionally, advancements in technology, particularly the adoption of LED lighting solutions that offer energy efficiency, durability, and design flexibility, are contributing to market growth. As consumer preferences shift towards more advanced and efficient lighting systems, the market is expected to continue expanding. Moreover, the growing demand for vehicles in developing nations, coupled with increasing disposable incomes and lifestyle improvements, is fueling the production of automobiles equipped with sophisticated lighting systems.

Manufacturers are investing heavily in research and development to innovate new lighting solutions that meet regulatory requirements and enhance safety and aesthetics. The market is witnessing a shift towards integrated lighting solutions that offer improved functionality and design elements.

Technology Insights

LED segment accounted for the largest market revenue share of 46.4% in 2023. LEDs offer superior energy efficiency compared to traditional halogen and xenon lighting systems, aligning with global efforts towards sustainability and fuel efficiency in vehicles. Automakers and consumers increasingly prioritize eco-friendly solutions, increasing the market growth. For instance, in July 2023, Lumileds Holding B.V. launched Nightscape technology to substantially reduce the blue light content emitted by outdoor LED lighting so as not to tamper with the oncoming driver’s vision. LEDs provide versatility in design and functionality, enabling automakers to incorporate advanced lighting features such as adaptive lighting systems, dynamic turn signals, and customizable ambient lighting. These innovations enhance vehicle aesthetics and improve safety and visibility on the road, thereby appealing to safety-conscious consumers and meeting stringent regulatory requirements globally.

The Xenon/HID segment is expected to register the fastest CAGR during the forecast period. The aesthetic appeal of HID lights has played a significant role in their adoption across various vehicle segments. HID lights produce a distinctive white or bluish-white light that enhances the appearance of vehicles, giving them a modern and luxurious look. This aesthetic appeal appeals to consumers who value style and design in their vehicles, driving demand for HID lighting options among automakers. Furthermore, advancements in HID technology have led to improved efficiency and longer lifespans for these lights, addressing concerns about energy consumption and maintenance costs.

Application Insights

Front lighting/headlamps accounted for the largest market revenue share in 2023. The evolution of vehicle design and styling has elevated the importance of headlamp aesthetics. Automakers are increasingly using headlamps as a design element to create distinctive brand identities and enhance the visual appeal of their vehicles. Features such as LED illumination and automated headlamp regulation enhance safety, convenience, and visual appeal, while innovations such as adaptive headlights and high-beam assist improve safety by modifying beam patterns for better visibility.

The rear lighting segment is expected to register the fastest CAGR during the forecast period. Rear lighting systems, including brake lights, turn signals, and rear fog lamps, play a critical role in communicating drivers' intentions to other road users, reducing the risk of accidents. Automakers increasingly integrate advanced LED technology into rear lighting systems as safety regulations become stricter worldwide. LEDs offer faster response times, brighter illumination, and longer lifespans than traditional incandescent bulbs, enhancing safety and reliability.

Sales Channel Insights

Original Equipment Manufacturers (OEMs) accounted for the largest market revenue share in 2023. The increasing production and sales of vehicles globally directly contribute to OEMs' demand for automotive lighting systems. According to the European Automobile Manufacturers' Association, global car production reached over 75 million units in 2023, 10% more than in 2022. As vehicle manufacturers strive to differentiate their models in a competitive market, they emphasize advanced lighting technologies that enhance safety, aesthetics, and overall vehicle appeal. OEMs are thus integrating innovative lighting solutions such as LED, Xenon/HID, and adaptive lighting systems into their new vehicle models to meet stringent regulatory standards and consumer expectations.

The aftermarket segment is expected to register the fastest CAGR during the forecast period. The increasing average age of vehicles on the road globally has increased demand for replacement parts, including lighting components. As vehicles age, their original lighting systems may degrade or fail, prompting vehicle owners to seek high-quality aftermarket solutions to maintain visibility and safety. This trend is particularly pronounced in mature automotive markets where consumers are more inclined to invest in upgrading or replacing worn-out lighting with newer, more efficient technologies like LEDs. Furthermore, the growing trend towards customization and personalization of vehicles is fueling demand within the aftermarket lighting segment. Enthusiasts and vehicle owners increasingly turn to aftermarket lighting products to enhance their vehicles' aesthetic appeal and functionality.

Vehicles Insights

The passenger vehicle segment accounted for the largest market revenue share in 2023. The increasing consumer preference for aesthetically appealing and technologically advanced vehicles is boosting the demand for innovative lighting solutions in passenger vehicles. Advancements in lighting technology contribute to enhancing vehicle functionality and energy efficiency, aligning with consumer expectations for sustainable and environmentally friendly vehicle options. As automakers prioritize safety, design innovation, and technological advancement in passenger vehicles, the demand for advanced lighting solutions is expected to grow.

The commercial vehicle segment is expected to register the fastest CAGR over the forecast period. The growth of e-commerce and logistics industries globally has increased the demand for commercial vehicles equipped with advanced lighting systems. Delivery trucks, buses, and heavy-duty vehicles require efficient lighting solutions that withstand long operating hours and frequent stops. Additionally, integrating smart lighting features in commercial vehicles, such as adaptive lighting and connectivity capabilities, further enhances safety and operational efficiency, driving adoption among fleet operators.

Regional Insights

North America automotive lighting market dominated the market in 2023. Stringent safety regulations set by organizations such as the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS) drive the adoption of advanced lighting technologies. Automakers in North America are increasingly integrating LED, Xenon/HID, and adaptive lighting systems into their vehicles to meet these standards, ensuring optimal visibility and safety for drivers and pedestrians alike. This regulatory push mandates compliance and fosters innovation as manufacturers strive to enhance performance and efficiency in their lighting solutions.

U.S. Automotive Lighting Market Trends

The U.S. dominated the regional automotive lighting market with a share of 81.3% in 2023. Consumer demand for vehicles equipped with state-of-the-art lighting contributes significantly to the growth of automotive lighting in the U.S. Modern consumers prioritize cars that perform well and offer advanced technologies that improve driving comfort, safety, and aesthetics. LED lighting, known for its versatility in design and energy efficiency, has gained popularity among U.S. consumers for its ability to create distinctive lighting signatures and enhance the overall appearance of vehicles. The preference for SUVs, trucks, and electric vehicles (E.V.s) further drives the adoption of advanced lighting systems tailored to these vehicle types, reinforcing the market demand for innovative automotive lighting solutions in the U.S.

Europe Automotive Lighting Market Trends

Europe automotive lighting market was identified as a lucrative region in this industry. The growing popularity of electric vehicles (E.V.s) in Europe contributes to the demand for energy-efficient lighting solutions that complement the sustainability goals of E.V. manufacturers and consumers alike. As automakers continue to prioritize safety, energy efficiency, and design innovation in response to European market preferences, the automotive lighting sector in Europe is poised for continued growth, offering opportunities for technological advancement and market expansion in the region.

U.K. automotive lighting is expected to grow rapidly in the coming years due to stringent safety regulations mandated by authorities such as the Department for Transport (DfT) and European regulations necessitate vehicles to be equipped with advanced lighting technologies. British consumers prioritize cars that provide reliable performance and incorporate advanced technology that enhances driving comfort and aesthetics. LED lighting, known for its versatility and ability to create distinctive lighting signatures, appeals to U.K. consumers who value style and innovation in their vehicles.

Germany automotive lighting market held a substantial market share in 2023. Germany, a leading automotive manufacturing hub in Europe, sets high vehicle safety and efficiency standards. The preference for stylish and technologically advanced lighting systems extends across various vehicle segments, including passenger cars, SUVs, and electric vehicles (E.V.s).

Asia Pacific Automotive Lighting Market Trends

The Asia Pacific automotive lighting market is anticipated to witness significant growth during the forecasted period. Rapid automotive production, rising consumer demand for premium features, and increasing government regulations mandating advanced safety systems like LED headlights are driving this growth.

The Japan automotive lighting market is expected to grow rapidly in the coming years due to high LED adoption rates, consumer preference for efficiency and design, stringent safety regulations pushing for advanced lighting systems, and a focus on cutting-edge technologies from Japanese companies. This positions them as leaders in developing the next generation of car lights.

Key Automotive Lighting Company Insights

Some of the key companies in the automotive lighting market include Sony Corporation, Samsung Electronics, Bosch Sensortec, Texas Instruments Incorporated., and STMicroelectronics. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Samsung Electronics offers a diverse range of products tailored to meet the automotive industry's stringent requirements. Samsung's portfolio includes LED headlights, taillights, interior lighting modules, and OLED displays, each designed to enhance vehicle safety, efficiency, and design aesthetics.

-

Texas Instruments (TI) offers a comprehensive portfolio of products and solutions designed to enhance safety, efficiency, and performance in automotive lighting applications. These include advanced LED driver ICs (Integrated Circuits) that enable precise control of LED brightness, color temperature, and dimming capabilities, which are crucial for achieving optimal visibility and energy efficiency in headlights, taillights, and interior lighting.

Key Automotive Lighting Companies:

The following are the leading companies in the automotive lighting market. These companies collectively hold the largest market share and dictate industry trends.

- Sony Corporation

- Samsung Electronics

- Bosch Sensortec

- Texas Instruments Incorporated.

- STMicroelectronics

- Omnivision Technologies

- Analog Devices

- Panasonic Corporation

- Knowles Electronics

- InvenSense

Recent Developments

-

In June 2024, Melexis launched MLX81123 IC to extend its LIN RGB family, offering a smaller SOIC8 and DFN-8 3mm x 3mm package. The miniaturization of the LED driver enables ambient lighting in more locations within the vehicle, overcoming previous space constraints.

-

In January 2024, OLEDWorks launched a new brand, Atala, in the automotive lighting industry. Atala aims to provide a more tailored experience for the unique relationship required when designing OLED lighting for automotive applications and provide cutting-edge OLED lighting solutions that meet the automotive industry's stringent requirements.

Automotive Lighting Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 34.44 billion

Revenue forecast in 2030

USD 48.73 billion

Growth Rate

CAGR of 5.95% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, Technology, Sales Channel, Vehicle, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, South Africa, UAE, and South Africa

Key companies profiled

Sony Corporation, Samsung Electronics, Bosch Sensortec, Texas Instruments Incorporated., STMicroelectronics, Omnivision Technologies, Analog Devices, Panasonic Corporation, Knowles Electronics and InvenSense.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive lighting market report based on application, technology, sales channel, vehicle and region.

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicle

-

Commercial Vehicle

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Original Equipment Manufacturers

-

Aftermarket

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Front Lighting/Headlamps

-

Rear Lighting

-

Side Lighting

-

Interior Lighting

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Halogen

-

Xenon/HD

-

LED

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.