- Home

- »

- Advanced Interior Materials

- »

-

Automotive Metal Stamping Market Size, Share Report, 2030GVR Report cover

![Automotive Metal Stamping Market Size, Share & Trends Report]()

Automotive Metal Stamping Market Size, Share & Trends Analysis Report By Process (Blanking, Embossing, Bending, Coining, Flanging), By Application (Passenger Cars), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-977-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Automotive Metal Stamping Market Trends

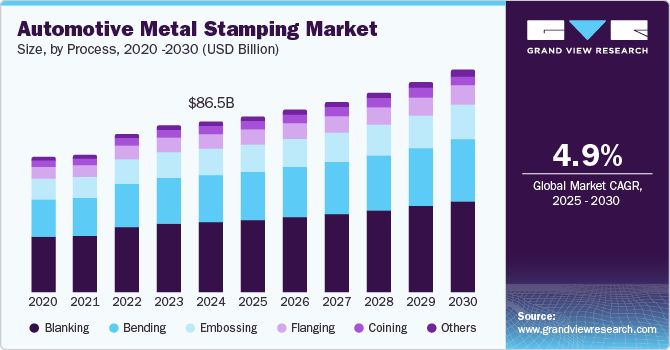

The global automotive metal stamping market size was valued at USD 86.5 billion in 2024 and is projected to grow at a CAGR of 4.9% from 2025 to 2030. This growth is driven by the rising production of vehicles and increased demand for passenger cars globally. The rising trend towards engine downsizing to improve fuel efficiency has led to a higher demand for lightweight metals such as aluminum, which are extensively used in metal stamping processes. Moreover, expanding manufacturing industries and establishing contracts between key original equipment manufacturers and automotive stamping companies boost market growth.

Technological advancements in manufacturing processes, including laser and hydraulic metal stamping, are enhancing production efficiency and cost-effectiveness, further stimulating market growth. Moreover, the increasing adoption of electric vehicles (EVs) necessitates specialized stamped components such as battery enclosures and lightweight structural parts, aligning with the industry's evolving requirements.

Process Insights

The blanking segment accounted for the largest share, 39.3%, in 2024 due to its widespread application and the efficiency it brings to the manufacturing process. Blanking allows for precise and consistent production of parts, reducing material waste and ensuring high-quality outcomes. This process is integral to meeting the high demand for automotive parts, driven by the growing automotive industry and the increasing production of vehicles globally.

The bendingsegment is expected to grow at a CAGR of 5.1% from 2025 to 2030. Bending involves deforming metal into a desired shape without altering its volume, which is essential for manufacturing components such as brackets, chassis, and frame structures. This process is critical for achieving the complex geometries required in modern automotive designs. The growth in the bending segment is propelled by advancements in bending technologies and the increasing emphasis on lightweight and fuel-efficient vehicles.

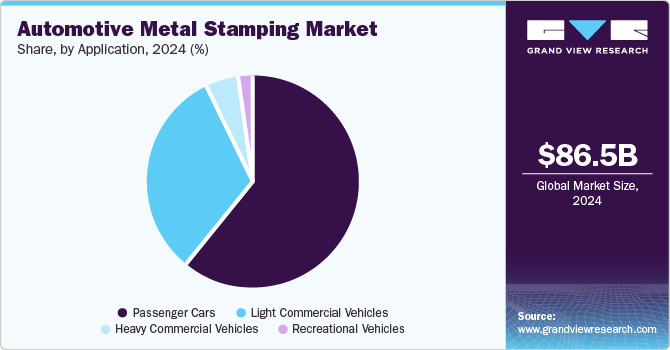

Application Insights

The passenger cars segment dominated the global automotive metal stamping market in 2024 due to the sheer volume of passenger vehicles produced worldwide, catering to developed and emerging economies. The rising disposable income and the growing urban population have significantly boosted the demand for passenger cars. Furthermore, the trend of vehicle electrification and the surge in the production of electric vehicles (EVs) have added impetus to this segment.

The heavy commercial vehicles segment is projected to grow at the fastest over the forecast period. Factors such as expanding construction and logistics industries, particularly in developing regions, drive this growth. The demand for heavy commercial vehicles, including trucks and buses, is rising due to infrastructure development and increased freight transportation. Metal stamping plays a vital role in manufacturing the robust and durable components required for these vehicles, such as chassis, frames, and axles. As the global economy continues to recover and expand, the need for efficient transportation and construction solutions fuels the growth of the heavy commercial vehicles segment.

Regional Insights

North America accounted for a 27.7% revenue share of the global automotive metal stamping market in 2024 due to the robust automotive industry in the region, characterized by a strong presence of key market players and ongoing advancements in automotive technology. Favorable government policies supporting manufacturing and technological innovation have also been critical in driving market growth.

U.S. Automotive Metal Stamping Market Trends

The U.S. dominated the North American automotive metal stamping market in 2024, driven by its substantial automotive manufacturing base and significant investments in research and development. The presence of leading automotive manufacturers, coupled with a strong focus on innovation and technology, has cemented the U.S.'s position in the market.

Europe Automotive Metal Stamping Market Trends

Europe's automotive metal stamping market is anticipated to grow steadily throughout the forecast period. The region's well-established automotive industry, characterized by leading car manufacturers and a strong emphasis on innovation and sustainability, plays a crucial role in driving market growth. Europe’s stringent emission regulations and the push for electric vehicles (EVs) are compelling manufacturers to adopt advanced metal stamping techniques to produce lighter and more efficient components.

Asia Pacific Automotive Metal Stamping Market Trends

The Asia Pacific dominated the global automotive metal stamping market with a revenue share of 40.8% in 2024, owing to its growing automotive industry and rapid industrialization. Countries such as China, Japan, and India are key players in this market, driven by the high demand for vehicles and the expansion of manufacturing facilities. Favorable government policies, significant investments in infrastructure, and the growing trend of vehicle electrification further fuel the region's dominance. The availability of affordable labor and raw materials in the Asia Pacific also contributes to the extensive adoption of metal stamping processes, solidifying the region's leading position in the global market.

Key Automotive Metal Stamping Company Insights

Some of the key companies in the automotive metal stamping market include AAPICO Hitech Public Company Limited, American Industrial Co., CAPARO, D&H Industries, Inc., FCA, Ford Motor Company, and others.

-

American Industrial Co. specializes in metal stamping for the automotive industry, offering cost-effective solutions for manufacturing parts such as fenders and hub caps. Their advanced stamping processes utilize various metals, including aluminum and steel, to produce high-volume runs of automotive components.

-

D&H Industries, Inc. offers precision metal stamping services for various automotive components. The company’s expertise includes producing parts such as body panels, chassis components, and structural elements.

Key Automotive Metal Stamping Companies:

The following are the leading companies in the automotive metal stamping market. These companies collectively hold the largest market share and dictate industry trends.

- AAPICO Hitech Public Company Limited

- American Industrial Co.

- CAPARO

- D&H Industries, Inc.

- FCA

- Ford Motor Company

- General Motors

- Gestamp

- Goshen Stamping Company

- Kenmode, Inc.

- Nissan Motor Co., Ltd

- Tempco Manufacturing Company, Inc

Recent Developments

-

In June 2024, BMW Manufacturing inaugurated a cutting-edge press shop at its Spartanburg facility. The shop, capable of producing up to 10,000 components daily, is a strategic addition to the plant’s production capabilities. The new press shop plays a pivotal role in the manufacturing of the BMW X3, stamping critical exterior body parts such as doors, side panels, fenders, and liftgate.

-

In May 2024, BENTELER Group inaugurated its new plant in Bratislava, Slovakia. Strategically located near Volkswagen, the plant will serve as a key hub for supplying the dynamic European market. The plant's proximity to the customer enables efficient production, assembly, and logistics, ensuring agile and high-quality solutions.

Automotive Metal Stamping Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 89.2 billion

Revenue forecast in 2030

USD 113.2 billion

Growth rate

CAGR of 4.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Process, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; China; Japan; India; Brazil

Key companies profiled

AAPICO Hitech Public Company Limited; American Industrial Co.; CAPARO; D&H Industries; Inc.; FCA; Ford Motor Company; General Motors; Gestamp; Goshen Stamping Company; Kenmode, Inc.; Nissan Motor Co., Ltd; Tempco Manufacturing Company, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Metal Stamping Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive metal stamping market report based on process, application, and region:

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Blanking

-

Embossing

-

Bending

-

Coining

-

Flanging

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

Recreational Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."