- Home

- »

- Electronic Devices

- »

-

Automotive Motor Market Size, Share, Industry Report, 2030GVR Report cover

![Automotive Motor Market Size, Share & Trends Report]()

Automotive Motor Market (2024 - 2030) Size, Share & Trends Analysis Report By Motor Type, By Sales Channel (OEM, Aftermarket), By Application, By Vehicle Type (Electric, Non-electric), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-048-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Motor Market Summary

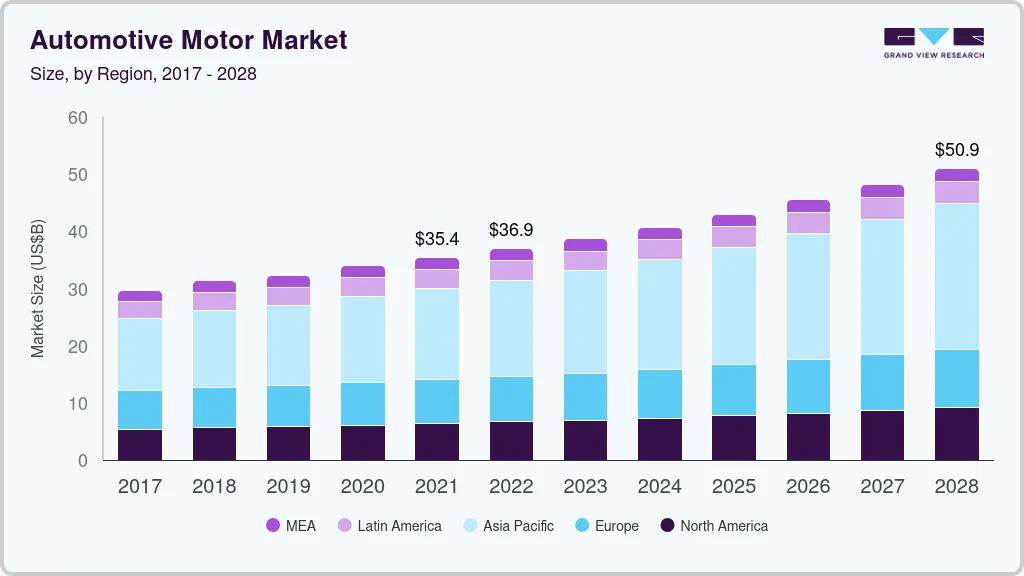

The global automotive motor market size was valued at USD 38.7 billion in 2023 and is projected to reach USD 56.9 billion by 2030, growing at a CAGR of 5.7% from 2024 to 2030. Increasing sales of vehicles, particularly of the electric variants, are expected to strengthen the demand for automotive motors in the coming years.

Key Market Trends & Insights

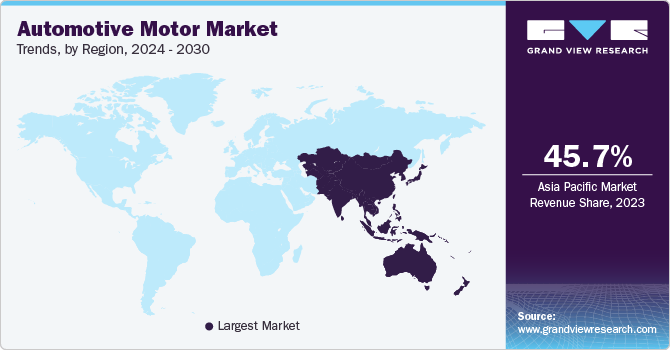

- The Asia Pacific automotive motor market region accounted for the largest revenue share of 45.7% in 2023.

- The U.S. automotive motor market holds a majority share in the regional market for automotive motors.

- By motor type, the brushless DC motor segment held the largest revenue share of 43.3% in the market in 2023.

- By sales channel, the aftermarket sales channel held a significant market revenue share of 71.3% in 2023.

- By application, the comfort segment held the leading market revenue share of 48.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 38.7 Billion

- 2030 Projected Market Size: USD 56.9 Billion

- CAGR (2024-2030): 5.7%

- Asia Pacific: Largest market in 2023

Automobiles require different types of electric motors to effectively perform a wide range of functions across components such as power windows, engine cooling fans, air conditioning systems, and sunroofs. Moreover, consumers are demanding vehicles that provide advanced safety features such as anti-lock braking systems (ABS), airbags, electronic stability control (ESC), and traction control. These features rely on electric motors, stimulating market expansion.

The global automotive industry is witnessing a rise in production volumes across various vehicle segments, including passenger cars, commercial vehicles, and two-wheelers. Globalization has led to economic prosperity and a rise in disposable income among existing untapped consumer markets. This has led to increasing demand for vehicles, encouraging multinational firms to set up their manufacturing bases in such thriving economies. This results in an increased demand for all types of automotive motors, from those used in core functionalities to those required to elevate comfort and convenience features.

Continuous advancements in motor design and manufacturing processes by automotive manufacturers have resulted in the development of more efficient, compact, and powerful motors. This not only improves vehicle performance but also offers an opportunity to incorporate new applications within automobiles. For instance, current vehicle manufacturers are increasingly incorporating advanced driver assistance systems (ADAS) in their vehicles. This is expected to fuel demand growth for steering-controlling functional motors used in these autonomous systems.

Motor Type Insights

The brushless DC motor (BLDC) segment held the largest revenue share of 43.3% in the market in 2023. BLDC motors offer significantly higher efficiency compared to traditional brushed DC motors. This results in greater driving range for electric vehicles (EVs) and improved fuel economy for hybrid vehicles, ultimately reducing emissions and operational costs. Furthermore, BLDC motors are available in a compact design and offer high power density. This is crucial for automakers who are constantly striving to optimize space utilization within vehicles. These characteristic advantages of BLDC motors account for the high market share of this segment.

The traction motor segment is expected to witness the fastest CAGR of 8.3% during the forecast period. This is owing to a growth in environmental awareness among consumers and their shifting preference towards electric vehicles. Traction motors are a fundamental component of EVs, improving vehicle performance and necessitating their growth alongside the EV market. They provide high torque for rapid acceleration, improved energy efficiency, and enable quieter operation. These factors create a favorable environment for the adoption of EVs over traditional vehicles, leading to steady market growth for this segment.

Sales Channel Insights

The aftermarket sales channel held a significant market revenue share of 71.3% in 2023. Vehicles undergo gradual wear and tear over time, leading to a constant requirement for replacement of parts and fluids, as well as repair and maintenance services. Automotive aftermarket caters to this need, providing a wider range of suppliers and service providers compared to the original equipment manufacturer (OEM) network. Additionally, aftermarket parts offer a more cost-competitive alternative to genuine OEM parts. This price difference makes them an attractive option for budget-conscious consumers and independent repair shops. These factors of affordability and availability account for high share of this segment.

Original equipment manufacturers (OEM) are expected to contribute substantially to the market revenue during the forecast period. OEMs focus primarily on the betterment of existing products through continuous research and development efforts. Despite their smaller share in this market, OEMs have important functions to perform, such as supplying motors directly to vehicle assembly lines, streamlining production, and ensuring compatibility between motors and other vehicle components. This direct control allows for stricter quality assurance, leading to the development and maintenance of reliable and efficient vehicles.

Application Insights

The comfort segment held the leading market revenue share of 48.1% in 2023 owing to the continuous efforts of automobile manufacturers towards providing features that ensure passenger comfort. For instance, modern-day vehicles come with several new features as standard offerings, which were earlier considered luxury, such as power windows, electrically adjusted seats, multi-zone air conditioning systems, sunroofs, and other comfort options. All of these functions are dependent upon electric motors for their smooth operation, leading to steady demand from manufacturers and subsequent segment growth.

The safety segment held a substantial market share in 2023 owing to the standardization of safety functions in modern automobiles. For instance, advancements in automotive safety technology have led to the development of more sophisticated systems that rely on electric motors for functionality. These systems, such as Advanced Emergency Braking (AEB) and Lane Departure Warning (LDW), require reliable and powerful electric motors for seamless functioning. The rapidly growing preference of consumers for improved safety features in their vehicles is expected to propel further market growth.

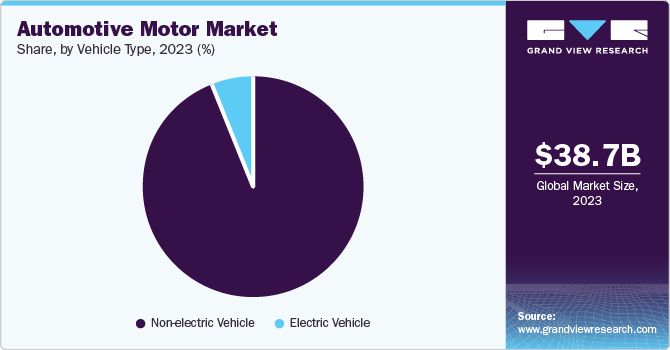

Vehicle Type Insights

The non-electric vehicle segment held a dominant position in the market, with a revenue share of 93.6% in 2023. Internal combustion engine (ICE) vehicles have been the leading automotive technology for over a century. The infrastructure for fueling and servicing these vehicles is well-established globally. Within the non-electric segment, passenger vehicles accounted for the highest revenue share, owing to their widespread demand and adoption globally. Majority of comfort and safety-related features are offered in this category, which consequently requires motors with varying capacities to enable these functions. These factors lead to consistent demand and market growth for automotive motors.

The electric vehicle (EV) segment is anticipated to witness the fastest growth rate of 12.5% during the forecast period. This notable segment expansion can be attributed to the current widespread adoption and proliferation of electric vehicles across global economies. Within the EV segment, the battery electric vehicle (BEV) segment held a majority share in 2023. These vehicles are equipped with large-capacity batteries and electric motors and produce zero emissions of harmful gases. Advancements in battery technology and improved range of vehicles are further expected to drive segment demand in the coming years.

Regional Insights

The Asia Pacific automotive motor market region accounted for the largest revenue share of 45.7% in 2023. This substantial share is owing to the changing economic landscape across economies in this region. For instance, increasing economic prosperity of countries and rising disposable income among the younger working population have led to a high demand for private passenger vehicles. These vehicles require motors for various functions such as power windows, power steering, and air conditioning systems. Additionally, advancements in BLDC motor technology have led to their adoption in the automotive sector, fueling market growth.

The presence of several notable manufacturing companies with enormous production capacities makes China one of the biggest producer as well as consumer of automotive motors. A favorable regulatory environment, presence of a large number of skilled workers, and establishment of efficient distribution channels make the country a prominent global exporter of automobiles and their related components.

Europe Automotive Motor Market Trends

Europe has a long history of automotive innovation. Prominent car manufacturing companies such as Volkswagen, Mercedes-Benz, BMW, and several others have originated from Europe, laying the foundation for modern automobiles. This trend has continued to the present day, with European automakers at the forefront of advancements in engine technology, safety features, and sustainable solutions such as electric vehicles. As a result, the industry for automotive motors is expansive in economies such as Germany, France, and the UK.

German car brands are renowned for their engineering excellence, performance, and design. This reputation translates into brand loyalty and consumer preference, not just within Europe but also in international markets. Germany has a well-established and highly integrated automotive manufacturing ecosystem. This network of Original Equipment Manufacturers (OEMs) and suppliers ensures efficient production, adaptability to changing market demands, and a consistent flow of high-quality vehicles, leading to promising growth prospects for the motor market.

North America Automotive Motor Market Trends

North America automotive motor market accounted for a notable market share in 2023. This share is attributed to a high demand for private vehicles in the region. The presence of highly industrialized economies of Canada and the U.S., along with modernization, has resulted in the development of a highly dense road network in North America. Apart from air travel, people prefer to commute by road, leading to a consistent demand for automobiles, which ultimately results in market growth for equipment such as motors.

U.S. Automotive Motor Market Trends

The U.S. automotive motor market holds a majority share in the regional market for automotive motors. This is owing to various factors such as the high popularity of trucks and SUVs in the country, the high purchasing power of American consumers, presence of a well-established and thriving automobile manufacturing sector, and favorable government policies. For instance, consumers in the economy have similar preferences for diesel-powered Ford trucks as well as battery-powered Tesla EVs. This nurturing environment promises consistent demand for passenger and commercial vehicles, leading to market growth.

Key Automotive Motor Company Insights:

Some key companies involved in the automotive motor market include Johnson Electric Holdings Limited, Siemens, DENSO CORPORATION, and others.

-

Johnson Electric Holdings Limited is a Hong Kong-based electro-mechanical equipment manufacturing company. It offers a wide range of products used in the automobile industry, such as actuators, DC motors, gear motors and gearboxes, and stepper motors. The company offers a variety of DC motor solutions for automotive applications such as compact DC motors, cooling fan motors, and brushless EC motors.

-

Denso Corporation is a Japanese automotive components manufacturer. The company operates in over 35 countries across different regions. In the automotive motor segment, Denso offers starter motors, alternators, compressors, condenser fan motors, power window motors, and engine cooling modules for two wheelers, four wheelers, and commercial vehicles. The company supplies its products to prominent manufacturers such as Toyota.

Key Automotive Motor Companies:

The following are the leading companies in the automotive motor market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens

- Robert Bosch GmbH

- Continental AG

- DENSO CORPORATION

- Mitsubishi Electric Corporation

- MAHLE GmbH

- NIDEC CORPORATION

- Johnson Electric Holdings Limited

- BorgWarner Inc.

- Valeo S.A.

Recent Developments

-

In June 2024, Nidec Corporation announced the development of a new air suspension motor by Nidec Motor (Dalian) Limited, the company’s Chinese branch. The new motor is claimed to feature a compact design, high power, long lifetime, and quick start & response time.

-

In August 2023, MAHLE announced the development of a “perfect motor” by leveraging the strengths of superior continuous torque (SCT) and magnet-free contactless transmitter (MCT) electric motors. The new system is expected to deliver continuous high peak power, contactless power transmission, and other combined benefits. The solution was showcased at the IAA Mobility event held in Munich in September 2023 and is expected to advance market expansion.

Automotive Motor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 40.7 billion

Revenue Forecast in 2030

USD 56.9 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Motor type, sales channel, application, vehicle type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, China, Japan, India, Brazil

Key companies profiled

Siemens; Robert Bosch GmbH; Continental AG; DENSO CORPORATION; Mitsubishi Electric Corporation; MAHLE GmbH; NIDEC CORPORATION; Johnson Electric Holdings Limited; BorgWarner Inc.; Valeo S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Motor Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive motor market report based on motor type, sales channel, application, vehicle type, and region:

-

Motor Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Brushed DC Motor

-

Brushless DC Motor

-

Stepper Motor

-

Traction Motor

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Safety

-

Comfort

-

Performance

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric Vehicle

-

BEV

-

PHEV

-

-

Non-electric Vehicle

-

Passenger

-

LCV

-

HCV

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Asia Pacific

-

Japan

-

India

-

China

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.