- Home

- »

- Electronic Devices

- »

-

Automotive Motor Market Size & Share Report, 2019-2025GVR Report cover

![Automotive Motor Market Size, Share & Trends Report]()

Automotive Motor Market Size, Share & Trends Analysis Report By Motor Type (Brushed DC, Traction), By Application, By Sales Channel (OEM, Aftermarket), By Vehicle Type, By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-4-68038-048-4

- Number of Pages: 97

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Semiconductors & Electronics

Report Overview

The global automotive motor market size was valued at USD 31.33 billion in 2018 and is expected to expand at a CAGR of 6.7% over the forecast period. The use of electric motors in automobiles has been witnessing a steady rise over the past few years. Rising emphasis on optimizing design and manufacturing processes for delivering better products with improved efficiency is anticipated to bode well for the product demand. The market is witnessing tremendous growth ascribed to the increase in automobile production and the number of motors used in a particular vehicle.

The recent advancements in designing high-efficiency and compact motors have created opportunities in the automobile industry. The motors also find application in seat cooling fan, engine cooling fan, power window, power steering, and safety fittings among others. The increasing popularity of features, such as motorized seats, wipers, doors, adjustable mirrors, and massage seats, is further driving the demand.

Development in electric vehicle production technology and a growing emphasis on renewable energy has proved to be the major factors driving the demand for electric vehicles. The adoption of electric vehicles can help alleviate problems, such as oil dependency, global warming, and environmental pollution. Hence, various governments have initiated and implemented different policies to encourage the adoption and production of electric vehicles. This factor is anticipated to drive the demand for automotive motors in near future. Rising demand for electric vehicles is also anticipated to drive the automotive motor market over the forecast period. Electric vehicles are expected to witness robust demand mainly due to their ability to reduce emissions or pollutants. Rising awareness about environmental protection across the world is projected to propel the use of electric vehicles, which in turn is expected to drive the demand.

Automotive motors need to be replaced after a certain interval of time, which is expected to affect the market growth. However, efforts from the OEMs to introduce motors with minimum wear and tear and longer life and efficiency are expected to create growth opportunities. Governments are undertaking several initiatives to encourage such projects. The government bodies are also investing significantly in the production of energy-efficient motors.

Motor Type Insights

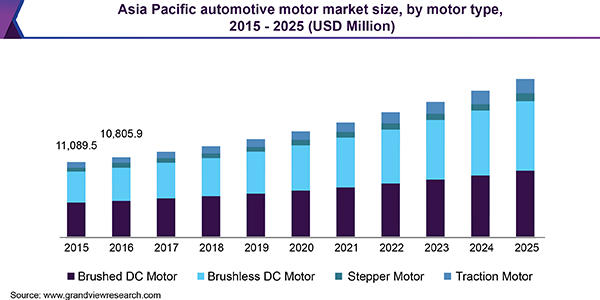

Brushed DC motor held the largest market share in 2018, ascribed to low cost and simple drive control model. They are easy to install and are used to provide high speed and power to the vehicle making them ideal for various automotive applications. Systems including power windows, cooling fan, windshield wipers, and so on make use of brushed DC motor.

Brushless DC held the second largest market share in 2018. The brushless DC motor is not much susceptible to damage or breakage and undergoes minimal wear and tear ascribed to the absence of a physical commutator and brushes. Brushless DC motors have a longer life, reliability, and efficiency. In several applications, the BLDC motor provides significant benefits in terms of power density, thereby providing better fuel economy, reduced weight, and lower emissions. They are used in cabin HVAC blowers and pumps and windshield wipers among others.

The traction motor is anticipated to witness the fastest growth over the forecast period. They are mainly used in Battery Electric Vehicles (BEV) and Hybrid Electric Vehicles (HEV) owing to high efficiency and low power consumption. The rising adoption in electric vehicles expected to spur the demand by 2025.

Sales Channel Insights

Based on the sales channel, the market has been categorized into OEMs and aftermarket. The OEM segment is accounted for a substantial market share in 2018. However, aftermarket emerged as a dominant segment in 2018 and is estimated to witness the fastest growth over the forecast years. The motors need to be replaced after a certain period due to their prolonged usage and for better vehicular performance which is driving the segment.

Rapid technological advancements are anticipated to fuel the aftermarket segment toward digitization. The marketplace is changing and the aftermarket is going online for the sale of auto parts and services. Usage of advanced technology in auto parts fabrication, the surge in the production of consumer and passenger automobile, and digitalization of automotive repair and maintenance services are some of the factors expected to benefit propel the expansion of the aftermarket segment over the forecast period.

Application Insights

Automotive motors serve a wide range of applications including safety, performance, and comfort. The comfort application segment accounted for the majority of the market share in 2018. Automotive motors are used in electric vehicles, hybrid vehicles, and cars among other types of vehicles. With the rising demand for passenger vehicles for transportation, the demand for the comfort of passengers and drivers has also increased. Advanced automotive equipment, such as electronically adjustable seats use these motors. The motor is integrated with a microcontroller platform that uses an advanced algorithm to decrease the impact on the driver as well as the passenger. Similarly, in electric power steering systems, the motor is integrated with a microcontroller platform to adjust the steering wheel position.

Furthermore, sophisticated safety mechanisms, such as the anti-lock braking system employ automotive motors to provide an estimation of the wheel speed and road identification using wavelet signal processing methods. Manufacturers of automobile parts strive to improve the comfort and safety offered by vehicles while focusing on maintaining the production costs. Automotive motors offer numerous advantages, such as compact size, low price, and the ability to integrate with microcontrollers to execute complex algorithms, widening the scope of application.

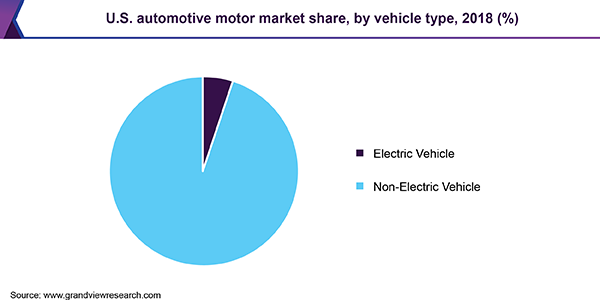

Vehicle Type Insights

The electric vehicle segment is expected to witness the fastest growth over the forecast period. Electric vehicles hold significant potential to improve local air quality, reduce carbon emissions, and increase energy security. The industry has shifted its focus toward hybrid and electric vehicles due to the rising concerns of carbon emissions from conventional fuel-driven automobiles and other transportation forms. This is in turn anticipated to drive the segment growth in the forthcoming years.

The electric vehicle segment is further bifurcated into BEVs and PHEVs. BEVs are anticipated to register the highest demand for the automotive motor in 2018. However, PHEV is expected to account for the fastest growth by 2025. Fast charging infrastructure and better batteries are improving the BEVs. Furthermore, large scale production is pushing down the battery costs thus increasing the BEV competitiveness. Such improvements are anticipated to bode well for the demand for BEVs.

Regional Insights

There are various government regulations, which have mandated safety features in vehicles including anti-lock braking systems, airbags, and start-stop systems among others. These safety feature components require motor installation, which is anticipated to increase the market demand in near future. The Asia Pacific accounted for the largest market share in terms of revenue in 2018 and is estimated to exhibit the fastest growth over the forecast period. This is ascribed to the growing vehicle production in emerging economies, such as China, India, and Japan.

North America is expected to emerge as the second-largest region by 2025. The strong presence of manufacturers in Canada and the U.S. is one of the key factors driving the regional market. Europe is also likely to be one of the key regional markets due to the growing presence of the automotive industry. Growing demand for more capable infotainment units in vehicles is expected to be a key regional growth driver.

Automotive Motor Market Share Insights

The key market players include Nidec Corporation, Johnson Electric Holdings Ltd., Robert Bosch GmbH, Denso Corporation, Continental AG, and Mitsubishi Electric Corporation among others. The companies are increasingly focusing on research and development projects to increase the efficiency of their offerings as well as to expand and diversify their product offerings. Intense competition has led manufacturers to invest in product developments to better serve customers’ requirements.

Automotive Motor Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 35.3 billion

Revenue forecast in 2025

USD 49.07 billion

Growth Rate

CAGR of 6.7% from 2019 to 2025

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Motor type, sales channel, vehicle type, application, and region.

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; China; India; Japan; Brazil; Mexico.

Key companies profiled

Nidec Corporation; Johnson Electric Holdings Ltd.; Robert Bosch GmbH; Denso Corporation; Continental AG; and Mitsubishi Electric Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends from 2015 to 2025 in each of the sub-segments. For this study, Grand View Research has segmented the global automotive motor market report based on motor type, sales channel, vehicle type, application, and region:

-

Motor Type Outlook (Revenue, USD Million, 2015 - 2025)

-

Brushed DC Motor

-

Brushless DC Motor

-

Stepper Motor

-

Traction Motor

-

-

Sales Channel Outlook (Revenue, USD Billion, 2015 - 2025)

-

OEM

-

Aftermarket

-

-

Application Outlook (Revenue, USD Billion, 2015 - 2025)

-

Safety

-

Comfort

-

Performance

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2015 - 2025)

-

Electric Vehicle

-

BEV

-

PHEV

-

-

Non-Electric Vehicle

-

Passenger

-

LCV

-

HCV

-

-

-

Regional Outlook (Revenue, USD Billion, 2015 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."