- Home

- »

- Plastics, Polymers & Resins

- »

-

Automotive Plastic Compounding Market Size Report, 2030GVR Report cover

![Automotive Plastic Compounding Market Size, Share & Trends Report]()

Automotive Plastic Compounding Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Polypropylene, Polycarbonate), By Application (Interior, Electrical Components & Lighting), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-079-4

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Plastic Compounding Market Summary

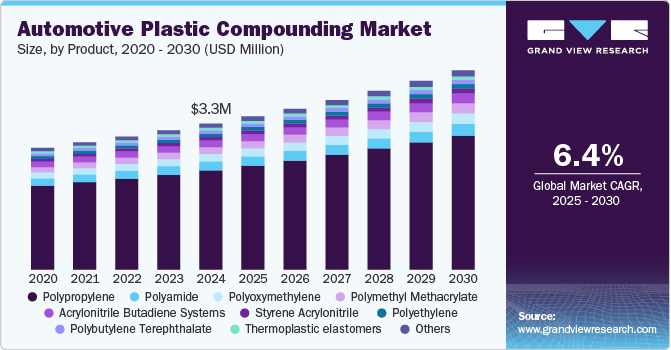

The global automotive plastic compounding market size was estimated at USD 3.32 billion in 2024 and is projected to reach USD 4.54 billion by 2030, growing at a CAGR of 6.44% from 2025 to 2030. The growing demand for fuel efficient vehicles and the shifting preference of consumers towards electric vehicles (EVs) due to increased awareness about sustainability is driving the market.

Key Market Trends & Insights

- Asia Pacific automotive plastic compounding market dominated the global market and accounted for the largest revenue share of 45.35% in 2024.

- The automotive plastic compounding market in China is growing due to the government’s strong support for EV production and adoption.

- Based on product, the polypropylene (PP) segment led the market with a revenue share of 67.97% in 2024.

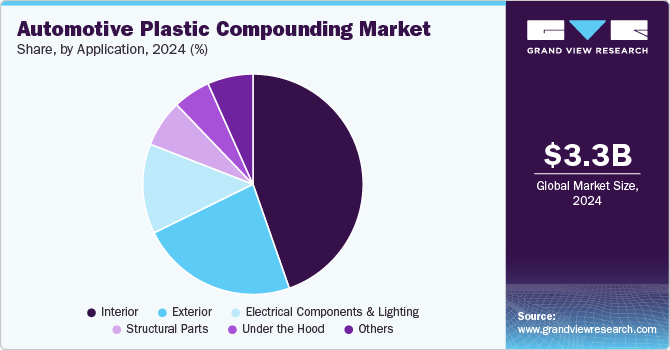

- In terms of application, the interior segment dominated the market with the largest revenue share of 44.65% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.32 Billion

- 2030 Projected Market Size: USD 4.54 Billion

- CAGR (2025-2030): 6.44%

- Asia Pacific: Largest market in 2024

There is a growing focus on light weighting in the automotive industry, which is driving demand for plastic compounds. Automakers are increasingly replacing traditional materials like steel and aluminum with high-performance plastics to reduce vehicle weight, improve fuel efficiency, and lower emissions.

This trend is closely aligned with global regulatory pressures for greener vehicles and the rising popularity of electric vehicles (EVs), where lighter materials can improve battery range. Consequently, the development of advanced plastic compounds that maintain strength, durability, and heat resistance while being lighter than metals is becoming a significant focus area for manufacturers.

Drivers, Opportunities & Restraints

The shift toward EVs and hybrid vehicles (HEVs) is a major driver for the market. EVs require innovative materials that can handle the unique challenges of battery systems, such as thermal management and electrical insulation. Plastics offer excellent electrical insulation properties and are lightweight, making them ideal for use in battery housings and other components. Furthermore, the growing global EV market, fueled by government incentives and the need to reduce carbon emissions, is pushing automakers to adopt more plastic compounds to optimize vehicle performance and safety.

The increasing adoption of bio-based and recycled plastics presents a significant opportunity in the automotive plastic compounding market. As sustainability becomes a top priority for both manufacturers and consumers, there is a rising demand for eco-friendly materials that reduce the environmental impact of automotive production. This has opened up opportunities for companies to develop plastic compounds using renewable or recycled materials that meet the strict performance and safety standards of the automotive sector. The use of bio-based plastics can also help automakers meet their sustainability targets while addressing consumer demand for greener products.

Despite its potential, the volatility in raw material prices, particularly petroleum-based resins, remains a significant restraint for the market. Since plastics are primarily derived from petrochemicals, fluctuations in oil prices can directly impact the cost of producing plastic compounds. Additionally, supply chain disruptions and shortages of key raw materials, such as certain additives or polymers, can further strain the market. These price fluctuations can create challenges for manufacturers looking to maintain cost efficiency while producing high-quality, high-performance plastic components for the automotive industry.

Product Insights

The polypropylene (PP) segment led the market with a revenue share of 67.97% in 2024. The increasing emphasis on vehicle fuel efficiency and emission reduction is a strong driver for the use of polypropylene (PP) in automotive plastic compounding. PP is favored for its lightweight properties, excellent chemical resistance, and cost-effectiveness, making it a popular choice for various automotive components such as bumpers, dashboards, and interior trims. As automakers strive to meet stricter global emissions regulations, particularly in regions like Europe and North America, the demand for materials that can reduce overall vehicle weight while maintaining performance is surging. Polypropylene’s versatility and ability to be molded into complex shapes, along with its recyclability, further boost its adoption, supporting automakers' goals of reducing carbon footprints and improving fuel economy.

The polycarbonate (PC) segment is expected to grow at a rapid rate from 2025 to 2030. The growing demand for enhanced safety and aesthetics in modern vehicles is a key driver for the use of polycarbonate (PC) in automotive plastic compounding. PC is known for its exceptional impact resistance, transparency, and thermal stability, making it ideal for applications such as headlamp lenses, panoramic roofs, and interior displays. As automotive design trends evolve to prioritize advanced lighting systems, larger digital displays, and sleek roof designs, PC's optical clarity and toughness are becoming increasingly essential.

Application Insights

The interior segment dominated the market with the largest revenue share of 44.65% in 2024, driven by the rising demand for premium and customizable vehicle interiors. Consumers are increasingly seeking high-quality, durable, and aesthetically pleasing materials for car interiors, including dashboards, door panels, seating, and trim components. Plastic compounds offer the flexibility to create intricate designs, soft-touch surfaces, and a variety of finishes while maintaining durability and cost-effectiveness. Furthermore, advancements in plastic technologies, such as improved heat resistance, noise reduction, and scratch resistance, are enhancing the overall in-cabin experience.

The electrical components & lighting segment is anticipated to augment at a substantial rate from 2025 to 2030. The increasing electrification of vehicles and the advancement of automotive lighting technologies are significant drivers for the electrical components and lighting segment of the automotive plastic compounding market. With the rise of EVs, HEVs, and advanced driver-assistance systems (ADAS), there is a growing need for high-performance plastics that offer excellent electrical insulation, thermal resistance, and lightweight properties. These plastic compounds are critical for producing components like connectors, wiring harnesses, and battery enclosures.

Regional Insights

In automotive plastic compounding market in North America is driven by the shift toward EVs and autonomous driving technologies. Automakers are increasingly incorporating advanced plastic materials to reduce vehicle weight and improve energy efficiency in EVs, where range and battery performance are critical. Moreover, the growing adoption of ADAS and connected vehicle technologies requires durable, lightweight plastics that can handle the increased electronic components.

U.S. Automotive Plastic Compounding Market Trends

The stringent fuel efficiency standards and emissions regulations are key drivers for the U.S. automotive plastic compounding market. The Corporate Average Fuel Economy (CAFE) standards, along with state-level initiatives like California’s zero-emission vehicle (ZEV) mandate, are pushing automakers to reduce vehicle weight and improve overall efficiency. Plastic compounds, known for their lightweight and high-strength properties, are increasingly being used to replace heavier materials like steel and aluminum.

Asia Pacific Automotive Plastic Compounding Market Trends

Asia Pacific automotive plastic compounding market dominated the global market and accounted for the largest revenue share of 45.35% in 2024, driven by the rapid growth of the automotive industry in Asia Pacific, particularly in emerging markets like India, Thailand, and Indonesia. Increasing urbanization, rising disposable incomes, and growing middle-class populations in these countries are fueling the demand for affordable, fuel-efficient vehicles. In addition, the presence of major global automakers with manufacturing hubs in the region is boosting the demand for advanced plastic compounds that can help reduce vehicle weight and improve performance. Local government initiatives supporting EV adoption and stricter environmental regulations are further pushing the use of lightweight and recyclable plastics in automotive production.

The automotive plastic compounding market in China is growing due to the government’s strong support for EV production and adoption. China is the world’s largest EV market, and the government's favorable policies, such as subsidies, tax incentives, and infrastructure development for EVs, are pushing automakers to develop lightweight, efficient vehicles. Plastic compounds are essential in reducing vehicle weight and improving battery performance, which are critical for extending the range of EVs.

Europe Automotive Plastic Compounding Market Trends

Europe automotive plastic compounding market is significantly driven by the push for sustainability and stricter emissions regulations. The European Union’s Green Deal and the push for carbon neutrality by 2050 are encouraging automakers to adopt lightweight materials, such as advanced plastic compounds, to reduce fuel consumption and CO2 emissions.

Key Automotive Plastic Compounding Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include LyondellBasell Industries Holdings B.V., and SCG Chemicals Public Company Limited. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Automotive Plastic Compounding Companies:

The following are the leading companies in the automotive plastic compounding market. These companies collectively hold the largest market share and dictate industry trends.

- LyondellBasell Industries Holdings B.V.

- BASF SE

- SABIC

- Dow

- Ferro Corporation

- Ascend Performance Materials

- Washington Pen

- Ravago

- KRATON CORPORATION

- Chevron Phillips Chemical Company LLC

- SCG Chemicals Public Company Limited

Recent Developments

-

In June 2024, Borealis launched a new product called Borcycle GD3600SY, a glass-fiber reinforced PP compound that incorporates 65% post-consumer recycled (PCR) materials. This innovative compound is to be first utilized in the Peugeot 3008 for center console carriers, marking a significant advancement in automotive sustainability.

-

In June 2024, Teijin Limited announced the launch of a new production line for its Panlite polycarbonate resin sheets and films at its Matsuyama plant in Japan, set to begin operations on June 17, 2024. This investment aims to meet the increasing demand for high-quality materials used in automotive interiors and electronic components, particularly as vehicles become more electrified and autonomous.

Automotive Plastic Compounding Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.49 billion

Revenue forecast in 2030

USD 4.54 billion

Growth rate

CAGR of 6.44% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Netherlands; Austria; Switzerland; Hungary; Czech Republic; China; India; Japan; South Korea; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

LyondellBasell Industries Holdings B.V.; BASF SE; SABIC; Dow; Ferro Corporation; Ascend Performance Materials; Washington Pen; Ravago; KRATON CORPORATION; Chevron Phillips Chemical Company LLC; SCG Chemicals Public Company Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Plastic Compounding Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global automotive plastic compounding market report based on the product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polypropylene (PP)

-

Polyethylene (PE)

-

Thermoplastic elastomers (TPE)

-

Polybutylene Terephthalate (PBT)

-

Polyamide (PA)

-

Polycarbonate (PC)

-

Acrylonitrile Butadiene Systems (ABS)

-

Styrene Acrylonitrile (SAN)

-

Polymethyl methacrylate (PMMA)

-

Polyoxymethylene (POM)

-

Blends (PC/ABS, ABS/PBT, PS/PP)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Interior

-

Exterior

-

Under the Hood

-

Structural Parts

-

Electrical Components & Lighting

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Netherlands

-

Austria

-

Switzerland

-

Hungary

-

Czech Republic

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global automotive plastic compounding market size was estimated at USD 3.32 billion in 2024 and is expected to reach USD 3.49 billion in 2025.

b. The global automotive plastic compounding market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2030 to reach USD 4.54 billion by 2030.

b. Polypropylene dominated the aerospace foam market with a share of 67.97% in 2024. The growing automotive industry globally is expected to create growth opportunities for players operating in the polypropylene market over the forecast period.

b. Some key players operating in the aerospace foam market include BASF SE, SABIC, Dow, Ferro Corporation, Ascend Performance Materials, Washington Pen, Ravago, KRATON CORPORATION, Chevron Phillips Chemical Company LLC, and others

b. Key factors that are driving the aerospace foam market growth include a rise in greenhouse gas emissions is expected to create demand for plastic compounds over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.