- Home

- »

- Automotive & Transportation

- »

-

Automotive Relay Market Size, Share, Industry Report, 2030GVR Report cover

![Automotive Relay Market Size, Share & Trends Report]()

Automotive Relay Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (PCB Relay, Plug-in Relay, High Voltage Relay), By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-305-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Relay Market Summary

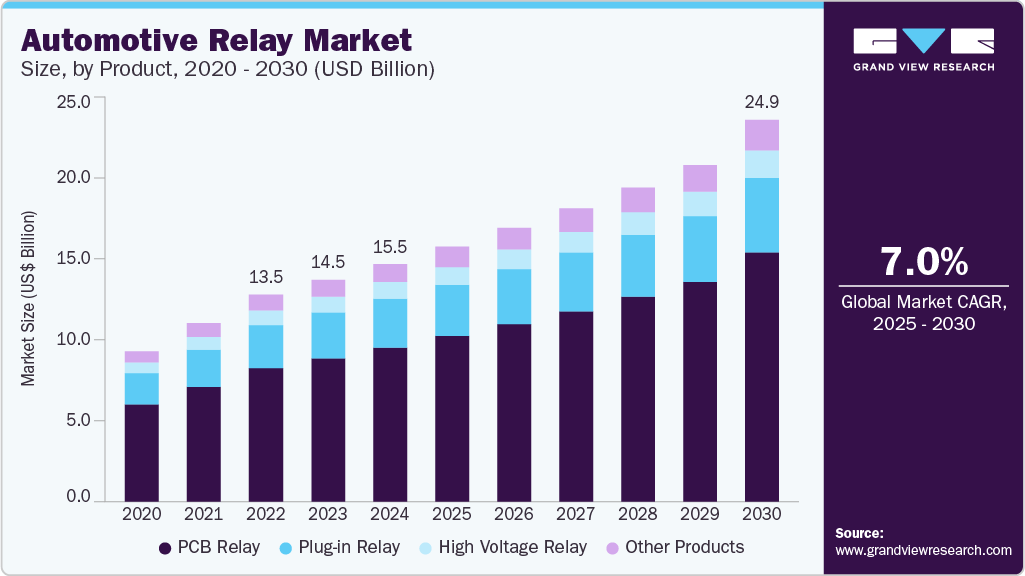

The global automotive relay market size was estimated at USD 15.5 billion in 2024 and is projected to reach USD 25.0 billion by 2030, growing at a CAGR of 7.0% from 2025 to 2030. Electric automotive parts have diversified over the past decade, leading to an increase in the number of relays used as switching devices and a variation in the required features of each relay.

Key Market Trends & Insights

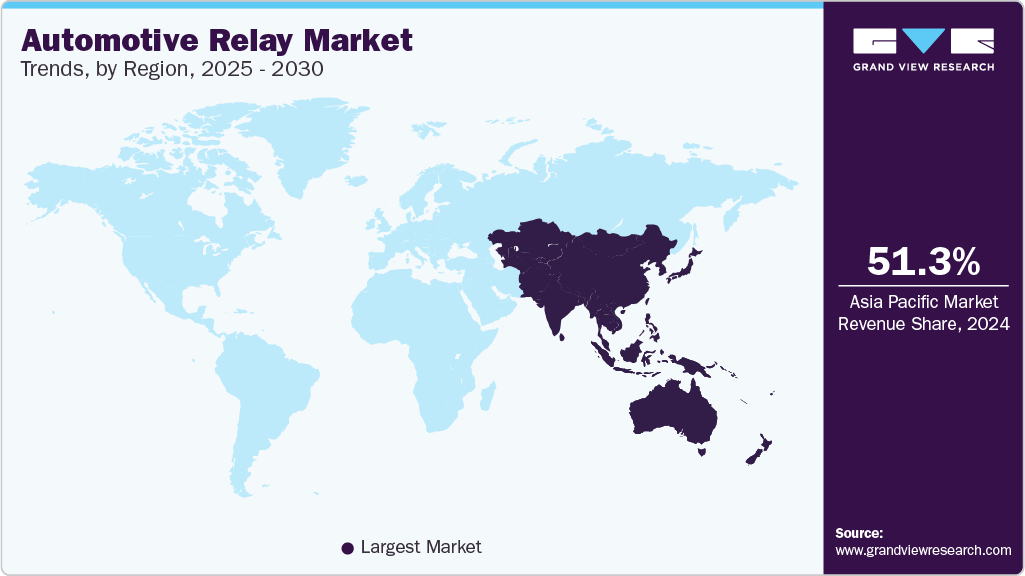

- The Asia Pacific Automotive Relay market accounted for 51.3% of the global share in 2024.

- Based on product, the PCB relay segment accounted for the largest share, 64.9%, in 2024.

- Based on vehicle type, the passenger vehicles segment accounted for the largest share in 2024.

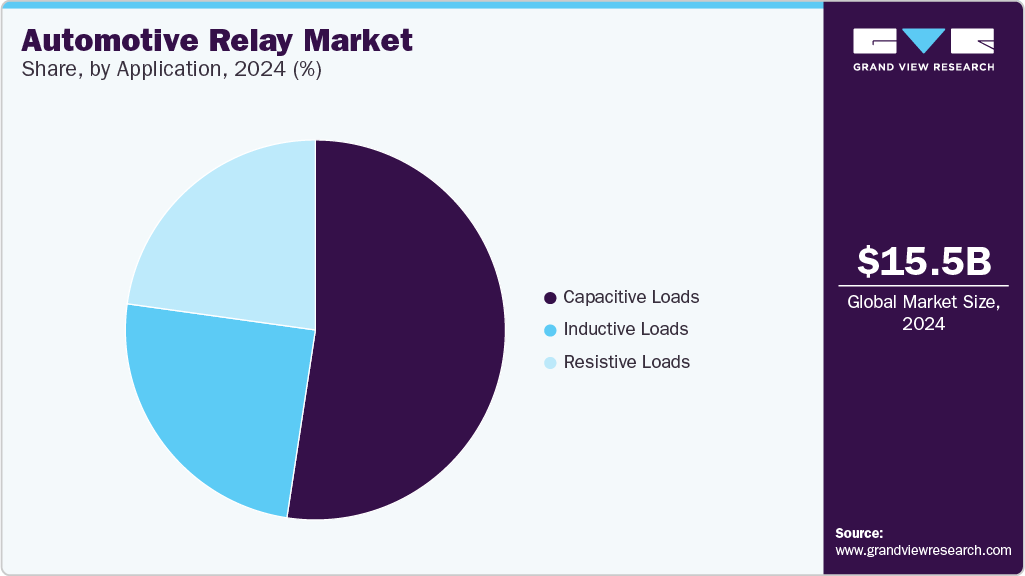

- Based on application, the capacitive loads segment accounted for the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.5 Billion

- 2030 Projected Market USD 25.0 Billion

- CAGR (2025-2030): 7.0%

- Asia Pacific: Largest market in 2024

The industry is expected to witness steady growth over the forecast period, owing to advancements in miniaturization and high contact capability development to address restrictions in mounting space in the Electric Control Unit (ECU) of vehicles.

The industry is expected to witness steady growth over the forecast period, owing to advancements in miniaturization and high contact capability development to address restrictions in mounting space in the Electric Control Unit (ECU) of vehicles.

Electric automotive parts have diversified, thereby increasing the number of relays used for switching; different features are required for each relay. Further miniaturization and high contact capability development are needed, especially in the Electric Control Unit (ECU), where there are restrictions in mounting space due to the presence of a cluster of relays. A high degree of reliability in relays is required from a safety point of view. Components equipped with features such as latching, low noise, and ultra-miniaturization have gained prominence owing to the need to provide switching technology for the latest generation of electronic functions in a car.

The average number of relays installed per vehicle is expected to increase over the forecast period due to the growing adoption of sophisticated electronic equipment and increased emphasis on safety and security. Switching supplementary devices required for safety, security, communications, and infotainment requires additional relays apart from those used in powertrain systems. Increased developments in PCB relays to decrease the overall vehicular weight for increasing fuel efficiency are expected to drive market growth over the forecast period.

With the automotive industry's transition from hardware to software-oriented vehicles, the average number of software and electronics per vehicle is rising rapidly. New features are integrated into vehicles using electronic devices with various application areas, such as safety management, powertrain, comfort, and infotainment, which employ automotive relays. This is expected to boost the demand in the market during the forecast period.

Passenger safety is another important factor in driving the adoption of automated automobile systems. Vehicle safety features have significantly reduced road accidents and fatalities over the last few decades. Also, the automotive industry is working to transform consumers' driving experience. Smarter cars capable of performing self-diagnosis are gaining popularity and are anticipated to augment the market's growth during the forecast period.

The lack of standardization and highly competitive players in relay manufacturing hinders the growth of the global market. During the operation of an automotive relay, large amounts of heat are generated, and other factors, such as durability limitations and switching noise, are expected to hamper the market growth.

The growing demand for hybrid and electric vehicles with advanced, lightweight, and high-performance relays is compelling manufacturers to invest in solid-state relays rather than traditional large electromechanical relays. Thus, this is anticipated to create an opportunity for the market to grow.

Product Insights

The PCB relay segment accounted for the largest share, 64.9%, in 2024. It's used in most electronic applications, such as ABS, cruise control, doors, power steering, power windows, and sunroof. They are used heavily in regions such as Europe and North America. However, in regions such as Asia-Oceania and RoW, Tier-1 manufacturers and OEMs still prefer plug-in versions.

Furthermore, the rising demand for electric and hybrid vehicles is driving the growth of PCB relays in the market. These eco-friendly vehicles heavily rely on electronic systems for efficient power management and control. PCB relays are vital components in electric vehicle charging systems, battery management systems, and motor control units, ensuring these vehicles' safe and reliable operation.

The high-voltage relay segment is expected to grow at the highest CAGR from 2025 to 2030. They are also estimated to increase as they have many applications in electric and hybrid vehicles. Automotive manufacturers and OEMs integrate the relays in the vehicle’s circuit based on their respective applications. They form tie-ups and alliances with service centers to ensure proper maintenance and replacement of components.

Vehicle Type Insights

The passenger vehicles segment accounted for the largest share in 2024. A positive factor responsible for the segment's growth is the increasing demand for electronic e-fuses over electromagnetic alternatives due to vehicle modernization. Furthermore, continuous advancements in automotive technology have led to the integration of sophisticated electronic features and systems in passenger vehicles. Modern passenger vehicles have numerous electronic vehicle types that require reliable and efficient power distribution.

The electric vehicles segment is expected to register a notable CAGR from 2025 to 2030. Many European countries follow incentive-based programs to promote EVs. Countries such as Germany and Austria offer tax exemptions and reductions. France and the UK offer bonus payments to EV buyers and discounts on insurance. Governments also provide lucrative offers to promote the sale and use of EVs. Tax benefits are provided at the time of purchase.

Application Insights

The capacitive loads segment accounted for the largest share in 2024. Automotive electronics consist of semiconductor devices used to do multiple functions in a car. A car's various safety and comfort systems would not have been possible without electronics. Electronic systems drive some basic applications in modern cars, requiring relays for efficient operation. These include a door lock system, power window, air conditioner, wiper, and fuel injection

The electronic applications are more in the passenger car than in the LCV segment. This is due to the increasing demand for premium cars with advanced features. Modern vehicles feature a multitude of intelligent systems that increase all safety aspects and driving comforts. Navigation systems with interactive traffic condition interfaces have become common even in mid-sized cars. Passive and active safety systems, such as airbags, belt tensioners, and antiskid brake/traction control, have increased the average number of relays per vehicle.

In high-spec cars, the value of the electric and electronic components sums up to almost a quarter of the total vehicle value. The wiring length can reach several thousand meters with as many connection systems between harnesses, ECU's and actuators. The vehicle's overall reliability is critical for switching lights, motors, heaters, and ECUs.

The resistive loads segment is expected to grow at a significant CAGR during the forecast period. Increasing emphasis on energy efficiency and sustainability in the automotive industry drives the segment growth in the market. Resistive loads, such as LED lighting and energy-efficient climate control systems, are becoming more prevalent in vehicles. As automakers strive to improve fuel efficiency and reduce environmental impact, the demand for relays in resistive load applications is expected to grow.

Regional Insights

The Asia Pacific Automotive Relay market accounted for 51.3% of the global share in 2024, The market in the Asia Pacific is experiencing significant growth, primarily due to the increasing penetration of automobiles in developing economies like China and the adoption of stringent safety standards in several Asian countries. The region, particularly China and Japan, exhibits a high growth potential driven by the rising vehicle demand. The automotive industry in Asia Pacific is witnessing an upward trend in vehicle demand, expected to drive the regional market's growth throughout the forecast period.

Growing demand for connectivity and car digitalization will favorably impact market growth over the forecast period. Further, due to space constraints, the high-growth potential across the compact car segment has also extensively driven the auto wiring harness demand. Stringent government regulations mandating certain electronic safety systems, such as the Anti-locking Braking System (ABS) and Electronic Stability Program (ESP), to reduce harmful fuel emissions offer avenues for market growth.

The China automotive relay industry held a substantial market share in 2024. The automotive Relay market in China is experiencing rapid growth, driven by the surge in vehicle production, increased electric vehicle penetration, and higher electronic content in modern vehicles. In 2023, China's total vehicle sales reached 30.1 million units, a 12% increase year-on-year, according to the China Association of Automobile Manufacturers (CAAM). This included 26.063 million passenger cars, supporting demand for relays in systems such as engine management, lighting, and power accessories. Government policies supporting New Energy Vehicle (NEV) expansion, coupled with rising investments in EV manufacturing, have significantly increased the adoption of high-voltage relays. Additionally, the growing consumer preference for technologically advanced vehicles is encouraging automakers to deploy more relay-driven electronic modules across both comfort and safety functions.

The Japan automotive relay market held a significant share in 2024. In Japan, the automotive relay market is influenced by the strong domestic automotive manufacturing, a high concentration of relay component suppliers, and advancements in hybrid vehicle technology. Japan is home to several globally recognized automakers and Tier 1 suppliers that maintain high relay demand for use in precision-controlled systems. The country also hosts major relay manufacturers with integrated R&D and production capabilities, enabling fast innovation and tailored product development. Moreover, Japan's continued leadership in hybrid vehicle adoption, supported by consistent consumer demand and government incentives, is driving the need for compact and durable relays optimized for high-frequency switching and thermal efficiency in hybrid powertrains.

Europe Automotive Relay Market Trends

The Europe automotive relay industry was identified as a lucrative region in 2024. The European automotive relay market is witnessing significant transformation, driven by the region's shift toward electric mobility, stringent vehicle safety regulations, and growing investments in advanced automotive electronics. According to the ACEA, the European Union's vehicle fleet includes 252.2 million cars and 37.4 million commercial vehicles and buses, underscoring a vast installed base that continues to drive demand for replacement and upgraded relay components. The EU's Fit for 55 and Euro 7 emission standards are accelerating the deployment of energy-efficient electrical architectures, increasing the use of relays in systems such as battery management and thermal control. Additionally, OEMs in countries including Germany and France are expanding production of EVs and connected vehicles, creating strong demand for high-voltage and PCB relays used in ADAS, infotainment, and smart power distribution units.

The German automotive relay market is being shaped by increasing deployment of battery electric vehicles (BEVs), evolving emissions regulations, and growing demand for relay integration in thermal and battery systems. According to the Federal Motor Transport Authority (KBA), Germany had 1.65 million BEVs registered by January 2025. While EV sales dipped following the termination of the government’s subsidy program in 2023, automakers are still under pressure to meet EU CO₂ reduction goals through expanded zero- and low-emission vehicle (ZLEV) offerings. This transition is supporting demand for high-voltage and thermally stable relays used in battery packs, traction inverters, and auxiliary systems, including HVAC and cooling fans. Additionally, the ongoing rollout of EV-dedicated production lines across major OEMs in Germany is fueling localized relay sourcing and innovation.

The UK automotive relay market is being influenced by the country’s transition timeline toward zero-emission vehicles (ZEVs), sustained hybrid vehicle demand, and regulatory certainty post-2030. With the UK government confirming that full and plug-in hybrid models can continue to be sold until 2035, relay demand is being sustained in combustion-hybrid drivetrains that use relays for power control, engine start-stop, and regenerative braking systems. The upcoming shift to ZEV-only sales is also prompting component suppliers and OEMs to localize production of high-efficiency relay systems suitable for EV platforms. Additionally, the government’s investment in localized EV supply chains is expected to drive further demand for relays used in battery packs, DC-DC converters, and electric drivetrain modules.

North America Automotive Relay Market Trends

The North America automotive relay industry was identified as a lucrative region in 2024. The automotive relay market in North America is being driven by growing adoption of EV platforms by U.S.-based OEMs, increasing demand for advanced driver-assistance systems, and the regional push for onshoring key electronic components. Automakers are ramping up relay usage in safety systems, battery control units, and energy management modules to meet both consumer expectations and regulatory safety requirements. In Canada, the automotive relay market is influenced by a rising number of electric vehicle assembly projects, supported by federal incentives and the country's Zero-Emission Vehicle Infrastructure Program (ZEVIP), which is accelerating the deployment of EV-ready relay systems in new models.

The Mexico automotive relay market is benefiting from strong vehicle export volumes and the continued expansion of Tier 1 and Tier 2 supplier operations. According to the U.S. International Trade Administration, Mexico ranks as the world’s seventh-largest producer of passenger vehicles and fifth-largest for heavy-duty cargo vehicles, making it a key production hub for relay-equipped systems such as engine modules, lighting, and power electronics.

U.S. Automotive Relay Market Trends

The U.S. automotive relay market held a dominant position in 2024. The automotive relay market in the U.S. is witnessing significant transformation, driven by rising premium EV adoption, expanding domestic EV manufacturing, and the electrification of luxury vehicle fleets. According to the International Energy Agency, new electric car registrations in the U.S. reached 1.4 million in 2023, marking a growth of over 40% from 2022. This surge is particularly pronounced in the luxury segment, where BEVs accounted for 35.8% of light-duty vehicle sales in Q3 2024, and luxury BEVs made up over 70% of total BEV sales, according to the U.S. Energy Information Administration. This shift is increasing the demand for high-performance relays used in battery disconnect units, infotainment systems, and zonal control modules.

Key Automotive Relay Company Insights

Some of the key players operating in the market include DENSO Corporation, Fujitsu Limited, Panasonic Corporation, TE Connectivity Ltd., and Robert Bosch GmbH.

-

Founded in 1949 and headquartered in Aichi, Japan, DENSO Corporation is a global leader in automotive components and systems. The company is a major supplier of automotive relays, offering a wide range of products including PCB relays, plug-in relays, and high-voltage relays for internal combustion engine vehicles and electric vehicles. DENSO’s relays are used in critical applications such as engine control, HVAC systems, power windows, and advanced driver assistance systems (ADAS). The company operates manufacturing and R&D facilities worldwide and emphasizes innovation in vehicle electrification, automation, and thermal systems.

-

Founded in 1935 and headquartered in Tokyo, Japan, Fujitsu Limited is a global information and communication technology company that also plays a significant role in the automotive electronics sector. The company manufactures a wide range of automotive relays, including compact and high-current PCB relays suitable for EVs, hybrid vehicles, and conventional cars. Fujitsu’s relay products are widely used in engine management systems, safety modules, and power control units. With a strong focus on miniaturization and energy efficiency, Fujitsu integrates its relay manufacturing with advanced semiconductor and circuit design capabilities across its global production network.

Key Automotive Relay: Companies:

The following are the leading companies in the automotive relay market. These companies collectively hold the largest market share and dictate industry trends.

- DENSO Corporation

- Fujitsu Limited

- Panasonic Corporation

- TE Connectivity Ltd.

- Robert Bosch GmbH

- Omron Corporation

- Hongfa Technology Co., Ltd.

- Eaton Corporation plc

- HELLA GmbH & Co. KGaA

- Littelfuse, Inc.

Recent Developments

-

In April 2025, OMRON launched the G9EK high-voltage DC relay, tailored for EVs, DC power systems, and compact battery platforms. Its bidirectional switching, low contact resistance, and space-efficient design align with growing electrification and carbon neutrality goals.

-

In August 2024, Toshiba released the TLX9152M automotive photorelay with a 900V withstand voltage, designed for 400V EV battery systems. It supports critical BMS functions like voltage monitoring and fault detection, offering a compact, high-insulation alternative to mechanical relays in high-voltage applications.

-

In April 2023, Fujitsu Limited introduced the FTR-G3 relay, an innovative plastic-sealed relay designed specifically for compact spaces, particularly in automotive applications with limited space. Despite its small size, the FTR-G3 relay can handle high currents of up to 30A, making it highly suitable for Junction boxes and body control units.

-

In March 2023, Panasonic Industry Europe GmbH launched its latest relay, the HE-R, which has undergone extensive testing for enhanced short-circuit performance. This relay is designed to provide a reliable and safe solution for electric vehicle (EV) charging industry customers. The HE-R relay has successfully passed the rigorous IEC62955 test, which involves a demanding 10kA short circuit assessment. Furthermore, the smaller HE-S relay complies with the IEC62955 standard for 3kA short circuits.

-

In February 2023, ABB launched the Relay Retrofit Program, which aims to replace specific SPACOM protection relays with advanced REX610 protection and control technology. The all-in-one REX610 relay is specifically designed to accommodate the changing requirements of modern power grids, making it a versatile, environmentally friendly, and future-ready option. The Retrofit Program enables customers to schedule and implement their retrofit projects in stages, ensuring prompt replacement while minimizing disruptions to production or power distribution operations.

-

In May 2022, Texas Instruments launched a new range of solid-state relays to enhance the safety of electric vehicles (EVs). This portfolio includes isolated drivers and switches that meet automotive standards, ensuring exceptional reliability. Furthermore, these isolated solid-state relays offer the smallest solution size available in the market, effectively reducing the cost of bill-of-materials (BOM) and powertrain expenses for 800-V battery-management systems.

-

In January 2022, Toshiba Electronics Europe GmbH (TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION) launched a novel photo relay designed for various applications in battery-powered and hybrid-electric vehicles. TLX9160T is a normally open (NO) 1-Form-A relay specifically developed for battery management systems (BMS), ground fault detection, and identification of faults with mechanical relays. The TLX9160T can also operate from a supply voltage (VDD) of up to 1000V, making it compatible with most traction batteries commonly used in the industry.

Automotive Relay Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.7 billion

Revenue Forecast in 2030

USD 25.0 billion

Growth rate

CAGR of 7.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments Covered

Product, vehicle type, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

DENSO Corporation; Fujitsu Limited; Panasonic Corporation; TE Connectivity Ltd.; Robert Bosch GmbH; Omron Corporation; Hongfa Technology Co., Ltd.; Eaton Corporation plc; HELLA GmbH & Co. KGaA; Littelfuse, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Relay Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Automotive Relay market report based on product, vehicle type, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

PCB Relay

-

Plug-in Relay

-

High Voltage Relay

-

Other Products

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicles

-

Commercial Vehicles

-

Electric Vehicles

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Resistive Loads

-

HVAC

-

-

Capacitive Loads

-

Engine Management Module

-

Fog Lights

-

ABS Module

-

Front and Rear Beam

-

-

Inductive Loads

-

Power Window

-

Central Lock

-

Cooling Fan

-

Clutches

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive relay market size was estimated at USD 15.5 billion in 2024 and is expected to reach USD 16.7 billion in 2025.

b. The global automotive relay market is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2030 to reach USD 25.0 billion by 2030.

b. Asia Pacific dominated the automotive relay market with a share of 51.3% in 2024. This is attributable to rising healthcare awareness coupled with cloud-based technologies acceptance and constant research and development initiatives.

b. Some key players operating in the automotive relay market include TDENSO Corporation, Fujitsu Limited, Panasonic Corporation, TE Connectivity Ltd., Robert Bosch GmbH, Omron Corporation, Hongfa Technology Co., Ltd., Eaton Corporation plc, HELLA GmbH & Co. KGaA, Littelfuse, Inc.

b. Key factors that are driving the market growth include increasing demand for electric vehicles, rising adoption of advanced safety and automation features, and growing need for reliable electrical systems in modern vehicles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.