- Home

- »

- Automotive & Transportation

- »

-

Automotive Semiconductor Market Size, Share Report, 2030GVR Report cover

![Automotive Semiconductor Market Size, Share & Trends Report]()

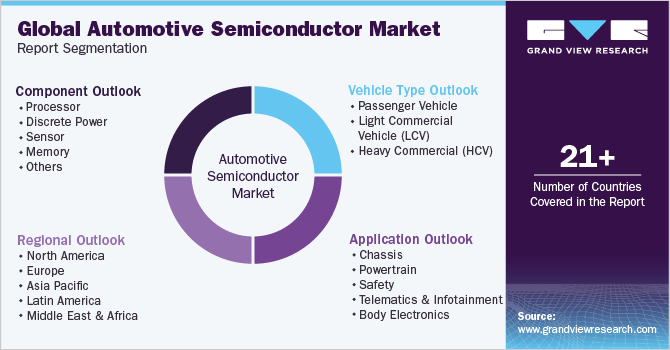

Automotive Semiconductor Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Processor, Sensor), By Vehicle Type (Passenger Vehicle, LCV, HCV), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-360-7

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Semiconductor Market Summary

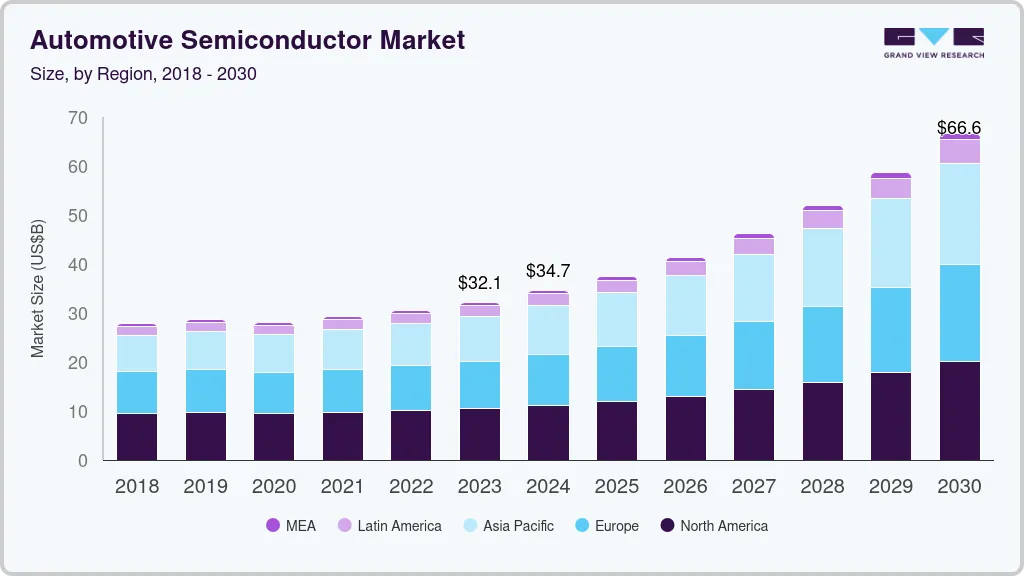

The global automotive semiconductor market size was estimated at USD 32,143.6 million in 2023 and is projected to reach USD 66,563.5 million by 2030, growing at a CAGR of 11.0% from 2024 to 2030. Increasing penetration of electronic components in luxury to mass-produced cars, increasing adoption of electronic control unit (ECU) in modern vehicles, and growing focus on safety systems in vehicles is expected to lead to steady growth of the market over the next few years.

Key Market Trends & Insights

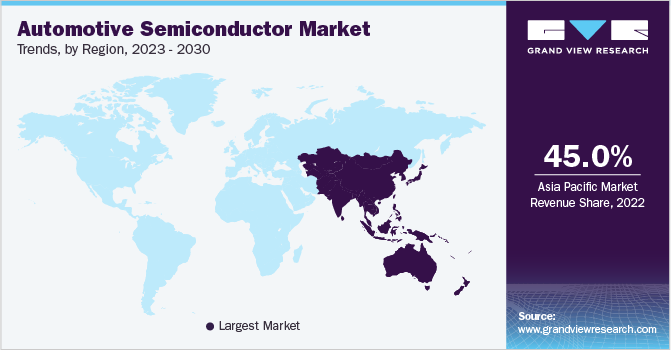

- The Asia Pacific region accounted for a market share of more than 45% of the global market in 2022 is expected to grow at a CAGR of 9.6% from 2023 to 2030.

- Europe is projected to expand at the second highest CAGR of over 7.2% over the forecast period.

- By component, the discrete power segment accounted for the largest share of more than 28%.

- By vehicle type, the passenger vehicles segment accounted for the largest market share of more than 66% of the global market in 2022.

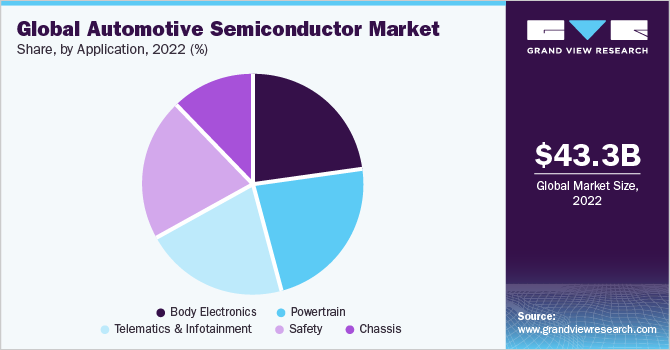

- By application, the body electronics segment accounted for the largest market share of more than 23% of the global market in 2022.

Market Size & Forecast

- 2023 Market Size: USD 32,143.6 Million

- 2030 Projected Market Size: USD 66,563.5 Million

- CAGR (2024-2030): 11.0%

- Asia Pacific: Largest market in 2022

The other factors contributing to the growth of the market include the proliferation of connected cars, infotainment systems, automotive safety systems, and fuel efficiency standards. The growing demand for electric and hybrid vehicles presents a significant opportunity for the automotive semiconductor market. These vehicles require semiconductors for devices such as ADAS and ECUs to manage the battery, motor, and other components, which creates a demand for sophisticated and specialized semiconductors in the automotive semiconductor market. These developments in the market are likely to impact the supply chain, aftermarket, and manufacturers of semiconductor electronic components. As a result, conventional diagnostic systems may be replaced by onboard diagnostic systems to enable the continuous monitoring of the condition of a vehicle's mechanical and electrical components.

As per a report published by the autonomous intergovernmental organization, International Energy Agency (IEA), EVs play an integral role in curbing carbon emissions. Moreover, the adoption of electric vehicles grew by 13% globally in 2022 compared to 2020. Three key trends - namely autonomy, electrification, and connected mobility - are expected to emerge as major revenue drivers for the global automotive semiconductor market. These trends play a pivotal role in driving the demand for electronic components in a car, subsequently driving the demand for semiconductors in the automotive space.

According to the World Health Organization, approximately there were 1.24 million casualities of individuals as a result of road traffic crashes each year. This has triggered an increased focus on the prevention of accidents through the implementation of active safety measures. As a result, active safety features are increasingly being integrated into vehicles to help avoid collisions and accidents. Amongst the vehicle safety provisions, crash avoidance technology, including automatic emergency braking systems, automatics driver assistance system (ADAS), for passenger vehicles, is set to remain a standard feature for majority of the new vehicles produced from 2022 to 2023. These technologies such as ADAS, emergency braking system among others uses sensors for monitoring changes in vehicle behaviour, and the semiconductor is a part of the senors. Thus, with the rise in the adoption of vehicle safety systems, the market for automotive semiconductors is expected to grow significantly over the forecast period.

The Russia-Ukraine war has had some impact on the automotive semiconductor production, but it is not a direct cause-and-effect relationship. The automotive semiconductor industry has been facing a shortage of semiconductors globally due to several factors, including the COVID-19 pandemic and disruptions in the semiconductor supply chain. The Russia-Ukraine conflict has added to these disruptions in the global supply chain, which has affected the automotive semiconductor production. The Minister of State for Electronics and Information Technology in the Government of India stated that Ukraine and Russia are major sources of Neon and Hexafluorobutadiene gases, moreover, the impact of the war is expected affect supply chains of semiconductors. These gases are an essential element for producing semiconductor chips as they are utilized for chip production in lithography process.

Component Insights

The discrete power segment accounted for the largest share of more than 28% of the global automotive semiconductor market and is expected to grow at a CAGR of 10.9% over the forecast period of 2023 to 2030. Based on component, the market for automotive semiconductor is segmented into processor, discrete power, sensor, memory, and others. These components help enhance vehicle electrification, connectivity, and shared mobility services. Several key players are taking strategic initiatives to launch new products in the market to expand their market in discrete power.

For instance, in April 2022, Magnachip announced the launch of a 40V Metal-Oxide-Semiconductor Field-Effect Transistor (MOSFET) for controlling Brushless Direct Current (BLDC) motors in automotive applications. The newly released 40V MOSFET is fully AEC-Q101 (Automotive Electronics Council-Q101) certified, as reliable automotive semiconductors are crucial to vehicle safety. The memory devices segment is projected to emerge as the second-fastest growing component segment. This growth can be mainly attributed to the ongoing electrification of the major applications of automobiles such as powertrain, which is creating more demand for power components such as IGBT and MOSFET. The need for better safety and advanced features in vehicles is creating the need for more memory devices per vehicle to program various control systems into an autonomous system.

Vehicle Type Insights

The passenger vehicles segment accounted for the largest market share of more than 66% of the global market in 2022 and is expected to account for the largest market share throughout the forecast period of 2023 to 2030. This growth can be attributed to the high demand for passenger cars across the globe. Moreover, increasing installation of automotive infotainment systems in passenger cars for hands-free phone connectivity and providing navigational services, climate control, voice control, parking assistance, two-way communication tools, and access to the internet is further stimulating the segment growth.

The light commercial vehicle segment is expected to expand at a CAGR of 6.5% over the forecast period, providing a huge scope to the global market growth. Several governments are implementing various incentive schemes and programs to encourage semiconductor manufacturing, which is expected to boost the growth of the automotive semiconductor market. For instance, in July 2022, the U.S. government passed the CHIPS Act to boost national semiconductor manufacturing, development, and research, strengthen financial stability and national security, and enhance America's chip supply networks.

Application Insights

The body electronics segment accounted for the largest market share of more than 23% of the global market in 2022 and is expected to expand at a CAGR of 9.1% from 2023 to 2030. With the growing demand for comfort and convenience features, such as power windows, electric seats, and climate control systems, automakers are incorporating more body electronics in their vehicles. Numerous key players in the market are taking initiatives to strengthen their operation in this segment. For instance, in July 2022, Indian automotive manufacturing company Mahindra & Mahindra Limited collaborated with semiconductor manufacturer Qualcomm for improving Mahindra’s vehicles embedded electronics. Furthermore, the collaboration is expected to provide new features for Snapdragon Cockpit platform in Scorpio N, advanced wireless technologies and several others.

The telematics & infotainment segment is expected to witness the highest CAGR in the automotive semiconductor market over the forecast period of 2023 to 2030. The growth can be attributed to the adoption of connected cars, autonomous, and semi-autonomous vehicles, telematics and infotainment systems play a crucial role in enhancing the driving experience by providing real-time information, entertainment options, and connectivity with external networks. Furthermore, the adoption of electric vehicles and development of autonomous driving technologies such as advanced driver assistance systems (ADAS) which requires semiconductor for power management, battery monitoring, and control systems is expected to propel the growth of telematics & infotainment segment in the automotive semiconductor market.

The telematics & infotainment segment is expected to witness the highest CAGR in the automotive semiconductor market over the forecast period of 2023 to 2030. The growth can be attributed to the adoption of connected cars, autonomous, and semi-autonomous vehicles, telematics and infotainment systems play a crucial role in enhancing the driving experience by providing real-time information, entertainment options, and connectivity with external networks. Furthermore, the adoption of electric vehicles and development of autonomous driving technologies such as advanced driver assistance systems (ADAS) which requires semiconductor for power management, battery monitoring, and control systems is expected to propel the growth of telematics & infotainment segment in the automotive semiconductor market.Regional Insights

The Asia Pacific region accounted for a market share of more than 45% of the global market in 2022 is expected to grow at a CAGR of 9.6% from 2023 to 2030. This attributed to the growth of the automotive industry, especially in emerging economies such as India, China, and Japan. In Asia Pacific, China led the market in 2022 and is expected to continue to dominate throughout the forecast period. Moreover, the growing e-commerce industry in the region is anticipated to surge the demand for commercial vehicles in the coming years in the market as the manufacturing of commercial vehicles would require the usage of automotive semiconductors.

Europe is projected to expand at the second highest CAGR of over 7.2% over the forecast period. The introduction of numerous automotive semiconductor-producing facilities in Germany is contributing to the country’s high production capacity, leading to the development of new technologies, further investments, and new job opportunities in the automotive semiconductor industry. This is expected to bode well for the growth of the automotive semiconductors market in the country. For instance, in February 2023, semiconductor manufacturer Infineon Technologies AG announced its plan to construct a USD 5.35 million factory for the production of semiconductors in Germany.

Key Companies & Market Share Insights

The market is moderately consolidated, with the presence of several global as well as regional players. The players in the market are focusing on product launch to expand product offerings and meet consumer demands. For instance, in February 2023, the most recent addition to NXP Semiconductors increased the production of S32R41 high-performance radar processors. Furthermore, these processors were designed specifically to meet the increased processing demands of L2+ autonomous driving and advanced driver assistance system (ADAS) solutions. The high-performance S32R41 plays a key role in developing high-resolution corner and front-facing long-range radars.

The key players in the market also focus on acquisition to expand product offerings and presence across the untapped market. For instance, in March 2023, Renesas Electronics Corporation, a provider of semiconductor solutions, enhanced its RISC-V portfolio by introducing the initial RISC-V MCU engineered for voice-controlled human-machine interface systems. This new 32-bit ASSP, called R9A06G150, has been developed in collaboration with RISC-V ecosystem partners and offers a fully operational, cost-effective voice-control system solution that eliminates the necessity for RISC-V tools and prior software investment. Some prominent players in the global automotive semiconductor market include:

-

Analog Devices, Inc.

-

Infineon Technologies AG

-

NXP Semiconductors

-

Renesas Electronics Corporation

-

Robert Bosch GmbH

-

ROHM CO., LTD.

-

Semiconductor Components Industries, LLC

-

STMicroelectronics

-

Texas Instruments Incorporated

-

TOSHIBA CORPORATION

Automotive Semiconductor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 34,650.8 million

Revenue forecast in 2030

USD 66,563.5 million

Growth Rate

CAGR of 11.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

June 2023

Quantitative Units

Revenue in USD million and CAGR from 2024 to 2030

Report updated

June 2023

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; China; India; France; Italy; Spain; Japan; Brazil; Mexico; United Arab Emirates (UAE); Saudi Arabia; South Africa

Segments Covered

Component, vehicle type, application, region

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Key Companies Profiled

Analog Devices, Inc., Infineon Technologies AG, NXP Semiconductors, Renesas Electronics Corporation, Robert Bosch GmbH, ROHM CO., LTD., Semiconductor Components Industries, LLC, STMicroelectronics, Texas Instruments Incorporated, TOSHIBA CORPORATION

15% free customization scope (equivalent to 5 analysts working days)

If you need specific market information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Semiconductor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive semiconductor market report by component, vehicle type, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Processor

-

Discrete Power

-

Sensor

-

Memory

-

Others

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicle

-

Light Commercial Vehicle (LCV)

-

Heavy Commercial (HCV)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chassis

-

Powertrain

-

Safety

-

Telematics & Infotainment

-

Body Electronics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive semiconductor market size was estimated at USD 43.26 billion in 2022 and is expected to reach USD 44.94 billion in 2023.

b. The global automotive semiconductor market is expected to grow at a compound annual growth rate of 8.1% from 2023 to 2030 to reach USD 77.76 billion by 2030.

b. The Asia Pacific dominated the automotive semiconductor market with a share of more than 45.0% in 2022. This is attributable to the rising growth of the automotive industry, especially in emerging economies such as India, China, and Japan.

b. Some key players operating in the automotive semiconductor market include Analog Devices, Inc., Infineon Technologies AG, NXP Semiconductors, Renesas Electronics Corporation, Robert Bosch GmbH, and Texas Instruments Incorporated.

b. Key factors that are driving the automotive semiconductor market growth include a significant increase in the adoption of Engine Control Units (ECU) in modern automobiles and the proliferation of connected cars, infotainment systems, automotive safety systems, and fuel efficiency standards, among others, will also bode well for future growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.