- Home

- »

- Plastics, Polymers & Resins

- »

-

Automotive Tinting Film Market Size & Share Report, 2030GVR Report cover

![Automotive Tinting Film Market Size, Share & Trends Report]()

Automotive Tinting Film Market Size, Share & Trends Analysis Report By Application (Windows, Windshields), By Product (Passenger Cars, LCVs, HCVs), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-018-7

- Number of Report Pages: 164

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Automotive Tinting Film Market Size & Trends

The global automotive tinting film market size was estimated at USD 3.62 billion in 2023 and is expected to grow at a CAGR of 5.2% from 2024 to 2030. The market is expected to be driven by the growth of the global automotive industry, especially in the developing nations of Asia Pacific, Central America, and South America. Consumers' desire to protect expensive luxury car interiors and personal safety from harmful sun rays are expected to drive the market over the forecast period. The demand for passenger cars in developing countries has increased due to rising disposable income, a growing working population, and rapid urbanization.

The growing automotive industry due to the rising demand globally as well as the increasing rate of adoption of electric vehicles is propelling the demand for automotive tinting films. According to the International Organization of Motor Vehicle Manufacturers, global production of cars reached 67.13 million in 2023 from 61.60 million in 2022. This increase can be attributed to rising disposable incomes, a growing working population, and rapid urbanization. As more people move to urban areas and earn higher wages, they are more likely to purchase vehicles, further boosting the market for automotive tinting films.

One key factor fueling this demand is consumers' desire to protect the interiors of their expensive luxury cars. Tinting films offer protection against harmful sun rays, which can damage upholstery and other interior components over time. Additionally, these films enhance personal safety by reducing glare and blocking UV rays, making driving more comfortable and safer.

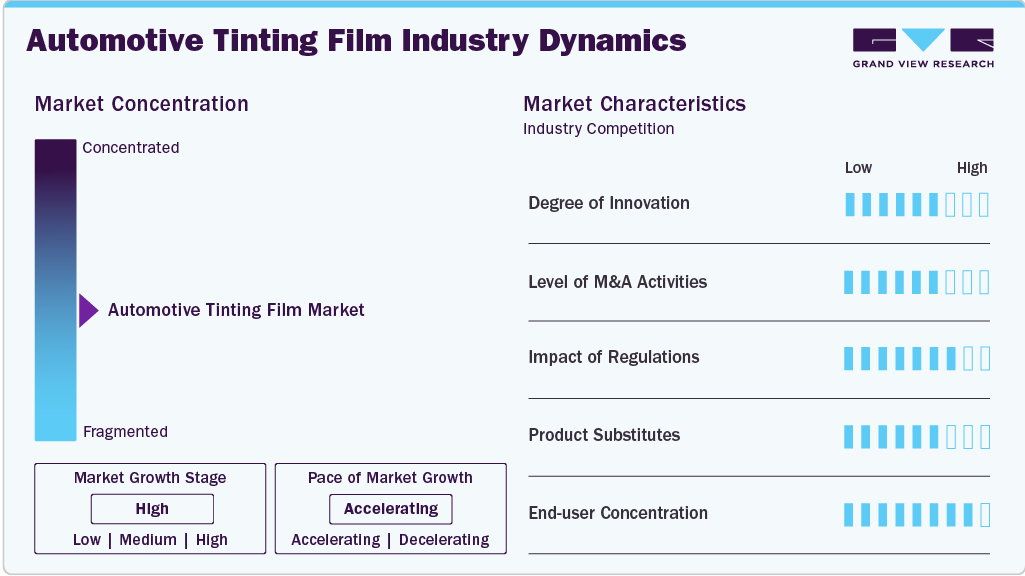

Market Concentration & Characteristics

The automotive tinting film market is consolidated in nature with the presence of key industry players such as 3M, Eastman Chemical Company, TintFit Window Filmas Ltd., Johnson Window Films, Inc., and Madico, Inc., which dominate a significant market share. These companies often engage in aggressive marketing strategies, research and development initiatives, and mergers and acquisitions to strengthen their market position and expand their product offerings.

The market is characterized by a slightly high degree of innovation. Technological advancements such as the introduction of bio-based polyester films, combined with rising consumer purchasing power, are expected to drive vehicle type growth. Companies are driving innovation in automotive tinting films to compete with other market players and strengthen their positions.

For instance, in April 2024, Hyundai Motor Company launched an innovative vehicle window tint film named Nano Cooling Film that improves interior cooling performance significantly compared to conventional tint films. The Nano Cooling Film uses a nanostructure design to maximize heat dissipation, making it more effective in hot and dry climates. Tests show it can reduce interior temperatures by up to 12.33°C compared to an untinted vehicle. Hyundai launched a "Made Cooler By Hyundai" campaign in Lahore, Pakistan, and applied the film to 70 customer vehicles to demonstrate its effectiveness. Unlike dark tints that compromise visibility, Nano Cooling Film maintains high transparency while reflecting incoming heat and radiating internal heat outwards. It can also be used in combination with conventional tints for enhanced cooling effects.

The regulations governing tinted windows in various countries are anticipated to have a detrimental effect on market growth within those nations. Certain countries, such as the United States, provide exemptions in cases where passengers or drivers suffer from specific medical conditions such as sunlight allergies, lupus, photosensitivity, or melanoma. In India, the utilization of tinted glass on vehicles is strictly controlled. In 2012, the Supreme Court instituted a comprehensive prohibition on all types of tint films due to safety concerns. However, in 2023, the ban was partially relaxed, permitting 50% visibility tints provided they are from the original manufacturer.

Product Insights

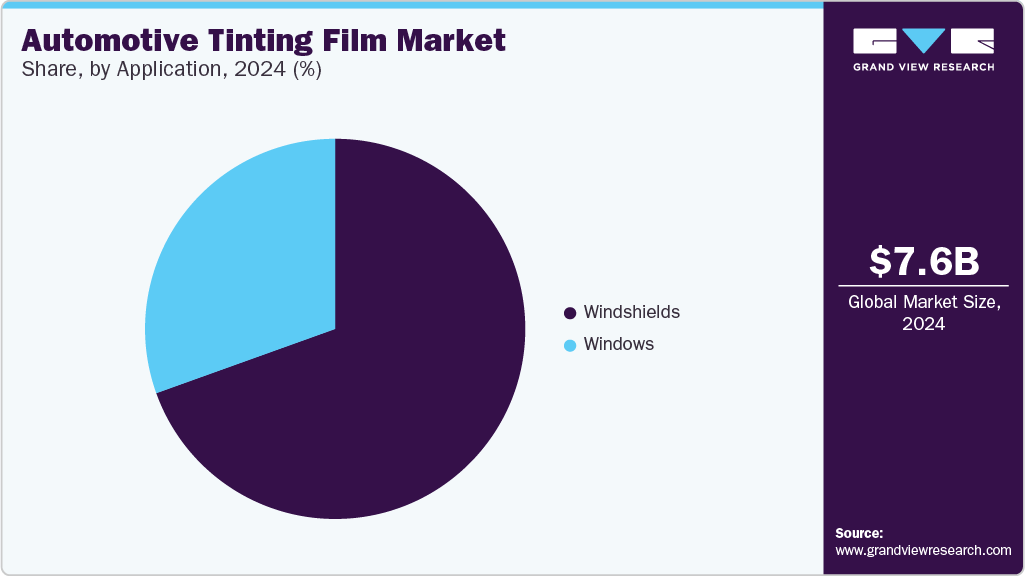

Based on product, the windshield segment held the largest share of about 70.0% of revenue in 2023. Tinting films protect passengers from the heat of the sun and UV rays. The vehicle type reduces glare and ensures the clear vision and safety of the vehicle driver. Most automobile manufacturers use tinting films to provide the best driving experience, protection and avoid glare.

Since, light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs) were primarily designed to transport goods from one place to another, the drivers of these vehicles cover long distances at the same time. Harmful sunlight entering the vehicle through the windshield can cause driving discomfort and make long drives difficult. The vehicle type helps reduce this effect and makes driving comfortable.

The Windows application segment is expected to experience significant growth over the forecast period. These tinting films are used to protect against harmful UV rays. Growing demand for a vehicle type to reduce vehicle interior temperatures, protect interiors from UV rays, and provide a comfortable driving experience for passengers is expected to drive demand over the forecast period.

Application Insights

Based on application, the market has been categorized as passenger cars, heavy commercial vehicles (HCV), and light commercial vehicles (LCV). In terms of revenue, passenger cars emerged as the largest segment in 2023.

With a huge improvement in transportation and trade around the world, especially in the Asia-Pacific region, the demand for light commercial vehicles is expected to rise during the forecast period. Window tint films are applied to the windshields of light commercial vehicles to reduce glare and block UV rays as drivers carrying goods spend more time behind the wheel of these vehicles and are exposed to harmful sunlight.

Tinting films are applied to passenger car windows and windscreens to protect passengers from harmful UV rays and vehicle interiors from harmful sunlight. The tinting films reduce heat and glare while also protecting against UV rays.

Due to rising disposable income and changing lifestyles, sales of passenger cars and light commercial vehicles worldwide are expected to increase during the forecast period, which in turn is anticipated to drive overall demand for the segment.

Regional Insights

North America region dominated the Automotive Tinting Film Market and accounted for the largest revenue share of more than 30.0% revenue share in 2023, due to growing demand for light commercial and passenger vehicles in the US. The market is also expected to grow due to minimum regulations regarding visible light transmission (VLT) percentage of tint films.

U.S. Automotive Tinting Film Market Trends

U.S. Automotive Tinting Film Market dominated the North America region in terms of revenue with a share of 82.7% in 2023. This can be attributed to the well-established road infrastructure and higher income per capita leading to an increased demand for automobile in the country. Moreover, a growing emphasis on vehicle customization and personalization among American consumers, with tinting films offering a practical and stylish way to enhance the appearance of vehicles while providing functional benefits such as UV protection and heat reduction.

Canada Automotive Tinting Film Market Trends

The Automotive Tinting Film Market in Canada is witnessing robust growth driven by stringent regulations on UV protection and increasing consumer awareness of skin health. Government regulations mandating effective UV protection in vehicles have spurred demand for advanced tinting films that offer high levels of UV ray blockage, ensuring compliance and enhancing driver and passenger safety.

Europe Automotive Tinting Film Market Trends

The European market is anticipated to grow at a moderate pace during the forecast period. The European Union's strict regulations on vehicle safety and energy efficiency push manufacturers to use tinting films that meet these high standards, ensuring compliance and enhancing vehicle performance. In addition, there is a growing focus on environmental sustainability, leading to increased adoption of tinting films that improve energy efficiency by reducing the need for air conditioning, which in turn lowers carbon emissions. These combined efforts to adhere to regulations and promote eco-friendly practices significantly boost the demand for automotive tinting films in Europe.

Automotive Tinting Film Market in Germany dominated the region in 2023. It is propelled by its strong and innovative automotive industry, known for its focus on premium vehicles. This robust sector continuously seeks advanced tinting solutions that enhance vehicle performance and aesthetics. The ongoing technological advancements in the industry, such as smart and adaptive tinting films, are driving market growth as manufacturers and consumers alike look for cutting-edge features that offer improved comfort, energy efficiency, and UV protection.

UK Automotive Tinting Film Market is growing over the forecast period. The growing popularity of electric vehicles (EVs) in UK significantly boosts the demand for energy-efficient automotive tinting films. Since EVs rely on battery power, maintaining energy efficiency is crucial to maximize their driving range. Tinting films help reduce the load on air conditioning systems by blocking heat from the sun, thus conserving battery power. As more consumers and manufacturers focus on energy efficiency and sustainability, the adoption of tinting films that enhance energy savings becomes increasingly important, driving the market for these specialized films in the electric vehicle sector.

Asia Pacific Automotive Tinting Film Trends

During the forecast period, Asia-Pacific is expected to see rapid growth for these films. The vehicle type is becoming increasingly popular in emerging markets for privacy and security reasons. Another factor that is expected to have a positive impact on the Asia-Pacific market is the increasing demand for the vehicle type from OEMs.

Automotive Tinting Film Market in China held the largest share in the Asia Pacific region in 2023. The country’s market is rapidly growing due to its booming automotive industry, which sees a high demand for vehicles. This surge in vehicle production and ownership increases the need for tinting films that offer UV protection, heat reduction, and enhanced privacy. Additionally, government initiatives aimed at reducing vehicle emissions and improving energy efficiency are promoting the use of tinting films. These policies encourage manufacturers and consumers to adopt tinting solutions that help lower energy consumption by reducing the need for air conditioning, aligning with China's broader goals of environmental sustainability and energy conservation.

Japan Automotive Tinting Film Market is poised to grow notably from 2024 to 2030, driven primarily by its status as a major vehicle manufacturer with significant domestic and international demand. The country's renowned automotive industry not only fuels the need for tinting films domestically but also supports export requirements, where high-quality products are essential to meet global standards. This demand is further amplified by consumer preferences for top-notch automotive solutions that prioritize durability, UV protection, and aesthetic enhancement.

Central & South America Automotive Tinting Film Trends

In Central and South America, the automotive tinting film market is experiencing significant growth driven by several key factors. The region's hot and sunny climates demand tinting films that provide adequate UV protection and heat reduction, enhancing driving comfort and protecting vehicle interiors from sun damage. As the middle-class population expands across countries like Brazil and Argentina, there is a notable rise in disposable incomes and a corresponding increase in vehicle ownership. This demographic shift fuels the adoption of automotive tinting films as consumers seek to enhance both the aesthetic appeal and practical functionality of their vehicles.

Middle East & Africa Automotive Tinting Film Trends

In the Middle East and Africa, the automotive tinting film market is thriving due to the region's extreme climate, characterized by scorching heat and intense sunlight that underscores the necessity for tinting films that effectively reduce heat inside vehicles. The region boasts a strong market for luxury and premium vehicles, where consumers prioritize both style and functionality. This preference drives the demand for high-quality tinting films that offer superior UV protection, privacy, and aesthetic appeal.

Key Automotive Tinting Film Company Insights

Key companies are adopting several organic and inorganic expansion strategies, such as mergers & acquisitions, new product launches, capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In August 2023, Solar Art, a window film company, announced the acquisition of Layr, a New York-based tinting film company. Layr's customer base includes mainly commercial clients such as office buildings, schools, and high-end retailers. This acquisition expands Solar Art's East Coast presence and adds additional New York market infrastructure.

-

In November 2021, Solar Control Films Inc. launched its newest nano ceramic structured window tinting film, the Ceramic Xtreme Plus 70. The film offers 70% visible light transmission (VLT), 92% infrared (IR), 51% heat, and 99% UV rejection.

-

In January 2020, Solar Gard, one of the global player in window tinting technology, launched a new paint protection brand in China with a brand name of ShengJia, and their crucial Asian automobile marketing collaboration. The collaboration is expected to strengthen the company's position in the Asian automotive industry.

Key Automotive Tinting Film Companies:

The following are the leading companies in the automotive tinting film market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Eastman Chemical Company

- TintFit Window Films Ltd.

- Avery Dennison Israel Ltd. (Hanita Coatings RCA Ltd.)

- Johnson Window Films, Inc.

- GLOBAL WINDOW FILMS

- Madico, Inc.

- Saint-Gobain Performance Plastics Corporation

- TWF

- Armolan

- NEXFIL

- Solar Screen International SA

- Huper Optik USA

Automotive Tinting Film Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.81 billion

Revenue forecast in 2030

USD 5.15 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Base Year

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in square foot, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; Russia; China; India; Japan; Thailand; Indonesia

Key companies profiled

3M, Eastman Chemical Company, TintFit Window Films Ltd., Avery Dennison Israel Ltd. (Hanita Coatings RCA Ltd.), Johnson Window Films, Inc., GLOBAL WINDOW FILMS, Madico, Inc., Saint-Gobain Performance Plastics Corporation, TWF, Armolan, NEXFIL, Solar Screen International SA, Huper Optik USA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Tinting Film Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive tinting film market report based on product, application, and region:

-

Product Outlook (Volume, Square Foot; Revenue, USD Million, 2018 - 2030)

-

Windows

-

Windshields

-

-

Application Outlook (Volume, Square Foot; Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicles (LCVs)

-

Heavy Commercial Vehicles (HCVs)

-

-

Regional Outlook (Volume, Square Foot; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

Indonesia

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global automotive tinting film market size was estimated at USD 3.62 billion in 2023 and is expected to reach USD 3.80 billion in 2024.

b. The global automotive tinting film market is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030 to reach USD 5.14 billion by 2030.

b. The passenger cars segment dominated the automotive tinting film market with a share of more than 65% in 2023. The increasing demand for passenger vehicles has seen an upsurge in developing economies on account of rapid urbanization.

b. Some key players operating in the automotive tinting film market include 3M; Eastman Chemical Company; Madico Inc.; and Saint-Gobain Solar Gard. It also boasts of a few medium and small-sized regional players, such as Hanita Coatings; Johnson Window Films, Inc.; Tintfit Window Films Ltd; and Global Window Films.

b. Key factors that are driving the market growth include the inclination of consumers towards safety from harmful sun rays and protection of expensive interiors of luxury cars.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."