- Home

- »

- Next Generation Technologies

- »

-

Automotive Vehicle-to-Everything Market, Industry Report, 2025GVR Report cover

![Automotive Vehicle-to-Everything Market Size, Share & Trends Report]()

Automotive Vehicle-to-Everything Market Size, Share & Trends Analysis Report By Communication Type, By Connectivity Type, By Vehicle Type, By Region (North America, South America, Asia Pacific, Europe), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-396-6

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2017 - 2025

- Industry: Technology

Industry Trends

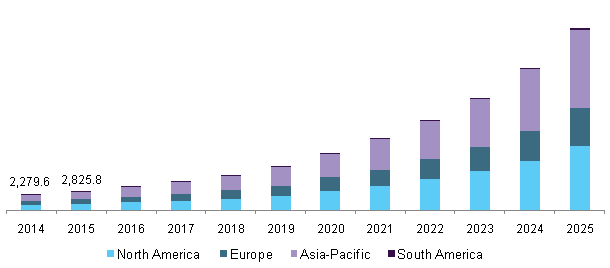

The global automotive Vehicle-to-Everything (V2X) market size was valued at USD 2.83 billion in 2015 and is expected to witness significant growth owing to the high demand for automobile safety features and better traffic management. The automotive industry has gained momentum and is moving toward sustainable growth. The integration of various communication technologies and safety features has enhanced the convenience aspect of the vehicles. Moreover, the consumer demand for such features has acted as a catalyst for market growth.

Driverless cars or autonomous cars concept is still in the research phase and its commercialization is expected to be no sooner. However, the incorporation of V2X communication technologies will lead to achieving driverless mobility. A definite regulatory framework pertaining to the integration of V2X technologies will be a key aspect of the implementation of these technologies. As the automotive V2X is all about communication between the automobiles, thus is subjected to threats such as hacking and manipulation. Hence, the security of the data communication will be a critical aspect of the growth of the market.

Automotive Vehicle-to-Everything (V2X) market by region, 2014-2025 (USD Million)

The automotive industry is growing at a steady rate owing to the rising disposable income of the emerging economies in countries such as China and India, which has boosted automotive sales in recent years. The rising number of passenger cars is one of the main reasons for traffic congestion. Due to these traffic congestions, the fuel consumption of an automobile increases which adds to the emission and air pollution. Thus the increasing demand for real-time traffic alerts and increased environmental concerns will boost the automotive V2X market.

Communication Type Insights

The automotive V2X communication covers various types of communication which are prominently used in various active safety features such as Adaptive cruise control, Blind spot detection and lane change assist among others.

With the growing stringency in safety regulations, these features will become mandatory in the near future. Thus Vehicle-to-Vehicle (V2V) is expected to dominate the market in the coming future. Incorporation of V2I and V2N communication would facilitate in resolving problems such as traffic congestion and will reduce emissions caused due to traffic. It would also enable the growth of convenient facilities such as e-parking and automated toll payments. Thus, the stated attributes would expedite the growth of the automotive V2X market.

Connectivity Type Insights

Currently, the automotive V2X systems that are being employed in the cars have their functioning is based on Dedicated Short Range Connectivity (DSRC). The current cost benefits of the DSRC over the cellular connectivity will drive the DSRC connectivity type market. The increasing popularity of DSRC connectivity among various tier 1 and tier 2 suppliers owing to the cost-benefit and ease of implementation will widen the growth opportunities.

Cellular connectivity with its wide coverage may be a lucrative connectivity option, however, it has some drawbacks. The cellular connectivity owing to its extensive coverage will require substantial time for deployment. The modem hardware required to fulfill the automotive industry requirement pertaining to V2X is expensive in nature. However, with secure cellular connectivity for V2X and a robust deployment strategy, the technology has strong potential in the near future.

Vehicle Type Insights

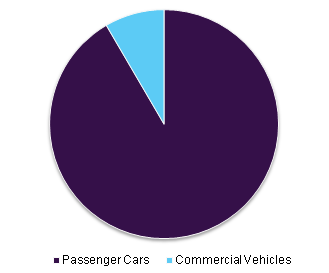

The automotive V2X market for passenger cars is expected to have the largest market as it accounted for the largest share in global automobile production in 2015. However, the demand for commercial vehicles (CV) is high as compared to passenger cars. For instance, according to OICA, CV sales increased by approximately 6% from 2015 to 2016 owing to the boom in the construction sector.

Automotive Vehicle-to-Everything (V2X) market, by vehicle type, 2015 (USD Million)

Also, the CVs are subjected to more travel time as compared to the passenger cars, thus the need for safety is high in the CV segment which will drive the automotive V2X market. The segment is expected to exhibit a growth rate of 30% over the forecast period.

Regional Insights

The North American region is estimated to have the largest market share in the automotive v2x market. The region is technologically advanced countries such as the U.S. and Canada which enables ease of technological adoption. The region is also one of the largest automotive markets, for instance, according to OICA, the region share’s approximately 26% of the automobile population of the world running on the roads. Thus traffic congestion and high greenhouse emission are some of the crucial problems for this region. The implementation of the V2X systems would lead to better traffic control and lower gas emissions. Hence acting as a major growth driver for the automotive v2x market.

The European automotive industry is governed by stringent safety as well as stringent emission norms. According to the European Environment Agency in 2015, vehicle emissions are still responsible for EU greenhouse gas emissions. Also with the growing stringency of safety norms, features such as adaptive cruise control, and blind-spot detection which uses V2V communication will become an absolute feature thus enabling the growth of the automotive V2X market.

Competitive Insights

The market is dominated by the presence of companies with high technological capabilities. The company operating in the automotive V2X market has a diversified product portfolio, and a strong global presence, and is involved in various strategic initiatives to hold on to its market share. The major players in the market include Continental AG (Germany), Delphi Automotive PLC (U.K.), Qualcomm Inc. (U.S.), Infineon Technologies AG (Germany), and Cisco Systems, Inc. (U.S.) among others. The industry is characterized by numerous vendors that offer differentiated products and services in the market. The strategic partnership will help the companies mark a stronghold in the highly competitive automotive v2x market. For instance, In October 2016, SAIC USA, a fully owned subsidiary of SAIC Motor (China) signed an agreement with Savari Inc. (U.S.) and will be manufacturing and distributing Savari’s V2X communications solutions in China and other ASEAN countries.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Revenue in USD Million and CAGR from 2016 to 2025

Regional scope

North America, Europe, Asia Pacific, and South America

Country scope

U.S., Canada, U.K., France, Germany, Japan, China, Brazil, and Mexico

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors. and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information that is not currently within the scope of the report, we will provide it to you as a part of the customization

Segments Covered in the ReportThis report forecasts revenue growth at global & regional levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global automotive V2X market on the basis of communication type, connectivity type, vehicle type, and region:

-

Communication Type Outlook (Revenue, USD Million; 2014 - 2025)

-

Vehicle-To-Vehicle (V2V)

-

Vehicle-To-Infrastructure (V2I)

-

Vehicle-To-Pedestrian (V2P)

-

Vehicle-To-Home (V2H)

-

Vehicle-To-Grid (V2G)

-

Vehicle-To-Network (V2N)

-

-

Connectivity Type Outlook (Revenue, USD Million; 2014 - 2025)

-

DSRC

-

Cellular Connectivity

-

-

Vehicle Type Outlook (Revenue, USD Million; 2014 - 2025)

-

Passenger Cars

-

CV

-

-

Regional Outlook (Revenue, USD Million; 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

-

South America

-

Brazil

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."