- Home

- »

- Automotive & Transportation

- »

-

Self-driving Cars And Trucks Market Size, Share Report 2030GVR Report cover

![Self-driving Cars And Trucks Market Size, Share & Trends Report]()

Self-driving Cars And Trucks Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Transportation, Defense), By Region (North America, Europe, Asia Pacific, South America, Middle East & Africa), And Segment Forecasts

- Report ID: 978-1-68038-884-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Self-driving Cars & Trucks Market Summary

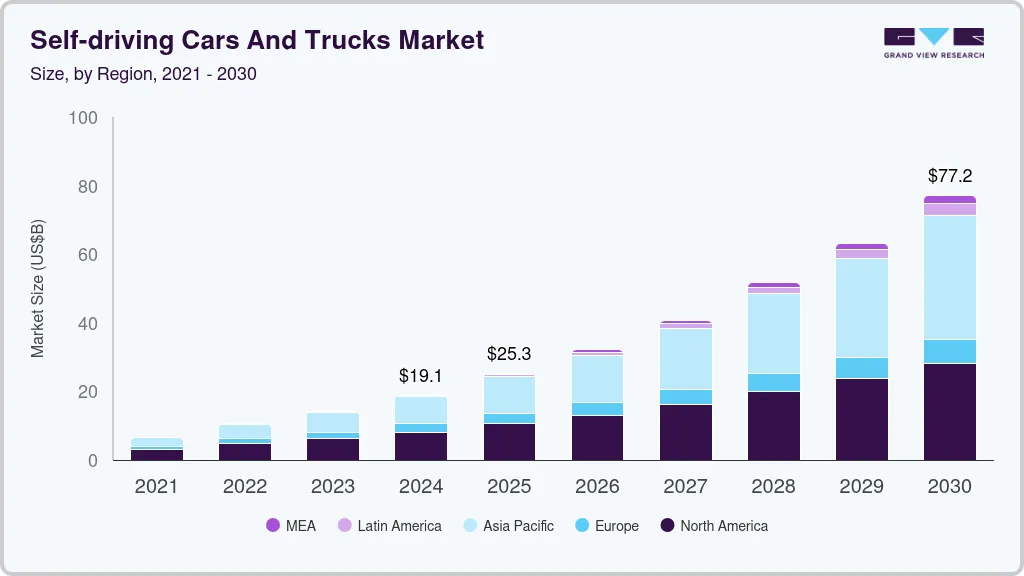

The global demand for self-driving cars and trucks market size was estimated at USD 19,077.7 million in 2024 and is projected to reach USD 77,190.6 million by 2030, growing at a CAGR of 25% from 2025 to 2030. The development of a supportive regulatory framework, government funding, and investment in digital infrastructure is expected to play a key role in driving the market growth.

Key Market Trends & Insights

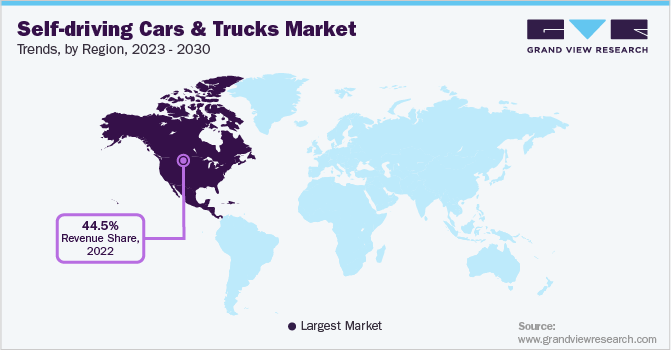

- The North American region led the market with a volume share of 44.5% in 2022.

- The self-driving cars and trucks market in the U.S. is expected to grow at a significant CAGR over the forecast period.

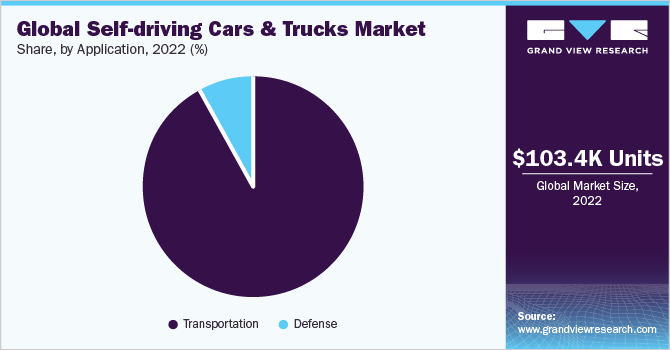

- By application, the transportation segment dominates the market with a volume share of 92.3% in 2022.

Market Size & Forecast

- 2024 Market Size: 19,077.7 Million

- 2030 Projected Market Size: 77,190.6 Million

- CAGR (2025-2030): 25%

- North America: Largest market in 2022

Self-drive cars, also known as autonomous vehicles, are a key innovation in the automotive industry, with high growth potential, and act as a catalyst in the technology development of automobiles. For instance, in August 2022, the U.K. pledged £100M for the self-driving vehicle revolution. This funding is intended to activate the autonomous vehicle industry's incredible potential, attracting investment and developing the UK's increasing self-driving vehicle distribution network. The market has a wide range of products and systems that make up the autonomous vehicle infrastructure.

The self-driving car is made up of numerous sensors, such as LiDAR and RADAR systems, working concurrently to carry out operations automatically without the help of drivers. Moreover, the self-driving car senses the environment and navigates by forming an active 3D map using artificial intelligence software, radio detection and ranging (RADAR), light detection and ranging (LiDAR), and cameras. By performing situational analysis, motion planning, and trajectory control, these sensors help in the process of navigation.

There is an increasing demand for self-driving cars for road safety measures. The number of road accidents is increasing daily; the primary cause of accidents is human error that occurs in the uncertainty of events, for instance, head-on collisions due to misinterpretation of the driver. The Self-driving vehicle is driven by a computer. Thus, it makes fewer errors than humans, such as accidents due to distracted driving, alcohol, not wearing seatbelts, speeding, and drowsy driving.

Self-driving vehicles are machines that optimally perform the task of driving and aren’t tired or bored, or wouldn’t be distracted. Thus, the traveler is safer in an autonomous vehicle than in a human-driven car. In the uncertainty of events, for instance, head-on collisions due to misinterpretation of the driver. For instance, in March 2020, Volkswagen, a vehicle manufacturer in Germany, developed the Car2X safety feature, which relies on the Wi-Fi p standard, designed explicitly for local vehicle communication without a cellular connection. This technology helps avoid accidents by connecting with other vehicles and the traffic infrastructure.

These cars are expected to be sold at the company showrooms. With the rise in technologies and increased connectedness of vehicles, the threat of car systems getting hacked is increasing. Thus, cyber security and safety solution providers such as Argus Cybersecurity Ltd. and Green Hill Software, among others, are developing anti-hacking algorithms for self-driving cars.

Application Insights

The transportation segment dominates the market with a volume share of more than 92.3% in 2022, attributed to government funding in self-driving car trials. For instance, the U.K. government’s Intelligent Mobility Fund (IMF) was funded for developing innovations for the transportation industry. The transportation segment is further bifurcated into industrial and commercial applications.

The U.S. is anticipated to witness high adoption of driverless technology in transportation due to increased government support in amending transport regulations to create a gateway for driverless cars. Furthermore, Europe is also expected to emerge as a potentially lucrative market for the adoption of self-driving cars with the growing consumer preference for using techno-advanced products.

The advances in technologies and rising acceptance of self-driving cars by various governments across the globe are expected to boost the growth of industrial applications of self-driving cars and trucks over the forecast period.

Several companies such as Audi and Tesla Motors collaborate with technology developers for better and rapid development of Self-driving technology in vehicles. For instance, collaboration companies such as Nvidia will assist automobile manufacturers in developing object recognition. Also, auto manufacturers such as Waymo have partnered with Intel Corporation to enhance automobile infotainment systems. Aptiv PLC, an automotive company in Ireland, collaborated with Lyft, a ridesharing company in the U.S., to provide a taxi service. Moreover, in 2020, Lyft and Aptiv stated that they had provided 100,000 paid rides in Aptiv's self-driving vehicles via the Lyft app.

Regional Insights

The North American region led the market with a volume share of 44.5% in 2022. The growth is attributed to amendments in traffic regulations in the U.S. to incorporate self-driving cars on public roads. The regulation is slowly being adopted across all the states of the U.S. to make transportation fully autonomous. Furthermore, the growth across the mobility as a service sector is anticipated to provide an impetus to the growth of the self-driving car market.

The U.S. Department of Transportation (USDOT) generated the automated vehicles comprehensive plan in collaboration with a broad coalition of academic, industry, state, local, advocacy, and transportation stakeholders to support the secure development, integration, and testing of automated vehicle technologies. Such a modernized regulatory environment & supportive government regulations are responsible for the growth of the market opportunities for autonomous vehicles.

In 2018, the Department of Transport of the UK, initiated a jurisdiction to operate autonomous vehicles on any public roads without any extra insurance or permits. The Department also established the Centre for Connected and Autonomous Vehicles in 2018. The U.K. government plans for self-driving vehicles to be in use by 2021, and it also plans to make the required changes to the regulations that can support the development of Self-driving cars in the U.K.

Key Companies & Market Share Insights

Leading players in the self-driving cars and trucks market stay ahead of the competition through collaborations and the development of innovative solutions. In February 2023, Darwin Innovation Group, a U.K.-based company that offers connectivity solutions and autonomous vehicle services, collaborated with Cognizant, a U.S.-based IT services company. Through this collaboration, Darwin aims to extend the reach of the autonomous vehicle market by introducing new vehicle management tools and dependable vehicle connectivity via 5G and satellite communications.

For instance, in August 2017, BMW AG, Intel Corporation, Mobileye, a subsidiary company of Intel Corporation, and Fiat Chrysler Automobiles (FCA) signed a memorandum of understanding for FCA to join the companies in developing a self-driving vehicle driving platform. The memorandum aims to combine the resources, capabilities, and strengths of all companies to reduce time to market, increase development efficiency, and enhance the application’s technology.

The automobile industry is dynamic and changes with technological advancements. Several major players in the industry, such as General Motors, Volkswagen, Mercedes, BMW, and others, invest a significant part of their revenue toward researching and developing technologies. Currently, there is a growing trend of self-driving cars in the automotive industry, thus attracting larger investments in developing these vehicles. The U.K. government granted permission to test self-driving cars on public roads. Furthermore, the Federal Department of Environment, Transport, Energy, and Communications in Switzerland permitted driverless testing on Zurich streets. Some prominent players in the global self-driving cars and truck market include:

-

Audi AG

-

BMW AG

-

Daimler AG

-

Ford Motor Company

-

General Motors Company

-

Google LLC

-

Honda Motor Co., Ltd.

-

Nissan Motor Company

-

Tesla

-

Toyota Motor Corporation

-

Uber Technologies, Inc.

-

Volvo Car Corporation

-

Volkswagen AG

Self-driving Cars And Trucks Market Report Scope

Report Attribute

Details

Market size value in 2025

217.55 thousand units

Revenue forecast in 2030

3,195.5 thousand units

Growth rate

CAGR of 46.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

Audi AG; BMW AG; Daimler AG; Ford Motor Company; General Motors Company; Google LLC; Honda Motor Co., Ltd.; Nissan Motor Company; Tesla; Toyota Motor Corporation; Uber Technologies, Inc.; Volvo Car Corporation; Volkswagen AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Self-driving Cars And Trucks Market Report Segmentation

This report forecasts volume growth on global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2030. For this study, Grand View Research has segmented the global self-driving cars and trucks market report based on application and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2030)

-

Transportation

-

Industrial

-

Commercial

-

-

Defense

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global self-driving cars and trucks market shipment was estimated at 103.4 thousand units in 2022 and is expected to reach 217.6 thousand units in 2023.

b. The global self-driving cars and trucks market is expected to grow at a compound annual growth rate of 46.8% from 2023 to 2030 to reach 3,195.5 thousand units by 2030.

b. North America dominated the self-driving cars and trucks market with a share of 46% in 2022. This is attributable to amendments in traffic regulations to incorporate autonomous cars on public roads.

b. Some key players operating in the self-driving cars and trucks market include Audi AG; BMW AG; Daimler AG (Mercedes Benz); Ford Motor Company; General Motors; Google LLC; Honda Motor Corporation; Nissan Motor Company; Tesla, Inc.; Toyota Motor Corporation.

b. Key factors that are driving the market growth include the rising need for road safety, environmental impact due to traditional vehicles and increased energy savings by autonomous vehicles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.