- Home

- »

- Plastics, Polymers & Resins

- »

-

Automotive Wrap Films Market Size & Share Report, 2030GVR Report cover

![Automotive Wrap Films Market Size, Share & Trends Report]()

Automotive Wrap Films Market Size, Share & Trends Analysis Report By Application (Trucks, Buses, Passengers Cars), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-674-5

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Automotive Wrap Films Market Size & Trends

The global automotive wrap films market size was estimated at USD 7.11 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 22.1% from 2024 to 2030. Automobile wrap films have numerous benefits, such as maintaining vehicle paints, enabling color option flexibility, and removing the need for an entire paint makeover, hence supporting the global growth of the automobile wrap film sector. The benefits provided by automotive wrap films in the form of preserving vehicle paints, allowing flexibility in color selection, and eliminating the requirement for a complete paint makeover, thus fueling the growth of the market across the globe.

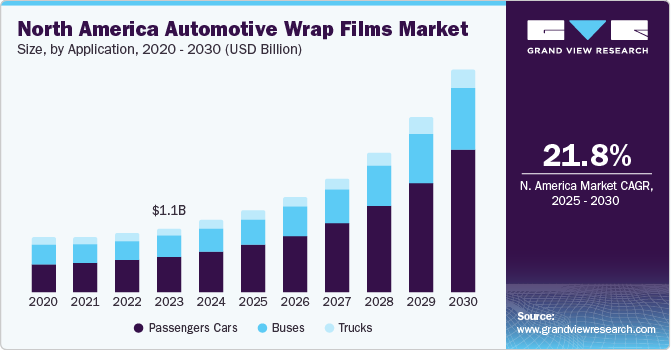

North America market is characterized by various manufacturing industries, as a result of the increased emphasis on research and development, combined with favorable government initiatives to attract investments in automotive industry, which is likely to result in regional market expansion. The effectiveness of these initiatives is measured by global positioning satellite tracking systems, which provide specific vehicle information. As a result, automobile wrap films are widely used for mobile marketing throughout the region.

Moreover, increasing demand for color wraps, including matte black and matte orange, in North America, is expected to drive the market over the forecast period. Heavy vehicles such as buses and large vans used for tourism use wrap films for promotions. The need to protect the vehicle’s original paint for an extended time is further spurring the demand for these films.

Furthermore, the growing consumer demand for customizing vehicles fuels the market for wrap films in a variety of colors, coatings, and textures. The growing automotive industry on account of electric vehicles across the globe, especially in Mexico and the U.S., on account of the increasing demand for compact family cars from the middle-class population is expected to positively impact the demand for wrap films in the automotive industry.

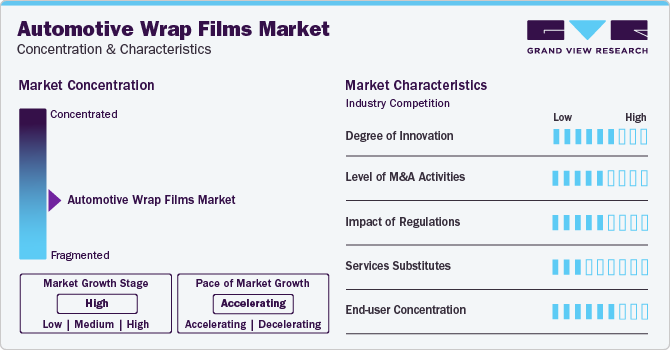

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The automotive wrap films market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in the production of wrap films, the availability of raw materials, and increasing plastic consumption across automotive interior and exterior applications. Subsequently, innovative wrap film applications are constantly emerging, disrupting existing industries and creating new ones.

The automotive wrap films market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players in the region. This is due to several factors, including the desire to gain access to new production technologies and talent, need to consolidate in a rapidly growing market, and increasing strategic initiatives of wrap films in the automotive industry.

The automotive wrap films market is also subject to increasing regulatory scrutiny. The market is subject to numerous regulations, guidelines, and restrictions regarding wrap film production and its applications owing to the toxic nature of raw materials such as polyvinyl chloride, coupled with certain health hazards of improperly disposed products and over-exposure to chemicals contained in these films.

There are a limited number of direct product substitutes for wrap films in automotive industry. However, there are several technologies that can be used to achieve sustainable outcomes to wrap films, such as Silicone and bio-degradable films. These substitutes can be used in certain applications, but they typically do not offer the same level of performance or flexibility as wrap films.

End-user concentration is a significant factor in the automotive wrap films market. Since there are several end-user industries that are driving demand for wrap films in the automotive industry. The concentration of demand in a small number of end-user industries creates opportunities for companies that focus on developing wrap filmsolutions for the automotive industry. However, it also creates challenges for companies that are trying to compete in a crowded market.

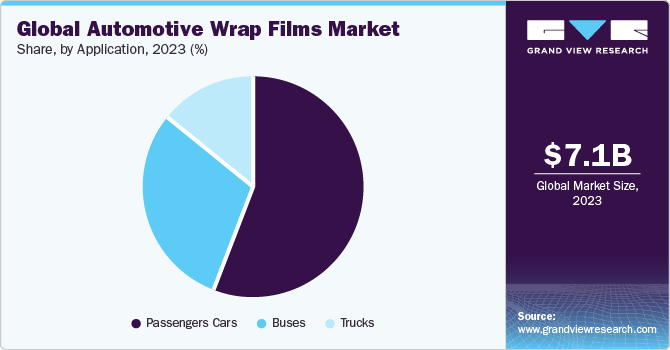

Application Insights

Passenger car applications dominated the market and accounted for a share of 55.67% in 2023. Wrap films are in high demand due to rising demand from customers in personalizing their vehicles. Automotive wrap films are used to change a vehicle's appearance or to protect the original paintwork, and passenger cars are widely customized for personal or commercial purposes. All of these factors for automotive wrap films in Passenger Cars are likely to impact on market growth.

The buses application is projected to grow at a significant CAGR over the forecast period. Some of the main factors driving the growth of buses segment of the market are flourishing industrial sectors in emerging economies and increasing demand from the logistics and construction sectors owing to surged construction activities taking place globally. These factors contribute to the usage of buses for transportation purposes, thereby leading to the application of automotive wrap films on them for advertisements.

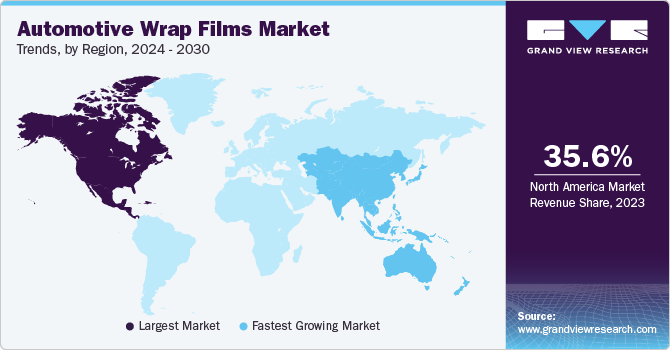

Regional Insights

North America dominated the market and accounted for a 35.64% share in 2023. Growing customer interest in customizing automobiles is expected to fuel demand for wrap films that come in a variety of colors, coatings, and appearance. There are a large number of local players offering manufacturing and installation of automotive wrap films. Various market players including Avery Dennison, 3M Company, JMR Graphics, Nissan, Ritrama, and Skinz wrap have been operating in the region.

Asia Pacific is anticipated to witness a fastest growth in the Automotive Wrap Films Market. The region has a significant automobile manufacturing sector. Automotive industry in Japan has grown over the years and generated billions through the production and exports of passenger cars.An increase in automotive production owing to increasing investments is expected to propel the demand for wrap films in the automotive industry in Japan.

Key Automotive Wrap Films Company Insights

Some of the key players operating in the market include AVERY DENNISON CORPORATION and 3M Company.

-

AVERY DENNISON CORPORATION operates through three business segments, namely pressure-sensitive materials, retail branding & information solutions, and Vantive medical technologies.

-

3M Company is involved in product development, manufacturing, and marketing for businesses including industrial, safety & graphics, electronics & energy, healthcare, and consumer.

Fedrigoni S.P.A and Hexis S.A.S are some of the emerging market participants in the Automotive Wrap Films Market.

-

Fedrigoni S.P.A is involved in the manufacturing and selling of different types of specialty papers for packaging and fine printing, and self-adhesive products for labeling.

-

Hexis S.A.S operates through six business segments, namely Hexis Graphics, Hexis Training, Hexis Health, Hexis Industrial Solutions, Hexis CM, and Hexis Energy, and specializes in pressure-sensitive adhesive coating thin plastic films and performance cast vinyl films.

Key Automotive Wrap Films Companies:

The following are the leading companies in the automotive wrap films market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these automotive wrap films companies are analyzed to map the supply network.

- Avery Dennison Corporation

- Arlon Graphics LLC

- 3M

- KPMF

- Fedrigoni S.P.A

- Vvivid Vinyl

- ORAFOL Europe GmbH

- Hexis S.A.S

- Guangzhou Carbins Film Co., LTD

- JMR Graphics

Recent Developments

-

In February 2023, Fedrigoni S.P.A acquired a new R&D center in Grenoble, France to enhance its production innovation path and meet the growing consumer demand for innovative automotive films and wraps.

-

In April 2022, AVERY DENNISON CORPORATION announced an expansion in its footprints by launching a new production facility in Noida, India. This expansion will help the company to strengthen its global position in the Asian markets

-

In April 2022, ORAFOL Europe GmbH announced an expansion in its production capacity for graphic films by launching a new manufacturing facility in Brandenburg to meet the growing consumer demand

Automotive Wrap Films Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.72 billion

Revenue forecast in 2030

USD 28.89 billion

Growth rate

CAGR of 22.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Belgium; Netherlands; Spain; Poland; China; India; Japan; Australia; Indonesia; Malaysia; Thailand; New Zealand; Philippines; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

AVIENT DENNISON CORPORATION; Arlon Graphics LLC; 3M; KPMF; Fedrigoni S.P.A.; Vvivid Vinyl; ORAFOL Europe GmbH; Hexis S.A.S.; Guangzhou Carbins Film Co. Ltd.; JMR Graphics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Wrap Films Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive wrap films market report based on application and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Trucks

-

Buses

-

Passengers Cars

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Belgium

-

The Netherlands

-

Spain

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Indonesia

-

Malaysia

-

Thailand

-

New Zealand

-

Philippines

-

-

Central & South America (MEA)

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive wrap films market size was estimated at USD 7.11 billion in 2023 and is expected to reach USD 8.72 billion in 2024.

b. The global automotive wrap films market is expected to grow at a compound annual growth rate of 22.1% from 2024 to 2030 to reach USD 28.89 billion by 2030.

b. The passenger cars vehicles segment dominated the automotive wrap films market with a share of 55.67% in 2023. Automotive films are primarily used for customization and personalization purposes in the passenger cars segment.

b. Some key players operating in the automotive wrap films market include 3M Company, Arlon Graphics LLC, Avery Dennison Corporation, Hexis UK, and Orafol Group.

b. Key factors that are driving the automotive wrap films market growth include the growing graphics and sign industry, reducing cost, and increasing demand for mobile advertising.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Automotive Wrap Films Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Distribution Channel Analysis

3.2.2. Raw Material Trends

3.2.3. Technological Overview

3.3. Regulatory Framework

3.4. Market Dynamics

3.4.1. Market Driver Analysis

3.4.2. Market Restraint Analysis

3.4.3. Industry Challenges

3.4.4. Industry Opportunities

3.5. Industry Analysis Tools

3.5.1. Porter’s Five Forces Analysis

3.5.2. Macro-environmental Analysis

Chapter 4. Automotive Wrap Films Market: Application Estimates & Trend Analysis

4.1. Application Movement Analysis & Market Share, 2023 & 2030

4.2. Tucks

4.3. Trucks Wrap Films Market Estimates & Forecast, By Application, 2018 to 2030 (USD Million)

4.4. Buses

4.4.1. Buses Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5. Passenger Cars

4.5.1. Passenger Cars Applications Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Automotive Wrap Films Market: Regional Estimates & Trend Analysis

5.1. Regional Movement Analysis & Market Share, 2023 & 2030

5.2. North America

5.2.1. North America Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

5.2.2. U.S.

5.2.2.1. Key country dynamics

5.2.2.2. U.S. Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.2.3. Canada

5.2.3.1. Key country dynamics

5.2.3.2. Canada Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.2.4. Mexico

5.2.4.1. Key country dynamics

5.2.4.2. Mexico Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.3. Europe

5.3.1. Europe Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

5.3.2. Germany

5.3.2.1. Key country dynamics

5.3.2.2. Germany Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.3.3. UK

5.3.3.1. Key country dynamics

5.3.3.2. UK Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.3.4. France

5.3.4.1. Key country dynamics

5.3.4.2. France Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.3.5. Italy

5.3.5.1. Key country dynamics

5.3.5.2. Italy Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.3.6. Belgium

5.3.6.1. Key country dynamics

5.3.6.2. Belgium Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.3.7. Netherlands

5.3.7.1. Key country dynamics

5.3.7.2. Netherlands Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.3.8. Spain

5.3.8.1. Key country dynamics

5.3.8.2. Spain Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.3.9. Poland

5.3.9.1. Key country dynamics

5.3.9.2. Poland Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.4. Asia Pacific

5.4.1. Asia Pacific Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

5.4.2. China

5.4.2.1. Key country dynamics

5.4.2.2. China Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.4.3. Japan

5.4.3.1. Key country dynamics

5.4.3.2. Japan Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.4.4. India

5.4.4.1. Key country dynamics

5.4.4.2. India Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.4.5. Australia

5.4.5.1. Key country dynamics

5.4.5.2. Australia Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.4.6. Indonesia

5.4.6.1. Key country dynamics

5.4.6.2. Indonesia Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.4.7. Malaysia

5.4.7.1. Key country dynamics

5.4.7.2. Malaysia Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.4.8. Thailand

5.4.8.1. Key country dynamics

5.4.8.2. Thailand Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.4.9. New Zealand

5.4.9.1. Key country dynamics

5.4.9.2. New Zealand Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.4.10. Philippines

5.4.10.1. Key country dynamics

5.4.10.2. Philippines Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.5. Central & South America

5.5.1. Central & South America Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

5.5.2. Brazil

5.5.2.1. Key country dynamics

5.5.2.2. Brazil Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

5.6. Middle East & Africa

5.6.1. Middles East & Africa Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Chapter 6. Automotive Wrap Films Market - Competitive Landscape

6.1. Recent Developments & Impact Analysis, By Key Market Participants

6.2. Company Categorization

6.3. Company Market Share/Position Analysis, 2023

6.4. Company Heat Map Analysis

6.5. Strategy Mapping

6.5.1. Expansion

6.5.2. Mergers & Acquisition

6.5.3. Partnerships & Collaborations

6.5.4. New Product Launches

6.5.5. Research And Development

6.6. Company Profiles

6.6.1. AVIENT DENNISON CORPORATION

6.6.1.1. Participant’s overview

6.6.1.2. Financial performance

6.6.1.3. Product benchmarking

6.6.1.4. Recent developments

6.6.2. Arlon Graphics LLC.

6.6.2.1. Participant’s overview

6.6.2.2. Financial performance

6.6.2.3. Product benchmarking

6.6.2.4. Recent developments

6.6.3. 3M

6.6.3.1. Participant’s overview

6.6.3.2. Financial performance

6.6.3.3. Product benchmarking

6.6.3.4. Recent developments

6.6.4. KPMF

6.6.4.1. Participant’s overview

6.6.4.2. Financial performance

6.6.4.3. Product benchmarking

6.6.4.4. Recent developments

6.6.5. Fedrigoni S.P.A.

6.6.5.1. Participant’s overview

6.6.5.2. Financial performance

6.6.5.3. Product benchmarking

6.6.5.4. Recent developments

6.6.6. Vvivid Vinyl

6.6.6.1. Participant’s overview

6.6.6.2. Financial performance

6.6.6.3. Product benchmarking

6.6.6.4. Recent developments

6.6.7. ORAFOL Europe GmbH

6.6.7.1. Participant’s overview

6.6.7.2. Financial performance

6.6.7.3. Product benchmarking

6.6.7.4. Recent developments

6.6.8. Guangzhou Carbins Film Co. Ltd.

6.6.8.1. Participant’s overview

6.6.8.2. Financial performance

6.6.8.3. Product benchmarking

6.6.8.4. Recent developments

6.6.9. JMR Graphics

6.6.9.1. Participant’s overview

6.6.9.2. Financial performance

6.6.9.3. Product benchmarking

6.6.9.4. Recent developments

List of Tables

Table 1 List of Abbreviations

Table 2 Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 3 Automotive Wrap Films market estimates and forecasts, by Clear, 2018 - 2030 (USD Million)

Table 4 Automotive Wrap Films market estimates and forecasts by Colored, 2018 - 2030 (USD Million)

Table 5 Automotive Wrap Films market estimates and forecasts, by End-use, 2018 - 2030 (USD Million)

Table 6 Automotive Wrap Films market estimates and forecasts, in Fiber, 2018 - 2030 (USD Million)

Table 7 Automotive Wrap Films market estimates and forecasts, in Sheet & Films, 2018 - 2030 (USD Million)

Table 8 Automotive Wrap Films market estimates and forecasts in Strapping, 2018 - 2030 (USD Million)

Table 9 Automotive Wrap Films market estimates and forecasts in Food & beverage containers and bottles, 2018 - 2030 (USD Million)

Table 10 Automotive Wrap Films market estimates and forecasts in Non-food containers and bottles, 2018 - 2030 (USD Million)

Table 11 Automotive Wrap Films market estimates and forecasts in Others, 2018 - 2030 (USD Million)

Table 12 North America Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 13 North America Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 14 North America Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 15 U.S. Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 16 U.S. Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 17 U.S. Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 18 Canada Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 19 Canada Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 20 Canada Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 21 Mexico Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 22 Mexico Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 23 Mexico Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 24 Europe Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 25 Europe Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 26 Europe Automotive Wrap Films Market Estimates and Forecasts, By Packagin Type, 2018 - 2030 (USD Million)

Table 27 Europe Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 28 Germany Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 29 Germany Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 30 Germany Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 31 UK Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 32 UK Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 33 UK Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 34 France Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 35 France Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 36 France Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 37 Italy Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 38 Italy Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 39 Italy Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 40 Spain Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 41 Spain Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 42 Spain Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 43 The Netherlands Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 44 The Netherlands Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 45 The Netherlands Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 46 Asia Pacific Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 47 Asia Pacific Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 48 Asia Pacific Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 49 China Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 50 China Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 51 China Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 52 India Automotive Wrap Films Market Estimates and Forecasts, By 2018 - 2030 (USD Million)

Table 53 India Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 54 Japan Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 55 Japan Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 56 Japan Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 57 South Korea Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 58 South Korea Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 59 South Korea Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 60 Australia Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 61 Australia Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 62 Australia Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 63 Malaysia Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 64 Malaysia Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 65 Malaysia Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 66 Singapore Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 67 Singapore Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 68 Singapore Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 69 Thailand Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 70 Thailand Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 71 Thailand Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 72 Vietnam Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 73 Vietnam Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 74 Vietnam Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 75 Central & South America Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 76 Central & South America Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 77 Central & South America Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 78 Brazil Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 79 Brazil Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 80 Brazil Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 81 Argentina Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 82 Argentina Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 83 Argentina Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 84 Middle East & Africa Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 85 Middle East & Africa Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 86 Middle East & Africa Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 87 Saudi Arabia Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 88 Saudi Arabia Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 89 Saudi Arabia Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 90 United Arab Emirates (UAE) Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 91 United Arab Emirates (UAE) Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 92 United Arab Emirates (UAE) Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

Table 93 South Africa Automotive Wrap Films Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Table 94 South Africa Automotive Wrap Films market estimates and forecasts by Type, 2018 - 2030 (USD Million)

Table 95 South Africa Automotive Wrap Films Market Estimates and Forecasts, By End-use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Automotive Wrap Films Market Segmentation

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Plastic Films Market, 2022 (USD Million)

Fig. 7 Penetration & Growth Prospect Mapping, 2019 - 2030 (USD Million)

Fig. 8 Automotive Wrap Films Market - Industry Value Chain Analysis

Fig. 9 PVC demand by region, 2022 (%)

Fig. 10 Automotive Wrap Films Market- Market Dynamics

Fig. 11 Advertising cost per thousand impressions, (USD)

Fig. 12 Outdoor / Out-of-home advertising (%)

Fig. 13 Average Price of Automotive Wrap Films, by Vehicle Type (USD)

Fig. 14 Automotive Wrap Films Market- Porter’s Five Force Analysis

Fig. 15 Automotive Wrap Films Market - Macroeconomic Analysis

Fig. 16 Current Scenario for Automotive Wrap Films/ Paint protection films

Fig. 17 Fleet Owners Point of Opinion, 2022

Fig. 18 Automotive Wrap Films Market, By Application: Key Takeaways

Fig. 19 Automotive Wrap Films Market, By Application: Market Share, 2022 & 2030

Fig. 20 Automotive Wrap Films Market Estimates & Forecasts, in Trucks, 2018 - 2030 (USD Million)

Fig. 21 Automotive Wrap Films Market Estimates & Forecasts, in Passenger Cars, 2018 - 2030 (USD Million)

Fig. 22 Automotive Wrap Films Market Estimates & Forecasts, in Buses 2018 - 2030 (USD Million)

Fig. 23 Automotive Wrap Films Market revenue, by region, 2022 & 2030, (USD Million)

Fig. 24 Region marketplace: Key takeaways

Fig. 25 Region marketplace: Key takeaways

Fig. 26 Region marketplace: Key takeaways

Fig. 27 North America Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 28 U.S. Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 29 Canada Automotive Wrap Films Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 30 Mexico Automotive Wrap Films Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 31 Europe Automotive Wrap Films Market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 32 Germany Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 33 UK Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 34 France Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 35 Italy Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 36 Belgium Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 37 Netherlands Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 38 Spain Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 39 Poland Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 40 Asia Pacific Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 41 China Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 42 Japan Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 43 India Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 44 Australia Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 45 Indonesia Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 46 Malaysia Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 47 Thailand Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 48 New Zealand Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 49 Philippines Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 50 Central & South America Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 51 Brazil Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 52 Argentina Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 53 Middle East & Africa Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 54 Saudi Arabia Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 55 UAE Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 56 South Africa Automotive Wrap Films Market Estimates & Forecast, 2018 - 2030 (USD Million)

Fig. 57 Key Company Categorization

Fig. 58 3M SWOT Analysis

Fig. 59 AVERY DENNISON CORPORATION SWOT AnalysisWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Automotive Wrap Films Application Outlook (Volume, Kilotons, Revenue, USD Billion, 2018 - 2030)

- Trucks

- Buses

- Passengers Cars

- Automotive Wrap Films Regional Outlook (Volume, Kilotons, Revenue, USD Billion, 2018 - 2030)

- North America

- North America Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- U.S.

- U.S. Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- U.S. Automotive Wrap Films Market, By Application

- Canada

- Canada Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- Canada Automotive Wrap Films Market, By Application

- North America Automotive Wrap Films Market, By Application

- Europe

- Europe Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- UK

- UK Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- UK Automotive Wrap Films Market, By Application

- Germany

- Germany Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- Germany Automotive Wrap Films Market, By Application

- France

- France Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- France Automotive Wrap Films Market, By Application

- Italy

- Italy Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- Italy Automotive Wrap Films Market, By Application

- Belgium

- Belgium Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- Belgium Automotive Wrap Films Market, By Application

- Netherlands

- Netherlands Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- Netherlands Automotive Wrap Films Market, By Application

- Spain

- Spain Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- Spain Automotive Wrap Films Market, By Application

- Poland

- Poland Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- Poland Automotive Wrap Films Market, By Application

- Europe Automotive Wrap Films Market, By Application

- Asia Pacific

- Asia Pacific Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- China

- China Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- China Automotive Wrap Films Market, By Application

- India

- India Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- India Automotive Wrap Films Market, By Application

- Japan

- Japan Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- Japan Automotive Wrap Films Market, By Application

- Australia

- Australia Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- Australia Automotive Wrap Films Market, By Application

- Indonesia

- Indonesia Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- Indonesia Automotive Wrap Films Market, By Application

- Malaysia

- Malaysia Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- Malaysia Automotive Wrap Films Market, By Application

- Thailand

- Thailand Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- Thailand Automotive Wrap Films Market, By Application

- New Zealand

- New Zealand Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- New Zealand Automotive Wrap Films Market, By Application

- Philippines

- Philippines Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- Philippines Automotive Wrap Films Market, By Application

- Asia Pacific Automotive Wrap Films Market, By Application

- Central & South America

- Central & South America Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- Brazil

- Brazil Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- Brazil Automotive Wrap Films Market, By Application

- Argentina

- Argentina Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- Argentina Automotive Wrap Films Market, By Application

- Central & South America Automotive Wrap Films Market, By Application

- Middle East & Africa

- Middle East & Africa Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- Saudi Arabia

- Saudi Arabia Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- UAE

- UAE Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- UAE Automotive Wrap Films Market, By Application

- South Africa

- South Africa Automotive Wrap Films Market, By Application

- Trucks

- Buses

- Passengers Cars

- South Africa Automotive Wrap Films Market, By Application

- Middle East & Africa Automotive Wrap Films Market, By Application

- North America

Automotive Wrap Films Market Dynamics

Driver: Increase In Demand For Mobile Advertising

Mobile advertising has emerged as an affordable and effective means of advertising over the past few years. Using automotive wrap films allows conversion of any vehicle including car, bus, and truck into a moving billboard, thus facilitating an increased number of views per day. Billboard advertising is restricted to particular zones, mobile advertising does not have any restrictions, thus allowing effective advertising. In addition, cost-effectiveness, ease of removal & re-application, and protection of original paint are expected to augment demand over the next six years. Automotive wrap films not only carry out their primary task of personalizing vehicles or advertising but also shield vehicles from scratches and scuffs. Fleet wraps are highly suitable for promoting and advertising new products. They are also used to create awareness about marketing events and increase name recognition by 15 times than other advertising media. Growing population and ongoing urbanization have led to consumers spending most of the time outside their homes at places such as airports, railways, stations, streets, and malls. These factors are expected to fuel demand for mobile advertising over the coming years.

Driver: Low Cost As Compared To Vehicle Paint

Automotive wrap films are a cost-effective and efficient method for the customization of any vehicle. These protect the original paints of cars and maintain their resale value. The lifespan of automotive wrap films is longer than low-quality vehicle paints. Moreover, these films result in low maintenance costs of vehicles. Vehicle wraps can be easily removed and re-applied to change color and texture that is not possible with paints. They offer higher quality than paints, leading to an increased overall return on investments for the end user. Spot graphics are the most cost-effective wraps as they are applied only to a particular area of the vehicles. A high level of flexibility and a long lifespan of automotive wrap films are expected to augment their demand globally over the forecast period.

Restraint: Technical Complexity

Wrapping a vehicle requires a high level of efficiency and proper environmental conditions. Proper printer coding should be done to get vibrant color and look on the wrap. In the case of a coding error, the design is dull and unfit to be used for vehicle wrapping. The preparation stage of the vehicle is the most time-consuming process wherein the vehicle surface has to be checked for any weather trims, cracks, and fenders. It is necessary to make sure that these cracks are clean and wax free in order to get a perfect wrap finish. The vehicle has to be washed a day before and should be completely dry while wrapping. It is first cleaned with a solution to remove all the wax content followed by alcohol to make sure that no solution is left. Furthermore, the temperature at which the wrap is installed is also essential for the proper installation of the vehicle wrap, for instance, at high temperatures, the wrap may overstretch, and at low temperatures, the wrap may shrink. The wraps are not a preferable option if the vehicle already has deep scratches, dents, corrosion, or any other roughness on it. Stringent technical standards to achieve a perfectly finished wrap act as a restraint for the automotive wrap films market.

What Does This Report Include?

This section will provide insights into the contents included in this automotive wrap films market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Automotive wrap films market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Automotive wrap films market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the automotive wrap films market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for automotive wrap films market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of automotive wrap films market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Automotive Wrap Films Market Categorization:

The automotive wrap films market was categorized into two segments, namely application (Trucks, Buses, Passenger Cars), and regions (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa).

Segment Market Methodology:

The automotive wrap films market was segmented into application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The automotive wrap films market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty-five countries, namely, the U.S.; Canada; Mexico; Germany; the UK; France; Italy; Belgium; The Netherlands; Spain; Poland; China; India; Japan; Australia; Indonesia; Malaysia; Thailand; New Zealand; Philippines; Brazil; Argentina; Saudi Arabia; United Arab Emirates; and South Africa

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Automotive wrap films market companies & financials:

The automotive wrap films market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Fedrigoni S.P.A - In February 2023, Fedrigoni S.P.A acquired a new R&D center in Grenoble, France to enhance its production innovation path and meet the growing consumer demand for innovative automotives films and wraps.

-

Hexis S.A.S. - In March 2023, Hexis S.A.S announced the acquisition of Stickittome Australia Pty Ltd, a distributor-partner of Hexis S.A.S. With this acquisition the company is expected to strengthen its market position and expand its customer base in the Australian market.

-

AVERY DENNISON CORPORATION - In April 2022, AVERY DENNISON CORPORATION announced an expansion in its footprints by launching a new production facility in Noida, India. This expansion will help the company to strengthen its global position in the Asian market.

-

ORAFOL Europe GmbH - In April 2022, ORAFOL Europe GmbH announced an expansion in its production capacity for graphic films by launching a new manufacturing facility in Brandenburg to meet the growing consumer demand.

-

Arlon Graphics LLC - Arlon Graphics, LLC is a graphic materials manufacturing company, which was established in 1958. It markets and manufactures high-quality pressure-sensitive materials for the fleet, architectural, digital imaging, and signage markets.

-

3M - 3M’s foray into the automotive sector includes cutting-edge technologies like the automotive wrap film. Renowned for its Scotchgard technology, 3M continues to shape the automotive customization industry providing both professionals and enthusiasts with high performance solutions for transforming vehicle aesthetics.

-

Guangzhou Carbins Film, Co., Ltd. - The company boss boasts a diverse range of automotive films catering to various preferences and needs in the vehicle customization market. Leveraging advanced production techniques the company ensures its films exhibit exceptional durability vibrant colours and ease of application. It is a prominent player in the automotive film industry specializing in the manufacturing and distribution of high quality car wrap films.

-

KPMF - KPMF limited is a renowned company specialising in the manufacturing and distribution of premium automotive and specialty films. KPMF has established itself as a leading global player in the industry.

-

Vvivid Vinyl - Vvivid Vinyl specializes in vinyl wraps for vehicles, architectural surfaces, and various applications. It offers a diverse range of products designed to meet the demands of professionals and DIY enthusiasts alike. The company's extensive catalog includes color change wraps paint protection films and specialty finishes.

-

JMR Graphics - JMR graphics specializes in vehicle wraps, fleet graphics, and large format printing. It offers a comprehensive suite of services designed to enhance brand visibility. Its features are eye-catching graphics that transform vehicles and spaces into powerful marketing assets.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Automotive Wrap Films Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2018 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Automotive Wrap Films Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."