- Home

- »

- Automotive & Transportation

- »

-

Automotive X-by-Wire Systems Market Size Report, 2030GVR Report cover

![Automotive X-by-Wire Systems Market Size, Share & Trends Report]()

Automotive X-by-Wire Systems Market Size, Share & Trends Analysis Report By Vehicle (Passenger cars, Commercial Cars), By Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-393-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

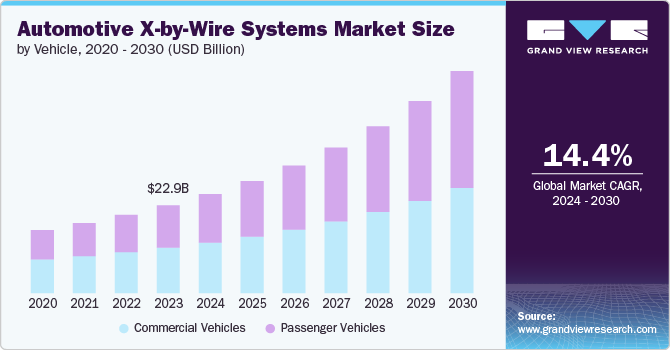

The global automotive x-by-wire systems market size was estimated at USD 22.96 billion in 2023 and is projected to grow at a CAGR of 14.4% from 2024 to 2030. The emergence of advanced driver assistance systems and the increasing levels of vehicle automation is expected to increase the demand for automotive x-by-wire systems. However, currently, these systems have low penetration rates in the automotive market. The focus of automobile manufacturers on increasing fuel efficiency and reducing the emission level of the vehicle is likely to boost the x-by-wire system market in the future.

Drive/X-by-Wire technology substitutes traditional robotic connections with electrical components like control units, motors, actuators, sensors, and batteries. Implementing these systems reduces vehicle weight, which not only enhances fuel efficiency but also lowers emissions. Additionally, sensors, motors, and actuators enable precise and swift responses to driver inputs, thereby improving vehicle performance. Looking ahead, the automotive industry is expected to prioritize fuel economy and emissions, which will drive the global X-by-wire systems market. The rising demand for hybrid electric vehicles presents a significant opportunity for Drive/X-by-wire systems, given their easier integration and ability to extend the range of electric vehicles due to their lightweight nature.

Vehicle Insights

The commercial vehicle segment led the market and accounted for 51.6% of the global revenue in 2023. The significant growth of Advanced Driver Assistance Systems (ADAS) technology in commercial vehicles is driving the expansion of the automotive X-by-wire systems market. ADAS play a vital role in enhancing safety for commercial vehicle drivers by reducing accident risks and protecting road users. For instance, the Traton Group, a subsidiary of Volkswagen Group, is continuously developing and improving ADAS in commercial vehicles to ensure maximum safety and efficiency.

A prime example is the forthcoming MAN TGE Next Level, scheduled for release in mid-2024, which will boast 27 assistance systems, such as a cornering assistant, blind spot warning, and collision warning. Notable features incorporate a lane departure warning system that maintains lane position with Crosswind Assist, and light steering interventions which stabilize the vehicle in strong crosswinds.

The Passenger vehicles segment is estimated to grow significantly over the forecast period. The rapid growth is driven by several key trends. X-by-wire technology replaces traditional mechanical or hydraulic systems with electronic controls, resulting in significant weight reduction and enhanced passenger vehicle performance. This technology includes systems such as throttle-by-wire, brake-by-wire, and steer-by-wire, which provide precise control and improved responsiveness.

The adoption of x-by-wire systems is particularly strong in passenger vehicles as consumers increasingly demand smart, connected vehicles with advanced safety and efficiency features. Furthermore, the pursuit of enhanced safety, fuel efficiency, and performance is a major driver for the adoption of x-by-wire systems. These systems are integral to the development of electric and autonomous passenger vehicles, which require precise electronic control for optimal operation. Regulatory emphasis on safety and environmental concerns also contribute to the growing adoption of x-by-wire technology, as it helps reduce CO2 emissions and improves vehicle stability and control.

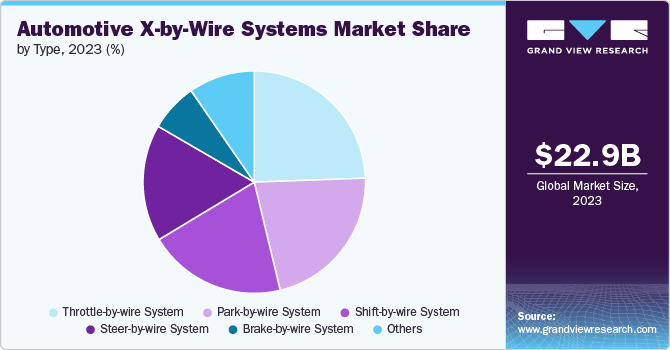

Type Insights

The Throttle-by-wire System segment led the market and accounted for highest revenue of the global revenue in 2023. The substantial growth of the throttle-by-wire system is attributed to its ability to enable the ECM to integrate and combine features such as torque management, stability control, cruise control, and traction control. Because the position of the throttle is constantly monitored it is possible to make required corrections in throttle levels and keep the vehicle stable and not lose control.

Moreover, Throttle by wire is to optimize air supply to the engine which will make sure that harmful gas emissions are kept to an absolute minimum and improve efficiency of the vehicle. The increasing demand for electric and hybrid vehicles, which require precise control over power delivery, is boosting the implementation of these systems. Furthermore, the growing emphasis on fuel efficiency and reduced emissions is prompting automakers to adopt throttle-by-wire technology, as it allows for more precise engine control and optimization.

The Steer-by-wire System is accounted to hold significant market share over the forecast period. This technology replaces traditional mechanical steering components with electronic controls, sensors, and actuators, providing numerous advantages in vehicle design and performance. The steer-by-wire system comprises two main sections. The steering wheel, feedback actuator, angle sensor, and the feedback actuator are included under the steering section. The wheel section comprises of the steering actuator, wheels, rack and pinion, and pinion angle sensor. The feedback angle sensor provides initial input to a microcontroller, which processes the data and converts it into a signal that hydraulically or electronically moves the wheels.

Regional Insight

North America automotive x-by-wire systems market accounted to hold significant share in the market and accounted for a 31.8% share in 2023. The growth is primarily fueled by the dominance of throttle-by-wire systems and the rising popularity of park-by-wire systems, particularly in electric vehicles in this region. The commercial vehicle segment is also seeing substantial growth due to the demand for improved fuel efficiency and advanced safety features. Major automotive manufacturers and technology companies in North America are focusing on commercializing autonomous vehicles, where X-by-wire systems play a crucial role.

U.S. Automotive X-by-Wire Systems Market Trends

The automotive x-by-wire system market in the U.S. is witnessing significant advancements, driven by the growing demand for enhanced vehicle safety, fuel efficiency, and autonomous driving capabilities. X-by-wire technology, which replaces traditional mechanical and hydraulic control systems with electronic controls, is increasingly being adopted for steering, braking, and throttle control. This shift is largely fueled by the rise of electric and hybrid vehicles, which benefit from the weight reduction and improved energy efficiency offered by x-by-wire system.

Europe Automotive X-by-Wire Systems Market Trends

Europe x-by-wire system marketgrowing is majorly driven by the popularity of electric and hybrid vehicles. These vehicles benefit from the superior fuel efficiency and reduced emissions offered by X-by-wire technologies. The integration of advanced driver-assistance systems (ADAS) further propels the demand for X-by-wire systems, as these systems provide precise control and enhance vehicle safety and performance.

Asia Pacific Automotive x-by-wire systems market Trends

The x-by-wire system market in Asia Pacific region is anticipated to witness the highest growth during the forecast period, driven by increased consumer spending power, demand for improved safety measures, and the requirement for increased vehicle fuel economy. Furthermore, the steer-by-wire system segment is expected to see substantial growth due to its benefits in reducing vehicle weight and improving fuel efficiency, which are crucial for both electric and internal combustion engine (ICE) vehicle

Key Automotive X-by-Wire systems Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, partnerships, and collaborations contracts, agreements, as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry.

For instance, in June 2023, Tesla has filed a patent for a new steer-by-wire system, which eliminates mechanical linkages in the steering mechanism, relying solely on electrical or electromechanical systems for steering. Like many automakers, Tesla has already incorporated motors and actuators for drive controls to enable its Autopilot and Full Self-Driving features, but it still maintains a mechanical connection to its steering system.

Key Automotive X-by-Wire Systems Companies:

The following are the leading companies in the automotive x-by-wire systems market. These companies collectively hold the largest market share and dictate industry trends.

- Aptiv

- Beijing Xiaoju Technology Co, Ltd.

- Cruise LLC

- Lyft, Inc.

- MOIA

- NAVYA

- Tesla

- Uber Technologies INC.

- Waymo LLC

- Zoox, Inc.

Recent Developments

-

In June 2023, In June 2023, Bosch announced its plan to launch steer-by-wire steering systems on a large scale by the mid-2020s. In collaboration with the startup Arnold NextG, Bosch aims to leverage their combined development expertise to accelerate the market readiness of these systems.

-

In May 2023, Uber Technologies Inc. and Waymo announced a strategic partnership to make the Waymo Driver accessible to more people through the Uber platform, beginning in Phoenix. This partnership was launched publicly later that year with a limited number of Waymo vehicles operating within Waymo’s newly expanded territory in Phoenix. The service covered both ride-hailing trips and local deliveries. Uber users had the opportunity to experience the safety and convenience of the Waymo Driver through the Uber and Uber Eats apps.

Automotive X-by-Wire Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 25.88 billion

Revenue forecast in 2030

USD 57.99 billion

Growth rate

CAGR of 14.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Aptiv; Beijing Xiaoju Technology Co, Ltd.; Cruise LLC; Lyft, Inc.; MOIA; NAVYA; Tesla; Uber Technologies INC.; Waymo LLC; Zoox, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive X-by-Wire Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global automotive x-by-wire systems marketreport based on vehicle, type and region.

-

Vehicle Outlook (Revenue, USD Billion, 2017 - 2030)

-

Passenger Cars

-

Commercial Cars

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Throttle-by-wire System

-

Brake-by-wire System

-

Steer-by-wire System

-

Park-by-wire System

-

Shift-by-wire System

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive x-by-wire systems market size was estimated at USD 22.96 billion in 2023 and is expected to reach USD 25.88 billion in 2024.

b. The global automotive x-by-wire systems market is expected to grow at a compound annual growth rate of 14.4% from 2024 to 2030 to reach USD 57.99 billion by 2030.

b. North America dominated the automotive x-by-wire systems market with a share of 31.8% in 2023. The growth is primarily fueled by the dominance of throttle-by-wire systems and the rising popularity of park-by-wire systems, particularly in electric vehicles in this region. The commercial vehicle segment is also seeing substantial growth due to the demand for improved fuel efficiency and advanced safety features.

b. Some key players operating in the automotive x-by-wire systems market include Aptiv; Beijing Xiaoju Technology Co, Ltd.; Cruise LLC; Lyft, Inc.; MOIA; NAVYA; Tesla; Uber Technologies INC.; Waymo LLC; Zoox, Inc.

b. Key factors that are driving the market growth include, the growing emphasis on fuel efficiency and reduced emissions is prompting automakers to adopt throttle-by-wire technology, as it allows for more precise engine control and optimization.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."