- Home

- »

- Next Generation Technologies

- »

-

Autonomous AI And Autonomous Agents Market Report 2030GVR Report cover

![Autonomous AI And Autonomous Agents Market Size, Share & Trends Report]()

Autonomous AI And Autonomous Agents Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Technology, By Deployment, By End-use Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-138-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Autonomous AI And Autonomous Agents Market Summary

The global autonomous AI and autonomous agents market size was estimated at USD 3.93 billion in 2022 and is projected to reach USD 70.53 billion by 2030, growing at a CAGR of 42.8% from 2023 to 2030. The “autonomous” or “self-driving” terminologies are used to describe artificial intelligence systems that can independently operate and make decisions, without the need for human intervention.

Key Market Trends & Insights

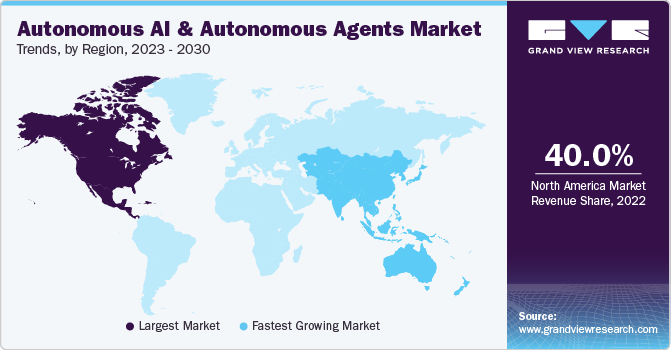

- North America dominated the market with a revenue share of over 40.0% in 2022.

- By component, the software segment led the market with a revenue share of over 42.0% in 2022.

- By technology, the machine learning segment led the market with a revenue share of over 35.0% in 2022.

- By end use industry, the BFSI segment led the market with a revenue share of 21.0% in 2022.

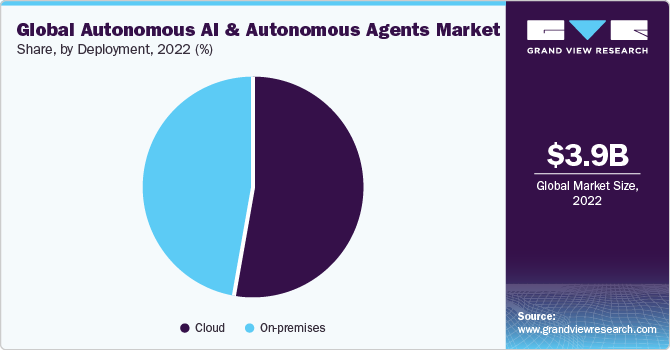

- By deployment, the cloud segment led the market with a revenue share of over 52.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 3.93 Billion

- 2030 Projected Market Size: USD 70.53 Billion

- CAGR (2023-2030): 42.8%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

This was particularly true in the nascent development stages of self-driving cars, where companies such as Waymo, Tesla, and traditional automakers were building autonomous vehicles. Autonomous agents were keen on developing virtual assistants, including Amazon’s Alexa, Apple’s Siri, and Google’s Assistant. By using machine learning (ML) and natural language processing (NLP) to understand and answer user queries, these virtual assistants became more advanced and autonomous.Autonomous agents were used in the field of robotics to develop robots for numerous applications, such as healthcare, warehouse automation, and agriculture. Businesses focused on investing in the research and development (R&D) activities to develop robots that could operate independently in various environments. The healthcare industry has adopted autonomous AI to deploy systems that could assist healthcare professionals in various tasks, including drug discovery, making medical diagnoses, and even performing robotic surgery. The goal of these systems was to improve the quality of care for patients.

In the financial sector, autonomous agents have been used in algorithmic trading, fraud detection, and customer service. They could process large amounts of financial information and make real-time decisions. The autonomous AI and autonomous agents’ industry market is expected to grow due to the rapid development of machine learning and deep learning technologies, as well as the increasing adoption of artificial intelligence in various industries. The utilization of autonomous agents in the financial sector enhances efficiency and contributes to greater accuracy in decision-making, helping financial institutions navigate the complexities of today's dynamic markets.

Autonomous AI algorithms use this information to make real-time decisions about how to steer, brake, and accelerate, enabling the vehicle to drive safely and independently of human control. Machine learning & deep learning are key technologies in the auto industry. ML and deep learning allow the car to learn from its data and enhance its driving performance over time. Neural networks, for instance, are trained to identify objects and recognize traffic signals and signs. These advancements in autonomous AI, bolstered by machine learning and deep learning technologies, are not only revolutionizing vehicle safety but also paving the way for the development of self-driving cars that can navigate complex environments with precision and reliability.

Autonomous AI often relies on the fusion of multiple sensors. Algorithms help autonomous agents integrate information from multiple sources to provide a more precise and reliable view of the world. Sensor fusion plays an important role in safe driving decisions. Vehicle path planning and decision-making vehicle autonomous agents use sophisticated algorithms to plan a vehicle’s route and make decisions in real-time. This includes changing lanes, passing slower vehicles, stopping at traffic lights, and responding to unexpected events, such as pedestrians or road hazards. However, despite the high potential, there were major obstacles to developing and deploying autonomous AI systems, such as safety concerns, regulatory barriers, and the requirement for reliable testing and validation.

Component Insights

The software segment led the market with a revenue share of over 42.0% in 2022. The market for software is growing rapidly due to the systems evolving over time, adapting to their environment, and learning from it. An autonomous agent is a piece of software or a program that can do things or make decisions for a user or a system without the need for human intervention. Autonomous agents are designed to accomplish specific tasks or goals while interacting with the environment or other autonomous agents. For instance, Chatbots are self-serve agents that can communicate with users via text or voice, respond to queries, provide data, and even complete tasks such as scheduling appointments or ordering products. For another instance, in March 2023, Adept, a U.S.-based software company, raised USD 350 million to build a digital assistant, which is an AI model that is able to transform a text command into sets of actions.

The service segment is predicted to witness significant growth in the forecast years. Consulting services are in demand due to increased requirements for expert guidance and strategic advice. The consultants worked with businesses to develop a roadmap for implementing autonomous AI and agents, identifying use cases, defining project objectives, assessing the suitability of existing technologies or platforms for autonomous AI integration, developing data strategy for collecting, storing, and managing data for training and operating autonomous agents, changing workflows and employee roles for the implementation of autonomous systems, improving and optimizing the performance of autonomous agents and AI systems, and advising on ethical considerations and compliance with regulations, especially in sectors with strict guidelines.

Technology Insights

The machine learning segment led the market with a revenue share of over 35.0% in 2022. Several factors drive this growth in machine learning technology because an autonomous agent is a software program that perceives its environment, makes decisions based on that perception, and acts accordingly. Autonomous agents are typically implemented using machine learning techniques such as reinforcement learning. Agents receive information from their environment, such as sensor data, camera images, sensor readings, & others, and then process the input data using machine learning algorithms and make decisions based on the current state and its goals. For example, using reinforcement learning, the autonomous agent learns how to take action that maximizes a cumulative reward.

The computer vision segment is expected to witness significant growth in the coming years. The factors propelling the technology market growth include autonomous agent’s computer vision technology enabled that are able to interact with their environment and make decisions based on visual data. They can be used in robotics, unmanned aerial vehicles, and other autonomous systems. The concept of autonomous agents is based on perception, where the agent perceives its environment through the use of computer vision. This can include tasks such as tracking objects, avoiding obstacles, or recognizing landmarks. The agent can then reason and decide about its actions based on the visual data. For instance, a robot with computer vision may be able to detect an object in its field of vision and decide to pick it up. Machine learning can also help autonomous agents improve their performance by allowing them to learn new objects, adjust to different lighting, and fine-tune their decision-making processes.

End-use Industry Insights

The BFSI segment led the market with a revenue share of 21.0% in 2022.The terms autonomous AI and autonomous agents are used to describe the use of cutting-edge artificial intelligence (AI) and automation (automation) technologies in the banking, financial services, and insurance (BFSI) industry. These technologies enable intelligent systems and autonomous agents to carry out various activities and make decisions independently of humans. Applications include automatically trade in high-frequency markets, making quick trading decisions, and manage risk by analyzing large data sets and market trends. Automatically provide customer support and answer questions, detect fraud and adjust investment portfolios to match market conditions and preferences, execute transactions, and manage portfolios.

The government segment is predicted to witness significant growth in the coming years.The implications of autonomous AI and autonomous agents for government and governance raise questions of ethics, law, and policy. The implications of autonomous AI and agents for government and governance are as follows: Governments will need to create new rules and regulations to govern the use of autonomous AI and agents. These rules will need to define the limits of autonomy and establish standards of safety, morality, and responsibility. Ethical considerations will need to be addressed, as autonomous systems can create ethical issues, such as liability and accountability when something goes wrong.

Deployment Insights

The cloud segment led the market with a revenue share of over 52.0% in 2022. Using autonomous AI and autonomous agents in combination with cloud deployment, users can create a variety of AI-powered applications and services that take advantage of cloud computing’s scalability and flexibility. Aligned with AI and autonomous agents, cloud computing involves deploying software applications and data, as well as services, on remote servers that are managed by a cloud service provider. Cloud computing provides scalability and availability from anywhere in the world that has access to the internet. Some of the most popular cloud providers are AWS (Amazon Web Services), Microsoft Azure (Microsoft Azure), and GCP (Google Cloud Platform).

The on-premises segment is expected to experience moderate growth over the forecast period. Autonomous AI and autonomous agents in on-premises computing refer to software systems and applications that can run on their own and make decisions independently of human control.On-premises computing environments, organizations can take advantage of the automation and autonomy benefits while maintaining the security of sensitive data and essential operations within the organization’s own infrastructure. This is especially important in industries where data privacy and security regulations are in place. All in all, the combination of autonomous AI & autonomous agents with on-premises computing can improve efficiency, reduce operating costs, and enhance decision-making through the use of advanced automation and intelligent technologies.

Regional Insights

North America dominated the market with a revenue share of over 40.0% in 2022. The U.S. and Canada emerged as promising growth hubs in the region. The region's dominance can be attributed to the high penetration of cloud computing, the rising adoption of omnichannel practices, and the growing demand for analytics and insights in multiple sectors. In addition, numerous leading organizations further bolster North America's market position. The U.S. and Canada stand out as key contributors to this growth due to their robust and mature industries and a strong emphasis on innovation and technology, which fuels the adoption of autonomous AI and autonomous agent computing solutions.

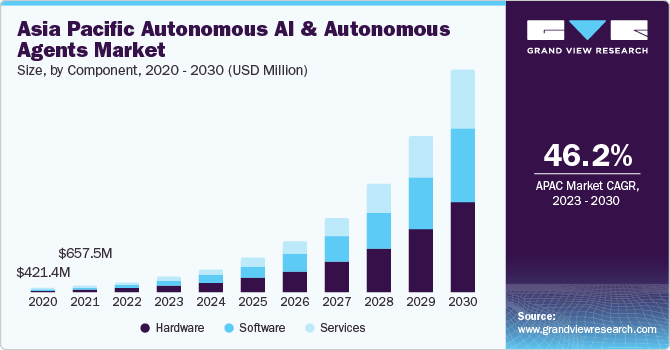

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. This growth is driven by a growing demand for cloud-based services from small and medium-sized enterprises (SMEs) in Asia Pacific. Recognizing the advantages of cloud solutions, SMBs are fueling the market's expansion by embracing these technologies to enhance their operations and competitiveness. Countries like China, India, and Japan are experiencing robust economic growth and rapidly increasing internet penetration and smartphone adoption. This, in turn, drives the demand for efficient autonomous AI solutions to support the thriving e-commerce industry. Additionally, the government's and businesses' significant investments in cloud-based security services further fuel the demand for security cloud solutions.

Key Companies & Market Share Insights

The market is a rapidly evolving industry that provides AI-based autonomous solutions. In the field of autonomous AI, Google (Alphabet Inc.) has been at the forefront of the field, especially through its subsidiary Waymo, which specializes in autonomous vehicles. Google has also invested heavily in artificial intelligence research and development (R&D) in various areas, making it a major player in the field.Tesla is a prominent player in autonomous driving technology. Their Autopilot and FSD systems are designed to allow fully autonomous driving in electric vehicles.

Amazon is a major player in the logistics and fulfillment industry. Amazon Robotics is a subsidiary of Amazon that designs and manufactures robots that are used in warehouses to carry out tasks such as picking up orders and transporting packages. Uber and Lyft are both major players in the ride-sharing industry. They are investing in autonomous vehicle technologies to reduce their reliance on human drivers and are working on developing their self-driving cars and partnering with other autonomous vehicle companies.

For instance, in September 2023, GPTConsole launched an intelligent command line interface (CLI) and autonomous AI agents Pixie and Bird. This development signifies a significant growth in AI, offering developers a more user-friendly way to interact with large language models (LLMs). An autonomous AI web developer, Pixie can generate ReactJS-based landing pages based on prompts. In contrast, Bird is a personal brand manager, enhancing Twitter account activity to bolster online presence. These features can potentially transform developers' AI-driven work, streamlining the creation of innovative products and services with LLMs. Some prominent players in the global autonomous AI and autonomous agents market include:

-

Google

-

IBM

-

Microsoft

-

Oracle

-

Waymo LLC

-

Deepmind

-

OpenAI

-

Salesforce

-

SAP SE

-

Nvidia Corporation

Autonomous AI And Autonomous Agents Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.82 billion

Revenue forecast in 2030

USD 70.53 billion

Growth rate

CAGR of 42.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, deployment, end-use industry

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany: UK: France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

Google; IBM; Microsoft; Oracle; Waymo LLC; Deepmind OpenAI; Salesforce; SAP SE; Nvidia Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autonomous AI and Autonomous Agents Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global autonomous AI and autonomous agents market report based on component, technology, deployment, and end-use industry and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Machine Learning

-

NLP

-

Context Awareness

-

Computer Vision

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

On-premises

-

Cloud

-

-

End-use Industry Outlook (Revenue, USD Billion, 2017 - 2030)

-

Retail & E-commerce

-

BFSI

-

IT & Telecommunication

-

Manufacturing

-

Healthcare & Lifesciences

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global autonomous AI and autonomous agents market size was estimated at USD 3.93 billion in 2022 and is expected to reach USD 5.82 billion in 2023.

b. The global autonomous AI and autonomous agents market is expected to grow at a compound annual growth rate of 42.8% from 2023 to 2030 to reach USD 70.53 billion by 2030.

b. North America dominated the market in 2022, accounting for over 40% share of the global revenue. The U.S. and Canada emerged as promising growth hubs in the region. The region's dominance can be attributed to the high penetration of cloud computing, the rising adoption of omnichannel practices, and the growing demand for analytics and insights in multiple sectors.

b. Some key players operating in the autonomous AI and autonomous agents market include Google, IBM, Microsoft, Oracle, Waymo LLC, Deepmind, OpenAI, Salesforce, SAP SE, and Nvidia Corporation.

b. Key factors driving the autonomous AI and autonomous agents market growth include growing demand for AI-enabled applications that act as a catalyst for the autonomous AI and autonomous agents market and increasing demand for similar computational resources.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.