- Home

- »

- Next Generation Technologies

- »

-

Autonomous Aircraft Market Size, Industry Report, 2033GVR Report cover

![Autonomous Aircraft Market Size, Share & Trends Report]()

Autonomous Aircraft Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Increasingly Autonomous, Fully Autonomous), By End Use (Commercial Aircraft, Cargo Aircraft, Medical Services, Combat & ISR), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-360-7

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Autonomous Aircraft Market Summary

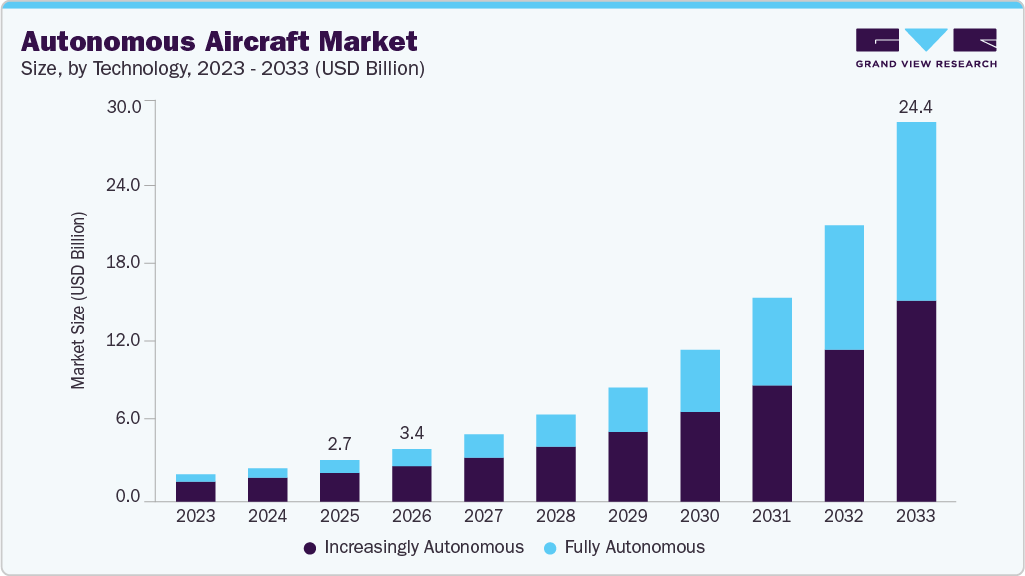

The global autonomous aircraft market size was valued at USD 2,674.8 million in 2025 and is projected to reach USD 24,446.6 million by 2033, growing at a CAGR of 32.7% from 2026 to 2033. The market growth is driven by advances in AI and autonomous flight systems, rising demand for cost-efficient cargo operations, and increasing investments in urban air mobility and next-generation aviation technologies.

Key Market Trends & Insights

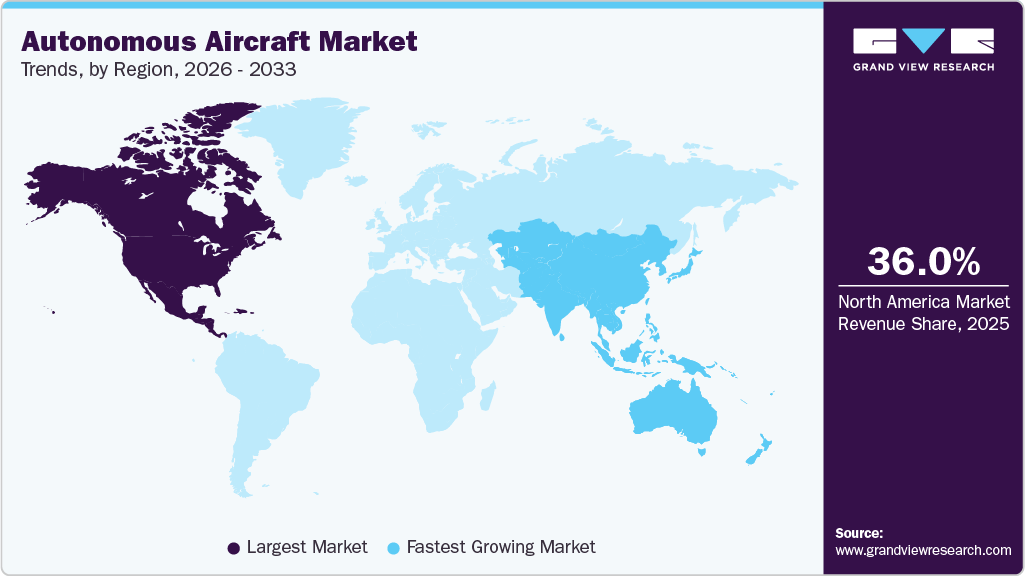

- The autonomous aircraft market in North America accounted for the largest revenue share of over 36% in 2025.

- The U.S. autonomous aircraft market dominated the market with a share of over 93% in 2025.

- Based on technology, the increasingly autonomous segment accounted for the largest revenue share of over 66% in 2025.

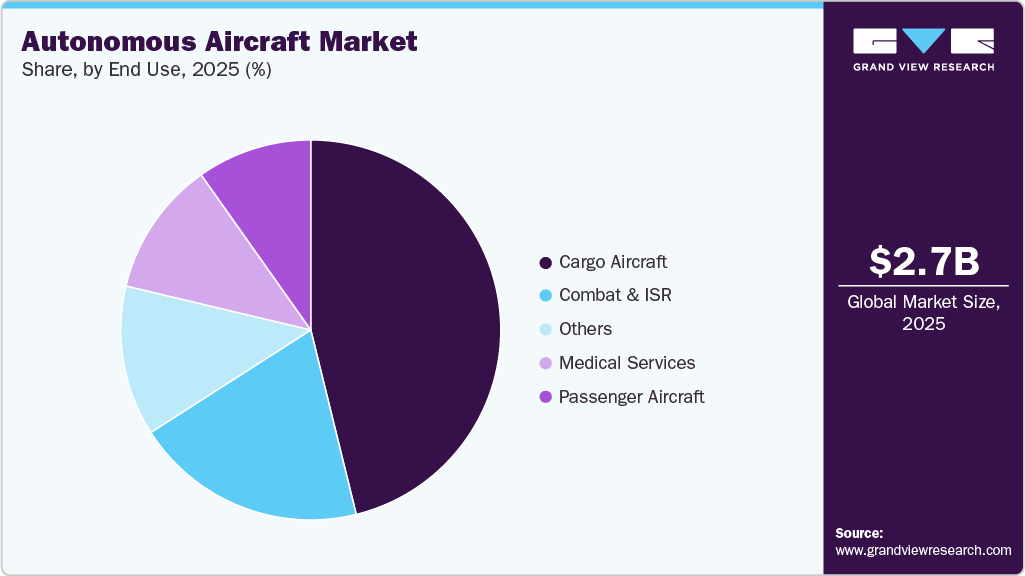

- Based on end use, the cargo aircraft segment accounted for the highest market share over 46% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2,674.8 Million

- 2033 Projected Market Size: USD 24,446.6 Million

- CAGR (2026-2033): 32.7%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The rising transition toward fully autonomous operations enabled by AI-powered flight management systems, real-time data analytics, and advanced collision avoidance algorithms is emerging as a key trend in the market. Increasing urbanization is driving demand for urban air mobility solutions, such as air taxis and personal air transport, which help reduce road congestion and commute times. The integration of 5G/6G communication infrastructure and advancements in battery technology and electric propulsion are further enhancing market potential by improving flight safety, efficiency, and sustainability.

Additionally, the rapid progress in AI-driven flight control systems, machine learning based navigation, edge computing, and digital twin simulations is significantly improving operational reliability and decision-making. These technologies enable real-time data processing, predictive maintenance, autonomous mission planning, and enhanced safety, reducing human intervention and operating costs. Advances in sensor fusion, computer vision, and high-performance avionics are further accelerating the deployment of fully autonomous and semi-autonomous aircraft across defense, cargo, surveillance, and urban air mobility applications, thereby driving market growth.

Furthermore, the increasing modernization of defense programs, and the rising demand for unmanned aerial capabilities are propelling the market. Governments are investing heavily in the autonomous aircraft industry for intelligence, surveillance, and reconnaissance (ISR) missions, as well as border security and combat support, to enhance operational efficiency and reduce pilot risk. Supportive regulatory frameworks, increased defense budgets, and growing adoption of autonomous systems in logistics, disaster response, and remote monitoring are reinforcing market expansion. These initiatives improve mission effectiveness and lower long-term operational expenditures.

Moreover, autonomous aircraft enable optimized flight paths, reduced fuel consumption, and lower emissions compared to traditional piloted aircraft, aligning with global decarbonization and net-zero targets. The integration of electric and hybrid propulsion systems, along with renewable-energy-powered ground infrastructure, is further accelerating adoption. Commercial players, governments, and urban planners seek cost-efficient and environmentally responsible aviation solutions, the autonomous aircraft market is positioned for sustained growth.

Technology Insights

The increasingly autonomous segment accounted for the largest market share, exceeding 66% in 2025. This segment is driven by advancements in artificial intelligence, sensor fusion, and machine learning, which enable aircraft to perform complex flight functions with minimal human intervention. These systems support real-time decision-making for navigation, collision avoidance, and adaptive flight control, making them suitable for commercial and cargo operations. Strong collaboration between aircraft manufacturers, technology providers, and regulators has further accelerated the deployment of semi-autonomous aircraft.

The fully autonomous segment is expected to register the fastest CAGR of over 39% from 2026 to 2033, driven by rapid progress in AI-driven autonomy and autonomous flight control systems. Fully autonomous aircraft offer significant cost advantages by eliminating pilot-related expenses and reducing human error, particularly in cargo and specialized missions. Evolving regulatory frameworks and growing acceptance of autonomous aviation technologies are expected to support long-term adoption further.

End Use Insights

The cargo aircraft segment accounted for the largest market share in 2025. The segment is driven by rising e-commerce volumes and the need for faster, reliable, and cost-efficient air logistics. Autonomous cargo aircraft enable optimized route planning, lower operating costs, and improved fleet utilization. Advancements in electric and hybrid propulsion, along with investments in autonomous aviation infrastructure, have further supported adoption for logistics, emergency response, and time-critical freight operations.

The commercial aircraft segment is expected to register the highest CAGR from 2026 to 2033, driven by growing global air passenger traffic and increasing interest in urban air mobility and regional air transport. The integration of autonomous flight assistance systems enhances operational efficiency, improves safety, and reduces pilot workload. Progressive regulatory developments and sustained investments in autonomous aviation technologies are expected to accelerate commercial deployment.

Regional Insights

North America dominated the market, accounting for over 36% of the share in 2025, driven by defense and homeland security budgets that fund the procurement of advanced UAVs, loitering munitions, and ISR platforms. Growing demand for logistics, infrastructure inspection, agricultural monitoring, and disaster response fosters autonomous aircraft adoption. This strong industrial, regulatory, and defense-backed foundation keeps North America at the forefront of autonomous aircraft market growth.

U.S. Autonomous Aircraft Market Trends

The U.S. autonomous aircraft market dominated the market with a share of over 93% in 2025, driven by large defense modernization budgets, government programs to scale attractable and collaborative unmanned systems, and strong R&D funding for autonomy, AI and sensor fusion. Public-private initiatives and export policies also boost domestic manufacturing and trusted supply chains for allied customers. These policies, procurement strategies, and industrial-scale capabilities firmly establish the U.S. as a growing hub in both defense and commercial autonomous aircraft markets.

Europe Autonomous Aircraft Market Trends

The Europe autonomous aircraft market is expected to grow at a CAGR of over 31% from 2026 to 2033. The growth is driven by security concerns, renewed defense modernization plans, and the development of UAVs and autonomous aerial platforms for surveillance, border patrol, and ISR missions. Growing interest in renewable-energy inspection, maritime surveillance, and smart-city monitoring further drives civilian drone demand. Thereby, Europe is becoming a balanced market for both defense-driven and commercial autonomous aircraft industry.

The Germany autonomous aircraft market is expected to grow significantly in the coming years, driven by strong industrial and governmental emphasis on digital transformation and embedded autonomy to support logistics and Industry 4.0 operations. The rapid expansion of 5G infrastructure is enabling real-time command, control, and fleet management capabilities, which are essential for scalable autonomous flight operations. These advancements position Germany as a leading hub for autonomous aircraft adoption within the Europe region.

The UK autonomous aircraft market is rapidly expanding, driven by a combination of robust defense modernization initiatives, growing investment in urban infrastructure maintenance, and regulatory movements toward unmanned traffic integration. The government’s commitment to border security, maritime surveillance, and smart-city projects is stimulating demand for UAVs and autonomous systems in both defense and civilian spheres. These developments position the UK as a strategic hub for autonomous aircraft deployment.

Asia Pacific Autonomous Aircraft Market Trends

The Asia Pacific market is expected to grow at the fastest CAGR of over 36% from 2026 to 2033, propelled by increasing defense budgets, border and maritime security needs, and investments in domestic UAV manufacturing. Improved communications infrastructure, growing demand for logistics automation, and rising urbanization further support autonomous aircraft adoption. These strategies ensure Asia Pacific's robust trajectory in the global autonomous aircraft market.

The China autonomous aircraft market is driven by a strategic shift toward unmanned naval and aerial dominance, with major investments in next-generation drones and carrier-capable UCAVs that expand long-range strike, ISR, and maritime mission capabilities. Domestic manufacturing scale, integrated supply chains, and advanced AI-driven autonomy systems enable rapid production and deployment of drones for both defense and civil applications. These combined trends reinforce China’s role as a leader in mass autonomous-aircraft adoption and innovation.

The Japan autonomous aircraft market is rapidly expanding, driven by the country’s increasing defense modernization and renewed focus on maritime and island-chain surveillance, demand for high-endurance UAVs and autonomous ISR platforms. The convergence of defense needs, geography-driven civilian demand, and high-tech industrial capacity positions Japan as a key market for next-generation autonomous aircraft industry.

Key Autonomous Aircraft Company Insights

Some of the key players operating in the market include Lockheed Martin Corporation and The Boeing Company among others.

-

Lockheed Martin Corporation is advancing in the market through a strategy centered on innovation and strategic partnerships. Leveraging its extensive experience in aerospace and defense, Lockheed Martin is developing advanced autonomous systems tailored for various applications, including military missions and commercial operations. They prioritize investments in advanced technology and research to enhance the performance, reliability, and safety of aircraft.

-

The Boeing Company is expanding its market by focusing on innovation, partnerships, and market diversification. It is leveraging its extensive aerospace expertise to develop advanced autonomous systems for both military and commercial applications. Boeing's strategy includes substantial investments in research and development to enhance autonomous technologies, improve safety, and optimize operational efficiency.

AeroVironment Inc. and Israel Aerospace Industries (IAI) are some of the emerging market participants in the autonomous aircraft market.

-

AeroVironment Inc. is expanding its market through a strategy focused on innovation and market penetration. They are leveraging their expertise in unmanned systems to develop advanced autonomous aircraft solutions tailored for commercial and defense applications. By investing in research and development, forging strategic partnerships, and enhancing manufacturing capabilities, AeroVironment seeks to capture a larger share of the growing market.

-

Elbit Systems Ltd. provides autonomous and uncrewed aircraft systems, including the Hermes series, known for fully autonomous takeoff, landing, taxi, and mission execution capabilities. The company integrates its proprietary avionics, EO/IR payloads, communication systems, and mission control technologies to deliver multi-domain autonomous operations.

Key Autonomous Aircraft Companies:

The following are the leading companies in the autonomous aircraft market. These companies collectively hold the largest market share and dictate industry trends.

- AeroVironment Inc.

- Airbus SE

- BAE Systems Plc

- Elbit Systems Ltd.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- RTX Corporation

- Saab AB

- Textron Inc.

- The Boeing Company

Recent Developments

-

In September 2025, Lockheed Martin Corporation expanded its operations through its Skunk Works division, unveiling the Vectis collaborative combat aircraft to develop modular, uncrewed autonomous air systems focusing on electronic warfare capabilities. This showcases Lockheed Martin’s commitment to leading next-gen autonomous defense platforms, reinforcing market dominance through innovation and partnerships.

-

In September 2025, Airbus SE collaborated with Shield AI to complete an autonomous flight demonstration using Airbus’s DT25 target drone equipped with Shield AI’s Hivemind autonomy software. This partnership strengthens Airbus’s ability to integrate advanced AI-based autonomy into next-generation autonomous aircraft.

-

In August 2025, RTX Corporation is investing in autonomy with Shield AI, advancing Networked Collaborative Autonomy (NCA) for real-time combat coordination and enhanced sensor technologies such as ViDAR. RTX’s Collins Aerospace segment leads aerospace electrification initiatives aligned with electrified propulsion markets. This shows RTX’s strategic focus on autonomous capabilities and sustainable aircraft systems for future aerospace markets.

Autonomous Aircraft Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3,382.3 million

Revenue forecast in 2033

USD 24,446.6 million

Growth rate

CAGR of 32.7% from 2026 to 2033

Base year of estimation

2025

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Northrop Grumman Corporation; The Boeing Company; Lockheed Martin Corporation; RTX Corporation; Elbit Systems Ltd.; AeroVironment Inc.; Saab AB; BAE Systems Plc; Airbus SE; Textron Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Autonomous Aircraft Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global autonomous aircraft market report based on technology, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Increasingly Autonomous

-

Fully Autonomous

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial Aircraft

-

Cargo Aircraft

-

Medical Services

-

Combat and ISR

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global autonomous aircraft market size was estimated at USD 2,674.8 million in 2025 and is expected to reach USD 3,382.3 million in 2026.

b. The global autonomous aircraft market is expected to grow at a compound annual growth rate of 32.7% from 2026 to 2033 to reach USD 24,446.6 million by 2033.

b. North America accounted for the highest market revenue share of nearly 36% in 2025, driven by robust technological innovation, substantial investments in research and development, and a supportive regulatory environment. Companies like Boeing, Lockheed Martin, and Alphabet's Wing are pioneering advancements in unmanned aerial systems (UAS).

b. Some key players operating in the autonomous aircraft market include The Boeing Company, Northrop Grumman Corporation, Lockheed Martin Corporation, AeroVironment Inc., IAI, Textron Inc and among others

b. Regulatory frameworks are another critical driver of market growth. Governments worldwide are increasingly establishing guidelines and regulations to integrate autonomous aircraft into the airspace safely.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.