- Home

- »

- Advanced Interior Materials

- »

-

Axial Flow Pump Market Size, Share & Trends Report, 2030GVR Report cover

![Axial Flow Pump Market Size, Share & Trends Report]()

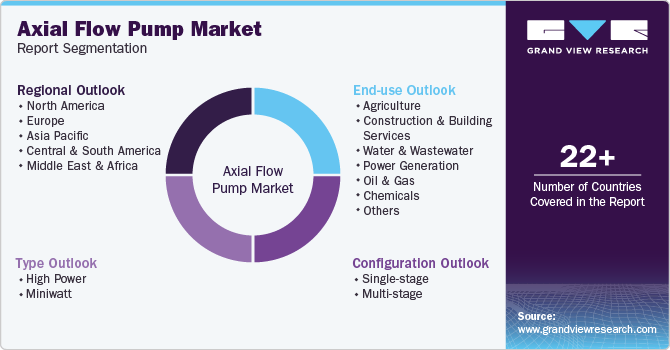

Axial Flow Pump Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (High Power, Miniwatt), By Configuration (Single-Stage, Multi-stage), By End-use (Agriculture, Power Generation), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-193-1

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Axial Flow Pump Market Summary

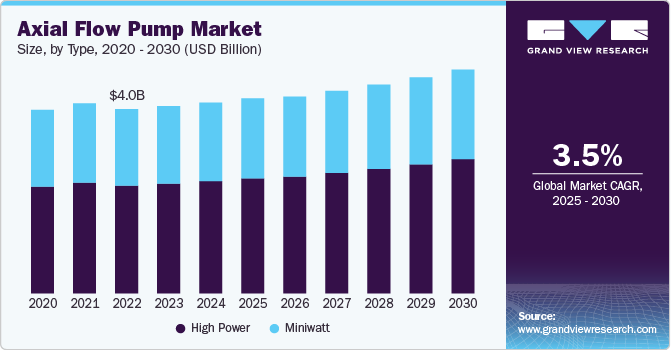

The global axial flow pump market size was estimated at USD 4,138.5 million in 2024 and is projected to reach USD 5,054.8 million by 2030, growing at a CAGR of 3.5% from 2025 to 2030. The rise of the market is primarily attributable to rising investments in wastewater treatment facilities and an uptick in activity in the oil industry to meet the rising demand for energy.

Key Market Trends & Insights

- The The Asia Pacific region is witnessing significant growth in the axial flow pump market, fueled by rapid industrialization and urbanization.

- The China axial flow pump market held 36.3% share in the Asia Pacific market.

- Based on type, the high power segment accounted for a significant market share of 59.2%, in terms of revenue, in 2024.

- Based on configuration, the single-stage segment accounted for a market share of 62.2%, in terms of revenue, in 2024.

- Based on end use, the agriculture energy source segment led the market and accounted for 22.7% of the global revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4,138.5 Million

- 2030 Projected Market Size: USD 5,054.8 Million

- CAGR (2025-2030): 3.5%

- Asia Pacific: Largest market in 2024

Additionally, it is anticipated that the world's rising urbanization and industrialization would have a beneficial effect on the expansion of the axial flow pump market in the coming years. Government laws such as DOE energy conservation standards that are strict on energy efficiency, safety, and standards are anticipated to have a significant impact on the pump market. Many government agencies have not only restructured their existing structures but also their current policies.

Moreover, the market for axial flow pump is expected to grow significantly in the U.S. owing to increasing exploration activities in both the onshore & offshore unconventional oil & gas sectors. In addition, renovation and technological developments of the existing industrial water and wastewater management infrastructure in the country are likely to drive the overall market. Axial flow pumps are increasingly finding applications in setting up of wastewater management & water treatment facilities in various countries, such as the U.S., China, the UAE, India, and Australia, which is expected to drive the market over the forecast period. In addition, the usage of axial flow pump is likely to grow in the chemical industry as they offer a high discharge rate with controlled vertical heads, thus avoiding spillage.

Drivers, Opportunities & Restraints

The growth of the axial flow pump market is primarily driven by the increasing demand for efficient water management systems across various industries. As urbanization progresses and industrial activities expand, there is a heightened need for effective pumping solutions in applications such as irrigation, wastewater treatment, and cooling systems in power plants. Additionally, the focus on sustainability and reducing energy consumption has led to a preference for axial flow pump, which are known for their high efficiency and low operating costs.

A significant restraint on the axial flow pump market is the high initial capital investment required for installation and maintenance. Many potential users may opt for less expensive alternatives, which can hinder market growth. Moreover, the technical complexity associated with the design and operation of axial flow pump can lead to challenges in finding skilled personnel for proper maintenance, further deterring companies from adopting these systems.

The axial flow pump market presents substantial opportunities through advancements in technology and materials. Innovations such as smart pumping systems equipped with IoT capabilities can enhance monitoring and control, making them more appealing to end-users. Additionally, as industries increasingly focus on automation and energy-efficient solutions, the demand for modern axial flow pump that integrate these features is likely to rise, opening new avenues for manufacturers and suppliers in the market.

Type Insights

“The demand for the high power type is expected to grow at a significant CAGR of 3.8% from 2025 to 2030 in terms of revenue.”

The high power type segment accounted for a significant market share of 59.2%, in terms of revenue, in 2024. High power axial flow pump offer a great rate of flow and power as compared to their counterparts. In this regard, the heightened application of these pumps in the flood dewatering, water and wastewater, and oil and gas industry, among others, is driving the segment’s growth. The increasing inclination towards using axial flow pump with high power to accelerate the industrial operation in various end-use industries is anticipated to provide impetus to the segment.

The demand for mini watt type axial flow pump has been steadily increasing due to their efficiency and versatility in various applications. These pumps are particularly valued in sectors such as agriculture, waste management, and industrial processes, where the need for reliable fluid handling is critical. Their ability to move large volumes of fluid at low pressures makes them ideal for irrigation systems, water treatment facilities, and cooling systems in power plants. Additionally, the compact size and energy-efficient designs of mini watt axial flow pump offer businesses cost-effective solutions, further fueling their popularity in both residential and commercial markets. As industries continue to focus on sustainability and cost reduction, the demand for these pumps is expected to grow even more in the coming years.

Configuration Insights

“The demand for the multi stage configuration segment is expected to grow at a significant CAGR of 4.2% from 2025 to 2030 in terms of revenue.”

The single-stage configuration segment accounted for a market share of 62.2%, in terms of revenue, in 2024. One of the primary driving factors for single stage axial flow pump is their ability to handle high flow rates of fluids. These pumps are well-suited for applications where a significant volume of fluid needs to be moved efficiently.

The demand for multi-stage type pumps is rising significantly across various industries due to their ability to achieve high pressure and flow rates in a compact design. These pumps are particularly sought after in applications such as water supply, irrigation, and chemical processing, where consistent performance and reliability are essential. Their efficiency in handling both clean and contaminated fluids makes them ideal for municipal water systems and wastewater treatment plants. Additionally, the trend towards energy efficiency and sustainable practices is driving the adoption of multi-stage pumps, as they can reduce operational costs while providing superior performance. As industries continue to expand and require more advanced pumping solutions, the market for multi-stage pumps is poised for continued growth.

End-use Insights

“The demand for the chemical end use segment is expected to grow at a significant CAGR of 4.8% from 2025 to 2030 in terms of revenue.”

The agriculture energy source segment led the market and accounted for 22.7% of the global revenue share in 2024. The utilization of axial flow pump in the agricultural sectors such as drainage, irrigation, and fisheries, among others, is a major driving factor for this segment. Additionally, there is a greater need for food production due to the growing population, and axial flow pump are frequently used for irrigation.

Axial flow pumps play a crucial role in the chemical industry due to their ability to efficiently handle large volumes of corrosive and viscous fluids at relatively low pressures. These pumps are ideal for processes such as mixing, transferring, and circulation of chemicals, making them essential in applications like bulk chemical manufacturing, wastewater treatment, and cooling systems. Their design allows for continuous operation with minimal vibration and noise, which is advantageous for maintaining a safe working environment.

Regional Insights

“India to witness fastest market growth at 5.3% CAGR”

North America Axial Flow Pump Market Trends

The demand for axial flow pump in North America is driven by the growing industrial sector, particularly in water treatment, oil and gas, and chemical processing. The region's emphasis on infrastructure development and the need for efficient fluid transfer solutions have propelled the market forward. Additionally, technological advancements and a focus on energy-efficient systems are expected to further enhance the adoption of these pumps.

U.S. Axial Flow Pump Market

The axial flow pump market in the U.S. is expected to grow at a CAGR of 1.4% from 2025 to 2030. In the United States, the increasing investments in water infrastructure and the oil and gas industry are key factors fueling the demand for axial flow pump. The need for efficient and reliable pumping solutions for large volumes of liquids, especially in municipal and industrial applications, is rising. Moreover, regulatory pressures for improved water quality and sustainability are encouraging the adoption of advanced pumping technologies.

The axial flow pump market in the Canada is expected to grow at a CAGR of 2.3% from 2025 to 2030. Canada's demand for axial flow pump is influenced by its expansive natural resource sector, particularly mining and forestry. The country’s commitment to environmental sustainability and energy efficiency has spurred investments in modernized pumping systems. Additionally, the need for effective water management in urban areas contributes to the growth of this market.

The axial flow pump market in the Mexico is expected to grow at a CAGR of 3.7% from 2025 to 2030. In Mexico, the demand for axial flow pump is closely linked to the country's expanding manufacturing sector and infrastructure projects. As urbanization continues to rise, there is a growing requirement for efficient water management systems. Additionally, investments in renewable energy projects and improved agricultural practices are driving the need for reliable pumping solutions.

Europe Axial Flow Pump Market Trends

The axial flow pump market in Europe held a share of 19.3% in 2024. The European market for axial flow pump is characterized by stringent environmental regulations and a strong focus on sustainability. Industries such as wastewater treatment, chemical processing, and food and beverage are increasingly adopting these pumps for their efficiency and reliability. The transition towards greener technologies and increased industrial automation further enhances market prospects.

Germany's axial flow pump market held 20.3% share in the European market. Germany stands out in Europe as a key market for axial flow pump, driven by its robust industrial base and emphasis on engineering excellence. The country’s strong commitment to environmental sustainability and innovative technologies supports the demand for efficient pumping solutions. Additionally, the automotive and manufacturing sectors contribute significantly to the growth of this market.

In the UK, the demand for axial flow pump is influenced by infrastructure investments in water and wastewater management. The government's focus on improving water quality and the transition to renewable energy sources are creating opportunities for advanced pumping solutions. Furthermore, the growing industrial sector and the need for reliable fluid handling systems are key growth drivers.

Asia Pacific Axial Flow Pump Market Trends

The Asia Pacific region is witnessing significant growth in the axial flow pump market, fueled by rapid industrialization and urbanization. Countries like China and India are investing heavily in infrastructure development, including water supply and sewage treatment systems. Additionally, the increasing demand for energy-efficient solutions and technological advancements in pumping systems are propelling market growth.

China axial flow pump market held 36.3% share in the Asia Pacific market. China's demand for axial flow pump is primarily driven by its large-scale industrial activities and extensive infrastructure projects. The government's initiatives to enhance water management and environmental protection are boosting the adoption of efficient pumping technologies. Moreover, the rapid expansion of urban areas and the need for reliable water supply systems contribute to the market's growth.

The axial flow pump market in the India is expected to grow at a CAGR of 17.7% from 2025 to 2030. In India, the growing population and urbanization are significant factors driving the demand for axial flow pump. The country is investing in water supply and sanitation projects to address the challenges of water scarcity and quality. Additionally, the expansion of industries such as agriculture, manufacturing, and power generation is increasing the need for efficient fluid transfer solutions.

Middle East & Africa Axial Flow Pump Market Trends

The Middle East and Africa region is witnessing an increasing demand for axial flow pump due to the need for effective water management solutions in arid areas. The oil and gas sector, along with infrastructural development in cities, are key drivers of this market. Additionally, the emphasis on sustainability and efficient water use is prompting the adoption of modern pumping technologies.

In the UAE, the demand for axial flow pump is growing rapidly, driven by ambitious infrastructure projects and a focus on sustainability. The country's investments in water and wastewater treatment facilities, coupled with its expanding industrial base, create significant opportunities for axial flow pump manufacturers. Furthermore, the government's commitment to reducing water scarcity through efficient management practices enhances market potential.

Latin America Axial Flow Pump Market Trends

Latin America is experiencing a rising demand for axial flow pump due to the growth in the mining, agriculture, and energy sectors. Countries like Brazil are investing in infrastructure improvements, particularly in water supply and wastewater treatment. The increasing focus on sustainable practices and efficient resource management further enhances the market potential in the region.

In Brazil, the demand for axial flow pump is closely linked to its vibrant agricultural sector and the expansion of mining operations. The country's focus on improving water infrastructure and managing resources efficiently drives the market. Additionally, the push for sustainable practices and investments in renewable energy projects are fostering the adoption of advanced pumping solutions.

Key Axial Flow Pump Company Insights

Some of the key players operating in the axial flow pump market include Ebara Corporation, Flowserve Corporation, Grundfos Holding A/S, among others.

-

Ebara Corporation has a subsidiary, namely EBARA Pumps Americas Corporation, in South Carolina, U.S. It provides products and services related to engineered pumps & pumping. The company serves its products to various industries, such as wastewater, water, municipal, commercial, energy, and power, which offer reliable product knowledge, responsive support, and application expertise including aftermarket replacement parts services. EBARA Pumps Americas Corporation, commonly known as EPAC, provides a complete line of stainless steel pumps that are corrosion resistant and include end suction centrifugal, submersible, sump, multistage, effluent, and sewage pumps. EBARA pump service and parts are accessible over a wide network across North America to support clientele for complete motors and pump parts replacement or service.

-

Flowserve Corporation, manufactures comprehensive flow control systems and provides aftermarket services. The company has a strong operational presence in more than 50 countries. Currently, it operates 206 facilities, including manufacturing and quick response centers (QRS), around the globe and provides an array of aftermarket services such as installation, advanced diagnostics, retrofitting, and repair. The company has been supplying to more than 10,000 customers globally, including OEMs. power, chemical, water, oil & gas, and general industries.

The Weir Group PLC, Handol Pumps Ltd. are some of the emerging players in the axial flow pump market.

-

The Weir Group PLC offers solutions in process equipment, equipment attachments, and wear parts segments. It is present in more than 50 countries. The company also provides support services, field services, rebuild & repair services, and digital services. The Weir Minerals division provides mill cut technology and services as well as slurry handling equipment and related aftermarket support. These technologies are particularly utilized in oil & gas, mineral, and general industrial markets. The Weir ESCO division offers ground-engaging tools that are used in large mining machines. Primary infrastructure markets catered by the ESCO division include construction, dredging and sand, and aggregates. The Weir Oil & Gas division offers products, including pressure pumping equipment and pressure control equipment, as well as aftermarket spare parts and services.

Key Axial Flow Pump Companies:

The following are the leading companies in the axial flow pump market. These companies collectively hold the largest market share and dictate industry trends.

- Ebara Corporation

- Flowserve Corporation

- Grundfos Holding A/S

- Handol Pumps Limited

- Hitachi Industrial Products Ltd.

- ITT Goulds Pumps

- Pentair PLC

- Sulzer Ltd.

- The Weir Group PLC

- Xylem Inc.

Recent Developments

-

In March 2024, ITT INC. disclosed an investment plan of USD 11.0 million aimed at expanded pump testing capabilities across Germany, India, and Saudi Arabia. This financial commitment is directed toward enhancing the company's power capacity related to pump, motor, and control systems testing. It will allow the company to conduct local testing of bigger and more complex pump systems.

Axial Flow Pump Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,257.0 million

Revenue forecast in 2030

USD 5,054.8 million

Growth Rate

CAGR of 3.5% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, configuration, end-use, region

Country scope

U.S.; Canada; Mexico; France; Germany; Italy; UK; China; Japan; India; Australia; Argentina; Brazil; Saudi Arabia; UAE

Key companies profiled

Ebara Corporation; Flowserve Corp.; Grundfos Holding A/S; Handol Pumps Ltd.; Hitachi Industrial Products Ltd.; ITT Goulds Pumps; Pentair PLC; Sulzer Ltd.; The Weir Group PLC; Xylem Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Axial Flow Pump Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the axial flow pump market on the basis of type, configuration, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

High Power

-

Miniwatt

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Construction & Building Services

-

Water & Wastewater

-

Power Generation

-

Oil & Gas

-

Chemicals

-

Others

-

-

Configuration Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-stage

-

Multi-stage

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global axial flow pump market size was estimated at USD 4,138.5 million in 2024 and is expected to reach USD 4,257.0 million in 2025

b. The global axial flow pump market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.5% from 2025 to 2030 to reach USD 5,054.8 million by 2030

b. The agriculture energy source segment led the market and accounted for 22.7% of the global revenue share in 2024. The utilization of axial flow pump in the agricultural sectors such as drainage, irrigation, and fisheries, among others, is a major driving factor for this segment. Additionally, there is a greater need for food production due to the growing population, and axial flow pump are frequently used for irrigation

b. Some of the key players operating in the axial flow pump market include Ebara Corporation; Flowserve Corp.; Grundfos Holding A/S; Handol Pumps Ltd.; Hitachi Industrial Products Ltd.; ITT Goulds Pumps; Pentair PLC; Sulzer Ltd.; The Weir Group PLC; Xylem Inc

b. The key factors that are driving the axial flow pump market include the growth of the market can be primarily attributed to the growth of the market can be primarily attributed to the rising investments taking place in the wastewater treatment plants and the increase in oil filed activities taking place to satisfy the increased energy demand

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.