- Home

- »

- Homecare & Decor

- »

-

Baby Training Pants Market Size, Industry Report, 2030GVR Report cover

![Baby Training Pants Market Size, Share & Trends Report]()

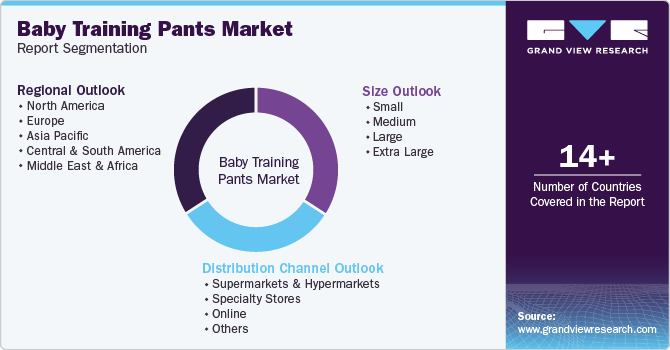

Baby Training Pants Market (2025 - 2030) Size, Share & Trends Analysis Report By Size (Small, Medium, Large, Extra Large), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-514-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Baby Training Pants Market Size & Trends

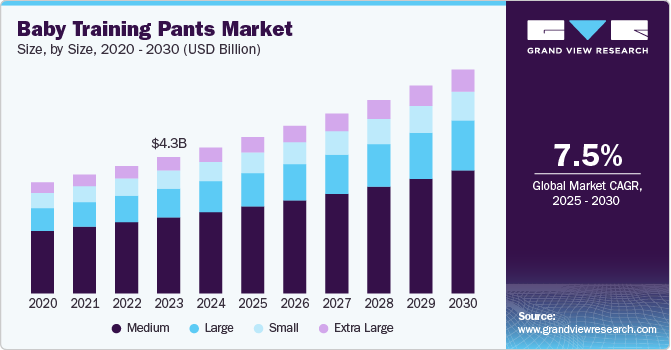

The global baby training pants market size was estimated at USD 4.57 billion in 2024 and is expected to grow at a CAGR of 7.5% from 2025 to 2030. The baby training pants market has grown significantly as part of the evolving baby care industry, reflecting changes in parenting preferences and toilet training approaches. These reusable cloth pants are designed for toddlers transitioning out of diapers, offering partial absorbency to manage minor accidents. Unlike fully absorbent diapers, they encourage children to recognize wetness, a critical step in the toilet training readiness. With increasing awareness of eco-friendly alternatives, many parents prefer cloth training pants over disposable options, contributing to the steady expansion of the baby training underwear industry globally.

The baby training pants industry benefits from trends emphasizing sustainable parenting and child readiness for toilet training. Modern parents seek products that are environmentally friendly, cost-effective, and aligned with a child-led potty-training approach. Cloth training pants appeal to these values, offering durability and multiple uses. The baby care industry has also adapted by introducing vibrant designs, breathable fabrics, and gender-neutral options, catering to diverse consumer preferences. As disposable diapers use delays training for some children, cloth training pants emerge as a solution encouraging earlier transitions.

Rising consumer demand for reusable alternatives has spurred innovation in the baby training pants market. Manufacturers now focus on incorporating organic fabrics and hypoallergenic materials to meet growing health-conscious demands. In addition, premium designs with layered protection provide a balance between comfort and function. The baby training underwear industry is witnessing increased traction in regions where disposable diaper costs or environmental concerns drive parents toward cloth options. This shift reflects broader trends in the baby care industry, emphasizing a return to traditional, sustainable practices.

The future of the baby training pants industry looks promising as awareness grows around eco-friendly parenting solutions. Parents increasingly value products that promote early potty training, reduce waste, and align with child-led approaches. The global baby care industry is expected to further integrate reusable training pants into its offerings, responding to trends such as zero-waste lifestyles. Market leaders in the baby training underwear industry are expanding their portfolios with stylish, absorbent, and breathable cloth options, meeting the rising demand for innovative solutions that benefit both children and the environment.

Consumer Surveys & Insights

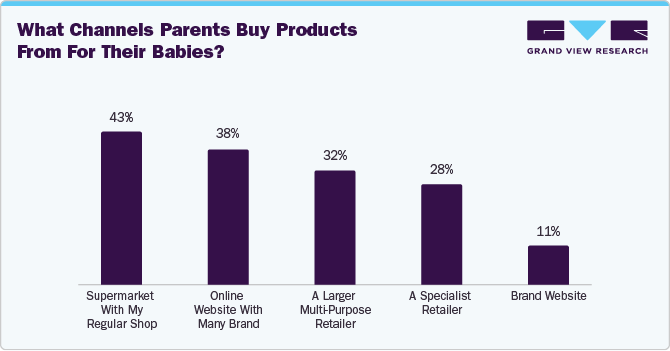

Since lockdown, shopping habits for baby care products have shifted significantly, with many parents relying on online shopping due to convenience and restrictions. This trend involves extensive research through reviews and price comparisons, often favoring local stores for purchases when possible. However, the inability to physically examine products has heightened concerns about returns and product satisfaction. This shift impacts the baby training pants market by emphasizing the importance of clear product descriptions, reliable reviews, and hassle-free return policies to meet evolving parental preferences. The ParentsandBrands survey results from 2021 regarding the preferred distribution channels for purchasing baby-related products are displayed in the graph below.

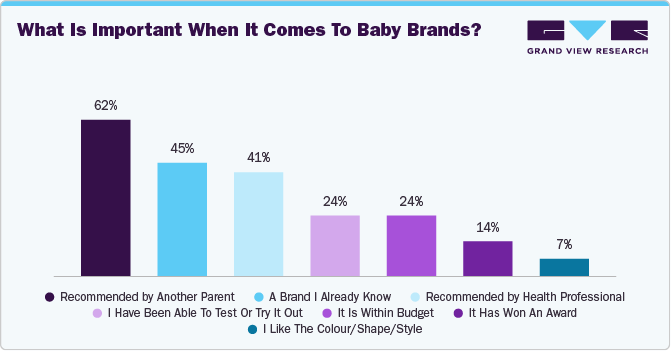

When buying products for their babies and toddlers, parents prioritize quality, affordability, and trusted recommendations from friends and family. They rely heavily on online platforms for research, valuing clear product information and reviews. For the baby training pants market, this highlights the need for high-quality, competitively priced options and leveraging word-of-mouth endorsements to build trust and attract consumers. The following graph by the 2021 ParentsandBrands survey shows what is important for parents when they buy products for their toddlers and babies.

Size Insights

In 2024, medium-sized baby training pants accounted for about 55% of the overall baby training pants market. In the baby training pants industry, the medium size is the most sold because it caters to toddlers, the primary age group undergoing potty training. This size fits children in the critical readiness phase, typically between 2 and 3 years old when most parents start transitioning from diapers. Its versatility makes it the go-to choice for the majority of consumers in the market.

Demand for large-sized baby training pants is expected to grow at a CAGR of 8.4% from 2025 to 2030. Modern trends in the sector indicate delayed potty training among kids. With parents prioritizing child readiness, many toddlers remain in training pants longer, often past age three. Improvements in training pants’ comfort and functionality have made them a preferred choice during extended training periods. This shift aligns with increasing parental focus on child-led approaches in the industry.

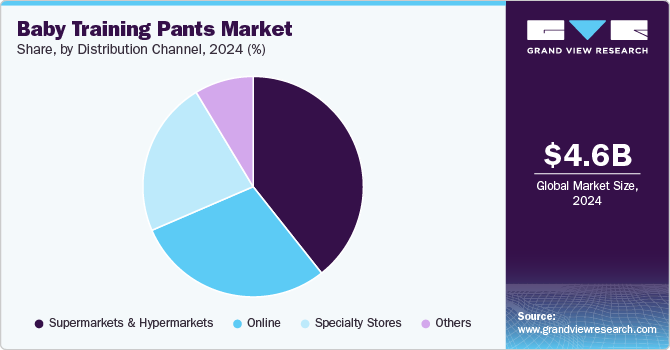

Distribution Channel Insights

Sales through hypermarkets and supermarkets accounted for a share of about 39% of the baby training pants market in 2024. These are major channels in the market due to their widespread presence and ability to offer a variety of products under one roof. These retail outlets provide convenience for parents seeking baby care essentials, including training pants, while allowing them to compare brands and prices. In addition, promotional discounts and bulk purchase options make them a preferred choice in the baby training pants industry.

Demand for baby training pants through the online channel is expected to rise at a CAGR of 8.1% from 2025 to 2030. Sales through online channels are expected to rise due to the growing preference for convenience and the ability to shop from home. E-commerce platforms offer a wide variety of brands, sizes, and discounts, making them attractive to busy parents. In addition, features such as subscription services and doorstep delivery enhance accessibility, while reviews and ratings help consumers make informed choices, driving growth in the online segment.

Regional Insights

The baby training pants market in North America accounted for a market share of around 30% in 2024 in the global baby training pants market. Many parents in North America are increasingly aware of the benefits of starting potty training at an appropriate age. Training pants are seen as a transitional tool that supports this process, making them a sought-after product. In addition, leading brands heavily market training pants with features such as easy pull-up designs and fun patterns. These efforts make training pants an attractive and familiar choice for parents.

U.S. Baby Training Pants Market Trends

In 2024, the baby training pants market in the U.S. held a dominant 80% share of the North American market. Baby training underwear, such as the U0U Baby Girls Training Pants, caters to a growing demand in the U.S. market due to its blend of practicality, comfort, and fun designs. These products support potty training with features such as added wetness protection, gentle elastic for a secure fit, and appealing patterns, making them a go-to choice for parents. The focus on helping children transition from diapers to underwear while encouraging independence has made such products a staple in many households, contributing to their popularity.

Europe Baby Training Pants Market Trends

In 2024, the baby training pants market in Europe accounted for about 27% of the overall market. The demand for baby training pants in Europe is significant due to the emphasis on health, safety, and washability when purchasing clothing for younger children. Parents prioritize practical and durable products that can withstand the rapid growth and wear-and-tear common in this age group. In addition, the popularity of baby showers and gifting trends, along with a strong preference for high-quality, uniquely designed clothing, drives the market for baby training pants as part of these thoughtful, practical gifts.

Asia Pacific Baby Training Pants Market Trends

The baby training pants market in Asia Pacific is set to grow at a CAGR of 8.7% from 2025 to 2030. In the region, the demand for baby training products such as the ones from the brand SuperBottoms is expected to rise as more parents seek eco-friendly alternatives to disposable options. Just as SuperBottoms capitalized on the need for better cloth diapers by engaging with mom communities and focusing on customer education, this approach resonates with growing sustainability concerns and a desire for practical, reliable solutions. The shift from traditional retail to digital platforms and strong customer trust-building strategies are key drivers for expansion in this market.

Key Baby Training Pants Company Insights

The baby training pants market is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some prominent companies in this market are Gerber Childrenswear, Hanna Andersson, HANESBRANDS INC., and Bambino Mio, among others. Market players are differentiating through expansions, investments, and launches to cater to evolving consumer preferences.

Key Baby Training Pants Companies:

The following are the leading companies in the baby training pants market. These companies collectively hold the largest market share and dictate industry trends

- Gerber Childrenswear

- Hanna Andersson

- HANESBRANDS INC.

- MooMoo Baby

- Bambino Mio

- Charlie Banana

- Thirsties Baby

- Big Elephant

- Kanga Care

- Green Mountain Diapers

Recent Developments

-

In September 2024, SuperBottoms, a sustainable D2C reusable cloth diaper brand that also offers baby training pants, launched its 'It Feels Right' campaign. The campaign celebrated the comfort, quality, and eco-friendly values of SuperBottoms' product line, connecting with parents on an emotional level. The campaign emphasizes the benefits of high-quality cloth diapers made from organic cotton, highlighting that SuperBottoms' products are absorbent, economical, chemical-free, and sustainable, unlike disposable options.

-

In December 2022, Loop, a global reuse platform, introduced the first national cloth diaper service in the U.S. The Loop Diaper Service offers doorstep delivery of premium cloth diapers and training pants, pick-up of used diapers, and professional cleaning services. Parents could select a diaper bundle, pay a refundable deposit and a service fee, and receive Charlie Banana reusable diapers, cloth inserts, and an anti-odor diaper bin.

Baby Training Pants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.90 billion

Revenue forecast in 2030

USD 7.02 billion

Growth rate (Revenue)

CAGR of 7.5% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Size, distribution channel

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Japan; South Korea; Australia & New Zealand; South Africa; UAE; Brazil; Argentina

Key companies profiled

Gerber Childrenswear; Hanna Andersson; Hanesbrands Inc.; MooMoo Baby; Bambino Mio; Charlie Banana; Thirsties Baby; Big Elephant; Kanga Care; Green Mountain Diapers

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Baby Training Pants Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the baby training pants market report on the basis of size, distribution channel, and region.

-

Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small

-

Medium

-

Large

-

Extra Large

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The baby training pants market was estimated at USD 4.57 billion in 2024 and is expected to reach USD 4.90 billion in 2025.

b. The baby training pants market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2030 to reach USD 7.02 billion by 2030.

b. North America dominated the baby training pants market in 2024 with a share of about 30%. Many parents in North America are increasingly aware of the benefits of starting potty training at an appropriate age. Training pants are seen as a transitional tool that supports this process, making them a sought-after product.

b. Key players in the baby training pants market are Gerber Childrenswear; Hanna Andersson; Hanesbrands Inc.; MooMoo Baby; Bambino Mio; Charlie Banana; Thirsties Baby; Big Elephant; Kanga Care; Green Mountain Diapers.

b. Key factors that are driving the baby training pants market growth include increasing parental focus on toilet training, growing awareness of child hygiene, rising disposable incomes, eco-friendly product demand, and innovative designs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.