- Home

- »

- Plastics, Polymers & Resins

- »

-

Bag-in-Box Container Market Size, Industry Report, 2033GVR Report cover

![Bag-in-Box Container Market Size, Share & Trends Report]()

Bag-in-Box Container Market (2026 - 2033) Size, Share & Trends Analysis Report By Component Type (Bags, Box, Fitments), By Capacity, By Material State, By Tap, By Application (Food & Beverages, Industrial Liquids, Household Products), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-655-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bag-in-Box Container Market Summary

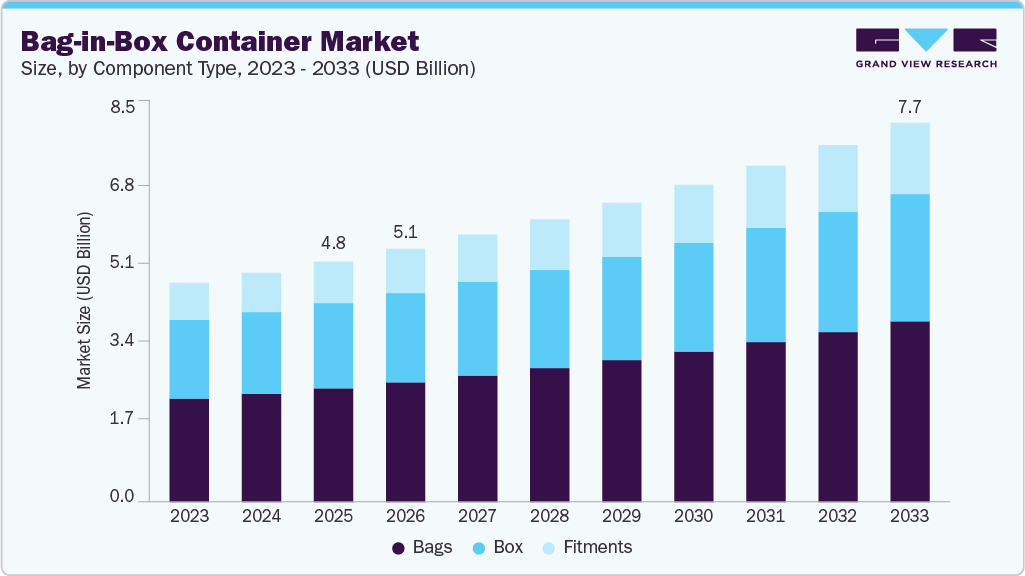

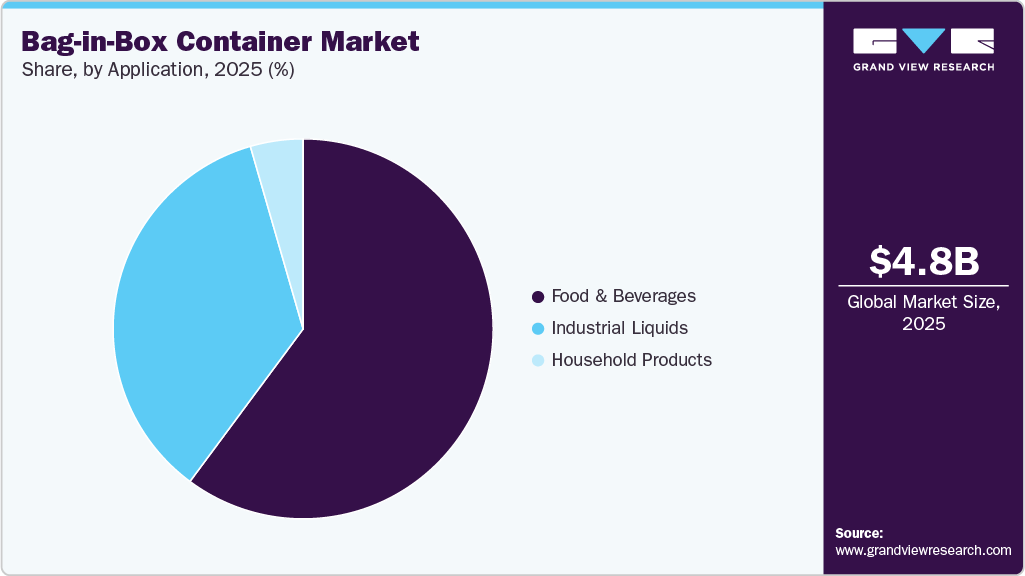

The global bag-in-box container market size was valued at USD 4.79 billion in 2025 and is expected to reach USD 7.70 billion by 2033, expanding at a CAGR of 6.2% from 2026 to 2033. The market is driven by rising demand for convenient, spill-free packaging in the food and beverage sector, growing adoption in wine and liquid dairy products, and increasing emphasis on sustainable, lightweight, and cost-effective packaging solutions.

Key Market Trends & Insights

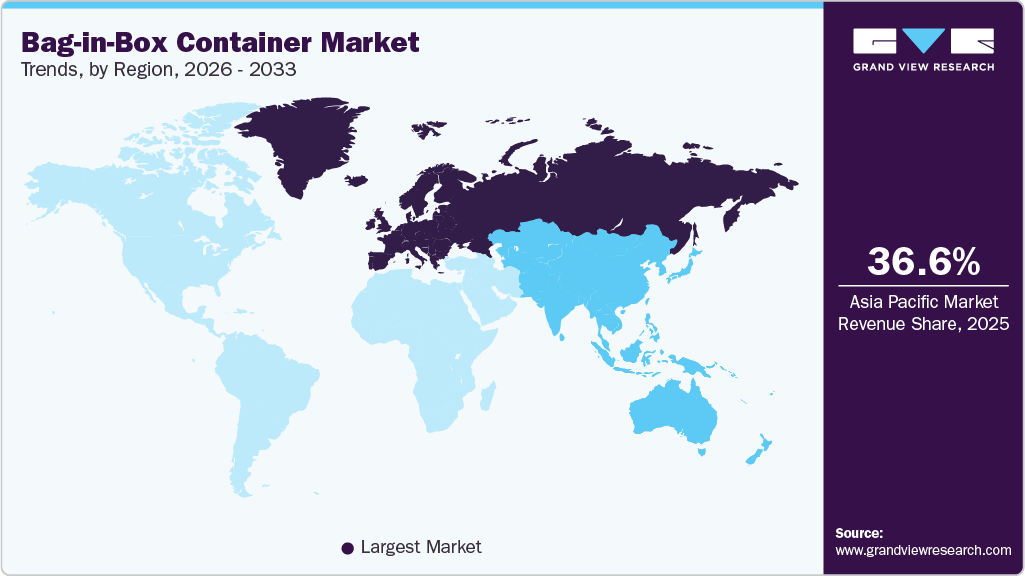

- Europe dominated the bag-in-box container market with the largest revenue share of over 36.61% in 2025.

- The bag-in-box container market in Asia Pacific is expected to grow at a substantial CAGR of 6.5% from 2026 to 2033.

- By capacity, the 5-10 liter segment is expected to grow at a considerable CAGR of 6.6% from 2026 to 2033 in terms of revenue.

- By material state, the liquid segment is expected to grow at a considerable CAGR of 6.5% from 2026 to 2033 in terms of revenue.

- By component type, the fitments segment is expected to grow at a considerable CAGR of 7.3% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 4.79 Billion

- 2033 Projected Market Size: USD 7.70 Billion

- CAGR (2026-2033): 6.2%

- Europe: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

The food and beverage sector has become a key driver of growth for the bag-in-box (BIB) packaging industry, thanks to its versatility, cost efficiency, and superior protection for liquid and semi-liquid products. Food and beverage producers are increasingly adopting BIB solutions for packaging edible oils, dairy products, fruit juices, sauces, and syrups, as the packaging format minimizes oxidation, reduces product waste, and ensures extended shelf life after opening. The airtight dispensing system prevents contamination, making it ideal for food service and catering operations where hygiene and portion control are critical. For instance, major beverage brands such as Coca-Cola, PepsiCo, and Nestlé use bag-in-box systems for syrup concentrates and juices used in dispensers, ensuring product consistency and ease of transport.

The demand for ready-to-drink (RTD) and on-the-go beverages is also influencing the uptake of BIB packaging. Foodservice chains and hospitality sectors prefer this format due to its efficiency in bulk storage and ease of use during refilling or dispensing. Additionally, consumers’ growing preference for eco-friendly and lightweight packaging alternatives is encouraging beverage producers to replace rigid plastic and glass containers with recyclable BIB solutions. For example, BIB packaging for fruit juices and liquid dairy products helps reduce overall packaging material usage and logistics costs, aligning with sustainability targets set by major beverage producers.

In the European wine industry, bag-in-box packaging has seen exceptional growth as consumers embrace its convenience, affordability, and ability to maintain wine quality for weeks after opening. According to the World Population Review, in 2023, EU countries such as France, Italy, and Spain together accounted for 48.2% of global wine production. Hence, these countries are witnessing an increasing shift toward BIB packaging, especially for mid-range and table wines. According to industry observations, France’s retail wine sector now features a significant share of BIB wines, particularly in supermarkets where value-oriented and sustainable packaging appeals to everyday consumers. Moreover, Scandinavian markets, notably Sweden and Norway, have also driven this trend, with over half of retail wine sales occurring in bag-in-box formats due to consumer preferences for convenience, reduced waste, and easy storage.

The bag-in-box (BIB) packaging industry is increasingly driven by sustainability concerns, as brands and consumers seek solutions that minimize environmental impact. A key advantage of BIB packaging is its recyclability and low waste generation. For example, DS Smith Rapak designs BIB systems for easy and convenient deconstruction, resulting in minimal packaging waste upon disposal. Their life cycle assessment (LCA) shows that Bag-in-Box generates up to five times less waste than rigid containers. The cardboard outer box is 100% recyclable and widely collected, while the inner liner, made of non-barrier polyethylene, can achieve up to 31% recycling rates, demonstrating the tangible waste reduction benefits of this packaging format.

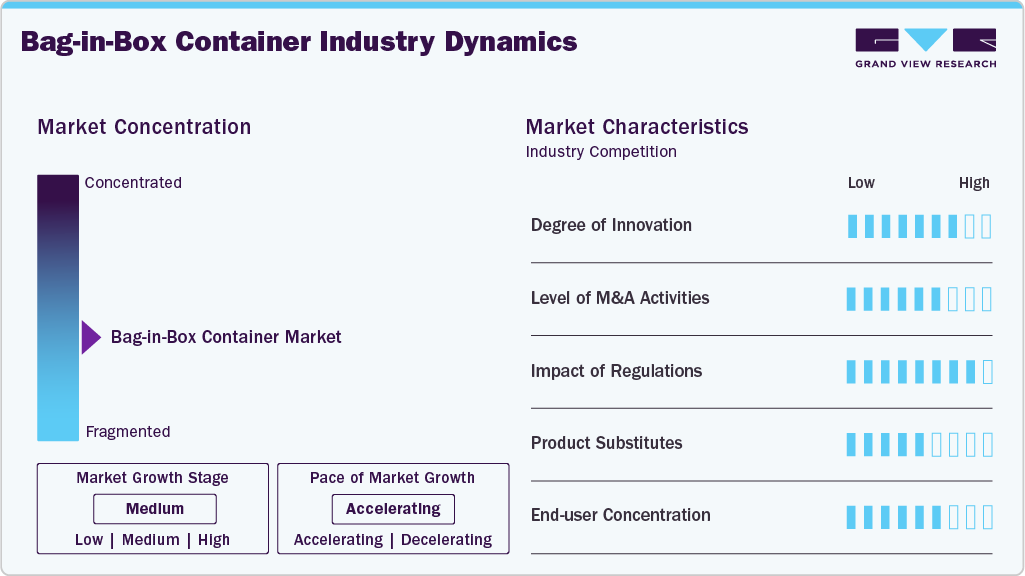

Market Concentration & Characteristics

The bag-in-box container industry is relatively mature, particularly in regions such as Europe and North America, where BIB solutions have been used for decades in wine, juice, and dairy packaging. Despite its maturity, the industry continues to evolve with innovations in materials, barrier technologies, and closure systems, allowing manufacturers to cater to new applications such as liquid foods, chemicals, and cleaning solutions. This combination of established adoption and ongoing innovation makes the industry both stable and dynamic.

The industry relies heavily on multi-layer laminate films, paperboard, and high-quality taps or fitments. Any disruption in raw material supply, such as fluctuations in plastic or paperboard availability, can significantly impact production. Manufacturers also need to coordinate closely with beverage or food producers to ensure the packaging meets barrier, shelf-life, and regulatory requirements. As a result, the industry is characterized by a complex and interconnected supply chain that demands precision and reliability.

Capacity Insights

The 1-5 liter segment recorded the largest market revenue share of over 33.2% in 2025. This is one of the most common and versatile BIB sizes used for beverages such as wine, fruit juices, milk, and cooking oils. It balances ease of handling with sufficient volume for family or small-scale commercial use. Packaging typically includes a sturdy outer box with an inner bag and a tap for easy dispensing. Consumers and businesses prefer this capacity for its cost-efficiency and reduced storage space compared to multiple smaller bottles. Additionally, the trend toward eco-friendly packaging, where larger BIBs minimize plastic use per liter, supports its adoption.

The 5-10 liter segment is expected to grow at the fastest CAGR of 6.6% during the forecast period. BIBs in the 5-10 liter range are widely adopted in commercial and industrial applications, such as beverage dispensing in cafeterias, schools, or event catering. They are also used for bulk sauces, syrups, cleaning solutions, and wine. The expansion of the foodservice and hospitality sector drives demand in this segment. Bulk purchasing reduces unit costs, ensures consistent supply, and improves operational efficiency.

Material State Insights

The liquid segment recorded the largest market revenue share of over 88.09% in 2025 and is expected to grow at the fastest CAGR of 6.5% during the forecast period. This segment of the BIB container industry primarily includes products that are fully fluid in nature, such as water, wine, juices, milk, and other beverages. These liquids require packaging that ensures leak-proof storage, maintains hygiene, and extends shelf life. The BIB format is highly suitable for liquids because it offers a flexible bag that collapses as the liquid is dispensed, preventing air contact and thereby reducing oxidation.

The semi-liquid segment includes viscous products that flow but not as freely as liquids. Examples include sauces, syrups, soups, condiments, and certain chemical formulations. Packaging semi-liquid products in BIB containers allows controlled dispensing without creating mess or wastage. The BIB structure supports products with higher viscosity while ensuring the bag can collapse and maintain product integrity. Food service industries, large-scale caterers, and commercial kitchens increasingly prefer BIBs for semi-liquid products due to ease of storage and portion control.

Component Type Insights

The bags segment recorded the largest market revenue share of over 47.34% in 2025. Bags are the primary storage component of a bag-in-box system, typically made from multi-layered plastic films such as polyethylene (PE), ethylene-vinyl alcohol (EVOH), or foil laminates. These layers provide excellent barrier properties against oxygen, moisture, and light, ensuring the product’s freshness over time. Bags can be designed in various sizes and thicknesses to accommodate different capacities, ranging from 1 liter to over 20 liters. Some advanced bags feature vacuum or collapsible designs that allow the liquid to be dispensed without exposure to air, extending shelf life and reducing wastage.

The fitments segment is expected to grow at the fastest CAGR of 7.3% during the forecast period. Fitments, also known as taps or dispensers, are the mechanisms that allow controlled dispensing of the liquid from the bag. These are typically made from food-grade plastics like polypropylene (PP) or polyethylene (PE) and come in various designs such as gravity taps, push taps, or lever taps. Fitments are designed to prevent leakage, contamination, and oxidation, making them crucial for products that need to maintain freshness after opening. The rise of on-premise consumption in foodservice and self-dispensing systems is fueling the demand for advanced fitments in the BIB industry.

Tap Insights

The with tap segment recorded the largest market revenue share of over 73.52% in 2025 and is expected to grow at the fastest CAGR of 6.5% during the forecast period. The “with tap” segment refers to BIB containers that are equipped with a built-in dispensing tap, usually made of plastic, allowing easy pouring of liquid contents without opening the entire package. These taps can range from simple push-pull mechanisms to more advanced self-sealing designs that prevent spillage and maintain product integrity. The convenience of controlled pouring and the ability to reseal the container makes it highly attractive to both consumers and businesses.

The “without tap” segment refers to BIB containers that do not include a dispensing mechanism and require manual opening to access the contents. These containers are simpler in design and typically used for industrial or foodservice applications where liquids are poured in large quantities, such as in catering, restaurants, or food processing plants. Common examples include bulk syrups, sauces, or water used in commercial kitchens. Without taps, these containers are generally more cost-effective to produce and are suitable for high-volume liquid storage and transportation, where specialized dispensing may not be necessary.

Application Insights

The food & beverages segment recorded the largest market share of over 69.33% in 2025 and is projected to grow at the fastest CAGR of 6.5% during the forecast period. BIBs are widely used for packaging products such as wine, fruit juices, edible oils, dairy liquids, sauces, and syrups. Their ability to preserve liquid freshness, prevent oxidation, and extend shelf life makes them ideal for sensitive products such as wine and juice. The packaging is lightweight, easy to handle, and reduces storage and transportation costs compared to glass bottles or cans.

Industrial liquids such as adhesives, chemicals, lubricants, liquid detergents, and oils are increasingly being packaged in BIBs due to their operational and logistical advantages. BIBs help prevent contamination, reduce spillage, and simplify bulk transportation. Industries such as automotive lubricants (engine oils) and industrial adhesives (epoxy resins, water-based adhesives) often prefer BIBs for their storage efficiency and ease of handling. These containers are particularly beneficial in settings where large volumes are used continuously, allowing direct dispensing without additional transfer steps, ultimately improving workflow efficiency and making BIBs a reliable, cost-effective choice for industrial applications.

Region Insights

North America is a mature yet steadily growing market for bag-in-box containers, driven primarily by well-established consumer preferences for convenience, a strong focus on sustainability, and deep penetration in the foodservice industry. The U.S. and Canada have a long history of using BiB for popular products like boxed wine, which has successfully shed its budget image and is now a mainstream category featuring premium brands. Beyond wine, the market is expanding into non-alcoholic areas such as cold-brew coffee, liquid egg products, syrups for soda fountains, and shelf-stable broths, where BiB's extended shelf life and efficient storage are key selling points for both retailers and consumers.

U.S. Bag-in-Box Container Market Trends

The U.S. is the largest and most dynamic market for bag-in-box, driven by innovation, a powerful foodservice sector, and the mainstream success of boxed wine. The U.S. consumer market is highly receptive to convenience-oriented formats. The continued premiumization of boxed wine, with offerings from respected wineries, has broken the stigma and established BiB as a legitimate quality option. This success has paved the way for its adoption in other fast-growing categories, including premium cocktail mixers, plant-based milks, and maple syrup, where brands leverage BiB's functional benefits as a key marketing point.

Europe Bag-in-Box Container Market Trends

Europe recorded the largest market share of over 36.61% in 2025. The region represents a highly developed market for Bag-in-Box, characterized by stringent environmental regulations, advanced recycling infrastructure, and a mature wine culture that has fully embraced the format. The European Union's circular economy action plan and policies like the Single-Use Plastics Directive create a regulatory environment that favors packaging formats with superior environmental credentials.

The primary driver in Europe remains the wine industry, particularly in France, Italy, Germany, and Spain. BiB packaging for wine is well-established and socially accepted for everyday consumption, valued for its ability to protect the wine from oxidation for several weeks after opening. This has been crucial for single-person households and casual consumption.

Asia Pacific Bag-in-Box Container Market Trends

Asia Pacific is expected to grow at the fastest CAGR of 6.5% over the forecast period. This positive outlook is due to economic expansion, shifting consumer habits, and a massive industrial base. The rapid urbanization and rising disposable incomes in countries such as India, Vietnam, and Indonesia are creating a burgeoning middle class with a growing appetite for convenience and packaged goods. This shift is particularly evident in the demand for BiB packaging for liquid food and beverages like fruit juices, dairy alternatives, and edible oils, where BiB offers a cost-effective and space-efficient solution compared to rigid containers. Furthermore, the expansion of modern retail formats, such as supermarkets and hypermarkets, across the region provides the ideal distribution channel for BiB products, making them accessible to millions of new consumers.

Key Bag-in-Box Container Company Insights

The bag-in-box container market is highly competitive and moderately consolidated, dominated by a mix of global packaging giants and regional players. Major companies such as Amcor plc, Smurfit WestRock, DS Smith, SIG, and Sealed Air lead the market with strong brand recognition, extensive distribution networks, and integrated supply chain capabilities.

Competition is primarily driven by product innovation, such as improved barrier films, eco-friendly materials, and convenient tap systems, alongside cost efficiency, customization for diverse liquid and semi-liquid applications, and sustainability initiatives. Emerging players are increasingly leveraging niche applications and regional demand, particularly in developing markets, to carve out market share, intensifying the competitive landscape and pushing both innovation and price competitiveness across the industry.

-

In September 2025, Smurfit Westrock launched the Bag-in-Box Powergrip at its Turnhout plant in Belgium to replace 2-5L HDPE bottles and jerrycans for products such as oils, cleaners, and agrochemicals. Featuring a cardboard casing with a handle and a vacuum bag, it uses up to 75% less plastic and meets upcoming EU packaging regulations with enhanced sustainability and convenience.

-

In September 2025, Carlsberg Britvic partnered with DS Smith to launch the OTOR8 Bag-in-Box, an eight-sided design that fits 25% more boxes per pallet. It improves supply chain efficiency, reduces transport emissions, enhances storage stability, and supports Carlsberg Britvic’s net-zero carbon goals.

Key Bag-in-Box Container Companies:

The following are the leading companies in the bag-in-box container market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Smurfit Westrock

- DS Smith

- GENERAL FILMS

- SIG

- Sealed Air

- CDF Corporation

- AstraPouch

- Optopack

- Aran Group

- BIBP sp. z o.o.

- Great Northern Corporation

- Peak Liquid Packaging

- Hangzhou Hansin New Packing Material Co., Ltd.

- Yantai Fushan Nanhua Packaging Factory

Bag-in-Box Container Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 5.07 billion

Revenue forecast in 2033

USD 7.70 billion

Growth rate

CAGR of 6.2% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Capacity, material state, component type, tap, application, region

States scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France

Italy; Spain; Turkey; Russia; China; India; Japan

South Korea; Australia; Brazil; Argentina

Saudi Arabia; South Africa; UAEKey companies profiled

Amcor plc; Smurfit Westrock; DS Smith; GENERAL FILMS; SIG; Sealed Air; CDF Corporation; AstraPouch; Optopack; Aran Group; BIBP sp. z o.o.; Great Northern Corporation; Peak Liquid Packaging; Hangzhou Hansin New Packing Material Co., Ltd.; Yantai Fushan Nanhua Packaging Factory

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bag-in-Box Container Market Report Segmentation

This report forecasts revenue growth at a global, regional, and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global bag-in-box container market report based on capacity, material state, component type, tap, application, and region:

-

Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

< 1 Liter

-

1-5 Liter

-

5-10 Liter

-

10-20 Liter

-

< 20 Liter

-

-

Material State Outlook (Revenue, USD Million, 2021 - 2033)

-

Liquid

-

Semi Liquid

-

-

Component Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Bags

-

Box

-

Fitments

-

-

Tap Outlook (Revenue, USD Million, 2021 - 2033)

-

With Tap

-

Without Tap

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Alcoholic Beverages

-

Wine

-

Beer

-

Others

-

-

Non-Alcoholic Beverages

-

Soft Drinks

-

Juices & Flavored Drinks

-

Water

-

-

Others

-

Tomato Products

-

Milk & Dairy Products

-

Liquid Eggs

-

Edible Oil

-

Others

-

-

-

Industrial Liquids

-

Oils

-

Industrial Fluids

-

Petroleum Products

-

-

Household Products

-

Household Cleaners

-

Liquid Detergents

-

Liquid Soaps & Hand wash

-

Others

-

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Turkey

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global bag-in-box container market was estimated at around USD 4.79 billion in the year 2025 and is expected to reach around USD 5.07 billion in 2026.

b. The global bag-in-box container market is expected to grow at a compound annual growth rate of 6.2% from 2026 to 2033 to reach around USD 7.70 billion by 2033.

b. The food & beverages segment dominates the bag-in-box market as BIB packaging preserves liquid freshness, extends shelf life, and offers convenient, spill-free dispensing for products such as wine, juice, and dairy.

b. The key market player in the Bag-in-box container market includes Amcor Ltd., Smurfit Kappa, DS Smith, Liquibox, Scholle IPN, CDF Corporation, Arlington Packaging (Rental) Limited, CENTRAL PACKAGE & DISPLAY, Accurate Box Company, Inc, TPS Rental System Ltd., Optopack Ltd, Zarcos America, Aran Group, BiBP SP. z O.O, Hangzhou Hansin New Packing Material Co., Ltd, and others.

b. The key factors that are driving the global bag-in-box containers market include, increasing consumption of the alcoholic beverages by developing and developed economies and increasing consumption of the household cleaners such as surface deodorizers, surface cleaners is expected to drive the demand for the bag-in-box container.

b. Asia Pacific dominated the global bag-in-box container market, owing to the rising demand form the countries such as South Korea and Australia due to the growing industrialization and increased alcohol consumption by young population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.