- Home

- »

- Homecare & Decor

- »

-

Bakeware Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Bakeware Market Size, Share & Trends Report]()

Bakeware Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Tin & Trays, Cups), By Material (Stainless Steel, Aluminum), By End-use (Commercial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-144-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bakeware Market Size & Trends

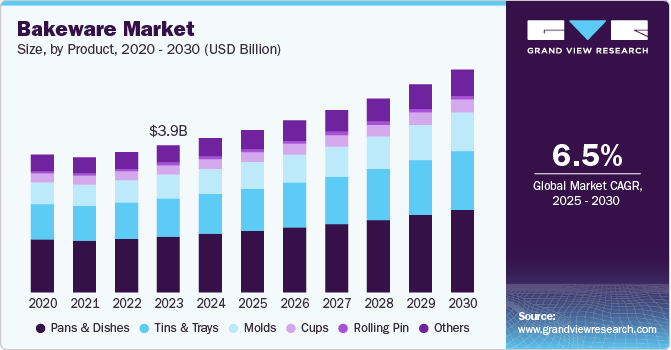

The global bakeware market size was estimated at USD 4.09 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. Shifts in lifestyle, heightened health consciousness, and the influence of social media on cooking culture fuel the demand for bakeware. More people are baking at home, a trend accelerated by the pandemic and sustained by an interest in healthier homemade alternatives. Home bakers enjoy having control over ingredients, avoiding preservatives, and creating unique treats, which has led to increased purchases of high-quality bakeware. Items like baking sheets, cake pans, and specialty molds are becoming common household essentials as baking evolves from a necessity into a form of self-care and creative expression.

Social media and cooking TV shows play a significant role in this trend. Platforms like Instagram, TikTok, and YouTube have popularized baking as an accessible, enjoyable hobby, with influencers showcasing recipes, techniques, and specific bakeware tools. This visual inspiration encourages people to experiment with new designs and techniques, often requiring unique items like bundt pans, muffin tins, or silicon mats. The “bake and share” culture has grown, further driving demand for innovative and stylish bakeware that allows home bakers to achieve professional-level results.

Sustainability and product quality are increasingly important to consumers. Eco-conscious individuals prefer bakeware made from durable, sustainable materials such as stainless steel, silicone, and ceramic. Non-stick and easy-to-clean products are particularly sought after for their convenience, and items that reduce waste, like reusable silicone mats, are gaining popularity. These shifts in consumer values, coupled with the joys of home baking, are collectively propelling the market forward on a global scale.

Furthermore, bakeware has become a popular gift choice, particularly during holidays like Thanksgiving and Christmas, as consumers are drawn to baking as a festive and family-centered activity. Seasonal demand sees a significant spike, with consumers purchasing bakeware for their holiday preparations or as gifts for friends and family interested in cooking and baking. This surge in demand is also supported by limited-edition holiday-themed bakeware sets and accessories that retailers often release, appealing to both novice and avid bakers. As a result, the gift-giving appeal and seasonal baking trends play a crucial role in driving growth within the market.

Product Insights

Bakeware pans & dishes held a revenue share of over 38% in 2024. Pans and baking dishes are essential for a wide variety of recipes, from roasting and baking to casseroles and desserts, making them staples in most kitchens. The trend toward home-cooked meals and health-conscious eating has increased the use of bakeware products, especially pans, and dishes, which offer adaptability for various cooking styles. Moreover, the popularity of non-stick and durable materials like ceramic and cast iron enhances convenience and longevity, appealing to consumers looking for quality multi-functional products.

The demand for bakeware molds sales is projected to grow at a CAGR of 7.5% from 2025 to 2030. As consumers increasingly explore creative baking options, from shaped cakes to intricate desserts, it fuels the demand for molds. Molds enable bakers to achieve decorative, professional-looking results at home, catering to the growing interest in unique and visually appealing treats. Social media trends featuring elaborate baked goods have further fueled this demand, inspiring home bakers to experiment with various shapes and designs. In addition, molds in durable, non-stick materials enhance convenience, making them attractive for both novice and experienced bakers.

Material Insights

The aluminum material segment accounted for a share of over 34% in 2024. Aluminum bakeware heats evenly, ensuring that baked goods cook consistently, which appeals to both home and professional bakers. In addition, aluminum’s affordability makes it an accessible choice, offering good value for long-lasting use. Its versatility is also a key factor, as aluminum can be used for various bakeware types, from cookie sheets to cake pans. This combination of efficiency, cost-effectiveness, and performance is driving demand for aluminum bakeware.

The demand for carbon steel bakeware is projected to grow at a CAGR of 7.4% from 2025 to 2030 due to its durability, even heating, and non-stick potential, which appeal to both casual and professional bakers. Carbon steel is highly resistant to warping, ensuring it maintains its shape even under high temperatures, which makes it ideal for a range of baking needs. In addition, its ability to retain heat aids in consistent baking results, a quality value for items like bread and pastries. Carbon steel’s longevity and robust construction also support its growing popularity in the bakeware sector.

End-use Insights

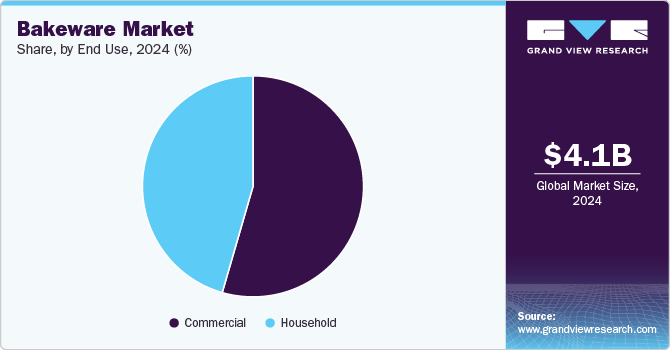

Commercial end use accounted for a share of over 55% in 2024. The increasing demand for commercial bakeware is attributed to the expansion of the food service industry, with more bakeries, restaurants, cafes, and catering businesses needing durable, high-performance baking equipment. Commercial bakeware is designed to handle frequent, high-volume baking, making it essential for professional settings where consistency and durability are critical. In addition, as consumer demand for fresh and artisanal baked goods rises, commercial kitchens are investing in advanced bakeware that supports efficient production and high-quality results. This growing emphasis on consistent, large-scale baking capabilities drives the demand for commercial-grade bakeware.

The demand for bakeware in household end use is projected to grow at a CAGR of 6.8% from 2025 to 2030 as more people turn to home baking, driven by health-consciousness and the joy of creating homemade foods. With an emphasis on controlling ingredients and reducing processed food intake, households are investing in quality bakeware to support frequent baking activities. In addition, social media and cooking shows continue to popularize baking, inspiring individuals to try new recipes at home. This rise in home-based cooking and baking is fueling steady growth in household bakeware demand.

Regional Insights

The North America bakeware market accounted for a share of 27.9% of the global market revenue in 2024, driven by health awareness, lifestyle trends, and the influence of social media. Many North Americans are opting for homemade baked goods to control ingredients, reduce additives, and explore creative baking as a hobby. The region’s strong culture of holiday baking and social gatherings further boosts demand, with households investing in quality bakeware to support frequent use. Additionally, North America’s preference for durable, high-performance kitchen products has led to greater interest in premium bakeware materials like carbon steel and silicone.

U.S. Bakeware Market Trends

The bakeware market in U.S. is expected to grow at a CAGR of 6.7% from 2025 to 2030, as home baking becomes more popular, fueled by health trends, convenience, and the desire for homemade goods, Americans are increasingly choosing to bake at home to control ingredients and avoid preservatives found in store-bought items. Additionally, social media has inspired many to try new baking projects, from artisan breads to intricate desserts, creating more interest in a variety of bakeware. Seasonal traditions, like holiday baking, further drive demand, making bakeware a staple in American kitchens.

Europe Bakeware Market Trends

The bakeware market in Europe accounted for a share of over 33% of the global market revenue in 2024. Many Europeans are embracing homemade options over processed foods, seeking greater control over ingredients and opting for fresh, quality baked goods. Additionally, regional traditions such as holiday baking and artisanal bread-making encourage households to invest in quality bakeware that enhances their baking experiences. The focus on sustainable, long-lasting materials in Europe has also led consumers to favor durable, eco-friendly bakeware options.

Asia Pacific Bakeware Market Trends

The Asia Pacific bakeware market is expected to grow at a CAGR of 7.7% from 2025 to 2030 due to rising interest in home baking, spurred by lifestyle changes, urbanization, and exposure to global food trends. As more people in countries like Japan, South Korea, and Australia experiment with Western-style pastries, cakes, and breads, there is a growing need for diverse and high-quality bakeware. Social media has also contributed to this trend, inspiring home bakers to try new recipes. Additionally, the preference for health-focused, homemade foods has led consumers to invest in durable, reliable bakeware.

Key Bakeware Company Insights

The market is moderately fragmented and characterized by the presence of key established players. Key players, such as Newell Brands Inc., WMF GmbH, and Nordic Ware, focus on diversification and sustainability, driving market competitiveness. Despite challenges, with continuous innovations and a growing global passion for baking, the future of the market appears promising. The global movement toward reducing carbon emissions and adopting eco-friendly practices has led to companies taking a significant step toward environmentally conscious bakeware production.

Key Bakeware Companies:

The following are the leading companies in the bakeware market. These companies collectively hold the largest market share and dictate industry trends.

- Groupe SEB

- Wilton Brands LLC

- Newell Brands Inc.

- Fackelmann GmbH + Co. KG

- Nordic War

- USA Pan

- Le Creuset

- International Cookware

- Emile Henry

- Meyer Corporation U.S.

Recent Developments

-

In February 2023, Guardini, a European bakeware brand, announced a partnership with ArcelorMittal, Cooper Coated Coil (CCC), and coating manufacturer ILAG to launch XBake, an eco-friendly bakeware line. Made from ArcelorMittal's XCarb green steel and featuring a PFAS-free non-stick coating, XBake was unveiled at the Ambiente fair in Frankfurt, Germany.

Bakeware Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.30 billion

Revenue forecast in 2030

USD 5.89 billion

Growth rate

CAGR of 6.5% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end-use, region

Regional scope

North America, Europe, Asia Pacific, Central and South America, Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Groupe SEB; Wilton Brands LLC; Newell Brands Inc.; Fackelmann GmbH+Co. KG; Nordic Ware; USA Pan; Le Creuset; International Cookware; Emile Henry; Meyer Corporation U.S.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bakeware Market Report Segmentation

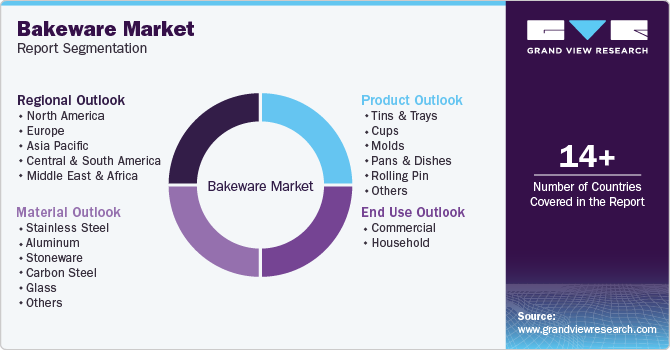

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bakeware market report based on product, material, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tins & Trays

-

Cups

-

Molds

-

Pans & Dishes

-

Rolling Pin

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Aluminum

-

Stoneware

-

Carbon Steel

-

Glass

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Household

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bakeware market was estimated at USD 4.09 billion in 2024 and is expected to reach USD 4.30 billion in 2025.

b. The global bakeware market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2030 to reach USD 5.89 billion by 2030.

b. Europe dominated the bakeware market with a share of more than 33% in 2024. The growth of the regional market is driven on account of the region's rich baking culture, a large number of commercial bakeries, and demand for a variety of bakery specialties requiring specific bakeware.

b. Some of the key players operating in the bakeware market include Wilton Brands LLC, Fackelmann GmbH + Co. KG, Nordic Ware, Groupe SEB, and Newell Brands Inc.

b. Key factors that are driving the bakeware market growth include a surge in the number of home bakers, growing interest in home baking as a hobby, rapid urbanization, and rising disposable income leading to increased expenditure on kitchen products including bakeware.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.