- Home

- »

- Next Generation Technologies

- »

-

Banking Encryption Software Market Size Report, 2030GVR Report cover

![Banking Encryption Software Market Size, Share & Trends Report]()

Banking Encryption Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Service), By Deployment, By Enterprise Size, By Function, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-964-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Banking Encryption Software Market Trends

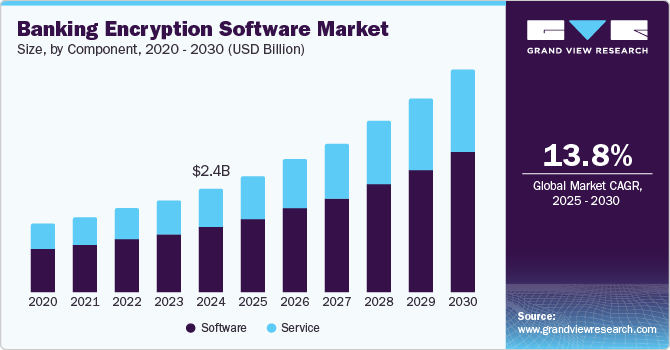

The global banking encryption software market size was estimated at USD 2.35 billion in 2024 and is projected to grow at a CAGR of 13.8% from 2025 to 2030. Banking encryption software provides numerous advantages, including seamless data transaction services and enhanced security. The increasing demand for secure payment solutions in the banking sector, aimed at delivering safer services to customers, is driving the market’s growth. In addition, the emergence of digital payment platforms and increased utilization of digital payment methods create a positive outlook for the industry. The prevalence of online payment platforms is intertwined with the threat of cyberattacks, which will provide additional opportunities for the market.

Integrating artificial intelligence (AI) in banking encryption software is transforming the financial sector by enhancing security measures and improving operational efficiency. This development is critical as the banking industry faces increasing cyberattack threats, necessitating robust protective measures for sensitive data. AI enhances the effectiveness of encryption software by enabling real-time adjustments to security protocols based on evolving threats. It employs machine learning algorithms to analyze vast datasets, identify patterns, and predict potential vulnerabilities, thus adapting encryption methods dynamically. This proactive approach allows banks to stay ahead of cybercriminals, significantly improving data protection. Thus, the rapid adoption of AI-enabled encryption software in the banking and finance sector, owing to its abovementioned benefits, is expected to boost market growth during the forecast period.

A surge in the implementation of data privacy laws, such as the Payment Card Industry Data Security Standards (PCI DSS) for the banking sector to protect sensitive data from fraud and theft, creates the demand for banking encryption software. Although authorities highly regulate the banking sector, it is the prime target of cybercriminals. The sector houses a large volume of data such as personal information, social security numbers, and payment card details. This creates a need for the banking industry to implement security measures to safeguard such data, leading to promising growth opportunities.

The banks are required to uphold the integrity of data throughout their life cycle. Consequently, it is also crucial for banks to implement the proper threat detection and response procedures as per their requirements. Data integrity can thereby be maintained by enforcing a variety of security policies, including data masking and encryption software by banks. As a result, this is anticipated to drive the demand for banking encryption software within the banking, finance, and insurance (BFSI) sector.

However, high implementation and maintenance costs associated with advanced encryption technologies can deter smaller financial institutions from adopting these solutions. In addition, the complexity of integrating encryption software with existing systems poses technical hurdles, leading to potential disruptions in operations. Regulatory compliance and evolving data protection laws can also create uncertainty, making it difficult for banks to navigate the landscape and adopt new technologies. Moreover, a lack of awareness and understanding of encryption benefits among customers may hinder broader adoption, which in turn is expected to hamper the market’s growth.

Component Insights

The software segment accounted for the largest share of 64.64% in 2024. The software provides the infrastructure for deploying, creating, and managing financial products. In addition, account holders' personal information, including names, addresses, and dates of birth, is stored and secured using the software. The segment is expected to grow as banks increasingly use encryption software to provide secure money transfer services to their customers.

The service segment is expected to witness significant growth during the forecast period. It includes professional services, managed services, and training and development, among others. Professional services help banks smoothly integrate encryption software with their existing systems. Managed services offer deep infrastructure support and maintenance to the banks.

Deployment Insights

The on-premise segment held the largest market in 2024. Institutions worldwide are making efforts to gain authority over their software and control over their data. As a result, they are demanding on-premise deployment, as it enables them to control their data and its security. At the same time, even if the connection to the internet is interrupted, employees can gain access to the data with on-premise solutions.

Cloud deployment is expected to grow at the highest CAGR during the forecast period. Since there are many management and security options available with cloud deployment, it can be deployed by practically any type of business. Banking companies can benefit from improved levels of fault tolerance, data protection, and disaster recovery with cloud deployment, where the service provider manages the technology. In addition, cloud deployment provides high levels of redundancy and backup at a lesser cost.

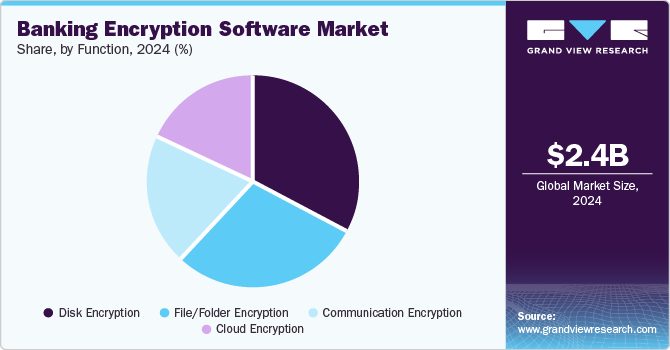

Function Insights

The disk encryption segment dominated the market in 2024. Disk encryption's capability to encrypt the tiniest bit of data stored in the disk volume creates demand across the banking sector. In addition, the market for this category is expanding because encrypted disks are secure. Even if they are lost or stolen, only authorized users can access their information. Moreover, it is comparably easier to implement across the institute, hence it is preferred over other functions.

The cloud encryption segment is anticipated to grow rapidly during the forecast period. Cloud encryption enables secure remote work and real-time data security. An encryption algorithm converts data into ciphertext. In addition, cloud encryption serves as proactive protection against data breaches and cyberattacks. It enables businesses and their clients to benefit from the advantages of cloud collaboration services without unduly risking their customers' data.

Enterprise Size Insights

The large enterprises segment dominated the market in 2024. Large enterprises comparably have to handle a lot of data owing to their large customer base, which is the key attribute responsible for the segment’s dominance. Unlike SMEs, they have huge funds to implement software to enhance security and protect customers’ interests. As a result, they can easily adopt modern security solutions to enhance their standards.

The small & medium enterprises segment is expected to grow at the highest CAGR during the forecast period. The rising incidents of cyber-attacks and frauds on SMEs are expected to increase the demand for comprehensive security solutions. These security solutions help banks prevent revenue loss due to the theft of sensitive information. Thus, the growing number of small and medium banks is expected to drive the segment’s growth.

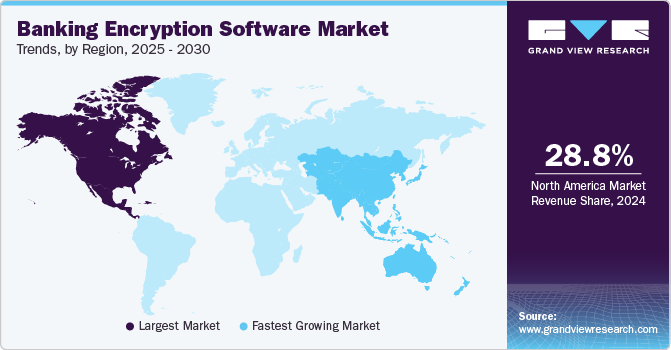

Regional Insights

North America banking encryption software market held the largest share in 2024 and accounted for 28.80%. The dominance is attributable to the improved regulatory norms in countries such as Canada and the U.S. that require banks to improve data privacy. Public and private banks have also expanded their demand for cryptographic software to safeguard privacy. In addition, the rise in cyberattacks & the threat to the information that affects business is expected to drive the regional market growth.

U.S. Banking Encryption Software Market Trends

The banking encryption software market in the U.S. held a dominant position in 2024. With the rise in cyber threats and data breaches, U.S. financial institutions are prioritizing the protection of sensitive customer information. Regulatory requirements, such as the Payment Card Industry Data Security Standard (PCI DSS), push banks to invest in robust encryption solutions. The increasing prevalence of cyber threats drives demand for advanced encryption solutions as banks seek to secure sensitive customer information and maintain trust.

Europe Banking Encryption Software Market Trends

The banking encryption software market in Europe was identified as a lucrative region in 2024 owing to factors such as rising demand for digital payment solutions and enhanced data security measures. The region's focus on digital transformation in banking drives financial institutions to adopt comprehensive encryption strategies to protect customer data across various platforms. Regulatory frameworks such as the General Data Protection Regulation (GDPR) compel banks to prioritize data privacy, further propelling market growth.

The UK banking encryption software market is expected to grow rapidly in the coming years. With a strong emphasis on compliance with regulations such as GDPR, banks are investing in advanced encryption solutions to mitigate risks associated with data breaches and cyberattacks. The growing trend of mobile banking and digital payment platforms necessitates secure transaction processes, driving demand for effective encryption technologies.

The banking encryption software market in Germany held a substantial market share in 2024. The market's growth can be attributed to a strong emphasis on data protection and compliance with stringent regulatory standards. The rise of digital banking services has increased the need for secure data transmission methods, encouraging banks to invest in advanced encryption technologies and thereby driving market growth.

Asia Pacific Banking Encryption Software Market Trends

The banking encryption software market in Asia Pacific is anticipated to grow at a CAGR of 14.9% during the forecast period. The market’s regional growth can be attributed to the growing awareness in countries such as China, Japan, and India about the benefits offered by banking encryption software. The demand for secure, all-encompassing, and dependable security systems among banking service providers is fueling the industry’s expansion. In addition, rising government privacy regulations and the use of mobile payment technology are two other key growth drivers.

China banking encryption software market held a substantial market share in 2024, driven by increasing awareness of cybersecurity among financial institutions. The country’s growing adoption of digital payment technologies necessitates robust encryption solutions to protect sensitive customer information from rising cyber threats. Government initiatives aimed at enhancing data privacy regulations also contribute to market growth.

The banking encryption software market in Japan is expected to register a moderate growth rate during the forecast period. The country's advanced technological infrastructure supports the adoption of sophisticated encryption solutions that protect sensitive financial data during transactions. In addition, the rise of mobile banking and e-commerce further highlights the necessity for secure data transmission methods, propelling market growth in this country.

Key Banking Encryption Software Company Insights

Some of the key companies in the banking encryption software market include IBM Corporation, Microsoft Corporation, and Broadcom Inc. Organizations are focusing on integrating advanced technologies into their offerings to maintain competitive advantages. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships.

-

IBM Corporation provides IBM Guardium Data Encryption, a key management and data encryption software. It features a unified suite of products built on a shared infrastructure and offers capabilities such as data masking, tokenization, data encryption, and key management.

-

Broadcom Inc.'s Symantec Encryption portfolio provides versatile data protection through a variety of solutions, including folder and file encryption, endpoint drive encryption, email encryption, and encryption for data exchange and transfer.

Key Banking Encryption Software Companies:

The following are the leading companies in the banking encryption software market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom Inc.

- ESET North America

- IBM Corporation

- Intel Corporation

- McAfee, LLC

- Microsoft Corporation

- Sophos Ltd.

- Thales Group

- Trend Micro Incorporated

- WinMagic

Recent Developments

-

In January 2024, Kurdistan International Islamic Bank for Investment and Development (KIB), a prominent Islamic financial institution in Iraq, initiated a digital transformation by adopting iMAL, the Islamic core banking platform from Azentio Software, a Singapore-based technology firm. The iMAL incorporates advanced encryption and security measures to protect against the most sophisticated electronic cyber threats.

Banking Encryption Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.63 billion

Revenue forecast in 2030

USD 5.03 billion

Growth rate

CAGR of 13.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, function, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Broadcom Inc., ESET North America, IBM Corporation, Intel Corporation, McAfee, LLC, Microsoft Corporation, Sophos Ltd., Thales Group, Trend Micro Incorporated, and WinMagic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Banking Encryption Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global banking encryption software market report based on component, deployment, enterprise size, function, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Service

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Disk Encryption

-

Communication Encryption

-

File/Folder Encryption

-

Cloud Encryption

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global banking encryption software market size was estimated at USD 2.35 million in 2024 and is expected to reach USD 2.63 billion in 2025.

b. The global banking encryption software market is expected to grow at a compound annual growth rate of 13.8% from 2025 to 2030 to reach USD 5.03 billion by 2030

b. North America dominated the banking encryption software market with a share of 28.80% in 2024. The dominance is attributable to the improved regulatory norms in countries such as Canada and the U.S. that require banks to improve data privacy.

b. Some key players operating in the banking encryption software market include Broadcom; ESET North America; IBM Corporation; Intel Corporation; McAfee, LLC; Microsoft; Sophos Ltd.; Thales Group; Trend Micro Incorporated; WinMagic

b. Key factors that are driving the banking encryption software market growth include increasing demand for security solutions among banks and growing emphasis on digitalization

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.