- Home

- »

- Network Security

- »

-

Encryption Software Market Size, Share, Trends Report 2030GVR Report cover

![Encryption Software Market Size, Share & Trends Report]()

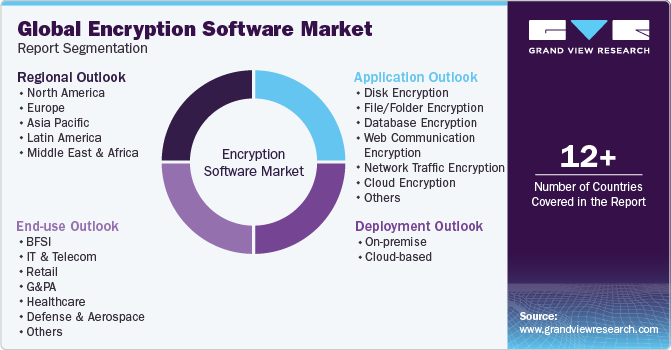

Encryption Software Market (2023 - 2030) Size, Share & Trends Analysis Report By Deployment (On-premise, Cloud-based), By Application (Disk Encryption, Database Encryption), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-167-2

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Encryption Software Market Summary

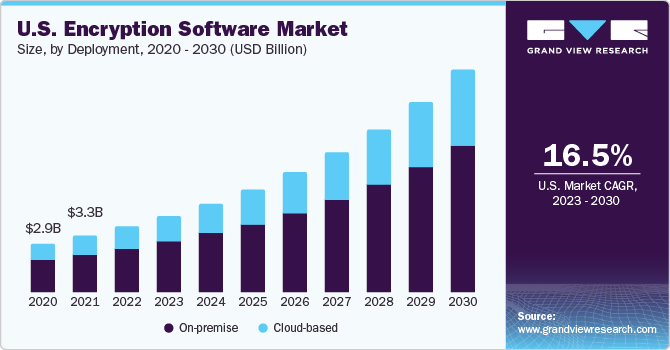

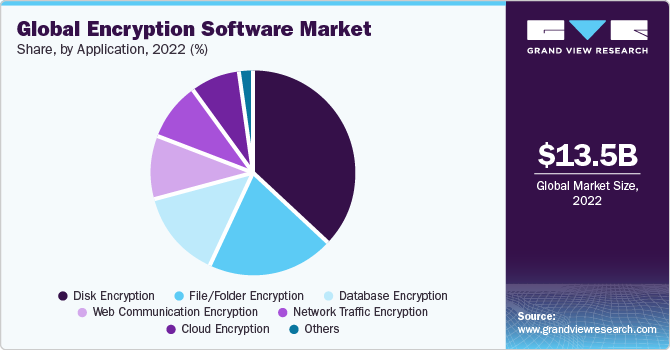

The global encryption software market size was estimated at USD 13.46 billion in 2022 and is projected to reach USD 44.55 billion by 2030, growing at a CAGR of 16.2% from 2023 to 2030. Data security concerns are rising with the growing trend of the Internet of Things (IoT) and Bring Your Own Device (BYOD) among enterprises.

Key Market Trends & Insights

- North America dominated the market with the largest revenue share of 37.2% in 2022.

- The Asia Pacific is expected to expand at the fastest CAGR of 20.5% during the forecast period.

- By deployment, the on-premise segment held 66.0% of the overall revenue share in 2022.

- By end-use, the BFSI segment accounted for a dominant share of 32.3% in the market in 2022.

- By application, the disk encryption segment dominated the market with the highest revenue share of 36.7% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 13.46 Billion

- 2030 Projected Market Size: USD 44.55 Billion

- CAGR (2023-2030): 16.2%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

It has further led to increased instances of cyberattacks, commercial espionage, data breaches, and theft & losses in companies, which is poised to escalate the need to protect sensitive data and ensure compliance.

Mobile technology advancements in hardware and software, their dissemination among businesses, and the growing penetration of smartphones are likely to catapult the demand for encryption software by 2030. The growing penetration of mobile devices across organizations has augmented the risk of data loss among enterprises, which has made executing encryption software imperative for safe data transmission. Furthermore, as enterprises are increasingly moving towards cloud computing, the need to safeguard sensitive data is increasing, thus resulting in increased deployment of this software.

Several industry verticals, such as BFSI and healthcare, must comply with stringent regulations, including PCI DSS and HIPAA, which require data security solutions. It translates to greater demand for encryption software globally. Furthermore, with rapid digitization and growing internet usage, enterprise and user intellectual property has become susceptible to theft and infringement. Owing to these risks, companies are required to protect the data. Encryption software enables organizations to safeguard their intellectual property and sensitive data, which is expected to boost its demand over the forecast period.

However, the purchase and implementation of these solutions involve huge costs, which can inhibit the growth of the encryption software market. Moreover, the deployment options for these solutions are time-consuming and complex. On the other hand, their benefits generally outweigh the challenges of the intricacy and time associated with their deployment.

North America dominated the market in 2022. The presence of a well-established IT & telecom sector in the region and the generation of massive amounts of data that needs to be safeguarded are contributing to the region’s dominance. A sudden upsurge in encrypted internet traffic due to the adoption of HTTPS by leading companies, including Facebook, Twitter, and Netflix, is expected to favor the market over the forecast period.

Deployment Insights

The widespread acceptance of social media, the Internet of Things (IoT), and the Internet of Everything (IoE) have enhanced business functioning and increased data being generated and retrieved through mobile devices. These factors are estimated to fuel the demand for on-premise and cloud-based deployment in the coming years. The on-premise segment held 66.0% of the overall revenue share in 2022. However, the cloud-based segment is expected to register the fastest CAGR of 16.7% over the forecast period.

The spiraling adoption of cloud storage solutions by several companies and expanding cloud infrastructure contribute to the cloud segment's growth. Moreover, developments in the IT & telecom sector, such as Choose Your Own Device (CYOD) and BYOD, are projected to impact the overall market growth during the forecast period significantly. The establishment of new businesses in emerging economies is poised to bolster the demand for cloud-based solutions further.

End-use Insights

The BFSI segment accounted for a dominant share of 32.3% in the market in 2022. It is further estimated to advance with the largest CAGR of 18.0% during the forecast period. The dynamic nature of the security industry and the rising number of cyberattacks result in an increased need to protect sensitive financial data from breaches with maximum returns and minimum risk. As banking institutions increasingly adopt cloud solutions, the segment is anticipated to experience a higher potential for deploying these security solutions.

Banks generally follow traditional techniques such as email and DVDs to transfer data, which pose a high threat of data breach, thereby increasing growth opportunities for encryption software in the banking and financial industry. Furthermore, high dependence on online transactions and the need to protect them will further boost the demand for encryption software in the BFSI sector in the coming years. The retail segment is projected to register a significant CAGR over the forecast period. The increasing need for data storage and the rising number of retail companies transitioning to cloud infrastructure fuel this segment's growth.

Application Insights

The disk encryption segment dominated the market with the highest revenue share of 36.7% in 2022. Encrypted disks are safe as even if they get stolen or misplaced, access to their contents remains limited to authorized users. With the emergence and growing prominence of the BYOD trend, the exchange of critical data has become possible on employee devices. This has further augmented the need for strong encryption techniques.

The cloud encryption segment will likely advance with the highest CAGR of 19.5% during the forecast period. Data storage is one of the key resources for various industries such as BFSI, retail, and others. The demand for cloud encryption solutions is expected to increase, as more organizations move towards the cloud due to its scalability and usage policy flexibility.Furthermore, the proliferation of big data analytics has led to increased usage of these solutions by internet services to ensure user data privacy. Burgeoning cyber-attacks and mobile theft are prompting regulatory bodies to mandate data transfer and security standards.

Regional Insights

North America dominated the market with the largest revenue share of 37.2% in 2022, owing the increased internet penetration in the region. Additionally, the presence of a well-established and renowned IT & telecom sector is also driving market growth in the region. The Asia Pacific is expected to expand at the fastest CAGR of 20.5% during the forecast period. The region is expected to be very promising for companies, owing to a lack of storage infrastructure, prompting organizations to store data on the cloud. It increases the risk of thefts & data losses, thus stoking the demand for encryption software.

Additionally, the rising penetration of IoT, cloud services, and BYOD has spurred the regional market’s growth. Rapid advancements in the manufacturing sector in countries, including India and China, coupled with the flourishing retail and IT & telecom sectors, are poised to stimulate the demand for encryption software over the forecast years.

Key Companies & Market Share Insights

Some of the major players in the market include Microsoft Corporation, Symantec, Intel Security, Sophos, Check Point Software Technologies, Trend Micro, and IBM Corporation. These companies offer data protection solutions to small- & medium-sized businesses (SBMs) and enterprises. Companies operating in the market focus on developing innovative techniques related to advanced cryptography to provide robust data security solutions.

Key Encryption Software Companies:

- Bloombase

- Cisco Systems, Inc.

- Check Point Software Technologies Ltd.

- Dell Inc.

- IBM Corporation

- McAfee, LLC

- Microsoft

- Oracle

- Sophos Ltd.

- Broadcom

- Trend Micro Incorporated

- WinMagic

Recent Developments

-

In June 2023, Amazon Web Services (AWS) introduced a new encryption option called Amazon S3 dual-layer server-side encryption with keys stored in AWS Key Management Service (DSSE-KMS). This advanced feature enhances the security of objects uploaded to an Amazon Simple Storage Service (Amazon S3) bucket by applying two layers of encryption. By utilizing DSSE-KMS, customers can meet regulatory requirements and apply multiple layers of encryption to their data, ensuring enhanced data protection

-

In May 2023, Vaultree significantly improved safeguarding healthcare data by introducing its state-of-the-art, fully functional Data-in-Use encryption solution to the industry. Accompanied by an innovative software development kit and an encrypted chat tool, Vaultree's technology transforms the data encryption landscape. It offers comprehensive protection for sensitive patient data, ensuring its security even during a breach, while maintaining operational efficiency and performance

-

In February 2023, Irdeto, a digital platform cybersecurity provider, introduced an enhanced version of its software development kit (SDK) known as ActiveCloak for Media (ACM). This upgraded solution incorporates multiple layers of security to safeguard against the unauthorized extraction of content encryption keys from devices

-

In January 2023, at AWS, Amazon Simple Storage Service (Amazon S3) implemented encryption by default for all newly uploaded objects. S3 applies server-side encryption (SSE-S3) to each new object unless an alternative encryption option is specified. Whenever a user uploads an object, a unique key is generated to encrypt the data, which is then encrypted again using a root key, all transparently to the user

-

In November 2022, IronCore Labs, a data security solution company for modern cloud applications, unveiled the latest iteration of Cloaked Search. This encrypted search proxy ensures data security in Elasticsearch and OpenSearch. The enhanced version of Cloaked Search introduces new features that enable existing and prospective customers to extend their application-layer encryption capabilities and safeguard sensitive data within their search services

-

In May 2021, Arqit, a company backed by UK Research and Innovation (UKRI) for its encryption technology development, revealed plans to generate 2,000 high-tech jobs in the UK. It comes after the company was able to successfully raise USD 400 million in investments. Arqit has announced intentions to construct two satellites within the UK by 2023 as part of its expansion. These satellites are expected to enable the company's quantum cybersecurity platform to ensure secure communications and a worldwide presence

Encryption Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.57 billion

Revenue forecast in 2030

USD 44.55 billion

Growth rate

CAGR of 16.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Bloombase; Cisco Systems, Inc.; Check Point Software Technologies Ltd.; Dell Inc.; IBM Corporation; McAfee, LLC; Microsoft; Oracle; Sophos Ltd.; Broadcom; Trend Micro Incorporated; WinMagic

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Encryption Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends in each sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global encryption software market report on the basis of deployment, application, end-use, and region:

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premise

-

Cloud-based

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Disk encryption

-

File/Folder Encryption

-

Database Encryption

-

Web Communication Encryption

-

Network Traffic Encryption

-

Cloud Encryption

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

IT & Telecom

-

Retail

-

G&PA

-

Healthcare

-

Defense & Aerospace

-

Education

-

Manufacturing

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global encryption software market size was estimated at USD 13.46 billion in 2022 and is expected to reach USD 15.57 billion by 2023.

b. The global encryption software market is expected to grow at a compound annual growth rate of 16.2% from 2023 to 2030 to reach USD 44.55 billion by 2030.

b. North America dominated the encryption software market with a share of 37.2% in 2022. This is attributable to the proliferation of cloud services, the presence of well-established market players, significant internet penetration, and the renowned IT & telecom sector.

b. Key players operating in the encryption software market include Microsoft Corporation, Oracle Corporation, Bloombase, McAfee, LLC, Braodcom, Inc., Dell Inc., Sophos Ltd., WinMagic, Check Point Software Technologies Ltd., Cisco Systems, Inc., Trend Micro Incorporated, and International Business Machines Corporation.

b. Key factors that are driving the market growth include rising concerns over data security,growing popularity of Bring Your Own Devices (BYOD) arrangement across enterprises, and growing penetration of mobile devices across organizations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.