- Home

- »

- Advanced Interior Materials

- »

-

Base Metal Mining Market Size, Share, Industry Report, 2033GVR Report cover

![Base Metal Mining Market Size, Share & Trends Report]()

Base Metal Mining Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Aluminum, Copper, Zinc, Lead, Nickel, Tin, Tungsten), By End-use (Construction, Automotive, Electrical & Electronics, Consumer Products), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-991-3

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Base Metal Mining Market Summary

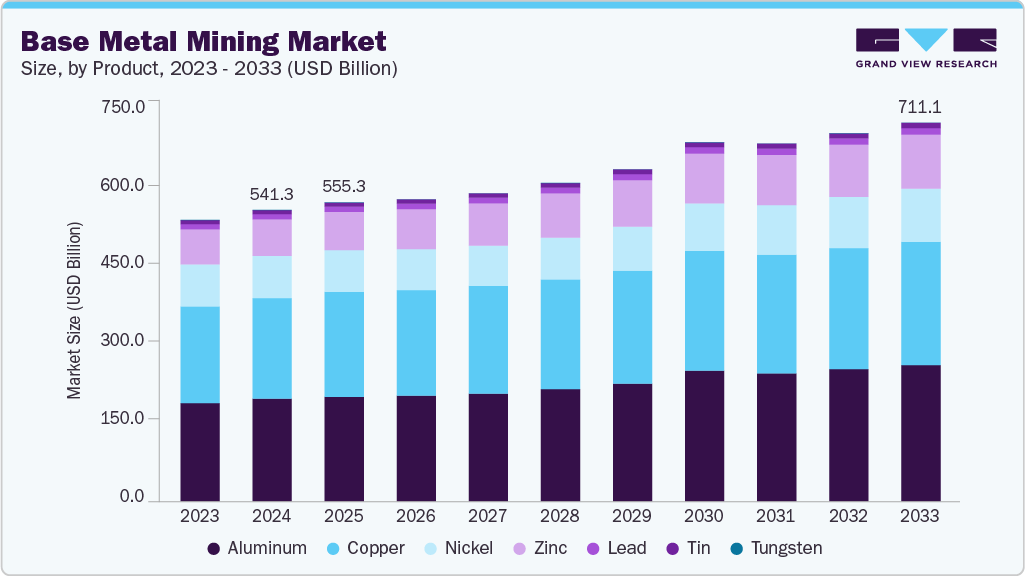

The global base metal mining market size was estimated at USD 541.34 billion in 2024 and is projected to reach USD 711.08 billion by 2033, growing at a CAGR of 3.1% from 2025 to 2033. Growth is driven by rising demand for copper, nickel, zinc, and aluminum in EVs, renewable infrastructure, and industrial manufacturing.

Key Market Trends & Insights

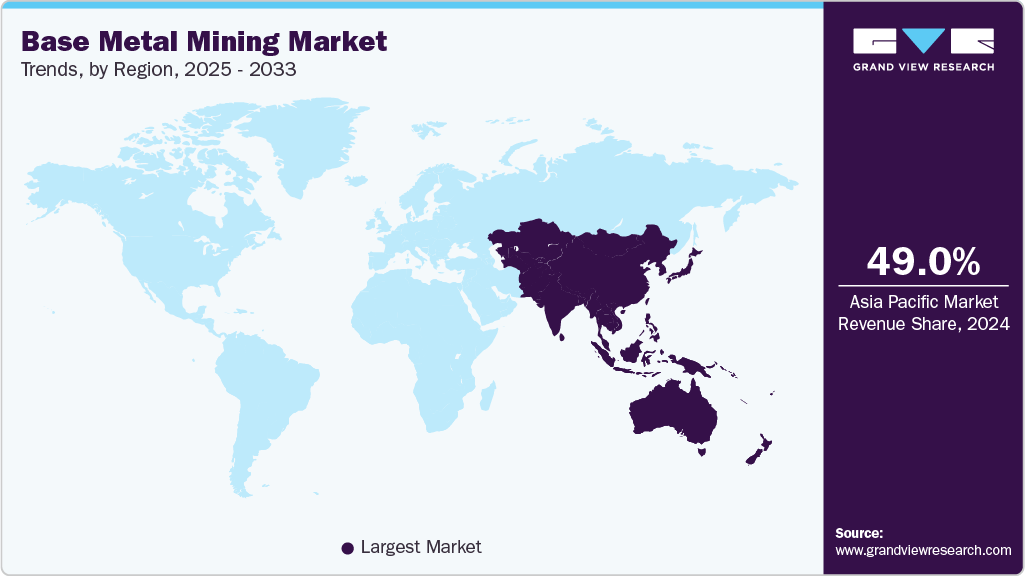

- Asia Pacific dominated the base metal mining market with a revenue share of over 49.0% in 2024.

- China is a pivotal market in global base metal mining, supported by its large-scale industrial activity, strong infrastructure spending, and world-leading refining capacity.

- By product, the aluminum dominated the market with a revenue share of over 35.0% in 2024.

- By end-use, the construction sector dominates the market with largest share over 39.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 541.34 Billion

- 2033 Projected Market Size: USD 711.08 Billion

- CAGR (2025-2033): 3.1%

- Asia Pacific: largest market in 2024

Additionally, increasing investments in low-carbon mining technologies, digital operations, and expanded resource exploration are supporting the long-term expansion of the industry. The industry is increasingly transitioning toward low-carbon, socially responsible, and circular-economy operating models as regulatory pressure, investor expectations, and ESG reporting standards tighten across global mining regions. Companies are prioritizing renewable-powered extraction, water-efficient ore processing, dry-stack tailings, biodiversity restoration, and scope 1-3 emission reduction targets to align with climate-aligned pathways. Moreover, partnerships with recycling companies, e-waste processors, and smelters are gaining prominence as end users, particularly manufacturers of EV batteries, renewable infrastructure, and electronics, seek responsibly sourced metals with full traceability and ethical provenance documentation. This shift is gradually repositioning sustainability from a cost center to a value-creation driver through premium pricing, access to sustainability-linked financing, and long-term offtake agreements with low-emission, procurement-focused customers.

Technology adoption across the base metal mining sector is centered on improving ore discovery success, automation, safety, productivity, and metallurgical recovery efficiency. Advanced solutions, such as AI-assisted geological modeling, drone-based mine mapping, autonomous haulage fleets, IoT-enabled condition monitoring, digital twins, and real-time ore-sorting sensors, are driving operational optimization and reducing the cost per ton. Emerging process technologies, including hydrometallurgical leaching advancements, bio-mining, microwave ore treatment, and low-temperature refining, are enabling the extraction of resources from lower-grade and complex deposits that were previously considered uneconomical. Additionally, blockchain-based traceability, integrated command-and-control digital platforms, and predictive maintenance algorithms are strengthening supply chain transparency, reducing unplanned downtime, and enhancing ESG compliance visibility across mining value chains.

Drivers, Opportunities & Restraints

The market is driven by clean-energy infrastructure and long-term electrification demand. On 07 October 2025, the Reserve Bank of Australia published an official bulletin highlighting copper and nickel as “critical minerals” expected to experience sustained demand growth due to EV manufacturing, battery systems, and renewable power grids. Additionally, on 15 June 2025, the Australian Government’s Resources & Energy Quarterly report confirmed that base metals such as copper, nickel, and zinc will remain cornerstones of the country’s export strategy, supported by expanding production targets and improved metallurgical efficiency.

The sector is witnessing a significant shift toward recycling, urban mining, and the recovery of high-purity metals within the circular economy, thereby reducing reliance on mined ore. On 24 September 2025, Aurubis officially commenced commercial operations at its multi-metal recycling facility in Richmond, Georgia, designed to process approximately 180,000 tons of complex scrap and electronic waste annually, generating strategic metals such as copper, nickel, tin, and PGMs. This development positions secondary metal production as a scalable, ESG-aligned profit model for mining and metallurgy players across North America, Europe, and Asia.

Environmental incidents, license-to-operate risks, and rising regulatory barriers continue to constrain growth and financing decisions for new base metal mines. On 12 February 2025, a tailings-dam failure at the Sino-Metals Leach copper operation in Zambia resulted in the discharge of acidic slurry into the Kafue River, triggering emergency water restrictions, community protests, and heightened government scrutiny over mining safety compliance. The incident heightened investor risk perception and is expected to impact future permitting timelines, insurance costs, and ESG reporting requirements.

Product Insights

Aluminum remains the dominating product segment with a revenue share of over 35.0% in 2024 due to its widespread application across construction, transportation, packaging, electrical systems, and consumer durables, supported by its lightweight, corrosion-resistant, and high-recyclability profile. Its demand is further reinforced by government-led sustainability and decarbonization initiatives, where aluminum is increasingly utilized for lightweight automotive manufacturing, EV body structures, and renewable energy infrastructure such as solar panel frames and transmission components. Additionally, investments in green aluminum, powered by renewable energy-based smelting, enable both cost efficiency and ESG-compliant supply chains, making aluminum a preferred base metal in multiple fast-growing industries globally.

Other base metals, including copper, nickel, zinc, and lead, continue to play significant roles across industrial and technological applications, each driven by distinct sectoral demand dynamics. Copper remains indispensable for power distribution, EV motors, and smart-grid development, while nickel is gaining strategic importance in battery-grade materials for next-generation energy storage solutions. Zinc maintains strong relevance in galvanization and corrosion-resistant steel manufacturing, particularly for construction and automotive safety components. Lead, on the other hand, sustains demand in battery applications, radiation shielding, and industrial chemicals. These metals collectively complement aluminum in supporting global infrastructure modernization, electrification, and digital manufacturing advancements.

End-use Insights

The construction sector dominates the market with largest share over 39.0% in 2024, driven by large-scale infrastructure development, urbanization, and government-funded modernization projects in both emerging and developed economies. Aluminum, copper, and zinc-based products are widely incorporated across building frameworks, roofing, cladding, HVAC systems, electrical wiring, and plumbing components due to their durability, corrosion resistance, and strength-to-weight advantages. Increasing investments in green buildings, smart cities, and energy-efficient structures continue to drive metal consumption in both residential and commercial projects, making construction the most influential demand-driving application for base metals globally.

Other key end use sectors, including automotive, electrical & electronics, and consumer products, collectively represent a growing demand base as industries adopt lightweight, high-conductivity, and longer-life metal components for advanced manufacturing. The automotive industry is transitioning toward EV production, which requires higher volumes of copper, aluminum, and nickel for batteries, motors, and lightweight chassis. Meanwhile, the electrical and electronics segment is expanding due to the rising penetration of smart devices, data centers, and renewable energy grids. At the same time, consumer products leverage these metals for appliances, furniture, hardware, and lifestyle goods. Combined, these segments form a diversified and technology-aligned market opportunity beyond traditional construction needs.

Regional Insights

Asia Pacific dominates the global industry with a revenue share of over 49.0% in 2024, driven by vast mineral reserves, extensive smelting and refining capacities, and robust end use demand from the construction, manufacturing, electronics, and automotive industries. China remains a key producer and consumer, while countries such as India, Indonesia, and Australia are expanding capacity through new exploration, foreign investment inflows, and value-added downstream development. Rapid urbanization, industrial corridor projects, and the growth of EV and renewable supply chain ecosystems continue to drive long-term regional demand.

China Base Metal Mining Market Trends

China is a pivotal market in global base metal mining, supported by its large-scale industrial activity, strong infrastructure spending, and world-leading refining capacity. The country is a major producer of aluminum, zinc, and lead, while remaining the largest consumer of copper and nickel for construction, power transmission, EV manufacturing, and renewable energy projects. Driven by state-backed investments and expanding metal-intensive industries, China continues to significantly influence global supply, pricing trends, and long-term demand for base metals.

North America Base Metal Mining Market Trends

The North American base metal mining market benefits from established mineral reserves, highly mechanized extraction operations, and strong demand from construction, automotive, defense, and electrical infrastructure sectors. The region is experiencing a surge in investment in copper, nickel, and zinc production, which supports the development of renewable energy infrastructure, the growth of electric vehicles, and grid modernization. Focus on digital mine management, worker safety, and emission reduction technologies such as autonomous haulage and electrified fleets continues to strengthen the region’s competitive position.

U.S. Base Metal Mining Market Trends

The base metal mining market in the U.S. remains strategically essential due to its large domestic consumption of copper, zinc, nickel, and lead for manufacturing, clean energy systems, and the production of defense-grade materials. Federal policies targeted at strengthening critical mineral independence and reducing reliance on imports are encouraging new exploration and brownfield expansions. Enhanced permitting reforms, ESG-driven operational transparency, and increasing private sector partnerships with technology developers are shaping the next phase of growth in U.S. base metal mining.

Europe Base Metal Mining Market Trends

The base metal mining market in Europe is heavily influenced by its clean energy transition, circular economy policies, and strategic interest in securing critical metals for batteries, wind turbines, and advanced manufacturing. Although mining activity is comparatively limited, the region focuses on efficient refinement, recycling, and processing technologies supported by strong regulatory frameworks and innovation funding. Increasing interest in domestic sourcing, reduced import risk, and partnerships across Africa, Latin America, and Canada are shaping Europe’s supply chain strategy for base metals.

Key Base Metal Mining Company Insights

Key players operating in the based metal mining market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include BHP, Freeport-McMoRan Inc., Antofagasta PLC, and others.

-

BHP, established in 1851 and headquartered in Melbourne, Australia, is a leading global diversified resources company engaged in the production of iron ore, copper, metallurgical coal, nickel, and potash. The company operates across major mining regions, supplying essential raw materials for infrastructure, manufacturing, and clean-energy applications. BHP focuses on long-term portfolio resilience, operational efficiency, and sustainability-driven value creation aligned with global decarbonization trends.

-

Freeport-McMoRan, Inc., formally structured in 1988 and headquartered in Phoenix, Arizona, is a major global mining company specializing in copper, gold, and molybdenum production. Key operations span North America, South America, and the Grasberg minerals district in Indonesia. The company emphasizes large-scale, long-life assets, integrated value chain capabilities, and continuous improvement in safety, social responsibility, environmental stewardship, and operational productivity.

-

Antofagasta PLC, founded in 1888 and headquartered in London, United Kingdom, is a Chile-focused mining group primarily engaged in copper production with additional outputs of gold, silver, and molybdenum. The company operates significant mining assets in northern Chile, alongside an integrated transport division that supports mine logistics. Antofagasta prioritizes sustainable mining practices, water-efficient processes such as desalination, and strategic project expansion to maintain long-term production stability.

Key Base Metal Mining Companies:

The following are the leading companies in the base metal mining market. These companies collectively hold the largest market share and dictate industry trends.

- Anglo American

- Antofagasta PLC

- Aurubis

- BHP

- CODELCO

- Freeport-McMoRan, Inc.

- Glencore

- Norilsk Nickel

- Vale

- Zijin Mining Group Co., Ltd.

Recent Developments

-

BHP, in July 2025, announced record group copper production of over 2 million tons, reflecting an 8% year-on-year increase driven by improved operational efficiency and stable ore grades at Escondida, Spence, and its broader Copper SA portfolio. The company stated that this production momentum aligns with its strategy to expand exposure to future-critical minerals while maintaining disciplined cost and asset performance.

-

Freeport-McMoRan, in May 2025, confirmed accelerated repair progress at its Manyar smelter in Gresik following a fire incident, noting that copper anode output had successfully resumed ahead of initial timelines. The company emphasized that rapid restoration efforts were supported by strengthened project supervision, contingency planning, and revised safety standards to avoid future disruptions.

-

Freeport-McMoRan, in Q2 2025, initiated operational start-up of its new downstream processing facility in East Java, achieving first copper anode production by July and targeting full ramp-up before the end of 2025. This development supports the company’s long-term objective of increasing domestic value addition, expanding refining capabilities, and improving supply chain resilience.

Base Metal Mining Market Report Scope

Report Attribute

Details

Market Definition

The base metal mining market includes the annual value of base metals that are obtained via mining.

Market size value in 2025

USD 555.30 billion

Revenue forecast in 2033

USD 711.08 billion

Growth rate

CAGR of 3.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Norway; Russia; India; China; Australia; Indonesia; Philippines; Brazil; Chile; Peru; Bahrain; UAE

Key companies profiled

Anglo American; Antofagasta PLC; Aurubis; BHP; CODELCO; Freeport-McMoRan, Inc.; Glencore; Norilsk Nickel; Vale; Zijin Mining Group Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Base Metal Mining Market Report Segmentation

This report forecasts global, regional, and country-level volume & revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global base metal mining market report by product, end-use, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Aluminum

-

Copper

-

Lead

-

Nickel

-

Zinc

-

Tin

-

Tungsten

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Construction

-

Automotive

-

Electrical & Electronics

-

Consumer Products

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Norway

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Australia

-

Indonesia

-

Philippines

-

-

Latin America

-

Brazil

-

Chile

-

Peru

-

-

Middle East & Africa

-

Bahrain

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global base metal mining market size was estimated at USD 541.34 billion in 2024 and is expected to reach USD 555.30 billion in 2025.

b. The global base metal mining market is expected to grow at a compound annual growth rate of 3.1% from 2025 to 2033, reaching USD 711.08 billion by 2033.

b. By product, aluminum dominated the market with a revenue share of over 35.0% in 2024.

b. Some of the key vendors in the global base metal mining market include Anglo American, Antofagasta PLC, Aurubis, BHP, CODELCO, Freeport-McMoRan, Inc., Glencore, Norilsk Nickel, Vale, Zijin Mining Group Co., Ltd., and others.

b. The global base metal mining market is driven by rising consumption of copper, nickel, zinc, and aluminum in EVs, renewable energy systems, electronics, and infrastructure. Increasing investments in new mines, resource exploration, and strategic government support for critical minerals accelerate production growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.