- Home

- »

- Clothing, Footwear & Accessories

- »

-

Basketball Gear Market Size, Share & Growth Report, 2030GVR Report cover

![Basketball Gear Market Size, Share & Trends Report]()

Basketball Gear Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Basketballs, Hoops & Backboards, Accessories), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-954-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Basketball Gear Market Summary

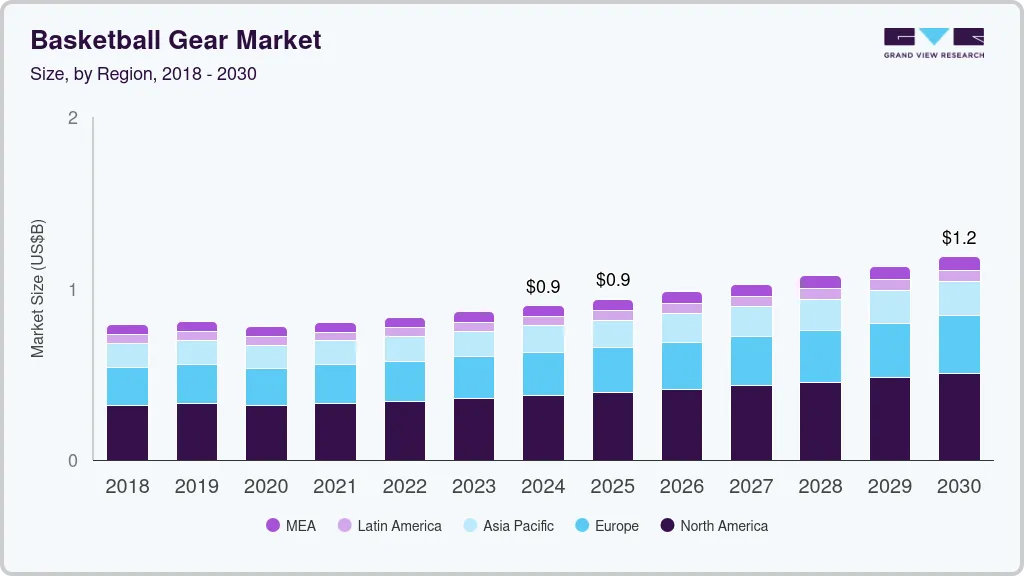

The global basketball gear market size was estimated at USD 900.5 million in 2024 and is projected to reach USD 1.19 billion by 2030, growing at a CAGR of 4.8% from 2025 to 2030. Increasing consciousness regarding fitness, inclination toward basketball, rising disposable income, and popularity of the National Basketball Association (NBA) are the main factors contributing to market growth.

Key Market Trends & Insights

- North America basketball gear market accounted for a revenue share of 41.58% in 2024.

- The U.S. basketball gear market is expected to grow at a CAGR of 5.4% from 2025 to 2030.

- By product, the basketball segment accounted for a revenue share of 51.45% in 2024.

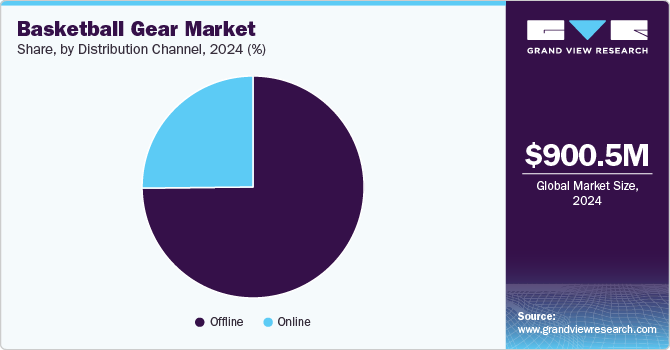

- By distribution channel, sales through the offline segment accounted for a revenue share of 74.84% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 900.5 Million

- 2030 Projected Market Size: USD 1.79 Billion

- CAGR (2025-2030): 4.8%

- North America: Largest market in 2024

However, fluctuating raw material prices of basketball equipment are restraining the market's growth. Nevertheless, investments in basketball leagues are expected to create lucrative opportunities for market growth. Several nations that now host competitive basketball leagues and tournaments will support the industry demand.

One of the primary drivers is the increasing global participation in basketball, both at recreational and competitive levels. As basketball expands its footprint across regions like North America, Europe, and Asia, demand for essential gear such as basketballs and hoops surges. Schools, colleges, and community centers invest in high-quality equipment to support training and gameplay, while individual players, from beginners to advanced athletes, purchase basketballs for home use and practice.

Technological innovation in the materials and design of basketballs and backboards is another important driver. Manufacturers are continuously improving basketballs' durability, grip, and bounce consistency by using advanced materials like microfiber composites or synthetic leather. These innovations cater to various playing environments, from indoor courts to outdoor playgrounds. Similarly, improvements in the construction of backboards and hoops, such as shatterproof glass backboards and breakaway rims, enhance the playing experience by providing durability and professional-grade performance.

The increasing interest among young people and teenagers further drives the demand for basketball gear. In addition, rising consumer purchasing power is expected to fuel market growth. However, international basketball associations such as the NBA and FIBA have specific standards for basketball gear, which many manufacturers may not meet. This has decreased sales in key segments such as basketballs, hoops, and backboards, posing a significant challenge to the global market.

The rising trend of home sports setups is further fueling market growth. Due to lifestyle changes and pandemic-driven behavior, at-home fitness and sports are becoming increasingly popular, and more consumers are purchasing hoops and backboards for personal use. Portable and adjustable hoop systems set up in driveways or backyards are in high demand, as they offer flexibility for recreational play at home.

Moreover, e-commerce has made basketball gear more accessible to a broader audience, allowing consumers to easily purchase gear online. This has expanded the market reach, enabling enthusiasts in regions without easy access to physical sports stores to buy basketballs and hoops conveniently.

Product Insights

Basketballs accounted for a revenue share of 51.45% in 2024. Basketball is the only piece of equipment needed to play basketball. It is the major gear largely used in national and league matches all over the world. For instance, the NBA gives 72 balls to each team at the start of the season. That brings the ball count to 2,160. According to the stats, over 8 million basketballs are sold yearly in the U.S. Thus, millions of basketballs are manufactured and sold globally.

Hoops & backboards market is expected to grow at a CAGR of 4.7% from 2025 to 2030. The segment is witnessing impressive growth owing to the increasing participation in basketball as a competitive and recreational sport. With the increasing number of national and international basketball competitions, the demand for basketball hoops has poured in, which, in turn, will surge the sales volume from retail stores to the company’s online sales channel.

Distribution Channel Insights

Sales through offline channels accounted for a revenue share of 74.84% in 2024. This is due to the exposure and accessibility to the largest number of shoppers. The major factor contributing to the growth of this segment is the increasing consumer preference for buying high-end products from retail outlets. Moreover, it becomes easy for customers to know the exact size and weight of the product from offline channels such as convenience stores and company-owned brand retail stores. In addition, season clearance sales and instant availability can lure customers toward this distribution channel.

Sales of basketball gear through online channels are expected to grow with a CAGR of 5.2% from 2025 to 2030. The online distribution channel is expected to witness significant growth in the coming years on account of the availability of the newest trends and rarest brands at the most convenient price, along with the biggest discounts. In addition, most of these online shopping spaces collaborate with other banks, which provide various payment modes and extra discounts when payments are completed using a particular medium. Owing to this, banks and other payment channels have been endorsing themselves via these e-commerce websites, thus leading to extra marketing and increasing total sales.

Regional Insights

North America basketball gear market accounted for a revenue share of 41.58% in 2024. In North America, basketball is deeply ingrained in the culture, particularly due to the immense popularity of the NBA. This directly impacts the demand for basketball gear, as the sport is played widely at amateur and professional levels. The strong presence of school basketball programs, from elementary to high school, drives demand for basketballs, hoops, and backboards. Local leagues and recreational sports are also growing, leading to continuous investment in basketball infrastructure.

U.S. Basketball Gear Market Trends

The U.S. basketball gear market is expected to grow at a CAGR of 5.4% from 2025 to 2030. Home fitness and recreation trends continue to drive sales of portable hoops and backboards for residential use in the U.S. Consumers are willing to invest in high-quality backboards and basketball systems for their homes. Furthermore, with numerous community centers, school gyms, and outdoor parks equipped with basketball courts, there is a high demand for basketball gear to stock these facilities.

Asia Pacific Basketball Gear Market Trends

The Asia Pacific basketball gear market is expected to grow at a CAGR of 4.4% from 2025 to 2030. Asia Pacific is seeing significant growth in the market, driven by the sport's rising popularity, particularly in countries like China, Japan, and the Philippines. China has one of the largest basketball fan bases globally, with millions regularly playing the sport. The Chinese Basketball Association (CBA) and the influence of the NBA in the region contribute to the growing demand for basketballs and hoops. Furthermore, rapid urbanization and the development of recreational infrastructure are increasing the number of public basketball courts, further driving the sales of hoops and basketballs.

Europe Basketball Gear Market Trends

The Europe basketball gear market is expected to grow at a CAGR of 4.9% from 2025 to 2030. Professional leagues like the EuroLeague are gaining prominence, driving the demand for basketball gear among aspiring players and fans alike. Furthermore, with a growing focus on physical activity and outdoor sports, consumers purchase basketball hoops for recreational use in parks and home driveways in the region.

Key Basketball Gear Company Insights

Omni-channel marketing by key players has had an optimistic impact on market growth. Moreover, sales expansion through online channels, advanced product launches, and eye-catching marketing and advertising strategies implemented by companies have driven the market. Most market players strive continuously to gain a competitive advantage over their competitors and develop a solid base for themselves.

Key Basketball Gear Companies:

The following are the leading companies in the basketball gear market. These companies collectively hold the largest market share and dictate industry trends.

- Wilson Sporting Goods

- Rawlings Sporting Goods Company, Inc.

- Anthem Sports

- Nivia

- Dick’s Sporting Goods, Inc.

- Target Brands, Inc.

- SCHEELS SPORTS

- Spalding Sports Worldwide, Inc.

- Under Armour, Inc.

- BSN Sports

- Spalding Sports Worldwide, Inc.

Recent Developments

- In September 2024, Milwaukee-based sports technology startup huupe, founded in 2019, introduced the world’s first smart basketball hoop. Built with rugged hardware to match the durability of a regulation hoop, the system integrates a video screen and computer vision to analyze player performance and deliver personalized training. In addition, the hoop allows users to play with friends remotely, enhancing the game's social aspect.

Basketball Gear Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 938.4 million

Revenue forecast in 2030

USD 1.19 billion

Growth rate (revenue)

CAGR of 4.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Greece; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Wilson Sporting Goods; Rawlings Sporting Goods Company, Inc.; Anthem Sports; Nivia; Dick’s Sporting Goods, Inc.; Target Brands, Inc.; SCHEELS SPORTS; Under Armour, Inc.; BSN Sports; Spalding Sports Worldwide, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Basketball Gear Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global basketball gear market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Basketballs

-

Hoops & Backboards

-

Accessories

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Greece

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global basketball gear market size was estimated at USD 900.5 million in 2024 and is expected to reach USD 938.4 million in 2025.

b. The global basketball gear market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2030 to reach USD 1.19 billion by 2030.

b. North America dominated the basketball gear market with a share of 41.58% in 2024. This is attributable to a number of professional league such as NBA and one of the most popular women's sports in the U.S.

b. Some key players operating in the basketball gear market include Wilson Sporting Goods; Rawlings Sporting Goods Company, Inc.; Anthem Sports; Nivia; Dick’s Sporting Goods, Inc.; Target Brands, Inc.; SCHEELS SPORTS; Anthem Sports; Under Armour, Inc.; and BSN Sports.

b. Key factors that are driving the basketball gear market growth include inclination toward basketball as a competitive sport as well as a recreational activity coupled with the popularity of the NBA across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.