- Home

- »

- Advanced Interior Materials

- »

-

Beach Sand Market Size And Share, Industry Report, 2033GVR Report cover

![Beach Sand Market Size, Share & Trends Report]()

Beach Sand Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Land Reclamation & Coastal Infrastructure, Beach Nourishment, Artificial Beaches, Landscaping & Aesthetic Use), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-818-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Beach Sand Market Summary

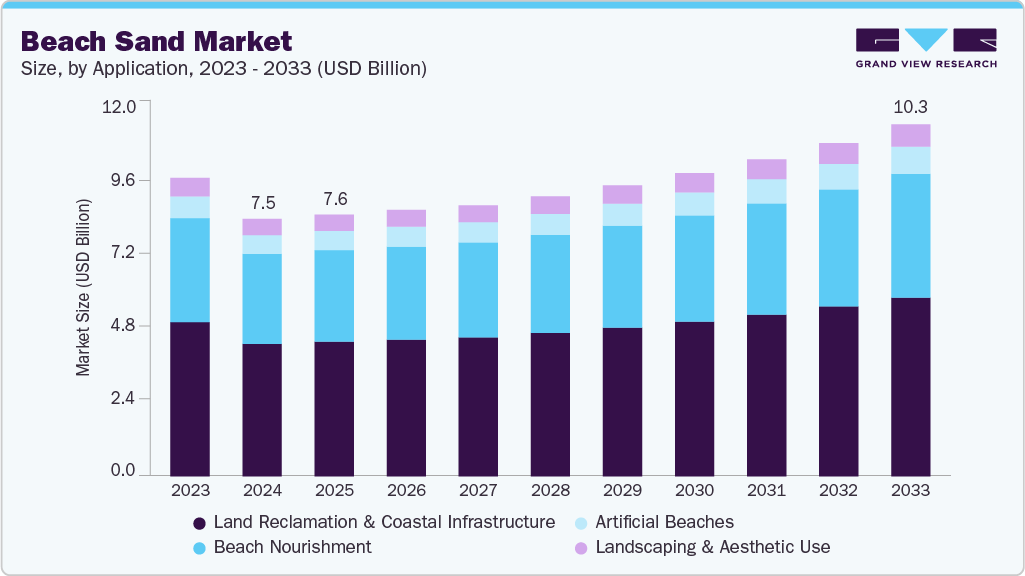

The global beach sand market size was estimated at USD 7.51 billion in 2024 and is projected to reach USD 10.26 billion by 2033, expanding at a CAGR of 3.8% from 2025 to 2033. The increasing demand for coastal infrastructure development, including ports, tourism facilities, and land reclamation projects, drives growth.

Key Market Trends & Insights

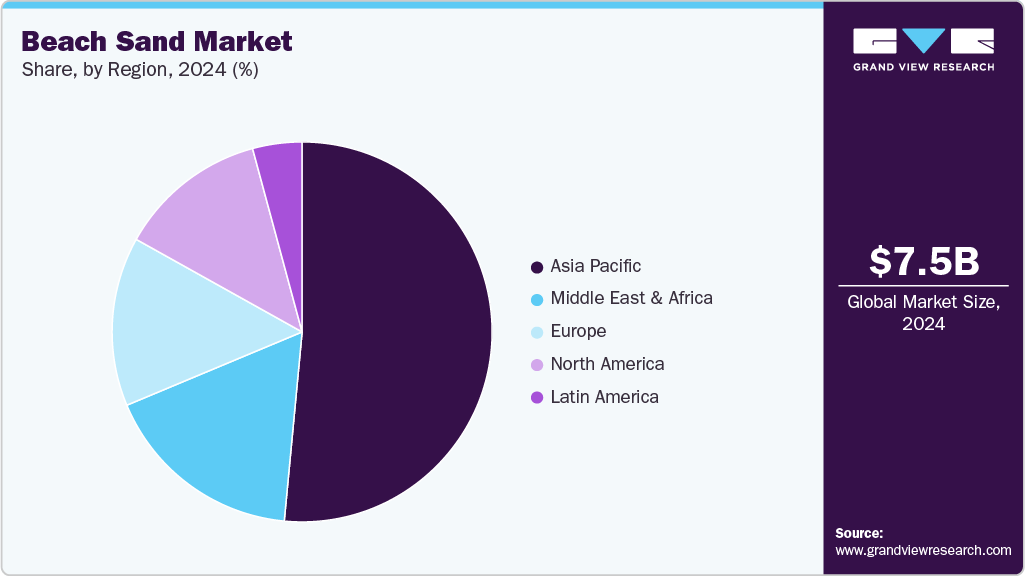

- Asia Pacific dominated the beach sand market with a revenue share of 51.5% in 2024.

- The beach sand market in North America is expected to grow at a CAGR of 4.1% from 2025 to 2033.

- By application, the land reclamation & coastal infrastructure mining segment held the largest share of 51.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.51 Billion

- 2033 Projected Market Size: USD 10.26 Billion

- CAGR (2025-2033): 3.8%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Rising government spending on beach nourishment and coastal erosion prevention is further supporting consumption. Moreover, the strong demand for heavy mineral sands, such as ilmenite, rutile, zircon, and garnet, used in pigments, ceramics, and metallurgical processes, continues to drive market value. The expansion of tourism activities and the need for regular beach maintenance across the Asia-Pacific and the Middle East also contribute significantly to long-term market growth.

Sustainability has become a central focus in the beach sand market due to growing concerns over coastal erosion, biodiversity loss, and illegal sand mining. Governments are increasingly enforcing stricter regulations on shoreline extraction and promoting environmentally responsible sourcing, including controlled dredging, restoration-based mining, and the use of alternative materials such as manufactured sand. Beach nourishment programs are now required to follow ecosystem impact assessments, ensuring that replenishment activities maintain natural coastal dynamics. The push toward circular practices, such as recycling dredged materials and reusing mineral tailings, further supports sustainable market development.

Technological innovations are improving extraction efficiency, mineral recovery, and environmental monitoring in the beach sand industry. Advanced dredging systems, remote sensing tools, and drone-based coastal mapping now enable precise assessment of sand reserves while minimizing ecological disturbance. Heavy mineral extraction benefits from improved gravity separation, magnetic separation, and electrostatic technologies, which enhance the recovery rates of ilmenite, rutile, zircon, and garnet. Moreover, AI-enabled coastal monitoring platforms are helping authorities track sand movement and illegal mining, while automated mineral processing plants are reducing operational costs and improving product quality.

Drivers, Opportunities & Restraints

Global demand for beach sand is rising, supported by major coastal nourishment projects, such as the Pinellas County Beach Renourishment Program, which was completed on April 22, 2025. This project involved large-scale dredging and the placement of sand. Expansion activities in the mineral-sand industry also accelerated, highlighted by the updated feasibility announcement of Australia’s Mallee Mineral Sands Project on 15 January 2024, boosting demand for ilmenite, rutile, and zircon. Tourism recovery since June 2023 has increased beach upkeep requirements across the Asia-Pacific and the Middle East. Large port and harbour expansions initiated on 10 September 2024 in India and 18 February 2025 in Indonesia further strengthened consumption. Public-private financing models introduced since March 2023 are enabling multi-year shoreline restoration contracts that ensure a recurring demand for sand.

Significant opportunities are emerging from new mineral-sand exploration permits, such as Sri Lanka’s national approval issued on August 5, 2024, which has opened pathways for fresh ilmenite and zircon investments. Coastal resilience initiatives, such as the Dubai Beach Reprofiling Program, launched on 12 February 2024, are expected to generate sustained offshore dredging requirements. The adoption of modern coastal-mapping technology increased sharply after pilot drone-based sediment tracking trials were conducted on 6 May 2024 by regional coastal authorities. Offshore sand exploration blocks offered in Malaysia on July 21, 2024, have generated interest among global dredging and construction firms. Additionally, circular-material reuse programs, introduced globally as of 14 October 2023, are converting dredged sediments into construction-grade aggregates, thereby expanding value-added prospects.

Regulatory tightening has intensified, particularly after India enforced stricter coastal mining norms on March 3, 2024, thereby increasing compliance obligations for operators. Environmental scrutiny rose sharply following the severe shoreline erosion documented on June 9, 2023, which compelled stricter ecological impact studies for extraction. Multiple crackdowns on illegal sand mining, including significant enforcement actions on 17 January 2025, have disrupted supply chains and heightened operational risks. Temporary extraction bans announced in Southeast Asia on 28 November 2023 and renewed on 4 April 2025 continue to restrict sand availability. Rising global pressure to protect coastal ecosystems intensified after updated marine conservation guidelines were issued on 20 January 2025, limiting permissions for beach and nearshore sand mining.

Application Insights

The land reclamation & coastal infrastructure segment is the dominant application, accounting for the vast majority of global beach sand consumption, driven by the rapid expansion of ports, harbors, waterfront real estate, and large-scale reclamation projects across Asia-Pacific and the Middle East. Governments are investing heavily in shoreline reinforcement, storm-surge protection, and artificial island development, all of which require massive volumes of dredged sand. Mega projects in countries such as Singapore, China, the UAE, and Indonesia continue to consume millions of tons annually, while rising climate-resilience budgets are further accelerating demand. The need to protect tourism assets and coastal communities from erosion ensures that this segment maintains long-term dominance.

Artificial beaches represent a rapidly expanding niche within the global beach sand market, driven by the rise of coastal tourism, resort development, and urban waterfront recreation projects. Countries in the Middle East, Southeast Asia, and the Mediterranean are increasingly constructing man-made beaches to enhance tourist appeal, support luxury hospitality zones, and convert underutilized shorelines into revenue-generating leisure destinations. These projects require high-quality sand, precise grading, and continuous replenishment to maintain aesthetics and safety standards. The growth of artificial islands, integrated resorts, and private beachfront developments further boosts demand, as governments and developers seek to create controlled, visually appealing coastal environments that attract both domestic and international visitors.

Regional Insights

North America beach sand market is shaped primarily by large-scale coastal protection, beach nourishment, and tourism maintenance projects. Frequent hurricanes, rising sea levels, and shoreline erosion along the Atlantic and Gulf coasts drive recurring demand for dredged sand. Municipalities and federal agencies regularly invest in renourishment programs to protect property and infrastructure, while popular tourist beaches require ongoing replenishment. The region also benefits from advanced dredging technology and well-established regulatory frameworks, which support steady, long-term demand.

U.S. Beach Sand Market Trends

The U.S. remains the largest market in North America due to its extensive coastline, high erosion rates, and substantial federal funding for shoreline resilience. States such as Florida, California, New Jersey, and North Carolina lead the way in consumption, driven by continuous beach renourishment cycles and major climate adaptation programs. The Army Corps of Engineers plays a central role in large-volume dredging initiatives, often supplying sand for storm-damage repair and recreational beach improvement. Growing tourism activity and stringent environmental standards further reinforce the sustained use of sand across the country.

Asia Pacific Beach Sand Market Trends

The Asia Pacific region dominates global beach sand consumption, driven by rapid coastal development, major land reclamation projects, and the expansion of tourism infrastructure. Countries such as China, Singapore, Indonesia, and the Philippines continue to construct artificial islands, new ports, and resort destinations that require massive quantities of sand. Rising urbanization along coastlines and the need to protect densely populated areas from erosion amplify demand. The region also has significant activity in heavy mineral sands extraction, which further contributes to overall beach sand usage.

Europe Beach Sand Market Trends

Europe’s beach sand market is driven by environmental protection efforts, coastal erosion management, and the maintenance of well-developed tourism coastlines, especially in Southern and Western Europe. Countries such as Spain, Italy, France, and the Netherlands frequently undertake beach nourishment to protect coastal communities and sustain tourism revenue. Strict environmental regulations guide extraction and replenishment activities, promoting responsible sourcing and the long-term preservation of ecosystems. Climate change impacts and increasingly severe storm events continue to strengthen the region’s reliance on renourishment programs.

Key Beach Sand Company Insights

Some of the key players operating in the market include Boskalis Westminster, Iluka Resources, DEME Group, and others.

-

Boskalis Westminster, established in 1910 and operating from its global marine services base, is engaged in dredging, land reclamation, and coastal infrastructure activities that support beach nourishment and shoreline protection. The company manages sand extraction, transportation, and placement through a fleet of dredging vessels specifically designed for coastal and nearshore projects. Boskalis focuses on enhancing project efficiency through the optimization of dredging methods, effective sediment management practices, and integrated coastal engineering solutions.

-

Iluka Resources, founded in 1954 and headquartered within a central mineral sands mining region, is involved in the extraction and processing of heavy minerals sourced from beach sand deposits, including ilmenite, rutile, and zircon. The company supplies mineral products used in ceramics, pigments, metal manufacturing, and industrial applications. Iluka continues to strengthen operational performance by enhancing mineral separation processes, implementing grade-control systems, and supporting sustainable resource management programs.

-

DEME Group, formed in 1991 and operates as a diversified marine engineering contractor, provides dredging, beach nourishment, and coastal development services across various regions. The company undertakes large-scale sand extraction and deposition works for land reclamation, erosion control, and coastal reinforcement projects. DEME applies integrated project-management practices, updated dredging technologies, and environmental monitoring tools to maintain operational reliability across its marine infrastructure activities.

Key Beach Sand Companies:

The following are the leading companies in the beach sand market. These companies collectively hold the largest market share and dictate industry trends.

- Boskalis Westminster

- Chemours Company

- DEME Group

- Iluka Resources

- Keppel Marine

- Lomon Billions

- Mineração Rio do Norte

- Rio Tinto - Richards Bay Minerals

- Royal IHC

- Trimex Sands

Recent Developments

-

Boskalis Westminster, in February 2025, announced the completion of a dredging and beach nourishment upgrade on one of its nearshore operating sites to increase sand-handling capacity for ongoing coastal reinforcement projects. The initiative aims to support increased demand from municipal shoreline protection programs and enhance operational scheduling flexibility. The company indicated that the upgraded system includes enhanced dredge-monitoring tools designed to maintain stable material flow rates.

-

Iluka Resources, in January 2025, confirmed the commissioning of a process-improvement module at one of its mineral separation plants to enhance the recovery of heavy minerals sourced from coastal deposits. The addition is expected to provide more consistent output for downstream customers in the ceramics and pigment production industries. Iluka stated that the new module integrates updated separation controls aimed at improving grade stability and reducing throughput variability.

-

DEME Group, in April 2025, reported the deployment of an upgraded trailing suction hopper dredger for its beach nourishment operations across selected coastal contracts. The enhancement is positioned to support ongoing land reclamation and erosion-management work scheduled for the year. The company noted that the vessel upgrade includes new navigation and sediment-distribution systems intended to improve placement accuracy and operational efficiency.

Beach Sand Market Report Scope

Report Attribute

Details

Market Definition

The beach sand market size represents the total annual value of beach sand supplied for various applications.

Market size value in 2025

USD 7.64 billion

Revenue forecast in 2033

USD 10.26 billion

Growth rate

CAGR of 3.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in Kilotons, Revenue in USD Million/Billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; China; India; Japan; Australia; Brazil; South Africa; Iran

Key companies profiled

Boskalis Westminster; Chemours Company; DEME Group; Iluka Resources; Keppel Marine; Lomon Billions (LB Group); Mineração Rio do Norte (MRN); Rio Tinto - Richards Bay Minerals; Royal IHC; Trimex Sands

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beach Sand Market Report Segmentation

This report forecasts global, country, and regional revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global beach sand market based on application and region.

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Land Reclamation & Coastal Infrastructure

-

Beach Nourishment

-

Artificial Beaches

-

Landscaping & Aesthetic Use

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global beach sand market size was estimated at USD 7.51 billion in 2024 and is expected to reach USD 7.64 billion in 2025.

b. The global beach sand market is expected to grow at a compound annual growth rate of 3.8% from 2025 to 2033, reaching USD 10.26 billion by 2033.

b. In 2024, the land reclamation & coastal infrastructure mining segment held the largest share, over 51.0% of the beach sand market.

b. Some of the key vendors in the global beach sand market include Boskalis Westminster, Chemours Company, DEME Group, Iluka Resources, Keppel Marine, Lomon Billions (LB Group), Mineração Rio do Norte (MRN), Rio Tinto – Richards Bay Minerals, Royal IHC, and Trimex Sands.

b. The global beach sand market is driven by growing demand for coastal protection, land reclamation, and beach nourishment projects across major coastal economies. Rising tourism development, including the construction of artificial beaches and resort upgrades, further boosts consumption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.