- Home

- »

- Advanced Interior Materials

- »

-

Bead Wire Market Size And Share, Industry Report, 2033GVR Report cover

![Bead Wire Market Size, Share & Trends Report]()

Bead Wire Market (2025 - 2033) Size, Share & Trends Analysis Report, By Tire Type (Passenger Car Tires, Light Commercial Vehicle Tires), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-809-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bead Wire Market Summary

The global bead wire market size was estimated at USD 1.44 billion in 2024 and is projected to reach USD 1.88 billion by 2033, at a CAGR of 3.1% from 2025 to 2033. Rising global vehicle production and stronger demand for replacement tires are the primary drivers of the bead wire market.

Key Market Trends & Insights

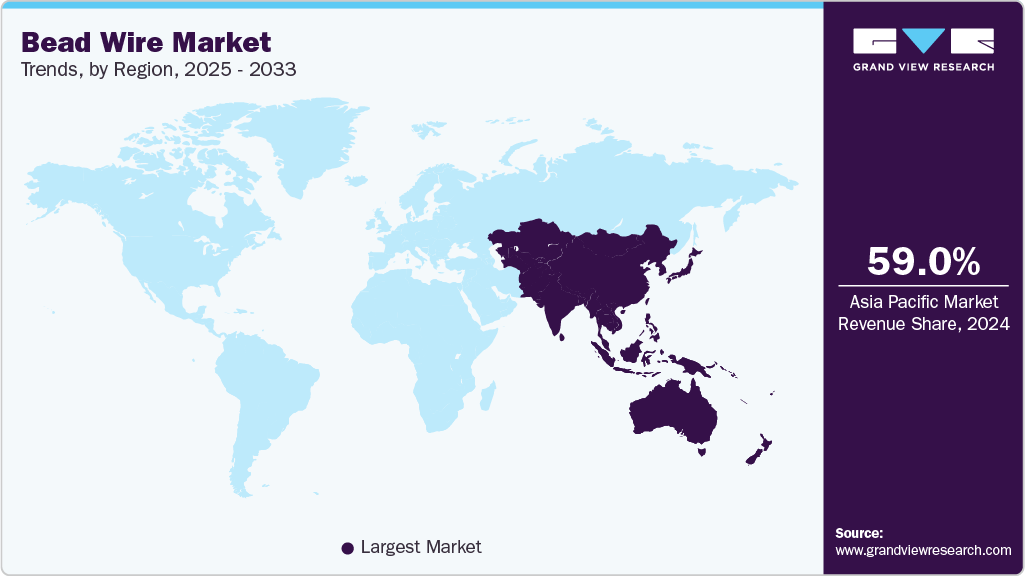

- Asia Pacific dominated the bead wire market with the largest market revenue share of 59.0%.

- By tire type, passenger car tires accounted for the largest market revenue share of over 47.9% in 2024.

- By application, replacement/retread segment is anticipated to register the fastest CAGR of 3.2% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1.44 Billion

- 2033 Projected Market Size: USD 1.88 Billion

- CAGR (2025-2033): 3.1%

- Largest Market Region in 2024: Asia Pacific

According to the International Organization of Motor Vehicle Manufacturers, global vehicle output reached around 93.5 million units in 2024, reflecting an increase from the previous year. As passenger vehicle and commercial vehicle fleets expand across emerging and developed regions, tire manufacturers require greater volumes of high-strength bead wire to meet original equipment specifications. Growth in commercial transport-related sectors amplifies demand for heavy-duty tires, where bead wire performance is crucial for load-bearing and durability.

Growth in infrastructure and construction activity supports demand for off-road and industrial tires that use specialized bead wire. Mining, agriculture, and construction machinery have long service lives and require robust tire designs that rely on reinforced bead assemblies. As governments invest in roads and logistics corridors, increased movement of goods and materials sustains the tire replacement cycle and associated bead wire consumption.

Advances in metallurgical processes and wire drawing technology are improving product performance while lowering production costs. Producers are adopting higher tensile steels, improved coatings, and precision drawing processes that enhance fatigue resistance and corrosion protection. These technological improvements expand the applications of bead wire, enabling manufacturers to offer differentiated products that meet more stringent OEM performance requirements.

Raw material availability and pricing dynamics influence market growth through cost pass-through and production planning. The supply conditions of steel scrap and cold-rolled wire rod affect the capacity and margins of bead wire producers. Manufacturers that secure stable upstream supply chains or invest in recycling and efficient material use can better manage cost volatility and maintain competitive pricing for tire makers.

Aftermarket trends and sustainability initiatives are shaping demand patterns for bead wire and associated end products. An increased focus on tire retreading and longer life cycle management supports the demand for quality bead wire that can withstand multiple service cycles. Environmental regulations and industry's shift toward circular economy practices encourage manufacturers to develop recyclable and lower environmental footprint solutions, which can become a market differentiator.

Drivers, Opportunities & Restraints

The bead wire market is gaining momentum due to the steady growth in the automotive and tire manufacturing industries. Rising vehicle production across emerging economies such as India, China, and Brazil has accelerated tire demand, directly influencing bead wire consumption. The increasing preference for radial tires, which require higher-quality and more durable bead wires, is another crucial driver. Furthermore, advancements in steel wire technology and the use of high-tensile, corrosion-resistant materials are enhancing tire performance and lifespan, thereby supporting the market’s expansion.

Expanding electric vehicle (EV) production presents significant opportunities for manufacturers of bead wire. As EVs demand lightweight yet durable components, the need for innovative tire designs incorporating advanced bead wire materials is increasing. Moreover, sustainable tire manufacturing practices and the growing trend of retreading present new growth opportunities for eco-friendly and recyclable bead wire products. Rapid industrialization in developing regions, coupled with infrastructure investments that boost commercial vehicle fleets, will further create new market prospects for bead wire producers.

Despite favorable demand dynamics, the bead wire market faces certain challenges. Fluctuations in steel prices significantly affect manufacturing costs, making profit margins volatile. In addition, the rising adoption of airless or non-pneumatic tires could limit bead wire usage over time. Strict environmental regulations concerning steel processing and recycling also impose additional compliance burdens on manufacturers. Supply chain disruptions and dependency on raw material imports can further restrain consistent market growth, particularly in regions with limited domestic steel production.

Tire Type Insights

Passenger car tires held the revenue share of 47.9% in 2024. Passenger car tires continue to drive demand for bead wire higher, as car production grows in key markets and people use their vehicles more frequently, leading to increased tire replacements. Rising sales of electric cars and a steady shift toward improved fuel efficiency and smoother ride quality have prompted tire makers to opt for high-tensile bead wire with tighter strength and stability specifications. This segment benefits from consumers leaning toward premium and performance tires, as stronger bead wire helps handle higher speeds and loads while maintaining ride comfort.

Light commercial vehicle tires is anticipated to register the fastest CAGR over the forecast period. The growth of e-commerce and small-scale goods transport has significantly raised the production and use of LCVs, which rely on durable tires capable of handling heavier loads and frequent braking. Tire manufacturers are therefore focusing on reinforced bead wire with enhanced fatigue resistance and load-bearing capacity to ensure structural integrity under constant operational stress. The preference for radial tires in this category has further driven the use of advanced bead wire materials, which offer improved adhesion, flexibility, and uniformity.

Application Insights

OEM held the revenue share of 54.9% in 2024. The OEM segment is expanding steadily, driven by the rising production of vehicles across passenger, commercial, and off-road categories. Automotive manufacturers are increasing their production to meet the global demand recovery, especially in developing regions where vehicle ownership continues to rise. Bead wire suppliers benefit directly from this, as every new tire fitted at the OEM stage requires precise and high-quality reinforcement to meet safety and performance standards. The growing preference for radial and tubeless tires in factory-fitted models has also increased demand for advanced bead wire grades with superior tensile strength and fatigue resistance, ensuring consistent tire seating and longevity throughout the vehicle’s initial life cycle.

The replacement and retread segment serves as a major revenue generator for the bead wire market, driven by continuous tire wear and rising vehicle utilization rates across both commercial and passenger fleets. As global road traffic and logistics intensify, the frequency of tire replacements increases, resulting in steady demand for bead wire used in both new and retreaded tires. In emerging economies, cost-sensitive consumers and fleet operators prefer retreading as a reliable and economical alternative to purchasing new tires, thereby sustaining long-term demand for bead wire. The growing popularity of radial retread tires in the truck, bus, and light commercial segments has further strengthened market prospects for high-quality bead wire with excellent adhesion and fatigue resistance.

Regional Insights

Asia Pacific accounted for the largest market revenue share of 59.0% in 2024. Rising vehicle production across the Asia Pacific remains a key catalyst for the bead wire market. In 2024, the region produced nearly 54.9 million vehicles, accounting for about 60% of global output. China led with around 31.3 million units, while India followed with approximately 6.01 million units, both showing steady year-on-year growth. Expanding automotive manufacturing in these countries strengthens demand for bead wire used in tire reinforcement, particularly as domestic and export-oriented vehicle assembly plants continue scaling up. Rapid urbanization, infrastructure investment, and increasing consumer purchasing power have further accelerated sales of passenger cars and light commercial vehicles, directly influencing tire consumption and consequently, bead wire requirements.

North America Bead Wire Market Trends

Vehicle production in North America continues to support steady demand for bead wire, driven by strong manufacturing activity in the U.S. and Mexico. In 2024, the U.S. produced around 10.56 million vehicles, while Mexico recorded approximately 4 million units, reflecting a growth rate of over 5% from the previous year. Canada contributed an additional 1.2 million units, aided by ongoing investments in electric vehicle assembly plants. Together, these figures highlight the region’s resilience in automotive output, which in turn sustains the consumption of bead wire used in tire production for both passenger and commercial vehicles. The region’s emphasis on high-performance and durable tires, supported by technological advancements in tire design, strengthens the market outlook for bead wire.

U.S. Bead Wire Market Trends

In the U.S., vehicle production continues to play a pivotal role in supporting the growth of the bead wire market. In 2024, the country produced approximately 10.6 million vehicles, driven by consistent demand from consumers for passenger cars, SUVs, and light commercial vehicles. The rebound in domestic automotive output following earlier supply chain disruptions has revived tire manufacturing activities, which directly boosts bead wire consumption. As each vehicle requires multiple tires reinforced with bead wire to maintain shape and stability under varying load and pressure conditions, even modest increases in production volumes translate to substantial demand for bead wire.

Europe Bead Wire Market Trends

In Europe, vehicle production has shown signs of slowdown, which influences the overall demand for bead wire used in tire manufacturing. In 2024, automobile output across the European Union totaled approximately 11.4 million units, representing a slight decline from the previous year, primarily due to higher production costs, stricter environmental regulations, and energy price volatility. Countries such as Germany, France, and Spain remain key contributors to regional vehicle production, supported by strong automotive supply chains and advanced manufacturing infrastructure. While production growth has been modest, Europe continues to be a major consumer of bead wire due to its large existing vehicle fleet and steady replacement tire demand.

Middle East & Africa Bead Wire Market Trends

In the Middle East and Africa, the bead wire market is gradually gaining momentum, driven by the expansion of automotive assembly operations and increasing demand for tires in both passenger and commercial vehicle segments. Countries such as Morocco, Egypt, South Africa, and the UAE are emerging as key hubs for vehicle production and distribution, driven by supportive government policies and increasing foreign investments in automotive manufacturing. The increasing number of assembly plants across North and Sub-Saharan Africa, coupled with ongoing infrastructure projects, is driving up tire consumption in the region. This growth in tire demand directly translates to higher consumption of bead wire, which is essential for providing structural strength and durability to tires used on varied terrain and in diverse climatic conditions.

Latin America Bead Wire Market Trends

In Latin America, growing vehicle production and sales are driving increased demand for tire-reinforcement materials, such as bead wire. Manufacturers are expanding capacity in countries such as Brazil, Mexico, and Argentina, and shifting production closer to local markets to reduce dependence on imports. This localization facilitates strong links between vehicle assembly, tire manufacturing, and the supply of reinforcement components. At the same time, expanding consumer access to vehicles, increased financing availability, and the launch of new SUVs and crossovers are driving higher tire volumes per vehicle, which in turn boosts bead wire usage.

Key Bead Wire Company Insights

Some of the key players operating in the market include Aarti Steels Limited, Jiangsu Xingda Steel Tyre Cord Co., Ltd., and others

-

Aarti Steels Limited is an Indian integrated steel manufacturer, established in 1979, with its headquarters in Ludhiana, Punjab. The company operates across several stages of the steel value chain, including sponge iron, billets, ferroalloys, and captive power generation, ensuring cost efficiency and consistent product quality. In the bead wire segment, Aarti Steels manufactures high-strength steel wires designed for use in the reinforcement of tire beads. The company’s bead wire products are engineered for superior adhesion with rubber, fatigue resistance, and dimensional precision, meeting the performance standards required by tire manufacturers.

-

Jiangsu Xingda Steel Tyre Cord Co., Ltd. is a China-based manufacturer specializing in steel reinforcement materials for the global tire industry. Headquartered in Jiangsu Province, the company produces a wide range of high-performance steel cords and bead wires that cater to leading tire brands worldwide. Within the bead wire market, Xingda offers a comprehensive portfolio that includes standard round, rectangular, and cable bead wires.

Key Bead Wire Companies:

The following are the leading companies in the bead wire market. These companies collectively hold the largest market share and dictate industry trends.

- Aarti Steels Limited

- Jiangsu Xingda Steel Tyre Cord Co., Ltd.

- Kiswire Ltd.

- NV Bekaert S.A.

- Rajratan Global Wire Limited

- Shandong Daye Co., Ltd.

- Shanghai Metal Corporation

- SNTAI Industrial Group Ltd.

- Tianjin Bladder Technology Co., Ltd.

- WireCo World Group Inc.

Recent Development

- In November 2024, Shandong Daye, a leading raw material supplier for tires, announced a substantial investment of approximately USD 203 million to construct a new manufacturing center in Morocco, focusing on bead wire and steel cord production. This strategic initiative aims to expand the company's international presence and enhance the regional tyre sector's supply chain with advanced materials.

Bead Wire Market Report Scope

Report Attribute

Details

Market definition

The bead wire market size represents the total annual value of steel or coated wire supplied for tire bead reinforcement and related uses.

Market size value in 2025

USD 1.47 billion

Revenue forecast in 2033

USD 1.88 billion

Growth rate

CAGR of 3.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Tire type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil; Saudi Arabia, UAE

Key companies profiled

NV Bekaert S.A.; Kiswire Ltd.; Rajratan Global Wire Limited; Shandong Daye Co., Ltd.; SNTAI Industrial Group Ltd.; WireCo World Group Inc.; Aarti Steels Limited; Jiangsu Xingda Steel Tyre Cord Co., Ltd.; Shanghai Metal Corporation; Tianjin Bladder Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bead Wire Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global bead wire market report on the basis of tire type, application, and region:

-

Tire Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Passenger Car Tires

-

Light Commercial Vehicle Tires

-

Heavy Commercial Vehicle Tires

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

OEM

-

Replacement/Retread

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global bead wire market size was estimated at USD 1.44 billion in 2024 and is expected to reach USD 1.47 billion in 2025.

b. The global bead wire market is expected to grow at a compound annual growth rate of 3.1% from 2025 to 2033 to reach USD 1.88 billion by 2033.

b. The passenger car tires segment dominated the market with a revenue share of 47.9% in 2024.

b. Some of the key players of the global bead wire market are NV Bekaert S.A., Kiswire Ltd., Rajratan Global Wire Limited, Shandong Daye Co., Ltd., SNTAI Industrial Group Ltd., WireCo World Group Inc., Aarti Steels Limited, Jiangsu Xingda Steel Tyre Cord Co., Ltd., Shanghai Metal Corporation, Tianjin Bladder Technology Co., Ltd., and others.

b. The key factor driving the growth of the global bead wire market is the increasing demand for tires from the automotive industry, supported by rising vehicle production and replacement tire sales across emerging and developed economies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.