- Home

- »

- Animal Health

- »

-

Beef Cattle Health Market Size, Share, Industry Report, 2033GVR Report cover

![Beef Cattle Health Market Size, Share & Trends Report]()

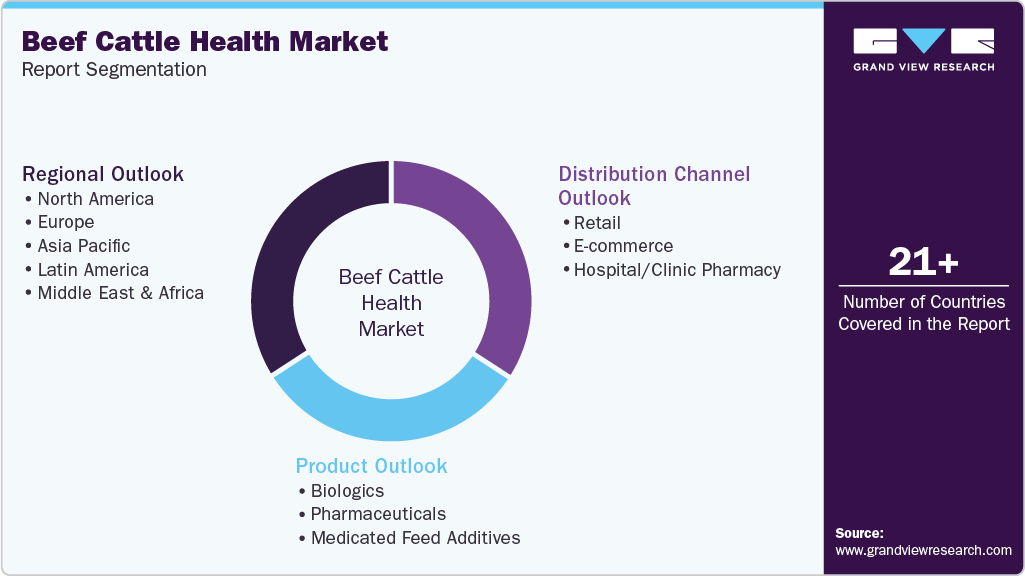

Beef Cattle Health Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Biologics, Pharmaceuticals, Medicated Feed Additives), By Distribution Channel (Retail, E-commerce, Hospital/Clinic Pharmacy), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-784-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Beef Cattle Health Market Summary

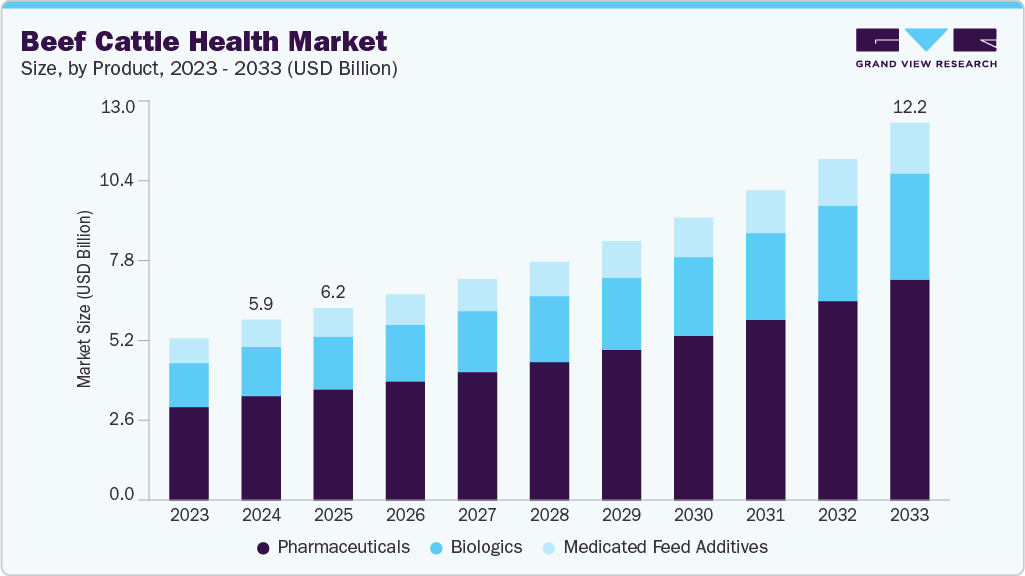

The global beef cattle health market size was estimated at USD 5.85 billion in 2024 and is projected to reach USD 12.22 billion by 2033, growing at a CAGR of 8.80% from 2025 to 2033. The market is experiencing growth driven by the rising prevalence of infectious and parasitic diseases, such as bovine respiratory disease and New World screwworm, which threaten herd productivity.

Key Market Trends & Insights

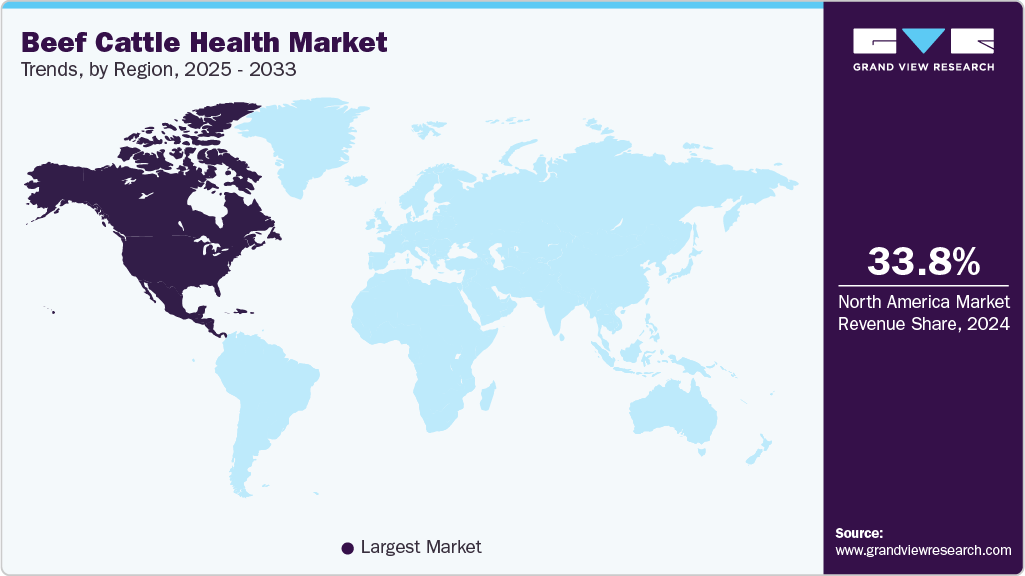

- The North America beef cattle health market held the largest revenue share of 33.79% in 2024.

- The U.S. beef cattle health industry held the largest revenue share in 2024.

- By product, the pharmaceuticals segment held the largest market share of 57.70% in 2024.

- By product, the biologics segment is expected to grow at the fastest CAGR of 9.17% from 2025 to 2033.

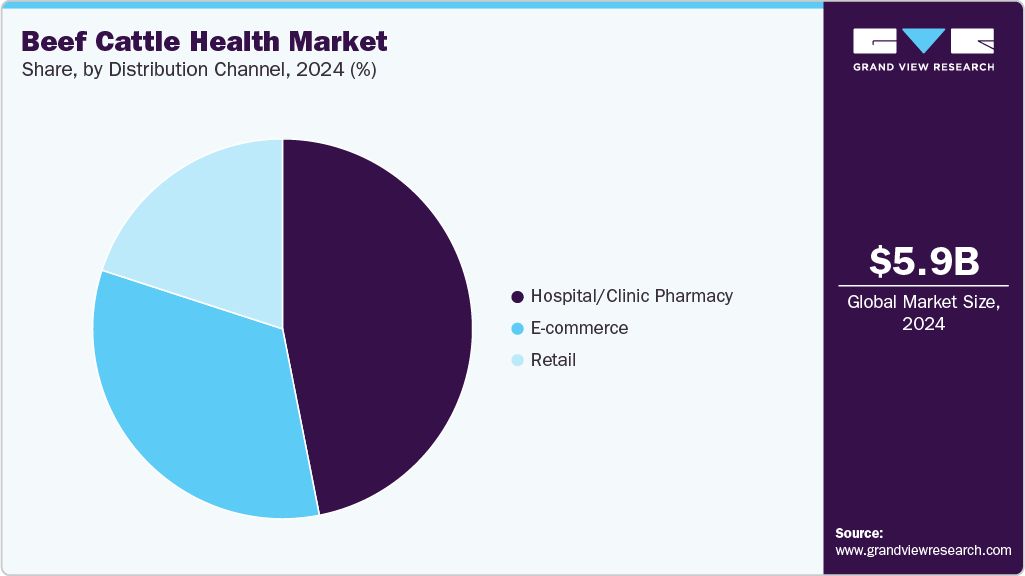

- By distribution channel, the hospital/clinic pharmacy segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.85 Billion

- 2033 Projected Market Size: USD 12.22 Billion

- CAGR (2025-2033): 8.80%

- North America: Largest Market in 2024

Innovations like injectable antibiotics and parasitic treatments, along with increased adoption of preventive healthcare and medicated feed additives, are boosting demand for effective cattle health solutions worldwide. Additionally, expanding awareness among producers about disease management, animal welfare, and productivity optimization has led to higher consumption of pharmaceuticals, biologics, and medicated feed additives. For example, rising concerns over bovine respiratory disease and foot-and-mouth disease have fueled the demand for vaccines and antibiotics, while nutritional supplements and probiotics are increasingly used to enhance feed efficiency and immunity.According to the report published by Ceva in July 2025, global beef prices will remain strong in June 2025, driven by tight cattle supplies and robust demand. In Europe and the USA, prices surged over 40% year-on-year, while Brazil saw steady growth supported by booming exports. China's prices stabilized after earlier gains, as increased imports balanced the market. Overall, global demand for beef continues to outpace supply. High cattle prices and strong international demand encourage producers to invest more in herd health, disease prevention, and productivity enhancement. This trend will likely boost the beef cattle health market, driving growth in vaccines, feed additives, and veterinary services to sustain herd performance and export quality.

Additionally, the increasing prevalence of infectious and parasitic diseases and growing FDA approvals for innovative products to maintain beef cattle health are expected to drive market growth. For instance, in September 2025, the FDA approved Dectomax-CA1 for New World screwworm prevention and treatment, highlighting the urgent need for effective parasitic control in cattle. Similarly, in February 2025, Elanco’s launch of Pradalex, a novel injectable antibiotic for bovine respiratory disease (BRD), underscores the demand for advanced therapeutics to manage highly prevalent and costly respiratory infections in feedlot and stocker cattle. These innovations enhance herd health, reduce mortality, and improve overall production efficiency, encouraging greater adoption of veterinary pharmaceuticals and biologics globally.

Top Beef Exporting Countries, 2024

Country

Export Volume (metric tons)

Brazil

~2,900,000

Australia

~1,690,000

U.S.

~1,500,000

India

~1,400,000

Argentina

~600,000

Uruguay

~420,000

Market Concentration & Characteristics

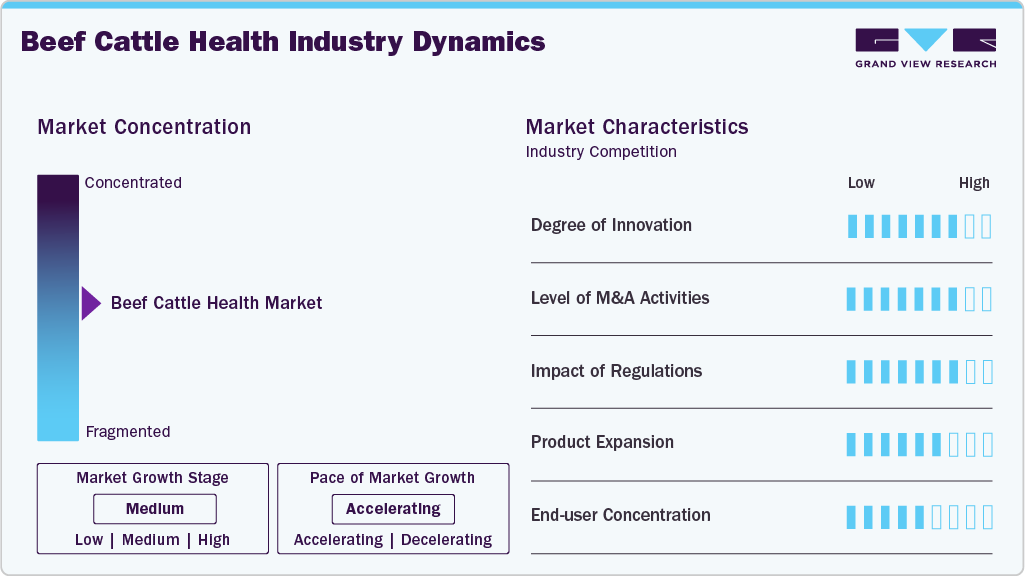

The global beef cattle health market is moderately concentrated, with a few major players controlling a significant share of pharmaceuticals, biologics, and feed additive segments. These key players focus on expanding regional footprints, product portfolios, and R&D capabilities, driving innovation and market stability. Smaller regional companies also contribute by catering to niche markets and local regulatory requirements, maintaining competitive dynamics.

The global beef cattle health industry is experiencing strong innovation, driven by advanced biologics, precision pharmaceuticals, and novel feed additives. Key developments include mRNA vaccines for viral diseases, CRISPR-based microbiome editing to reduce methane emissions, and probiotics or enzyme-based supplements to enhance feed efficiency and gut health. Innovative delivery systems, such as intranasal vaccines and sustained-release formulations, improve disease prevention and herd health management. These advances are boosting productivity, sustainability, and overall cattle well-being worldwide.

The market is witnessing significant M&A activity, driven by the need to expand product portfolios, enter new geographies, and strengthen vaccine and pharmaceutical capabilities. Recent acquisitions focus on farm animal vaccines, biologics, and nutritional supplements to enhance herd health solutions. These mergers and acquisitions enable companies to consolidate market share, leverage R&D infrastructure, and respond rapidly to emerging cattle diseases, boosting regional and global market reach. Such strategic deals accelerate innovation and improve access to advanced cattle health products worldwide.

Regulations play a critical role in shaping the global beef cattle health market, influencing product approvals, safety standards, and market entry timelines. Strict veterinary drug and vaccine regulations ensure efficacy and safety, driving demand for approved pharmaceuticals, biologics, and medicated feed additives. Compliance with international standards also affects export opportunities, as seen with disease outbreak responses and vaccination mandates. Regulatory frameworks incentivize innovation while maintaining animal welfare, but lengthy approval processes can delay product launches and affect market growth.

Product expansion is a key market growth driver, with companies developing new vaccines, biologics, and medicated feed additives to address emerging diseases and improve cattle productivity. Innovations such as mRNA vaccines for foot-and-mouth disease and next-generation probiotics for gut health exemplify this trend. Expansion also includes region-specific formulations to tackle local pathogens and enhance disease prevention. These efforts help strengthen herd immunity, reduce antibiotic reliance, and create new revenue streams across global markets.

The global beef cattle health market shows high end-user concentration, with significant demand from large-scale commercial farms and feedlots requiring consistent disease prevention and productivity management. Veterinary hospitals and clinics contribute significantly, providing vaccination, therapeutics, and preventive care services. This concentration drives the adoption of advanced pharmaceuticals, biologics, and medicated feed additives, ensuring herd health and reducing economic losses. Smaller farms contribute less to overall market revenue but gradually adopt solutions through cooperative programs and e-commerce platforms.

Product Insights

The pharmaceuticals segment held the largest revenue share in 2024, owing to widespread and consistent demand for antibiotics, antiparasitics, and anti-inflammatories to prevent and treat diseases like bovine respiratory disease, foot-and-mouth disease, and parasitic infections. Companies such as Zoetis, Elanco, and Merck Animal Health supply broad-spectrum antibiotics and injectable treatments that are essential for herd health management. The segment’s dominance is driven by its critical role in reducing mortality, improving productivity, and ensuring food safety across commercial beef operations worldwide.

The biologics segment is expected to register the fastest CAGR during the forecast period, due to increasing adoption of vaccines, recombinant proteins, and monoclonal antibodies for disease prevention and herd immunity. Innovations like mRNA vaccines for foot-and-mouth disease and viral-vector vaccines for bovine respiratory disease are driving demand, with companies such as Zoetis, Elanco, and Merck Animal Health expanding their biologics portfolios. Growing emphasis on reducing antibiotic use and improving animal welfare further accelerates the shift toward biologics in cattle health management.

Distribution Channel Insights

The hospital/clinic pharmacy dominated the beef cattle health industry with the largest revenue share in 2024. This dominance is driven by their role as primary distribution points for vaccines, antibiotics, and biologics to large-scale farms and veterinary practices. These facilities ensure timely access to critical treatments for bovine respiratory disease, foot-and-mouth disease, and parasitic infections, with examples including Zoetis and Elanco supplying products directly through veterinary clinics. Their ability to provide expert guidance, on-site storage, and administration of medications enhances trust and adoption among producers, particularly in North America and Europe, sustaining high revenue generation.

The e-commerce segment is projected to register the fastest CAGR over the forecast period, due to the increasing online adoption by farmers to purchase vaccines, pharmaceuticals, and feed additives directly from manufacturers and distributors. Platforms offering convenient access to veterinary products, real-time delivery, and competitive pricing, such as Zoetis’ online portals and Elanco's digital farm solutions, are driving this trend. E-commerce enables smaller farms and remote operations, particularly in regions like North America, Europe, and the Asia Pacific, to access advanced cattle health solutions without traditional supply-chain limitations. Growing digital literacy among livestock producers and expanding agri-tech marketplaces further accelerate this segment’s adoption.

Regional Insights

North America dominated the global beef cattle health market in 2024, holding the largest revenue share of 33.79%. The market growth is attributed to rising investments in preventive healthcare, advanced vaccines, and precision livestock management technologies. Key trends include adopting digital monitoring systems for disease detection, increasing use of probiotics and feed additives to enhance gut health and reduce antibiotic dependence, and strong research focus on bovine respiratory disease (BRD) and antimicrobial resistance as seen in Canada’s BCRC-funded projects. The market is also witnessing demand for mRNA-based and next-generation vaccines, precision nutrition, and methane-reducing feed innovations aligned with sustainability goals. Major players such as Zoetis, Elanco, and Merck Animal Health are expanding their R&D portfolios and product lines, positioning North America as a leader in developing resilient, health-focused beef production systems.

U.S. Beef Cattle Health Market Trends

The beef cattle health industry in the U.S. accounted for the highest revenue share in North America, owing to rising demand for preventive care, vaccines, and precision livestock technologies. Key trends include increasing adoption of mRNA and viral-vector vaccines for diseases like FMD and BRD, feed additives and probiotics to improve gut health and reduce antibiotic reliance, and digital monitoring tools for real-time herd health management. Key companies are expanding product portfolios, while innovations such as methane-reducing feed additives (Bovaer) reflect the focus on sustainability alongside animal health. These trends highlight a shift toward resilient, productivity-driven, and welfare-focused beef production systems.

Europe Beef Cattle Health Market Trends:

The Europe beef cattle health industry is growing due to increased focus on disease prevention, biosecurity, and herd productivity. Key drivers include adopting vaccines against emerging diseases like bluetongue serotype-3 (Bluevac-3, Syvazul BTV 3), foot-and-mouth disease, antimicrobial stewardship, and gut health management. Innovations in digital monitoring, feed additives, and probiotics further support animal welfare and production efficiency. Leading companies such as Zoetis, Elanco, and Boehringer Ingelheim are expanding vaccine and veterinary health portfolios to meet rising demand.

The beef cattle health market in Germany held the highest revenue share in 2024. This expansion is driven by rising demand for preventive care, vaccination, and herd management amid declining cattle populations and high beef prices. Key trends include increased FMD and bluetongue (BTV-3) vaccine use, early calf immunization, and biosecurity measures to mitigate disease risks. Organizations like the Lower Saxony Farmers’ Association and support from the Animal Disease Fund are promoting vaccination and herd health programs, driving demand for veterinary products and services.

The UK beef cattle health market is expected to grow significantly over the forecast period. Increasing focus on disease prevention, herd productivity, and sustainable farming practices influences the country's growth. Rising concerns over bovine respiratory disease (BRD), lumpy skin disease, and bluetongue drive demand for vaccines, biosecurity measures, and veterinary services. Preventive solutions, including intranasal BRD vaccines and nutritional supplements to support immunity and gut health, are increasingly adopted by producers. Additionally, initiatives to improve antimicrobial stewardship and the use of digital herd monitoring tools are expanding the market.

Asia Pacific Beef Cattle Health Market Trends

Asia Pacific is expected to grow significantly over the forecast period.This expansion is attributed to rising beef consumption, expanding cattle farming, and increased focus on animal health and productivity. Key trends include increased adoption of veterinary pharmaceuticals such as antibiotics and antiparasitics, biologics including vaccines for foot-and-mouth disease (FMD), lumpy skin disease, and hemorrhagic septicemia, and medicated feed additives to enhance growth, immunity, and milk yield. For example, China is rapidly deploying combination vaccines and fortified feeds for large-scale beef and dairy herds. India and Southeast Asian countries are expanding FMD vaccination campaigns and using probiotics and mineral-enriched feeds. Additionally, rising awareness of disease prevention, improved farm management, and government-supported livestock health programs are boosting demand for cattle health products across the region.

The China beef cattle health market is witnessing new growth opportunities due to growing rapidly due to rising domestic beef consumption, expanding feedlot operations, and increasing focus on herd disease prevention and productivity. Demand for pharmaceuticals such as antibiotics and antiparasitics remains strong, while biologics, including vaccines against bovine respiratory disease (BRD) and foot-and-mouth disease (FMD), are increasingly adopted to reduce losses from contagious diseases.

The beef cattle health market in Japan is driven by rising demand for high-quality Wagyu and crossbred beef, shrinking cattle stocks, and high production costs. To support herd health and productivity, producers are increasingly investing in pharmaceuticals such as antibiotics and antiparasitics, biologics including vaccines for bovine respiratory disease and other endemic infections, and medicated feed additives that enhance growth, immunity, and digestive efficiency. For example, Holstein and crossbred cattle in Hokkaido are routinely managed with nutritional supplements and vaccination programs to maintain performance under intensive fattening systems, while advanced breeding and herd management technologies further drive the adoption of veterinary products, creating robust growth in Japan’s beef cattle health sector.

The India beef cattle health market is experiencing notable growth, driven by rising demand for dairy and buffalo meat products, coupled with increasing awareness of animal welfare and productivity enhancement. Growth is driven by the adoption of veterinary pharmaceuticals such as antibiotics and antiparasitics, biologics including vaccines for foot-and-mouth disease (FMD), hemorrhagic septicemia, and brucellosis, and medicated feed additives to improve immunity, growth rates, and milk yield. For instance, government-supported vaccination campaigns against FMD and the use of probiotic and mineral-enriched feeds in large dairy and buffalo herds are boosting cattle health and productivity, while private sector companies are increasingly offering combination vaccines and fortified feeds, contributing to steady growth in India’s beef and buffalo cattle health market.

Latin America Beef Cattle Health Market Trends

The beef cattle health industry in Latin America is expected to grow significantly due to herd management challenges, climate variability, and increasing export demands. Countries like Argentina and Brazil focus on disease prevention, vaccination, and nutritional interventions to optimize herd productivity amid shrinking cattle populations and drought-related stress. For instance, Argentine producers use medicated feed additives and mineral supplements to enhance growth and carcass quality, while Brazilian operations invest in vaccines and biologics to control diseases. Rising demand from China, the U.S., and emerging Asian markets is further driving the adoption of veterinary pharmaceuticals, biologics, and feed additives, boosting the overall cattle health market in the region.

Brazil's beef cattle health market is witnessing notable growth due to the country's status as one of the world's largest beef exporters and the need to maintain herd productivity amid disease pressures and climate challenges. Key drivers include widespread adoption of vaccines against BRD, FMD, and clostridial infections, alongside increased use of medicated feed additives and probiotics to enhance growth, immunity, and gut health. For example, large-scale feedlot operations in Mato Grosso and São Paulo implement BRD vaccination programs and supplement rations with ionophores and mineral mixes to reduce morbidity and improve feed efficiency. Additionally, rising international demand, especially from China, the US, and Middle Eastern markets, is encouraging producers to invest in biologics and veterinary pharmaceuticals, fueling steady growth of the market.

Middle East & Africa Beef Cattle Health Market Trends

The market for beef cattle health is expanding significantly in the Middle East and Africa due to increasing beef consumption, rising investments in feedlot systems, and growing concerns over livestock diseases such as foot-and-mouth disease, bluetongue, and bovine respiratory disease. Governments and private players are investing in vaccination campaigns, veterinary pharmaceuticals, biologics, and medicated feed additives to improve herd health and productivity. For instance, South Africa’s mass FMD vaccination drive and the UAE’s enhanced feedlot vaccination programs highlight the region’s focus on preventive healthcare, while rising adoption of probiotics, mineral supplements, and disease diagnostics in countries like Saudi Arabia and Egypt is further driving market growth.

The beef cattle health market in South Africa is the fastest growing over the forecast period, propelled by increased disease prevention and herd management initiatives, driven by outbreaks of foot-and-mouth disease (FMD) and avian influenza. Government-led vaccination campaigns, such as the procurement of over 900,000 FMD vaccine doses and large-scale inoculations at major feedlots like Karan Beef, are boosting demand for veterinary pharmaceuticals, biologics, and medicated feed additives. Rising awareness of biosecurity and export requirements, especially to markets like China, Namibia, and Zimbabwe, further accelerates the adoption of health interventions, making preventive medicine and advanced therapeutics key growth drivers in the country's beef sector.

The UAE beef cattle health market is experiencing growth driven by rising domestic demand for high-quality beef and the government's focus on food security and livestock biosecurity. Increased imports of breeding stock and feedlot cattle have spurred demand for veterinary pharmaceuticals, vaccines, and medicated feed additives to prevent diseases such as bovine respiratory disease and foot-and-mouth disease. For example, vaccination programs and enhanced nutritional management in large-scale feedlots in Abu Dhabi and Dubai fuel market expansion, while partnerships with international biotech and animal health companies support the adoption of advanced biologics and health monitoring solutions in the sector.

Key Beef Cattle Health Company Insights

The global beef cattle health industry is moderately concentrated, dominated by a few multinational companies that provide vaccines, pharmaceuticals, biologics, and feed additives, alongside numerous regional players addressing local livestock needs. Key global leaders include Zoetis, Elanco, Boehringer Ingelheim, Merck Animal Health, and Ceva, which together capture a significant market share through comprehensive cattle health portfolios and extensive distribution networks. Smaller and regional firms contribute by offering niche solutions such as probiotics, mineral supplements, and targeted disease diagnostics, particularly in emerging markets like Latin America, Asia Pacific, and the Middle East & Africa.

Key Beef Cattle Health Companies:

The following are the leading companies in the beef cattle health market. These companies collectively hold the largest market share and dictate industry trends.

- Boehringer Ingelheim International GmbH

- Zoetis Inc.

- Merck & Co., Inc

- Vetoquinol S.A

- Elanco Animal Health Incorporated

- Virbac

- Phibro Animal Health Corporation

- Norbrook

- Dechra Pharmaceuticals Plc

- Bimeda, Inc

- Cargill, Incorporated

Recent Developments

-

In September 2025, the FDA conditionally approved Dectomax-CA1 (doramectin injection) to prevent and treat New World screwworm infestations in cattle, marking the first U.S. approval for this purpose. The drug, sponsored by Zoetis, is deemed safe with a reasonable expectation of effectiveness and provides 21 days of protection while complete approval data are being collected.

-

In July 2025, the Friedrich-Loeffler-Institut (FLI) successfully tested the world's first mRNA vaccine against foot-and-mouth disease (FMD) in cattle, developed by New South Wales and Tiba Biotech. Two doses provided full protection and greatly reduced virus shedding, eliminating the need to cultivate live virus or complex antigen purification.

-

In April 2024, the FDA approved Pradalex (pradofloxacin injection), a fluoroquinolone antimicrobial from Elanco US Inc., for treating respiratory diseases in cattle.

Beef Cattle Health Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.23 billion

Revenue forecast in 2033

USD 12.22 billion

Growth rate

CAGR of 8.80% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, Netherlands, Switzerland, Sweden, Ireland, Poland, Denmark, Norway, Japan, China, India, Indonesia, Thailand, Australia, South Korea, Philippines, Malaysia, Singapore, Brazil, Argentina, South Africa, Saudi Arabia, Turkey, Iran, UAE, Israel, Kuwait, Egypt, Qatar, Oman

Key companies profiled

Boehringer Ingelheim International GmbH, Zoetis Inc., Merck & Co., Inc., Vetoquinol S.A., Elanco Animal Health Incorporated, Virbac, Phibro Animal Health Corporation, Norbrook, Dechra Pharmaceuticals Plc, Bimeda, Inc., Cargill, Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beef Cattle Health Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global beef cattle health market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Biologics

-

Vaccines

-

Attenuated Live Vaccines

-

Inactivated Vaccines

-

Subunit Vaccines

-

DNA Vaccines

-

Recombinant Vaccines

-

Autogenous Vaccines

-

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Medicated Feed Additives

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail

-

E-commerce

-

Hospital/Clinic Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Russia

-

Netherlands

-

Switzerland

-

Ireland

-

Poland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Philippines

-

Malaysia

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

Turkey

-

Iran

-

Israel

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global beef cattle health market size was estimated at USD 5.85 billion in 2024 and is expected to reach USD 6.23 billion in 2025.

b. The global beef cattle health market is expected to grow at a compound annual growth rate of 8.80% from 2025 to 2033 to reach USD 12.22 billion by 2033.

b. North America dominated the global beef cattle health market in 2024, holding the largest revenue share of 33.79% The market growth is attributed to rising investments in preventive healthcare, advanced vaccines, and precision livestock management technologies.

b. Some key players operating in the beef cattle health market include Boehringer Ingelheim International GmbH, Zoetis Inc., Merck & Co., Inc., Vetoquinol S.A., Elanco Animal Health Incorporated, Virbac, Phibro Animal Health Corporation, Norbrook, Dechra Pharmaceuticals Plc, Bimeda, Inc., Cargill, Incorporated

b. Key factors that are driving the market growth include rising prevalence of infectious and parasitic diseases, such as bovine respiratory disease and New World screwworm, which threaten herd productivity. Innovations like injectable antibiotics and parasitic treatments, along with increased adoption of preventive healthcare and medicated feed additives, are boosting demand for effective cattle health solutions worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.