- Home

- »

- Homecare & Decor

- »

-

Beer Glassware Market Size & Share, Industry Report, 2030GVR Report cover

![Beer Glassware Market Size, Share & Trends Report]()

Beer Glassware Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Mugs, Pints, Pilsner, Weizen), By Application (Household, Commercial), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-264-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Beer Glassware Market Size & Trends

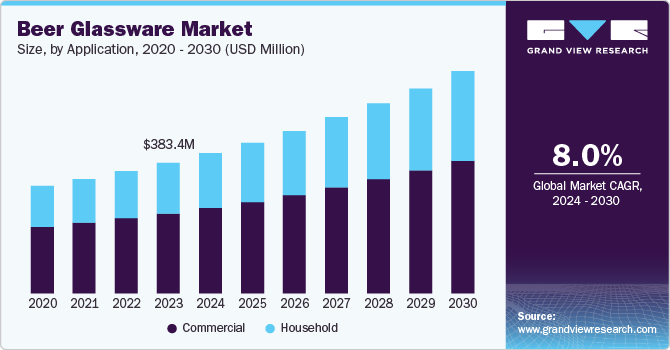

The global beer glassware market size was valued at USD 383.4 million in 2023 and is projected to grow at a CAGR of 8.0% from 2024 to 2030. Beer is a widely popular beverage globally that is prepared by fermenting sugars from grains and is served in a variety of vessels and glasses of different sizes. A steady rise in beer consumption among the young population, coupled with the budding post-work drinking culture, has been driving market expansion worldwide. Furthermore, a significant rise in disposable income and growing number of bars and pubs in developing economies such as China and India is expected to further drive the demand for beer glassware in the near future.

Beer leads in terms of the consumption of alcoholic beverages worldwide, with a high demand from bars, hotels, clubs, pubs, restaurants, supermarkets, wine shops, and online retail stores. The product demand has progressed substantially, with consumer tastes and brewers being in a continuous pursuit of introducing unique flavors and styles. Brewers additionally emphasize on the importance of proper glassware to enhance the drinking experience. Specific glasses are designed for different types of beer, with these glasses optimizing factors such as head retention, aroma release, and temperature control. This range of offerings is expected to elevate beer consumption and thus boost the demand for beer glassware.

The increasing popularity of craft beer, a beverage prepared using traditional ingredients in smaller batch sizes, is a major factor for the rising demand for beer glassware worldwide. Furthermore, growing adoption and proclivity for the western culture has encouraged consumers to prefer beer over whiskey, rum, and other alcoholic beverages. A growth in the number of Friday night club parties, drinking games, and house parties among the younger demographic, particularly working professionals, is anticipated to drive alcoholic beverage consumption, resulting in an increasing demand for the appropriate glassware.

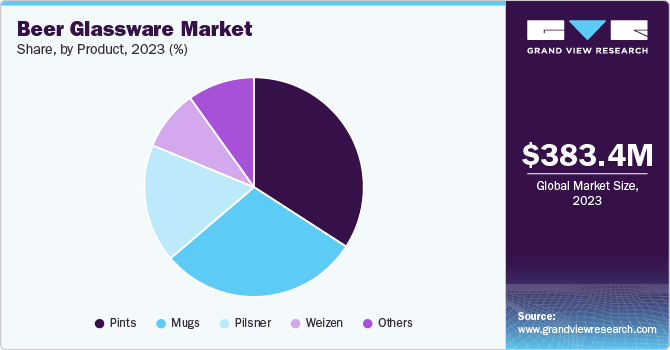

Product Insights

The pints segment dominated the market with a revenue share of 34.1% in 2023 owing to certain characteristics of pints such as their availability in different sizes (16-ounce American or 20-ounce British) and shapes (Conical, Nonik, Dimple-glassed Tulip, and can-shaped), thus offering a variety of choices in terms of balance between capacity and practicality for beer consumers to choose from. Additionally, the size of a pint differs according to country and is associated with regional culture. Head retention and aroma concentration are vital aspects of visual and taste appeal for beer consumers, which are effectively managed in a pint, driving segment growth.

Mugs accounted for a significant share in the product segment of the beer glassware market owing to the versatility in terms of size and ease of holding that mugs offer over other forms of glassware. Mugs are available in different sizes, ranging from 200 ml to 1000ml, thus catering to the style and volume needs of a variety of consumers. Furthermore, mugs can be manufactured from durable materials, making them a popular choice among club and bar owners. The demand for weizen glasses is expected to advance at the fastest growth rate during the forecast period owing to their aesthetically appealing design and distinctive shape, which makes them a preferred option for craft beer consumers.

Application Insights

The commercial application segment accounted for the largest revenue share in 2023. A constant rise in the number of clubs, bars, and pubs has fueled the demand for beer glassware from the commercial sector. After a hectic work week, people generally prefer to go to nightclubs to party and relieve their stress, and they prefer mild alcoholic drinks such as beer. Consequently, the commercial sector requires large quantities of beer glasses to cater to their customer base. This translates to consistent and high-volume demand for various types of beer glassware, including weizen, mugs, pilsner, and pints. Additionally, incidences of frequent accidental breakage and loss of glassware ensures a consistent demand for beer glassware from the commercial sector.

On the other hand, the household segment is expected to grow at a faster CAGR during the forecast period. This increasing demand is being fueled by factors such as convenience, affordability, and a desire for a more personalized drinking experience. Additionally, the rising trend of home gatherings and social events is a major factor accounting for increased product demand. The growing craft beer culture among residential consumers, wherein a special emphasis is given to visual appeal, has led to a rise in the consumer base buying fancy beer glassware in recent years.

Distribution Channel Insights

The offline segment held a dominant revenue share in the global market in 2023. Traditional brick-and-mortar stores such as supermarkets, hypermarkets, and specialty kitchenware stores have a well-established infrastructure. These stores display and sell a wide variety of beer glassware. This convenience of ready availability and expansive choice of selection caters to consumers who prefer to see and physically handle the product before purchasing. Additionally, while shopping for other grocery items, consumers have a habit of impulse purchases, which is further fueled by discounts and offerings given by stores, which leads to increased buying from offline stores.

Meanwhile, the online segment is anticipated to witness significant growth by 2030 attributed to an increasing prevalence of online marketplaces and e-commerce websites, offering a variety of products across different categories. With significant growth in the usage of smartphones and internet users and the subsequent growth of online payment options and convenience offered, the younger demographic tends to purchase products online more frequently. This purchasing behavior along with the assurance of safer delivery of fragile glassware from delivery firms has resulted in the high growth of the online market.

Regional Insights

Europe beer glassware market held the largest share of 30.1% of the global revenue in 2023 attributed to Europe being home to over 10,000 breweries, spread across the countries of France, UK, Germany, and others. With over 80 beer styles and 50,000 different brands, Europe is considered as a cradle of modern brewing. The trend of establishing microbreweries and making malt beers is on the rise, which is expected to propel further demand for beer glassware. A significant rise in disposable income and the popular trend of bar and club culture across emerging economies has created promising prospects for market expansion.

The France beer glassware market remains a significant contributor to the region, with the highest number of breweries amounting to over 2500. Despite being a traditional wine country, beer consumption is on rise, with supermarkets accounting for 65% of the overall beer sales in France. Beer has emerged as the most popular beverage category among 41% of consumers in bars, restaurants, and other venues. French consumers prefer specialty beers such as tequila-flavored and fruit-flavored beers, to mention a few.

The UK beer glassware market accounted for a substantial revenue share in 2023. The country has a long tradition of beer drinking and has a network of over 3,000 breweries, according to data from UHY Hacker Young. A significant growth has been observed in the craft beer culture, which translates to increased demand for special purpose beer glassware to enhance the visual and aromatic appeal for beer consumers. Additionally, the promising growth of online marketplaces has fueled the demand for fancy and specialized beer glassware.

Asia Pacific Beer Glassware Market Trends

The Asia Pacific beer glassware market is expected to witness the fastest CAGR of 10.6% over the forecast period pertaining to the rising young population in the region, which prefers drinking mild alcoholic beverages such as beer. Moreover, a significant rise in disposable income levels and emergence of pub and bar culture are major contributors to the region’s growth prospects. Additionally, western cultural influence on younger generation through films, web series, and social media trends is expected to further fuel cultural exchange and in turn, advance this market.

The India beer glassware market is expected to showcase promising growth opportunities in the coming years. This is owing to the country having the world’s largest share of young population. For instance, over 800 million people in the country are below 35 years of age. Globalization and its associated impacts can be seen in the economy’s urban culture. With an increase in the number of white-collar jobs in urban areas along with rising living standards, alcohol consumption is on the rise. This is accompanied by the proliferation of online marketplaces, ensuring timely and reliable service in far-flung areas of the country. The demand for beer glassware is majorly observed in tier-1 and tier-2 cities, where density of bars and clubs is high.

North America Beer Glassware Market Trends

North America beer glassware market accounted for a substantial revenue share in the global market. The region’s large and diverse consumer base enjoys a wide variety of beers. This translates to a steady demand for different types of beer glasses catering to specific styles. A surge in popularity of craft beers and demand for a variety of flavors & aromas requires custom-designed vessels to enhance the drinking experience. Additionally, the hospitality industry is on the rise, which is expected to maintain a constant demand for glassware in the near future.

U.S. Beer Glassware Market Trends

The U.S. beer glassware market accounts for a significant contribution in the region, as a wide consumer base in the country prefers craft beer in their leisure time. This translates to surged demand for custom-designed beer glassware such as thick-walled, broad-based, honeycomb-shaped, among others that cater to the needs of individuals. Corona, Guinness, and Bud Light are well-known and prominent beer brands in the country, among the younger population. Moreover, cities such as Grands Rapids and Portland are known globally for their beer culture. These factors fuel the growth and ensure promising prospects for the countrywide market.

Key Beer Glassware Company Insights

Some of the notable companies involved in the beer glassware market include Hamilton Housewares Pvt. Ltd.; Guangdong Garbo Industrial Co. Ltd.; and Eagle Glass Deco Pvt. Ltd.

-

Hamilton Housewares markets its glassware under the Treo brand. They offer glass and ceramic serveware in a wide range of shapes, patterns, and sizes. Ceramic mugs offered by them are dishwasher-safe and come in a variety of colors to choose from. Barware glasses offered include beer glasses, wine, and martini glasses, catering to the diverse needs of consumers.

-

Garbo Glassware offers manufacturing and distribution services for glassware products. The company focuses on the wholesale market, catering to the needs of bulk buyers. Beer glassware offered by the company ranges from pint glasses to pilsners and beer mugs, addressing the needs of individuals as well as bars.

Key Beer Glassware Companies:

The following are the leading companies in the beer glassware market. These companies collectively hold the largest market share and dictate industry trends.

- Fiskars Group

- Eagle Glass Deco Pvt. Ltd.

- Hamilton Housewares Pvt. Ltd.

- Guangdong Garbo Industrial Co., Ltd.

- Cello World Pvt. Ltd.

- Libbey Inc.

- Lifetime Brands Inc.

- Ngwenya Glass

- Ocean Glass Public Co. Ltd.

- Borosil Ltd.

Recent Developments

-

In April 2024, Fiskars Group announced that it would be making investments in the company’s Rogaska glass factory in Slovenia, amounting to around USD 16 million, where the company manufactures crystal products through its luxury brand Waterford. Through this initiative, the company aims to modernize its operations, improve its production efficiency in the luxury and premium product portfolio, and reduce carbon emissions.

Beer Glassware Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 411.1 million

Revenue Forecast in 2030

USD 651.9 million

Growth rate

CAGR of 8.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, Australia, South Korea, India, Brazil, UAE

Key companies profiled

Borosil Ltd.; Cello World Pvt. Ltd.; Eagle Glass Deco Pvt. Ltd.; Fiskars Group; Guangdong Garbo Industrial Co. Ltd.; Hamilton Housewares Pvt. Ltd.; Libbey Inc.; Lifetime Brands Inc.; Ngwenya Glass; Ocean Glass Public Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beer Glassware Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global beer glassware market report based on product, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Mugs

-

Pints

-

Pilsner

-

Weizen

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.