- Home

- »

- Food Safety & Processing

- »

-

Beverage Carton Packaging Machinery Market Report, 2030GVR Report cover

![Beverage Carton Packaging Machinery Market Size, Share & Trends Report]()

Beverage Carton Packaging Machinery Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Application, By Mode Of Operation (Semi-Automatic, Automatic), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-477-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

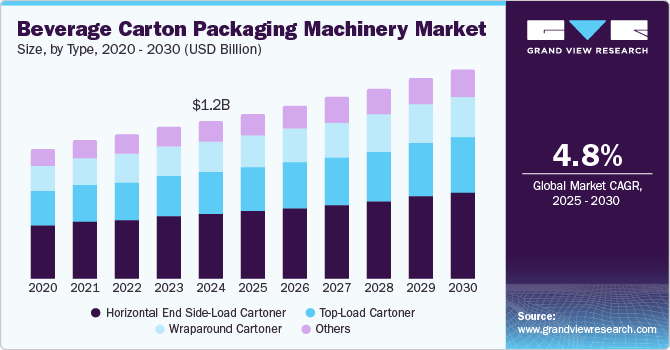

The global beverage carton packaging machinery market size was valued at USD 1.15 billion in 2024 and is expected to grow at a CAGR of 4.8% from 2025 to 2030. The projected growth can be attributed to several factors, including the rising demand for sustainable packaging solutions as consumers and regulatory bodies increasingly prioritize eco-friendly materials over traditional plastic. For instance, in 2024, The Coca-Cola Company rolled out 100% recycled PET (rPET) bottles in over 40 markets as part of its commitment to sustainability and goal to make 100% of its packaging recyclable globally by 2025. Through its World Without Waste initiative, the company seeks to collect and recycle a bottle or can for every piece sold by 2030.

The growth of the beverage industry, driven by changing consumer preferences toward ready-to-drink and health-conscious products, has amplified the need for efficient packaging machinery. Moreover, technological advancements in packaging machinery, such as automation, robotics, and IoT integration, have significantly improved production efficiency and accuracy. These technologies enable manufacturers to streamline operations, reduce waste, and enhance product quality. As companies seek to optimize their production processes and meet the demands of a rapidly evolving market, adopting advanced packaging machinery becomes essential for maintaining competitiveness.

Furthermore, the expanding global beverage market, especially in emerging economies, is expected to present substantial growth opportunities for the beverage carton packaging machinery industry. The consumer base for packaged beverages is expected to witness growth with increasing disposable income and rising urbanization in these regions. This trend necessitates scalable and cost-effective packaging solutions to meet growing demand. In addition, the focus on health and wellness drives innovation in beverage offerings, further fueling the need for specialized carton packaging that preserves product integrity while appealing to environmentally conscious consumers.

Type Insights

The horizontal end side-load cartoner segment dominated the market and accounted for the largest revenue share of 39.3% in 2024. This can be attributed to its efficiency in handling various beverage types and its ability to accommodate different carton sizes. The design of horizontal end side-load cartoners allows for seamless integration into existing production lines, making them a preferred choice for manufacturers looking to optimize their packaging processes. In addition, these machines offer enhanced flexibility, enabling producers to quickly switch between product lines without significant downtime, which is crucial in a fast-paced market.

The wraparound cartoner segment is expected to grow at a significant CAGR over the forecast period. This growth is driven by the increasing demand for flexible packaging that wraps around products efficiently. As consumer preferences shift toward convenience and portability, wraparound carton designs are gaining traction. They allow brands to enhance product visibility while maintaining structural integrity during transport and storage. Furthermore, the ability to customize wraparound designs for branding purposes adds value for manufacturers seeking to differentiate their products in a competitive landscape.

Mode of Operation Insights

The automatic segment dominated the market with the largest revenue share in 2024, reflecting a growing trend toward automation in manufacturing processes. Automatic machines offer high speed and reduced labor costs, appealing to companies seeking to enhance productivity and efficiency. These systems have advanced features, such as real-time monitoring and predictive maintenance capabilities, which minimize downtime and optimize performance. Manufacturers invest in cutting-edge technologies that streamline operations and improve product consistency and quality as the industry moves toward more automated solutions.

The semi-automatic segment is projected to grow at a significant CAGR during the forecast period. This can be attributed to the flexibility offered by semi-automatic systems, which allow manufacturers to scale operations based on demand fluctuations. These systems provide an ideal balance between manual intervention and automation, making them suitable for businesses that require adaptability in their packaging processes. In addition, semi-automatic machines are often available at a lower initial investment cost compared to fully automatic counterparts, making them an attractive option for small to medium-sized enterprises looking to enhance their packaging capabilities.

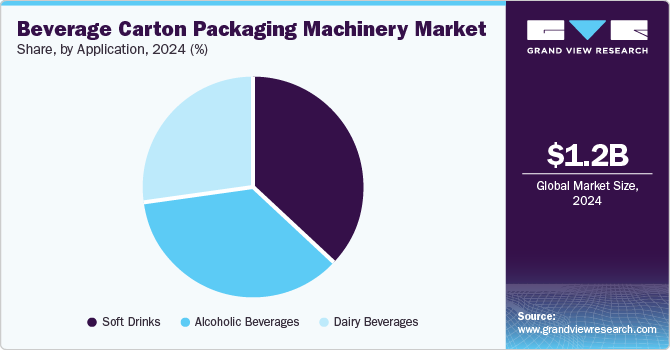

Application Insights

The soft drinks segment dominated the market with the largest revenue share in 2024 due to the high consumption rates of soft drinks globally. This segment demands efficient packaging solutions that ensure product freshness and compliance with safety standards. Continuous innovation in flavors and formulations also drives demand for specialized carton packaging machinery tailored for this segment. As brands introduce new products targeting health-conscious consumers, such as low-sugar or functional beverages, the need for versatile packaging solutions to accommodate these variations becomes increasingly important.

The alcoholic beverages segment is projected to grow at the highest CAGR during the forecast period. Consumers' rising interest in craft beers, ready-to-drink cocktails, and premium spirits fuels the anticipated growth. According to the Brewers Association, in 2023, craft beer sales reached USD 28.9 billion, accounting for 24.7% of the U.S. beer market, now valued at USD 117 billion, up from USD 115 billion in 2022. As brands seek innovative packaging solutions that enhance shelf appeal and preserve product quality, investment in advanced carton machinery becomes crucial for meeting market requirements. Moreover, changing regulations regarding alcohol packaging are prompting manufacturers to adopt more sustainable practices, further driving innovation within this segment of the beverage carton packaging machinery industry.

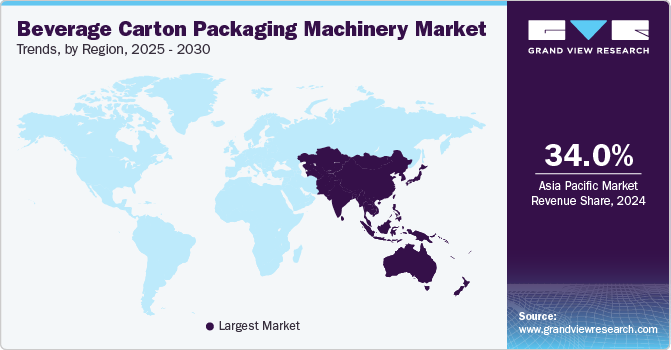

Regional Insights

The Asia Pacific beverage carton packaging machinery market dominated the global market and accounted for the largest revenue share of 34.0% in 2024. This dominance is driven by rapid urbanization, increasing disposable incomes, and consumer preference for packaged beverages. The region's robust manufacturing capabilities further support its leadership position in the global market. In addition, initiatives to improve supply chain efficiencies and reduce production costs encourage investments in modernized carton packaging technologies across Asia Pacific countries, including China, India, and Japan.

China Beverage Carton Packaging Machinery Market Trends

China beverage carton packaging machinery market dominated the regional market and accounted for the largest revenue share in 2024. The country's extensive beverage industry and focus on sustainable packaging solutions have propelled investments in carton machinery. As consumers in China become more environmentally conscious and demand high-quality products, manufacturers are increasingly turning to advanced carton solutions that meet these expectations while also adhering to regulatory standards related to sustainability.

North America Beverage Carton Packaging Machinery Market Trends

The North America beverage carton packaging machinery market is expected to grow at a CAGR of 4.4% over the forecast period. This can be attributed to an increasing demand for premium beverages and innovations in packaging technology that cater to evolving consumer preferences. The region's established beverage industry is a strong foundation for continued investment in advanced carton packaging solutions. Furthermore, collaboration between beverage companies and machinery manufacturers fosters innovation to enhance efficiency and reduce environmental impact within production processes.

The U.S. beverage carton packaging machinery market led the North American market and accounted for the largest revenue share in 2024. This reflects the country's diverse beverage landscape and strong consumer demand for both alcoholic and non-alcoholic products. As manufacturers seek to enhance operational efficiency through modernized carton machinery, competitive dynamics within this market segment are expected to intensify. In addition, ongoing research related to sustainable materials and production methods is likely to shape future developments within this sector.

Europe Beverage Carton Packaging Machinery Market Trends

The Europe beverage carton packaging machinery market is expected to witness significant growth over the forecast period. Factors such as stringent regulations on plastic usage and an increasing emphasis on sustainability are driving European manufacturers toward adopting carton-based solutions. For instance, in 2024, the European Union introduced the Packaging and Packaging Waste Regulation (PPWR) to enhance efforts to reduce, reuse, and recycle packaging waste. This regulation expands upon existing directives to create a more harmonized framework for packaging laws across the EU. The region's commitment to reduce the environmental impact aligns with trends favoring recyclable materials, further boosting the growth of the beverage carton packaging machinery industry.

Key Beverage Carton Packaging Machinery Company Insights

The beverage carton packaging machinery industry features several key players that shape its landscape. R.A. Jones specializes in providing advanced packaging solutions, focusing on efficiency and sustainability in beverage packaging. Coesia S.p.A. offers a range of automated packaging machinery, emphasizing high performance and adaptability to various beverage types, while Nichrome Packaging Solutions is recognized for its versatile packaging systems that cater to the needs of the beverage industry, providing reliable and cost-effective solutions. Imanpack Packaging and Eco Solutions S.p.A. focuses on eco-friendly packaging technologies, aligning with the industry's shift toward sustainable practices. These companies play a significant role in shaping the beverage carton packaging machinery industry.

-

Coesia S.p.A. provides a wide range of automated machinery and services tailored for various applications, including food and beverage packaging. Coesia emphasizes innovation and sustainability in its product offerings, aiming to optimize production processes while reducing the environmental impact. The company comprises several brands specializing in packaging technology, allowing it to deliver comprehensive solutions to its clients worldwide.

-

Nichrome Packaging Solutions offers comprehensive packaging machinery and solutions for multiple sectors, including the beverage market. The company designs and manufactures various packaging systems, such as form-fill-seal machines and vacuum packing equipment. Nichrome emphasizes quality and innovation in its offerings, aiming to meet the specific needs of beverage producers while promoting efficient and sustainable packaging practices.

Key Beverage Carton Packaging Machinery Companies:

The following are the leading companies in the beverage carton packaging machinery market. These companies collectively hold the largest market share and dictate industry trends.

- R.A.Jones

- Coesia S.p.A.

- Nichrome Packaging Solutions

- Imanpack Packaging and Eco Solutions S.p.A.

- Langley Holdings plc

- Jacob White Packaging Ltd.

- KHS Group

- OPTIMA

- Syntegon Technology GmbH

- Mpac Group plc

Recent Developments

-

In November 2024, SIG unveiled its SIG Neo Slimline 15 Aseptic filling machine at the Gulfood Manufacturing event in the UAE. This advanced machine is recognized for its speed and versatility in aseptic carton filling for multi-serve formats, with a capacity to fill up to 15,000 SIG SlimlineBloc packs per hour.

-

In October 2024, Pactiv Evergreen Inc. launched its SmartPour packaging solution for easy pouring and resealing. This innovative package is ideal for various pourable dry ingredients, including premium cereals, beverages, snacks, baking ingredients, pet food, and powdered detergents. The SmartPour design eliminates the need for a plastic bag insert, reducing spillage and maintaining freshness with its resealable closure.

Beverage Carton Packaging Machinery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.20 billion

Revenue forecast in 2030

USD 1.52 billion

Growth rate

CAGR of 4.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, mode of operation, region

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East & Africa.

Country scope

U.S.; Canada; Mexico; China; India; Japan; Australia; South Korea; Germany; UK; France; Italy; Spain; Brazil; South Africa

Key companies profiled

R.A.Jones; Coesia S.p.A.; Nichrome Packaging Solutions; Imanpack Packaging and Eco Solutions S.p.A.; Langley Holdings plc; Jacob White Packaging Ltd.; KHS Group; OPTIMA; Mpac Group plc; Syntegon Technology GmbH

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

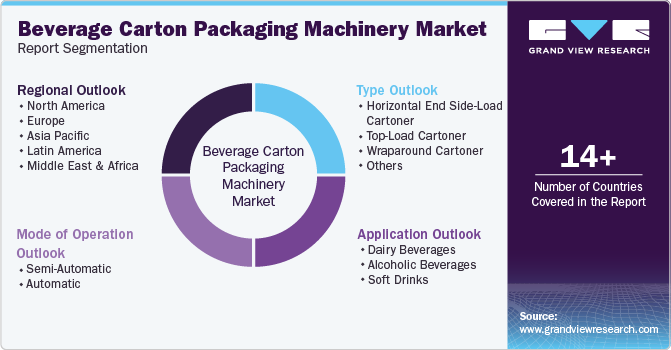

Global Beverage Carton Packaging Machinery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global beverage carton packaging machinery market report based on type, application, mode of operation, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Horizontal End Side-Load Cartoner

-

Top-Load Cartoner

-

Wraparound Cartoner

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dairy Beverages

-

Alcoholic Beverages

-

Soft Drinks

-

-

Mode of Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Semi-Automatic

-

Automatic

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.