- Home

- »

- Consumer F&B

- »

-

Sports Drink Market Size, Share And Growth Report, 2030GVR Report cover

![Sports Drink Market Size, Share & Trends Report]()

Sports Drink Market Size, Share & Trends Analysis Report By Product (Hypotonic, Hypertonic, Isotonic), By Form (Liquid, Powder), By Packaging, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-894-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Sports Drink Market Size & Trends

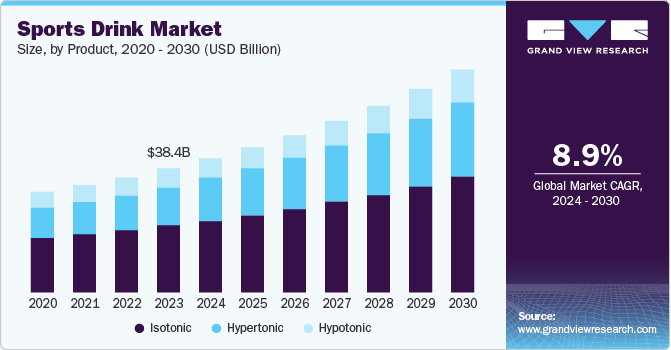

The global sports drink market size was valued at USD 38.42 billion in 2023 and is projected to grow at a CAGR of 8.9% from 2024 to 2030. Increasing participation in sports and fitness activities, effective branding & marketing strategies adopted by key companies, ease of availability, and changing lifestyles are significant growth-driving factors for this market.

The increasing popularity of sports drinks made with clean-label ingredients and natural sources has generated greater demand for the product. Customers prefer natural and organic choices over drinks with added colors, synthetic ingredients, and sweeteners. Therefore, numerous sports drink companies are changing and innovating the formulations for these products. Natural coconut water, fruit extracts, and plant-based electrolyte sources are some natural & organic ingredients manufacturers use to attract greater customer engagement.

Furthermore, prominent businesses in the industry prioritize sustainable packaging options to cater to the eco-friendly preferences of their customer base. Advancements in packaging technology and distribution networks have played a crucial role in driving the growth of the sports drink market. Ease of availability, accessibility through offline stores, tie-ups and collaborations by companies and sporting clubs or teams, and efficient branding are some of the significant aspects expected to generate an upsurge in demand for this market during the forecast period.

Product Insights

The Isotonic segment dominated the market and accounted for a revenue share of 54.1% in 2023. Isotonic sports drinks contain levels of sugar and salt similar to those of the human body. Sports drinks offered in this category are preferred for the ability to replace fluids lost through sweat and ensure the availability of carbohydrates. Athletes involved in strenuous games, such as long-range running, organized team sports, and others, often prefer isotonic drinks. Growing sports participation, increasing collaborations with teams and individuals, ease of accessibility, and rising expenditure on fitness regimes are expected to drive demand for this segment.

The hypertonic segment is expected to experience the fastest CAGR during the forecast period. Hypertonic beverages contain excess salt and sugar levels compared to the human body. They are often consumed after intensive exercise routines to increase daily carbohydrate consumption and replenish muscle glycogen levels. Some athletes prefer to consume hypertonic and isotonic sports drinks due to their dual benefits during long-distance events: fulfilling energy needs and replenishing lost fluids.

Form Insights

The liquid form sports drink segment accounted for the largest revenue share in 2023. Ease of consumption, convenience, enhanced availability & accessibility are vital growth-driving factors for this market. Furthermore, liquid sports drinks are usually more hydrating and refreshing than other forms, such as gels or powders. It encourages larger consumer groups to prefer it to other forms. These products are often served in the ready-to-drink category through bottles and cans.

The powder form sports drink segment is expected to experience the fastest CAGR during the forecast period. The increasing preference to improve performance has influenced sports and fitness enthusiasts to invest in energy-enhancing food items such as powdered supplements that support their workout routines. Due to its ability to boost energy production in muscle cells, significant manufacturers are incorporating additional creatine into sports supplements. A large existing customer base, enhanced distribution, and ease of accessibility are some of the key growth-driving factors for this segment.

Packaging Insights

The bottles segment accounted for the largest revenue share in 2023. This is attributed to the rising urge for portability and convenience. Polyethylene terephthalate (PET) bottles are primarily used as packaging material for sports drinks due to their lightweight, portable nature, high durability, and excellent barrier capacity against gases. Moreover, the growing awareness about environmental concerns due to packaging materials has resulted in a shift towards PET bottles due to their recyclability and lower carbon footprint than other packaging materials. As a result, the bottle packaging segment is expected to experience significant expansion in the sports beverage industry during the forecast period.

The pouches segment is expected to experience the fastest CAGR during the forecast period. The primary benefits of pouch packaging, such as convenience, sustainability, enhanced product protection, and cost-effectiveness, drive the market. Spout packaging has been one of the preferred choices by the manufacturers as it ensures the opportunity to develop various designs and offers enhanced brand visibility to the companies. Innovations such as sustainably sourced materials and the availability of biodegradable ingredients are fueling the growth of this segment.

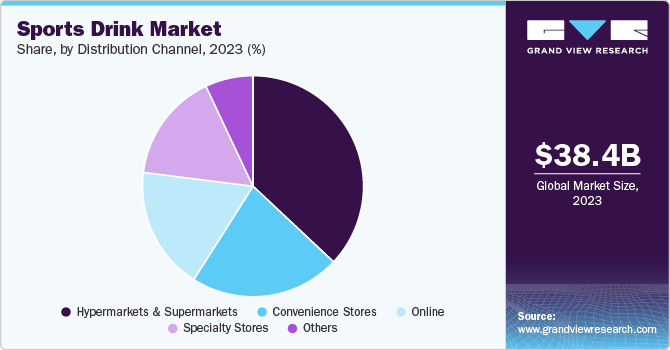

Distribution Channel Insights

The hypermarket & supermarket segment dominated the global industry in 2023. The availability of various sports drinks, including different flavors and types, in hypermarkets and supermarkets has attracted a large consumer base. These retail stores offer a diverse range of sports drinks, catering to various preferences and dietary needs. In addition, discounts and special offers provided to frequent or repeat customers contribute to the growing sales volume through these channels.

The online distribution channel is expected to experience the fastest CAGR during the forecast period. Enhanced availability, presence of multiple global brands on e-commerce platforms, and ease of use are critical growth-driving factors for this segment. Furthermore, additional services provided by the online platforms, such as doorstep deliveries, enhanced customer assistance, display of detailed product information, availability of multiple payment alternatives, and discretion, are projected to develop greater penetration for this segment in the approaching years.

Regional Insights

North America sports drink market dominated the revenue share with 42.1% in 2023. The elevated popularity of sports beverages, changing dietary habits, and the rise in demand for natural and organic products have significantly contributed to the expansion of the sports drink market in the region. The North America region has contributed to the surge in demand for sports drink.

U.S. Sports Drink Market Trends

The U.S. sports drink market dominated the regional industry in 2023. Increasing sports participation, the presence of multiple global and domestic brands in the region, ease of availability, and enhanced distribution by the companies are expected to develop higher demand for this industry in the coming years. In addition, the large existing customer base, endorsements by sports icons and celebrities, effective branding strategies, collaborations with sports clubs, and technology advancements associated with manufacturing, procurements, and packaging are likely to fuel the growth of this market.

Europe Sports Drink Market Trends

Europe sports drink market was identified as a lucrative region in 2023. Consumers are more frequently seeking products that are easy to use, portable, and require minimal effort. Furthermore, the growing penetration of online shopping drives the market, allowing consumers to buy sports drinks from their homes quickly. The entry of multiple international brands in the region, the presence of numerous domestic brands, and many sporting events hosted in the region are projected to generate a rise in demand for this industry.

Germany sports drink market is expected to grow rapidly in the upcoming years. An increase in active participation in outdoor activities and sports, the presence of several sporting clubs and teams, a large number of sports tournaments organized in the country, and the availability of diverse product portfolios offered by the major industry participants are expected to fuel growth for this market during forecast years.

Asia Pacific Sports Drink Market Trends

Asia Pacific sports drink market is anticipated to witness significant growth in the sports drink market. The rise in health awareness among consumers and the growing trend of sports and fitness activities contribute to the growth experienced by this industry in the region. Furthermore, the increasing income levels in countries such as India fuel the demand for sports beverages. The rise in inclination towards natural & organic product consumption has driven a large customer base towards adopting the premium range of sports drinks.

China sports drink market held a substantial market share in 2023. The rapid growth of e-commerce platforms in China has significantly boosted the accessibility and availability of sports drinks to a broader consumer base. In addition, large groups of athletes, teams, and clubs representing several sports are expected to drive demand for this market in the next few years.

Key Sports Drink Company Insights

Some of the key companies in the sports drink market include PepsiCo, The Coca‑Cola Company, Danone S.A., Britvic plc, Abbott, and others. Owing to the growth in competition, the key industry participants have adopted strategies such as collaborations, tie-ups with influencers, teams, and clubs, effective distribution, enhanced packaging, and expansion of product portfolios.

-

PepsiCo, an American multinational food, beverage, and snack corporation, offers an applauded range of sports drinks through its subsidiary. The Gatorade Company, a part of PepsiCo, offers innovative sports performance solutions tailored for athletes in various sports and competitions. The company operates in multiple regions and delivers a wide range of food and beverage products.

-

The Coca‑Cola Company, an American multinational corporation, offers numerous brands in various beverage categories. The company focuses on building a diversified product portfolio, including water, sports drinks, coffee, and tea brands, including Powerade, the company's sports drink brand.

Key Sports Drink Companies:

The following are the leading companies in the sports drink market. These companies collectively hold the largest market share and dictate industry trends.

- PepsiCo

- The Coca‑Cola Company

- Danone S.A.

- Britvic plc

- Abbott.

- AJE Group

- Monster Energy Company

- Congo Brands

- Otsuka Pharmaceutical Co., Ltd.

- Fraser & Neave Holdings Bhd

Recent Developments

-

In June 2024, PepsiCo India expanded its beverage offerings in Jammu and Kashmir, India, by introducing its well-known hydration drink, Gatorade. This strategic move aimed to provide consumers in the region with access to a trusted and effective sports drink.

-

In June 2024, Special Olympics, Inc. and The Coca-Cola Company announced an eight-year extension of their global partnership, which is expected to continue through 2031. This extension marked the longest renewal in the partnership's history, reflecting Coca-Cola's commitment to Special Olympics' mission to highlight the potential of individuals with intellectual disabilities and promote inclusivity through sports.

Sports Drink Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 41.52 billion

Revenue forecast in 2030

USD 69.23 billion

Growth rate

CAGR of 8.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD Billion/Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, packaging, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

PepsiCo; The Coca‑Cola Company.; Danone S.A.; Britvic plc; Abbott.; AJE Group; Monster Energy Company.; Congo Brands; Otsuka Pharmaceutical Co., Ltd.; Fraser & Neave Holdings Bhd .

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sports Drink Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the sports drink market report based on product, form, packaging, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypotonic

-

Hypertonic

-

Isotonic

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

Pouches

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."